legl 2700 unit 3.

Unit 3 Notes:

Intellectual Property:

- Justification

- Importance

- Competition

- Capturing:

- Does not happen automatically, steps need to be taken in order to transform it into valuable assets

- Once the information is in public domain, an intellectual property right can not be applied to recapture

Trade Secret:

A common way of asserting property or knowledge based on tangible resources.

Knowledge or Info:

- Kept Secret (reasonable measures taken): Commercially valuable because it is secret and subject to reasonable steps to keep it secret.

- Economic value: Has economic value because it is not known by others or ascertainable by reasonable means.

Uniform Trade Secrets Act-Many states have adopted the Uniform Trade Secrets Act, and it in part defines a trade secret as information, technique, or process. It can also include marketing sales, etc. and need not be unique. To be successful, it has to be proven it court first that you have a trade secret, then proved that someone misappropriated it.

Establishing the Existence of a Trade Secret:

- Conduct a trade secret audit to identify confidential knowledge-based resources

- Preserve secrecy

- Lock written material

- Secure computer-stored knowledge with firewalls and encryption

- Impose confidentiality restrictions

- Regulate visitors

- Ask employees, customers, and business partners to sign nondisclosure agreements

Court Case: Al Minor & Associates, Inc. v. Martin, 881 N.E. 2d 850 (Ohio 2008): Martin is an employee at-will at Al Minor & Associates (he doesn’t have a contract or non-complete). Martin decides after a few years at AMA to start his own business and a year later, he leaves AMA. When he leaves he doesn’t take any documents or save any papers from his work, but memorizes information for 15 of AMA clients for his own company. AMA sues for monetary and injunctive relief (order him to stop). The court rules that there is no provision that suggests for trade secrets between information from a tangible form and what has been memorized. Memorized information can in fact be a trade violation, because many states have adopted the Uniform Trade Secrets Act. He knew it was a secret and confidential, and still memorized it and approached those people, and Martin lost the lawsuit.

Demonstrating Misappropriation:

- Misappropriation occurs when one improperly acquires or discloses secret information

- Independent creation (creating something on your own) and reverse engineering (putting something out, and someone reverse creates it; patents can help to dissuade this from happening) are exempted

- Employee mobility and trade secrets: Trade secrets can be protected forever (for example, Coca-cola made an agreement many years ago deciding not to share their full ingredients, maintaining their formula as a trade secret)

- Confidentiality contracts forbid employees from disclosing knowledge obtained in the workplace

- Employers can enforce agreements not to compete only when there is a valid business purpose for the contract

- Trade owner may seek money damages if someone misappropriates

- Most criminal prosecution for this is under the EAA act, and these claims can only be brought by the federal government because it is a criminal allegation. Includes missappropriation that benefits the federal government.

Many Companies Do Not Allow:

- Things like carrying/using cell phones, usb/flash drive, notes derived during meetings

Document Markings:

- Documents generated should possess appropriate “markings” to imply what is considered a trade secret or protected data

Patent Law:

- New invention

- Legal monopoly

Chapter 11 Notes:

- The essence of “property” is a certain system of law

- Property establishes a relationship of legal exclusion between an owner and other people regarding limited resources

- Property includes the legal uses of what you own, and the full extent of these uses is frequently unclear

- It’s the job of both common and statutory tort law to determine when you cross the boundary separating your proper use from wrongful injury to what belongs legally to others

- Modern businesses count on the advantage of controlling inventions, expressions, marks, designs, and business secrets like marketing plans or a list of customers. This may include employee skills and talents, production designs, inventions, and technologies, marketing plans, etc.

- Intellectual property represents protection of some of the most valuable resources that businesses have

The Justification for Intellectual Property:

- Property relationships are believed to be more productive in allocating scarce resources and producing new ones than legal relationships that merely divide resources equally

- The creation of patents goes back to Article 1, Section 8 of the Constitution, which grants Congress the power to “promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries.”

- The Constitution also ensures that after “limited Times” defined by Congress, the resources of new expression and invention, which were formerly exclusive to “Authors and Inventors,” will be freely available to everyone

Intellectual Property and Competition:

- The basic economic system of intellectual property is grounded in the idea of incentives

- The possibility of economic return on investment encourages firms and individuals to create more informatiuon than they otherwise would

- Without intellectual property, they pace of creative research and development in business would slow dramatically

- Property rights in information reduce competition that could otherwise increase availability and keep prices low for consumers

- Intellectual property systems presume that the long-term benefits of increased information and investment are greater than the short-term costs

- Intellectual property is believed to incrementally increase the production of information and investment over that which would normally occur

- The great debate regarding intellectual property laws is whether they are truly calibrated to provide a net benefit to society

Capturing Intellectual Property:

- The protections of property often don’t apply automatically to intangible knowledge resources all information a business creates

- Some intellectual property forms have very strict deadlines for asserting rights or other formal requirements

- Once information is in the public domain, an intellectual property right cannot be applied to recapture it

- Firms that don’t have an intellectual property strategy in place risk losing valuable assets

Trade Secrets:

- A trade secret is any form of knowledge or information that has economic value from not being generally known to others or readily ascertainable by proper means and has been the subject of reasonable efforts by the owner to maintain secrecy

- Trade secret law developed in the common law industrial revolutions of the 1800s

- The employees of factories weren’t apprentices and at first were free to take their employers’ knowledge, leave employment, and compete against their former employers. Trade secret law arose to protect the employers’ valuable knowledge

- All states except NY and NC have adopted the Uniform Trade Secrets Act as the basis of their protection. NC has their own act and NY uses common law rules that are very similar to UTSA rules

- Defend Trade Secrets Act: Applies the two basic elements of state trade secret law, though it can provide more consistent nationwide protection through a single federal statute

- The DTSA contains a civil seizure mechanism that allows a trade secret owner to secure property that may allow unauthorized dissemination of the secret

Establishing the Evidence of a Trade Secret:

- A first step in protecting trade secrets is to identify confidential knowledge based resources

- All businesses may conduct a trade secret audit, which simply identifies all the valuable forms of information possessed by businesses

- Trade secret audits help identify the valuable information that a business produces

- Trade secrets do not have to be unique; two businesses may have trade secret property in substantially the same knowledge. For example, they may each have customer lists that overlap with many of the same names

- After identifying potential trade secrets, a business must next work to preserve secrecy

- Reasonable measures to protect trade secrets include physically locking away written material, securing computer-stored knowledge with protective “firewalls” and encryption, etc

- Prospective business partners, customers, suppliers, and repair technicians may also have access to knowledge that a company values and protects, and may be asked to sign NDAS to keep these confidential

- Case Example-Al Minor and Associates, Inc. v. Martin: In 1998, AMA hired Martin as a pension analyst but didn’t require him to sign either an employment contract or a noncomplete agreement. He took the information he memorized from his work and used it to start his own business. It was found that a client list can serve as a trade secret because it provides value to the owner and information that was memorized and not written down.

Demonstrating Misappropriation:

- Misappropriation occurs when one improperly acquires secret information through burglary, espionage, or computer hacking

- If one acquires a secret from another who has a duty to maintain secrecy, and one knows that duty, misappropriation has occurred

- Independent creation does not constitute misappropriation

- If valuable information relates to processes or techniques that won’t be disclosed when a product or service is sold, trade secret rights may be a viable, relatively inexpensive, and long-lived option

Employee Mobility and Trade Secrets:

- Businesses have to take reasonable measures to protect trade secrets even from employees

- Employers require employees to sign confidentiality contracts promising not to disclose what they have gained to compete against their former employer, or they may go to work for their employer’s competitors

- Contractual confidentiality agreements and noncomplete agreements have a role in trade secret protection but aren’t always required

- The law states that employers can enforce agreements not to compete only when there is a “valid business purpose” for the contract. This means that employers are protecting trade secrets, or protecting their nvestmet in the training of their employees

Civil Enforcement of Trade Secrets:

- The wrongful taking of any kind of intellectual property is called misappropriation or infringement

- An injunction is an order by a judge either to do something or to refrain from doing something

- The injunction orders those who have misappropriated the trade secret to refrain from using it or telling others about it

Criminal Enforcement of Trade Secrets:

- Although various state laws make intentional trade secret misappropriation a crime, most criminal prosecutions today take place under the federal Economic Espionage Act, which makes it a crime to steal (intentionally missapropriate) trade secrets and provides for fines and up to ten years’ imprisonment for individuals and up to a $5 million fine for organizations

- Although one provision of the EEA makes one liable for standard trade secret misappropriation, another provision addresses misappropriation to benefit a foreign government–true espionage

Patent Law:

- Historically, a patent was any legal monopoly openly issued by the government, and it was not necessarily associated with a new idea. However, there’s evidence of patents being associated with invention as early as the 1400s. The Venetian Patent Act of 1474 is considered to be the world’s first patent statute for the purpose of rewarding new ideas

- Today, a patent is firmly associated with an incentive act, and conveys a right to exclude others from making, using, selling, or importing the covered invention

Obtaining a Patent:

- Patents last for only a limited period of time: 20 years from the date the application is filed in the Patent and Trademark Office (PTO)

- A patent is an exclusive right crated by statute and conveyed by the U.S. Patent and Trademark Office for a limited period of time. The property applies to inventions, which are new applications of information

Patent Type-

- In the United States, there are actually three types of patents granted by the PTO, each with its own distinct subject matter

- The difference between a utility patent and a design patent is that utility patents apply to useful, functioning inventions. Design patents apply to the appearance of an article of manufacture, unrelated to its function, and cover subject matter more similar to copyrights

- Inventions related to plants may also be protected as utility patents, for example, genetically modified plants.

