Chapters 29.1-29.2: Money Creation

The Fractional Reserve System

- The United States like most countries today has a fractional reserve banking system

- fractional reserve banking system::

- only a portion (fraction) of checkable deposits are backed up by reserves of currency in bank vaults or deposits at the central bank.

Significant Characteristics of Fractional Reserve Banking

banks can create money through lending

banks can loan out more money than is held in their reserves and get repaid a greater amount later by charging borrowers an interest rate

currency serves as bank reserves

- the creation of checkable-deposit money by banks (via their lending) is limited by the amount of currency reserves that the banks feel obligated, or are required by law, to keep.

banks operating on the basis of fractional reserves are vulnerable to “panics” or “runs.”

A bank that loaned out more deposits than its reserves are worth would be unable to give all of the holders of those deposits their currency if they demanded to withdraw at the same time.

what happened in bank runs:

- rumors would spread that a bank was about to go bankrupt and that it only had a small amount of reserves left in its vaults.

- depositors would run to the bank, competing to be the few to withdraw their money

- even if the rumors were false, the bank would run out of reserves and go bankrupt

a bank panic is highly unlikely if the banker’s reserve and lending policies are prudent, so banking systems are highly regulated

This is also why the United States has the system of deposit insurance

- guarantees depositors that they will always get their money so they don’t panic and rush to withdraw their deposits at once

A Single Commercial Bank

- The balance sheet of a commercial bank (or thrift) is:

- a statement of assets and claims on those assets.

- assets::

- things owned by the bank or owed to the bank

- The claims shown on a balance sheet are divided into two groups:

- liabilities::

- the claims of nonowners of the bank against the firm’s assets

- things owed by the bank to depositors or others

- net worth::

- the claims of the owners of the firm against the firm’s assets

- Every balance sheet must balance because:

- the value of assets must equal the amount of claims against those assets.

- ^^Assets = liabilities + net worth^^

- Every $1 change in assets must be offset by a $1 change in liabilities + net worth and vice versa

Worked example w/ balance sheets: How individual banks can create money

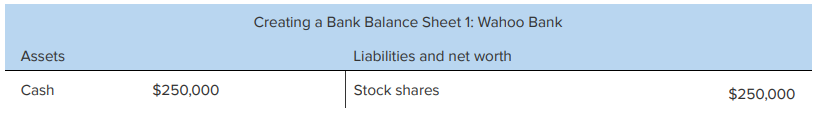

Transaction 1: Creating a Bank

The founders of the “Wahoo bank” sell $250,000 worth of shares of stock in the bank—some to themselves, some to other people.

the bank now has $250,000 in cash on hand and $250,000 worth of stock shares outstanding.

- The cash is an asset to the bank

- The shares of stock outstanding constitute an equal amount of claims that the owners have against the bank’s assets, so they make up the net worth of the bank.

Cash held by a bank is sometimes called vault cash or till money.

Each item listed in a balance sheet is called an account.

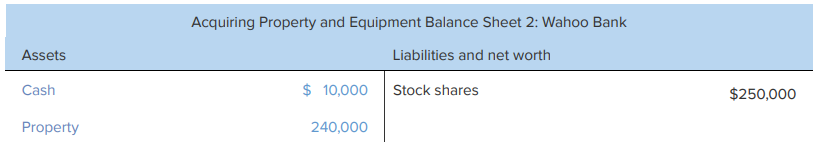

Transaction 2: Acquiring Property and Equipment

the directors of the Wahoo bank purchase a building for $220,000 and office equipment for $20,000

The bank now has $240,000 less in cash and $240,000 of new property assets

the blue text denotes accounts affected by each transaction

balance sheet still balances after every transaction

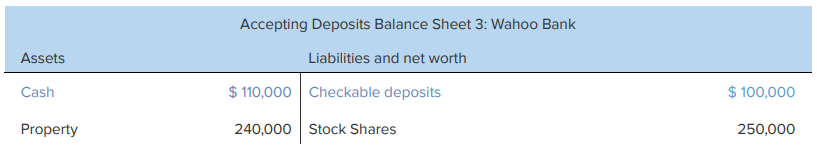

Transaction 3: Accepting Deposits

citizens and businesses decide to deposit $100,000 into Wahoo bank

The bank receives cash, which is an asset to the bank.

this money is deposited as checkable deposits (checking account entries), rather than as savings accounts or time deposits.

- These newly created checkable deposits constitute claims that the depositors have against the assets of the bank and thus a new liability account.

