Unit 4 ECON 2105

Unit 4:

Chapter 15 Notes:

The U.S. Money Supplies:

Money is a widely accepted means of payment and serves as a quick and efficient way of making small transactions.

The most important assets that serve as means of payment in the United States today are:

- Total reserves held by banks at the Fed

- The means of payment you probably don’t have personal experience with, but total reserves play a very important role in the financial system

- All major banks have accounts at the Federal Reserve System (accounts that they use for trading with other major banks and for dealings with the Fed itself)

- Checkable deposits–your checking or debit account

- Deposits that you can write checks on or can access with a debit card

- The sorts of deposits we use most often in making daily transactions

- Also called demand deposits because you can access this money on demand

- Savings deposits, money market mutual funds, and small-time deposits

- The largest means of payment are savings accounts, money market mutual funds, and small time deposits

- Each of these components can be used to pay for goods and services, but typically with a little extra work or trouble

- Payment from a savings account can be made by first transferring the money to a checkable account. A money market mutual fund invested in relatively safe short-term debt and government securities

- Small time deposits cannot be withdrawn without penalty before a certain time period has elapsed, usually six months or a year

- Liquid asset:

- An asset that can be used for payments or, quickly and without loss of value, be converted into an asset that can be used for payments.

- The more liquid the asset, the more easily it can serve as money.

- Currency is usually the most liquid asset (currency can be spent anywhere); checkable deposits and reserves are also very liquid, since they can also be spent easily and they can be turned into currency without loss

- Money market mutual funds and time deposits are less liquid since sometimes it takes time to turn these assets into currency or checkable deposits.

- The money supply can be defined in different ways depending on exactly which kinds of liquid assets are included in the definition

- The monetary base: Currency and total reserves held at the Fed

- M1: Currency plus checkable deposits

- M2: M1 plus savings deposits, money market mutual funds, and small time deposits

- The Fed has direct control only over the monetary base. The Fed can increase bank reserves, but if the banks aren’t lending, the increase in reserves won’t do much to increase aggregate demand

- The central bank tried to use its control over MB to influence M1 and M2, but there are many other influences on M1 and M2 so each monetary aggregate can shrink or grow independently of others

Fractional Reserve Banking, the Reserve Ratio, and the Money Multiplier:

- Fractional reserve banking: A system in which banks hold only a portion of deposits in reserve, lending the rest

- Competition among banks to attract funds means that if the bank lends out your money and charges 5% interest, the bank must share some of that return with you. They will pay, for example, 2% for providing the money that they lend. You don’t get the full 5% return because the bank is bearing the risk on the loans, plus paying the costs of making the loans and monitoring the loan borrowers

- Banks balance benefits and costs and thus decide the ratio between reserves and deposits

- Reserve ratio: The ratio of reserves to deposits. If $1 in cash is held in reserve for every $10 of deposits, the reserve ratio is 1/10

- Money multiplier: The amount of money supply expands with each dollar increase in reserves; MM = 1/RR where RR is the reserve ratio. The money multiplier is the ratio of deposits to reserves, or in this case, 10.

- The Fed can create new money at will either by printing it or by adding numbers to bank accounts held at the Fed

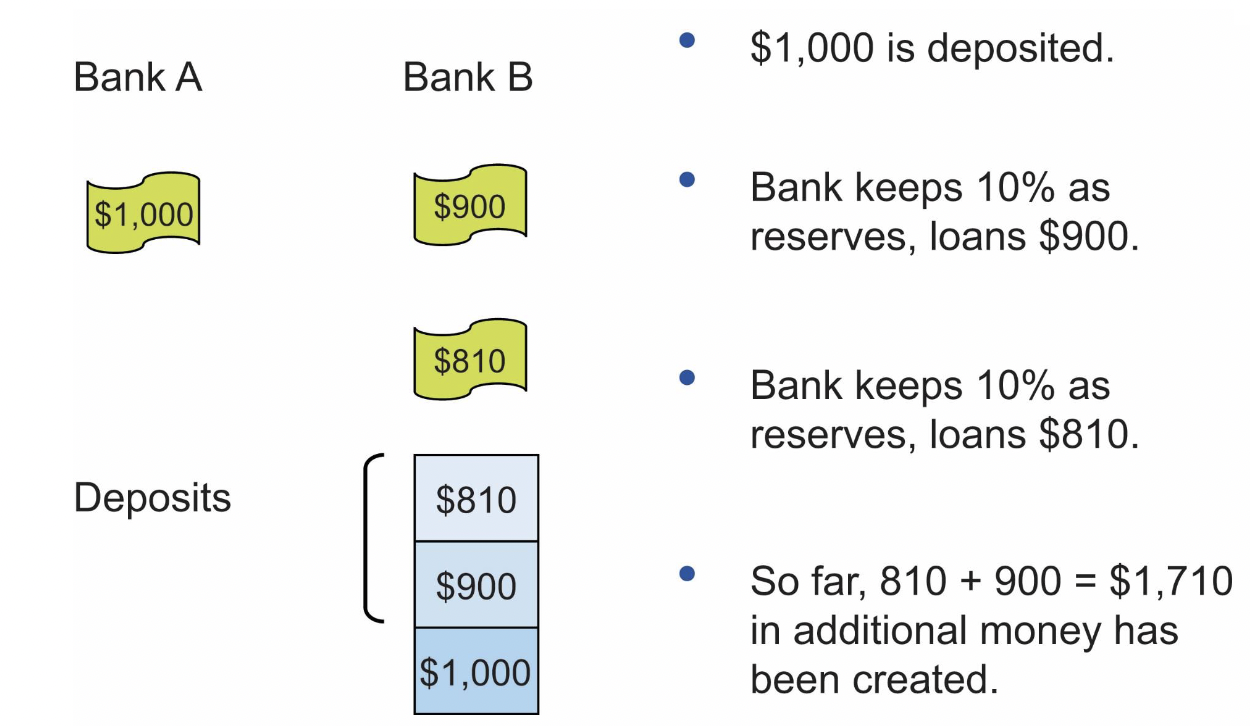

- Example: Your bank account has been credited with an additional $1,000. Your bank now has $1,000 in extra reserves, so in order to restore its reserve ratio to 1/10, your bank will want to keep $100 in reserve and make additional loans of $900, lending that amount to sam. Now Sam’s bank has an extra $900, and it doesn’t want to keep all of that in reserves, so it keeps $90 and lends the rest, keeping its reserve ratio at 1/10 and so on and so on. This process becomes a ripple effect as one bank increases its loans, leading to another bank doing the same, etc.

- If banks want a reserve ratio of 1/10, then when the Federal Reserve increases reserves by $1,000, deposits must ultimately increase by $10,000. The money multiplier is the inverse of the reserve ratio, or 10. Deposits eventually increase by the increase in reserves multiplied by the money multiplier.

- If the money multiplier is 10 for example, then an increase in reserves of $1,000 will lead to an increase in deposits of $10,000.

- Change in money supply = change in reserves x money multiplier (MS = Reserves x MM

How the Fed Controls the Money Supply:

Two Major tools the Fed uses to control the money supply-

- Open market operations–the buying and selling of (usually) short-term U.S. government bonds on the open market

- Paying interest on reserves held by banks at the Fed

Open Market Operations:

- The Fed’s increase in the money supply spreads throughout the economy. And if the Fed wanted to reduce the money supply, it could sell items it had previously bought, like government bonds

- Treasury bills or T-bills: Short-term bonds

- Government bonds can be stored and shipped electronically and the market for government bonds is liquid and deep, which means that the Fed can easily buy and sell billions of dollars’ worth of government bonds in a matter of minutes:

- Open market operation: The buying and selling of government bonds by the Fed.

- Banks will make additional loans, the loans will in turn be used to buy goods and pay wages, and people will deposit some of these payments into other banks, which will now also be able to make more loans

- The purchase of bonds by the Federal Reserve leads to a ripple process of increasing deposits, loans, and so forth

- The sixe of the money multiplier is not fixed. It is the inverse of the reserve ratio, and the reserve ratio is determined by banks

- When banks are reluctant to lend the money multiplier will be low and a change in the monetary base need not change the broader monetary aggregates much at all

- Even though the Fed controls the monetary base, the Fed may not know how much or how quickly changes in the base will change loans and the broader measures of the money supply

- The federal reserve can increase or decrease reserve banks by buying or selling government bonds, the increase in reserves boosts the money supply through a multiplier process, and the size of the multiplier is not fixed but depends on how much of their assets the banks want to hold as reserves

Open Market Operations and Interest Rates:

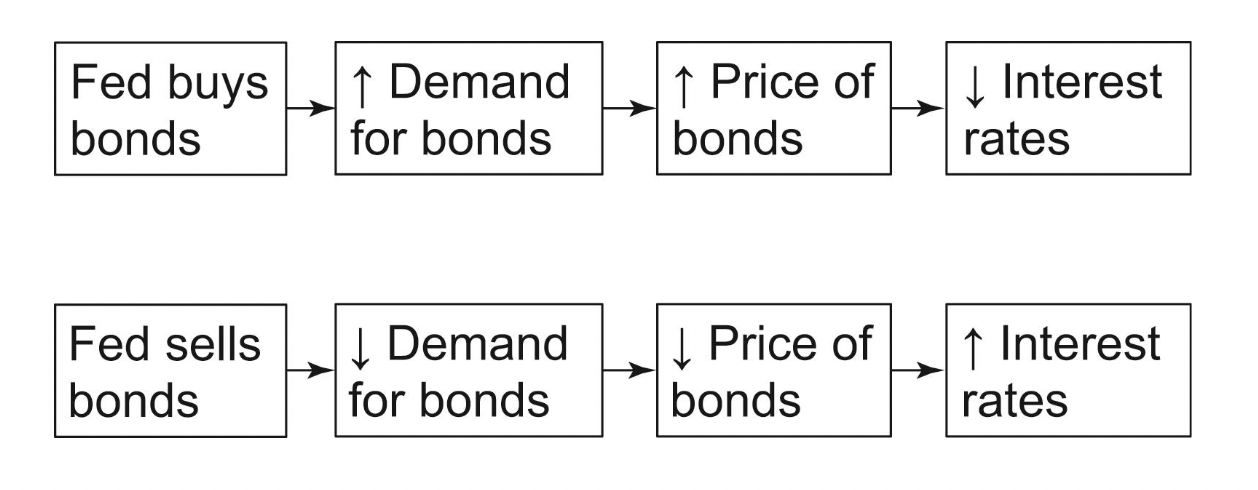

- When bond prices go up, that is another way of saying interest rates go down, and when bond prices go down, that means interest rates go up. When the Fed buys or sells bonds, it changes the monetary base and influences interest rates at the same time

- When the Fed buys bonds, it increases the demand, which pushes up the price of the bonds

- Interest rates are determined in a broad market through the supply and demand for loans

The Fed Controls a Real Rate Only in the Short Run:

- Lending and borrowing decisions depend on the real interest rate, the interest rate after inflation has been taken into account

- Federal funds rate: The overnight lending rate from one major bank to another

- Instead of deciding to increase the money supply by $50 billion, the Fed might decide to reduce the Federal Funds rate by a quarter of a percentage point–the Fed will then buy bonds until the Federal Funds rate drops by a quarter of a point

Quantitative Easing:

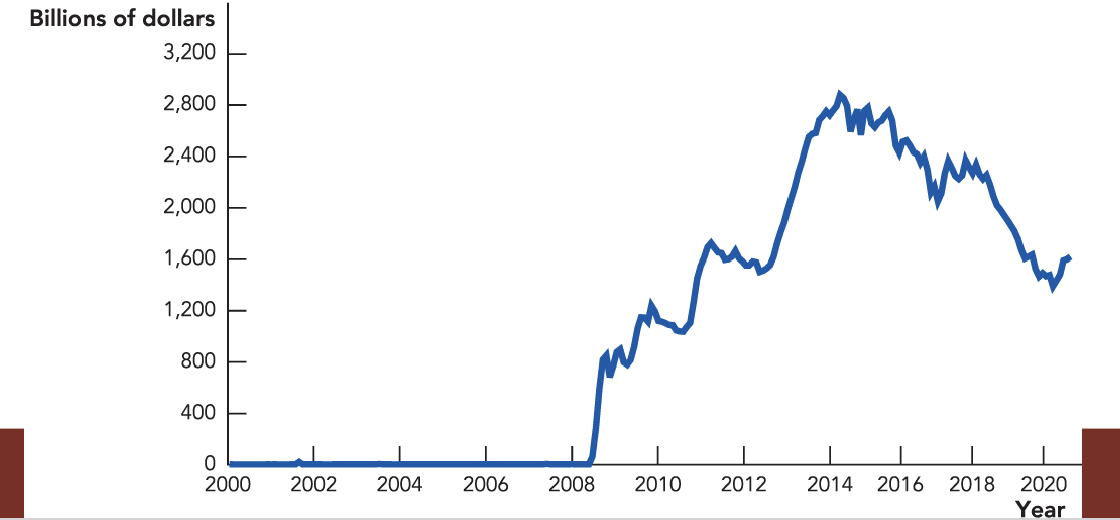

- The Fed dramatically increased the supply of reserves–so much that it pushed the Federal Funds rate very close to zero

- Zero lower bound: Situation in which the Federal Funds rate is close to zero

- In 2009, the Fed pushed the Federal Funds rate to near the zero lower bound, and still the economy wasn’t bomming

- Quantitative easing: Situation that occurs when the Fed buys longer-term government bonds or other securities

Payment of Interest on Reserves:

- In the midst of the financial crisis, the Federal Reserve focused on a payment of interest on reserves to control the money supply

- Before October 2008, the supply of reserves and the Federal Funds rate were tied closely together. When the Fed increased the supply of reserves the Federal Funds rate would be pushed down, and when the Fed decreased the supply of reserves the Federal Funds rate would be pushed up

- When the Fed pays interests on reserves, it puts a floor on the Federal Funds rate because no bank would want to lend to another bank at a rate that was less than what they could get just by holding onto their reserves

- Starting in 2008, excess reserves increased from 2 billion to 2.8 trillion. Even though the Fed pays only a very low interest rate on reserves, banks are willing to hold many reserves because interest rates in the wider economy are also close to zero

- The Federal Reserve conducts monetary policy by changing the demand for reserves

- They raise the rate of interest they pay on reserves, and that increases the demand, also placing upward pressure on other short-term interest rates

- Liquidity trap: Situation in which interest rates are close to the zero lower bound, so pushing them lower is not possible or not effective at increasing aggregate demand.

The Federal Reserve is the Lender of Last resort:

- Insolvent institution: A bank or institution whose liabilities are greater in value than its assets.

- Illiquid asset: An asset that cannot be quickly converted into cash without a large loss in value; perhaps because the asset is difficult to value and it takes time to find the right buyer

- Banks establish long-term relationships with their customers

- A bank run can break the continuity necessary to fund long-term projects

- Deposit insurance ensures depositors that even if the bank is insolvent they will still be paid

- Systemic risk: The risk that the failure of one financial institution can bring down other institutions

- At the height of the 2008-2009 financial crisis, the FDIC, and the U.S. Treasury stepped in to support the financial system on an unprecedented scale

- The Fed also extended its lending beyond banks to become the lender of last resort to other financial intermediaries in the commercial paper and asset-backed securities markets

- When individuals or institutions are insured, they tend to take on too much risk

- Moral hazard:Moral hazard increases incentives to double bets to make up for a large loss

- Limiting systemic risk while checking moral hazard is the fundamental problem the Fed faces as a bank regulator. In addition, the financial system has become more complex and intertwined as financial assets are packaged, subdivided, bought, and sold more than every before

- The Fed is trying to steer a course between two problems. If a panic occurs, it may be best to bail out some firms, even bad actors, to protect the system, and yet the promise to bail out firms in a future panish encourages risk taking and increases the probability that a panic will happen in the first place

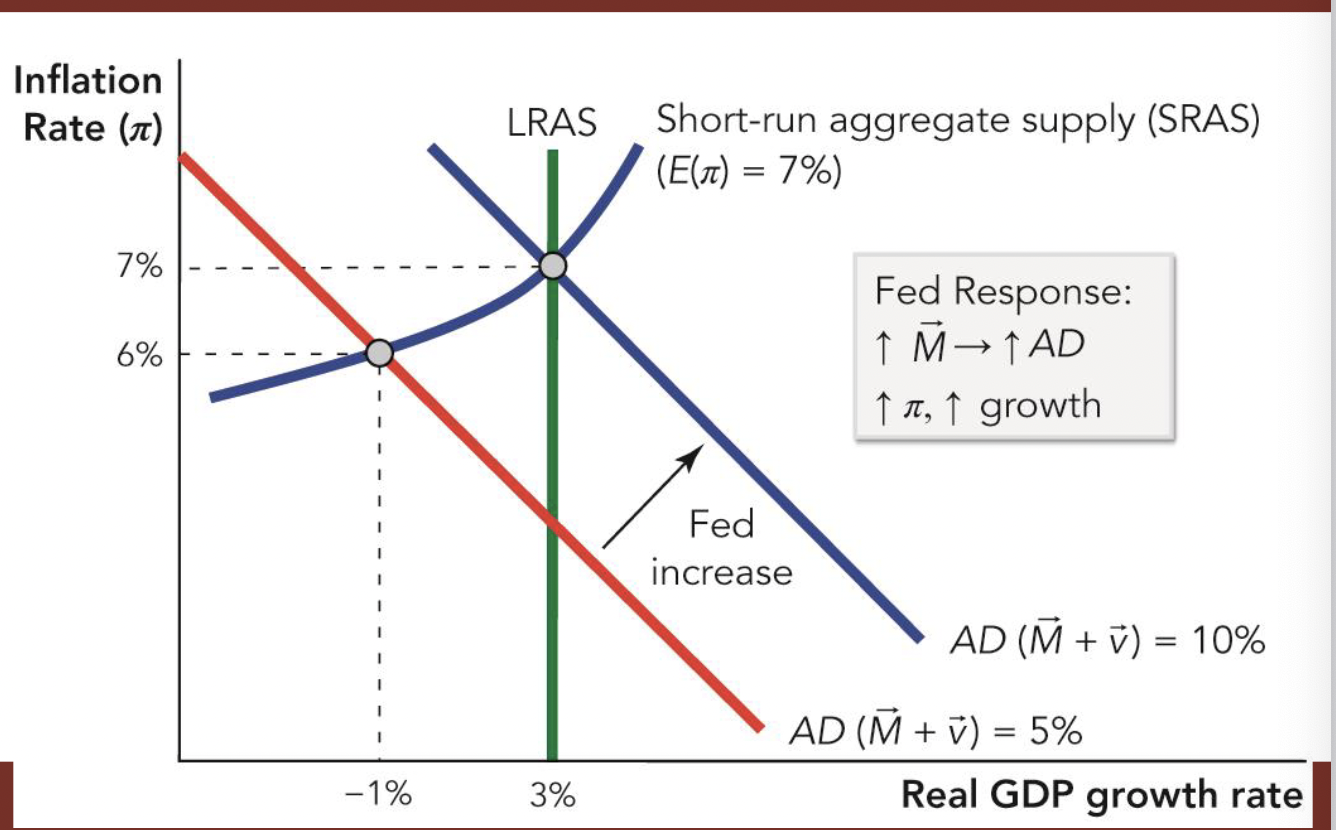

Aggregate Demand and Monetary Policy:

