3.4.4 Oligopolies

Characteristics of Oligopolies:

High Barriers to Entry and Exit: Oligopolistic markets often have significant barriers that prevent new firms from entering the industry or existing firms from easily exiting. These barriers can include high capital requirements, economies of scale, patents, and government regulations.

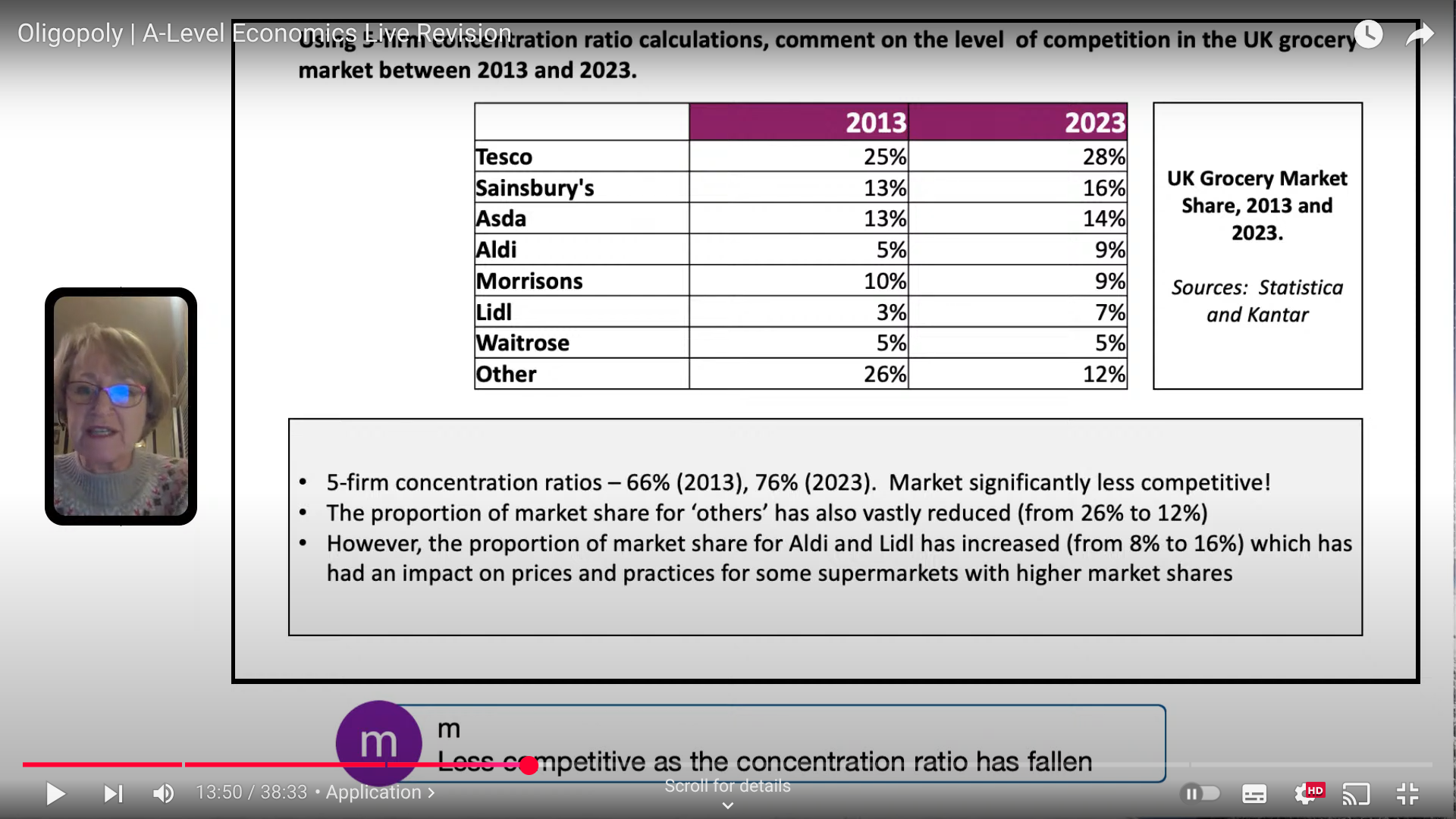

High Concentration Ratio: Oligopolies are characterized by a small number of large firms dominating the market usually 2 - 5. The concentration ratio measures the market share held by the largest firms in the industry, and in oligopolistic markets, this ratio is typically high.

Interdependence of Firms: Oligopolistic firms are highly aware of the actions and decisions of their competitors. They must consider how their own choices, such as pricing and marketing strategies, will affect the behaviour and reactions of rival firms.

