ACCT501_Chapter_4_Flashcards

Chapter 4: Revenue Recognition and the Statement of Income

Learning Objectives

LO1: Explain the nature of revenue and its significance.

LO2: Identify and explain the contract-based approach to revenue recognition.

LO3: Discuss how revenue recognition is influenced by returns, warranties, consignment, and third-party sales.

LO4: Differentiate between single-step and multi-step statements of income.

LO5: Distinguish between comprehensive income and net income.

LO6: Explain expense presentation by function vs. nature.

LO7: Calculate and interpret basic earnings per share (EPS).

Understanding Revenues

Definition: Revenues are inflows of economic benefits resulting from a company's ordinary operating activities, specifically through cash and accounts receivable.

Sources of Revenue:

Sales of goods

Provision of services

Earnings Assessment:

Quantity: Measured by revenue growth.

Quality: Evaluated by the source of growth.

Revenue Recognition Overview

Challenge: Determining the timing of revenue recognition can be complex.

Approaches:

IFRS (International Financial Reporting Standards): Contract-based approach (asset-liability approach).

ASPE (Accounting Standards for Private Enterprises): Earnings-based approach.

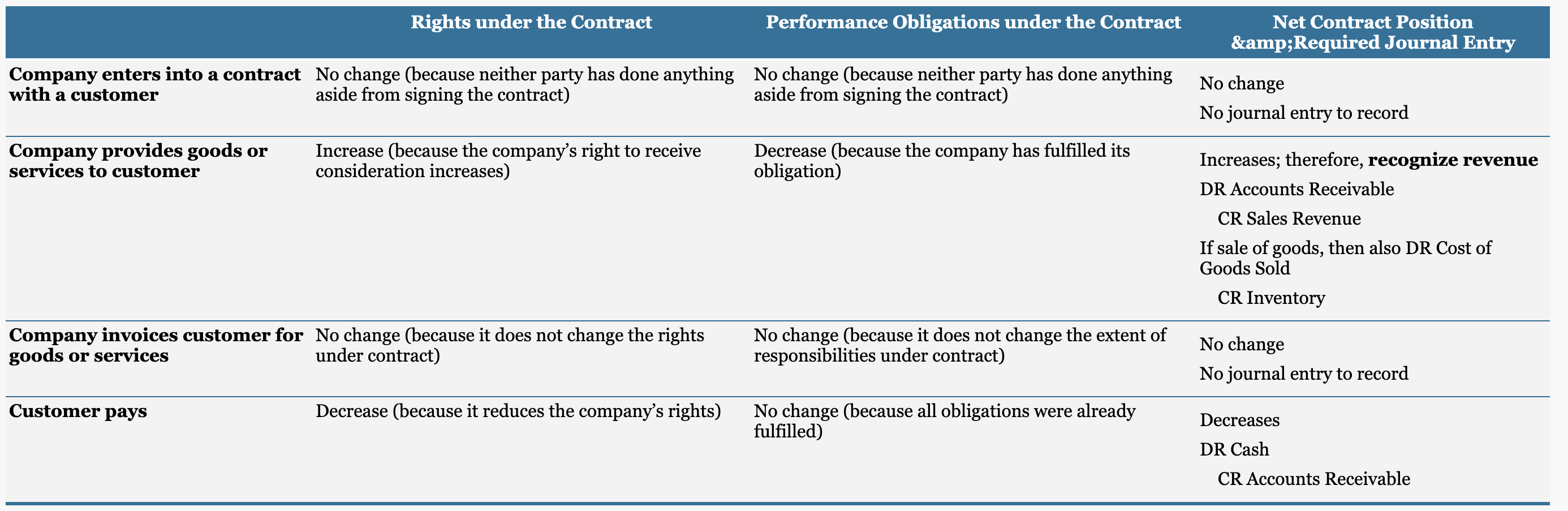

Revenue Recognition: Contract-based Approach

Revenue is recognized when a company’s net position in a contract increases, indicated by:

Increase in rights under the contract.

Decrease in performance obligations.

Performance Obligations: These must be fulfilled to recognize revenue.

Revenue Recognition: Five-Step Model

Identify the contract: Understand the terms and conditions.

Identify performance obligations: Define what needs to be delivered to fulfill the contract.

Determine transaction price: Establish the price the company expects to receive.

Allocate the transaction price: Assign the price to performance obligations based on their standalone selling prices.

Recognize revenue: Revenue is recognized when performance obligations are satisfied, either at a point in time or over time.

Revenue Recognition Issues

Right of Returns: Companies must estimate expected product returns.

Warranties:

Assurance warranties: Not considered separate performance obligations.

Service warranties: A portion of the transaction price must be allocated to these.

Consignment Sales: Revenue is recognized only when goods are sold.

Third-Party Sales: Companies acting as agents recognize only their commission.

Statement of Income Types

Single-Step Income Statement: Simplifies income calculation without separating operational results.

Multi-Step Income Statement: Provides detailed information, separating operational revenues from non-operational revenues and expenses.

Hybrid Forms: Companies may use elements from both formats in their statements.

Comprehensive Income

Definition: Comprehensive income is the total change in shareholders' equity from non-owner sources, which includes:

Gains/losses from revaluation to fair value.

Gains/losses from foreign exchange rate changes.

Formula: Comprehensive Income = Net Income + Other Comprehensive Income.

Expense Presentation

Function: Groups expenses according to their functional area (e.g., cost of sales, administrative expenses).

Nature: Lists expenses based on type (e.g., wages, depreciation).

Financial Statement Analysis - Earnings per Share (EPS)

EPS Definition: Represents net income attributable to common shares, calculated after deducting preferred share dividends.

Significance: Used to assess company performance and is frequently cited in financial analysis.

Calculation: Basic EPS can be calculated when there is no change in common share numbers or when changes occur.

(EPS = [Net income - preferred dividends]/ weighted avg of common shares outstanding)

Example Calculation: Montgomery Ltd. reported net income of $625,000 with preferred dividends of $30,000, resulting in 250,000 common shares outstanding.