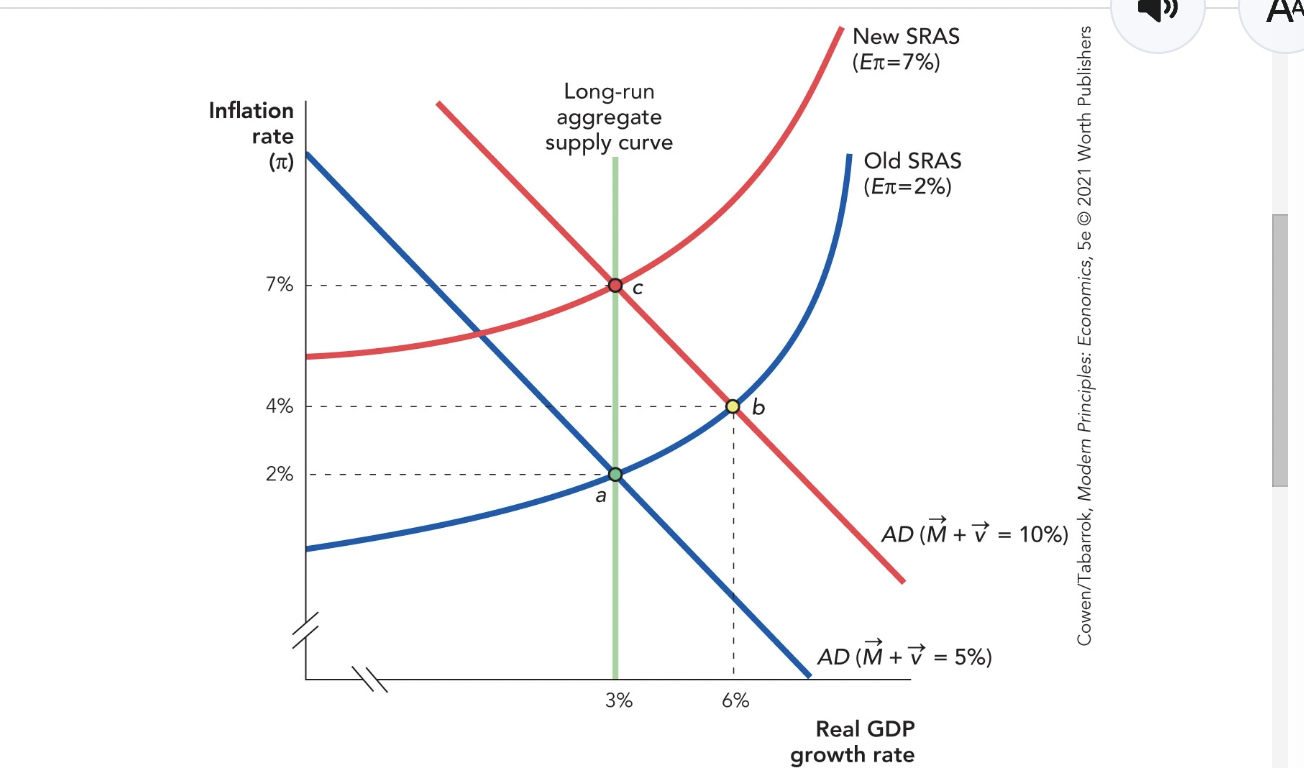

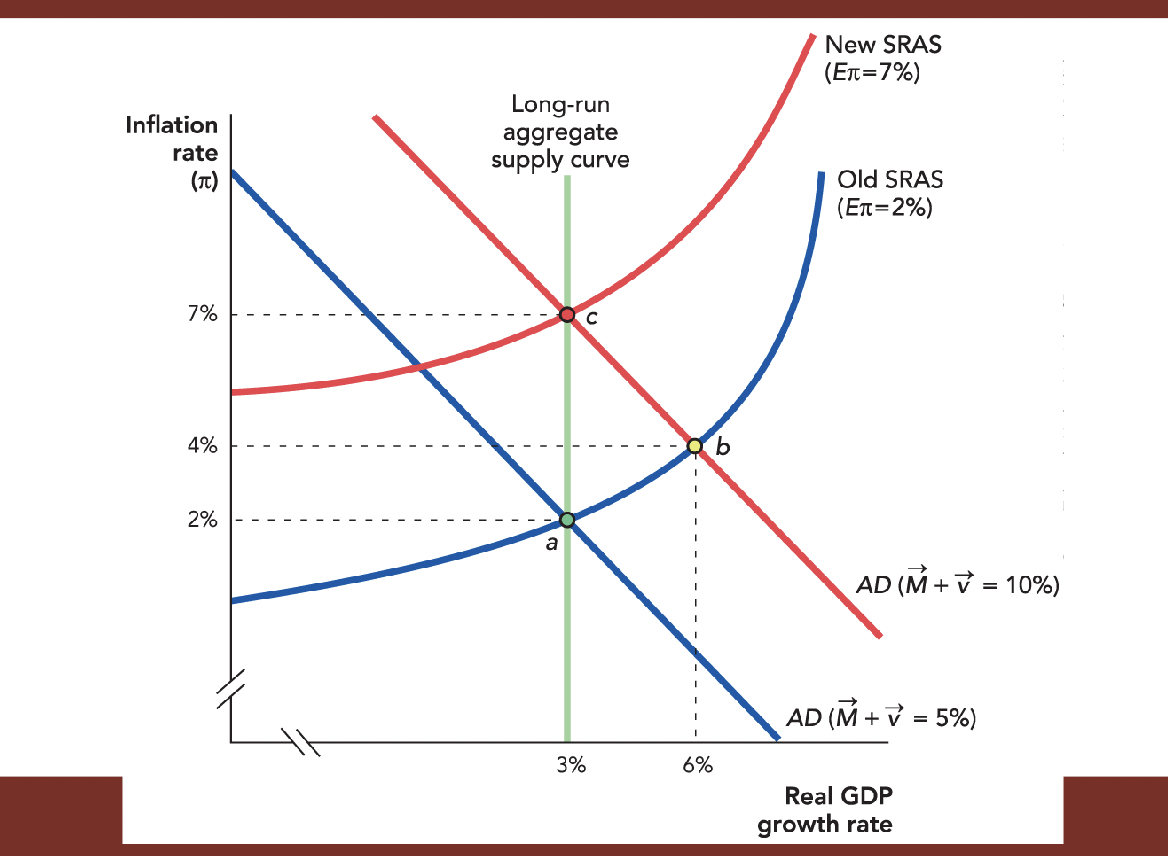

- Beginning at a, an increase in M shifts the aggregate demand curve outward, moving the economy to point b, where inflation and the real growth rate are higher

- After transition the economy will move to point c with a higher inflation rate but a growth rate given by the fundamentals at the long-tun potential level

- To estimate the effect of its actions on aggregate demand, the Fed must try to predict and monitor many variables determining the size and timing of the response to its actions

- The Federal Reserve’s power should not be underestimated but increasing or decreasing aggregate demand is not like turning a tap on and off

Who Controls the Fed?

- The Fed has a seven-member Board of Governors, who are appointed by the president and confirmed by the Senate

- Governors are appointed for 14-year terms and cannot be reappointed–this means a single president will rarely appoint a majority of the board

- The Fed has to periodically report to overseers in both houses of Congress

- The Fed is not just one bank but 12 Federal Reserve Banks, each headquartered in a different region of the country

- The Fed is a quasi-private, quasi-public institution

- Each regional bank is a nonprofit with nine directors: Six of these are elected by commercial banks from the region and three are elected by the Board of Governors

- No single president appoints all the governors of the Fed, the governors do not have complete control over Fed policy, the regional bank presidents come from all over the U.S., and they are appoointed by directors who are drawn not just from banking but from a wide variety of fields

- In the financial crisis of 2008, the Fed had to work closely with the Treasury Department

- Political pressures have been put on the Federal Reserve and some chairpersons have been less independent than others

- An independent Federal Reserve is defended by most economists as part of the U.S. system of checks and balances

Takeaway:

- The Federal Reserve is the government’s bank and the bankers’ bank, and it has the power to create money

- The ability to create money, regulate the money supply, and potentially lend trillions of dollars means the Fed has significant powers to influence aggregate demand in the world’s largest economy

- MS = Reserves x MM

- When the government buys securities, the interest rate decreases and that stimulates consumption and investment borrowing

April 8th Notes:

Introduction:

- Through its influence over the money supply, the Federal reserve has more influence over inflation and aggregate demand than any other institution

- Shifts in aggregate demand can greatly influence the economy in the short run

- This chapter looks at the Federal Reserve System and the tools it uses to influence the money supply, aggregate demand, and the economy

Functions of Money:

- Medium of exchange → Money is used to buy goods and services

- Unit of account → Money is a common unit used to measure economic value

- Store of value → Money can be saved

Before the Fed:

Like most early moderns, colonial Americans faced “the big problem of small change:

- “Small”

- Small enough for everyday transactions

- “Change”

- Convertible to legal tender with more than local circulation

- Hamilton’s Report on Public Credit

- First Bank of the U.S. (1791-1811)

- 20-year charter

- ⅕ of shares owned by th efederal government

- Remaining ⅘ privately owned

- Fiscal agent of the U.S.

- Commercial Banking

- Second Bank of the U.S. (1816-1836)

- Some business model as 1st

- Both also regulated the money supply like a modern central bank

- After the S.F. earthquake, railroad-rate regulation, and an antitrust ruling against Standard Oil weaken markets, a failed October-1907 attempt to corner united Copper Company stock brought the collapse of NY’s 3rd largest trust

- The Knickerbocker Trust Co.’s failure led to a panic, where regional banks withdrew reserves from NY banks

- The result was the Panic of 1907

- J.P. Morgan (1837-1913) pledged millions of his own money and corralled NY’s other leading investment bankers to stave off further fire sales

- Though his actions averted deeper financial disaster, Morgan’s lead role in the Panic of 1907 inspired congressional investigations of this “money trust”

Jekyll Island Meeting, Nov. 1910-

- R.I. Sen. Nelson Aldrich invites five associates on a 10-day “duck hunting trip”

The Aldrich Plan (1910)-

- 15 regional central banks, each governed by boards elected by local bankers

- Regional central banks coordinated by a national board of commercial bankers

- The plan would have created an independent central bank capable of acting as the missing lender of last resort in the Panic of 1907 while providing an elastic currency, but a Democratic house voted it down

Glass-Owen Federal Reserve Act-

- The Wilson Administration’s response to the Aldrich Act

- Feared dominance by bankers and populist challenges

- Maintained much of its model for central banking but brought more federal oversight with the president appointing central board members

- Passed and signed into law on Dec. 23, 1913

What is the Federal Reserve System?

- Since 1913, the Federal Reserve has been America’s central bank

- The Fed is the government’s bank

- Maintains the U.S. Treasury account

- Manages government borrowing through U.S. Treasury bonds, bills, and notes

- The Fed is also the bankers’ bank

- Regulates banks and lends them money

- Manages the nation’s payment system

- Protects financial consumers with disclosure regulations

- The Fed’s most important job is to regulate the U.S. money supply

- It has the power to print money

- It can also add to the monetary base by adding reserves to bank accounts held at the Fed

- This new money can be given away or lent out in a way that increases aggregate demand

- In so doing, the Fed can also shape interest rates

- Comprised of the Board of Governors in Washington D.C., and 12 Federal Reserve distinct banks scattered across the country

What is Money?

- Money is a widely accepted means of payment

- The most important assets that serve as means of payment in the United States today:

- Currency–paper bills and coins

- Total reserves held at the fed

- Liquid deposits–primary checking and savings accounts

- Money market mutual funds and small time deposits

Who Controls the Fed?

- The Fed has a seven-member Board of Governors who are appointed by the president for 14-year terms and confirmed by the Senate

- The president appoints one of the members of the Fed’s Board of Governors as its chair

- After being confirmed by the Senate, the appointee serves as chair for a four-year term

- The Fed is made up of 12 Federal Reserve Banks, each headquartered in a different region of the country

- The Federal reserve is one of the most independent agencies in the U.s. government

- Its considerable power is dispersed.

- No one president appoints all the governors

- The governors do not have complete control over Fed policy

- The governors do not have complete control over Fed policy

- The regional bank presidents come from all over the United States

- Regional bank presidents are appointed by directors from many sectors, not just banking

Whatis not a function of the Federal Reserve: Lending money to consumers

Lender of Last Resort:

- Under certain conditions, depositors may panic and then all try to withdraw their money at once, causing a bank run

- Depositors can’t tell whether the bank is really insolvent or just illiquid

- An insolvent institution has liabilities that are greater than its assets

- A bank with illiquid assets hold assets that cannot be quickly converted into cash without a large loss in value. A bank may be liquid but not insolvent

- That’s where deposit insurance and the Federal Reserve come in–to prevent solvent but illiquid institutions from facing bank runs

- Traditionally, the Fed lent to solvent but illiquid banks

- In a panic, the Fed may also lend to insolvent institutions to limit systemic risk

- Systemic risk (aka systemic uncertainty) is the hazard that the failure of one financial institution can bring down other institutions.

- During the 2008 financial crisis, the Fed bought trillions of dollars’ worth of longer-term government bonds and mortgage-backed securities, lending more than $1 trillion to financial intermediaries

- When individuals or institutions are insured, they tend to take on too much risk

- Institutions that policymakers have deemed “too big to fail” have too little incentive to make responsible financial investments, bringing a problem of moral hazard

- Moral hazard in the financial system occurs when banks and other financial institutions take on too much risk, hoping thatthe Fed and regulators will later bail them out

- The Fed thus faces a trade-off between limiting systemic risk and checking moral hazard

Money:

- A widely accepted means of payment

- Businesses transfer money by wiring money from one bank to another. Likewise, consumers use debit cards or transfer services such as Venmo

- Banks are instructed to transfer money to teh seller’s bank

- All major banks have bank accounts at the Federal Reserve (the Fed)

- When Bank A makes a payment to Bank B, it authorizes the Fed to deduct the money from its account at the Fed and credit the Bank B’s account at th eFed

- Bank accounts at the Fed are often called total reserves and play an important role in the financial system.

- The Fed controls two major means of payment in the United States: currency and reserves held at the Fed

- The Fed also has the power to create money

- It doesn’t have to literally print money since it can add reserves to bank accounts held at the Fed

- This new money can be given away or lent out in a way that increases aggregate demand

- Currency and total reserves are the two final means of payment, but are not the only widely accepted menas of payment

- The most important assets that serve as means of payment in the U.S. today:

- Currency–paper bills and coins

- Total reserves held at the Fed

- Liquid deposits–primary checking and savings account

- Money market mutual funds and small time deposits

- Currency is coins and paper bills held by people andnonbank firms.

- Total U.S. currency amounts to about $5,200 per person.

- Quite a bit of U.S. cash is used in other countries.

- Panama, Ecuador, El Salvador, and some other countries use the U.S. dollar as their official currency.

- Dollars are also used unofficially in unstable countries as a means of preserving wealth.

- Total reserves play an important role in the financial

- system.

- All major banks have accounts at the Federal Reserve, which they use for trading with other banks and theFed itself.

- Electronic claims, though not actually currency, can be converted into currency if the bank wishes.

- Checkable deposits are deposits that you can write checks on or access with a debit card.

- They are the deposits used most often in making daily transactions.

- They are also called demand deposits because you can access this money “on demand.”

Chapter 16 Notes:

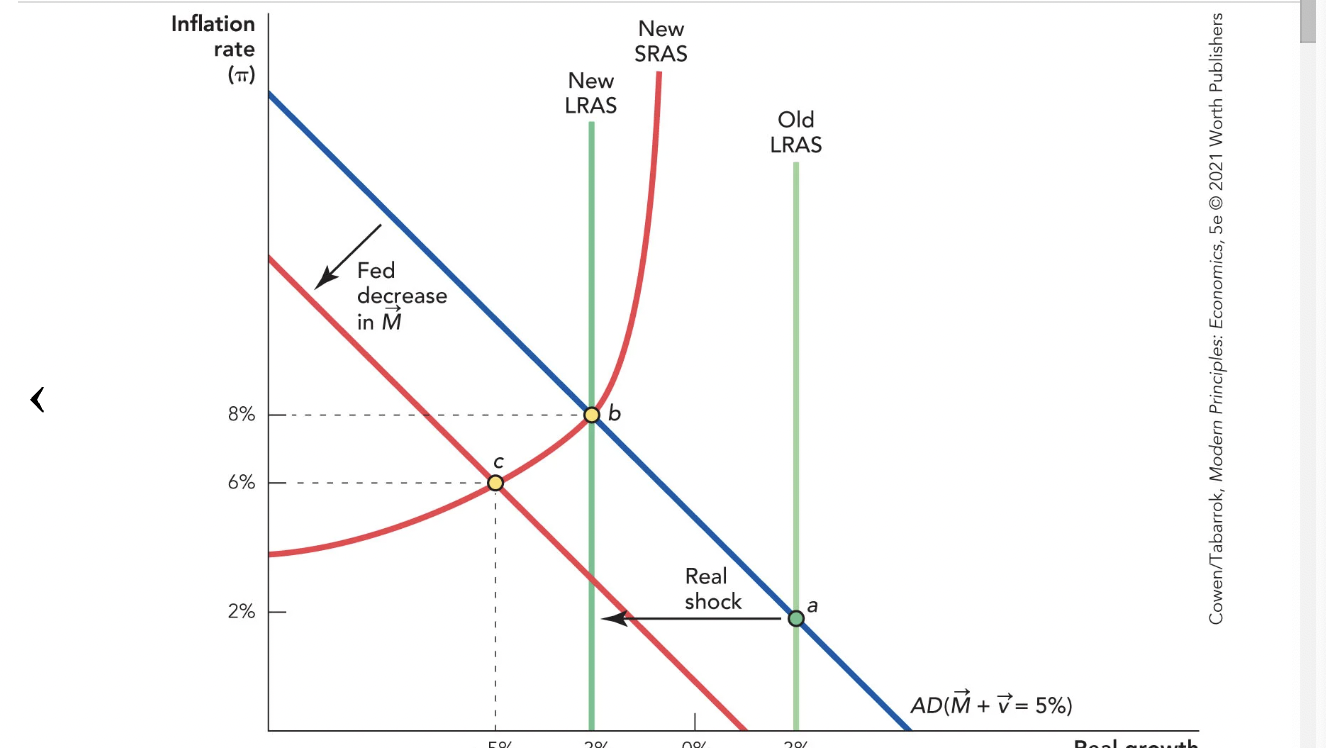

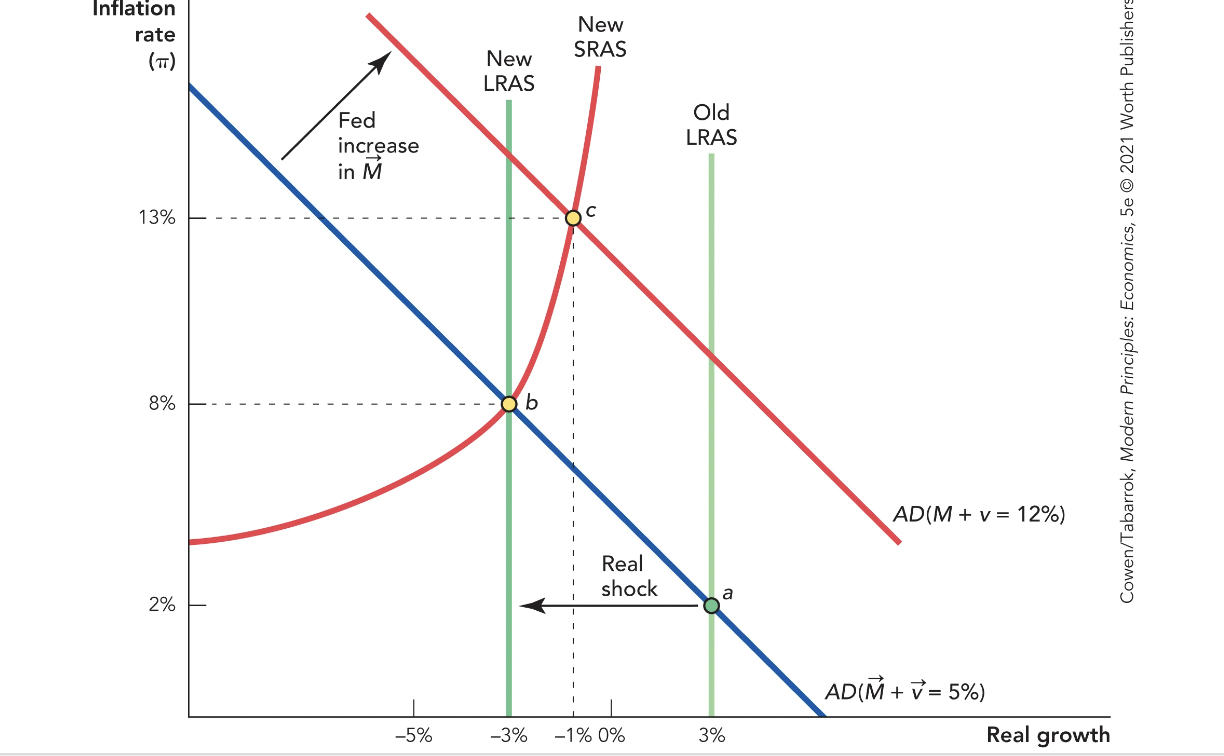

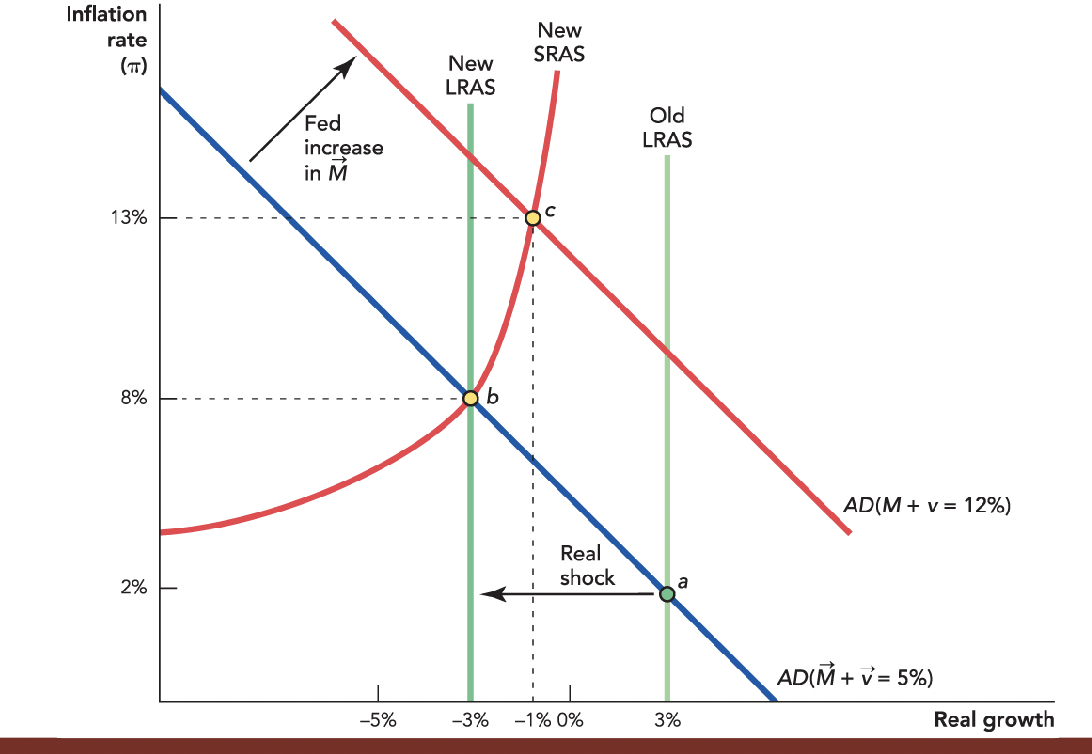

The Negative Real Shock Dilemma:

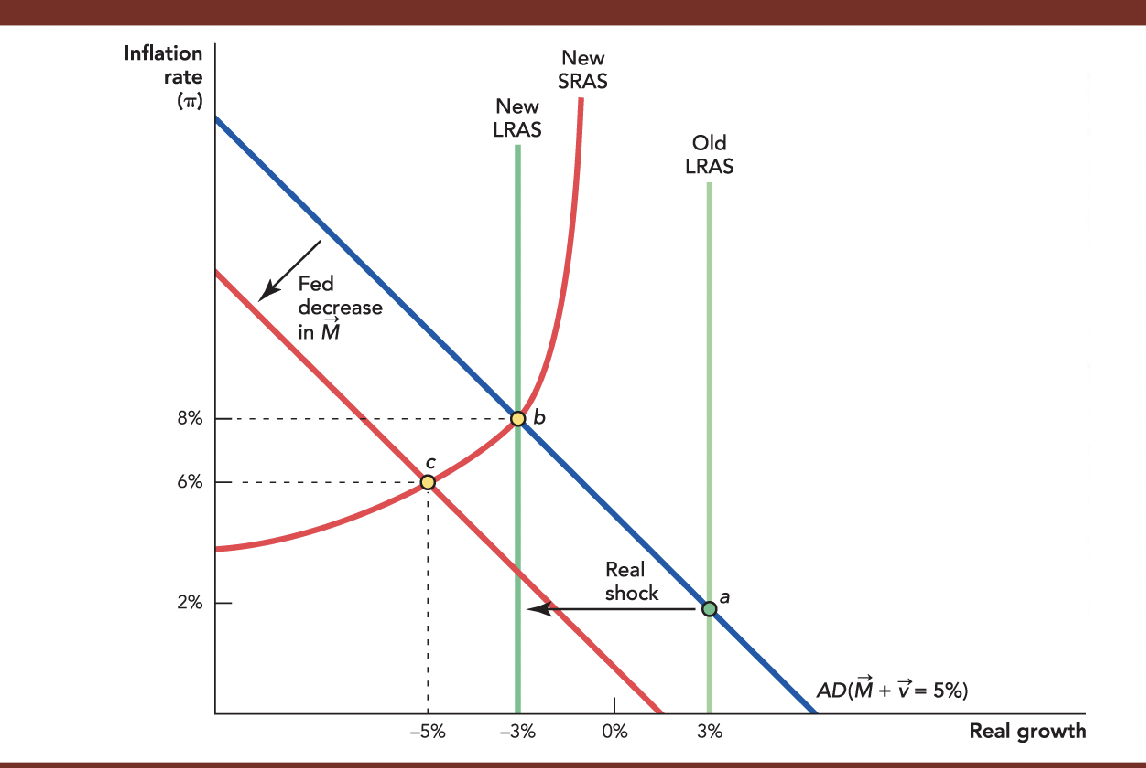

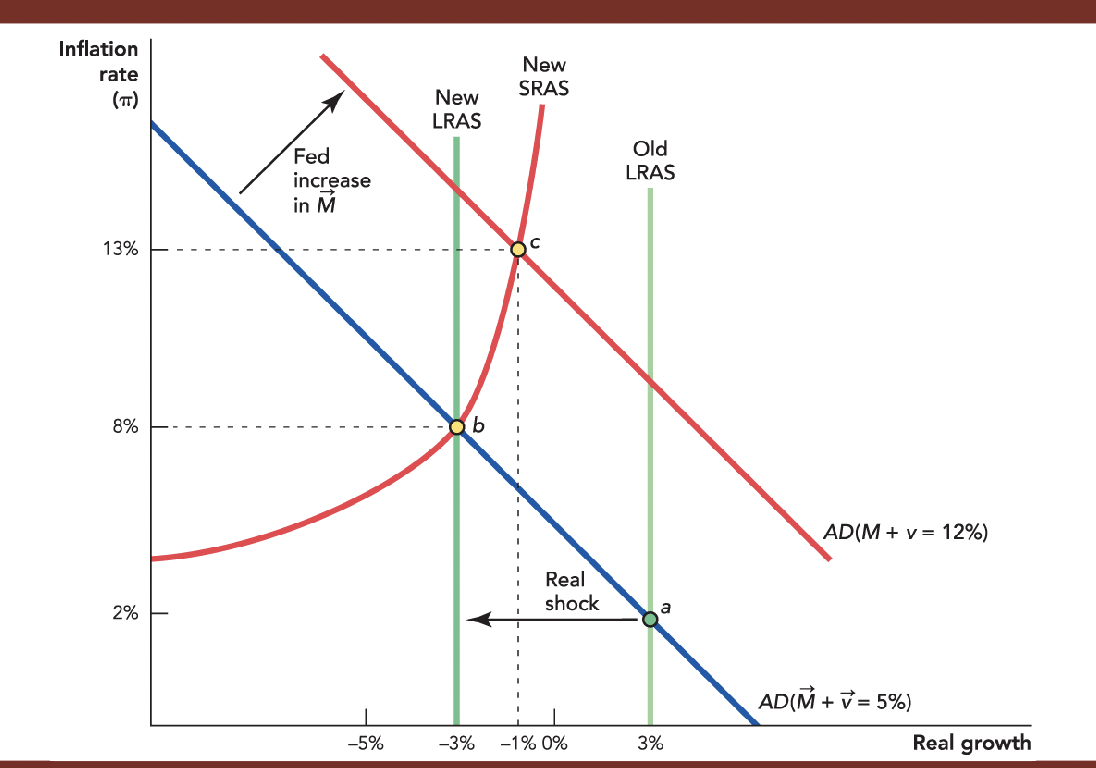

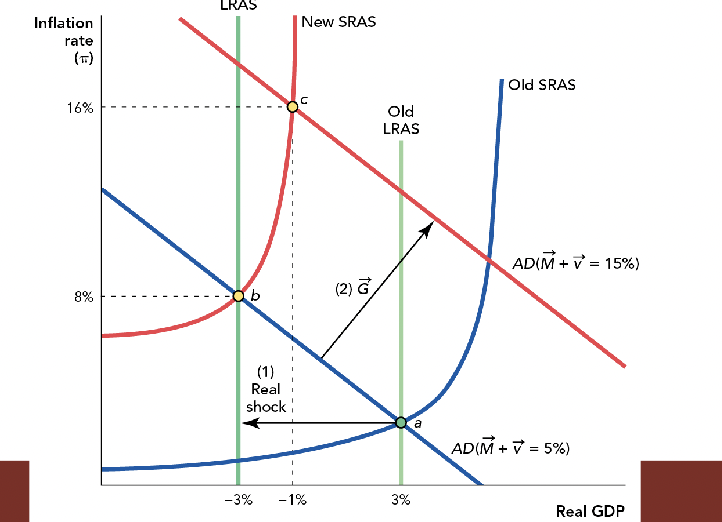

- A very difficult case for monetary policy is when the economy is hit by a negative real shock such as a rapid oil price increase

- A negative real shock shifts the long-run aggregate supply curve to the left, moving the equilibrium from point a to point b

- One approach for monetary policy is to focus on the inflation rate, which has jumped from 2% to 8%. A decrease in inflation occurs due to a decrease in M

- The Federal Reserve often responded to supply shocks, such as an oil shock, by decreasing M and reducing aggregate demand. This menas taking the AD curve and shifting it farther back to the left through the use of monetary policy

- In the figure, the new equilibrium is at point c. The reduction in M reduces the inflation rate from 8% to 6%, but also reduces economic growth and by more than the supply shock alone would have done.

- The Federal Reserve can increase aggregate demand by increasing the money growth ate, but, when the economy is facing a negative real shock, it is less productive than at other times, due to the real shock

- Central bankers are more likely to believe that a central bank should respond to a respond to a negative real shock by increasing aggregate demand

- An increase in M will not move the economy back to point a. Instead, most of the increase in M will show up in inflation rather than in real growth so the economy will shift from point b to point c, as shown in the graph with a much higher inflation rate and a slightly higher growth rate

- Although an increase in M may increase the growth ate a little, the inflation rate increases by a lot and, higher inflation now can cause serious problems later

- If the inflation rate gets too high, the Fed has to reduce inflation, thereby creating a lot of unemployment

- Real shocks are often accompanied by aggregate demand shocks, so the figures are considerably simplified

- Social distancing and lockdown orders created a recession that monetary policy couldn’t fix

- The Federal Reserve looks at real-time data

- With a real shock, the central bank has to choose between too low a rate of growth and too high a rate of inflation

When The Fed Does Too Much:

- The Fed has considerable power to influence aggregate demand but, power is constrained by uncertainty and by an inability for anyone to fully understand the complexity of the economy

- A number of economists have argued that Federal Reserve policy in 2001-2004 contributed to the housing boom and eventual bust that led to the financial crisis in 2007-2008

- Many factors contributed to the financial crisis, including too much leverage and irrational exuberance

- The financial crisis and the Fed’s role in it are highly debated topics among economists and a consensus has not yet been reached

- In the late 1990s, the American economy was the envy of the world. Economic growth was strong and the unemployment rate was low, even dipping below 4% in 2000

- The unemployment rate continued to increase even after the recession had officially ended

- From a rate of 4% in 2000, unemployment increased during the recession to 5.5% and then kept increasing until it peaked at 6.3% (almost a 50% increase) in June 2003

- To combat the high unemployment rate after 9/11, the Fed tried to increase aggregate demand through expansionary monetary policy

- The Federal Funds rate is a short-term interest rate that is largely under the control of the Federal Reserve. During the recession, the Fed pushed down the Federal Funds rate from about 6.5% in 2000 to 2% at the end of 2001 when the recession ended

- From mid-2003 to mid-2004, the Fed held the Federal Funds rate at 1%, an extraordinarily low rate

- The low Federal Funds rate helped to make credit cheap throughout the economy

- A bubble arises when asset prices rise far higher and more rapidly than can be accounted for by the fundamental prospects of the asset. Prices are instead driven by shifts in market psychology and successive waves of irrational exuberance. Cheap, easy credit makes it easier for investors to operate and intensify bubbles.

- The low interest rates are, in essence, signalling to market participants that credit is easy and it is a good idea to borrow money

- Distorted price signal: Arises when government policy moves in a manner that encourages investors to take risks

- The Fed began to raise interest rates in mid-2004 but rates remained very low until at least mid-2005. In 2006 housing prices peaked, and by 2007 were in free fall

- Because housing prices peaked, they would soon after fall: This reduced aggregate demand, contributed to a freezing up of financial intermediation as banks and others took huge losses on poor investments in mortgage securities

- Since bank lending is a main generator of M1 and M2, thisi menas lower rates of growth for the money supply. By the fall of 2008, the growth rate was negative, meaning that that the American economy was shrinking

Dealing with Asset Price Bubbles:

- The economy had quickly recovered from the much larger drop in stock prices during the tech bubble that ended with the recession of 2001

- It’s not always easy to identify when a bubble is present. If everyone knew it was an unsustainable bubble, then all should have invested accordingly and bet against the bubble, thereby enriching themselves and also stopping the bubble in the first place

- Monetary policy is a crude means of popping a bubble. It can influence aggregate demand, or target credit markets at the aggregate level, but monetary policy can’t push the demand for housing down and keep the demand for everything else up. Thus, popping a bubble means reducing th growth rate of GDP for the broader economy as a whole

- In addition to monetary policy, the Fed does have the power to regulate banks and it probably could have restrained some of the “subprime,” no-questions-asked mortgages that were sold during the boom and later went into default

- Monetary policy is difficult in the worst of times and it’s not easy in the best of times

Rules vs. Discretion:

- The possibility of the “too little and “too much” responses, or in othe rwords the imperfections of monetary policy, has led to a debate over rules versus discretion when it comes to monetary policy

- Ideally, monetary policy tries to adjust for shocks to aggregate demand, but it is often debated whether these adjustments are effective in reducing the volatility of output

- If Fed responds too often in the wrong direction or with the wrong strength, GDP volatility will increase rather than decrease

- A typical monetary rule would set target ranges for the monetary aggregates like M1 or M2 or for the rate of inflation. Nobel Prize winner Milton Friedman, for example, advocated a strict rule in which the money supply would grow by 3% a year every year, since the U.S. economy has a long-run growth rate near 3%.

- A monetary rule works best only when v, monetary velocity, doesn’t change rapidly. To see one problem with a monetary rule, the quantity theory of money can be used (Mv=PYr), where M is the money supply, v is velocity, P is the price index, and Yr is real GDP

- A monetary rule says keep M constant, but that menas that the Fed must ignore changes in v.