Product Differentiation: Oligopolistic firms often engage in product differentiation to distinguish their offerings from competitors. This can include branding, quality variations, and advertising to create brand loyalty.

Reasons for and against collusive behaviour

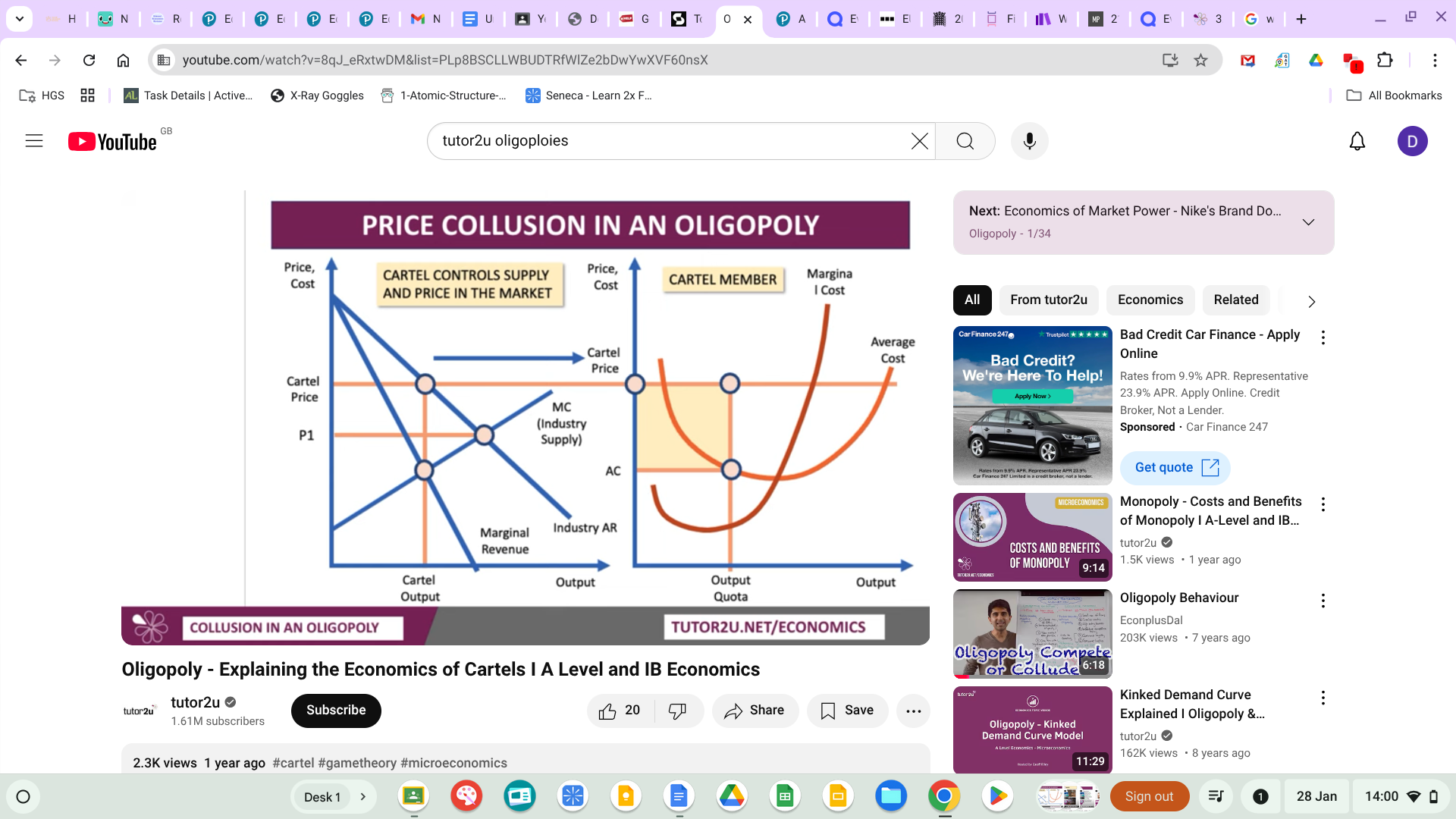

Collusion - Anti competitive behaviour where firms work together to set price or output levels. By working together firms can set higher prices and limit output.

