Econs

Economics is the study of the ways individuals and society decide to use scare/limited resources to satisfy their unlimited needs and wants

Micro

Focuses on the decisions of individual, households, firms and industry

Ceteris Paribus - all other things constant [everything else stays the same except for the change]

Economic Problem - limited resources to satisfy unlimited needs and wants

Opportunity Cost - next best alternative forgone

Questions when Decision making:

What to produce?

How to produce?

How much to produce?

Whom to produce for?

PPF - possible combinations of goods/services that can be produced

Consumer Good: immediate goods

Capital Good: investments to increase economy

Assumptions of PPF:

Resources are fixed

Economy is operating at max capacity and resources are utilised efficiently

Technology is fixed

There are only 2 types of goods

Points on PPF:

If inside PPF the economy isn’t maximised and resources aren’t being allocated effectively

If outside PPF it is an impossible point as resources are already maximised with current resources so there isn’t a possibility to reach that point without a change

If on curve economy is maximised

Market

Market Economy | Planned Economy | |

Definition | An economy that allocates resources primarily through the interaction of individuals and firms | Economic system run by central authorities rather than market participants |

Ownership | Producer | Central Authorities |

Decision Making | Decentralised | Centralised |

Incentives | Profit | N/A |

Price & Wages | Producers and Market | Central Authorities |

Income Distribution | Wider disparity or income inequality | Smaller income inequality [gov control] |

Personal Freedom | Large amount of freedom to produce and consume | minimal freedom to produce and consume |

Consumer Choice | Many diverse choices available in market | Limited choices given by central authorities |

Examples | Australia | North Korea |

A market is where buyers and sellers exchange goods & services & resources

Product Market | Factor Market | |

Definition | Marketplace in which a final good or service is bought or sold | Market where factors of production are bought or sold |

Who Demand | Consumers | Producers |

Who Supply | Producers | Consumers and Producers |

What is sold/bought | Good/services | CELL |

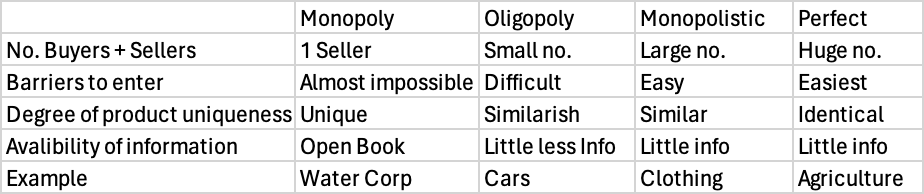

Classification of Competition:

no. of firms

degree of similarity in product

ease of entry and exit

no. of buyers and sellers

Competitive: Interaction between buyers and sellers where sellers are the price takers e.g. pasta

Non-Competitive: Little to no competition where sellers are price makers e.g. watercorp

Demand: Buying intentions of consumers where they are willing and able to buy at a particular price at the time

Law of demand: as price increases, demand decreases, vice versa

Inverse relationship

Income effect: price ↑, demand ↓ because of ↓ in purchasing power

Substitution effect: price of one good ↑, other goods become more attractive

Normal goods | Inferior goods | |

Definition | one where demand increases as income increases (most goods in the economy) | Good where demand decreases as income rises |

Example | ice cream | Home Brand (woolies) |

↑ in disposable income | Increase in demand | Decrease in demand |

Substitute goods | Complementary Goods | |

Definition | Pairs of goods that are used in place of each other | Goods that are purchased & used together |

Example | Sausage or Burger | Computer & computer program |

Situation | Price of burgers rise people will buy sausages instead | Price rises for computer less people will buy both |

Price Factors (Movement)

increase in price: contraction

decrease in price: expansion

Non-Price Factors (Shifts) [increase and decrease]

Level of disposable income - income increases, demand increases

Price of related goods - substitute goods at lower price people buy it instead

Interest rates - low rates means more spending or borrowing

Number of buyers - ads, wealth and health impact buyers

Taste/Trends/Consumer preference - taste change, demand change

Consumer expectations - expectation that price ↑ in future, demand ↑

Supply: Quantity producers are willing and able to produce at a particular price at a time

Law of Supply: as price increases supply increase, vice versa

Proportional relationship

Individual Supply | Market Supply | |

Definition | Supply of a singular producer | Supply of all producers in market |

Example | Ice cream from a particular producer | All supply of ice cream |

Price Factors (Movement)

increase in price: expansion

decrease in price: contraction

Non-Price Factors (Shifts) [increase and decrease]

