1.6 Growth & evolution

Introduction

- Scale of operation: maximum output that can be achieved using the available inputs (resources) - this scale can only be increased in the long term by employing more of all inputs.

Increasing the scale of operations

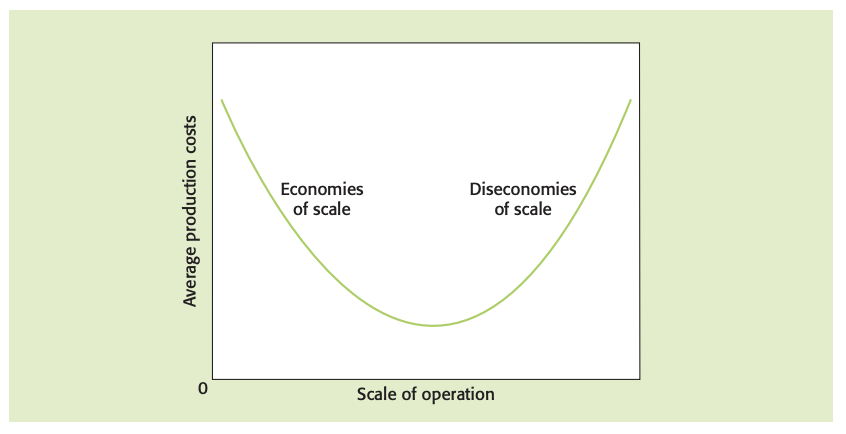

Economies of scale: reductions in a firm’s unit (average) costs of production that result from an increase in the scale of operations.

- Reasons for the cost benefits to arise:

- Purchasing economies

- Technical economies

- Financial economies

- Marketing economies

- Managerial economies

Diseconomies of scale: factors that cause average costs of production to rise when the scale of operation is increased.

- Causes of management problems:

- Communication problems

- Alienation of the workforce

- Poor coordination and slow decision-making

Large-scale production - unit costs

Merits of small and large organizations

Potential advantages of small and large businesses

- Small businesses:

- Can be managed and controlled by the owner(s)

- Often able to adapt quickly to meet changing customer needs

- Offer personal service to customers

- Find it easier to know each worker and many staff prefer to work for a smaller, more “human” business

- Average costs may be low due to no diseconomies of scale and low overheads

- Easier communication with workers and customers

- Large businesses:

- Can afford to employ specialist professional managers

- Benefit from cost reductions associated with large-scale production

- May be able to set prices that other firms have to follow

- Have access to several different sources of finance

- May be diversified in several markets and products, so risks are spread

- More likely to be able to afford research and development into new products and processes

Potential disadvantages of small and large businesses

- Small businesses:

- May have limited access to sources of finance

- May find the owner(s) has to carry a large burden of responsibility if unable to afford to employ specialist managers

- May not be diversified, so there are greater risks of negative impact of external change

- Unlikely to benefit from economies of scale

- Large businesses:

- May be difficult to manage, especially if geographically spread

- May have potential cost increases associated with large-scale production

- May suffer from slow decision-making and poor communication due to the structure of the large organization

- May often suffer from i divorce between ownership and control that can lead to conflicting objectives

What is an appropriate scale of operation?

- Business owners must weigh up and assess:

- Owners’ objectives

- Capital available

- Size of the market the firm operates in

- Number of competitors

- Scope for economies of scale

Business growth

Internal growth: expansion of a business by means of opening new branches, shops or factories (also known as organic growth).

External growth: business expansion achieved by means of merging with or taking over another business, from either the same or a different industry.

Merger: agreement by shareholders and managers of two businesses to bring both firms together under a common board of directors with shareholders in both businesses owning shares in the newly merged business.

Takeover: when a company buys over 50% of the shares of another company and becomes the controlling owner often referred to as “acquisition”.

Horizontal integration: integration with a firm in the same industry and at the same stage of production.

Forward vertical integration: integration with a business in the same industry but a customer of the existing business.

Backward vertical integration: integration with a business in the same industry but a supplier of the existing business.

Conglomerate integration: merger with or takeover of a business in a different industry.

Joint ventures, strategic alliances and franchising

Joint venture: two or more businesses agree to work closely together on a particular project and create a separate business division to do so.

Strategic alliances: agreements between firms in which each agrees to commit resources to achieve an agreed set of objectives.

Franchise: business that uses the name, logo and trading systems of an existing successful business.

Globalization: growing integration of countries through increased freedom of global movement of goods, capital and people.

Free trade: no restrictions or trade barriers exist that might prevent or limit trade between countries.

Protectionism: using barriers to free trade, such as tariffs and quotas, to protect a country's own domestic industries.

Multinational businesses

Multinational company/business: business organization that has its headquarters in one country, but with operating branches, factories and assembly plants in other countries.

Why become a multinational?

- Closer to main markets

- Lower costs of production

- Avoid import restrictions

- Access to local natural resources