Ch 12 - Market power: Monopoly and oligopoly

Revenue and cost curves in a monopolistic competition:

- Each firm is able to differentiate to some degree, it can reduce its price and increase its net revenues

- The demand curve for this market will tend to have a sloping downward demand curve

Monopoly: the exclusive possession or control of the supply of or trade in a commodity or service.

Characteristic of demand curve of the monopolistic competitive firm:

- Market faces a relatively elastic demand

- For every addition output to be sold, the firm will need to sell its output at a lower price

Short run and long run profits of MC firms:

- Economic profits made in short run attract new firms to enter the market

- Demand for goods reduced as competition increases

- Firms are more likely to make a profit since they maximise their profits at a level where MR=MC

- Profit is equal to average total cost

- Firms in the market can easily make losses due to reducing demand

\n }}A firm’s monopolistic market cannot achieve both productive efficiency and allocative efficiency (produces at a point where MC curve cuts the AR curve). Despite firms in this type of market being profit maximisers, in the long run, they are neither allocative efficient nor productive efficient.}}

Oligopoly: market with few dominant sellers which together controls all or most of a market share.

- Interdependence of firms: action of one firm affects the action of the other firms

- Barriers to entry: market maintains its small number

- Non price competition

Formal Collusion: exists when firms form an organisation or a group which prices the amount of output to be produced is decided

Tacit Collusion: type of collusion that exists when firms charge the same price on goods they produce without having a formal agreement

Market efficiency in Oligopoly:

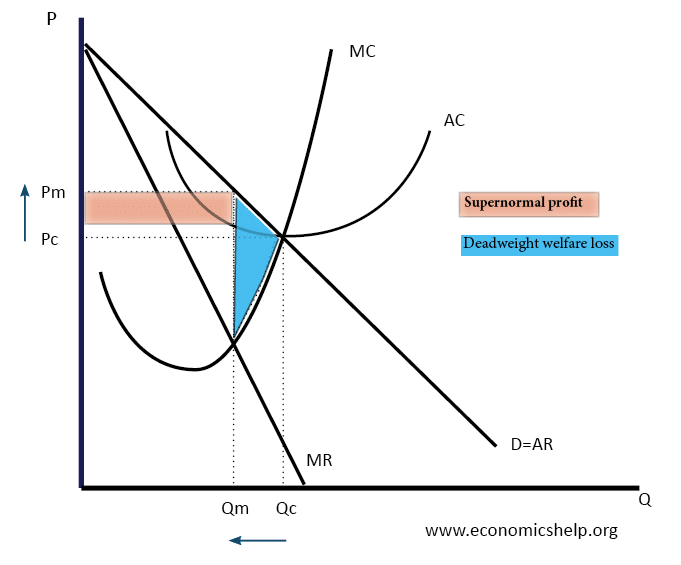

- Produces where marginal revenue is equal to marginal cost MR=MC

Non-collusive oligopoly:

- exists when firms in the market do not organise themselves to decide on the price and the quantity of outputs to be produced

Disadvantages of monopoly:

- Higher prices Higher price and lower output than under perfect competition. This leads to a decline in consumer surplus and a deadweight welfare loss

- Allocative inefficiency. A monopoly is allocatively inefficient because in monopoly the price is greater than MC. P > MC. In a competitive market, the price would be lower and more consumers would benefit

- Diseconomies of scale – It is possible that if a monopoly gets too big, it may experience diseconomies of scale. – higher average costs because it gets too big

Advantages of monopoly:

- Research and development: The supernormal profit can enable more investment in research and development, leading to better products.

- Good quality firm: A firm may gain monopoly power because it is very innovative and successful, e.g. Google, Amazon, Apple. Therefore, monopoly does not always lead to inefficiency.