- To obtain a patent, an inventor must pay a filing fee and file an application with the PTO

- In 2019, the US PTO granted a record 354,430 patents. This was more than double the number issued in 2000

- The PTO assigns a patent examiner to consider the application, and there is a great deal of communication between the examiner and the applicant over the adequacy of the application’s explanations, the scope of the proposed patent, and whether the invention qualifies

- The patent process can take several years

- America Invents Act: Passed in 2011, president Obama signed into law, it was the first substantial revision to US patent law since 1999. It meant that in a contest between two inventors claiming the same patentable idea, the first to get to the patent office will win (add image here).

Patentable Subject Matter:

- The validity of a patent can be challenged in court by an alleged infringer, or challenged by any individual or business in the PTO

- After the PTO issues a patent, the patent owner may choose to maintain its exclusivity in the invention

- The patentee may license others to use the invention

- When the patent owner threatens a lawsuit, it is common for the alleged infringer to respond by attacking the validity of the patent. Validity can be challenged in court or the PTO

- Attacking the “subject matter” of a patent is one common way of testing the validity of a patent

- In the case Diamond v. Chakrabarty, the Supreme Court ruled that a scientist could cover with a utility patent a genetically modified bacterium that ate hydrocarbons found in oil spills

- The 2011 revisions to the Patent Act explicitly preclude patents covering humans

- Laws of nature, natural phenomena, and abstract ideas are unpatentable

- One of the most controversial areas of potentially patentable subject matter concerns “processes:Business methods like double-entry bookkeeping is an example

- Case Example- Alice Corporation Pty. v. CLS Bank: Alice Corporation owns several patents that disclose a method system, and computer program for mitigating settlement risks in financial transactions like currency trades. Because they used computers to recite the concept of intermediated settlement there was not enough to transform an abstract idea into a patent-eligible innovation

- Many of the Supreme Court’s opinions on patentable subject matter refer to the idea of idea or concept “preemption”.

Novelty, Nonobviousness, and Utility:

- Perhaps the most common way of challenging a patent’s validity is to claim that the invention is obvious to someone with knowledge in the field

- To be patentable, it is not enough for something to be appropriate subject matter

- An invention must be novel, nonobvious, and useful

- The characteristic of novelty indicates that something is new and different from the prior art

- Under patent law, even if an invention is otherwise new, it fails the novelty test if it has been described in a publication, sold, or put to public use more than one year before a patent application on it is filed

- Nonobviousness refers to the ability of an invention to produce surprising or unexpected results: that is, results not anticipated by prior art. This standard is measured in relation to someone who has ordinary skill in the prior art

- Obviousness is assessed as of the date of the application as opposed to later in an infringement case

- Except for patents issued on designs or plants, a valid invention must have utility/must do something useful

- Any utility is sufficient, even if it is not the use that is eventually commercialized by the patentee. One major category of patent claims that lack utility are those that do not work. An inoperable invention, is not useful

Patent Enforcement:

- When a patent expires, the invention is in the public domain, and others may use it without permission of the patentee

- The consequences of patent infringement can be high, with recent cases involving jury awards of more than $1 billion. Such awards are often reduced on appeal but still amount to millions in damages

- As the U.S. Constitution specifies, the property represented by patents runs for limited duration

- Statutes limit utility patents and plant patents to 20 years from the filing date, and design patents to 15 years from the issue date. When a patent expires, the invention is in the public domain, and others may use it without the permission of the patentee

- Complicating the business environment for patents is the fact that inventions can cover methods and articles that can overlap

- The explicit purpose of patent law is to make inventions public following the limited period of legal property right

- The situation of overlapping patents exists to varying degrees with other products

Patent Trolls and the Litigation Threat:

- Some non-practicing patent entities have quite large portfolios, raising concerns on their impact on the marketplace

- In 2018, approximately 40% of all patent cases were filed in two district courts

- Patent trolls are non-producing patent owners that do not contribute as much to the innovation environment compared to the costs imposed by their enforcement.

- Patents do not require their owners to actually make and sell a product

- Judges have some ability to reduce trolling incentives by forcing the losing party to pay the winning side’s costs.

- At least two aspects of the 2011 reforms to patent law may reduce troll behavior. The new law precents patent owners from suing multiple parties merely because they infringe the same patent

- Business method parents are subject to a new review proceeding if litigated

- In addition to measures in the federal courts and legislature, state governments have taken action against patent trolls under their consumer protection laws

Trademark Law:

- According to a 2019 study by Forbes, the five most valuable brands belong to Apple, Google, Microsoft, Amazon, and Facebook

- Trademarks may indicate a specific producer, and the law protects them against use by others

- Trademarks are a form of intellectual property and can be registered with the PTO as well as are some of the most valuable properties that businesses own.

- Although registration systems exist at the federal and state level, it is important to understand that trademark rights come from use of the mark in association with goods or services

- Recognbizability or distinctiveness is the function of trademarks. In a world cluttered with stimulation, information, and advertising, trademarks pierce through the clutter and let people know that the goods or services represented are the “real thing” and come from one source.

- They are an information property

- Trademark infringement involves the intentional use of the owner’s mark or an accidental deisgn of one’s own mark too similar to another’s

Types of Trademarks-

- Lanham Act of 1946: Protects the following marks used to represent a product, service, or organization:

- Trademark: Any mark, word, picture, or design that attaches to goods to indicate their source

- Service mark: A mark associated with a service, for example, LinkedIn

- Certification mark: A mark used by someone other than the owner to certify the quality, point of origin, or other characteristics of goods or services

- Collective mark: A mark representing membership in a certain organization

Trade Dress-

- A color or shape associated with a product or service. For example, the distinctive “wasp-shaped” Coca-Cola bottle is part of its trade dress

- Case example- Two Pesos, Inc. v. Taco Cabana Inc., 505 US 763 (1992): The Court stated that trade dress may include the shape and general appearance of the exterior of the restaurant, the identifying sign, the interior kitchen floor plan, the decor, the menu, the equipmemnt, and other features reflecting on the total image of the restaurant. They upheld the decision that Two Pesos had violated Taco Cabana’s trade dress

Trademark Registration-

- If someone wishes to register a trademark with the PTO, they must use it in interstate commerce. For example, they could post the trademark on an Internet website in association with a product or service

- A mark that is descriptive or generic in one context may be unique and distinctive in another. For example, “Apple” in terms of electronics is very distinguishable, but a trademark would not be able to register for a fruit stand that sells apples

- The PTO places a proposed mark in the “Official Gazette,” which gives existing mark owners notice and allows them to object to the proposed mark if it is similar to theirs

- If the PTO determines the mark registrable, it registers the mark on the Principal Register

- After six years, the trademark owner must notify the PTO that the trademark is still in use

- People’s names or descriptive terms can sometimes be registered, but only if it is listed on the PTO’s Supplemental Register for five years and acquires a secondary meaning

- Secondary meaning: A public meaning that is different from its meaning as a person’s name or as a descriptive term, it makes the name distinctive (like “Levi’s” or “Ford”)

Trademark Enforcement-

- Civil violation of a trademark is termed infringement

- Likelihood of confusion: Parties with strong marks in different areas may be in conflict when selling produts in the same stores

- Generic marks cannot be protected as trade marks

- A number of trademarks have been lost because the public came to think of them as generic terms

