The Circular Flow and Grow Domestic Product - Section 3, Module 10

national income and product accounts (or just national accounts) - keep track of the spending of consumers, sales of producers, business investment spending, government purchases, and a variety of other flows of money among different sectors of the economy

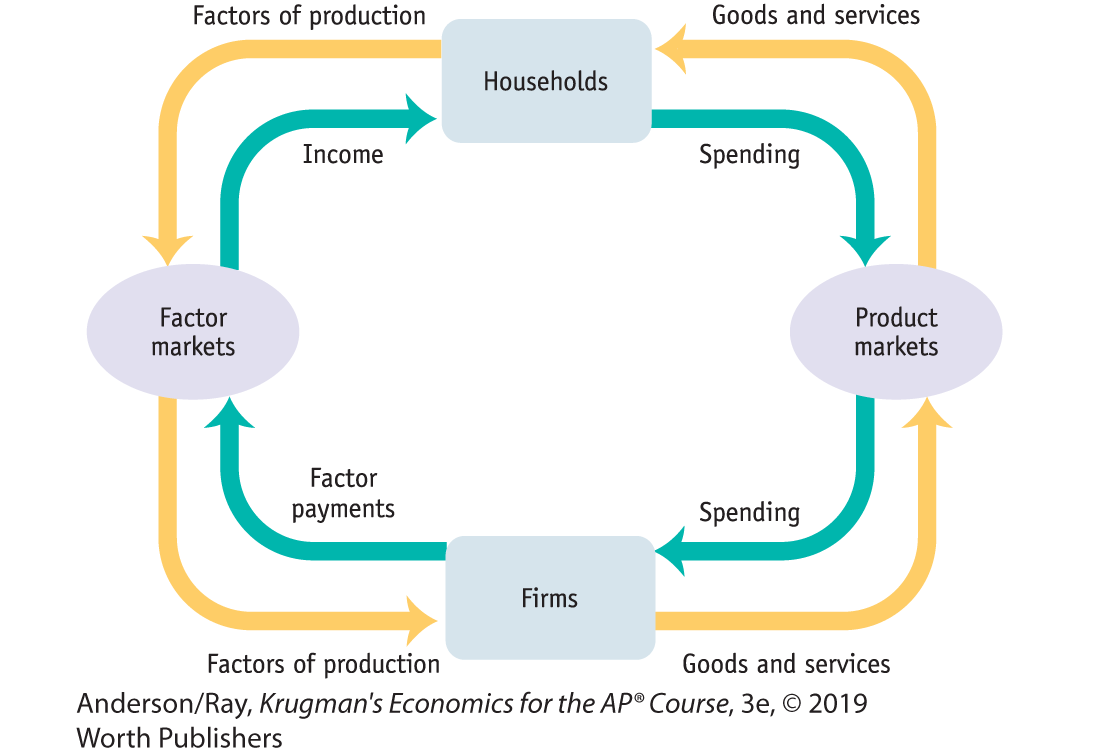

Circular Flow diagram - simplified representation of macroeconomy showing the flows of money, goods and services, and factors of production

simplified circular flow diagram:

shows that economy contains only two groups - households and firms

Households → consists of either and individual or group of people who share their income

Firms → an organization that produces goods and services for sale and that employs members of households

two kinds of markets

product markets - where households buy the products they want from firms

consumer spending - household payments for goods and services

flow of goods and services to households and money to firms

factor markets - firms buy the factors of production (resources)

