Business Organization & Environment Notes (IB)

1. Introduction to Business Management

The Role of Businesses in Combining Resources to Create Goods and Services

Business - an organization engaged in commercial, industrial, or professional activities that can be a for-profit or a non-profit. Profit-making organizations persuade customers through effective marketing to purchase their products or services at a higher price than it costs to produce them.

Goal: To meet the needs and wants of consumers by combining human, physical, and financial resources to create goods and services.

Features of a business

A decision-making organization.

Made up of groups of workers, managers, directors, and stakeholders.

Exists in association with customers, suppliers, competitors, the environment, local, national, and other governments.

Uses factors of production.

Produces and sells goods/services.

Normally profit-making.

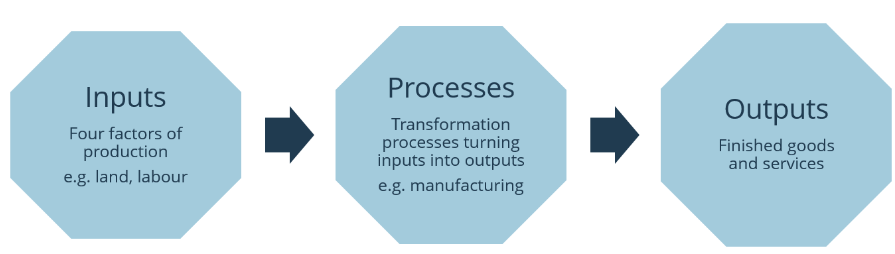

Business Activity

Aim: To generate outputs and add value, by selling the outputs for more than the costs of the inputs.

When producing an output, the business uses resources, often known as inputs. Inputs are land, labor, capital, and enterprise (or entrepreneurship). Collectively these are called the four factors of production.

An output of either a good or service is produced.

Business functions (processes) include administration, production, marketing, and finance. In larger organizations, these functions are carried out by specialist departments.

Businesses are affected by external activity, such as social changes, government policies, and external shocks (e.g. sudden oil price change).

Inputs: Factors of production

Land (physical resources) – any natural resource, e.g., raw materials.

Labor – services given by employees. A labor-intensive business has a high proportion of labor compared to other inputs because labor is cheap.

Capital – money, or assets used for production, e.g., buildings, plants, and equipment. A capital-intensive business depends more on capital than other factors of production; because labor is relatively expensive.

Enterprise – that ‘spark’ or idea provided by the entrepreneur, and the planning that combines the other three factors of production.

Production

Capital intensive - processes use a large proportion of land or machinery relative to other inputs, especially labor.

Labor-intensive - processes use a large proportion of labor relative to other inputs, especially in relation to land or machinery

Outputs: Goods and Services

Goods (visible or tangible items) - are items that can be seen and touched, e.g., shoes.

Services (invisible or intangible items) - are items that cannot be seen or touched but have visible results, e.g., hairdressers’ services. Customers pay for the skill and experience shown by the person delivering the service.

Goods

Consumer goods | Producer goods |

|---|---|

FMCG’s (Fast Moving Consumer Goods) Items bought regularly, e.g., food. | Consumables Items with a short life and little value, e.g., raw materials and paper. |

Consumer durables Goods that last through many uses, e.g., furniture, cars, and clothing. | Capital goods Plant and equipment used to produce consumer goods. Not for sale as they are the ‘lifeblood’ of the business. |

Purchasers vs. Consumers

Purchasers of products = customers

Enjoyers of products = consumers.

When marketing a product, a firm must decide whether the customer or consumer is most influential in the purchasing decision.

Services

Services can be:

Personal

Commercial (business)

There are often overlaps between the two, e.g., banks offer financial services to both individual and business customers.

Business Functions and Their Roles

Function (department) | Role |

|---|---|

Human resources (HR) | Managing people in an organization, including recruitment and training. |

Finance and Accounting | Finance is managing the financial operations of an organization. Accounting is recording, summarizing, and reporting transactions to provide an accurate picture of a firm’s financial position and performance. |

Marketing | Anticipating, identifying, and satisfying the needs and wants of consumers, e.g. promoting and selling products or services. The marketing department coordinates the marketing ‘mix’. |

Operations management/ production | Management of resources used for the production of goods and services at the required quality and as efficiently as possible. |

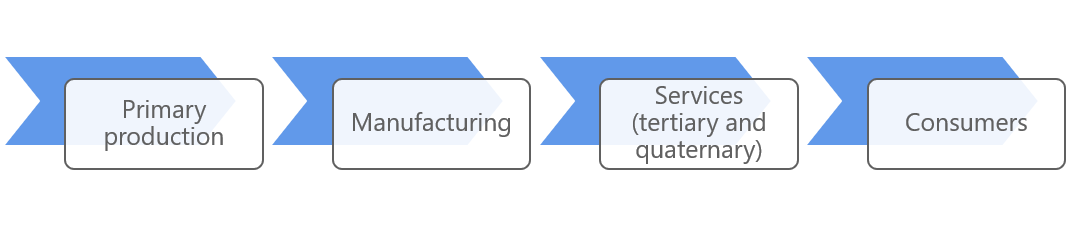

Sectors of business activity

Chain of production - the stages in the production of a particular product.

Value is added at every stage, so they can be sold for more than the cost of the raw materials.

Business organizations operate in one or more of the following sectors:

Output | Sector | Activity |

|---|---|---|

Goods | Primary | Extractive industries that acquire raw materials for production, e.g., farming, mining, forestry, and fishing. |

Goods | Secondary | Manufacturing and construction. Raw materials are processed and turned into consumer and/or capital goods. |

Services | Tertiary | Personal and commercial services, e.g. shops and banks. |

Services | Quaternary | Specialist technology businesses and/or knowledge industries, e.g., e-commerce. |

Primary-sector activities tend to dominate in less economically developed countries (LEDCs).

Tertiary and quaternary-sector activities tend to dominate in more economically developed countries (MEDCs).

Secondary-sector activities tend to dominate in newly industrializing or emerging economies (NICs).

The Nature of Business Activity in Each Sector and Sectoral Change

Sectoral change - is the trend for the percentage of a workforce in agriculture to decline over time, and for the secondary and then tertiary sectors to become increasingly important as economies develop. Developing countries are characterized by subsistence primary production and low levels of income. As they develop, they industrialize, with manufacturing becoming dominant. This has the following effects:

urbanization

capital-intensive industries

increases in GDP/living standards

increasing employment

As development continues, there is a move towards tertiary-sector activity, with the following effects:

higher incomes and increasing consumption of luxury goods

increasing specialization

increasing demand for personal services

growth of technology and communication

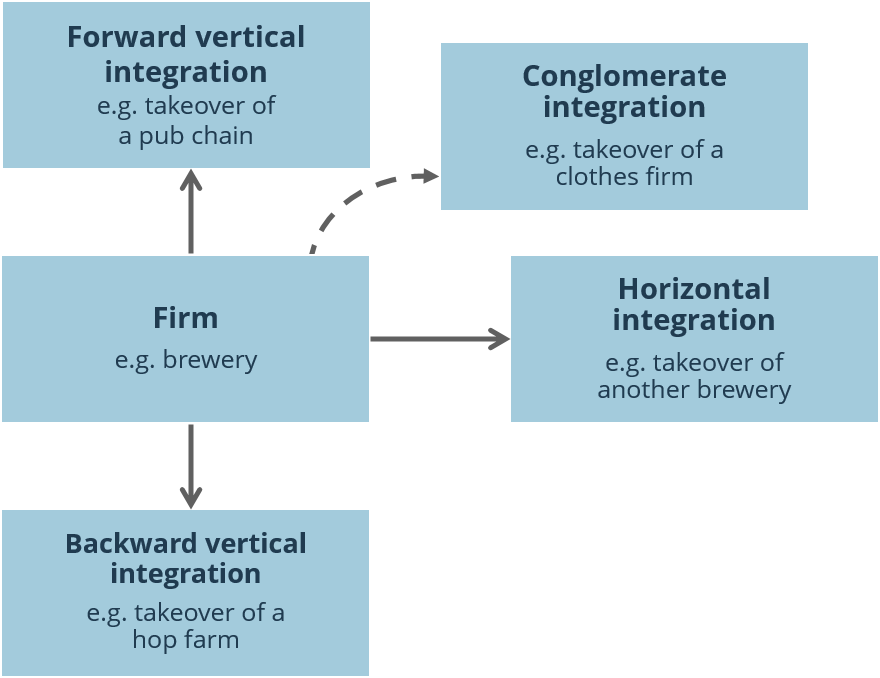

Types of business growth

Horizontal growth refers to a business acquiring or merging with another business engaged in more or less the same activity.