There is no change in the economy’s total supply of money, only a change in the composition of the money supply

- Bank money, or checkable deposits, has increased by $100,000, and currency held by the public has decreased by $100,000

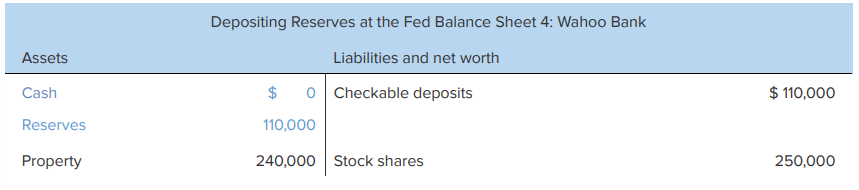

Transaction 4: Depositing Reserves in a Federal Reserve Bank

All commercial banks and thrift institutions that provide checkable deposits must by law keep required reserves

Required reserves::

- an amount of funds equal to a specified percentage of the bank’s own deposit liabilities

A bank must keep these reserves with the Federal Reserve Bank in its district or as cash in the bank’s vault

- for simplicity in this example, the bank keeps its required reserves entirely as deposits in the Federal Reserve Bank of its district

- real world banks keep a significant portion of their reserves in their vaults

reserve ratio::

- the specified percentage of checkable-deposit liabilities that a commercial bank must keep as reserves

- ex.

- If the reserve ratio is 10 percent, the bank having accepted $100,000 in deposits from the public, would have to keep $10,000 as reserves

lets say the reserve ratio is 20% so Wahoo bank’s required reserves are $20,000

- for simplicity, Wahoo bank stores all $110,000 of its cash as reserves in a Federal Reserve Bank

Textbook error: the checkable deposits on the right side should be $100,000 to keep both sides balanced

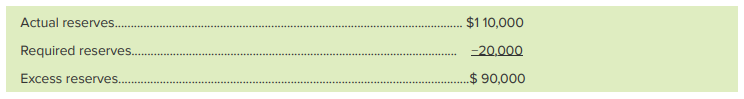

Excess Reserves

^^Excess reserves = actual reserves − required reserves^^

- multiply the bank’s checkable-deposit liabilities by the reserve ratio to get required reserves ($100,000 × 20 percent = $20,000)

- then to subtract the required reserves from the actual reserves listed on the asset side of the bank’s balance sheet.

From the example,

Function of reserves

- a bank’s required reserves are still not great enough to meet sudden, massive cash withdrawals.

- Because reserves are fractional, checkable deposits may be much greater than a bank’s required reserves.

- commercial bank deposits must be protected by other means:

- Periodic bank examinations

- insurance funds administered by the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Administration (NCUA) insure individual deposits in banks and thrifts up to $250,000

- ^^the function of reserves is control^^

- Required reserves help the Fed control the lending ability of commercial banks.

- The Fed can either increase or decrease commercial bank reserves and affect the ability of banks to grant credit.

- The objective is to prevent banks from overextending or underextending bank credit

- by influencing the volume of commercial bank credit, the Fed can help the economy avoid business fluctuations

- Another function is to facilitate the collection or “clearing” of checks.

Asset and Liability

- the reserves created in transaction 4 are an asset to the depositing commercial bank because they are a claim it has against the assets of another institution—the Federal Reserve Bank

- Likewise, the checkable deposit you get by depositing money in a commercial bank is an asset to you and a liability to the bank

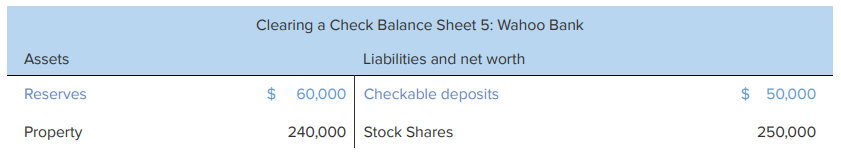

Transaction 5: Clearing a Check Drawn against the Bank

A buyer with a checkable deposit in the Wahoo bank pays for machinery by writing a check against their deposit for $50,000

- the machinery company deposits the $50,000 check into their checkable deposit in a different bank called the “Surprise bank”

- Wahoo Bank’s reserves (bank’s assets) decrease by $50,000 and the buyer’s checkable deposit (bank’s liabilities) decreases by $50,000

- Surprise Bank’s reserves (bank’s assets) increase by $50,000 and the company’s checkable deposit (bank’s liabilities) increases by $50,000

Whenever a check is drawn against one bank and deposited in another bank, collection of that check will reduce both the reserves and the checkable deposits of the bank on which the check is drawn.

if a bank receives a check drawn on another bank, the bank receiving the check will have its reserves and deposits increased by the amount of the check.