- To win a trademark infringement lawsuit, a defendant must prove: the mark is not distinctive, there’s little chance of the public being confused by use of a term trademarked by someone else, or the use if a “fair use”

- Case Example- Kraft Foods Group Brands LLC v. Cracker Barrel Old Country Store, Inc: Kraft, a well known manufacturer, sells packaged cheeses under the trademarked “Cracker Barrel” label, however, Cracker Barrel Old Country Store, the chain of restaurants planned to sell a variety of food products, so Kraft filed a lawsuit saying customers will be confused by the similarity of the logos in grocery stores. This is an issue because if people see CBOCS’s products as not good, they may confuse it with Kraft’s products and Kraft’s sales would decline. Therefore, the grant of the preliminary injunction was affirmed

- One defense is that there is little chance of public confusion over two uses of the same mark (ex. Ford automobile and Ford modeling agency)

- Fair use: Yet another defense for trademark infringement. Fair use of a registered trademark is allowed by the Lanham Act and relates to a discussion, criticism, or parody of the trademark, the product, or its owner

Trademarks and the Internet:

- One new issue concerns the relationship between a website domain name registered with the Internet Corporation for Asigned Names and Numbers and a trademark registered with the PTO

- Generally, it is a violation of trademark law to use another’s registered mark in your domain name

Trademark Dilution:

- Only the owners of famous marks can prevail under the Federal Trademark Dilution Act

- The Federal Trademark Dilution Act prohibits you from using a mark the same as or similar to another’s “famous” trademark so as to dilute its significance, reputation, and goodwill

- The owner of the “senior” famous trademark can get an injunction prohibiting further use of the junior mark on the basis of trade-mark dilution

- There are two types of dilution that are recognized under federal law: blurring and tarnishment

- Blurring occurs when firm uses another trademark in a way that blurs the distinctiveness of a famous mark

- Tarnishment occurs when a firm uses a trademark in a way that creates a negative impression about the famous company

- In 2006, Congress passed the Trademark Dilution Revision Act, which established that dilution exists when a defendant creates a “likelihood of dilution,” and was designed to overrule an earlier Supreme Court decision, Moseley v. Secret Catalogue, Inc., 537 U.S. 418, which set a higher standard of actual dilution

Copyright Law:

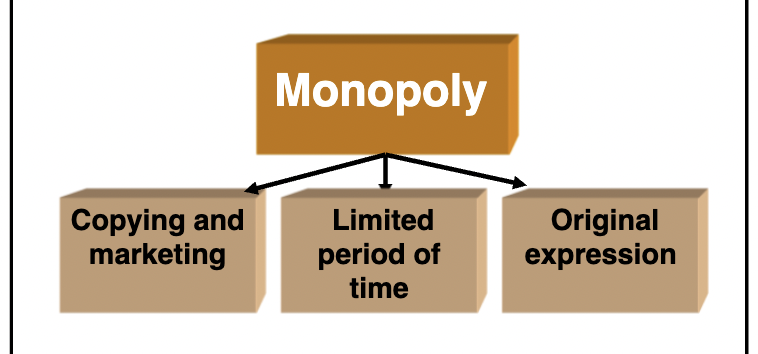

- Gives those who have this property a monopoly over the right to exclude others from copying and marketing for a limited period of time

- Copyright deals with original expression rather than invention

- The first copyright law was the Statute of Anne, enacted in England in 1710

- The U.S. has joined most other countries in international agreements, like the Berne Convention, in protecting the copyright of other nations, but, copyright has come to a turning point in the road. People can copy materials quickly and almost without cost and send them around the world in a blink of an eye

Copyright Ownership:

- Copyright law grants property in certain creative expressions that keeps others from reproducing it without the owner’s permission

- A work must be original, fixed in a tangible medium of expression like a book, canvas, etc., and must show some creative expression

- It is a fundamental principle that copyright doesn’t cover functional or utilitarian aspects of a product, as that is the domain of patents and trade secrets

- Copyright laws protect authors rather than investors

- Copyright laws protect authors rather than inventors

- Companies can be considered authors under copyright law

- The copyright allows the holder to control the reproduction, display, distribution, and performance of a protected work

- The U.S. government cannot own copyrights in works created by its employees within the scope of their duties

Copright Enforcement:

- To make a case of infringement, a copyright owner must establish that a defendant violated one of the owner’s exclusive rights (reproduction, creation of derivative works, distribution, performance, or display)

- Case- Skidmore v. Led Zeppelin: Skidmore filed a suit alleging that Stairway to Heaven by the Led Zeppelin band infringed the copyright in Taurus, although there was no direct evidence the bands toured together or that Led Zeppelin band members heard Spirit perform their song Taurus. The court rejected the idea of infringement in this case, because the more access a defendant has to works online, the less similarity is necessary to prove infringement. If a plaintiff claims a defendant copied part of a work that is standard for a certain kind of music, there’s no infringement

- Piracy: Large-scale copyright infringement is often referred to as piracy

Copright Fair Use:

- Fair use includes copying for “criticism, comment, news reporting, teaching,” etc.

- The assessment of fair use is made on a case-by-case basis, which can lead to uncertainty

Copyright in the Digital Age:

- International piracy of copyrighted material is a major problem, but international enforcement efforts are improving slowly

Digital Millenium Copyright Act:

- Makes illegal the effort to get around (circumvent) devices used by copyright owners to keep their works from being infringed

International Intellectual Property Rights:

- There is in fact no fully international intellectual property rights

- Local or regional law controls the creation and ownership of patents, copyrights, etc.

- Agreement on Trade-Related Aspects of Intellectual Property Rights: International treaty formed in 1994 as part of the treaty that made the WTO. The WTO and WIPO (World Intellectual Property Organization) settles disputes, and administers several international intellectual property treaties like the TRIP agreement

Conclusion:

- Article 1, Section 8 of U.S. Constitution: Assets that the purpose for Congress granting “to authors and inventors the exclusive right to their respective writings and discoveries” is to promote the progress of science and business, which society believes promotes the common good

March 27th Notes:

Patent Law:

- New invention —> legal monopoly

Types of Patents:

- Utility Patent: New, non-obvious, useful processes, machines, compositions of matter or improvements thereof

- Design Patent: New, original and ornamental design for an article of manufacture

- Plant Patent: New, variety of plant that can be produced asexually

Obtaining a Patent:

- File application

- Filing fee

- Explain invention: How this invention is new and unique

- Show difference from prior art

- Describe patentable aspects

- Evaluation by the patent examiner: Appointed by the PTO, examines whether the invention abides by the examination requirements, goes over all details. Businesses may hire a patent lawyer or agent to provide assistance in dealing with the patent examiner. There is a patent bar exam attorneys must take to show they have legal qualifications and understand the technicalities; they look at attorneys’ undergraduate degree and want to see a hard science/engineering degree (bachelors in chemistry, biology, etc) in order to be considered for the patent bar exam. Businesses must sign the application for the patent.

- Patent: Exclusive right to invention

Characteristics of Patents:

- Novelty

- Something new and different from the prior art

- Nonobviousness

- Ability of an invention to produce surprising or unexpected results

- Utility

- Must do something useful

Patent Enforcement:

- If someone sees a patent owner doing something seemingly unallowed by their patent (ex. Something used in the innovation was already created, or was shown on TV shows, if the invention was put for sale before the patent was filed, etc.), they can challenge their patent and the PTO has the ability to take away a patent if novelty, nonobviousness, and utility are not met

- There is a one year grace period for patents

- Patent owner can sue against infringement for injunction and damages

- Inventions can cover methods and articles that can overlap

- Overlapping rights provide an opportunity for firms to purchase patent rights and sue companies-Patent Trolls (term applied to a business that obtains the rights of one or more patents to profit, and buys many patents and sues people for infringement of their patents)

- Owning a patent does not give the right to own and import a whole product, businesses have to pay the licensing fee for parts of the product

- UGARF: gets many patents every year and own the patents for inventions made at UGA (manuals are copyrighted by the UGA, things produced by labs on campus are owned by UGARF, etc)

- Patents can also be invalid if the paperwork does not meet requirements or if the subject matter of the patent was not right at all

Subject Matter of Patents:

- If someone has discovered and not invented this doesn’t count as eligible for a patent (ex. If you take a flower, extract a new element, and create a salve, that is patentable, but just discovering the flower is not)

- Patents can not cover people

- Patents can not lockdown an entire field of discovery

- Case Example: Association for Molecular Pathology v. Myriad Genetics, Inc. 133 S.Ct.2107 (2013). Myriad created a way to treat breast cancer through using the genes BRCA-1 and 2 to reduce breast cancer. The Association for Molecular Pathology sued and stated that you cannot patent DNA. It was founded that abstract ideas, naturally occurring things, etc are not patentable. They didn’t invent, they discovered, which is not patentable. Patent law is intended to reward invention, not investment. Justice Thomas stated that if they had created an innovative method of manipulating genes, manufactured DNA, etc. then that would’ve been patentable.