- If M is constant and v falls, then either P must fall or Yr must fall. Since prices are sticky, the usual outcome is that both P and Yr fall, and a fall in Yr means a recession

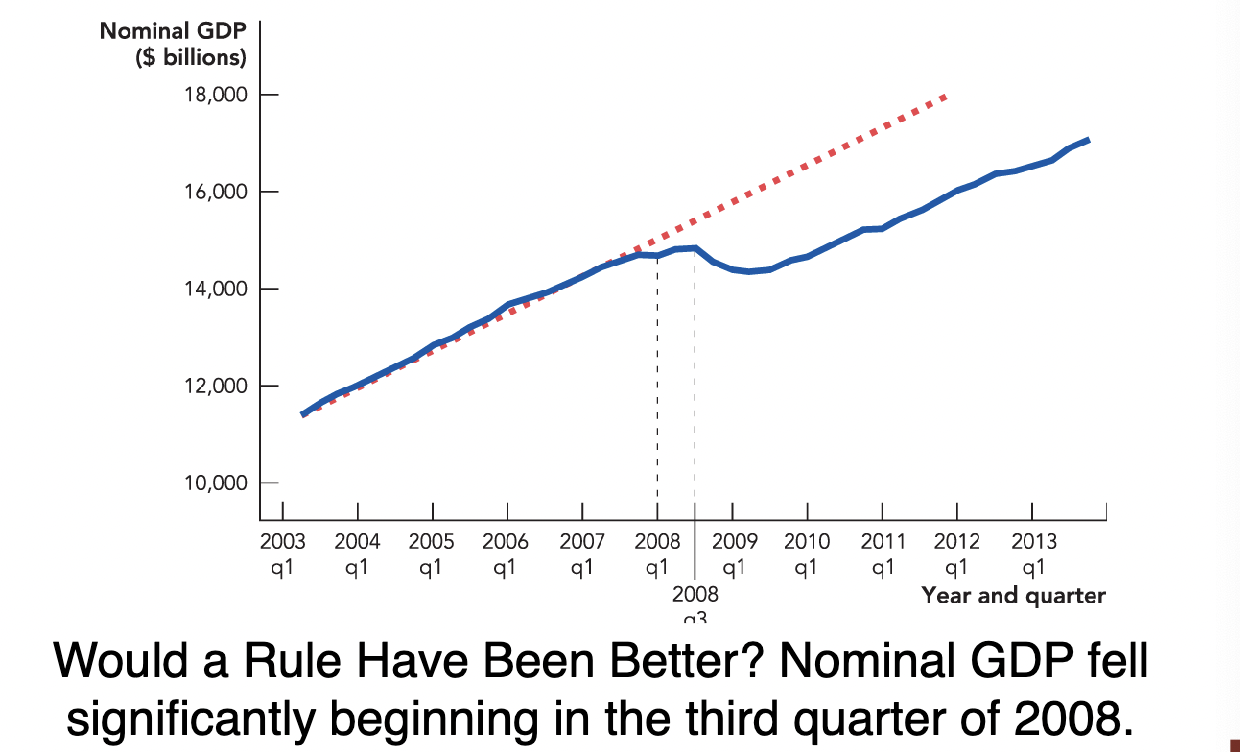

- The nominal GDP rule: Keeps Mv constant. If Mv doesn’t change or grows smoothly, then so does PYr, and that would be ideal

- A nominal GDP rule would have required the Federal Reserve to increase M by as much as it takes to keep nominal GDP growing at around 5% a year.

- If the Fed had followed a nominal GDp rule, the recession of 2008 would have been much milder

- Proponents of a nominal GDP rule say the Fed did too little, too late. In this view, if the Fed had acted sooner and given the markets clearer guidance, then v would have stayed higher and the Fed could have more easily returned nominal GDP to its trend.

Takeaway:

- The Fed has some influence over the growth rate of GDP through influence over the money supply and thus AD

- An increase in M increases AD and a decrease in M decreases AD

- When faced with a negative shock to AD, the central bank can restore aggregate demand through an expansionary monetary policy. Poor monetary policy can decrease the stability of GDP

- If in responding to a series of recessions, the Fed increases M too much, it may find that it later has to contract when inflation becomes too high

- A disinflation goes best when the central bank has some degree of credibility in its attempt to set things right

- A central bank would like low unemployment and low inflation, but it is not always possible to achieve both goals

- Monetary policy is difficult in the worst of times and it’s not easy in the best of times. The Federal Reserve has significant power but that power is not always easy to wield.

- Real shocks and aggregate demand shocks are always mixed and not easy to disentangle

April 10th Notes:

The U.S. Money Supplies:

- The money supply can be defined in different ways depending on which liquid assets are included in the definition

- Liquid assets are assets that can be used for payments or, quickly and without loss of value, be converted into assets that can be used for payments

Three most important definitions of the money supply:

- M1: Currency plus checkable deposits

- M2: M1 plus savings deposits, money market mutual funds, and small time deposits

- The Fed has direct control only over the monetary base. The Fed can increase bank reserves, but if the banks aren’t lending, the increase in reserves won’t do much to increase aggregate demand

- The central bank tried to use its control over MB to influence M1 and M2, but there are many other influences on M1 and M2 so each monetary aggregate can shrink or grow independently of others

- This control is indirect due to fractional reserve banking, which means banks hold only a fraction of their deposits in reserve, lending the rest.

- Thus, there are many other influences on M1 and M2.

- Although M1 and M2 affect aggregate demand, there are also other influences.

Fractional Reserve Banking:

- When money is deposited into an account, the bank holds a fraction of the account balance in reserve and uses the rest to make loans.

- Banks earn a profit on these loans.

- Banks share some of the profit with depositors by paying interest on the money you provide.

- They also provide services like check writing and check clearing

- The law and the Federal Reserve require banks to

- keep some reserves.

- Banks need those reserves to meet depositor demands for currency and payment services.

- Reserves involve opportunity costs: Money held in reserve isn’t being lent, and lending is where banks earn most of their profits.

- Banks balance these benefits and costs when deciding on the ratio between reserves and deposits.

- The monetary base includes: currency and reserves held by banks at the federal reserve

Reserve Ratio:

- The Reserve ratio (RR) is the ratio of bank reserves to deposits.

- If $1 in cash is held in reserve for every $10 of deposits, the reserve ratio is: 1/10=0.10

- The reserve ratio is determined primarily by how liquid banks wish to be

The Reserve Ratio and Money Multiplier:

- The inverse of the reserve ratio is called the money multiplier (MM).

- This Money multiplier (MM) is the amount that the money supply expands with each dollar increase in reserves.

- The money multiplier is the ratio of deposits to reserves. MM = 1/RR.

- In our case:= 10/1=10

- The money multiplier tells us how much deposits expand with each dollar increase in reserves.

Money Multiplier:

- The process continues until there are no excess reserves to lend.

- With a reserve ratio of 10%, the money multiplier = 1/0.10 = 10.

- The initial $1,000 increase in reserves can expand total deposits (money supply) by:

- Change in reserves × MM = Change in money supply

$1,000 × 10 = $10,000

- If the reserve ratio is 5%, the money multiplier is equal to: 1/0.05 = 20

Controlling the Money Supply:

- The Fed has two major tools to control the money supply:

1. Open market operations

2. Paying interest on reserves held by banks at the Fed

The Fed’s Tools to Change the Money Supply or “Liquidity”

The Fed has three tools to change the supply of money:

- Open market operations

- Repurchase agreements (repos)

- Quantitative easing

Open Market Operations:

- Open market operations occur when the Fed buys or sells government bonds

- The Fed changes the money supply by buying or selling government bonds (T-bills).

- To pay for the T-bills, the Fed electronically increases the reserves of the seller, usually a bank or large dealer.

- With more reserves, the bank can make additional loans, which are used to buy goods and pay wages.

- Reserves are again deposited in a bank.

- The payments for goods and wages are deposited into other banks.

- The new deposits increase the reserves of the banks, which can also make more loans.

- The Fed controls the monetary base, but it does not control how much or how quickly the base will change loans and the money supply.

- The money multiplier is determined by the reserve ratio, which is determined by banks.

- When banks are confident, they will keep their reserves low so the MM will be large.

- When banks are reluctant to lend, the MM will be low and a change in the monetary base will not change the money supply by much.

- When the Fed buys or sells bonds, it changes the monetary base and influences interest rates at the same time.

- When the Fed buys bonds, the demand for bonds increases, pushing up the price of bonds and lowering the interest rate.

- Buying bonds stimulates the economy through higher money supplies and lower interest rates.

- When the Fed sells bonds, the process works in reverse.

- Buying and selling government bonds influences interest rates:

- The Fed usually focuses on the Federal Funds rate, or the interest rate one major bank charges another for an overnight loan.

- It is a convenient signal of monetary policy.

- It responds quickly to actions by the Fed.

- It can be monitored on a day-to-day basis.

- Instead of increasing the money supply, the Fed can buy bonds until the Federal Funds rate drops by the desired amount.

- •The Fed can also increase the Federal Funds rate by selling bonds.

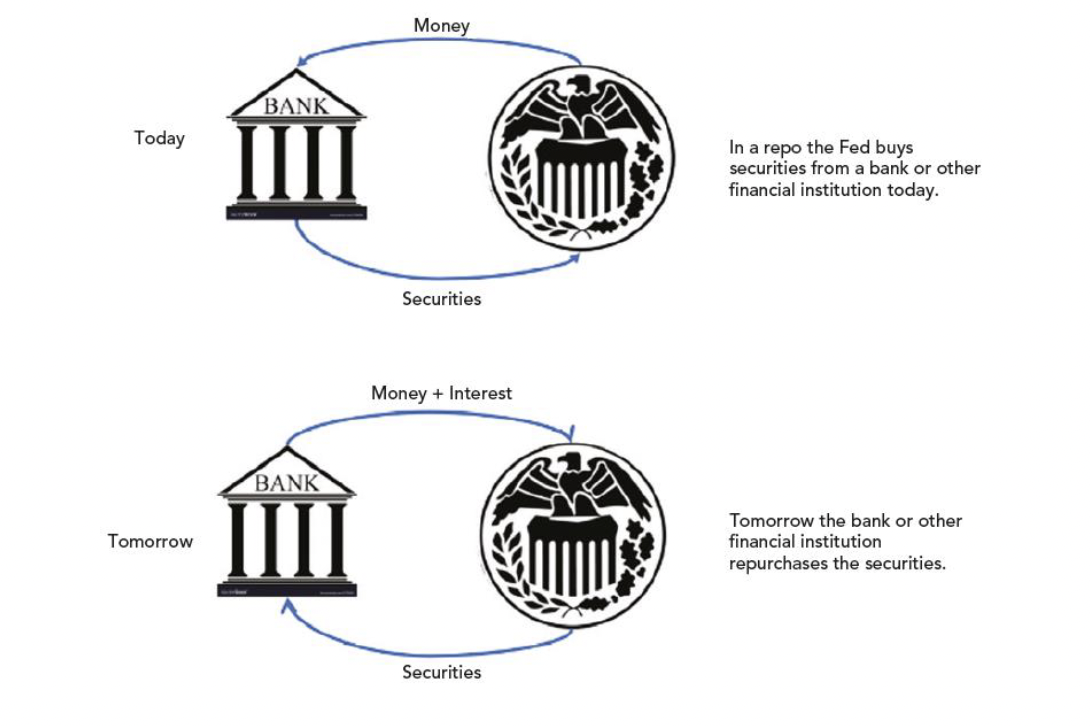

Repos:

- A repo is a temporary open market purchase and adds

- liquid reserves to the banking system.

- From the bank's point of view, a repo is a short-term loan from the Fed to the bank.

- A reverse repo is the opposite

Quantitative Easing:

- During the 2008–2009 recession, the Fed dramatically increased reserves.

- It pushed the Federal Funds rate very close to zero (“zero lower bound”).

- The economy still wasn’t responding.

- The Fed moved to buying and selling longer-term government bonds.

- This kind of quantitative easing is used when the Federal Funds rate is near the zero lower bound.

Quantitative Easing

Quantitative easing:

- When the Fed buys longer-term government bonds or other securities.

Quantitative tightening:

- When the Fed sells longer-term government bonds or other securities

Payment of Interest on Reserves

- Traditionally, the Fed influenced the Federal Funds rate by changing the supply of reserves.

- During the 2008 financial crisis, the Fed wanted to separate these two aspects of monetary policy.

- Paying interest on reserves allowed the Fed to separate the two channels of monetary policy.

- Starting in 2008, it increased excess reserves in the banking system from $2 billion to $2.8 trillion.

- Even though the Fed pays a very low interest rate on reserves, banks are willing to hold lots of reserves because interest rates for other low-risk investments are also close to zero.

- Since then, banks’ accounts at the Fed have grown, representing between $2 trillion and $4 trillion

- There are costs and benefits to holding reserves at the Fed:

– Cost: banks could be using these funds to earn interest by making loans.

– Benefit: Fed pays interest on reserves

- Banks are constantly comparing how much they could earn by lending funds with how much they could earn by holding their funds at the Fed.

- The Fed can choose the interest rate that it pays on reserves to influence lending and aggregate demand:

- If the Fed raises the rate on reserves, banks hold more reserves and make fewer loans, thus decreasing the aggregate demand.

- If the Fed lowers the rate on reserves, banks hold less reserves and make more loans, thus increasing the aggregate demand.

- If the Fed lowers the rate paid on reserves:

– Banks will find it more profitable to lend, increasing the amount of short-term loans

– The lower interest rate encourages consumers and businesses to borrow and invest, which increases spending.

- If the Fed raises the rate paid on reserves:

– Banks will find it less profitable to lend, decreasing the amount of short-term loans

– The higher interest rate discourages consumers and businesses to borrow and invest, which decreases spending.

The Fed’s Tools:

- Open market operations–the buying and selling of short-term U.S. government bonds. The Fed buys bonds to lower interest rates and expand the money supply, and sells bonds to raise interest rates and contract the money supply.

- Raising or lowering the interest rate paid on reserves. The FEd lowers the rate paid on reserves to decrease reserve demand and expand bank lending, and raises the rate to increase reserve demand and reduce bank lending.

- Quantitative easing–the buying and selling of longer-term U.S. government bonds or other securities. Used to influence longer-term rates directly or to support borrowing and lending in especially distressed markets in a crisis

- Lender of last resort–leading to banks and other financial intermediaries in a crisis to maintain borrowing and lending

April 12th Notes:

Coordinating Expectations:

- The Fed’s final tool is talking

- Talking can help the Fed manage and coordinate expectations

Limits to the Fed’s Powers:

- The Fed can change the interest rate to encourage banks to either increase or decrease lending, but what if banks do not change their lending?

- The Fed must try to predict and monitor:

- How much changes in interest rates affect spending, borrowing, and lending

- How quickly changes in interest rates affect spending, borrowing and lending

- Whether businesses and consumers want to invest and borrow

- If businesses do borrow, will they promptly hire labor and capital, or will they just hold the money as a precaution?

- How will the expectation of people and firms respond to the Fed’s actions? Will the Fed’s actions be regarded as temporary?

The Fed Only Influences Real Rates in the Short Run:

- Remember that money is neutral in the long run—that neutrality includes real interest rates.

- Also recall that an increase in aggregate demand increases the real growth rate only in the short run.

- The long-run neutrality of money, the long-run neutrality of aggregate demand, and the long-run neutrality of the Fed's influence over real interest rates are all different sides of the same "coin."

AD and Monetary Policy:

- The Fed uses monetary policy to influence aggregate demand (AD).

- For example, to increase AD, it can buy bonds in an open market operation.

- This expands the monetary base, increasing deposits and loans by the multiplier process.

- It also lowers short-term interest rates, stimulating investment and consumption borrowing.

- If all goes well, AD will increase.

- To estimate the effect on AD, the Fed must try to predict and monitor the following:

– Will banks lend out all the new reserves or only a portion?

– How quickly will increases in the monetary base translate into new bank loans?

– Do businesses want to borrow? How low do short-term interest rates have to go to stimulate more investment borrowing?

– If businesses do borrow, will they hire labor and capital, or just hold the money as a precaution?

Takeaways:

- The Federal Reserve is the government’s bank and the banker’s bank.

- It has the power to create money, regulate the money supply, and potentially lend trillions of dollars.

- This gives it the power to influence aggregate demand in the world’s largest economy.

- The Fed controls the money supply by buying and selling government bonds in open market operations

- The Fed has several tools to influence the aggregate demand.

– Changing the interest rate that it pays on bank reserves

– Open market operations, repos, and quantitative easing

– Acting as the "lender of last resort"

– Coordinating expectations

- It has the most influence over short-term interest rates.

Chapter 16 Lecture Notes:

Introduction:

- In this chapter, we turn to three key practical questions:

1. When should the Fed try to influence aggregate demand

(AD)?

2. When will the Fed be able to influence AD?

3. When will the influence on AD result in higher GDP

growth rates?