Vertical growth refers to acquiring other businesses involved in earlier or later stages of the chain of production or by beginning operations in an earlier stage through internal growth.

Backwards vertical integration - the activity of the business acquired is earlier in the chain.

Forward vertical integration - the activity of the business acquired is later in the chain.

Entrepreneurship vs. Intrapreneurship

Entrepreneurs - an individual who demonstrates enterprise and initiative in order to make a profit.

Intrapreneurs - an individual employed by a large organization who demonstrates entrepreneurial thinking in the development of new products or services.

Innovation is central to what entrepreneurs and intrapreneurs do. This typically comes in one of three forms:

Market reading: observing customers and competitors and then making small changes to existing products

Need seeking: communicating with current and potential customers to determine their needs

Technology driving: investing in research and development and following opportunities offered by technological capabilities.

Opportunities and Challenges in Starting a Business

Why do individuals set up businesses when there are so many risks? Reasons include that entrepreneurs:

spot a gap in the market

want to be their own bosses and organize their business lives

enjoy a challenge and/or have a passion for an activity

believe they can produce a good or service better than their competitors

have skills that are in short supply

want to earn a profit and possibly ‘get rich'

want to pass on wealth to their family.

Seven main stages are involved in setting up a new business:

Identify a business opportunity and a target market and generate ideas about meeting the needs and wants of that market.

Research the potential market and customer base.

Produce a business plan.

Select the correct form of business organization and satisfy the legal requirements for registration.

Raise the initial finance from personal savings or by borrowing.

Choose a suitable location.

Market the product or service.

Reasons for Business Failure

Start-up costs can be high, e.g., recruitment and marketing.

Initial demand and revenue may be low – no brand recognition or customer loyalty.

Time before production begins.

Cash flow problems.

Inadequate demand for the goods and services.

Poor marketing and failure to supply sufficient goods to satisfy orders.

Changing external environment, e.g., recession.

Other businesses copy the idea.

Legal restrictions, e.g., licenses.

Uncompetitive prices because small firms lack economies of scale.

Poor location as the result of a lack of finance.

The personality and skills of the entrepreneur are inadequate.

Elements of a business plan

The business idea, aims, and objectives: setting out the business idea in the right context

Business organization: how the business will be organized

Human resources: how the business will be staffed

Finance: how the business will be financed

Marketing: how best to market the product

Operations: how the product will be made

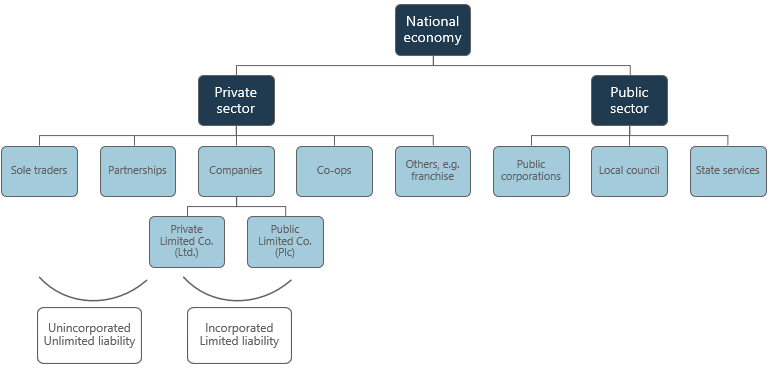

2. Types of Business Entities

Distinction Between the Private and Public Sectors

Private sector - organizations owned, controlled, and managed by private individuals to make a profit, e.g., Microsoft.

Public sector - organizations owned, controlled, and managed by the government to provide essential goods and services for the general public, e.g., a national health service.

Privatization - moving firms from public ownership to private ownership.

Features of For-Profit Organization Types

The common feature of all of these types of businesses is that one of their aims is to generate profit.

Profits = total revenues - total costs

Legal Structure

Most organizations operating in the private sector aim to make profits. The choice of legal structure determines how a business is financed, managed, and organized, and its growth prospects. When a firm is set up, it chooses between unincorporated or incorporated status, which affects the liability of the owners for business debts.

Unincorporated organizations

In these organizations, the owner is ‘one and the same as the business itself’. An unincorporated business has unlimited liability. The owner is legally responsible for all debts of the business and his or her possessions, such as a house, can be seized to pay outstanding debts. Unlimited liability, difficulties in raising finance, and taxation issues may encourage businesses to incorporate.

There are two types of unincorporated organizations: sole traders and partnerships.

Sole traders (sole proprietors) - businesses owned and run by one individual with no legal distinction between the owner and the business.

Advantages:

Cheap and easy to set up with few legal formalities.

All income/profit belongs to the owner.

Quick decision-making, as only one person makes decisions.

Being ‘your own boss’ is motivating.

Privacy and confidentiality as public accounts are not required.

Flexibility and the ability to offer a personal service.

Disadvantages:

Unlimited liability – risks personal assets.

Limited sources of finance because of the high risk of failure. Lenders usually demand security for loans, e.g., the owner’s house.

The owner is responsible for all business functions.

High risks – few economies of scale and higher costs.

Workload and stress – the owner cannot rely on others for support.

Lack of legal continuity – the business ends if the owner retires or dies.

Partnerships - these are owned by two or more people. The maximum number of partners varies from country to country. The ownership, profit, and liabilities are shared between partners. Like sole traders, partnerships cannot sell shares to other people, restricting the raising of capital for expansion.

Advantages:

Greater financial strength than sole proprietorship, as there are more investors.

Owners receive a share of all the profits.

Decision-making is shared between partners who may be specialists, allowing the division of labor.

No responsibility to shareholders.

Privacy and confidentiality as public accounts are not required.

Disadvantages:

More complicated to set up than a sole tradership, requiring a legal agreement (Deed of Partnership).

Unlimited liability – partners risk personal assets.

Limited sources of finance compared to companies.

Decision-making can be slower than sole proprietorship, as more owners are involved.

Possible disagreements between partners.

Few economies of scale and vulnerable to competition from larger businesses.

Lack of legal continuity – if one partner dies or leaves, the partnership ends.

Partners are responsible for all losses, ‘wholly or severally’. If only one partner has assets, this partner is responsible for all debts.

Incorporated organizations - these organizations may be referred to as companies, corporations, or joint-stock companies, depending on the countries in which they operate. The firm is a legal entity in itself, with rights and responsibilities separate from those of the owner. Incorporation is like a birth – a legal entity is created with rights and responsibilities. The company has a ‘legal personality’.

An incorporated business is owned by shareholders, who have limited liability.

If the business fails, the shareholders’ liability for debts is limited to the maximum value of the shares they hold.

The business and its owners are separate legal entities with a ‘separation of control and ownership’.

Owners may appoint specialist managers to run the business.

Forming a company

Owners prepare legal documents to be registered with the authorities, including:

Articles of Association: the internal rules of the business, e.g., calling of meetings and types of shares.

Memorandum of Association: this details the relationships between the business and its external environment, e.g., the objectives of the business.

There are two types of companies: private limited companies and public limited companies.

Private limited companies (‘Ltd’) - most companies start as private limited companies because the set-up is relatively quick and inexpensive.