Firms can either formally do this by simply agreeing or they can perform tacit collusion which is where they do this unoffically where they simply follow other firms - more so the price leader

Tacit collusion - i.e. a firm raises their price and other firms follow through price leadership - but more wink wink nod nod

Aim: Joint profit maximisation for all firms involved

They don’t have to compete on price which makes markets more stable and predictable

In a cartel firms are working together to maximise profits for all firms involved rather than just the individual firm

Why would firms do this:

Small number of supplier producing homogenous goods so the output can be easily measured by quotas

High barriers to entry which means small number of firms usually share the same objectives i.e. profit max

However, cooperation IS legal by working together to ensure standards are up to scale on products

Reasons against:

Firms in a cartel may maximise their profit more if they worked individually by expanding output and undercutting - Or competitive pricing

This is usually why cartels fail

As well as the entry of new firms

Oligopoly performance evaluation

Competitive:

If concentration is low and organising collusion when there is lots of firms in a market

New market entry - if this is possible due to the large sums of SNP this makes collusion less attractive

If one firm has large cost advantages i.e. economies of scale - this makes it very hard to collude as naturally they will be able to set prices much lower

Saturated markets - when the only way to get ahead of firms is to increase market share

Pro’s:

You get the static efficency gains: allocative, productive and X

Con’s:

Lose Dynamic efficency

None competitive ( collusion )

When there isn’y many firms in a market this incentivises collusion as it is easier to organise

Similary costs - makes it easier for firms to set prices and quotas

High barriers to entry

Ineffective competition policy

Consumer loyalty / interia - this decreases likelihood of cheating from firms as firms know that consumers may not switch to them

