Financial Literacy

Unit 1 - Cognitive Biases

Cognitive Bias: A systematic error in thinking that occurs when people are processing and interpreting information in the world around them; this error affects the decisions and judgments that they make

**Recognizing these biases will help us handle money better

**Traditional economics***: believe people will always act rationally when making financial decisionsBehavioral economics**: Believe people can act irrationally due to cognitive biases; interested in cognitive biases---------------------------------------------------------------------------------------------__Loss Aversion:

\

\

\

- \

- \

- \

\

- \

- \

- \

- \

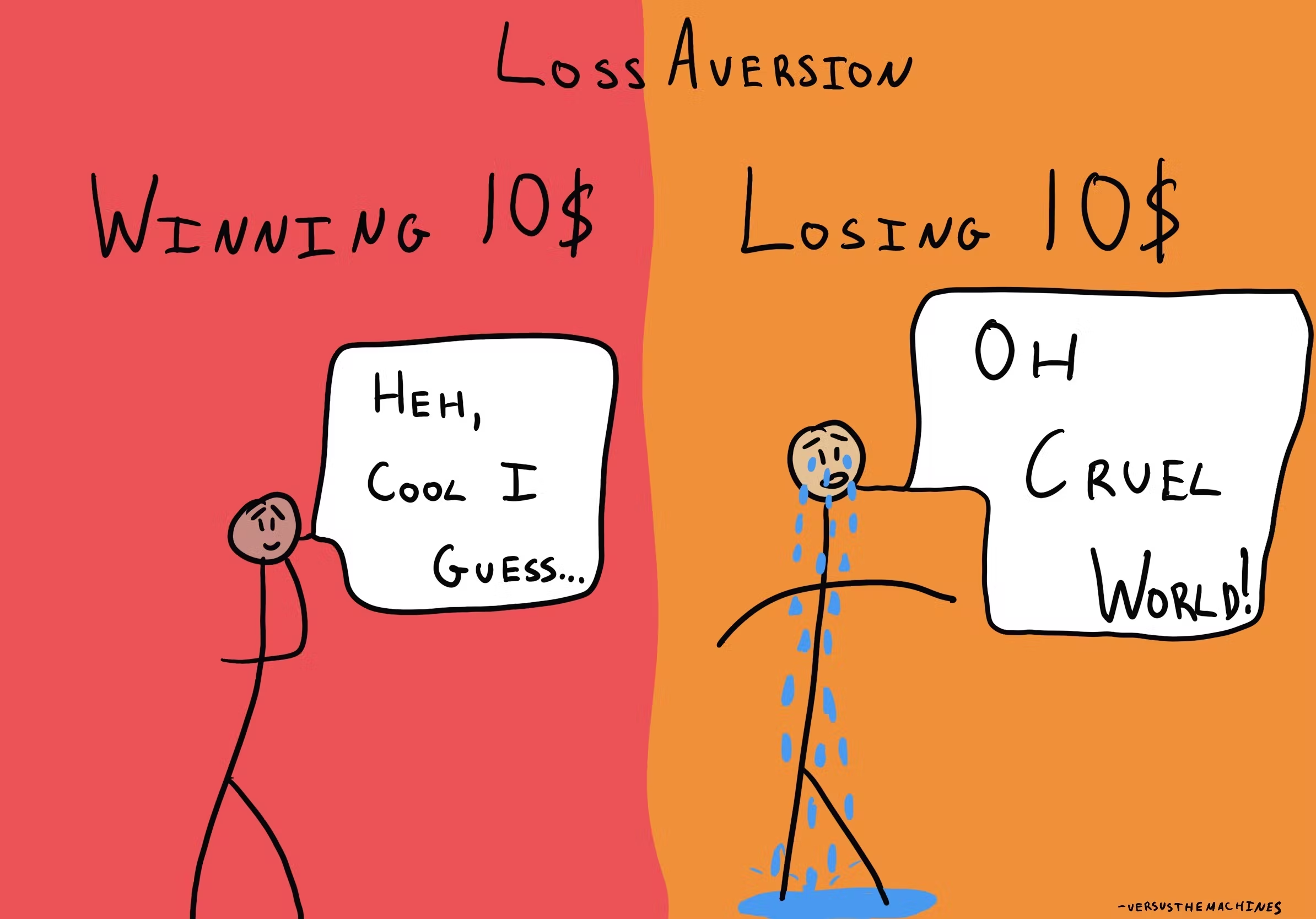

Wanting to avoid the pain of losing that you make an irrational choiceWe hate losing more than we enjoy gainingWe’ll fight to not lose somethingExamplesPeople are willing to keep paying after a free trial because they don’t want to lose their subscriptions.Investing in low-risk, low-return investments instead of higher more profitable investments because you don’t want to even risk losing your money or timeFor more than a decade, General Motors failed to recall cars with faulty ignition switches. Even as evidence of the defect grew, GM officials continued to deny that there was a problem to avoid the expense and embarrassment of a massive recall.Loss doesn't just mean money. It can mean losing:ReputationIdentityConvenienceLifestyle markersLoss aversion can also prevent individuals, corporations, and countries from making riskier decisions to address complex challenges.----------------------------------------------------------------------------------------------------------------------------------------------------------Endowment Effect