Each year, companies prepare and publish a set of legal accounts, which are approved (audited) by independent accountants.

There has to be at least one director. Shares can be sold privately, but not on national stock markets.

Shareholders have limited liability.

Many private limited companies are family businesses with less risk of a takeover, as existing shareholders can restrict the sale and transfer of shares.

Public limited companies (‘plc’) - the shares of public limited companies are traded on national and international stock exchanges.

Flotation or initial public offering (IPO) - occurs when a private limited company issues shares to the public for the first time, seeking capital to expand. The company becomes a public limited company and is listed on one, or several, stock exchanges. It is said to have ‘gone public’ or ‘been floated’.

Becoming a PLC is expensive as the company must have a minimum share capital, which is more than many entrepreneurs can afford.

Anybody can buy shares in a public limited company. Shareholders receive one vote for every share, so they control a business if they own more than 50% of the shares because they can appoint their own directors.

In practice, few shareholders vote at general meetings, so actual control can exist at lower levels of share ownership. A plc can be taken over without the agreement of the directors.

The decision-makers (the directors) are not normally the owners. This separation (‘divorce’) between ownership and control causes problems if the directors do not act in the shareholders’ interests.

Advantages of companies

Access to large amounts of capital by selling shares.

Money raised from shares is permanent capital that never has to be repaid unless the business is liquidated. Companies pay dividends to shareholders.

Legal continuity.

Directors can be shareholders, incentivizing performance to maximize dividends.

Enjoy economies of scale, lower costs, lower prices, and higher profit.

Specialist managers and employees improve efficiency.

Better customer recognition, more trust, and brand loyalty.

Disadvantages of companies

Lack of confidentiality, because they produce public accounts.

Less flexibility with the risk of diseconomies of scale.

More standardized with less personal service.

High set-up costs because of legal requirements.

Original owners may lose control because sales of shares are unrestricted.

Summary of legal structures and their advantages and disadvantages

Legal structure | Advantages | Disadvantages |

|---|---|---|

Sole traders |

|

|

Partnerships |

|

|

Private limited companies |

|

|

Public limited companies |

|

|

Features of For-Profit Social Enterprises

Feature: Making profit is still essential, but making the world ‘a better place’ is central to the business mission.

Cooperatives - run by a group of people, each of whom has a financial interest in its success. Most are registered as limited liability companies.

There are five main types of cooperatives:

Financial - is a financial institution the ethical and social aims of which take precedence over profits.

Housing - is run to provide housing for its members as opposed to providing rent for private landlords.

Worker - a business that is owned and operated by the workers themselves, which does not pay significantly higher wages or salary to managers, and has employed workers as a priority

Producer - is where groups of producers collaborate in certain stages of production.

Consumer - provides a service to its consumers who are also part owners of the business.

Microfinance - refers to services – including credit, savings, insurance, and other financial products targeted at low-income groups – that find borrowing difficult from banks. They often operate in rural communities and lend small sums to help individuals set up their own businesses.

Public–private partnerships (PPPs) - governments may not have the finances to provide a required good or service, so may enter into a partnership with a private firm(s) to create a public–private partnership (PPP) to supply the good or service. The private firm operates the business on behalf of the government. PPPs are used to develop infrastructure in education, transport, defense, and health.

PPPs combine two funding types:

Government funded – the government provides the funds for projects operated and managed by private companies using their resources and expertise.

Private-sector funded – the government operates and manages projects using private-sector funding.

Advantages of PPPs over public-sector projects:

quicker and more efficient delivery

value for money for the taxpayer

combined public and private sector skills, knowledge and expertise

better labor and capital productivity

competition between bidding firms lowers costs

innovation in the provision of public services

However, critics argue that:

taxpayers pay the bill for PPPs

some private firms fail to deliver workable projects

private companies cut corners to maximize profits

short-term savings lead to longer-term debts for the government

private finance is riskier than public finance

private firms may not take account of social objectives

PPP contracts are complex and costly

Features of Non-Profit Social Enterprises

Non-profit organizations (NPOs) or not-for-profit organizations, - like private firms, may have a surplus of income over expenditure, but this is reinvested for the benefit of their members.

Non-profit organizations include clubs, charities, religious associations, and pressure groups. These may share some aims with private businesses, but profit is not one of them.

A surplus is any extra revenue generated after subtracting an NPO’s costs.

Surplus = total revenues - total costs

Non-governmental organizations (NGOs) - NGOs operate in the private sector for the benefit of others and are non-profit organizations, independent from the government. In the USA, they are known as private voluntary organizations.

NGOs support socially desirable causes, such as

the Red Cross

Amnesty International

The International Olympic Committee

Charities - are NPOs that often raise awareness of social problems, such as homelessness, and pressure governments to increase resources for underprivileged or excluded groups.

Charities use marketing to create brand awareness and frequently use celebrity endorsement. They combine professional managers and full-time employees with volunteer staff. Large companies associate with charities to raise their ethical image.

3. Organizational Objectives

Organizations need objectives because they:

provide a sense of direction

underpin strategic and tactical activities

provide a means of measuring performance

motivate stakeholders

develop teamwork.

Vision and Mission Statement

In practice, the vision statement and the mission statement may overlap or one may be a part of the other. However, there are differences:

A mission statement is more specific to what the enterprise can achieve.

The vision statement describes why it is important to achieve the organization’s mission by defining its purpose, social aims, or broader goals, such as health improvements.

The mission statement

A business is not defined by its name, statutes, or articles of incorporation. It is defined by the business mission. Only a clear definition of the missions and purpose of the organization makes possible clear and realistic business objectives. - Peter Drucker

Mission statements define an organization’s purpose and primary objectives, stating ‘who we are and what we do’. They act as a whole philosophy for the firm. They may not have quantifiable targets but aim to inform customers, employees, and other stakeholders about the firm’s objectives. The mission statement should:

be a concise statement of where the business is now and show its future direction

provide a statement of what the business wants to achieve in the long term, as well as now

allow the business to develop specific goals and objectives to achieve its aims

provide inspiration to stakeholders.

The vision statement

The vision statement is a general statement on where the business wishes to be in the future and the values it holds; what it wants to become and what it wants to achieve. The vision statement should make employees feel proud, motivated, and excited to be part of the organization’s journey.