Input price/Cost of production - increase in cost decrease in supply

Technology - improvement in tech, decrease cost, increase supply

Expectations - increase in price in future = decrease in current supply

No. of sellers - increase in sellers = increase in supply

Market Equilibrium: occurs when consumers and producers come together and exchange a mutually agreeable quantity at a mutually agreeable price

Shortage - price is lower than the =

Surplus - price is above the =

Price Mechanism: Adam Smith, father of Economics, talked about how free markets can motivate individuals, acting in their own self-interest, to produce what is societally necessary aka the invisible hand or price mechanism.

Elasticity

Finding Elasticity Equations

The Point Method

(ΔQ/Qi) / (ΔP/Pi)

%ΔQ/%ΔP

The Midpoint Method

(ΔQ/Qav) x (Pav/ΔP)

PED: Measure of how demand reacts to change in price

Price Elasticity of Demand: shift is demand for a good or service when changes happen on a variable that consumers consider apart of purchasing decision

Businesses and the Government follow PED as it is an indicator to price

PED Value | Name | Situation to price change |

PED = 0 | Perfectly inelastic | No reaction - demand doesn’t change |

PED < 1 | Relatively inelastic | Minimal reaction - small change in QD |

PED = 1 | Unitary elastic | Equal reaction - change price = change quantity |

PED > 1 | Relatively elastic | Large reaction - change in price < change in quantity |

PED = infinity | Perfectly elastic | Infinite reaction - price doesn’t change |

Factors affecting PED

Necessities |

|

No. Substitutes |

|

Habits formed |

|

Time to react |

|

Definition of Market |

|

Income Spent |

|

Complementary Good |

|

PES: change in supply relative to change in price

PES Value | Name | Situation to price change |

PES = 0 | Perfectly inelastic | No reaction - demand doesn’t change |

PES < 1 | Relatively inelastic | Minimal reaction - small change in QS |

PES = 1 | Unitary elastic | Equal reaction - change price = change quantity |

PES > 1 | Relatively elastic | Large reaction - change in price < change in quantity |

PES = infinity | Perfectly elastic | Infinite reaction - price doesn’t change |

Factors affecting PES

Time |

|

Nature of Industry |

|

Ability to store inventory |

|

Government Taxing

Elastic goods are unlikely to be taxed compared to inelastic goods due to revenue

Elastic goods cause Producer Tax index - producers taking on the burden of tax

Inelastic goods cause Consumer Tax index - consumers taking on the burden of tax

DWL (dead weight loss) is causes by tax as it is a loss of max efficiency which was avoidable

TS (total surplus) is decreased with tax as CS [consumer surplus] and/or PS [producer surplus] decrease

Governments tax to increase revenue

Price discrimination

Businesses change their prices for different times/groups for customers

Women haircuts > Men haircuts

Uber at night > Uber at day

Market Efficiency

Producing goods/services that are desirable to consumers at lowest cost

Not possible to make someone better off without making someone worse off

Utilising scarce resources to make best possible decisions

All information is included in price so market isn’t overvalued or undervalued

Marginal Benefit: Max price consumers willing to pay for an additional good

decreases as more goods are added as enjoyment/benefit decreases

Can also be known as the price in demand curve

Marginal Cost: Min amount producer willing to sell for additional cost for + unit

Increases as more units are made

MC > Price producers will stop supplying

Consumer Surplus: Max amount consumer willing to pay vs what they pay

CS > CE (consumer expenditure) increase in consumer welfare

Max - actual

Producer Surplus: Min amount producers are willing to accept vs what they receive

$ ↑, PS ↑

PS > Cost of Production, ↑ economic welfare

Total Surplus: Measure of economic efficiency

TS = TPS + TCS

TPS = ½ (Actual - min) x Q

TCS = ½ (Max - actual) x Q

Deadweight Loss: avoidable decrease in TS, preventing production of optimal output

If market has DWL it is failing

Government Policies in Reducing Efficiency

Government reduces market efficiency to trade off for social benefit, equity and much more