\

\

- \

- \

\

\

\

- \

- \

\

\

\

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

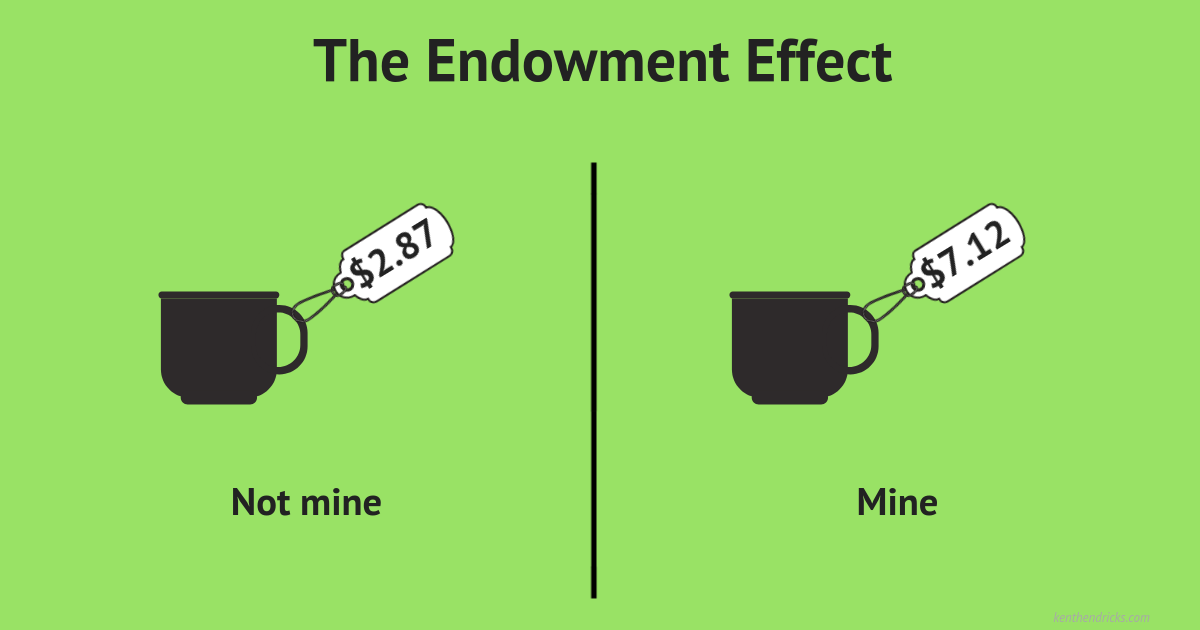

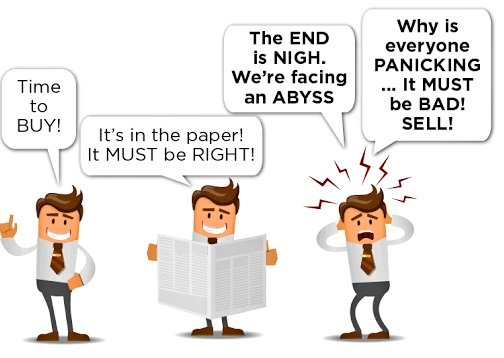

: Believing that something you own is more valuable than it really isDriven by ego, we think highly of ourselves so we think more highly of our stuff too.ExamplesWhen potential buyers take the car for a test drive, the endowment effect begins to influence. They pretend to be the real owners of the car and as a result, are ready to spend more money on it because of their emotional attachment.Selling something you owned for more than its worth because you attach more value to itSunk Cost Fallacy: Believing that you already invested time, money, effort, or identity means you shouldn’t abandon/quit something that, in reality, is not worth it.Sometimes quitting is the best choice.In investing, changing strategies is seen as admitting failure, which is why people try to make their initial investments seem worthwhile.ExamplesChoosing to finish a boring movie because you already paid for the ticketContinuing to invest in a company because you’ve already put in a lot of money and timeHerd Mentality/Bandwagon Effect: The tendency to choose what the majority has chosen (rather than doing their own analysis to see if an investment fits their personal goals.)People join groups and follow the actions of others under the assumption that other individuals have already done their researchCompanies use this to their advantage in marketing;ExamplesCompanies create fake reviews to create more positive reviews that will influence potential buyersHousing BubbleCrypto CurrenciesFOMO: Anxiety that comes from the sense that others are doing something exciting or better than we are (often felt when scrolling through social media)Causes people to make financial decisions in order to not miss outExamplesTrader or investor feels that they are missing out on a potentially lucrative investment or trading opportunity.Confirmation Bias: The tendency to look for or over-value information that confirms what we already believe (rather than search for possible counterpoints)We want comforting lies rather than believing unpleasant truthsSocial media (through algorithms) curate information for us that just confirms our beliefs.Examples:a client who is committed to owning shares of a particular company may ignore unfavorable news about that company.Not paying attention to negative information about a candidate you support, only looking for favorable information about themTo combat confirmation bias:Ask others to challenge your thinkingSeek alternative viewsTry to disprove your “rule” or “assumption”. Don’t just keep trying to prove what you believeDo real research; don’t be spoon-fed by the algorithmsOverconfidence: The tendency to overestimate your own abilitiesCan lead investors to take stupid risks when their success was really just dumb luckOverconfidence can lead to fraud because you didn’t want to failExamplesInvestors with overconfidence bias often tend to believe that they can pick the next big stock. As a result, they often invest in a lot of risky penny stocks.Hedonic Adaptation:

\

\n

- \

- \

- \

__****

\

\

\

\n

\

- \

\

\

\

\

\

- The idea that happiness and pleasure are temporary. There is a base level of happiness, despite spikes in happiness and unhappiness. You ADAPT to life the way it is. We return to a “set level of average happiness, no matter what.Hedonism - Living life for pure pleasure (especially through drinking, partying, eating, etc.)Unit 2 - BankingYou earn interest for keeping your assets in the bank (but very little)The bank pays you interest because they are loaning your money to othersThe bank earns MORE interest by loaning out your money to people making large purchases and charging THEM interestDO NOT expect to earn interest from the bank on the money you have in a checking account. There are better ways to earn interest.What are 3 key differences between a prepaid and a debit or credit card?Prepaid cards are already loaded with a set amount of money unlike debit cards, whose limit can fluctuate based on how much money you have in your checking accountPrepaid cards aren’t linked to a bank account like a debit card isYou don’t have to borrow money or pay it back, unlike a credit card. You pay for the card upfront and have that amount of money to spend with it.A payroll card is a prepaid card some employers use to pay their employees' wages or salaries each payday.Payroll cards help employers save money by not having to issue printed checks and also allow them to offer cards to employees who do not have bank accounts.For employees, advantages to payroll cards include the ability to pay bills online, shop online, make automatic bill payments, and get cash at an ATM.Disadvantages include the possibility of monthly maintenance fees, out-of-network ATM fees, and balance inquiry fees.Only open bank accounts with banks that are FDIC-insured or credit unions that are covered under NCUSIFIf you are insured by the FDIC, this will protect up to $250,00 of your deposits if the bank goes out of businessThis policy was created after the Great DepressionChecking AccountsVery low interest paid to youNot good for wealth building, but good for quick access to moneyDebit card transactions take cash immediately from the checking accountOnline-only bank accounts can offer higher interestsHaving a checking account allows you to use ATMs to get cash out__Only put a debit card into an ATM!!!