To evaluate talk about pros and cons of monoplies

Collusion and game theory

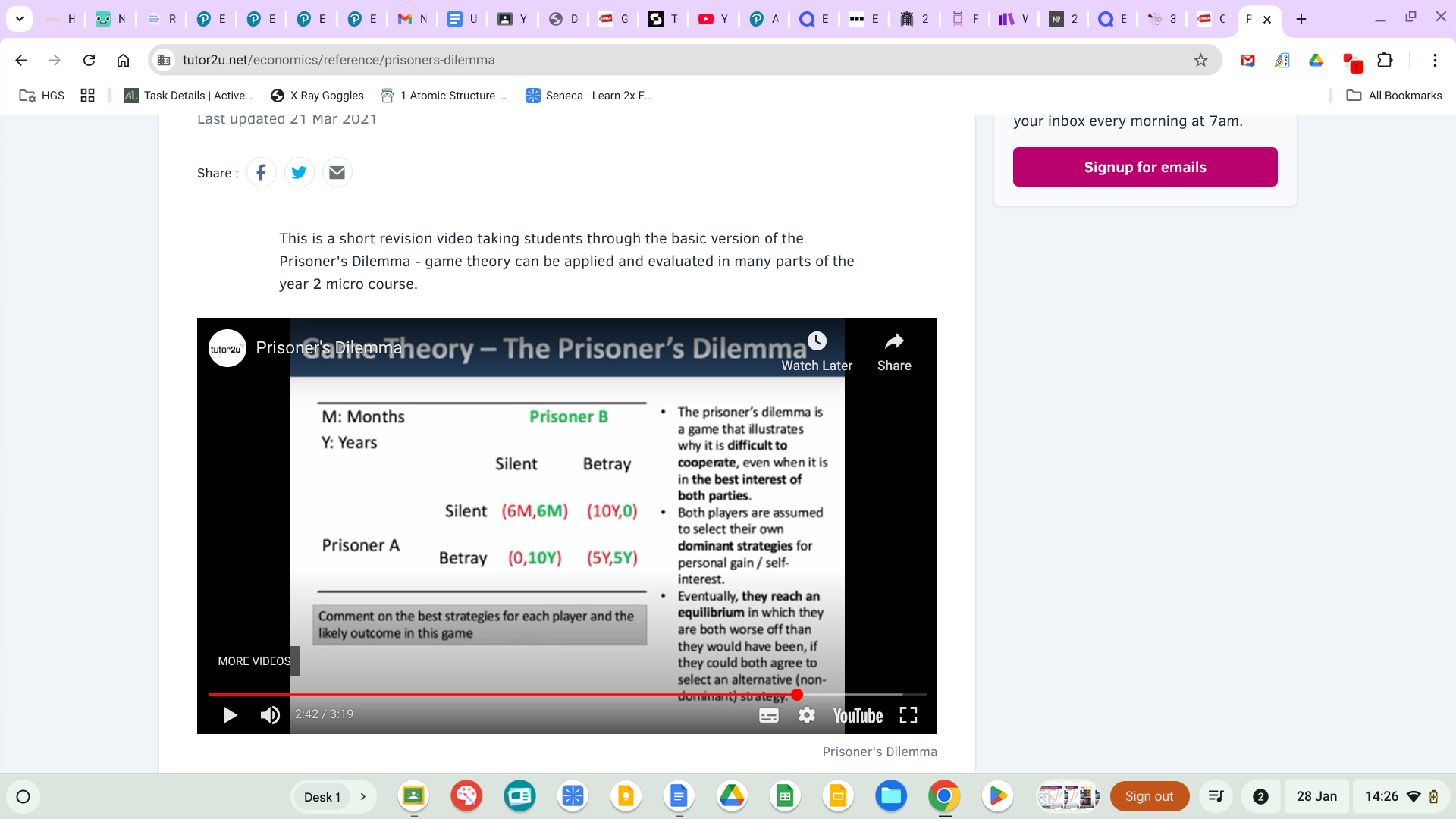

Game theory is looking at the decisions of firms based on the uncertainty of how other firms will react. It illustrates the concept of interdependence. For example, if a firm agrees to collude and set low output – it relies on the other firm sticking to the collusive agreement. If the firm restricts output (sets the High price), and then the other firm betrays its agreement (setting low price). The firm will be worse off.

Collusion and game theory is more complex if we add in the possibility of firms being fined by a government regulator.

Collusion is illegal and firms can be fined. Usually, the first firm that confesses to the regulator is protected from prosecution, so there is always an incentive to be the first to confess.

Dominant strategy – when one choice gives better result than other

Nash equilibrium – where each player has nothing to gain by changing strategy, given the choices of the other player. A Nash equilibrium is not necessarily pareto efficient. Both players could gain from co-operation.

Using the Prisoner's Dilemma in Economic Analysis

The Prisoner's Dilemma can be used in economic analysis to understand and model situations where there is a conflict between individual self-interest and the collective (or social) interest.

Here are a few ways in which ideas drawn from the Prisoner's Dilemma can be applied to economic analysis:

Oligopoly competition: The Prisoner's Dilemma can be used to model oligopoly competition, where a small number of firms dominate in a market.

In this context, each firm has an incentive to maximize its profits, but if all firms do so, it can lead to a suboptimal outcome for the industry as a whole. The Prisoner's Dilemma provides a framework for understanding how firms can coordinate their actions perhaps through tacit collusion to achieve a better outcome.

Firms rational choice where both benefit and is sustainable in the LR is the nash equilibrium which makes no sense to stray from this price - price rigidity

However, this is not the the most profit

BUT if both firms collude they can fix prices and earn the most SNP

Yet there is a high incentive to cheat

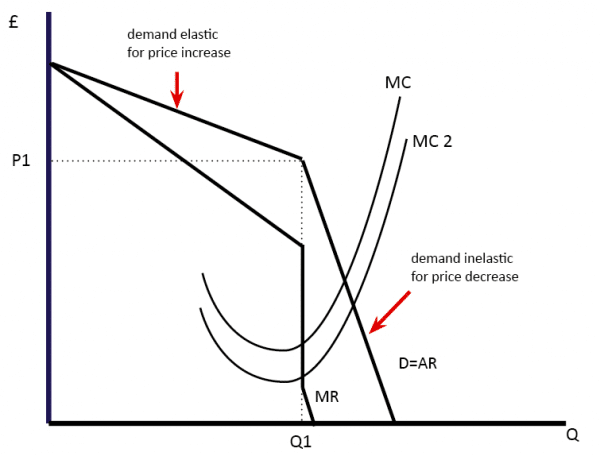

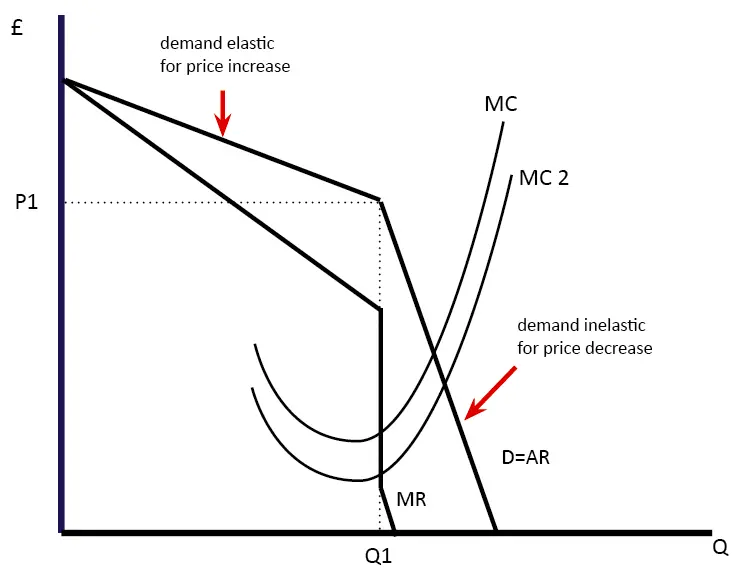

The Kinked Demand Curve

Nicely illustrates inter dependence of oli’s

Firms don’t want to change price

Firms don’t need to change price

All to do with elasticities

If a firm increases its prices from p1 - p2 then the change in QD is going to be more than the increase in price as at this point demand is elastic - this is because all other firms in the market will not increase their prices and undercut this business and therefore they will lose market share therefore revenue