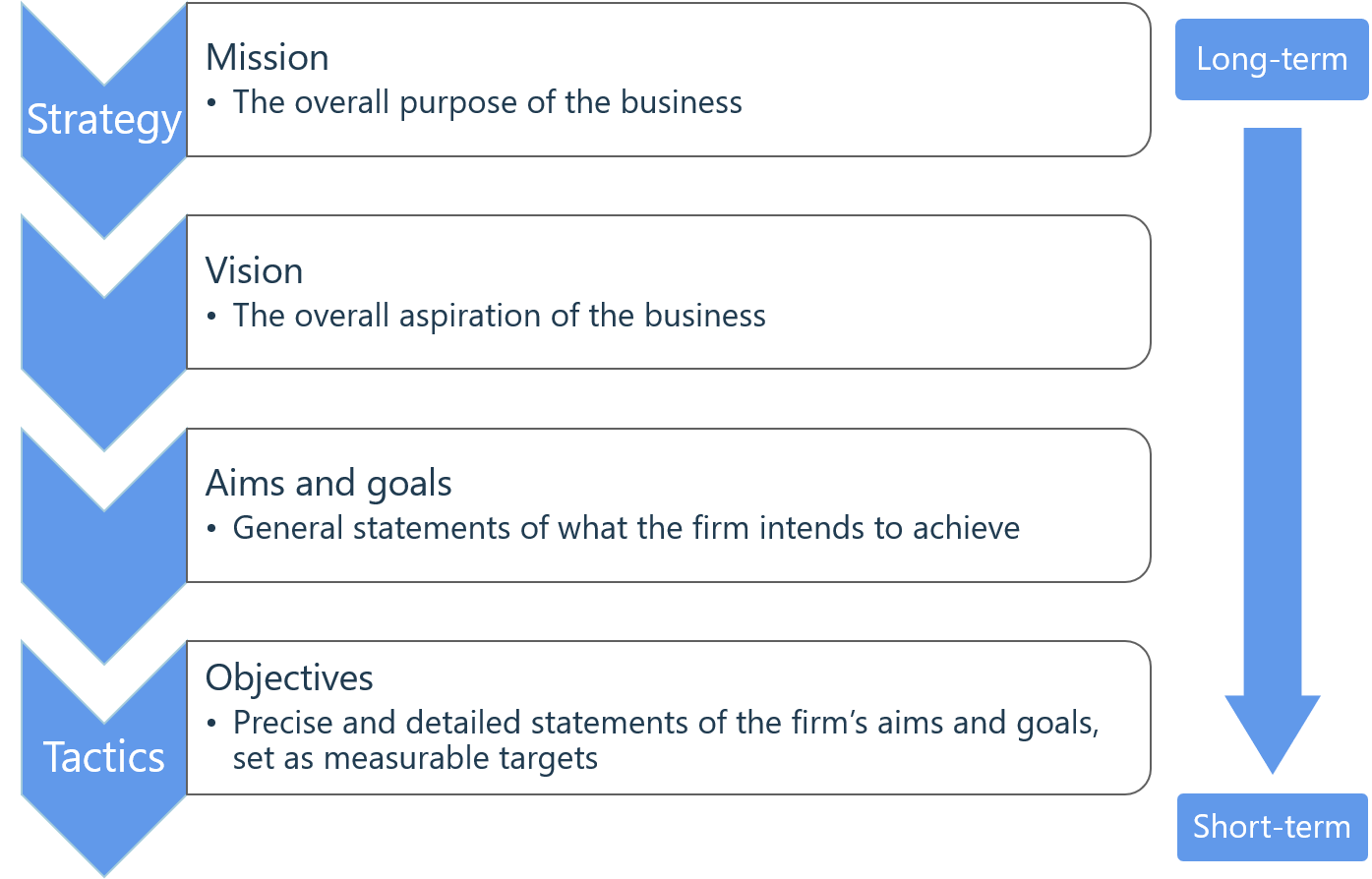

Aims, objectives, strategies, tactics, and their relationships

Why organizations exist

Aims and objectives allow businesses to measure success by comparing actual performance against targeted performance. Aims and objectives drive decision-making and provide targets that aim to motivate staff.

Definition of Terms

Aims are statements of intent written in broad terms, describing what the organization wants to achieve and where it wants to be in the future.

Objectives are specific objectives required to achieve the organization’s desired aims, defined in measurable outcomes. For example, an individual aims to become a journalist. To achieve this aim, he/she sets specific objectives in terms of qualifications.

A business strategy is a plan illustrating how the organization will achieve its corporate objectives. Strategic objectives are significant long-term goals relating to key business objectives such as market share.

Business tactics are operational activities undertaken regularly to implement the business strategy.

A long-term period is usually defined as between one and five years. In terms of business, long-term planning is associated with strategy.

A short-term period refers to planning for one year or less. Tactical objectives may be daily, weekly, or monthly.

The planning process

The aims of a firm are its strategy. From these are derived tactical objectives; shorter-term objectives to provide immediate targets and motivators for managers and other employees.

The first, the most basic, and the perpetual goal of any firm is survival. Only after this has been secured can it develop significant strategic aims, such as:

increased profit

greater market share

elimination of competition

possible takeovers

international expansion

improving corporate image

improving quality.

Management by objectives

The term ‘management by objectives’, popularized by the management theorist Peter Drucker, refers to the process of management and employees agreeing on objectives for the organization. Objectives set in this way need to be SMART or SMARTER.

SMART objectives

S = Specific, clear, and easily defined.

M = Measurable and quantifiable targets and tasks.

A = Achievable using existing resources, so objectives should be realistic.

R = Relevant and must not conflict with other objectives.

T = Time-bound (within a specified period) allowing measurement.

SMARTER objectives

A business can make objectives SMARTER by ensuring it can:

Extend the target to account for new circumstances and/or make them Exciting.

Reward the achievement of objectives and/or Record the results.

Hierarchy of objectives

HP gives its corporate objectives and shared values as follows:

Customer loyalty: to earn customer respect and loyalty by consistently providing the highest quality and value.

Profit: to achieve sufficient profit to finance growth, create value for our shareholders, and achieve our corporate objectives.

Growth: to recognize and seize growth opportunities that build upon our strengths and competencies.

Market leadership: to lead in the marketplace by developing and delivering useful and innovative products, services, and solutions.

Commitment to employees: to demonstrate our commitment to employees by promoting and rewarding them based on performance and by creating a work environment that reflects our values.

Leadership capability: to develop leaders at all levels who achieve business results, exemplify our values, and lead us to grow and win.

Global citizenship: to fulfill our responsibility to society by being an economic, intellectual, and social asset to each country and community where we do business.

Changes in internal and external environments

Aims and objectives are not fixed. They respond to changes in internal and external environments, which offer opportunities or pose threats.

The internal environment

This is the part of a business under its control and includes functions such as human resources and marketing. The drivers for change in the internal environment may be negative or positive.

Negative changes:

high staff turnover and/or absenteeism

falling quality standards

loss of productivity and falling motivation

liquidity problems

increasing costs

Negative changes are a threat to the business.

Positive changes:

recruiting talented individuals

improving productivity and quality

successful innovation

exceeding performance measures

Positive changes should result in new business activity and strategic objectives.

The external environment

The external environment is the ‘world beyond the firm’ and is not controllable by it.

It includes the political, economic, social, and technological changes that impact the business.

The external environment provides opportunities for business growth and poses threats to its financial and operating activities.

The drivers of change in the external environment may be negative or positive.

Negative changes:

recession

new competition

new products from competitors

new laws and regulations that increase the firm’s costs

changes in social behavior and trends decreasing demand for a firm’s products

These are threats to the business. Although the firm cannot change its external environment, it may alter its operations to reduce its effects.

Positive changes:

economic booms

new technologies reducing production costs

changes in consumer behavior favoring the firm’s products

lower taxes

Changing external factors should lead the business to review its corporate objectives and strategy.

Ethical Corporate Social Responsibility

The distinction between ethical objectives and corporate social responsibility (CSR)

CSR is an umbrella term that covers the firm’s ethical objectives, but there is a distinction:

Ethical behavior is about managing the behavior of individual employees and other stakeholders.

CSR is focused on the behavior of the organization as a whole as opposed to the actions of individuals within it. It is about the positive role of the organization in its environment and its social impact.

Ethical objectives are the moral principles and values underpinning human behavior. Morals are concerned with ‘right’ or ‘wrong’. Business ethics are moral principles that underpin business behavior.

Ethical businesses

Setting ethical objectives requires organizations to apply ethical values to all their tactical and strategic actions. An ethical business:

applies moral principles to all interactions with stakeholders, e.g., the treatment of employees and customers

goes beyond merely complying with laws and regulations

excludes behavior that, although legal, conflicts with its ethical policy.

Ethical decisions

Businesses may face some of the following ethical decisions:

Should we produce in a low-cost developing economy?

Should we promote products that might damage health?

Should we seek to undermine our competitors?

Should we pay minimum wage rates to our employees?

As with any business decision, the decisions may rest on whether it is cost-effective to be ethical. Most corporations claim to have high ethical standards, so it is difficult to make ethics a unique selling point (USP).

Adopting an ethical approach

Benefits

improved employee motivation

reduced labor turnover and improved recruitment

positive consumer reaction, enhancing brand value (e.g., fair trade)

attracting investors who avoid firms that pollute the environment or support oppressive regimes

Costs

using ethically sourced raw materials may raise costs and make a firm less price competitive

suppliers may not hold the same ethical views as the firm, leading to conflict

lower profit margins if higher costs cannot be passed on to the consumer

not all stakeholders will be keen on an ethical approach if it affects their interests, e.g. if it reduces dividends for shareholders.