\

\

\

\

\

\

\

\

\

\

\

\

\

__**

\n

- \

****

***Overdraft FeesOptional “protection” for checking account - you DONT have to choose itWhen you go below 0 for a transaction, the bank will still allow the transaction but will charge you a fee ($35 on average)Direct DepositEmployer automatically sends your pay to bank account on paydayNeed to provide a routing number and an account number to set upBank StatementsYou receive statements monthly for any accounts you have openCheck those statements for fraud, double charges, fees, weird ATM withdrawals etc.Online BankingUsing a bank’s app allows you to check your accounts more often than waiting for the statementYou can also shift money back and forth between different accounts easilyYou can send money through Zelle from your account directly to another person’s bank account (Not the same as Venmo)Person-to-Person Payment AppsEX: Venmo and CashAppUsed between people/individuals, not typically accepted by big businessesYou have to transfer the money out of your Venmo balance and into your bank account to use it in other situationsVenmo earns interest as your money sits in the app if you do not transfer it into your bank accountMaintenance fee average: $5.14 ---> monthly, bi-monthly etcOut-of-network ATM Average: $1.77Different Types of Savings AccountsRegular Savings AccountCertificate of DepositMoney Market Account- Pays some interest, but pretty low % (average = 0.06% per year!)- Can move money out of this account (into checking)- Might have a limit on # of transactions per money- Pays a slightly higher interest rate- Must keep money in there until maturity date (penalty for early withdrawal)- Pays a slightly higher interest rate- Can write a limited number of checks from this type of account - Must maintain a high balance (usually 10,000 or more)- Hybrid of checking and savingsReminder: If you are trying to build long-term wealth, you can earn a lot more interest by investing in the stock market rather than by just opening up a saving accountIf inflation is higher than the interest you are earning from your savings account, then your money is losing its purchasing power every yearSaving is notJust keeping all money in traditional savings accountsIn both 2016/17, over 60% of people between the ages 18 and 34 reported less than 1,000 in savingsMore than 40% of people between ages 18 and 34 said they had no savings at all78% of US workers live pay check to pay checkThis means they have no money saved and their income is just barely enough to cover their expenses each month (nothing left over)Pay yourself first - automatically set your checking account to transfer money into your savings account on your paydays. DO NOT wait until the end of the month to save what is left over.50-30-20 Rule

50% of your income towards needs

30% of your income towards wants

20% of your income towards savings

\n

\

\

\

\

\

\

\

\

\

\

\

\n

\n \n

\n \n

\n

\

- \

\

\

\

\

\

\

- \

\n

- \

- \

- \

- \

Emergency Fund:Have enough money to cover 3 to 6 months of your living expensesRent, food, gas, utilities (heat, water, internet), health insurance, car insurance, homeowners insurance/renter’s insuranceStart with 1-month living expensesBuild up 3-6 months of living expense sUse only for real emergenciesReplenish when you take money out, build it back up!Short-Term GoalsMedium-Term GoalsLong-Term GoalsNew Tires for carNew cell phoneNew guitarNew suitDinner with friends this weekendCollege tuition for the next school yearBig tattoo pieceNew air conditioning unitVacation next yearDown payment for a house Start a new businessRetirement in 20 yearsStart saving when you have a full-time job (40 hours a week or more) ‘Being Unbanked:No access to credit or loans (no credit score = no loans)Spend extra time paying bills in person or through the mailHard to shop online or at stores that don’t accept cashPay extra fees for check cashing or prepaid cardsThe only small advantage of not having a bank account is avoiding fees such as overdrafts or monthly maintenance fees. However, this is a small price to pay for having access to a bank.Highest to lowest interest rates10-year CD, 5-year CD, Online savings account, Savings account at traditional bankDirect deposit typically refers to your employer sending your bills electronically to your bank account.Unit 3/4 - CreditSecured vs Unsecured LoansSecured LoansUnsecuredCollateralNo collateralLower interestHigher InterestLess risky for lenderRiskier for lenderFixed interest rate loan vs Variable interest rate loanFixed rate loanVariable rate loanPredictableNot predictableGenerally higher interestGenerally lower interestVocab***Principal** - Amount you borrowInterest: % of interest you pay on topAmortized *loans allow you to borrow a large amount of money all at once (for college, car, house)*After borrowing, your monthly payment will not changeMore stableDown Payment - The amount of your own money that you put towards a purchase at the beginning.Loan Principle - After your down payment, how much do you still need to borrow? That is the loan principal (the base amount you borrowed)Term - The length of time you have to pay back a full loan (pay back principal + all the interest you owedSecured Loan - The bank can take something back from you if you stop repaying *(houses and car loans)***Unsecured Loan** - The bank doesn’t get anything back from you if you stop payingFixed-rate - Interest rate never changes (home and auto loans, Student loans from gov)Variable/adjustable rate - interest rate can bounce around after an initial period of stability (credit cards)Adjustable Rate Mortage (ARM) -Starts out lower than a fixed rate, but after 3-5 years but can jump up ALOTAn ARM can be a good idea if you plan to move or sell in just a couple of years (short term)Amortization - Amortized loans are known as installment loans because the installment (amount) you pay every year will never changeAllow you to borrow a large amount all at once (for college, house, car)After borrowing, your monthly payment will not change..it is on a schedule for the entire term of the loanConstant payment will help you budget your money each month and feel stableUsually has a long-term lengthMathematical formula: Keeps the payment constant while slowly starting to increase the amount that is going back to your principal and decreases the amount that goes to the bankCredit cards are not amortized/installment loans: the amount you will owe on a credit card can and will bounce up and down every monthCredit Cards are revolving because what is owed can change oftenHow to pay less interestBorrow for a shorter term (15 years vs 30 years)Make a bigger downpaymentPay a little extra each monthGet a lower interest rate - by having a better credit scoreLonger term ---> Higher interest rate (ex. 30 years = 7% but 15 years = 6%)Shorter Term ---> bank earns less interest off you (if you borrow money for a short ime the monthly payment will be way higher)%%How can a young person get a credit card?