Market Restrictions

Limits supply

Taxi licenses

→ reduce congestion and pollution

Price Control

Price Ceiling

→ Maximum price below equilibrium to protect consumers

→ Medicine

→ Rent

Price Floor

→ Minimum price above equilibrium to protect suppliers from sellers

→ Milk

Taxes

Raise revenue for government to improve efficiency of economy

Tax is added to supply such as cigarettes

GST

Subsidies

A cash payment from government to business to encourage the production of goods an services (grant to firms)

→ shift to right as it reduces cost of production

Reduce pressure to improve efficiency in future

Market Failure

Occurs when resources aren’t allocated efficiently (TS isn’t maximised)

Government intervention:

Improve efficiency

Influence the nature of price

Respond to fluctuation in economic growth

Types of Market Failure

Market Power

only seller

price setters

product differentiation

Government intervention

→ ACCC prohibits price fixing and collusions [consumer law]

→ collusions reduce competition and increase profit

→ legislate, regulate

Externality

when there are costs or benefits imposed on a third party that is not involved with the economic transaction

Private cost: cost incurred by producer and consumer

Social cost: cost on third party external to price mechanism

Private benefit: benefits reaped by producer and consumer

Social benefit: benefit society has, external to price mechanism

Within the 2 different types of externality it further splits into consumption and production externalities

Negative Externality

→ Production or consumption of a good or service that indirectly causes harm to third party e.g. smoking or pollution

→ Causes overconsumption and overproduction impacting peoples health through secondhand smoke and it harms the environment with ↑ CO2

→ PC<SC

→ Government intervenes with 2 types of policies:

Market Based

→ Taxing CO2

→ Taxing Cigarettes by certain percent each year

Command and Control

→ Regulating what age, demographic and groups can use product

→ Banning where product can be used

Positive Externality

→ Production or consumption of a good or service that indirectly benefits a third party e.g. beekeepers or vaccines

→ There is underconsumption and underproduction as the market is unable to see the benefits to third parties such as herd immunity and pollination

→ PB<SB

→ Government intervenes with 2 types of polices:

Market based

→ Subsidising the cost of production to producers to increase production

Command and Control

→ Making it mandatory for certain ages, demographics and people to have it

→ Prioritising the licenses needed

Characteristics of goods

Rival Goods: by using good/service it effects other people using good or service

Excludable Goods: good can only be used by person who bought

Public Goods

→ Non-rival, non-excludable

→ Parks

→ private firms refuse to pay for these goods as they can’t be monetised and there is no profit from it

→ Governments pay for these goods as they benefit society

→ Problem with it is there are free riders who don’t contribute to the good but take advantage of it

Private Goods

→ Excludable, Rival

→ Household goods

→ People go buy things at the shop which cannot be used by others as they own the item

→ By buying the item it reduces the stock for others

Club Goods

→ Excludable, non-rival

→ Netflix

→ People buy good that others can’t use as it is theirs

→ By someone purchasing good it does not impact another purchasing good as their isn’t a set supply

→ Government can allow companies to set price above marginal cost levels

Common Resources

→ Rival, non-excludable

→ Ocean - fishing

→ Tragedy of the commons

→ Fish are free to get from the ocean but people become greedy and take more it will deplete the population of fish meaning others can’t take the same amount

→ Governments restrict the time, area and amount of fish people can take to protect the species and make sure there will be some in the future

→ There are people who disregard these laws made and it negatively impacts others

Macro

Focuses on total economic activity and performance on a whole

What it includes:

GDP [gross domestic production] - target rate of 3.5%

Price Stability

Measured with CPI

Inflation should rise by 2-3% each year

Unemployment rate - 4-5%

Equitable income distribution

Measured using Gini coefficient in Lorenz curve

Efficient resource allocation

Maximising output to achieve allocative/production efficiency

Aggregate Demand

Total amount spent in economy over a particular time period

Aggregate Supply

Total value of final goods+services produced over a period

Participants in economy

Households

Firms

Government

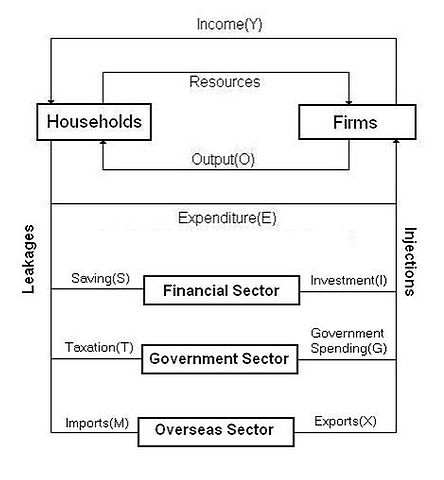

Circular Flow of Income

Basic Circular Flow Assumptions:

households spend all income

all output is sold

no savings

no government or overseas sectors

Circular Flow Assumptions:

Financial Sector

businesses can only invest and borrow while households can only save

investments are capital goods

banks attract surplus funds from savers by offering interest rates and make funds to borrowers at high rates

Government Sector

gov employs approx. 20% of workforce

taxes improve social welfare

Overseas Sector

drives economic growth around world

exports - purchase of goods and services from other countries

2 Flows

Real Flow - movement of physical resources from HH to firms

Money Flow - flow of [E , S , I , T , G , X , M]

Markets

Factor/resource - Resources sold by HH to firms

Product - goods + services sold by firms to HH

Financial - lenders/savers/borrowers meet at bank

Overseas - trade

Economic activity measured

Aggregate Output - value of real flow leaving firms

Aggregate Income - value of money flow entering HH

Aggregate Spending - value of money flow entering firms {C+I+G+(X-M)}

Equilibrium

Level of economic activity is stable

TL = TI [S+T+M = I+G+X]

No change in activity

Disequilibrium

Income and expenditure is impacted by L and I

TL > TI , AI decreases, C decreases, economy slows

TI > TL , AI increases, C increases, economy increases

Impact

TL > TI output will decrease, employment will decrease, less jobs being occupied causes economy to fall as less is being bought as income has decreased, this causes a contraction in the economy

TI > TL employment will increase, output will increase, more jobs being occupied causes a boost in the economy as more people are having a higher income which causes more to be consumed which causes an expansion in the economy

Adjustments

increase in injection leads to an increase to adjustments reaching increase in income I > L

increase in leakages leads to adjustments decreasing income L > I

creates a new equilibrium

equilibrium is a theoretical concept [ Y = C + S ] because income can only be used for spending or saving

Aggregate Expenditure

AE = C + I + G + (X - M) = GDP

Total spending in economy

Aggregate Demand

We study the change in level and why they vary so economic activity can be explained snd managed

Total amount spent in economy over a particular time period

Consumption: Total spending on goods and services by HH

Composition in AE is 55%

3 Types of Goods and Services

Durable {15% composition}

used for 3+ years e.g. washing machine

Non-durable {35% composition}

short period of time e.g. milk

Services {55% composition}

can’t touch product e.g. insurance

5 Factors Affecting C

Disposable income

increase in disposable income leads to increase in consumption as people are more willing to more make purchases as there is less financial burden

Cost of Credit and Availability of Credit

increase in interest rates means a decrease in consumption as people are saving more and less borrowing is occurring

Stock of Personal Wealth

assets on hand [e.g. house] increase, people spend less frugally

Expectations

expected increase in income people are more willing to spend more increasing consumption

Government Policy

Fiscal Policy

if government want so increase EG they use expansionary fiscal policy by decreasing taxes to increase spending

Income: Income available to an individual after payment of tax

Government Expenditure: Total spending on goods and services by government at local, state and federal levels

Composition in AE is 25%

Government injects around $400 bn every year to overcome the impact COVID had

2 Types of Gov Spending

G1: day to day spending that has to happen e.g. schools, healthcare

G2: expenditure to stabilise the business cycle e.g. investment

Decided Upon by Budget

Structural Expenditure

allocative expenditure, providing public resources to transfer to households to provide social security e.g. schools

Cyclical Expenditure

changes with the business cycles

2 Factors Affecting Gov Spending

Where we are in the business cycle

economy in trough, expansionary fiscal policy, increase in eg

economy in boom, contractionary fiscal policy, decrease in eg

Political Ideology

Labour: increases government spending

Liberal: decrease government spending

Depends on different party in power

Net Exports: Income earned by exports minus the imports spending

Composition in AE is -3% to 5%

Trade Balance

Either deficit or surplus

Currently Surplus [E>M]

4 Factors Affecting Net Exports

Where we are in the business cycle

upswing/boom, increase in Y, M elastic, trade deficit

downswing/trough, decrease in Y, M inelastic, trade surplus

The business cycle for business partners

trading partners increase, exports increase, trade surplus

vise versa

Exchange Rate

dollar value increases, X decreases, M increase, trade deficit

vise versa [deprecates]