Ethics vary from country to country, culture to culture, and individual to individual. Even within a firm, there will be a range of opinions about what is right and wrong. A business may act legally but in a manner that many consider unethical, e.g. selling weapons.

SWOT ANALYSIS

SWOT analysis - is an internal audit of where a business is at present and how it is affected by its external environment.

S = Strengths – what the firm does well and its advantages.

W = Weaknesses – what the firm does not do well.

O = Opportunities – changes in external conditions that allow the firm to develop markets, expand, and make more profits.

T = Threats – external factors that may prevent the firm from achieving its aims (constraints and barriers).

A SWOT analysis supports effective strategic planning, based on an examination of a firm’s capabilities and its external environment.

The strengths and weaknesses are a summary of the present position of the product, decision, or organization

The opportunities and threats represent future positive or negative concerns for the business.

Functions of Swot Analysis

provides a picture of the firm’s market position

is a good training tool

develops a better understanding of the firm’s service level, product range, and brands

forces the firm to examine its business and consider the present and future competition

examines external influences and future changes

encourages an assessment of strategic opportunities.

Strategic development

Firms with well-trained workforces (strengths) will be in a good position to adapt to market changes (opportunities) and to produce products and services to meet new customer needs.

Firms build on their strengths to put them in a position to take advantage of new opportunities.

Firms with unmotivated workforces and poor quality service (weaknesses) may not be in a good position to compete with new suppliers in the marketplace (threats).

Firms reduce weaknesses to address growing threats.

The Ansoff (Growth) Matrix

Helps firms understand and assess their growth potential, set marketing objectives, and consider the risk of various growth strategies.

Firms should concentrate on those things that they know and do well already, and build on these core competencies.

4 Ways to Grow

selling more of what a firm already sells to existing customers

entering new markets with existing products and/or services

producing new goods or services

selling new goods and services to new customers

ANSOFF MATRIX

| Existing PRODUCT | New PRODUCT |

|---|---|---|

Existing MARKET | Market penetration | Product development |

New MARKET | Market development | Diversification |

Market penetration

Selling more goods and services to existing customers by doing what it is already doing, but better.

Benefits

This involves changing the marketing mix.

Increase brand loyalty to reduce brand switching

differentiate products by creating a unique selling point (USP)

Persuade existing customers to use the product more frequently

Encourage customers to use more of the product at a time.

2. Product development

Marketing new, or modified, products to existing markets.

3. Market development

Marketing existing products into new markets.

4. Diversification

Selling new products and services to a new market.

This is the riskiest strategy as it moves the firm away from its core competencies.

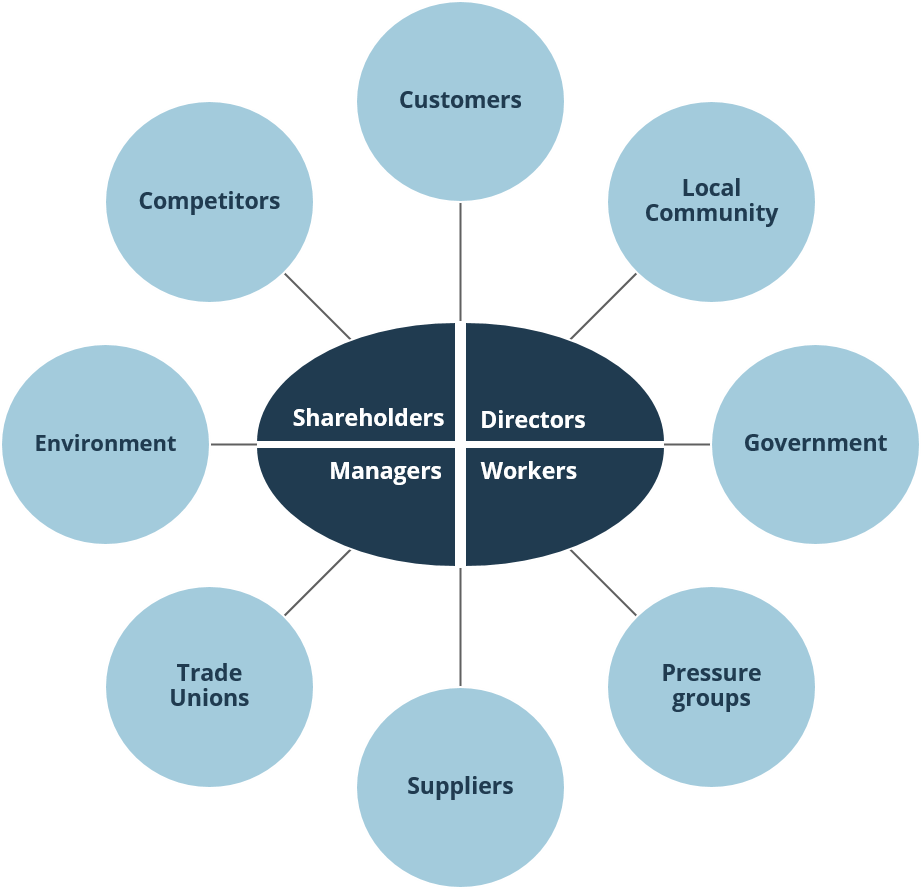

4. Stakeholders

Stakeholders - a range of individuals and groups, as well as other firms and public organizations, have an interest in the survival and operation of a business. These are called stakeholders, as they have a stake, investment, or interest in the firm’s success. Normally, this stake is financial.

Stakeholders can be separated into internal and external stakeholders.

The interests of internal stakeholders

Include owners, managers, and employees working within the business. They have different objectives.

Stakeholder | Interests include: |

|---|---|

Shareholders | Dividend return and a say in the running of the business. |

Executive directors | Income, respect, experience, status, and power. They seek to maximize profits for the owners of the business. |

Non-executive directors | Income, respect, experience, status, and limited power. |

Senior managers | Success income, status, and job satisfaction. They seek success in implementing their strategic objectives. |

Middle managers | Income, status, and job satisfaction. They seek success in implementing tactical objectives. |

Workers | Income, job satisfaction, and good working conditions. |

The interests of external stakeholders

include the local community, customers, suppliers, the government, and lenders that influence, and are influenced by, an organization but are not members of it.

Stakeholder | Interests include |

|---|---|

Government | Tax returns and the success of businesses in improving economic success and economic growth. |

Customers or consumers | The availability of goods and services to meet their needs and wants. |

Suppliers | The maintenance of a long-term and mutually beneficial relationship with the firm. |

Local community | Protecting the local environment and seeking employment opportunities. |

Lenders | Maximizing investment returns. |

Pressure groups | Persuading the firm to adapt its practices to support its cause. |

Mutual benefit and conflict between stakeholder interests

Mutual benefit

Stakeholders share many common interests. For example, making a profit allows for:

dividend payments to shareholders

business expansion, creating more orders for suppliers and jobs for the local community

the payment of taxes to the government

increases in wages for employees.

Competitive wages and good terms and conditions result in a highly motivated and productive workforce with low turnover. This in turn leads to higher output and market share, economies of scale and lower costs, and higher sales and profits. This benefits all stakeholders in the medium and long term.

Potential stakeholder conflicts

There are many potential stakeholder conflicts in the short term.

Being ethical may increase costs in the short term and reduce profits and dividends.

Shareholders expect profits in return for their investment risk and may not want the firm to be more ethical than its competitors.

Directors have a legal obligation to the shareholders to act in their best interests.

The local community wants local firms to be environmentally sensitive in their operations, and pressure groups may take action against those that are not.

Employees may be split in their opinions. They may want improved terms and conditions, but not to be associated with a socially irresponsible organization.

Stakeholder conflicts can be extremely damaging.