\

\

\

\n

\n %%Become anauthorized user on a parent’s credit card. But if their credit score drops, then yours will tooGet a parent to be a co-signer for your credit card if you are 18-21 years old - their credit score doesn’t necessarily affect yoursOpen a secured credit card *by putting a down payment of $500-1000 (which gets refunded to you when you close the credit card later)**Downpayment is your credit limit. If you mess up the payments - they will keep the downpayment. The limit is set by whatever your downpayment is. They will still charge you interest if you don’t pay each monthly payment on time.Credit card companies will allow you to just pay the min so they can charge you interest^^What’s included in the Schumer Box

\

- \

- \

\

- \

- \

- \

\

- \

- \

- \

\

- \

- \

\

- \

- \

\

- \

- \

- \

- \

- \

- \

\n

- \

- \

- \

- \

- \

- \

^^Annual FeeThe yearly fee just to have the credit card (even if you don’t use the card much)Try to find a card with 0 yearly feeAPRAnnual percentage rate - aka interest rateThe lower or worse your credit score - the higher your interest ratePay the full balance every month and you’ll never have to pay interestPenalty FeeA late fee you must pay when you submit payment after your due date (usually around 25-35Penalty rate = new and higher (worse) APR you have if you let your credit card be more than 2 months late (e.g no payments for 2+ months)If you can’t pay your full balance, at least pay something every month so you avoid late fees and penalty APRGrace PeriodAbout 28 days after your billing cycle stops before you actually have to pay for the things from that billing cycleLook for a credit card with a long grace periodCredit LimitThe maximum amount you can charge on a cardEx: starting limit = 1000. Over time you've charged 1500 onto the card. New credit limit (until you pay off your balance)Payday LoansTechnically another form of creditIt’s a loan in advance of your paycheckYou have 2 weeks to repay itThere is no credit check to get a payday loan (your credit score doesn’t matter to themYou will pay an average of 400% interest due to Huge feesCreates a nasty chain reaction of taking out loans in order to pay previous loans from the same placeSnowball Effect - pay off your debts from smallest to largest (after paying minimum of each debt) - will keep you motivatedHigh Rate Method - Pay off whatever debt has the highest interest rate first so you end up paying less money in interest in the long run - paying the least interest overall^Pay minimum on every debt first^The federal government can garnish your wages or take your tax refund if you don’t pay your student loansStrategies for paying down debtReducing spending to only the essentialsTaking extra shifts at workStart gig work if needed (Uber, DoorDash, Instacart, etc)Paying more than the minimum on debtsDO NOT OPEN ANOTHER CREDIT CARDIt can be worth it to call your lender and ask to negotiate a lower monthly payment or some other deal!!!**Credit Scores