However, if firms decrease their prices quantity demanded will increase less than their decrease in price - pointless - Other firms will react and follow this price change and get into a price war with these firms and result in a price war

Therefore, altering prices makes no sense for the firm - needs to keep it at market price

Evlt:

Just because it’s irrational doesn’t mean firms don’t give price competition a go to try and increase market share i.e. Supermarkets But less likely

Context

Unstuck summaries

1. Definition of Collusion Collusion occurs when two or more firms in an oligopolistic industry cooperate to set prices or limit output, which is typically illegal in many advanced economies due to its anti-competitive nature 1.

2. Types of Collusion

Explicit Collusion: This involves direct agreements between firms to fix prices or output.

Tacit Collusion: Firms indirectly coordinate their actions without explicit agreements, often by following a price leader 2.

3. Legal Framework Governments enforce antitrust laws to prevent collusion, imposing penalties such as fines or prison sentences for involved directors 3.

4. Mechanisms of Collusion

Price Leadership: One firm sets a price, and others follow, aiming for joint profit maximization 4.

Cartels: Groups of firms that coordinate to restrict output and raise prices, exemplified by OPEC and the Canadian maple syrup cartel 5.

5. Economic Implications Collusion can lead to higher prices and reduced output, negatively impacting consumer welfare. The aim is often to achieve monopoly-like profits by restricting competition 6.

6. Challenges to Sustaining Collusion Collusion is often unstable due to:

Temptation to Cheat: Individual firms may undercut prices to gain market share, undermining the collusive agreement 7.

Entry of New Firms: New entrants can disrupt the market dynamics, making it harder for existing firms to maintain collusion 8.

7. Conditions Favouring Collusion Collusion is more likely to succeed in markets with:

A small number of firms producing a homogeneous product.

High barriers to entry that prevent new competitors from entering the market

Context

OPEC: The Organization of the Petroleum Exporting Countries (OPEC) is a well-known example of a cartel where member countries collaborate to control oil production and prices, aiming for joint profit maximization rather than individual profit maximization 1.

Canadian Maple Syrup Cartel: In Quebec, the Federation of Quebec Maple Syrup Producers controls the production and pricing of maple syrup, effectively acting as a cartel to stabilize prices and maximize profits across the industry