Conflict between management and the workforce may result in strikes. The outcome of negotiations is influenced by the relative strengths of the stakeholder groups.

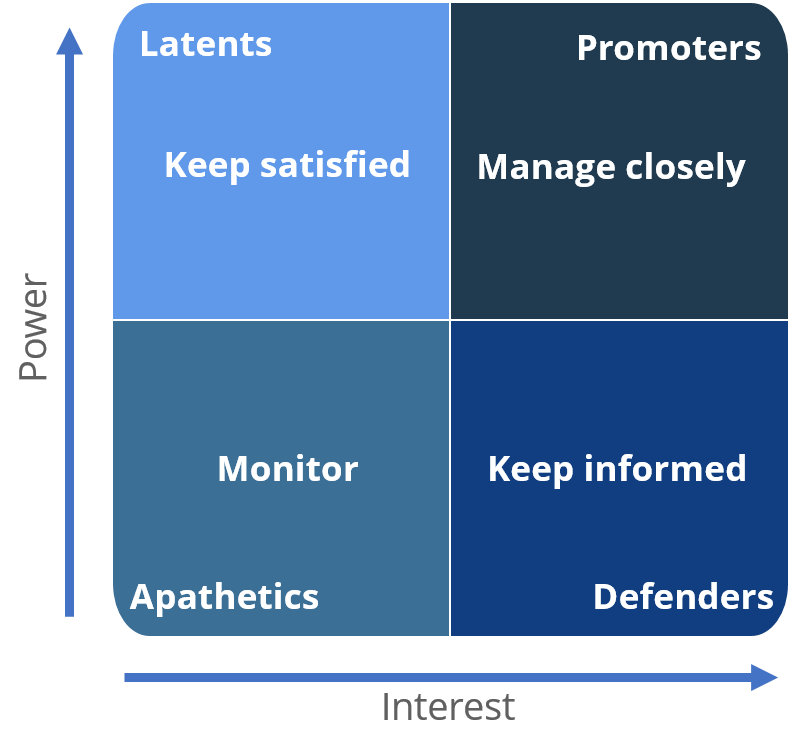

Stakeholder analysis and mapping

Stakeholder analysis - identifies the individuals or groups affected by a proposed course of action or a decision and sorts them according to their impact on the action and the impact the action will have on them.

A matrix represents two dimensions of interest in a project or activity. Common ‘dimensions’ include:

power (high, medium, low)

support (positive, neutral, negative)

influence (high or low)

need (strong, medium, weak)

By placing each stakeholder group into a quadrant, the firm can decide on its priorities and strategies. In the following matrix, the firm identifies four main stakeholder groups. The most important groups are those with high power and high interest. These ‘promoters’ must be carefully managed. The least important group, the ‘apathetic’, has little power and low interest. The firm will devote little energy to this group.

Minimizing stakeholder conflicts

Possible approaches to minimizing stakeholder conflicts include:

rewarding employees by linking their performance to business success using share options and performance-related pay

involving more stakeholders in the decision-making process

improving channels of communication between stakeholder groups

using public relations (PR) channels to inform stakeholders of the positive aspects of the business operations

5. The external environment

Activities and events outside a firm affect its operations and choices.

Although the firm is unable to control the external environment, it will seek to forecast and prepare for change. The external environment provides both opportunities and threats.

Organizations need to understand the wider ‘macroeconomic’ environments in which they operate, so they can maximize the opportunities and minimize the threats.

STEEPLE analysis of the external environment

Classifying the external environment

Marketers use acronyms as a shorthand classification of the external environment.

PEST: Political, Economic, Social and Technological

PESTLE: Political, Economic, Social, Technological, Legal and Environmental

STEEPLE: Social, Technological, Economic, Environmental, Political, Legal and Ethical

STEEPLE factors

STEEPLE | Factors |

|---|---|

Social | Demographics, social mobility, cultural influences, education, health, fashion, leisure |

Technological | Technological innovation, technological incentives, research and development, e-commerce, technology transfer, internet, and web developments and trends, automation and robotics, nanotechnology |

Economic | GDP growth rate, inflation rates, interest rates, government spending, unemployment, recession, exchange rates, business cycle, trade, foreign direct investment (FDI), membership of trading blocs, stock market trends |

Environmental | Weather and climate, natural resources, sustainability, flora and fauna, carbon footprint, pollution levels, waste disposal and recycling |

Political | Environment regulation, fiscal and monetary policy, trade policies, terrorism, press freedom, government stability, immigration policy |

Legal | Consumer and employment legislation, competition laws, corporate governance, contract law, health and safety standards, discrimination protections, antitrust legislation, data protection |

Ethical | Corruption, intellectual property, fair trade, employment standards, business ethics, confidentiality, accounting standards |

6. Growth and evolution

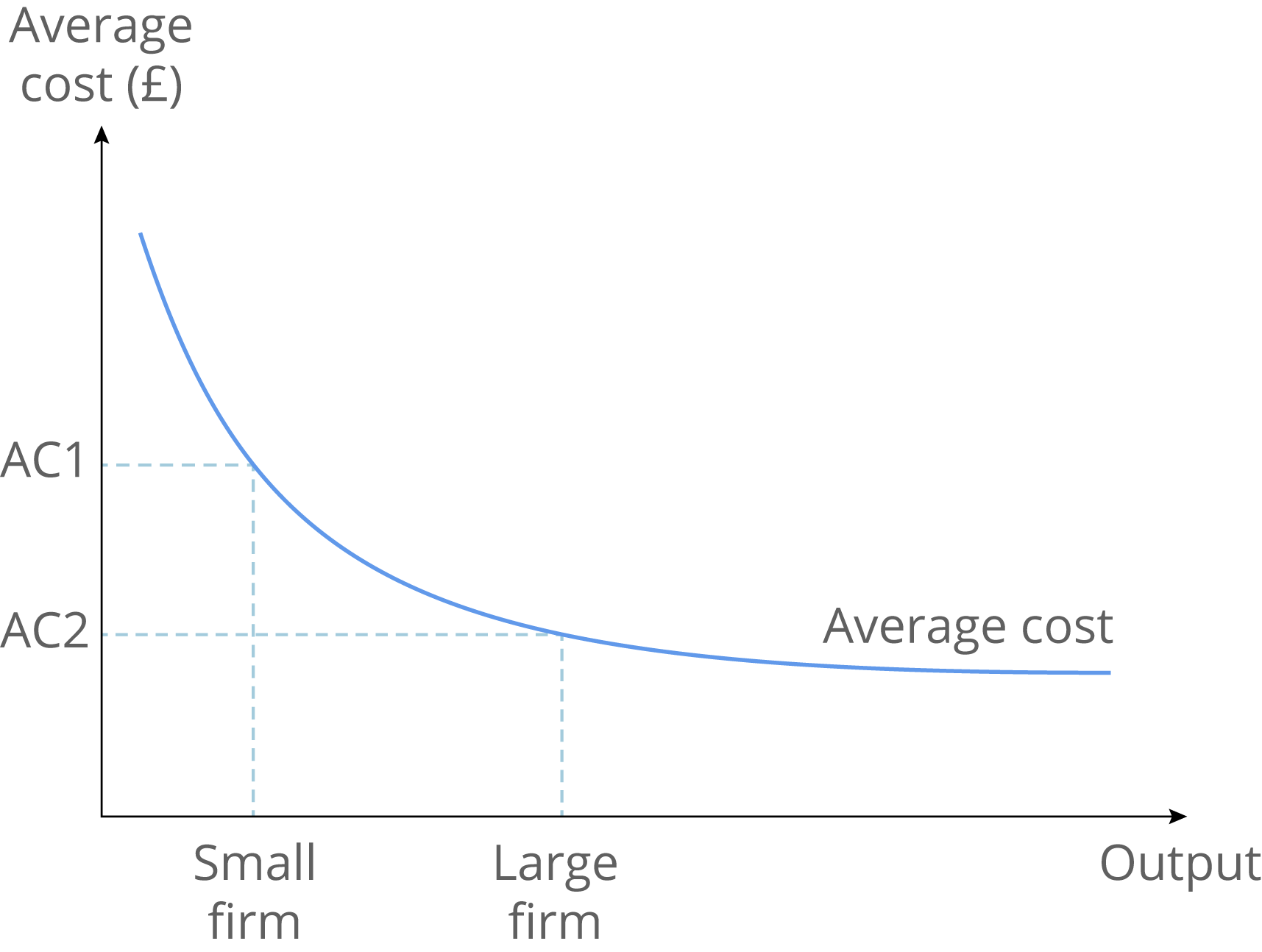

Economies of scale

As a business grows, it becomes more efficient, cutting its average cost of production (unit cost).