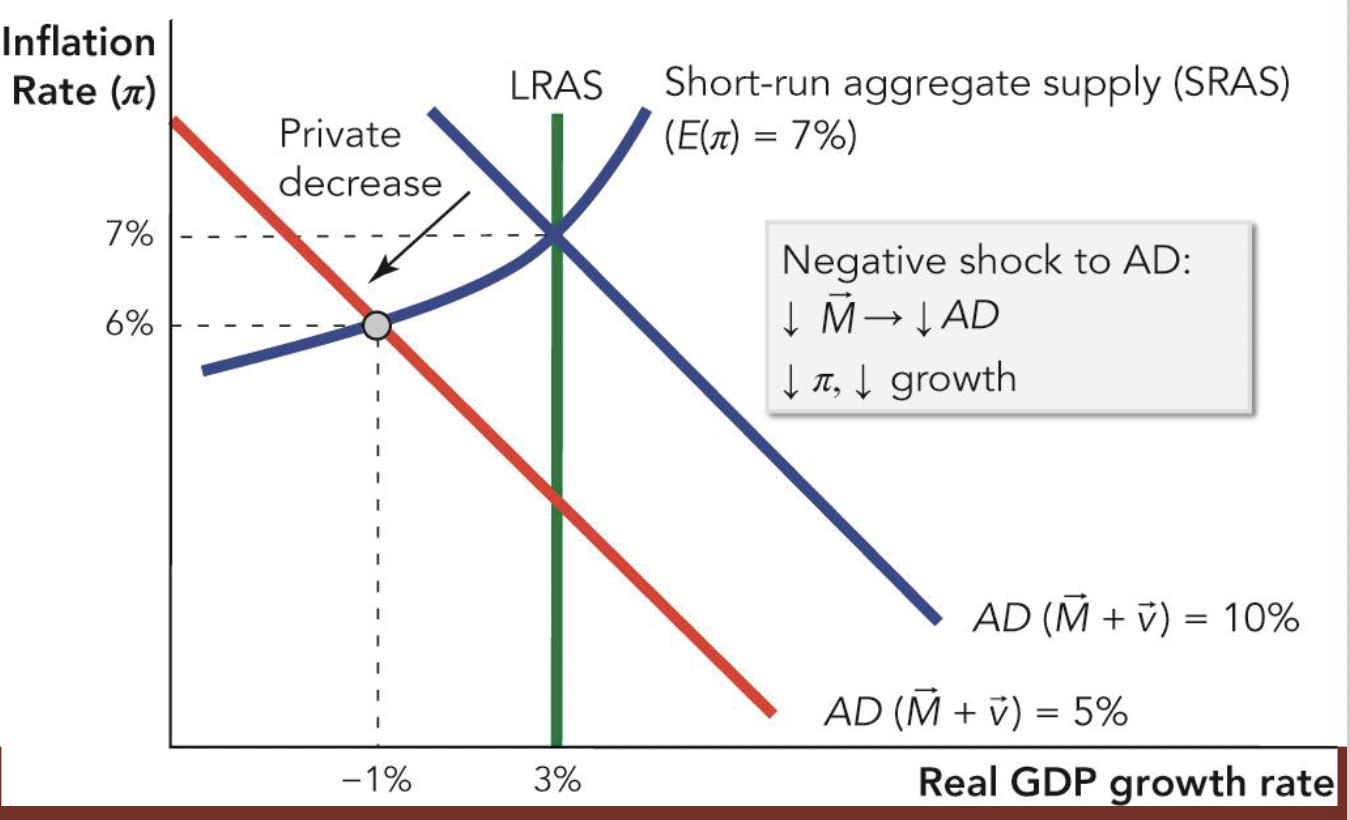

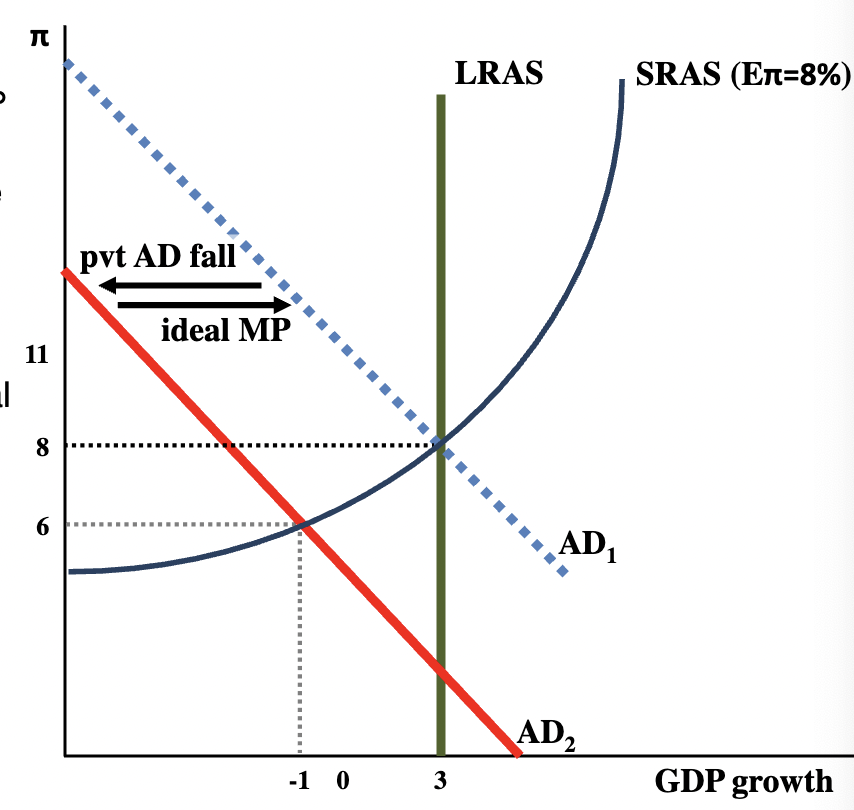

Monetary Policy: The Best Case

- Let’s start with an economy that has been growing at 3% with an inflation rate of 7%.

- Suppose it faces a negative shock to AD driven by “animal spirits”—emotions such as fear.

– Consumers become pessimistic, borrowing and spending less.

– Banks lend less, and entrepreneurs cut back on expansions and invest less.

– The negative shock shifts AD to the left, and the growth rate of output declines.

- Eventually, the economy will recover from the negative AD shock.

- Fear recedes and the economy returns to its steady-state growth level.

- However, there is slow growth and increased unemployment, or even a recession in the meantime.

- The Fed can combat this sluggish growth with monetary policy.

- To shift the AD curve back up and to the right, the Fed can:

– Increase the rate of growth of the money supply

– Reduce interest rates and encourage more borrowing

Self-Check:

Which monetary policy can the Fed use to increase AD?

a. increase the rate of growth of the money supply

b. increase interest rates

c. discourage consumer borrowing

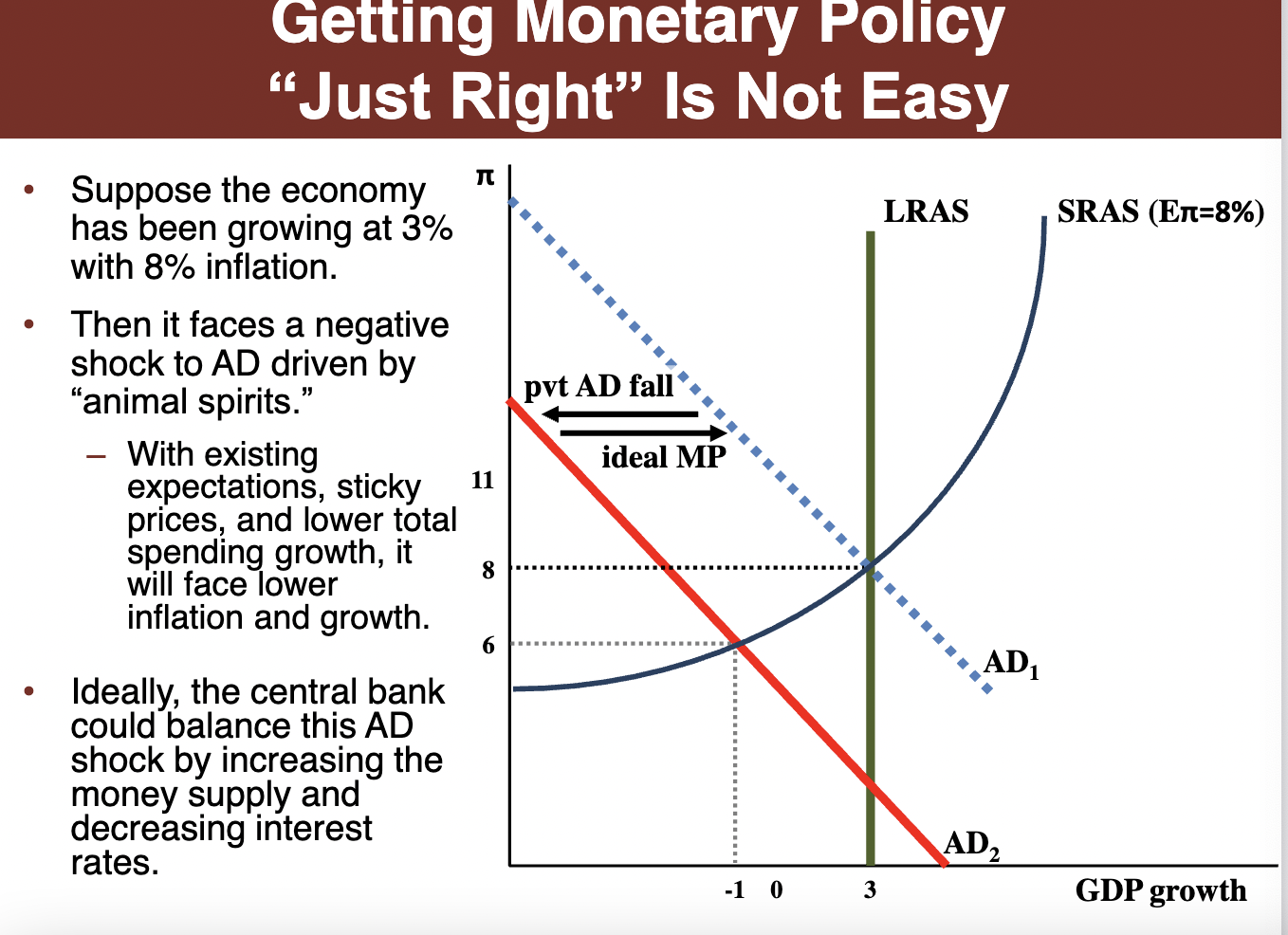

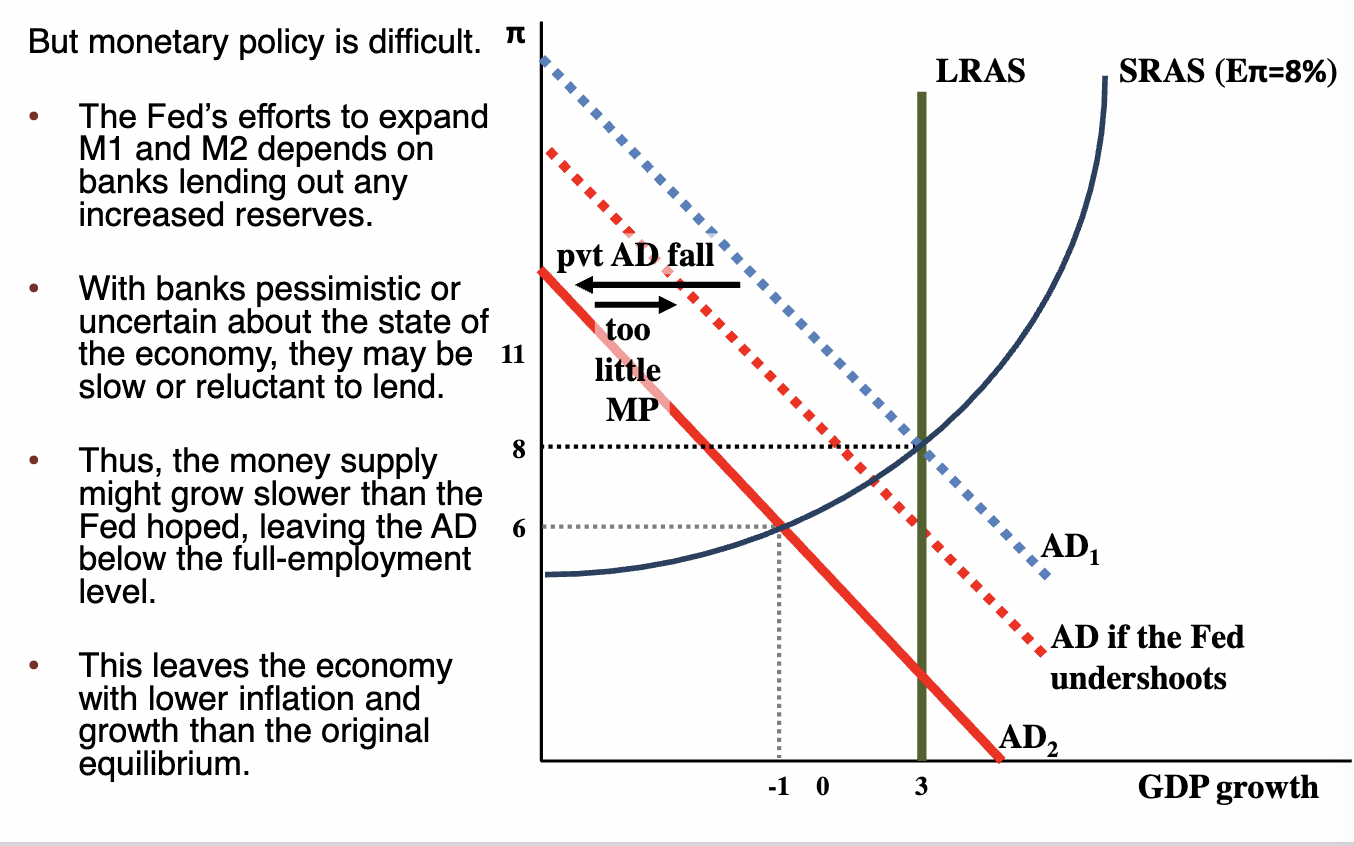

Getting Monetary Policy “Just Right” Is Not Easy

- Monetary policy is difficult because:

– The Fed must operate in real time when much of the data about the state of the economy is unknown.

– The Fed’s control of the money supply is incomplete and subject to uncertain lags.

- The Fed can also increase the money supply by more than the cyclical AD decline

- If it does this, it overstimulates the economy

- This leads to a temporary boom, but also higher inflation

- Ideally, the Fed could balance out a decline in aggregate demand by expanding the money supply and lowering interest rates

- But the Fed’s incomplete control over the money supply and limited access to real time date means that

- It might provide too little monetary stimulus to avoid a downward business cycle

- Or it could overstimulate the economy leading to inflation

Decreasing AD:

- Sometimes the Fed overstimulates the economy, increasing AD too much

- Economies may get stuck between continuing a costly rate of inflation or reducing it at the risk of a recession

- Many economists believe the Fed overstimulated the economy in the 1970s, resulting in an inflation rate of 13.5% by 1980

- By 1983, tough monetary policy had reduced the inflation rate to 3%.

- The consequence was a very severe recession with an unemployment rate of a little more than 10%.

- However, the Volcker Shock’s disinflation slowed inflation and provided the foundation for 25 or so years of economic growth.

– Remember that disinflation is a significant reduction in the rate of inflation

- If nominal wage growth outpaces inflation by too much, workers will become expensive, and employers may lay some workers off.

- The key to a less painful disinflation is to increase nominal wage flexibility.

- When they view announcements about tightened monetary policy as credible, workers will be prepared for slower wage growth and will quickly adjust to the inevitable.

– A monetary policy is credible when it is expected that a central bank will stick with its policy.

- A credible disinflation therefore reduces the unemployment effects.

Market Confidence:

- Fear and confidence are some of the most important shifters of aggregate demand.

- When investors are uncertain, they often prefer to wait.

- This is compounded by the bandwagon effect as investors coordinate their actions with others

- One of the Federal Reserve’s most powerful tools is its influence over expectations—namely, its ability to boost market confidence.

– The Federal Reserve influences market confidence by shaping expectations, not by directly changing the money supply.

- For example, uncertainty increased after the terrorist attacks of September 11, 2001.

- If enough people had taken the attacks as a signal to reduce investment, the bandwagon effect or uncertainty could have created a severe recession.

- The Fed increased lending to banks from $34 million to $45.5 billion on September 12.

- This helped stabilize expectations, reduce fear, and raise confidence.

Real Shocks-A Monetary Policy Dilemma:

- A difficult case for monetary policy is when the economy is hit by a negative real shock, such as a rapid oil price increase.

- This shifts the LRAS curve to the left, increasing inflation and decreasing GDP growth.

- A reduction inM reduces the inflation rate, but also reduces economic growth.

- The Fed can increase AD by increasingM

- But the economy is less productive than before, so most of the increase will show up in inflation.

- With a real shock, the central bank must choose between:

- Too low a rate of growth (with a high rate of unemployment)

- Too high a rate of inflation

Self-Check

A negative real shock poses difficulties for monetary policy

because:

a. policymakers can reduce inflation or unemployment,

but not both.

b. increasing the money supply is politically unpopular.

c. increasing the money supply is illegal.

Monetary policy and how real shocks affect it. Negative real shocks can reduce inflation. Sell bonds to decrease money supply and vice versa

April 15th Notes:

Monetary Policy-The Best Case:

- Costaguana has a Solow growth rate of 4%, while its money supply is growing by 10% and its velocity of money supply is growing by 1%. It is going to double in 17.5 years because 70/4=17.5

- With 11% total spending growth and 4% real growth, Costaguana must currently have a 7% inflation rate

- Suppose Costaguana faces a financial crisis, where consumers and entrepreneurs become more pessimistic

- With existing expectations and sticky prices, decreased spending growth will result in decreased real growth and increased unemployment

- Eventually consumers and entrepreneurs’ dears will recede

Self-Check: Which monetary policy can the Fed use to increase AD? The Fed can increase the rate fo growth of the money supply to increase AD

Getting Monetary Policy “Just Right” Is Not Easy:

- Monetary policy is difficult because:

- The Fed must operate in real time when much of the data about the state of the economy is unknown

- The Fed’s control of the money supply is incomplete and subject to uncertain lags

- Ideally, the Fed could balance out a decline in aggregate demand by expanding the money supply and lowering interest rates

- But the Fed’s incomplete control over the money supply and limited access to real time data means that

- It might provide too little monetary stimulus to avoid a downward business cycle

- Or it could overstimulate the economy leading to inflation

Decreasing AD:

- Sometimes the Fed overstimulates the economy, increasing AD too much

- Economies may get stuck between continuing

- By 1983, tough monetary policy had reduced the inflation rate to 3%

- The consequence was a very severe recession with an unemployment rate of a little more than 10%

- However, the Volcker Sh

- If nominal wage growth outpaces inflation by too much, workers will become expensive, and employers may lay some workers off

- The key to a less painful disinflation is to increase nominal wage flexibility

Market Confidence:

- Fear and confidence are some of the most important shifters of aggregate demand

- When investors are uncertain, they often prefer to wait

- This is compounded by the bandwagon effect as investors coordinate their actions with others

- One of the Federal Reserve’s most powerful tools is its influence over expectations–namely, its ability to boost market confidence

- The Federal Reserve influences market confidence by shaping expectations, not by directly changing the money supply

- For example, uncertainty increased after the terrorist attacks of September 11, 2001

- If enough people had taken the attacks as a signal to reduce investment, the bandwagon effect or uncertainty could have created a severe recession

- The Fed increased lending to banks from $34 million to $45.5 billion on September 12

- This helped stabilize expectations, reduce fear, and raise confidence

Real Shocks-A Monetary Policy Dilemma:

- A difficult case for monetary policy is when the economy is hit by a negative real shock, such as a rapid oil price increase

- This shifts the LRAS curve to the left, increasing inflation and decreasing GDP growth

- A reduction in M reduces the inflation rate, but also reduces economic growth

- The Fed can increase AD by increasing M

- But the economy is less productive than before, so most of the increase will show up in inflation

- With a real shock, the central bank must choose between:

- Too law a rate of growth (with a high rate of unemployment)

- Too high a rate of inflation

Self-Check:

A negative real shock poses difficulties for monetary policy because:

Policymakers can reduce inflation or unemployment, but not both

When the Fed Does too Much:

- In the late 1990s, U.S. economic growth was strong and unemployment was low

- The 2001 recession didn’t last long, but unemployment continued to increase even after it officially ended

- Three years after the recession ended, the unemployment rate remained near its recession high

- Unemployment kept increasing until it peaked with a 57.5% increase in June 2003 than it was in 2000 with a 4% unemployment rate

- The Fed kept pushing down the Federal Funds rate from about 6.5% in 2000 and held it at 1% until 2004

- The low Federal Funds rate helped to make credit cheap throughout the economy

- It encouraged people to take out more mortgages, bidding up the price of homes

- This fuled a speculative bubble in housing

- Rates remained very low until mid-2005

- In 2006, housing prices peaked; by 2007, they were in free fall

- The real estate crash contibuted to a freezing up of financial intermediation

Asset Price Bubbles:

- It’s easy to say in restrospect that the Fed should have raised rates sooner or more quickly

- There are several problems with this:

- Few people expected that a fall in housing prices would wreak as much havoc as it did

- It’s not always easy to identify when a bubble is present

- Monetary policy is a crude means of “popping” a bubble, because it affects the whole economy

- The Fed has the power to regulate banks

- It could have restrained some of the “subprime,” no questions-asked mortgages that later went into default

- That would have been the best way of limiting the bubble without taking down the broader economy

- Economists have not settled on what to do when asset prices boom

Self Check: Which of the following strategies should the Fed have used to limit the recent housing bubble? The Fed should have regulated subprime mortgages to lmit the housing bubble

Rules v. Discretion:

- Ideally, monetary policy adjusts for shocks to AD, but it is uncertain whether these adjustments are effective in reducing the volatility of output.