- Case Example: Alice Corporation Pty. Ltd. v. CLS Bank Int’l 134 S.Ct. 2347 (2014). The Alice Corporation had several patents to mitigate risks like security trades. The patent that they had allowed computers to act as a third party to allow both parties to proceed in transactions and were sued by CLS on whether they had subject matter that was patentable. CLS claimed that they are mere abstract ideas a computer is exercising, not an invention. The Supreme Court stated that the use of a third party is beyond the scope of protection and they must examine the elements of the claim to determine if it includes a new/innovative concept and must include additional elements on top. Having an abstract idea and applying it on a computer does not allow patent eligibility unless there is some inventive element in addition to that. This was just an abstract idea. Since there was no layer of inventive act, Alice Corporation was not eligible for a patent. This court decision has made it hard for software companies to become patent eligibile.

Trademarks:

- Marks on what is produced to represent the origin of goods and services → Recognizability or distinctiveness → Protection against confusion

- UGA had issues with trademarks (™) and businesses must get permission from UGA to put their logo on objects.

- Service marks (SM): Marks associated with a service rather than a product. Used for advertising a service

- Certification marks: Used by groups to show that products meet certain standards or characteristics (like mark for gluten free, fair trade certified, etc.)

- Collective mark: Used by an organization, should only be used by the members of that particular association

- Trade Dress: The look or design of a product or service. Applies to the total image like the layout, color scheme, furniture, and distinctiveness (Chik-fil-a for example, coca-cola, heinz ketchup). Businesses can get trademarks for color, which would be a limited color and limited in their use. For example, the shade of blue used for Tiffany’s boxes only applied to jewelry stores, no other jewelry store can have bags or boxes the same shade of blue as them. Louboutons tried to sue another fashion house for making an entirely red show, but their color trade mark only included the sole being red, not entire shoes

March 29th Notes:

Sound Trademarks “Sound Marks”:

- Certain shows/channels/movies play sound marks before showing something on their channel (for example the sound mark for NBC news)

Trademark Registration:

- Usage of mark in interstate commerce is required for registration with PTO

- Can PTO deny registration?

- Same or similar to another mark

- Prohibited or reserved names or designs

- Names or likeness without permission (to use a president’s name, there has to be permission from the wife/family)

- Descriptive (like salty crackers)

- Generic

- Disparaging

- Immoral and scandalous (now off the list because of Matal and Iancu)

Matal v. Tam, 582 U.S. ___, 137 S.Ct.1744 (2017): Asks whether the Disparagement Clause in the Lanham Act is invalid under the First Amendment. This case involved a band made up of people of Asian descent, and they wanted to call themselves “The Slants,” claiming they were reclaiming a marginalized term, but the Court stated that they could not use this name because it demeans on the basis of race, gender, sex, etc. The justice at the Supreme Court decided that the disparagement clause in the Lanham Act was discriminating on the Court’s part because people should have the right to express their thoughts in regards to disparaging statements.

Iancu v. Brunetti, 588 U.S. ___, 139 S.Ct.2294 (2019). FUCT. A brand tried to use an abbreviation on t-shirts, FUCT and were sued because it seemed like immoral speech. The question of this case was whether Section 2(a) of the Lanham Act, which prohibits the federal registration of “immoral” or “scandalous acts”

- Immoral, scandalous names or symbols

Trademark Registration:

- PTO places the mark in the Official Gazaette

- Registered on the Principal Register if the mark is acceptable

- If listed on the Supplemental Register for five years and acquires a secondary meaning, a name or descriptive term can acquire full trademark status

Trademark Enforcement:

- Law protects the owner from unauthorized use of the mark

- Infringement:Civil violation of a trademark

- Remedies include damages and injunctions and orders to destroy infringing products

- Generic marks cannot be protected (a trademark becomes generic if the brand becomes synonymous in the consumer’s mind with a good or service)

Jack Daniel’s Properties Inc. v. VIP Products LLC, 599 U.S. ___ (2023). A brand made a chewable whiskey dogtoy (with dog poop on the bottle) that was designed to look exactly like the Jack Daniels whiskey bottle (stating that it was a parody). Jack Daniels didn’t want their alcohol to be associated with dog poop and that people might be confused or think that Jack Daniel had something to do with this.

Kraft Foods Group Brands LLC v. Cracker Barrel Old Country Store: Both had their individual trade marks. Kraft foods sells cheese under the name Cracker Barrel (cheddar cheese), and Cracker Barrel Old Country Store, the restaurant chain, wanted to come into the grcoery store with their own products, including ham, meet, cheese, etc. Kraft Foods stated that if they do this, people may think Cracker Barrel Old Country Store’s food is theirs and have bad thoughts against the food, and think that it was Kraft’s, resulting in people stopping buying their products. Justice Posner stated that the issue is that these products will be in the same stores and since most people buying these are poor and its harder for them to understand things, they put an injunction on Old Country Store. Cracker Barrel Old Country store was eventually allowed to be put in grocery stores, but only after they changed the branding on their products in stores saying “Old Country Store,”.

Costco v. Tiffany: Costco was using the Tiffany word to describe diamonds pronged/setted a certain way. Tiffany sued because their name was mentioned, thinking people may think that Costco’s diamonds are theirs. However, it was founded that people these are sophisticated consumers, who will be able to understand that Tiffany is a diamond setting.

- Marks can not be used in an unauthorized way

- Manufacturing and trafficking counterfeit trademarked products is a criminal violation

Trademark Dilution:

- Federal Trademark Dilution Act, 1995

- Prohibits the usage of a mark same as or similar to another’s trademark to dilute its significance, reputation, and goodwill

- Types:

- Blurring - When usage of a mark blurs distinctiveness of a famous mark

- Tarnishment - When usage of a mark creates a negative impression about the famous company

Copyright:

Copyright Ownership:

- Copyright law grants property in certain creative expressions and prohibits others from reproducing it w/o permission

- Criteria for copyright protection:

- Work must be original

- Must be fixed in a tangible medium of expression

- Must show creative expression

- Individuals: author’s life plus 70 years

- Company: 95 years from publication of 120 years from creation of the work, whichever expires first

- Public Domain Day: January 1st of each year

- As of Jan 1, 2024, works published in or before 1928 are in Public Domain

Copyright Infringement:

- The owner has to establish that defendant violates his or her exclusive rights of:

- Reproduction

- Creation of derivative works

- Distribution

- Performance

- Display

Copyright Fair Use:

- Includes copying for:

- Criticism

- Comment

- News reporting

- Teaching

- Scholarship

- Research

Andy Worhol Foundation for the Visual Arts, Inc. v. Goldsmith: Warhol was allowed to use one picture Goldsmith took of Prince in his early career for his work, but Vanity Fair tried to use different colors of paintings made by Warhol of that same picture. Warhol foundation loses.

Google LLC v. Oracle America Inc., 593 U.S. ___ (2021). Decided April 5th, 2021. Trying to determine whether java apis counted under fair use in copyright law. The Supreme Court ruled, by a 6-2 decision, that Google had not violated Oracle’s copyright by using components of Oracle’s Java programming language in Google’s Android operating system employed in most of its smartphones. SCOTUS sidestepped the issue of copyrights on Application Programming Interfaces and assumed fair use. Google loses

- Factors for “fair use” considered on case-by-case basis

April 1st-Chapter Fourteen: Business Organizations Notes:

Closely Held Businesses:

- Businesses owned and operated by a small amount of people (usually five or less) and there is a restriction on who can own shares

- Typically family businesses

Publicly Held:

- Stock is sold and owned by the public instead of investors

Forms of Business Organizations:

- Basic:

- Sole proprietorships:

- Least expensive business organization to create

- Proprietorship’s continuity is tied directly to the will of the owner

- Sole proprietor is in total control of the business’s goals and operations

- Only one owner and no formal documentation is required besides a business license

- Owner has unlimited liability for the obligations of the business organization

- Not taxed as an organization, the individual is taxed

- Examples: Home based business, Etsy, business in farmer’s markets

- Partnerships:

- Agreement between two or more persons to share a common interest in a commercial endeavour sharing profits and losses

- Easily formed compared to other business forms

- If the name of the organization is different from the partners’ names, they must file something to the government showing who they are. The state’s assumed name statute states that the name of the partners must be listed

- Each partner has an equal choice in the business’s affairs

- All partners have unlimited personal liability (no shield), and partners are generally and jointly liable for the decisions

- Disadvantages: shared profits,

- Share financial agreement

- Corporations

- Artificial and intangible entity created under the authority of a state’s law

Types:

- Domestic: Businesses made in a certain state are considered domestic to that state.