Larger firms may enjoy lower costs than smaller competitors, creating larger profit margins and allowing lower prices.

Total costs = fixed cost + variable cost

Average cost = total cost / quantity produced

Fixed costs are costs that do not change as production changes.

Variable costs are costs that vary as production changes.

Average costs are total cost per unit.

Internal economies of scale

Costs fall as the firm grows in size. These efficiencies benefit the individual firm.

Type of economy of scale | Effect on the firm |

|---|---|

Technical | More expensive technology is usually more productive and cheaper per item, e.g., a computer that is twice as powerful as another will not cost twice as much to buy. Fixed costs can be spread across more output, lowering average fixed cost. |

Purchasing | Raw materials and finished goods can be bought in bulk and at a discount (bulk-buying). |

Financial | Loans are easier to get and interest charged is lower – larger firms have more collateral (security). |

Marketing | Marketing is more professional and effective. Advertising and marketing by large companies is more impressive, e.g., it may include celebrities. |

Managerial | Division of labor can be used (the production of a product can be split into smaller and less complicated activities); for example, a production line makes manufacturing cheaper and more efficient. Specialist managers are recruited for functional areas. |

Risk-bearing | Diversification: by producing many products, a firm can compensate for falling demand for one product by increasing output of another. |

External economies of scale - benefit the industry as a whole as it grows.

Diseconomies of scale - as a business becomes larger, it becomes less efficient, leading to a higher average cost of production (unit cost).

Internal diseconomies of scale

Coordination problems arise as increasing delegation slows decision-making.

Larger firms have many layers of hierarchy, resulting in delayed communications.

Motivation may fall as junior employees feel disengaged from decision-makers.

Monitoring productivity and quality in big corporations is difficult and potentially costly.

External diseconomies of scale

As an industry grows, the demand for labor increases. If skilled labor is in short supply, wages, and salaries rise, increasing the costs for individual firms.

The merits of small versus large organizations

Advantages of being a small business

greater focus on investments where they want, creating higher return on investment

greater sense of exclusiveness

greater motivation to the employees because they feel like they matter to the business

competitive advantage through more personalized service

less competition when involved in a niche market

Advantages of being a big business

economies of scale

brand loyalty and higher status

market leader status and increased market share

access to greater funds

a better chance of longer-term survival.

The difference between internal and external growth

Internal (organic) growth

Organic (natural) growth - is where a firm grows using its own resources to increase sales and profits.

Organic growth is achieved by:

improving products and services

better marketing

investment in research and development

improving workforce training

expanding the number of offices, factories, and outlets

Internal growth is relatively inexpensive because the firm can use retained profits rather than external loans.

Methods of external (inorganic) growth

External (inorganic) growth - is where growth in an organization's operations arises from mergers or takeovers, rather than from an increase in the firm’s own business activity.

Major types of external growth include:

mergers and acquisitions (M&As)

joint ventures

strategic alliances

franchising

Mergers and acquisitions (M&As) - the joining of two firms is known as an integration.

In a merger, two firms agree to become partners in a larger business.

An acquisition (or takeover) is when one firm buys another, either with its approval (voluntary takeover) or without its approval (hostile takeover).

One firm is dominant and becomes the owner. The taken-over firm faces redundancies, cost-cutting, or closures of branches.

The reasons for mergers and acquisitions include:

cost economies through rationalization

greater market share

reducing business risk

better control of distribution channels

complementary activities

Firms operate in one of the following sectors:

primary sector – farming, mining, etc.

secondary sector – manufacturing

tertiary sector – services

quaternary sector – high technology

Mergers and acquisitions can be horizontal or vertical.

Horizontal mergers (horizontal integration)

Firms in the same industry and in the same sector merge, e.g. a merger between two car manufacturers such as Daimler-Benz and Chrysler to form DaimlerChrysler.

Vertical mergers (vertical integration)

Firms in different sectors merge, e.g., the Walt Disney Company and ABC to create Walt Disney Television. This type of merger may be forward or backward:

Vertical forward integration is when a firm merges with another further up the production chain, e.g., a brewery takes over a chain of bars, often to secure a retail outlet.

Vertical backward integration is when a firm merges with another further down the production chain, e.g., a wine producer takes over a vineyard, to ensure supply.

If a firm controls the whole distribution channel, it is totally vertically integrated, e.g., Shell owns oil rigs, oil tankers and pipes, refineries, and petrol stations.

Conglomerate mergers

Conglomerate mergers involve the integration of firms in different businesses and/or sectors with a range of activities. The main motive is diversification and spreading risk. Most conglomerates are multinationals operating in more than one country, e.g., Sahara India Pariwar is an Indian conglomerate with business interests in finance, media and entertainment, retail, manufacturing, and information technology.

Outcomes of mergers and acquisitions

The results of mergers and acquisitions are often disappointing because of:

culture clashes

increased bureaucracy and loss of control

internal competition

lack of experience in another industry

negative publicity as employees are made redundant

Joint ventures

Joint ventures - involve an agreement between two or more organizations to undertake a particular business activity for a limited period of time. The contractual agreement creates a new business division with a separate legal entity, allowing the participants to grow while maintaining their own individual identities and brands. The organizations share profits or losses and the investment.

Strategic alliances - are collaborative agreements between two or more firms to pursue a set of agreed goals and to commit resources to achieve these. The firms remain completely independent, and the alliance ends when the goals are achieved.

Advantages and disadvantages of joint ventures and strategic alliances

Advantages

Competition may be reduced as firms cooperate.

A synergy is created where the combined skills, resources, and experience of the businesses exceed those of the two businesses acting independently.

By partnering with a local firm, there are fewer logistical problems entering a new and/or overseas market, lowering distribution costs.

Mergers or takeovers are expensive and difficult to reverse.

They enable a firm to move into a new product or market much faster.

Disadvantages

Profits are shared.

Communication and control issues caused by different cultures, languages, and management styles.

Conflict and disagreements between the partner organizations.

Franchising

A franchise is an agreement where a business (franchisor) sells rights to another business or individual (franchisee), allowing them to use the brand name, logo, trademark, and products/services of the franchisor in return for a fixed fee and/or a percentage of the annual sales turnover (royalty).

This model is less risky and costly than setting up a new business.

Advantages and disadvantages for the franchisee

Advantages | Disadvantages |

|---|---|

No need for a new idea – someone else had the idea and tested it, too! | High initial and ongoing costs. The franchisee may be contracted to buy products from the franchisor, which may not be the best or the cheapest. |

Failure rates are far lower than other start-ups, often around one in ten. | The franchisor might go out of business, or change the way they do things. |

Well-established franchise operations have national advertising campaigns and a respected brand and trading name. | Restrictions on the operation of the business, preventing changes to suit the local market. |

Good franchisors offer comprehensive training programs in business skills. | Other franchisees could give the brand a bad reputation. |

Good franchisors help secure funding for your investment and discount suppliers. | The franchisee may find it difficult to sell the franchise. The terms of the contract may restrict sale to someone approved by the franchisor. |

Customers believe the franchise is part of a larger organization with existing credibility. | Reduced risk usually means lower profits than an independent, riskier venture. |

Advantages and disadvantages for the franchisor

Advantages | Disadvantages |

|---|---|

The business can achieve rapid growth without high capital investment and running costs. | A poor or unscrupulous franchisee may affect the brand image of the entire business. |

Franchisees are likely to be more motivated and committed than paid managers as increasing profits is a major incentive. | It is not unknown for franchisees to ‘steal’ the franchise idea and set up in opposition. |

The franchisor can use the franchisees’ local knowledge and expertise. | The franchisor loses day-to-control over the operations of the business. |

The impact of globalization

Increased competition – large foreign businesses can force domestic producers to become more efficient as the domestic consumer has more choice.

