What is FinTech - LinkedIn Learning

FinTech is emerging and rapidly growing areas like blockchain, robot-advising, AI, online lending and crowdfunding. These can disrupt traditional finance and this leads to increased focus on it.

FinTech impacts investment advisory services, trading stocks, blockchain (trade settlements, online marketplace lending, capital/business formation

Regulation within FinTech is limited right now as it is built for the old system, were technology is not so much involved. This leads to issues for investor protection, SEC rules built for the old era.

As of 2019, it has not lead to an impact but it will in the future (now)

Algorithmic/Computer-driven Trading

Makes of over 90% of trades on the stock market

Human being a stock picker is old and the role for humans is now in designing algorithms to make these algorithmic trades

Algorithmic trading can be either market making (attempt to capitalize on the bid-ask spread, high-frequency traders) or data mining (based on patterns and data, looking at stock prices and other data points and capitalizing on them)

Blockchain

21st century version of a ledger book.

A blockchain is a distributed secure logfile that is protected by a super-secure username and password and it contains a complete record of every transition on the blockchain

First popularized as a behind the scenes tool for bitcoin

Blockchain underlies in every digital currency. Blockchain can speed up assets transfer

Blockchain Mechanics

Similar to Wikipedia. People can write entries into a record of information, and a community of users can control how the record of information is amended and updated. Blockchain automated this process to make it faster and simpler

What is Bitcoin?

The first successful peer-to-peer digital currency

Bitcoin comes with a build-in ledger, the blockchain, which records all of the transactions that occur. This is a public ledger of transactions

Built-in auditors/accountants called ‘miner's. Mining is to make sure the system is working and no counterfeit is occurring

Three Parts of Bitcoin

Private key cryptography

A distributed network with a shared ledger

Auditing of transactions (mining)

Features of Bitcoin

Deflationary, as the number of users grows the number of bitcoin grows at a slower pace

Divisible to 8 decimal places

Minimal transaction fees

The fees get paid out to the miners, voluntary fees but you pay to ensure your transaction gets reviewed

Consensus driven - no central authority

Counterfeit resilient

Cognitive Tasks Performed by AI

Natural language processing, knowledge representation, automated reasoning computer vison and machine learning

AI advantages

Efficiency, fast, good at solving new problems, good at dealing with information overload and organizing/processing it into knowledge

AI disadvantages

Costly upfront, slow software development, in 2019 few practical products

AI Impact of Industry

Chatbots that are AI-powered

Intelligent personal investment products

CFA exam has added a AI section

Companies are spending heavily on AI

What is AI?

AI is a branch of computer science focused on the automation of intelligent behavior

Intelligence is flexible responses rather then mechanical behavior. Having the ability to adapt to ambiguous or contradictory messages

It has to be able to assess relative importance of different elements of a situation (for example, quality vs. price)

Find similarities between situations despite difference’s which may separate them (find two dogs in two different pictures)

Ai should be able to draw distinctions between situations despite similarities

What is Robo-Advising?

The use of automation and digital techniques to build and manage portfolios of exchange-traded funds (ETFs) and other investments

Current capabilities are basic, uses surveys to allocate assets

The portfolio gets monitored, rebalanced and reported on

Robo-Marketing

Fills a void are millennials, a low-cost way to invest in the markets

Robo-Advising in the works

Creates a survey with a survey to create a portfolio

Age, risk-tolerance, international stocks, national stocks, research/knowledge on topic, bonds, small cap vs large stocks, how much to invest and savings to invest in the future

Creates a variety of ETFs that are recommended to invest in

The parameters that are required by robo-advising needs to set-up by humans and then the robo-advisier can use it to make recommendations

AI can be used to watch the market change and then make adjustments to the robo-advising recommendations

This allows for automated portfolio rebalancing, reinvesting and watching of the stock market to have the best investments

Online investing and lending company’s are a great example of FinTech as they use online money that other people have invested to put into other loans. Everything has tons of data as its mostly automated and focus on transparency

The rise of online lending and crowdfunded-based lending

Using AI within excel called Ideas

Cryptocurrency

Act as a medium of exchange

No centered agency/government baking

No physical form, in digital wallets

Nealy impossible to duplicate

Created and stored using blockchain

Transactions and transfers are anonymous

Finite supply, for example Bitcoin will only create 21 billion max and each year it will release few and fewer

Cryptocurrency Investing

Crypto ETFs may be coming in the future (looks like there is now)

Limited investing offers

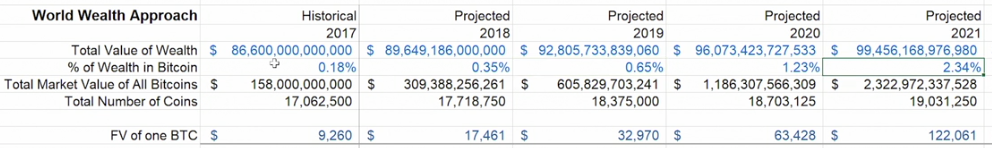

The worth of cryptocurrency can be grey and not have an exact method of determining it. Exchange rate is difficult.

Valuing crypto can be done a few ways, based on financial models that can vary based on different approach’s

Very risky trades

Using a crypto website allows for trade, for example, bitcoin but this if not a trader this can be difficult as we don’t have all day to watch the market. This leads to turning to algorithmic trading

A computer program can do the trading for you though AI automation and use a financial model that is we are confident in

Blockchain in a Nutshell

Shared ledger + consensus to help with auditing + cryptography + shared contract

Has shifted to smart contracts (smart legal contracts for example)