- Foreign: In states other than the state in which the business is created, the business is considered foreign. Businesses must register as foreign in states under the one they created.

-Alien: Companies that are coming from different countries and opening up in the U.S. Much more costly

- Hybrid:

- Limited partnerships

- S corporations

- Limited liability companies

- Limited liability partnerships

Factors to Consider When Selecting a Business’s Organization Form:

- Cost of creation: Legal steps in order to form a type of business organization

- Continuity of the organization

- Managerial control of decision: Who’s making the decisions and how are those decisions made.

- Owner liability

- Taxation: Some organizations are single taxed or double taxed.

Important to Continuity of a business:

Disillusion: Any change in an organization that changes their legal existence. For example, a business would need to dissolve and come back when adding more owners.

Termination: Includes the complete termination of a business.

Delaware Court of Chancery:

- Court of equity in Delaware

- Five justices, generally only take two clerks

- Nominated and elected by the governor of Delaware

- One of Delaware’s hree constitutional courts

- Can order forms of equitable relief such as specific performance or injuctions

- The nations preeminent forum for the determination of disputes regarding internal affairs

Georgia State-wide Business Court:

- Has state-wide jurisdiction to focus on complex business litigation that would otherwise land in county courts

- Judge appointed by Governor (not elected) and approved by majority vote of Senate and house judiciary committees

- Relatively new

April 3rd Notes:

Corporate Managerial Control:

Employees → Officers (Manage the daily operations and rules set by Board of Directors) → Board of Directors (Make decisions and rules) → Shareholders (elect Board of Directors)

Managerial Control:

- Proxy: An agent appointed by a shareholder for the purpose of voting shares

- Fiduciary Duties: An obligation to act in the best interest of another party; it exists when one has a special trust, confidence, or reliance on a fiduciary to exercise discretion or expertise (attorney has fiduciary duty to a client; corporate officer has fiduciary duty to shareholders)

- Directors/officers have fiduciary duties to the corporation and minority shareholders in closely held corporations

- Closely held: Have near absolute control, can pay themselves large salaries that obliterate most profit. Minority shareholders would not be left with much, however majority shareholders have fiduciary duty to the corporation and minority shareholders to act in the best interests of the corporation and minority shareholders

Derivative Suit:

- A minority shareholder who believes that a majority shareholder has acted in his or her personal interest to the detriment of the corporation may bring a derivative suit against the majority shareholder on behalf of the corporation.

Corporate Liability/Piercing the Corporate Veil:

- Notwithstanding the limited liability enjoyed by corporate shareholders, creditors of a closely held corporation may be able to reach shareholders’ personal assets in the following situations:

- The shareholders used the corporation to defraud customers and/or counterparties

- The shareholders commingled corporate and personal assets

Case Example: Alli v. U.S., 83 Fed. Cl. 250 (2008) - Focused on whether the court should pierce the corporate veil and strip away the liability protection of the Allis. Dr.Alli and Mrs.Alli bought many apartment complexes and put them under a corporation, the BSA corporation. This corporation entered into a contract with HUD, stating that they would pay BSA to have their employees stay in the apartments. However, the Allis were using the assets from BSA for their own wants, leading to the apartments being in horrible condition. HUD had to go through many government expenses to move the people out and breached the contract to have liveable housing. The BSA sued HUD, and HUD counterclaims for $2 million in damages for moving housing, costs of providing basic services, repairs, etc. It was found that BSA breached the contract because they did not provide liveable housing. The court ruled in HUD’s favor, however, due to the Allis’ price shield HUD could only get the value of BSA, which was next to nothing. The court permitted the piercing of the corporate veil, and allowed HUD to go after the Allis’ personal assets.

Limited Partnerships:

- Includes all the attributes of a partnership

- Limited partners: Not responsible for the debts of the business organziation/limited liability

- General partners: Personally liable for the organization’s debts/management control

S Corporations:

- Shareholders of certain corporations unanimously elect to have the organization treated like a partnership for income tax purposes

- Has all legal features of a corporation

- Shareholders have to account on their individual income tax returns for share of profits or losses

- Shareholders avoid having a tax assessed on the corporate income

- Cannot have more than 100 shareholders/must be individuals/must be domestic corporation

Limited Liability Organizations:

- Limited liability partnership (LLP)

- Variation of the LLC

- Have characteristics of both a partnership and a corporation

- Limited liability company (LLC)

- Treated as nontaxable entities like partnerships

- Limited liability for members like corporations

- Owners have more flexibility compared with S corporation

- Created through filings, terminology is different than in an LLP

- To form an LLC there needs to be organizers filing organization with the state (corporation needs to be stated as an LLC), there are not shareholders, there are members

Operating the Organization through Agents:

- Principal, agent, third-party, independent contractor

- Actual (the principal allows the agent to do something, like making a purchase. The principal will write, email, or call stating that they give the agent authority), implied (actions are aligned with authority and make sense), and apparent authority (A protocol in place when it comes to terminating employees is important. This would be notifying third parties the employee is no longer authorized to do business with them, changing locks, etc. If this is not done, then the agent may have apparent authority because they would still have access to company resources after being fired)

- Contractual authority: binding the principal

- Respondeat Superior/Vicarious Liability: An employer is vicariously liable for the behavior of an employee working in the scope of their employment.

- Frolic and Detour: Defenses and includes scope of employment. For example, an employee is sent to go to the bank, but stop at Chik-fil-a, going across traffic to get there, causing an accident. The employer did not authorize this frolic and detour

Trends in Management of the Organization:

- Benefit Corporations vs. B Corps

- Corporate Personhood

- Federal Communications Commission v. AT&T, Inc.

Chapter 14 Notes:

Forms of Business Organizations:

- The law recognizes three basic forms and several hybrid forms that contain attributes of two or more basic forms

- The three basic forms are: sole proprietorships, general partnerships, corporations

- The hybrid forms are: limited partnerships, S corporations, limited liability companies, and limited liability partnerships

- Some organizations are only owned by a few persons, and are known as closely held

- The issue of which organizational form is best usually involves closely held businesses; publicly held businesses typically are corporations

- The decision of selecting an appropriate organizational form usually is limited to those situations involving the few owners of a closely held business. The reason for this corporate form being used is that shareholders can transfer their ownership without interfering with the organization’s management

Factors to Consider When Selecting a Business’s Organizational Form:

Significant factors to consider in selecting the best organizational form for a particular business activity include-

- The cost of creating the organization

- The continuity or stability of the organization

- The control of decisions

- The personal liability of the owners

- The taxation of the organization’s earnings and its distribution of profits to the owners

In these sections, each of these factors is defined so that it is more easily applicable to their meaning for business structures:

Creation-

- The legal steps necessary to form a particular business organization

- The issues when considering methods of creating business organizations usually are time and money

- Usually the cost of creation is not a major factor in considering which form of business organization a person will choose to operate a business

Continuity-

- This becomes associated with the stability or durability of the organization

- The crucial issue with this continuity factor is the method by which a business organization can be dissolved

- A dissolution is any change in the ownership of an organization that changes the legal existence of the organization

- The death, retirement, or withdrawal of an owner creates issues of whether an organization and its business will continue

Managerial Control-

- The factor of control concerns who is managing the business organization

- The egos of businesspeople can cause them to insist on equal voices in management

- Usually when people are excited about getting started in a business opportunity, no one takes time to discuss methods of resolving potential deadlocks

- The failure to consider how to overcome disputes involving managerial control can cause business activities to suffer and the organization to fail

- Voice in management can be decided between co-owners

Liability-

- Always examine how liability passes from the organization to the owner

- Generally, businesspeople want to limit their personal liability. Although there are organizations that appear to accomplish this goal, you will see that such appearances might be misleading when actually conducting business transactions

Taxation-

- Remember a single tax is not always better than a double tax

- Some say that the double taxation of corporate income should be avoided by selecting a different form of organization

Selecting the Best Organizational Form:

- Sole Proprietorship: No formal documentation–business licenses only

- General Partnership: Automatic based on business conduct; modified by agreement

- Corporation: Incorporators apply for state charter with articles of incorporation

- Limited Partnership: Partnership agreement and certificate filed in public office where business is conducted

- S Corporation: Incorporators apply for state charter with articles of incorporation

- Limited Liability Company for Partnership: Organizers file artles of organization with state official

- Non-Profit Corporation: Incorporators apply for state charter with articles of incorporation

Sole Proprietorships:

- Creation: A sole proprietorship is the easiest and least expensive business organizataion to create. Legally, no formal documentation is needed

- Continuity: A proprietorship’s continuity is tied directly to the will of the proprietor. The proprietor may dissolve his or her organization at any time by changing the organization or terminating the business activity. Ownership of a sole proprietorship cannot be transferred.