households own/receive income from selling the factors of production

income from labor, rent, interest, profit, wages

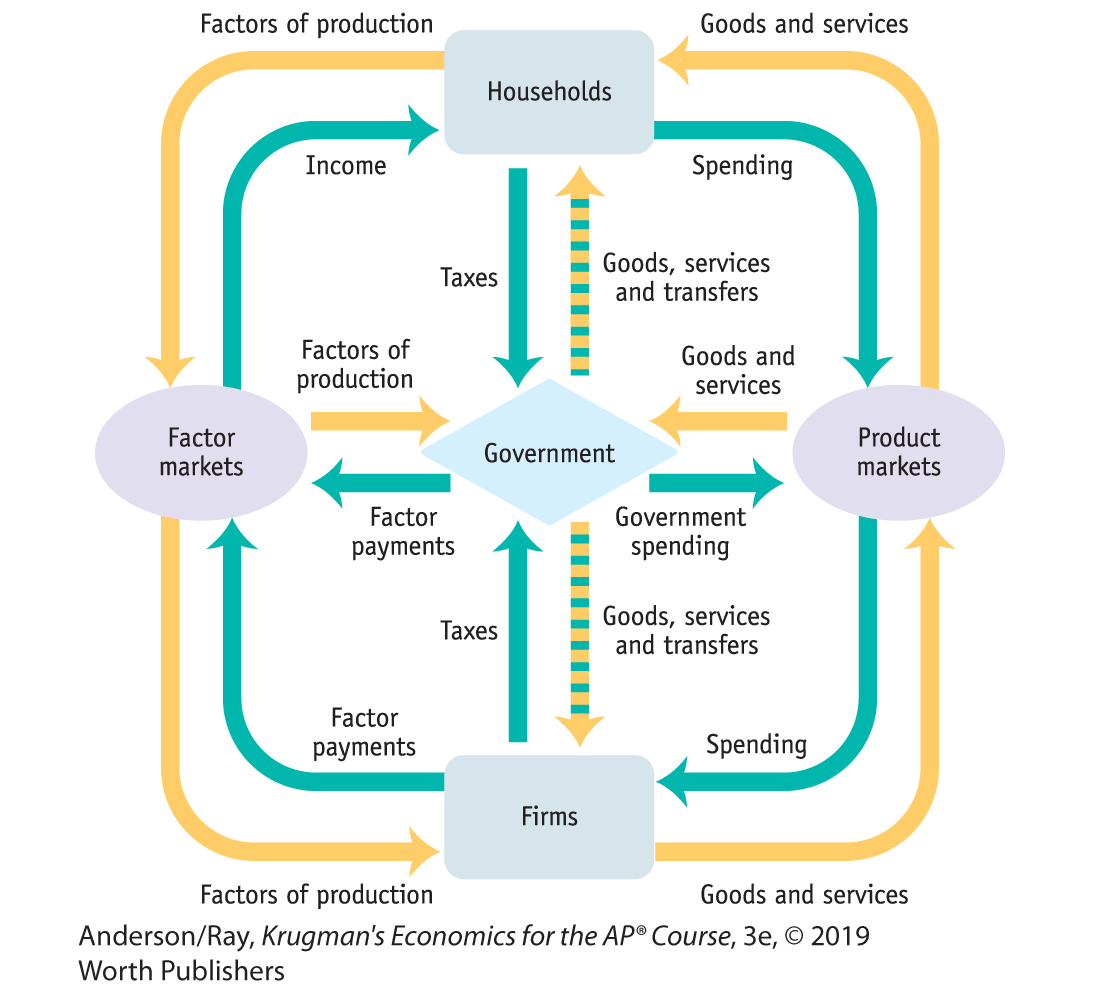

expanded circular flow diagram:

same as before, but flows to and from government is also added

government injects funds through government spending and takes out funds through taxes

government spending - the total of purchases made by federal, state, and local government

Taxes - payments that firms and households are required to make to the government

tax revenue - funds the government receives from taxes

disposable income - the total amount of household income available to spend on consumption (left after taxes)

government transfers - payments that the government makes to households or firms without expecting a good or service in return

circular flow diagram with financial markets

private savings - when households do not spend all of their money on consumption or taxes and there are leftover savings that are not spent, they leak out of the circular flow

frequently held by financial institutions (such as banks) that inject it back into the circular flow through loans

financial markets - channel private savings into government borrowing (borrowed by the government) and investment spending (borrowed by firms)

investment spending includes spending on new productive capital

inventories - goods and raw materials held by firms to facilitate their operations → included in investment spending because they influence the ability of a firm to make future sales (just like investing in new machines, etc)

investment spending also includes construction

Circular Flow with the rest of the world

exports - goods and services sold to other countries

payments for exports lead to an injection of funds from the rest of the world into the US’s circular flow

imports - goods and services purchased from other countries

lead to a leakage of funds out of the US’s circular flow

Foreign Lending - lending by foreigners to US borrowers generates a flow of funds into the US

foreign borrowing = opposite

Gross Domestic Product (GDP) - total value of FINAL goods and services produced in an economy in a given period

3 approaches to calculate GDP:

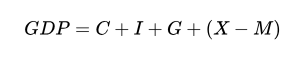

expenditure approach - adds up aggregate spending (total spending on domestically produced final goods and services in the economy → sum of consumer spending, investment spending, government purchases of goods and services, and exports minus imports)

income approach - adds up total factor income earned by households from firms in the economy (rent, wages, interest, and profit)

Value-added approach - surveys firms and adds their individual contributions to the value of each final good and service

Expenditure Approach

most common way to calculate GDP

to prevent double counting, final goods (goods and services sold to the end user) are counted and intermediate goods (goods and services that are inputs into the production of final goods and services) are excluded

To calculate:

net exports - exports minus imports (x-m)

Income Approach

add up all the income earned by factors of production

Value Added Approach

counts only the value added - the value of a producer’s sales minus the value of the inputs purchased from other businesses

input costs are subtracted at each stage