- Some economists believe the Fed should follow a consistent policy and not try to adjust to every aggregate demand shock.

- A typical monetary rule would set target ranges for the monetary aggregates like M1 or M2, or for the rate of inflation.

- A monetary rule works best only when v, monetary velocity, doesn’t change rapidly.

- If M is constant and v falls, then either P must fall or Y must fall.

- Since prices are sticky, the usual outcome is that both P and Y fall, and a fall in Y means a recession.

- Other economists have suggested a nominal GDP rule: Keep Mv constant (or growing at a constant rate).

- If Mv doesn’t change or grows smoothly, then so does PY, and that would be ideal

- If the Fed had followed a nominal GDP rule, the recession of 2008 would have been much milder.

- The Fed did not increase M enough to make up for a fall in v, even though the monetary base doubled between August and December 2008.

- Whether the Fed should have or could have kept nominal GDP on track continues to be debated.

April 17th Notes:

Rules vs. Discretion:

- Ideally, monetary policy adjusts for shocks to AD, but it is uncertain whether these adjustments are effective in reducing the volatility of output

- Some economists believe the Fed shouldn’t try to adjust to every aggregate demand shock but should instead follow a consistent policy

- Targeting monetary aggregates like M1 or M2, or for the rate of inflation

- Or targeting a constant NGDP (Mv) or NGDP growth (M+v)

Chapter 18 Lecture Notes:

Introduction:

- After a year of crescendoing financial crisis, the bankruptcy of Lehman Brothers on September 15, 2008, froze up markets. Uncertainty reigned.

- Amid uncertainty and decreased household wealth, consumer spending dropped by 3.7% in the third quarter of 2008 alone

- This collapse in consumer spending and investment, decreased America’s aggregate demand.

- The Fed attempted to stimulate AD

– but banks were reluctant to expand lending even as we faced a liquidity trap.

– Thus, the Fed’s monetary policy proved too weak to avoid a downward business cycle

- To encourage spending, the government sent tax rebate checks to millions of U.S. taxpayers

- In 2009, hundreds of billions of dollars were spent on infastructure

- These tax cuts and increased government spending are two examples of fiscal policy

- Fiscal policy is federal government policy on taxes, spending, and borrowing that is designed to influence business fluctuations

Why Should Fiscal Policy Work?

- When the economy is at full employment, spending more won’t appreciably increase output

- New production will pull resources from other sectors of the economy

- At full employment, the increase in government spending will most likely crowd out production by the private sector.

- Crowding out is the decrease in private spending that occurs

when government spending increases.

- The net effect on GDP will be close to zero

Why Should Fiscal Policy Work?

- If the resources used in new production would have otherwise

been unemployed, then every dollar spent will add one dollar to GDP.

- Increased spending by the previously unemployed workers could increase GDP by more than the initial amount.

- The additional increase in spending is due to the multiplier effect.

– The multiplier effect is the additional increase in spending caused

by the initial increase in government spending.

- Fiscal policy can work because when resources are unemployed, the economy is operating inefficiently

Self-Check:

An increase in government spending that causes a decrease in private spending is called: crowding out

Which of the following is not fiscal policy: Managing the money supply (this is part of monetary policy)

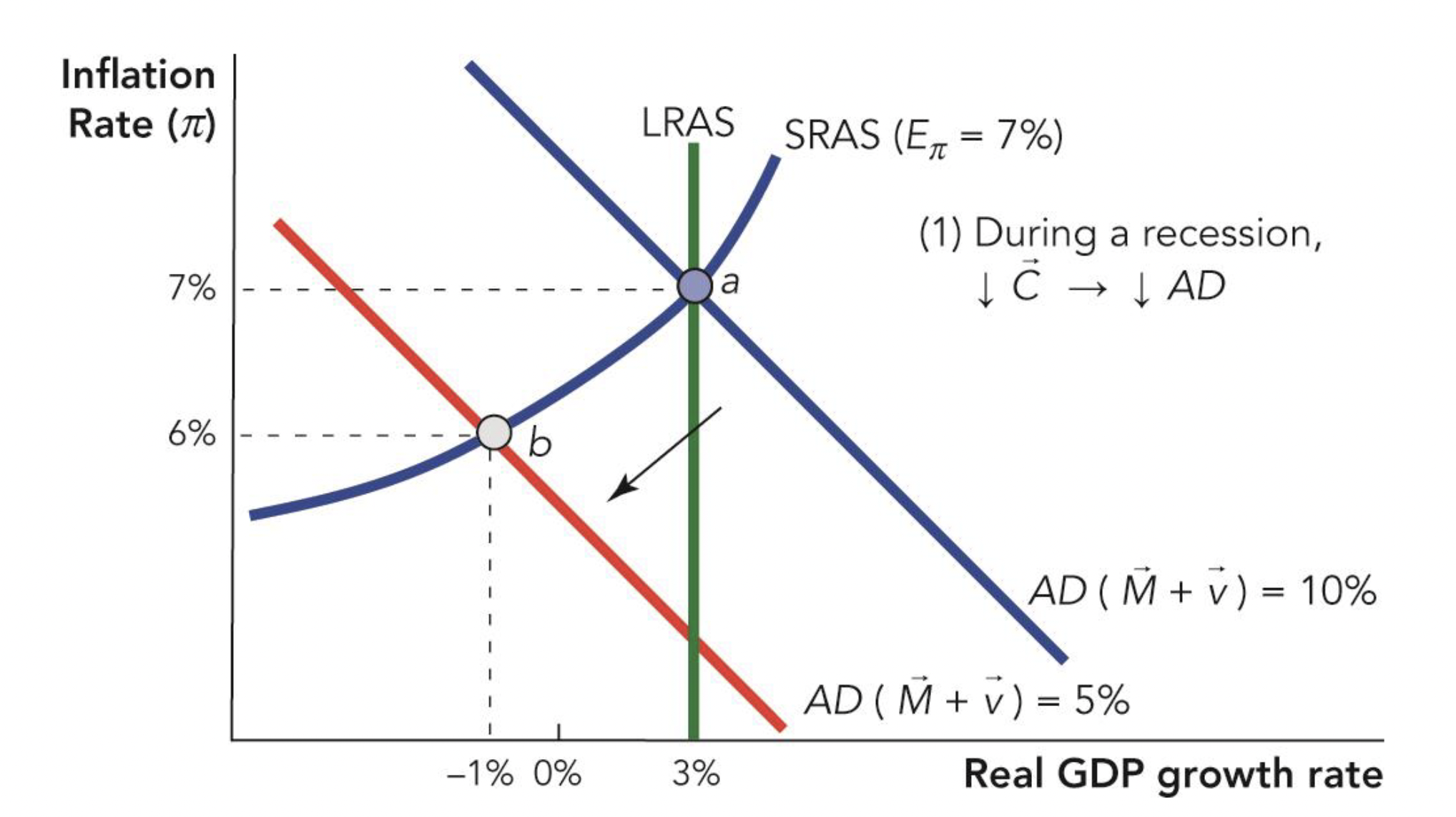

Why Should Fiscal Policy Work?

- A decrease in consumer spending growth, c, is equivalent to a decrease in velocity, v

- AD shifts to the left.

- The economy moves from a long-run equilibrium at point a to a short-run equilibrium at point b.

- At point b, the economy is in a recession.

- Because consumers want to hold more money, inflation decreases.

- Because wages are sticky, real growth decreases

Fiscal Policy-The Best Case:

- If government does nothing, wages will adjust in the long run

- The economy will eventually return to its normal growth rate

- The government can offset decreasing C by increasing G

- The increase in government spending doesn’t have to be that large as the decrease in consumption because of the multiplier effect

The Size of the Multiplier:

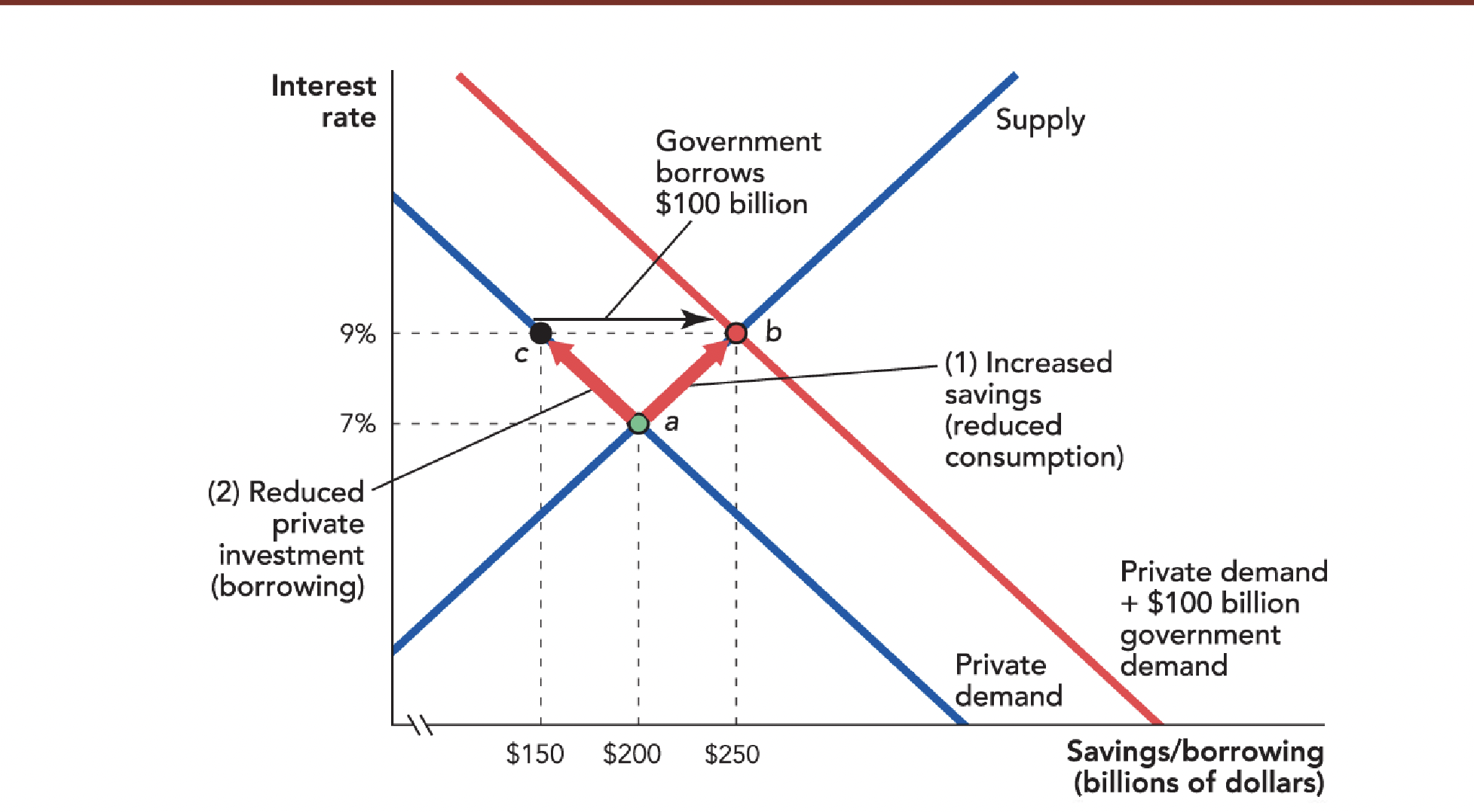

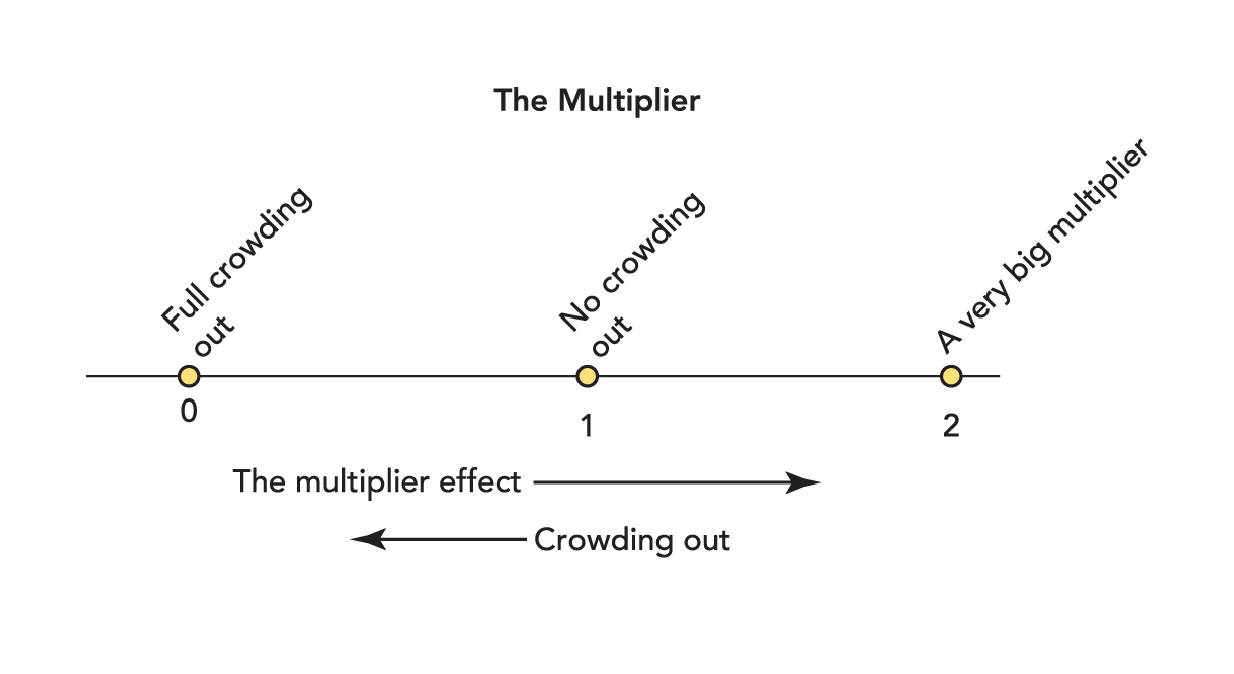

- The debate over fiscal policy is about the balance of two opposing forces: crowding out versus the multiplier effect

- If additional government spending crowds out equivalent spending from the private sector, then the multiplier is zero.

- If no amount of private sector spending is crowded out, the multiplier is 1.

- If the increase in government spending causes additional private spending, the multiplier is greater than 1

- Fiscal policy is much more successful when the multiplier is big.

- The size of the multiplier is bigger when:

– There are lots of unemployed resources.

– The government can target spending on the unemployed.

– Tax cuts go to people who want to spend immediately.

– The government can tax savings.

– Government borrowing doesn’t crowd out private consumption or investment

April 19th Notes:

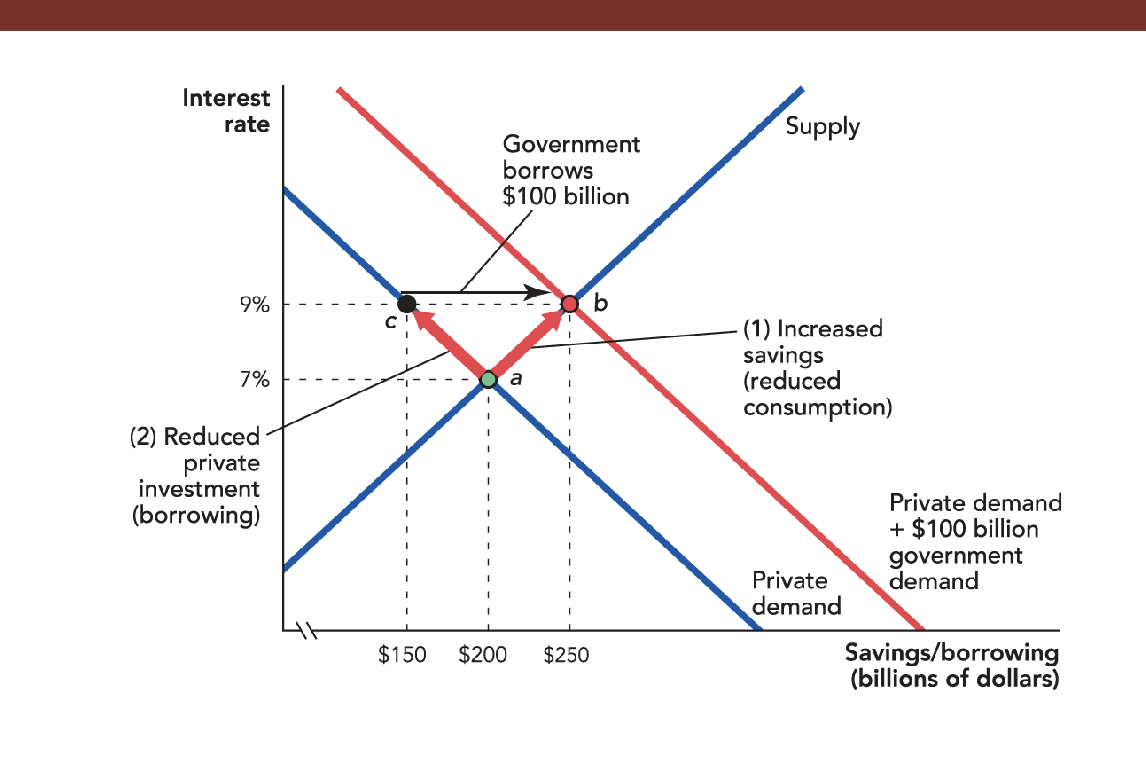

Government Borrowing and Crowding Out:

Higher interest rates leads to a reduced amount of private investment

The Size of the Multiplier:

- Fiscal policy is much more successful when the multiplier is big

- The size of the multiplier is bigger when:

- There are lots of unemployed resources

- The government can target spending on the unemployed

- Tax cuts go to people who want to spend immediately

- The government can tax savings

- Government borrowing doesn’t crowd out private consumption or investment

Definition:

Ricardian equivalence:

- When people see that lower taxes today mean higher taxes in the future and so, instead of spending their tax cut, save it to pay future taxes. When Ricardian equivalence holds, a tax cut doesn’t increase aggregate demand even in the short run