- Managerial Control: The sole proprietor is in total control of his or her business’s goals and operations. While the proprietor has complete responsibility for the business’s success or failure, the owners of all organizational forms usually share control to some degree

- Liability: A sole proprietor is personally obligated for the debt of the proprietorship. The desire to avoid the potentially high risk of personal liability is an important reason other organizational firms might be viewed as preferable to the proprietorship. A sole proprietorship may appear to have many advantages; sharing responsibility and liability with others are not among them

- Taxation: A sole proprietorship is not taxed as an organization. All the proprietorship’s income subject to taxation is attributed to the proprietor. The initial appearance of this tax treatment may appear favorable because the business organization is not taxed. However, the individual proprietor must pay a tax rate based on their income

Partnerships:

- Agreement between two or more persons to share a common interest in a commercial endavor and to share profits and losses

- Creation: A partnership is easily formed. The key to a partnership’s existence is satisfying the elements of its definition- two or more persons, a common interest in business, and sharing profits and losses

- Continuity: A general partnership is dissolved any time there is a change in the partners. If a partner dies, retires, or withdraws, the partnership is dissolved. If a person is added as a new partner, there is a technical dissolution of the organization/ Dissolution is simply the legal form of organization no longer exists

- Managerial Control: In a general partnership, unless the agreement provides to the contrary, each partner has an equal voice in the firm’s affairs. Partners may agree to divide control in such a way as to make controlling partners and minority partners. A written partnership agreement should provide specific language governing managerial control

- Liability: All partners in a general partnership have unlimited liability for their organization’s debts. Partners are jointly and severally liable for the partnership’s obligations. Example: Assume that a general partnership has three partners that it owes a creditor $300,000. As an alternative, the creditor can sue any one partner or any combination of two for the entire $300,000

- Taxation: Like proprietorships, partnerships are not a taxable entity. A partnership files an information return that allocates to each partner his or her proportionate share of profits or losses from operations, dividend income, capital gains or losses, and other items that would affect the income tax owed by a partner. A partnership does not pay taxes, this may be a benefit or detriment to the partners depending on whether the organization makes or loses money and whether it distributes or retains any profits made

Corporations:

- A corporation is an artificial, intangible entity created under the authority of a state’s law. A corporation is known as a domestic corporation in the state in which it is incorporated. In all other states, this corporation is called a foreign corporation. A corporation created under a foreign country is an alien corporation

- Creation: A corporation is created by a state issuing a charter upon the application of individuals known as incorporators. Among the costs of incorporation are filing fees, license fees, franchise taxes, attorneys’ fees, and the cost of supplies

- If a corporation wants to conduct business in states other than the state of incorporation, they must be licensed in these foreign states

- Continuity: A corporation usually has perpetual existence. It is distinct from its owners’ status as shareholders. A shareholder’s death or sale of her or his stock doesn’t affect the organizational structure of a corporation

- Managerial Control: The shareholders elect the members of the board of directors. These directors set the objectives or goals of the corporation, and they appoint the officers. These officers are charged with managing the daily operations of a corporation.

- Publicly Held Corporations: In large corporations, control by management is maintained with a small percentage of stock ownership through the use of corporate records and funds to solicit proxies

- Closely Held Corporations: Shareholders with the largest amount of stock are often elected to this board of directors. In order to prevent fraud by majority shareholders, minority shareholders can file a derivative suit, seeking to enjoin the unlawful activity or to collect damages on behalf of the corporation

- Liability: The legal ability to separate a corporation’s shareholders from its mamagers means owners are liable for the debts of the corporation only to the extent of those shareholders’ investment in the cost of the stock (corporate shareholders, for example, have limited personal liability). Shareholders will usually be required to add their own individual liability as security for borrowing

- Piercing the corporate veil: When courts find the corporate organization is being misued, the corporate entity can be disregarded

- Alter ego theory: The corporate veil can be pierced through this, and may also be used to impose personal liability upon corporate officers, directors, and stockholders. If the corporate entity is disregarded by these officials themselves, so that there is such a unity of ownership and interest that seperateness of the corporation has ceased to exist, the alter-ego theory will be followed and the corporate veil will be pierced

Case example: Alli v. U.S. The Allis owned several apartments in bad condition and were sued by the US Department of Housing and Urban Development for failing to pay housing assistance for residents of three apartment complexes. They pierced the corporate veil in this situation because the Allis had been embezzling money to the point where their corporation was worth nothing and HUD could come after their personal assets

- Taxation: Corporations must pay income taxes on their earnings. They can also have tax disadvantages, like if a corporation suffers a loss during a given tax year. A double tax is teh existence of a second tax for selecting the best organizational form for a business

- Avoiding Double Taxation: Corporations have employed a variety of techniques for avoiding the double taxation of corporate income. Reasonable salaries paid to corporate officials may be deducted in computing the taxable income of the business. Corporations provide expense accounts for many employees, including shareholder employees. The capital structure of the corporation may include both common stock and interest-bearing loans from shareholders. Another technique for double taxation includes not paying dividends in order to accumulate the earnings.

- Limited Partnerships: A limited partnership has all the attributes of a partnership except that one or more of the partners are designated as limited partners. The management is left in the hands of one or more general partners who remain personally liable for the organization’s debts

- Creation: A limited partnership is created by agreement. The amount of cash or the agreed value of property to be contributed by each partner, and the share of profit or compensation each limited partner should receive

- Continuity: The principles guiding partnerships also apply to limited partnerships if there is a change in the general partners

- Managerial Control: In a limited partnership, the general partners are in control. Limited partners have no right to participate in management

- Liability: The true nature of the limited partnership being a hybrid is in the area of owner’s liability. Revised Uniform Limited Partnership Act: A limited partner’s surname may not be used in the partnership’s name unless there’s a general partner with the same name

S Corporations:

- Beginning in 1958, the federal government permitted shareholders of certain corporations to unanimously elect to have their organization treated like a partnership for income tax purposes.

- An S corporation has all the legal characteristics a corporation typically has, with the exception that shareholders in the S corporation are responsible for accounting on their individual income tax returns for their respective shares of their organization’s profits or losses

Limited Liability Organizations:

- The limited liability company is an increasingly popular organizational alternative

- Over the past two decades, the growth of LLPs and LLCs has made organizational forms popular for closely held businesses

- A variation of the LLC is known as the limited liability partnership

- Creation: An LLC is created through filings much like those used when creating a corporation. Articles of organization are filed with a state official, usually the secretary of state. Instead of incorporators, the term organizers is used

- Contunity: The owners of LLCs are called members rather than shareholders or partners

- Managerial Control: The managerial control of an LLC is vested in its members, unless the articles of organization provide for one or more managers. A dissenting member has the right to sell the membership interest to the other members of the LLC

- Liability: Members act as agents of their LLC for liability purposes.

- Taxation: State laws and the IRS recognize LLCs as nontaxable entities

Non-Profits:

- State law dictates what organizations are permissible, the necessary filings, and the governance structure

- An important part of any non-profit administration is the avoidance of conflicts of interest between the non-profit and board members

Making the Decision:

- The criteria used to select a form of organization needs to be reviewed periodically and is often done with attorneys, accountants, insurers, etc

Operating the Organization through Agents:

- Terminology: First, a principal interacts with someone for the purpose of obtaining the second party’s assistance. The second party is the agent. A principal may hire an independent contractor to perform a task

Contractual Liability from an Agent’s Acts:

Contractual authority can take the following forms-

- Actual authority: Specific instructions, whether spoken or written, given by an employer to an employee to create actual authority. For example, you write a note to your friend Terry, the manager of the local grocery store, giving authority to your employee, Alex, to charge $100 worth of coffee to the restaurant.