Terms of Trade

ratio of export price to import price

TOT increase, trade balance improves

Private Investment Expenditure: Purchase of capital/investment by firms to increase ability to produce output

Composition in AE is 16% to 25%

Planned Investment

Spending on producer or capital goods that are used by businesses to produce final goods and services

Fixed investment: equipment, buildings, construction

Residential fixed investment: new housing

Working Capital: stocks and inventory

Refers to change in capital stock

When businesses change the level of planned investment all other equal things AE and AD changes creating a new equilibrium

5 Factors Affecting Investment

Degree of Uncertainty

as it increases firms are less likely to invest [political, overseas, change in tastes]

Real rate of Interest

Real Rate of Interest excludes inflation and shows firms the real value of money that needs to be paid back based on the base year it can be found [nominal rate of interest - inflation]

increase in real rate of interest, investment becomes expensive and less profitable meaning there will be a decrease in investment

Business Expectations/Confidence

confidence in economy increases, investments increases

Profit Levels of the Business

increase in profit, increase in investment

Government Policies such as Fiscal Policy

changes in taxes and gov spending can incentivise firms how to invest

decrease in taxes leads to increase in investment

Economic Growth

Increasing the capacity of an economy to satisfy the growing needs and wants of the population

GDP in the Circular Flow of Income

Market value of output = spending = income received = wages = profit

Resources match money so we can track what is going on (equal and opposite)

all output is sold at market price (market value = spending)

total spending = total income

total output = total spending = total income (measure of value of GDP)

GDP

Market value of all final goods and services produced within a period of time in an economy

includes stock regardless if sold or not as it is produced

AE = GDP = C + I + G + (X - M)

C: HH [including rent]

I: inventories

G: transfer of money between groups

(X - M): net value of exports - import

Benchmark to compare country size and productivity

Can add up all the total output of all businesses to measure

O: 84% of GDP is services and manufacturing is declining

Y: allows us to see if living standards are increasing as it shows GDP per Person

also shows where the money is going

2 sides to transaction

capital gain/losses are not counted

PPF

Moving along curve shows opportunity cost as an increase production of consumer goods, decrease in capital goods [vice versa]

Shift outwards demonstrates economic growth as there is a increase in potential output e.g. increase in resources or technology

APF [Aggregate Production Frontier]

The relationship between input and GDP

Total production in economy

Shows efficiency of economy by measuring the output per input

Increasing the input does not increase the output per input, it moves along the curve

When efficiency increases output increases per input and the APF model moves upwards e.g. technology has improved

Proportional relationship between output and input [other factors are constant]

Determines max quantities

Changes in production are subject to the law of marginal returns

Law of Diminishing Returns

an additional amount of a single factor of production will result in a decreasing marginal output of production [other factors are constant]

Capital widening when the efficiency is maintaining an increase in economic activity aka consumer spending

Capital deepening when efficiency increase, economic growth increases due to an increase in supply

Limitations of GDP

Prices are not the value

GDP is the market value but things are constantly sold below the value so GDP is greater than what it actually should be

Non-market activities [HH] production not included

GDP only measures what market goods and services that are sold which excludes HH work like laundry ect.

Shadow economy is missing

Excludes off the book work like babysitting and excludes illegal activities such as the black market

Environmental Damage

Pollution is ignored and natural resources have no value

Leisure doesn’t count

Increase in work, increase in money, decrease in quality of life as leisure decreases

GDP ignores distribution

Views income as the same for everyone ignoring some are better and worse off

Measure of Living Standards

GDP per person measures average income of a country, increase incomes, increases investing to education, healthcare, etc

Real and Nominal GDP

Nominal is GDP in todays prices (total production at market value)

Inflation makes GDP increase even when the actual production hasn’t changed and same amount is produced

Real is GDP is constant prices

Inflation is excluded

GDP due to change in output [isolates economic growth]

Measures change in production

When we use 1 year price to calculate it is called the base year

Economists adjust nominal GDP for price changes to obtain a measure of real GDP, they ‘deflate’ nominal GDP using price index

Equations

Real GDP (YR 2+) = NGDP 2 x (CPI 1 / CPI 2)