Pricing Strategies

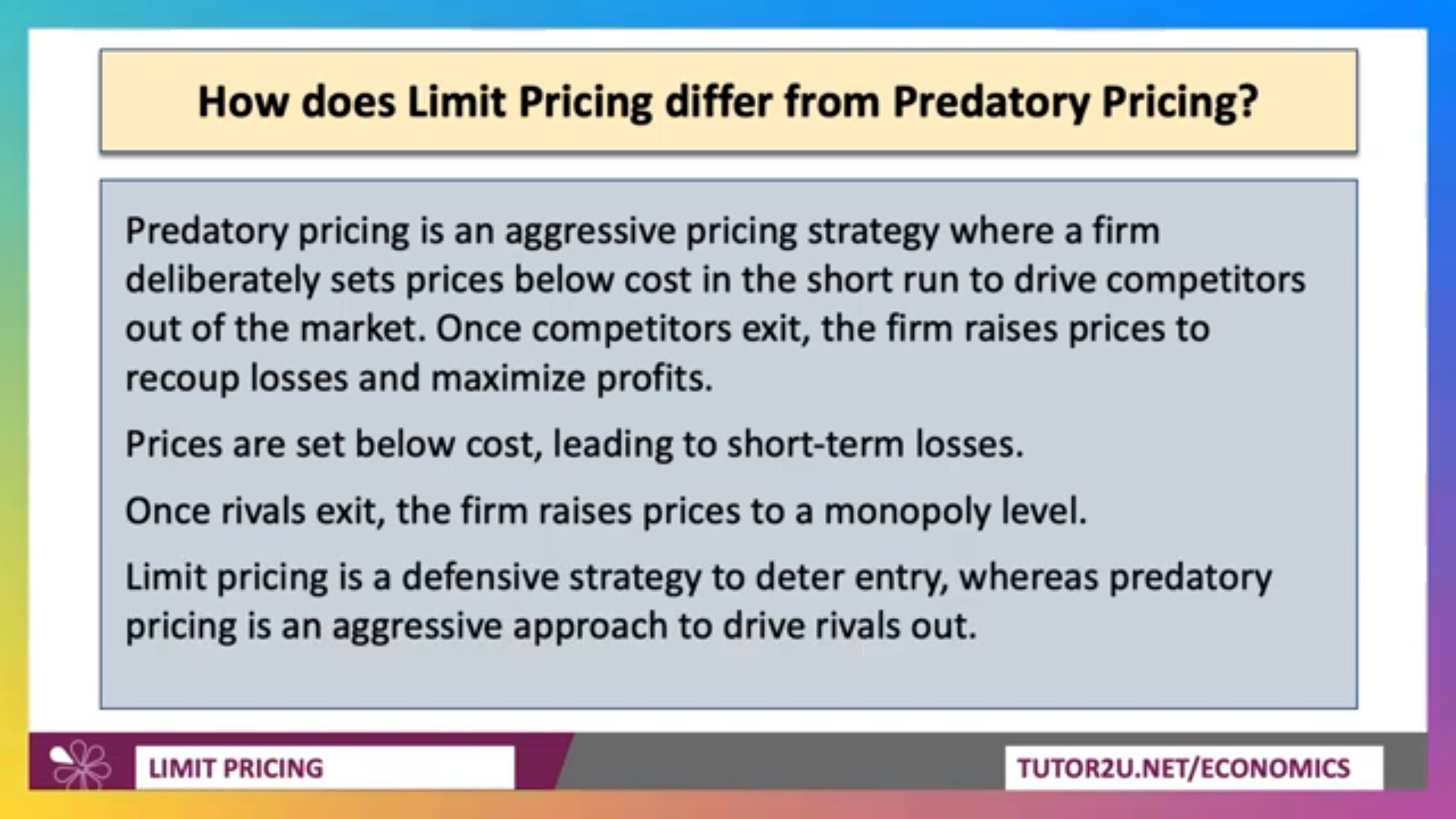

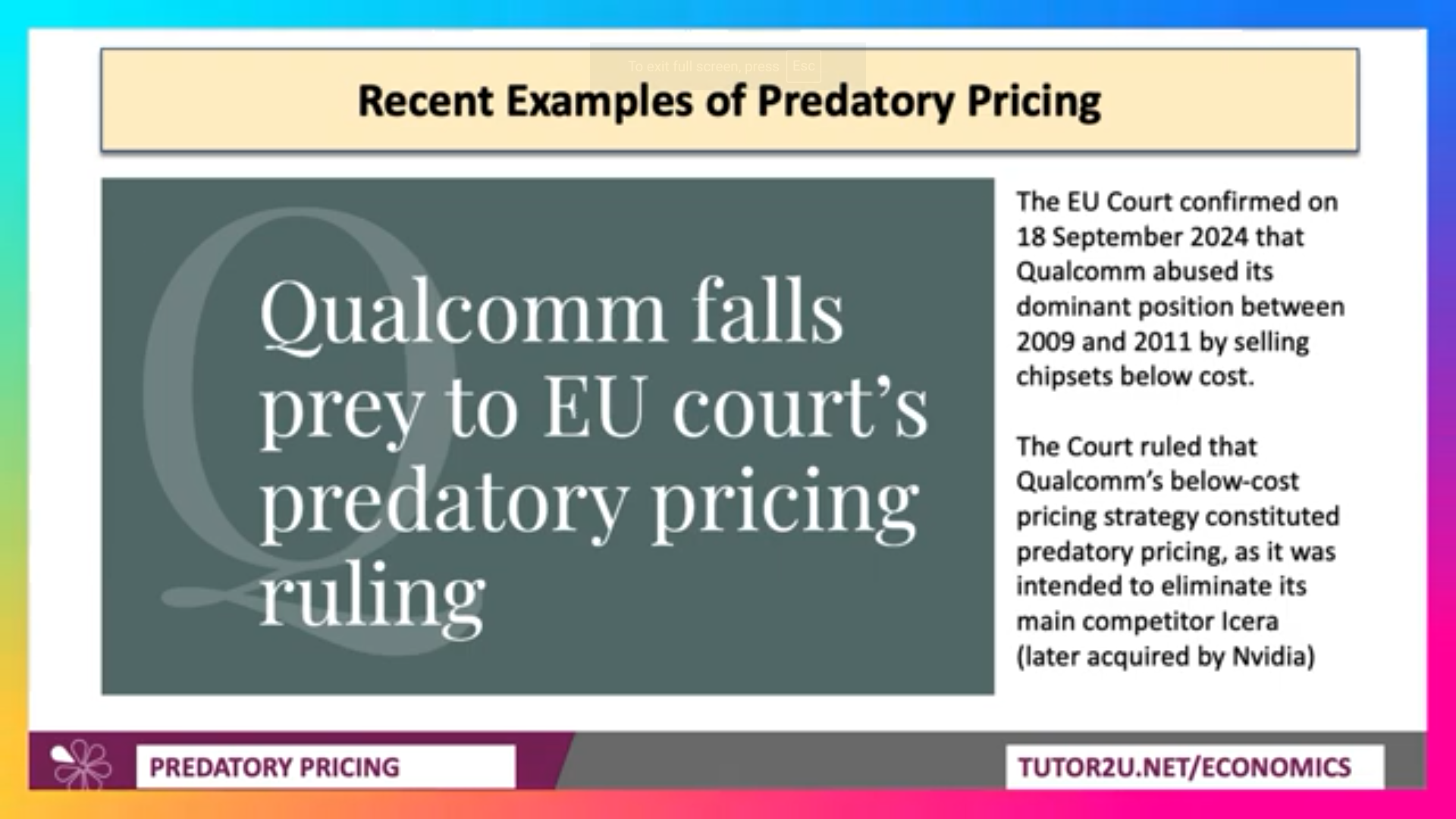

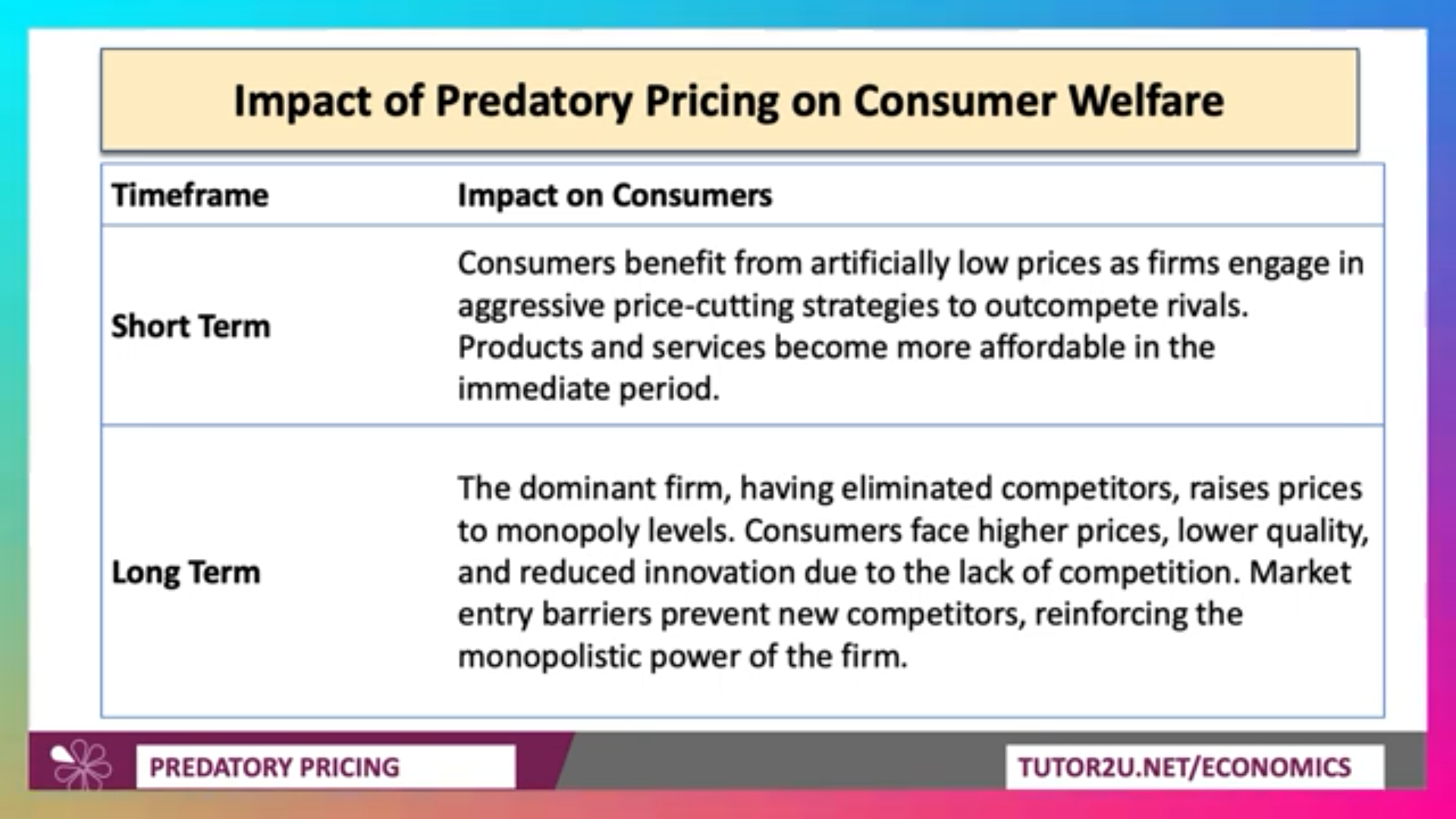

Predatory Pricing = Firms deliberately set prices lower than AC in the short run in order to eliminate existing competitors and when they leave firms will increase their prices again to make up for lost profits