\n

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\n

\n

\

\

\

\

\

\

\

\

\

\

- \

- \

\

\

\

\

- \

- \

- \

- \

- \

- \

\

\

\

\

\

\

\

\

\

\

\

\

\n

**Your credit score is a measure of how trustworthy you are when it comes to repaying your debts. - Can also be called FICO score**300-650 = VERY BAD TO BAD**650-700 = FAIR CREDIT SCORE**700-750 = GOOD**750+ = EXCELLENT**What goes into creating my credit score?**Most to least influential:Payment History = 35%Missing a payment lowers your credit score but will not permanently damage it as long as you keep upTotal debt = 30%Credit to debt ratio.Length of History = 15%How long have you had a history with a bank/with a credit cardCredit Mix/Diversity = 10%Do you have proof that you can handle DIFFERENT types of creditLoans, student loans, credit cards, etcNew Credit = 10%New Credit = 10%How much new credit are you openingIf you open up a lot of credit, you look bad!Your salary is not a part of your credit score, it doesn’t show up on your credit reportYou can earn a small salary and still have excellent creditYou can earn a huge salary and have a credit report that looks like trashA lower credit score may mean higher interest if you can get loansThe number one way to improve your credit score** is to make on-time payments and pay off your full balanceThe **number two way to improve the score** is to only use a small % of your available credit (30% or less) - don't max out your cardsOne major way to hurt your credit score is to be **late with payments**Another way to hurt your credit score is to **max out** your credit cardsAnother way to hurt your credit score is to **apply for a lot of credit cards** in a short period of timeLower credit history → Less trustworthy → charged higher interest rate to borrowCosigners on Loans -You can also get a cosigner for a loan (not just a credit card)You might have a better chance of getting approved for a loanMight get a lower interest rate if co-signer has a good credit scoreIt takes **6 months** after you start using credit to get your credit scoreThere are 3 main credit reporting agencies/bureaus: **Equifax, Experian,** and **TransUnion**They ask your bank and federal government for all the information regarding your creditMaybe ten points off from each other - lenders will take a look at the highest oneBy law, these agencies/bureaus must provide you with one free credit report per yearAnnualCreditReport.com - you can see it once a year for freeA lot of people/organizations pull your credit report. However, there are hard pulls and soft pullsHARD Pull:**They can hurt your score, unless in a 1-2 month window when actively shopping for a new car or a new monthWho pulls:Credit Card Companies before approving new card - every time you open a new card it can hurt your credit scoreLenders for auto loans & mortgages**SOFT Pull:**Can’t hurt your credit scoreThey could mean you don’t get your job, insurance, apartment etcWho pullsEmployersPhone, TV, and internet companies before providing servicePublic utility companies (gas, electricity, water)Insurance companies before agreeing to insure youLandlords before agreeing to rent to youAssisted living facilities and nursing homesEstablish a revolving line of credit - like a credit cardSome secured cards can become unsecured - dependsUtilization1000 dollar limit - borrowed 500 - 50% utilization rateThe lowers the utilization rate the better - try to keep below 30%Revolving credit and installment credit - good credit mixCredit builder loans - reported as traditional installment loansInquiry - every time you apply for a new line of credit, your credit score lowers for a bit **ERRORS IN CREDIT REPORT**Look for late payments - are they true? If not, you can call credit card companies to dispute and have them correct the information with the agency/bureau.Look for any accounts you don’t recognize. Did someone steal your identity and open credit in your name?Look for any credit or loan balances that are higher than you think are accurate. Is your interest piling up too much? Did your adjustable rate change?Which of the following is most likely to represent a fixed rate, secured debt?Auto loanWhen loans are amortized, monthly payments are constant, while the amount of your monthly payment applied to interest decreases and the amount of your monthly payment applied to the principal increases over time.**Video:**You'll be watching part of a documentary titled "Spent: Looking for Change." Based on the stories of Justin, Tiffany, Debbie, and Melissa & Alex in this documentary, describe 4-5 specific __**hardships****