%ΔGDP = [(GDP2 - GDP1) / GDP1] x 100

Real Rate % = %ΔGDP - CPI%

%ΔNGDP = %ΔRGDP + %Δincome

GDP per Capita = RGDP/population = $ per person

Factors Contributing to Economic Growth

Potential rate of economic growth over time is determined by the stock of natural, human and capital resources used to produce [qualitative and quantitive]

Depends on willingness to buy goods/services

Illustrated with APF

Benefits of Growth

Material living standards increase

higher goods and services

higher income

higher employment

creates further growth via multiplier k

Fiscal dividend

rise in output

income and spending increases, tax payments used to improve public and merit goods and services

Cost of Growth

Inflation risk: AD > AS

Environmental concerns: air quality

Damage to Social Welfare: excess consumption increases

Income and wealth inequality

Structural changes + structural unemployment: may become overly dependent on one sector

Source of Economic Growth

Sustained economic growth must come from demand side and supply side

D economic activity can increase by:

Fiscal Policy

Monetary Policy - RBA reduces interest rates to increase consumption and investment

S economic activity can increase by:

Increasing use of resources

Finding better resources

Use resources more efficiently

Make labour more productive via capital

Invest in human capital

Increase education and training makes labour force more efficient, motivated, skilled and productive

Relation Between AD and Economic Growth

AD and AS need to increase to achieve economic growth

without AD

investments are low

depreciation in capital stock

lower levels of tax revenue

decrease in labour force

fall in international competitiveness

Inflation

Unemployment

Business Cycle

Income Distribution

Government redistributes income to support and maintain a minimum standard of living (40% of spending/budget used)

Role of Government in a Modified Market Economy

Provision of goods and service

Provide without profit

Private firms have no incentive so govt takes over providing these as they benefit people

Street lamps, education, healthcare

Redistribution of Income

The government uses progressive tax (personal income tax) to redistribute income within the country

Income can be redistributed while wealth can't really (Inheritance cannot be taxed in Australia)

The higher income earners take majority of the burden with the highest tax bracket being $190K and up with it claim a ≅ 45% of income

The government then uses this for welfare such as jobseeker

Regulation of Business Enterprise

ACCC - Australian consumer act, ceilings and floors

Used to have fair competition and protect consumers (rules against anti-competition)

Macroeconomic Management

Fiscal policy is used by the government to increase or decrease the flow of money in the economy by either increasing or decreasing taxes and spending

This was introduced in the 1940s to help with the fluctuation in the business cycle

Redistributive Role

Welfare benefits (pension/jobseeker)

Progressive taxes

Provision of essential goods/services

Public housing, education, healthcare

Reduces burden on people, leaving more for spending on discretionary goods

Compulsory Superannuation

Employers are required to put a % of income into a superannuation account which employees can access when they are over the age of 67.

This improves equity and allows elders to have a decent living standard when they retire

Causes of Income Inequality

- Mobility of Labour

- Ease of movement between occupations or geographic regions

- Primary Labour Market

- Little to no likelihood of unemployment e.g. doctor

- Secondary Labour Market

- Frequent unemployment, casual employment and low/declining wages e.g. waiter

- Relative Poverty

- Situation where income/lifestyle is below minimal/average living standards

- Unemployment

- long-term or permanent loss of job e.g. bank tellers

- Underemployment

- employed less than full time or inadequate amount in respect to economic needs

Income VS Wealth

- As income increases the capacity to have greater wealth increases

Income is the flow of funds

Majority of households have at least one income with some households also receiving transfer payments from the government

Once direct and indirect payments are applied HH are left with disposable income

Direct Tax: personal income tax

Indirect Tax: GST

Many HH receive some form of indirect benefits e.g. education, healthcare

Wealth is the stock of assets

It refers to the current value of assets a HH has accumulated overtime

This can be through savings, investment, business profits and inheritance

Defined as the difference between HH assets and its liabilities

Assets generally are as property, shares, savings

Liabilities are generally loans, mortgages, debt

Distribution of Income

- Very few Aussie live in absolute poverty (basic needs)

- 20% Aussies live in relative poverty (just below minimal living standards)

Income Redistribution

- Key elements of income redistribution

- Direct Taxation - Progressive tax

- Spending Powers - Direct Transfer (40% of budget)

- Indirect Payments - Public Services