- Implied authority: Can be inferred from the acts of an agent who holds a position of authority or who had actual authority in previous situations. For example, Alex is in charge of the restaurant for an evening. He notices the tuna salad is in short supply, so he goes to Terry’s grocery store and buys tuna charging the restaurant.

- Apparent authority: Seemingly having authority. Example: Terminating Alex’s employment, and in retaliation, he goes to Terry’s and charges a variety of groceries, making the restaurant liable for the bill because you did not notify Terry that Alex had been terminated. A partner in a trading partnership(one that is engaged in the business of buying and selling commodities) has the implied authority to borrow money in the usual course of business. A partner in a nontrading partnership has no implied power to borrow money

- Ratification: Occurs when a principal voluntarily decides to honor an agreement

Tort Liability from an Agent’s Acts:

- The reason for respondeat superior is that the employee is advancing the interests of the employer when the tortious act occurs. If the employee is not doing the work, the employer would have to do it.

- Some respondeat superior cases involve employee negligence.

- Usually the only defense the employer has to the strict liability of respondeat superior is that the employee was outside the scope of employment

- Sometimes a defense is made using frolic and detour. An employee who is on a frolic or detour i sno longer acting for the employer. An employer who must pay for an employee’s tort under respondeat superior may legally sue the employees for reimbursement

- Each partner is in effect both an agent of the partnership and a principal, being capable of creating both contract and tort liability for the firm and for copartners and likewise being responsible for acts of copartners

Criminal Liability:

- Agents can impose criminal liability on business organizations.

Trends in Managing the Organization:

- Generally, the business judgement rule provides a significant degree of protection for the decisions of directors by presuming they are in the interests of the firm

- Trend:To avoid concerns of diverging shareholder and director interests, some recommend organizing the firm from the outset as a benefit corporation

- B-Corp: A private certification rather than a legal business structure

- Creating the benefit corporation structure comes from the perception that traditional corporate forms place too much emphasis on profit maximization. However, traditional corporations aren’t legally or functionally precluded from offering essentially the same social benefits due to the flexibility in corporate governance (yjos was made clear in Burwell v. Hobby Lobby Stores)

- As the effect of climate change and other sustainability issues become more impactful on a firm’s bottom line, one could argue that not addressing them is actually a breach of fiduciary duty

Marchand v. Barnhill: Bluebell Creameries, a Delaware corporation founded in Texas selling ice cream had ice cream contaminated with Listeria produced in their factories. This led to the poisoning and deaths of three customers. Marchand, a shareholder in Blue Bell sued the company. It was found that although the corporate directors are given significant deterrence in their decision making, when confronted with risks that can impact “essential and mission critical” operations, a court may apply more scrutiny. The court determined that the plaintiff alleged sufficient facts to make the case that the Blue Bell directors did not take food safety risks seriously enough

- Second trend: The continued definition of the nature of corporate personhood

- The U.S. Code explicitly states that the words “person” and “whoever” include corporations, companies, associations, firms, partnerships, societies, and joint stock companies, as well as individuals. Corporations and individuals reasonably have a largely equal claim to rights and protections under the law.

- In Citizens United v. Federal Election Commission, 558 U.S. 310 (2010), the Supreme Court affirmed a corporation’s speech protections under the Constitution’s First Amendment by striking down a federal law that limited spending on political advertising

- In Burwell v. Hobby Lobby Stores, Inc. (2014), the Supreme Court was compelled to determine whether for-profit corporations are “persons” within teh meaning of the Religious Freedom Restoration Act

- Third Trend: The evolving role of flexible workplaces and online customer interactions in business operations and governance

- The business work has been on the path toward substituting remote interactions for in-person activities for many years. Some businesses have shifted much of their work force to some form of telecommuting. However, this trend greatly accelerated in the wake of the 2020 Covid-19 pandemic

- In some parts of the United States, pickup or home delivery became the only option for maintaining a retail presence. The extent to which the shift to more online interactions becomes a permanent reality may not be fully determined for years, and it may differ by industrial sector.

April 5th Notes:

- Benefit Corporations vs. B Corps

- Corporate Personhood:

Federal Communications Commission v. AT&T Inc. 131 S.Ct. 1177 (2011). There is an investigation by the FCC on AT&T because of the possibility that the government overpaid AT&T. AT&T voluntarily turned over documents to the federal government and it paid back what was due. After this, AT&T competitors made a FOIA (requires the government to hand over federal documents) request, wanting AT&T’s documents for their use. AT&T argued back using Section 7c, that stated that businesses can not request personal documents. The court determined that businesses do not have personal private rights under Section 7c because a business does not include personal privacy, however, under other sections of FOIA, AT&T has privacy rights

- Director Liability

Marchand v. Barnhill, 212 A.3d 805 (Del.2019). Did Blue Bell Creameries Board breach their fiduciary duties by disregarding the contamination risks? Blue Bell Creameries ice cream was contaminated with listeria, leading to three people’s deaths from the contamination. A shareholder, Jack Merchand, sued Blue Bell Creameries saying they failed to follow appropriate food safety protocols. Amounts of bacteria over legal limits appeared in tests in January 2015 and spread to Blue Bell products by February, and the outbreak spiraled out of control. The directors moved to dismiss, claiming Marchand had not alleged anything showing bad faith, a prerequisite to holding directors liable. The judge dismissed the claims against the directors. Marchand appealed.Chief Justine Strine expressed the Delaware Supreme Court’s view that to avoid liability under Caremark, boards must demonstrate that they have instituted and supervised a board-level process to oversee and monitor a system of compliance that addresses the company’s mission-critical risks.

Chapter 15-The Regulatory Process Lecture Notes:

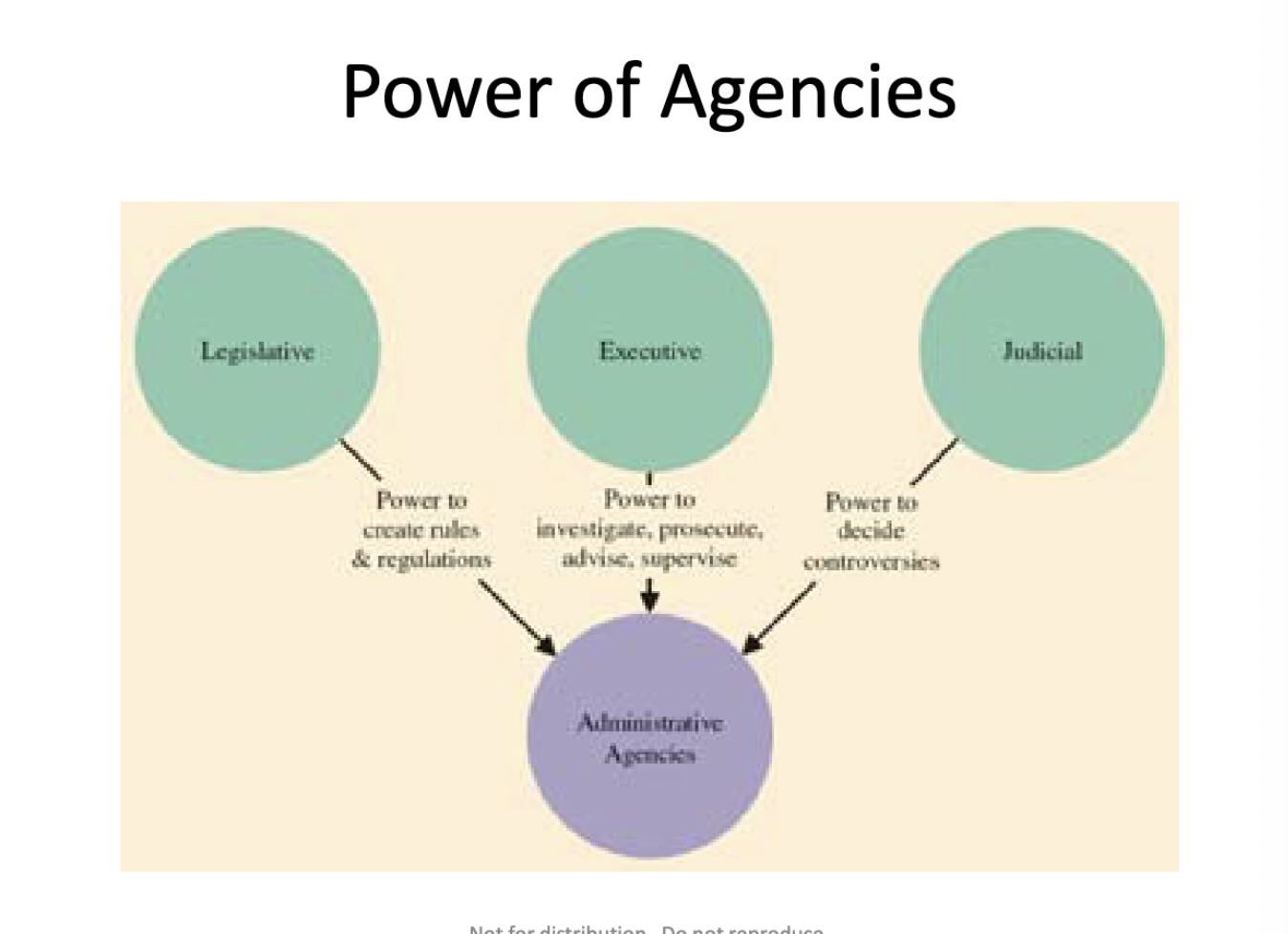

Administrative Agencies:

- Board, bureaus, commisions, and organizations that make up the governmental bureaucracy

- Types of regulatory authority

- Quasi-legislative

- Quasi-judicial

- Create and enforce laws constituting the legal environment of business

The Station Nightclub Fire: This was the fourth deadliest nightclub fire in the U.S. It occured in New England in 2003. The fire was started from proximate audience pyrotechnics (pyrotechnics that can be used inside) by the band playing at a club. Most people went through exits that they came in through, all trying to go to through the same door. People sued the government stating that they should have not allowed this to occur, and there should have been more requirements.

Reasons for Agencies:

- Provide Specificity

- Provide Expertise

- Provide Protection: Agencies are made to protect people, so they are primarily regulating businesses. When a government program for protection is made by law, they must create proper administrative agencies that have the correct authority, consistencies, and responsibilities, or they work with already made agencies to regulate in the right area.

- Provide Regulation

- Provide Services

Functions of Agencies:

- Rule making: An agencies quasi-legislative powers, an agency can make rules that can be enforced by law. This can be general practices, or made specifically. The agencies publish guidelines to supplement and explain rules. These are not necessarily law, and are more like an annotation to help people understand the rules

- Adjudicating: Involves fact-finding and applying law to the facts

- Advising: Agencies can propose new legislation to Congress, report information to the general public and publish advisory opinions to aid businesses to deal with issues. An advisory opinion is a unique device used by administrative agencies, generally not available in the court system. Agencies send out a hypothetical example, businesses ask about their situation, and agencies send back out an advisory opinion. These are not binding and are more of a vuideline. This is unique to the administrative agency process and not to the courts.

- Investigating: Agencies have subpoena power, they can take businesses to court, make decisions. Agencies can send out cease and desist orders to companies, however companies often enter into consenting orders to avoid this.

April 8th Notes:

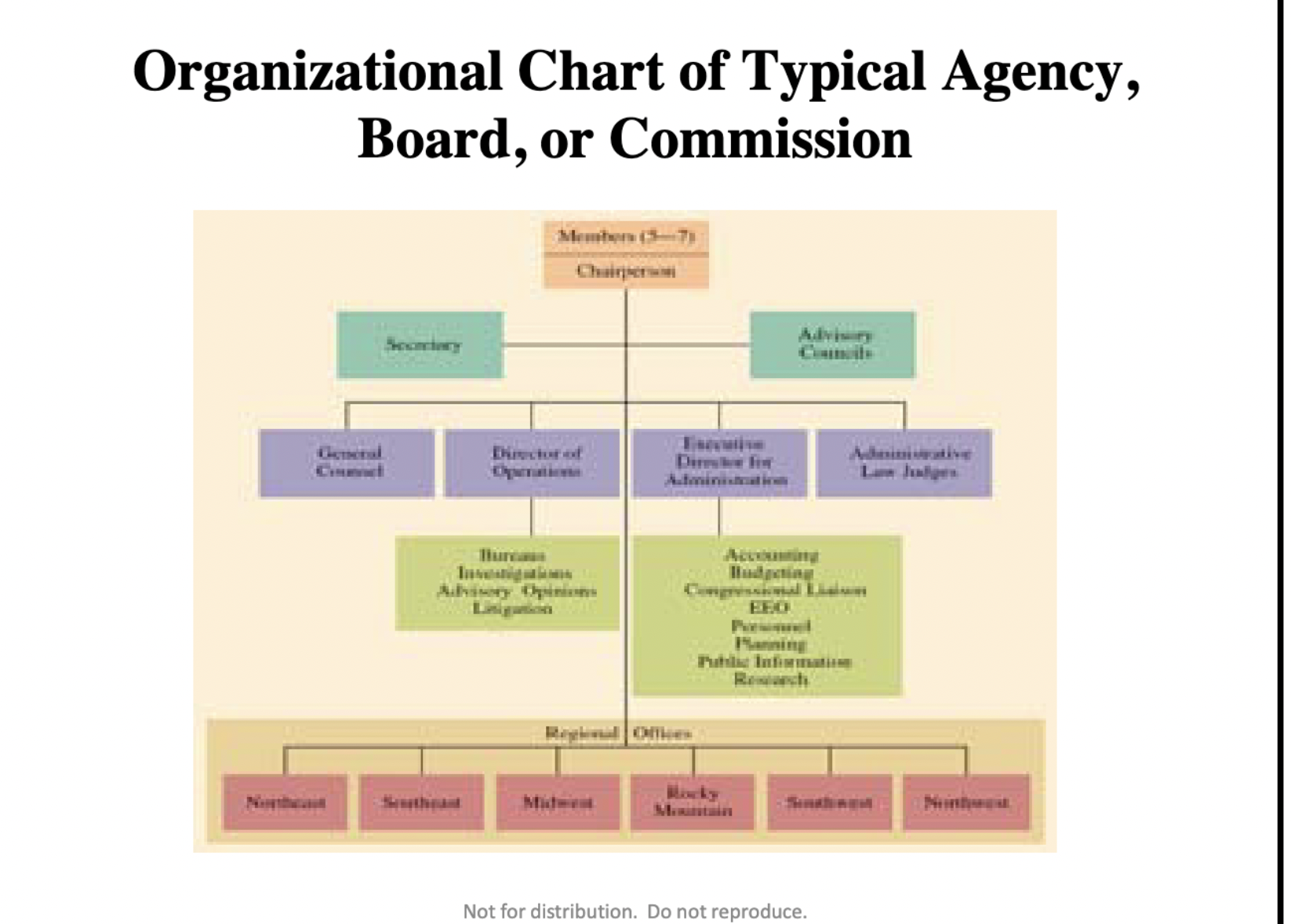

Organization of Agencies:

- Consist of five to seven members

- One member is appointed as chairperson

- No more than half can be majority one political party

- Appointments require Senate confirmation

- Removal by president only, by cause

- One named a chair by the president, have equal voting

- Secretary: keeps meeting minutes, signs all orders, deals with everything on the federal register

- Chief calice can sometimes hav eto be approved by the senate, seen as extremely powerful

- Appointees are not permitted to engage in other employment during the terms

- Agencies have distinctive organizational structure to meet its responsibilities

Free Enterprise Fund v. Public Company Accounting Ocersight Board, 561 U.S. 477, 130 S.Ct. 3138 (2010): In 2002, Congress enacted the Sarbanes-Oxley Act (SOX), which added on to the SEC with the goal of regulating private accounting firms. It created a new board, PCAOB to regulate private accounting firms and were appointed by the SEC. They were not employed by the government and were modeled by private industries, hoping people would feel more secure. People challenged the PCAOB because of the dual “for cause” ability of the president and SEC to remove members was a separation of powers violation. The dual for cause limitation on the removal of SEC and PCAOB members violates the separation of powers but this decision can be severed, and SOX can stay.

- SOX is not unconstitutional, the dual for clause limitation was the main issue that violated the separation of powers.

- Congress creates sox to regulate accounting firms, an agency under the SEC called PCAOB

- Since not appointed by president it allows for recruitment outside the government but not limited to government rules

- No appointment clause violation

- Seperation of powers issue

The Federal Register:

- Published everyday

- Gets involved right then

- File any proposed rules

- The secretary has the responsibility to explain why information is published in the register

- This is where the FTC secretary puts all rules that are proposed or want to be passed, as well as public notices.

- PTO: Uses the principal gazette, supplemental register

- The burden of the Federal Register on the U.S. population is $1.9 trillion

- President Truman cut the number of the pages in the 60s to 9,000 papers