ILLEGAL - CMA & EU as it is a strategy to eliminate competition - not in consumer interest

I.e. Amazon books

Uber - dominate markets - local taxies

Airlines

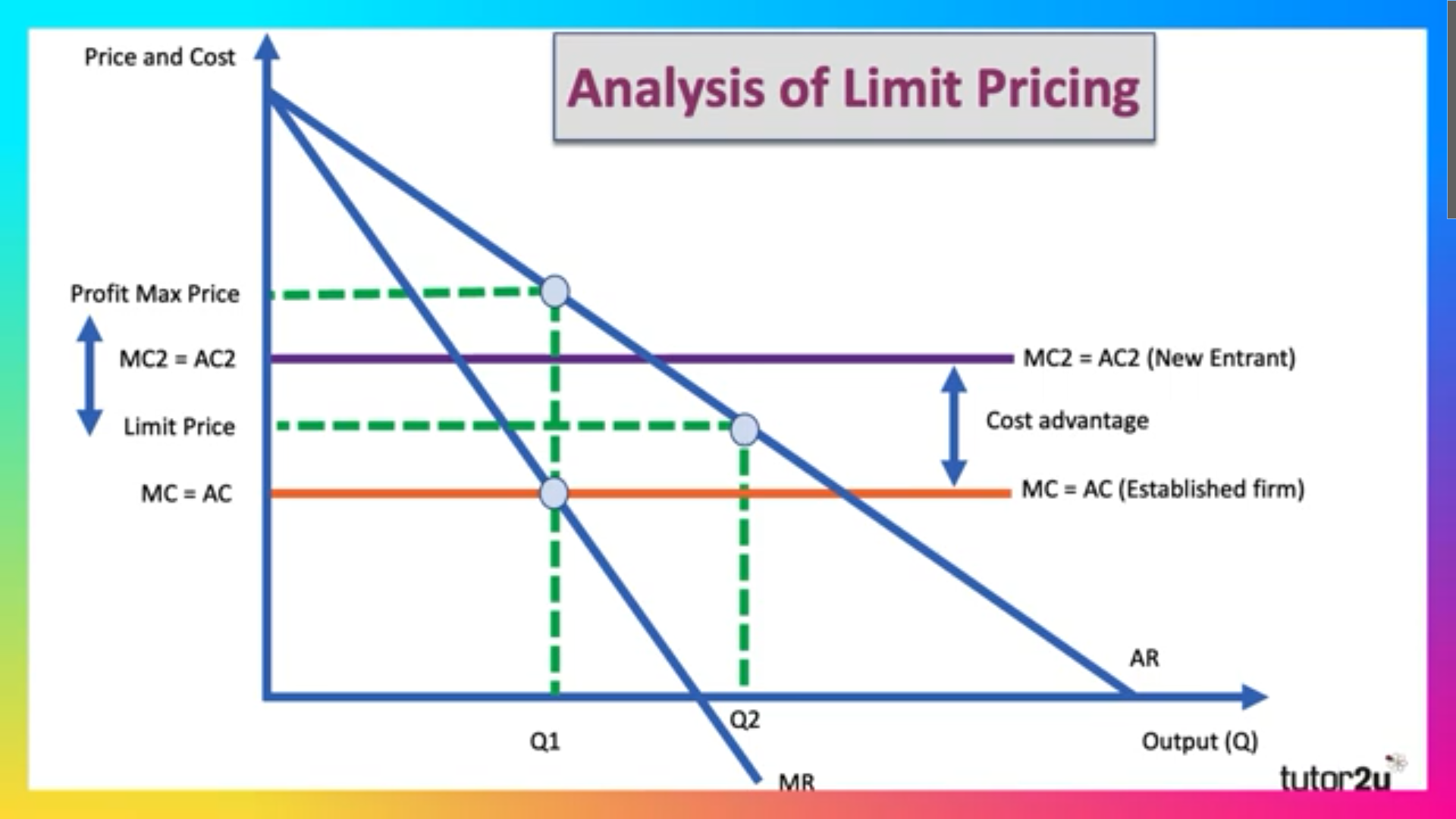

Limit Pricing - Incumbent firms setting prices at a low level in order to discourage other entrants from entering the market but still high enough to remain profits

Above its own AC yet lower than potential entrants AC

This is usually possible as the established firm has already achieved economies of scale

Common in industries with high fixed costs and economies of scale