Greater brand awareness - domestic producers have to compete with big brand names and so need to create their own unique selling point (USP).

Skills transfer - foreign businesses, no matter how big, must use some local knowledge.

Closer collaboration - domestic producers can create new business opportunities.

The impact of MNCs on the host countries

Multinational companies provide developing countries with finances and infrastructure for economic and social development, but may exploit limited resources.

Advantages for the host country | Disadvantages for the host country |

|---|---|

Foreign direct investment (FDI) usually results in more local jobs, improving economic growth. | MNCs want to produce as efficiently and as cheaply as possible and may cut corners on health and safety. |

Profits of multinationals are locally taxed, providing a valuable source of revenue for the domestic government. | Natural resources are depleted. |

Inward investment should help a country’s balance of payment. | MNCs are increasingly ‘footloose’, meaning they can move locations at short notice, creating uncertainty for the local economy. |

MNCs introduce new technology and local employees are trained to use these (technology transfer). | Newly arrived MNCs increase the competition in the local economy. Local firms may lose market share or close altogether. |

Local population gains from a wider choice of goods and services at lower prices. | Borrowing by MNCs in the domestic economy may reduce access to funds and increase interest rates for local firms. |

The presence of one MNC may improve the reputation of the host country and other MNCs may follow. | MNCs may have a disproportionate influence in the host country. Governments may agree to changes that will not benefit the local population. |

MNCs help build new infrastructure, such as roads and factories. | Jobs created in the local environment may be low-skilled. Expatriate workers are recruited for more senior and skilled roles. |

Local firms are forced to become more efficient to compete with the new MNCs. | Large numbers of foreign businesses dilute local customs and traditional cultures, e.g., McDonaldization describes increasing standardization. |

| Large MNCs repatriate profits to their ‘home country’, leaving little financial benefits for the host country. |

7. Organizational planning tools

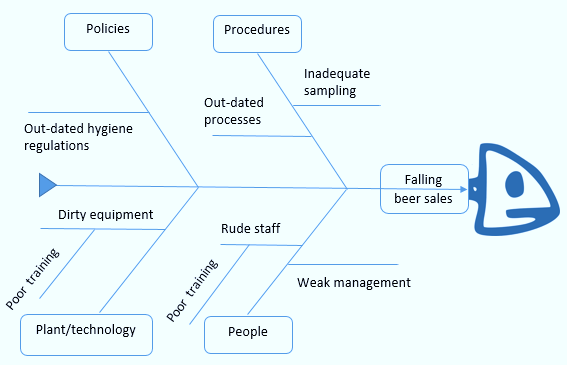

The fishbone (cause and effect) diagram or Ishikawa diagram

A visual tool developed to support decision-making.

By identifying the causes of a certain event, problems can be overcome or avoided.

The diagram resembles the skeleton of a fish, with a main bone running horizontally, and several smaller bones coming off it.

Construction of a fishbone diagram

The idea is that the effect of the problem is placed in the head of the fish.

Then each fishbone is allocated to a particular factor that may have caused the problem. Typical factors are set out below, but it is also possible to create other factors relevant to a particular problem.

After discussion by the group, each factor is broken down into a subfactor and is drawn as a smaller fishbone coming out of the original one.

Finally, after brainstorming and discussion, the group discards those issues (“fishbones”, large or small) that are not the root cause of the problem, thus identifying which fishbone is the problem.

Advantages and disadvantages of using a fishbone diagram

Advantages | Disadvantages |

|---|---|

|

|

Decision tree

Decision trees present options and probabilities diagrammatically

Reflects the fact that firms frequently have to make decisions in circumstances of doubt and uncertainty.

A decision tree is constructed working from left to right, but all calculations are made from right to left.

Parts

Squares: decision points

Circles: chance or probability nodes. Each outcome node will have an expected value.

The lines that come out of the squares or decision points represent the available options to the decision maker.

The choices are decided by the decision-maker.

Decision tree choices

The lines that come out of the circles or chance nodes represent the various outcomes.

These outcomes may be uncontrollable by the decision maker, such as success or failure.

Outline decision tree

Data is collected on possible costs, returns, and probabilities and added to the outline decision tree.

The figures in brackets indicate a cost; all others are incomes or revenues.

Example

Project A has three possible outcomes; each is expressed as a percentage chance, e.g. it is estimated that ‘very good gains’ has a 30% chance of being the outcome, ‘average gains’ a 50% chance, and ‘poor gains’ a 20% chance.

The value of all the probabilities must add up to 100% (in other words, one of the possibilities must happen).

By multiplying the possible outcomes by their probabilities and adding them together, we get the expected value.

| Outcome | x | Probability | = | Expected Value |

|---|---|---|---|---|---|

Very good marketing | 1000 | x | 0.3 | = | 300 |

Average marketing | 600 | x | 0.5 | = | 300 |

Poor marketing | 200 | x | 0.2 | = | 40 |

Total | 640 | ||||

However, there are costs associated with each project. Project A costs 500, so the net Expected Value is 140.

640−500 = 140

Advantages and disadvantages of using a decision tree

Advantages | Disadvantages |

|---|---|

Reveals alternative courses of action not previously identified | Not all factors can be given numerical values |

Decision making more objective and logical | Probabilities are usually estimates |

Offers a visual presentation of the options | Ignores important qualitative factors |

Numerical values are more reliable | Data may be out of date |

Management is forced to consider risk | Expected values are weighted averages of outcomes |

Force field analysis

Proponent: German psychologist Kurt Lewin

Premise: People’s behavior is affected by forces in their surrounding environment or ‘field’.

Successful firms need to adapt to changes in the environment.

Forces Involved

Driving forces - promote change

Restraining forces - hinder change.

Restraining forces, act to oppose driving forces.

To move towards a desired change, the firm develops a strategy to minimize the restraining forces and/or maximize the driving forces.

These form the basis of change management.

Force Field Analysis Diagram

Performing the Analysis

It is common for the strength of the force to be represented by:

Length of the arrow: the longer the arrow, the stronger the force

Weight attached to the arrow: usually between 1 and 5

Functions

examining the balance between driving and restraining forces by totaling the weights for each

identifying the individuals or groups affected by a change

identifying supporters and opponents of the change

Managers examine each of the forces to establish strategies to reduce restraining factors and strengthen driving forces.

Advantages and disadvantages of using a force field analysis

Advantages | Disadvantages |

|---|---|

|

|

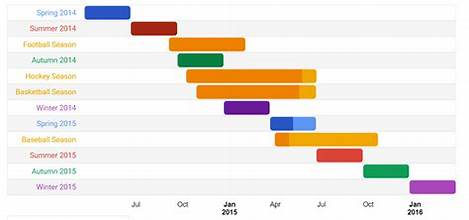

Gantt chart

A visual representation of the progress of a project, broken down into its component tasks.

It is commonly found in offices and factories and used to schedule projects.

Developed by Henry Gantt.

Functions

a list of the activities in the project and how they are scheduled

the start and end of each activity

the date today

the percentage of the task completed and the percentage unfinished

relationships between tasks

delays requiring action and resources required to bring tasks back on time

Diagram

Advantages and disadvantages of using a Gantt chart

Advantages | Disadvantages |

|---|---|

|

|