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

****

****

****

****

- \

****

*__ people can face financially.Justin grew up poor but started his own production company and now makes a good livingHe lacks access to a traditonal fnacial systemHe must cash his checks at other placesUnbanked - has to use a prepaid card but has to pay pees for every purchas he makesyou cna losse 80 cashing checksCan loose 100 just through fees from trancastionPaid rent at 16 to support himselfUsed a card to cover what he couldnltWas still too young to understandIs paying off his credit debtBanks don;t see where hes goin only wheres hes been “Cant afford a home with just hus gfs name on the papersHowever hus credit is so bad, he couldnt put his nameTiffany:Has a daugherGot taught to pay what she owed and saedT vaved whatvers she could 401k to leave something behind for her daughterWants her to be successfulPut her daughter in a private schooLWorks as a nurseCreated a nest egg for her daigheHad 100,000 in her 401k -Mother was diagnosed with cancer suddenlyTiffany left her job to take care of her motherMelissa and AlexAlex was a musician when they first met2 kids nd 2 incomes - initiallyTheir son was diagnosed with autism -jONAHAlex was diagnosed with multiple scoliosisHuge expenses that they had no savings forAlex had to stop working due to his illnessWrote a check for their bills with money they didnt haveLive soley on cash to not avoid feesDid not have credit because they didnt want to jeporidze herselfSaved them from debt but hurt them from getting a car because they have no credit historyCouldn’t ger a morgae eitherDebbieDesigner - struggling to make her businesFirst in her familt to go to collegeFather was in construcion and mother cleaned homesPutherself through colleg ewith student homesStarted own business making leather bags by handAfter 6 months her bags ar starting to sellHopes to grow her companyStudent loans have weakened her credit1000,000 in student loansWants to grow her creditReused to offer her a business oloanOnly offerd her a secured credit card - $250 limit on cardHas to wait up tp three months to be paidSpends the majorty of her money on suppliesBanks were looking for profits from cumber bank accountshilo check sequencesOverddrrat fees from not enough money piled upBank reirder seuqence of bills so that they would have to pay overdraft feesAmericans have to wait 3 - 5 days for checks to clear but most people dont have that timeCheck casher gives you the money right at that momentpeople spend as much on fees as families do on grocieriesBeing unbanked is like habing a part time job” - you spend more mnney and time than people in the banking systemLess places that accept cash - makes life more expensiveCredit dosnt see a persons hard work only a set of numbersMillions are struggling with debt as a result of student loansC**heck Cashers -**open later,offering we can get you what you need right now,immideateUnit 6 - Paying for College==Video Notes