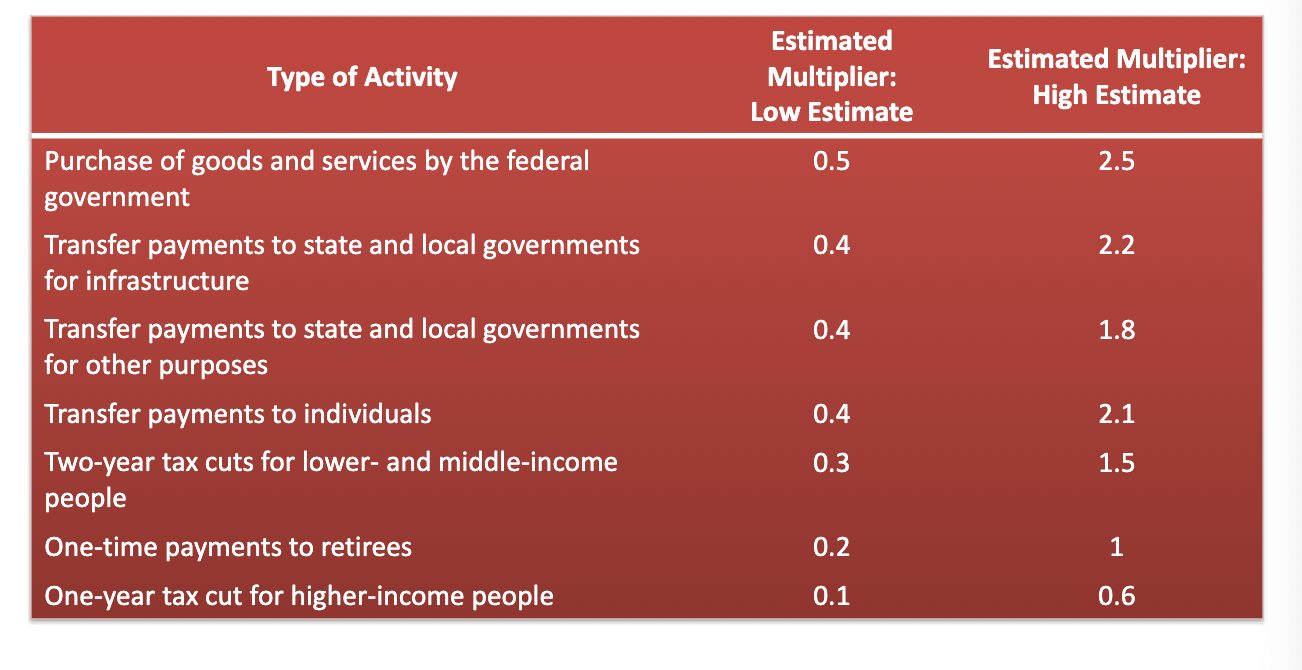

Estimating the Multiplier:

Limits to Fiscal Policy-Magnitude:

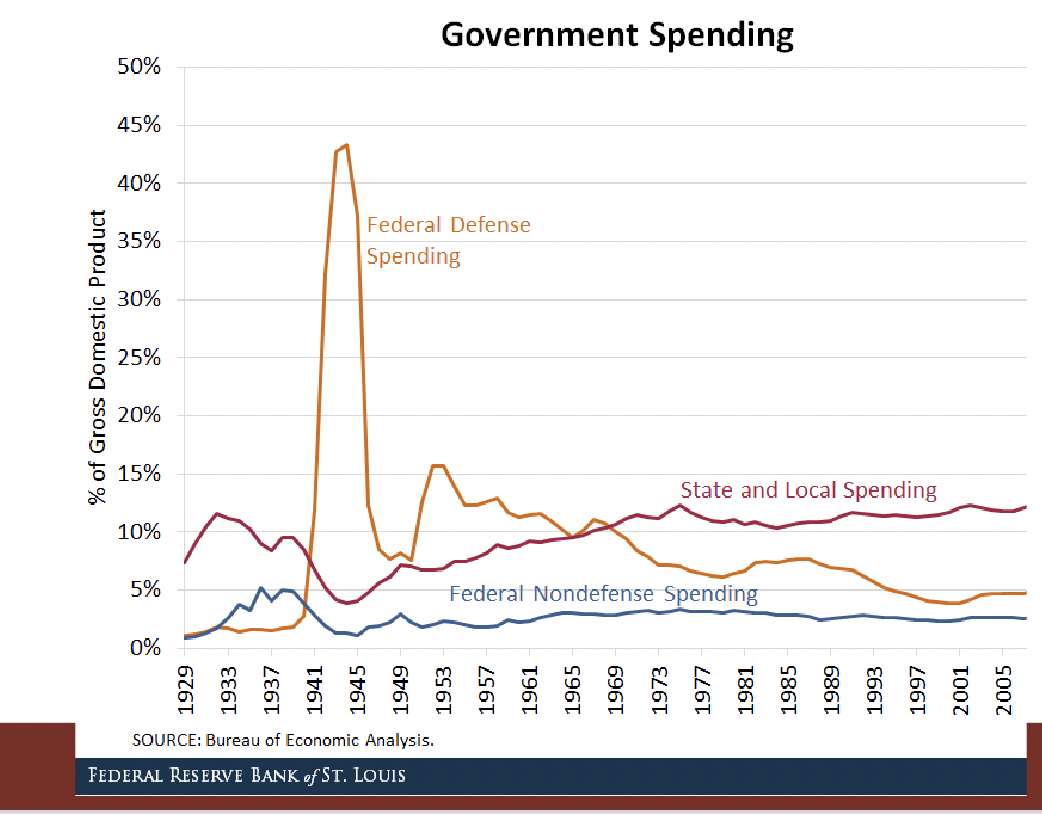

- Government spending doesn’t change very much from year to year in percentage terms

- Most of the federal budget is determined well in advance and is remarkably stable

- Any changes are not large enough in the short run to boost aggregate demand very much

Limits to Fiscal Policy-Timing:

- Fiscal policy is subject to many lags:

- Recognition lag: The problem must be recognized

- Legislative lag: Congress must propose and pass a plan

- Implementation lag: Bureaucracies must implement the plan

- Effectiveness lag: The plan takes time to work

- Evaluation and adjustment lag: Did the plan work? Have conditions changed?

- Tax cuts–the other major form of fiscal policy–also involve lags and uncertainties.

- Monetary policy is subject to lags as well, but these are generally much shorter than those for fiscal policy

- Fiscal policy is rarely adjusted in response to changes in economic conditions

- The only place where fiscal policy might have an advantage over monetary policy is through the effectiveness lag

- Exception: Automatic stabilizers are built right into the tax and transfer system

- Automatic stabilizers are changes in fiscal policy that stimulate AD in a recession without the need for explicit action by policymakers

- They take effect without significant lags

Automatic Stabilizers:

- Fiscal policy automatically changes to keep private spending higher during bad economic times

- When the economy is doing poorly:

- Income, capital gains, and profits are all down, so everyone pays lower taxes

- More people apply for welfare, food stamps, and unemployment insurance

- Consumption smoothing and credit also act as automatic stabilizers

The time it takes for fiscal policy to work is called the: effectiveness lag

Government Spending vs. Tax Cuts:

- The two types of fiscal policy differ politically and economically

- A tax cut or tax rebate puts more spending in the hands of the private sector

- An increase in government spending puts more spending in the hands of the government

- If we can find productive public investments such as improvements to schools, science funding, and infrastructure, then the case for public investment is strong

Balancing Fiscal Policy:

- Despite its limited magnitude and timing, some fiscal stimulus can make sense as part of the economy’s response to the business cycle

- Have to pay for this stimulus eventually

- Government surpluses balancing out government deficits will shrink AD–causing unemployment

- The resulting unemployment will be the smallest when the economy is booming–as will crowding out

- It makes sense for governments to pursue a counter-cyclical fiscal policy, which runs opposite or counter to the business cycle–spending more when the economy is in a recession, and spending less when the economy is booming.

Fiscal Policy and Real Shocks:

- When a real shock reduces the productivity of labor and capital, LRAS decreases

- An increase in government spending will increase aggregate demand

- However, due to the real shock, the economy is now less productive, so most of the increase will be felt as higher inflation rather than as real growth

- Fiscal policy is therefore not always an effective method of combating a recession

Fiscal Policy is Less Effective at Combating a Real Shock-

A real shock shifts the long-run aggregate supply curve (LRAS) to the left (step 1), moving the economy from point a to a recession at point b.

Covid and Fiscal Policy:

- The COVID-19 pandemic was a real shock because our abundance of caution made it more costly for people to work together.

- This shifted the LRAS supply curve to the left.

- Policymakers worried that getting people back to work could

- make the pandemic worse.

- Fiscal policy focused on temporarily protecting jobs and

- addressing the health costs of the pandemic.

- Overall, the U.S. federal government spent more than $5 trillion on COVID-19 relief.

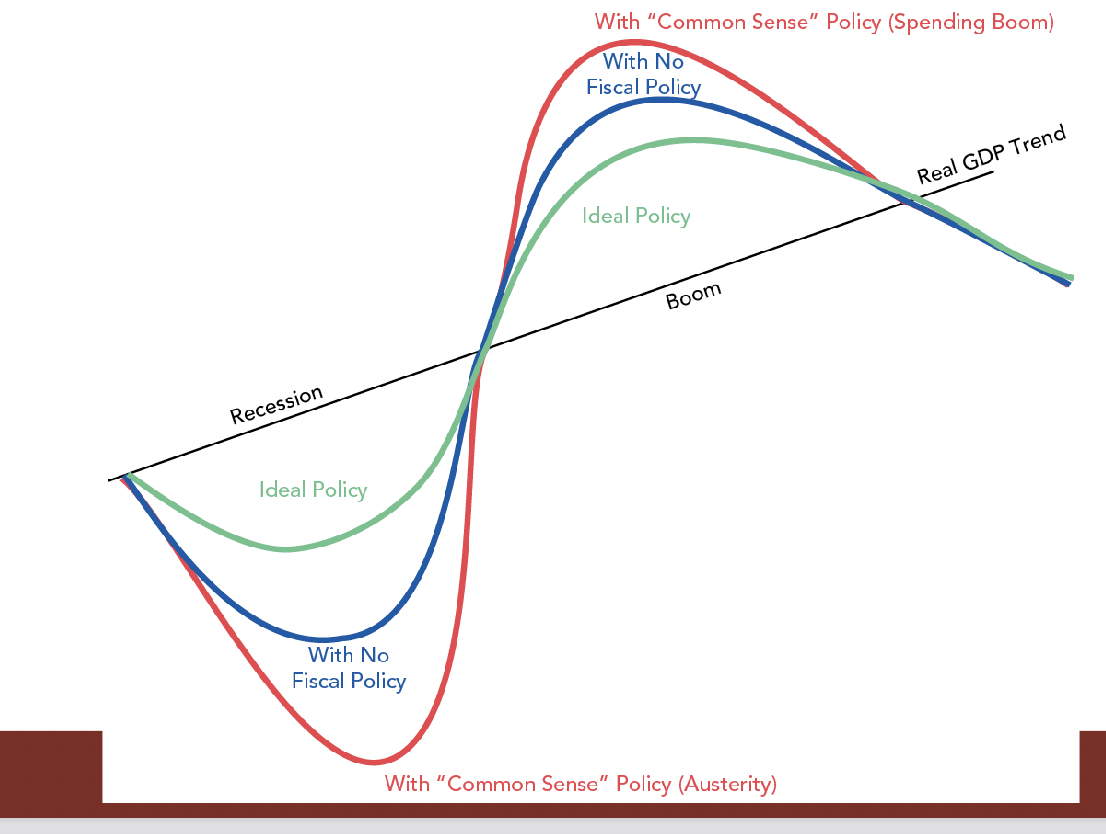

Counter-Cyclical vs. “Common Sense” Fiscal Policy:

- Increased spending and tax cuts today tend to be followed by decreased spending or tax increases tomorrow.

- When spending falls and taxes rise, AD will fall—this is one reason why long-run or net multipliers are smaller than short-run multipliers.

- Spending more in bad times when the multiplier is big, and taxing more in good times when the multiplier is small, will lead to higher GDP overall.

- Again, this is the case for governments to pursue a counter-cyclical fiscal policy

- Ideal fiscal policy will increase AD by spending in bad times and reduce AD by taxing and paying off the bill in good times.

- Makes both the busts and booms smaller and the economy less volatile.

- Ideal fiscal policy is counter-cyclical because when the economy is down, the government should spend more, and when the economy is up, the government should

spend less.

- Common sense fiscal policy also warns about having too much debt

- In extreme situations, debt can be such a problem that expansionary fiscal policy can reduce real growth

- Some countries are so heavily in debt that any more government borrowing runs the risk of total economic collapse

- In this setting, if the government increases spending, aggregate demand falls because uncertainty causes people to save or hoard their money in anticipation of hard times

When Fiscal Policy is a Good Idea:

The stimulus under President Barack Obama-

- A lot of the tax cuts were saved or used to pay off

debts, rather than spent.

• This boosted economic security for some people but

didn’t reemploy a lot of workers.

• The grants to the states prevented many state-

government layoffs, which was good for economic

Output.

Chapter 21 Notes:

- Public Choice: The study of political behavior using the tools of economics

- Behavioral symmetry: Self-interest is as important in politics as in economics

- Comparitive institutional analysis is all about analyzing the incentive issues associated with alternative institutional arrangements

Voters and the Incentive to be Ignorant:

- Studying politics doesn’t pay because the outcome of an election is mostly determined by what other people do, not by what you do

- Rationally ignorant: The incentives to be informed are low so people choose not to be informed

- The two largest sources of government spending are defense and Social Security

- Most Americans know “not much” or “nothing” about important pieces of legislation such as the USA Patriot Act.

- Most Americans cannot estimate the inflation rate or the unemployment rate to within five percentage points

Why Rational Ignorance Matters:

- If voters don’t know what the USA Patriot Act says or what the unemployment rate is, then it’s difficult to make informed choices

- Voters are supposed to be the drivers in a democracy, but if the drivers don’t know where they are of where they want to fo or how to get there, they are unlikely to ever arrive at a desirable destination

- Voters who are rationally ignorant will often make decisions on the basis of low-quality, unreliable, or potentially biased information

- Not everyone is rationally ignorant

Special Interests and the Incetive to be Informed:

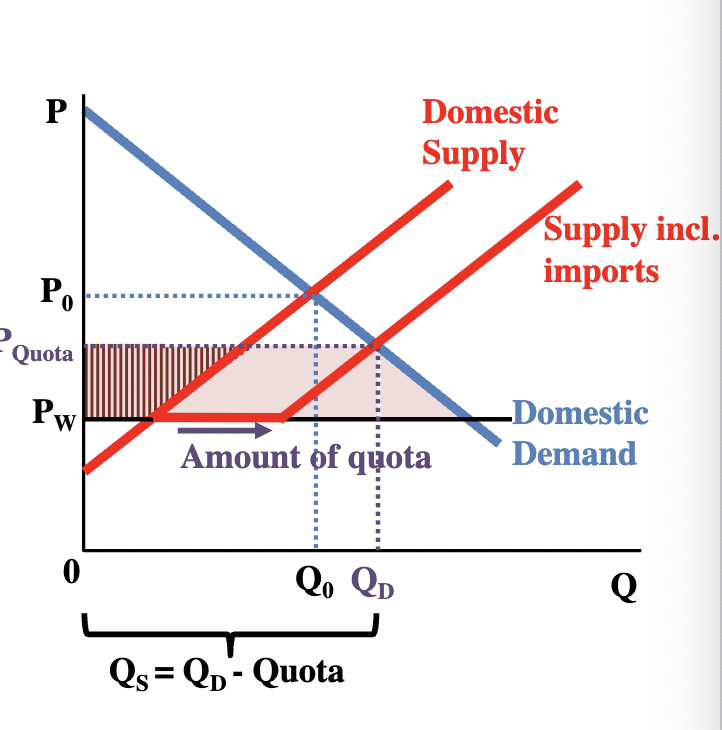

Quota Example-

- Even if sugar consumers did know about the quota, they probably wouldn’t spend much time or effort to oppose it

- Sugar consumers won’t do much to oppose the quota, but U.S. sugar producers benefit enormously from quotas

- Sugar production is concentrated among a handful of producers. Each producer benefits from the quota by millions of dollars

- Sugar producers have more money at stake, which is a strong incentive to be rationally informed. For example, they know which politicians are running for election and donate accordingly.

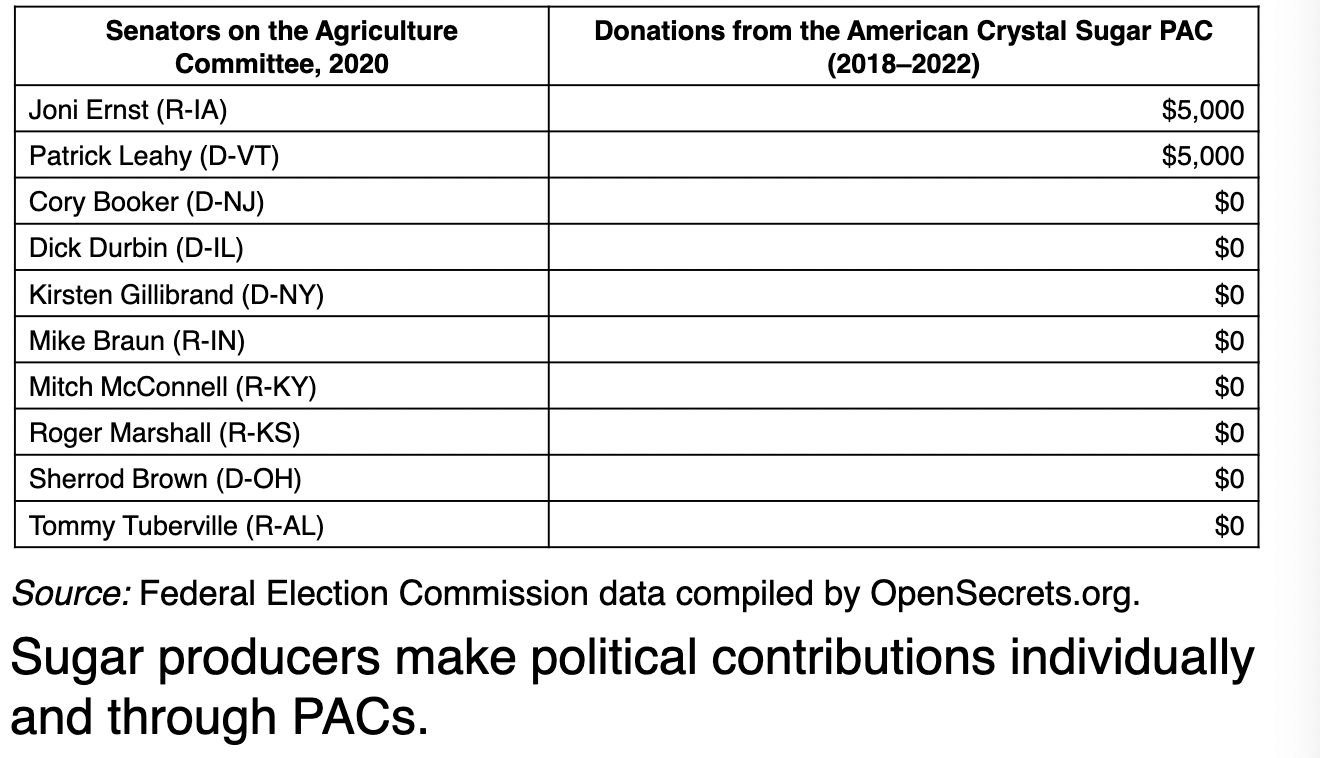

- 13 of 21 senators on the Agricultural Committee received money from the American Crystal Sugar PAC. Many senators also received money from the American Sugar Cane League, the Florida Sugar Cane League, etc.

