Macro U3 P2

1. Fiscal Policy-

Actions by Congress to stabilize the economy.

2. Monetary Policy-Actions by the Federal Reserve Bank to stabilize the economy.

Discretionary Fiscal Policy

Congress creates a new bill that is designed to change AD through government spending or taxation.

Problem is time lags due to bureaucracy.

Takes time for Congress to act.

Ex: In a recession, Congress increases spending.

Non-Discretionary Fiscal Policy

AKA: Automatic Stabilizers

Permanent spending or taxation laws enacted to work counter cyclically to stabilize the economy

Ex: Welfare, Unemployment, Min. Wage, etc.

When there is high unemployment, unemployment benefits to citizens increase consumer spending.

Contractionary Fiscal Policy (The BRAKE)

Laws that reduce inflation, decrease GDP (Close an Inflationary Gap)

Decrease Government Spending

Increase Taxes (Decreasing disposable income)

Combinations of the Two

Expansionary Fiscal Policy (The GAS)

Laws that reduce unemployment and increase GDP (Close a Recessionary Gap)

Increase Government Spending

Decrease Taxes (Increasing disposable income)

Combinations of the Two

When interest rates increase, bond prices decrease.

When interest rates decrease, bond prices increase.

Interest rates and bond prices are inversely related!

Deficit Spending

Timing Problems

Political Motivations

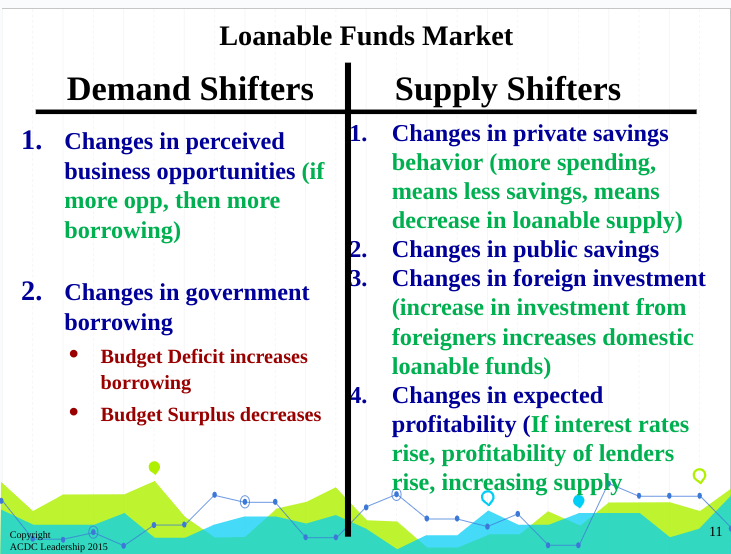

Crowding Out

International Trade Effect