\

- \

- \

- \

- \

\

- \

- \

- \

- \

- \

\

\

\

\

\

\

\

\

\

\

\

\

\

\

- \

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

\

- \

- \

- \

\

\

\

\

\

- \

- \

- \

- \

- \

\

\

- \

- \

- \

- \

- \

- \

- \

\

\

- \

\

\

\

\

\

\

\

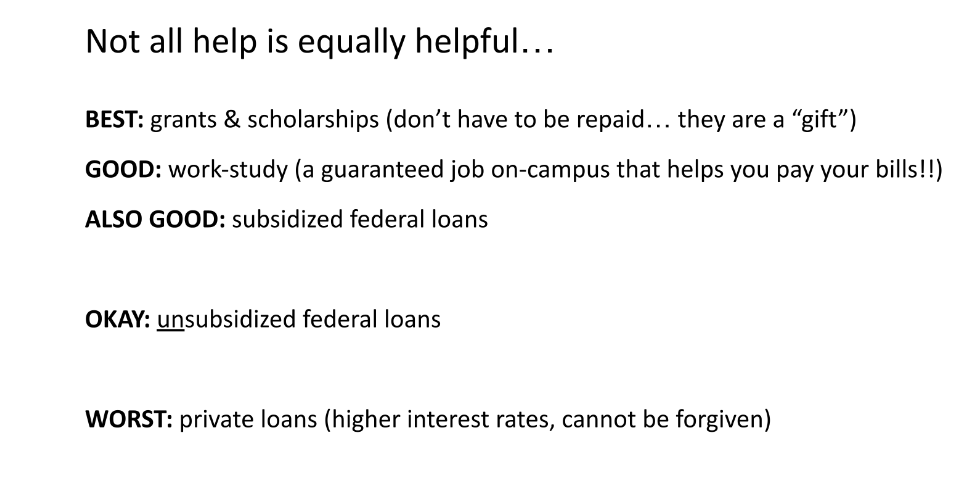

==Higher educationAccess to Higher paying jobsPricey - major debt decision - paying long after you graduateThis can lead to a higher-paying job to pay the debtTime dedicationWorkmoney can go towards experiences or savingsWork experience can lead to other work opportunitiesLearning new skillsYou may need aformal education to level upStudent loan debt from 2021 - 1.71 trillionPeople with college degrees make about 1,000,000 more than those wuthout degrees throughout their careersCollege graudates DO NOT sleep better but are healthuer, live longer, and are healthier \Best option is federal student loans from government \36% of adults 25-34 have a college degreeAverage starting salary for a college grad with a degree is 50,000a college grad will make an extra 20,000 per year over a person without aFamily income doesn’t impact your career earningsVideo 2164% HIGHER FEES THAN 20 YEARS AGOCollege is not keeping up with tech advancements30,000 75% more money per year for gradsmore education you gave - the happier you areMore stable marriages and longer lives for gradsmore than half of undergrads use private loansGraduate owning no more than the entry-level salary of your careerYou can start paying right awayCommunity college or job training programs can help you with technical jobsA college grad will earn 435 - (423?) more per week than a non-grad - over 22,000 per yearVideo 3on average earn $1173 per week for college grads 461 per week for high school gradsThink about your future career - can affect your future earnings43% of college students end up dropping outThe average cost of tuition and fees for public colleges is 9410Room board and food can be double thatThe average balance for recents grads is about 30,000College dropouts with small amounts of studnt debt >5k struggle the most with repaying student debtYou should borrow no more than one times your expected starting salary when you graduatePrivate colleges give a discount of about 50% offMost people combine finacial aid, personal savings, student loans, scholarships etcYou will pay interest on loansFile FAFSA, net price calculator, scholarshupsDirect College Costs - Paid directly to the universityThings that are paid directly to the college/universityRoom and Board (housing and meal plans if living on campus)Fees (tech fees, lab fees)Institutional Health InsuranceIndirect College Costs - Budgeted and paid for on your own (varies)TextbooksRent and Utilities (for apartments/off-campus)GroceriesGas, parking, bus passCell phone, laptop, wifiSticker Price - A college’s published price (tuition and fees, room and board, etc) (minus -)Scholarships and Grants - Merit or need based aid money that you dont have to pay back =Net prce - what you actually pay (typically with loans, sabings and income)Families spent about 26373 on callge from 2020-2145% comes from parent incomg and savings25% comes from scholarships and grants20% comes from borrowed money8% comes from student savingsFrom 2020-21 AY, 58% of familes have a plan for paying for collegeFAFSANot guarnteed to get financial aid - esp if youre high incomeFree!Opens Oct 1stYou can submit an appearl for more moneySubmit FAFSA everyyear that you eed finacial aidDetermines how mich finaical aid you receive from govGrants/ SchoalrshopsLoansWork-studyDon’t pay for FAFSA!!Dont give out personal information over the phone!FREE APPLICATION FOR FEDERAL STUDENT AIDThe US Deperatmnet of Education is the largest provider of finaical aidYou mist compete the FAFSA to qualify for financial aidFill out every October/November for the next school yearFill out for each year that you are planninng to attend collgeBecause your income status and need may have changedd (yours or your family’s)Fill out early because some of the aid is first come, furst servedOnce aid is gone, it’s goneState governments and colleges have money to give out too, they rely on FAFSA to help them decide who to give money to.Once submitted, the government will send you a SAR (Student Aid Report)Summarizes the info that you submitted in your applicationReview and correct info, if neededWill explain the combo of aid that you are being offeredTells you your EFC (Expected Family Contribution)The ammount that the government expects your family to contribute to your education (without loans)Will also have a DRN (Date Release Number)You’ll need this number of you eant your college to be able to change info on your FAFSAThe schools you listed on your FAFSA form will use your SAR to determine your eligibility for federal - and possibly nonfederal (school based) - financial aidStates and colleged can send you seperate “award” letters, tooYou should compare these letters/offers and choose the school that works best for youFAFSA IS NOT GIVVING YOUR ANY MONEY - ITS JUST THE APPLICATIONThe actual money will come fromFederal government (loans and grants)Colleges (loans and grants)Possibky private companies (grants and scholarships)Federal Student aid can come in 3 different waysGrants - free money that does not need to be paid back (similar to a scholarship) - often based on financial need (like the Pell Grant), mostly comes fron US GovernmentLoans - money that does need to be repaid, plus interest (just like a car/home loan)Only take out loans that you actually needWork Study - a guaranteed job during college (on campus) that hekps you earn money to pay your expensesDirect Subsidized Loan==While you are in school, the government is paying the interest on the loans for you

\

\

- \

\

\

\

\

\

\

\

\

\

\

\

\

\

\

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

- \

==****