A Formula for Political Success-Diffuse Costs, Concentrate Benefits-

- The politics behind the sugar quota illustrate a formula for political success, diffuse costs and concentrate benefits

- The people who are harmed are rationally ignorant and have little incentive to oppose the policy, while the people who benefit are rationally informed and have strong incentives to support the policy. Therefore, we can see one reason why the self-interest of politicians doesn’t always align with the social interest

- The formula for political success works for many types of public policies, not just trade quotas and tariffs

- Agricultural subsidies and price supports fit the diffused costs and concentrated benefits story. The political power of farmers has increased as the share of farmers in the population has decreased. When farmers decline in population, the benefits of, for example, a price support become more concentrated on farmers and the costs become more diffused on nonfarmers

- The benefits of many government projects such as roads, bridges, dams, and parks are concentrated on local residents and producers, while the costs of these projects can be diffused over all federal taxpayers.

- Example: A ferry service runs to the island but some people in the town complain that it costs too much. If the town’s residents had to pay the $320 million cost of the bridge themselves

- As far as the residents of the town are concerned, the costs of the bridge are external costs

- The formula for political success works for tax credits and deductions, as well as for spending. Tax breaks for various manufacturing industries have long been common, the term manufacturing was significantly expanded so that oil and gas drilling as well as mining and timber could be included as manufacturing industries

- Every year, Congress inserts many thousands of special spending projects, exemptions, regulations, and tax breaks into major bills.

- When benefits are concentrated and costs are diffused, resources can be wasted on projects with low benefits and high costs

- Example: A special interest group representing 1% of society that proposes a simple policy that benefits the special interest by $100 and costs society $100. The policy benefits the special interest by $100 and it costs the special interest just $1. The special interest group will certainly lobby for a policy like this

- No society can get rich by passing policies with benefits that are less than costs

- Example: The fall of the Roman Empire was caused in part by bad political institutions. As the Roman Empire grew, courting politicians in Rome became a more secure path to riches than starting a new business

Another Formula-Concentrated Costs, Diffuse Benefits:

- Policies with concentrated benefits and diffuse costs can win in a democratic process even when the benefits are less than the costs

- When costs are concentrated and benefits are diffused another government failure can happen–policies with concentrated costs and diffuse benefits can lose in a democratic system even when the benefits are more than the costs

- Many cities make it costly and dificult to build new housing. In a typical process, even when land is zoned for construction, a builder must also get approval from a neighborhood review board which holds hearings

- The costs of a project, whether real or imagined, are concentrated on a small number of people who are likely to be vocal about their opposition. The benefits are diffuse

- The developer will benefit and will speak in favor, but the future residents are probably unknown, even to themselves

- Diffuse beneficiaries are more likely to vote about general rules than they are to attend and speak at a review board about a specific proposal

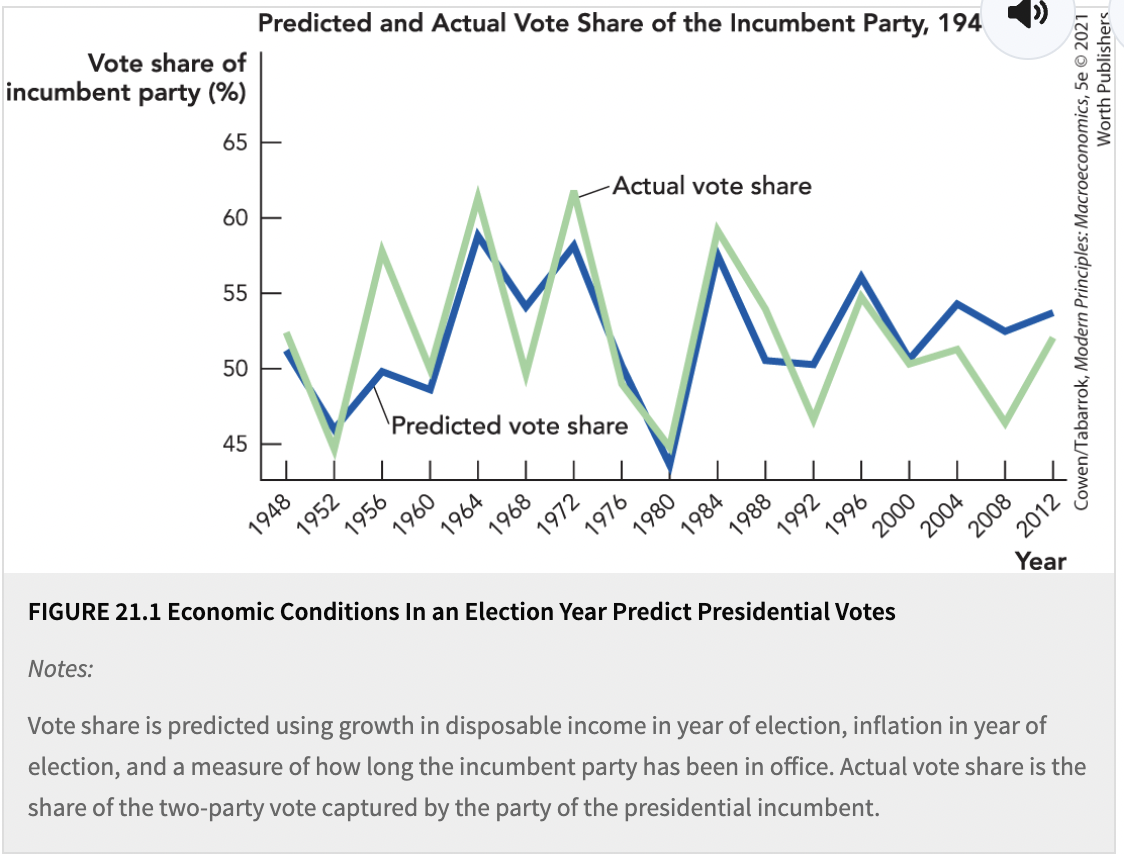

Voter Myopia and Political Business Cycles:

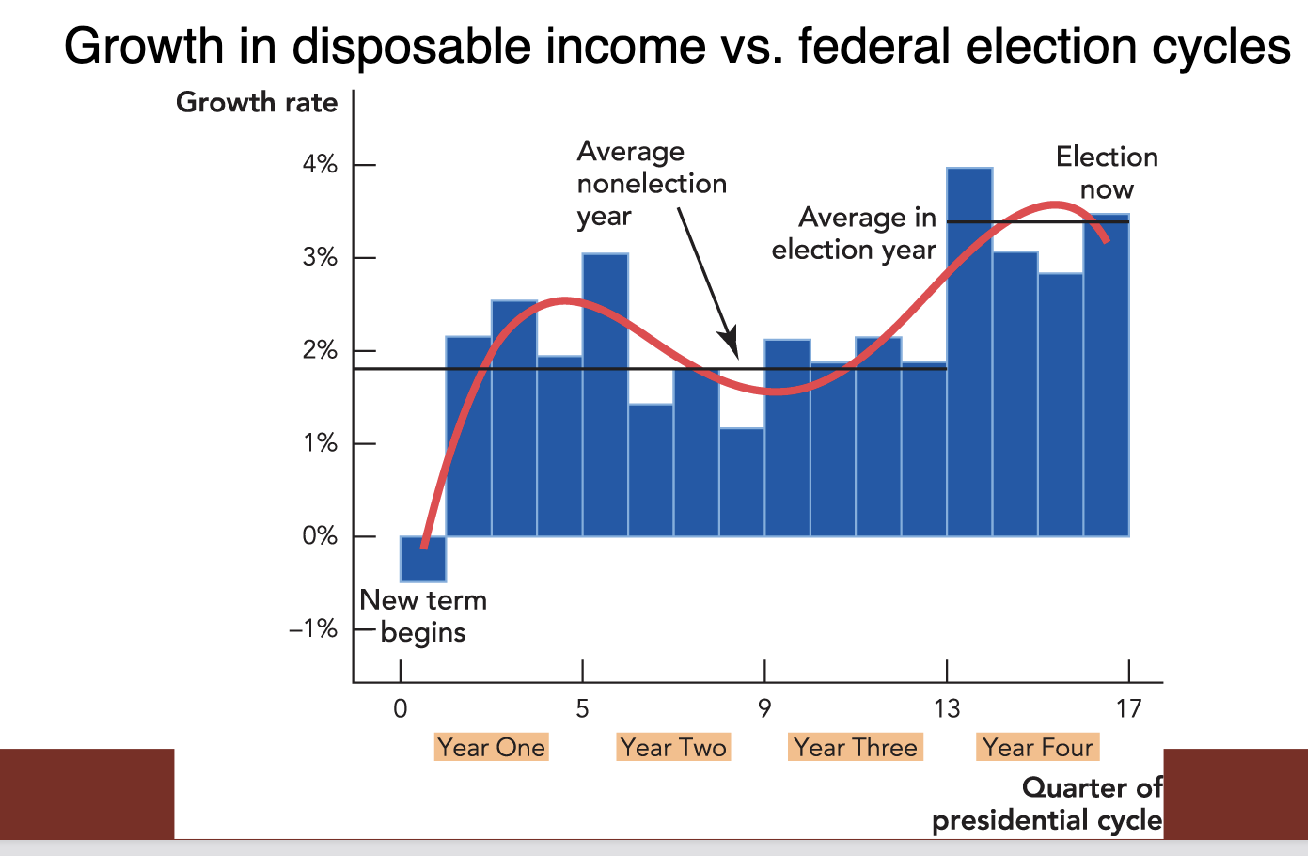

- Rational ignorance and voter myopia can encourage politicians to boost the economy before an election to increase their chances of reelection

- Personalities and leadership loom large and are reckoned to swing voters one way or another

- Economists and political scientists have been surprised to discover that a simpler logic underlies this apparent chaos of seemingly unique and momentous events

- Voters are so responsive to economic conditions that the winner of a presidential election can be predicted with considerable accuracy, even if one knows nothing about the personalities, issues, or events that seem to matter so much

- For each presidential election since 1948, the share of the two-party vote won by the party of the incumbent

- The incumbent party wins elections when personal disposable income is growing, when the inflation rate in the election year is low, and when the incumbent party has not been in power for too many terms in a row

- The inflation rate is the general increase in prices. Voters seem to get tired or disillusioned with a party the longer it has been in power, so there is a natural tendency for the presidency to switch parties even if all remains the same

- Voters are myopic–they don’t look at economic conditions over a president’s entire term

- Politicians who want to be reelected, therefore, are wise to do whatever they can to increase personal disposable income and reduce inflation in the year of an election even if this means decreases in income and increases in inflation at other times

- Inflation also follows a cyclical pattern, but since voters dislike inflation, it tends to decrease in the year of an election and increase after the election

- Mayors and governors try to increase the number of police on the streets in an election year, so that crime will fall and people will feel safer

- Presidents don’t always succeed in increasing income during an election year

Two Cheers for Democracy:

- When a policy is specializwd in its impact, difficult to understand, and affects a small part of the economy, it is likely that special interests get their way

- When a policy is highly visible, appears often in the news and on social media, and has a major effect on the lives of millions of Americans, the voters are likely to have an opinion.

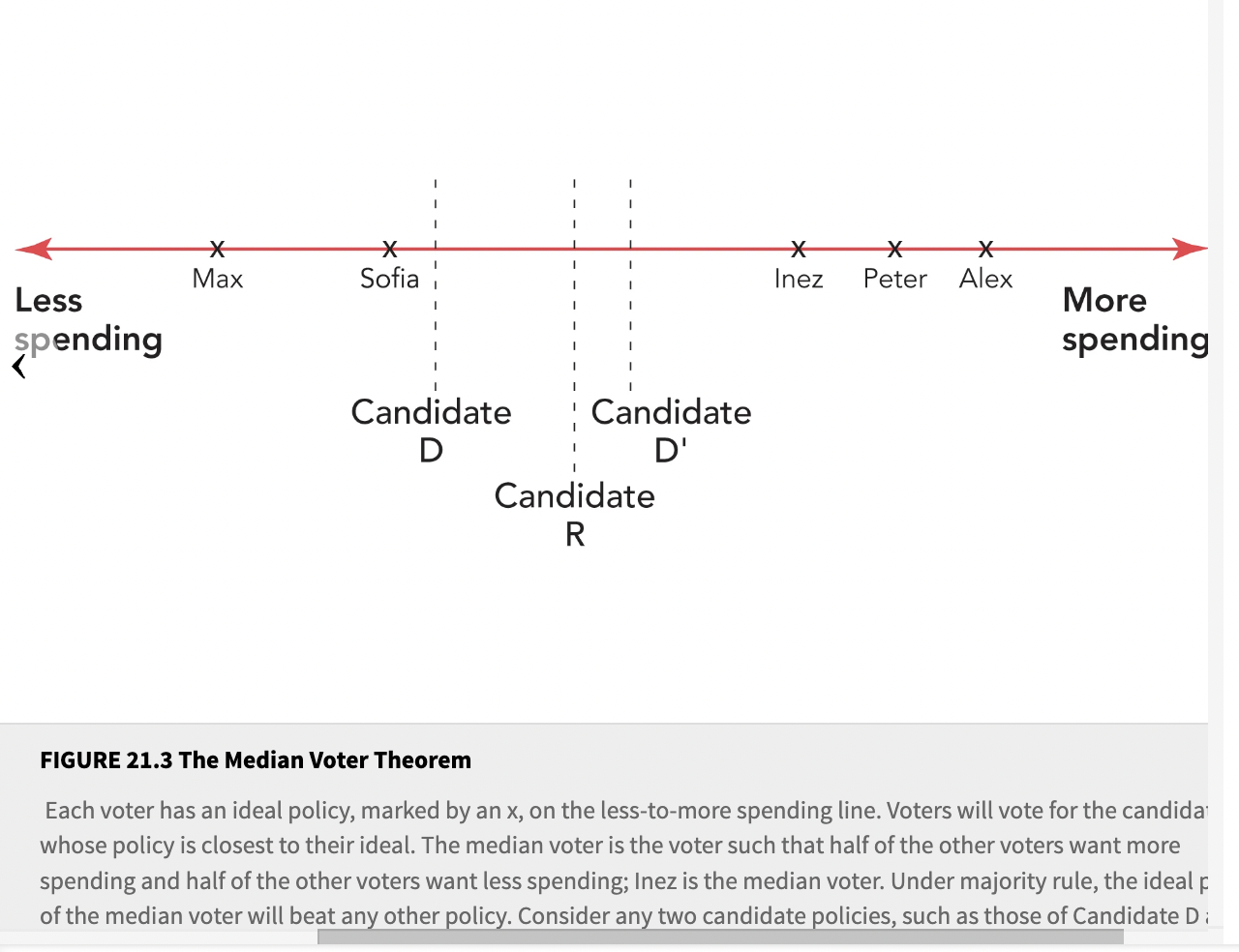

The Median Voter Theorem:

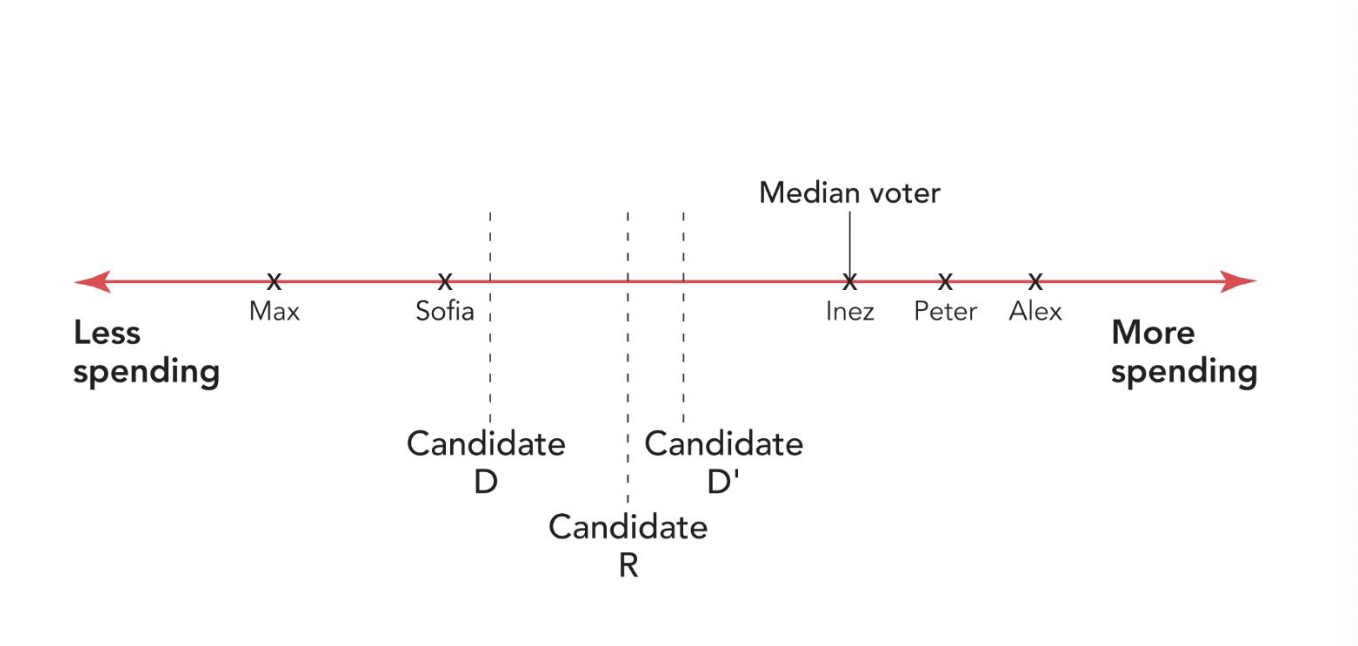

- Example: There are five voters, each who has an opinion about the ideal amount of spending on Social Securiy. Each voter’s ideal policy is along a line from least to most spending.

- The median voter theorem:Says that when voters cote for the policy that is closest to their ideal point on a line, then the ideal point of teh median voter will beat any other policy in a majority rule election

- Of the two policies being offered, the closest to that of the median voter’s ideal policy won the election

- The median voter theorem can be interpreted as the standard political spectrum of left to right