6a. Indirect taxes

Indirect taxes

An indirect tax is imposed on producers (suppliers) by the government. Examples include duties on cigarettes, alcohol and fuel and also VAT

Taxes are split into two categories; specific tax and ad valorem tax

Ad valorem is percentage-based (Cigarette duty to rise by 2%)

Specific tax is a tax per unit (wine to rise by 8p per bottle)

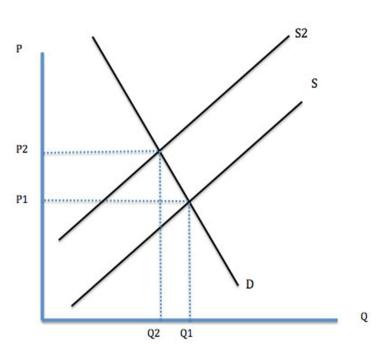

Specific tax diagram

The supply curves in this diagram are parallel because the tax is the same at each price level and unit of output.

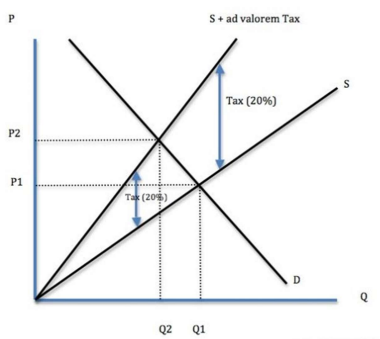

Ad Valorem tax diagram

The supply curves in this diagram diverge because the tax is percentage based. Therefore, the tax on a higher-priced item is more.

Advantages of indirect tax

Everyone can contribute

Convenient for both taxpayer and government

Broad-based

Non-evadable

Reduce negative externalities (third part effects such as second hand smoke)

Disadvantages of indirect tax

Regressive

Raises prices

The cost of collection can be high

Can be harmful to industries

Can encourage black markets

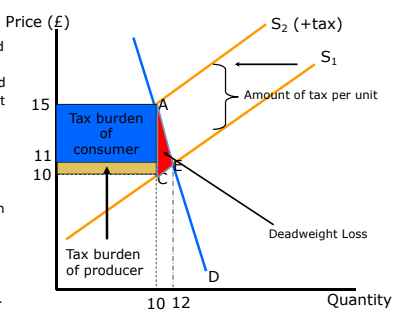

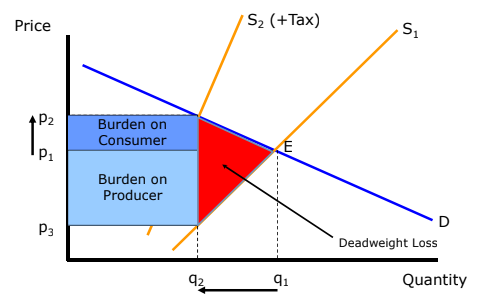

Tax incidence

The relative burden, or incidence, of an indirect tax, is determined by the price elasticity of demand (PED) of the consumer in response to a price rise. If the consumer is unresponsive, and PED is inelastic, the burden will fall mainly on the consumer. However, if the consumer is responsive to the price rise, and PED is elastic, the burden will fall mainly on the firm.

Incidence of an indirect tax

In almost all cases some of the tax would be paid by the consumer and some would be paid by the producer. If the elasticity of demand is 1 (unitary) the burden will be split equally.

If the PED is inelastic, more of the burden will fall onto the consumer. Due to the nature of an inelastic good, producers know that they can pass the tax on rather than pay it themselves.

If the good was perfectly inelastic the consumer would pay all the tax.

Incidence of an indirect tax

If the PED is elastic, more of the burden will fall onto the producer. Firms will know that if they pass on the tax to consumers, they will buy a lot less of the good.

If the good is perfectly elastic, the producer pays all the tax.

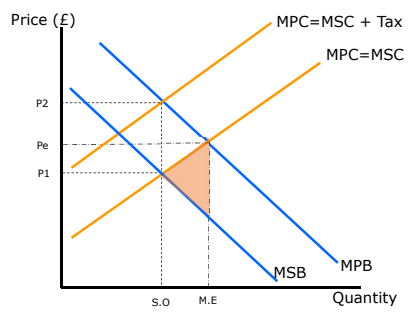

Internalising a negative externality using a tax Price (£)

A negative externality of consumption is demonstrated by the shaded welfare loss.

To internalise the externality a tax (specific indirect tax) is used. This changes MPB=MPC to an equilibrium in line with the socially optimal output.

Importantly, the tax is also paid for by the producers of the good and the consumers of the good and not by the third party.

To internalise a negative externality of production using a tax it isn’t necessary to add any additional curves. You simply tax as far as the MSC.