1.4.1 Government Intervention

Subsidies and indirect taxes done

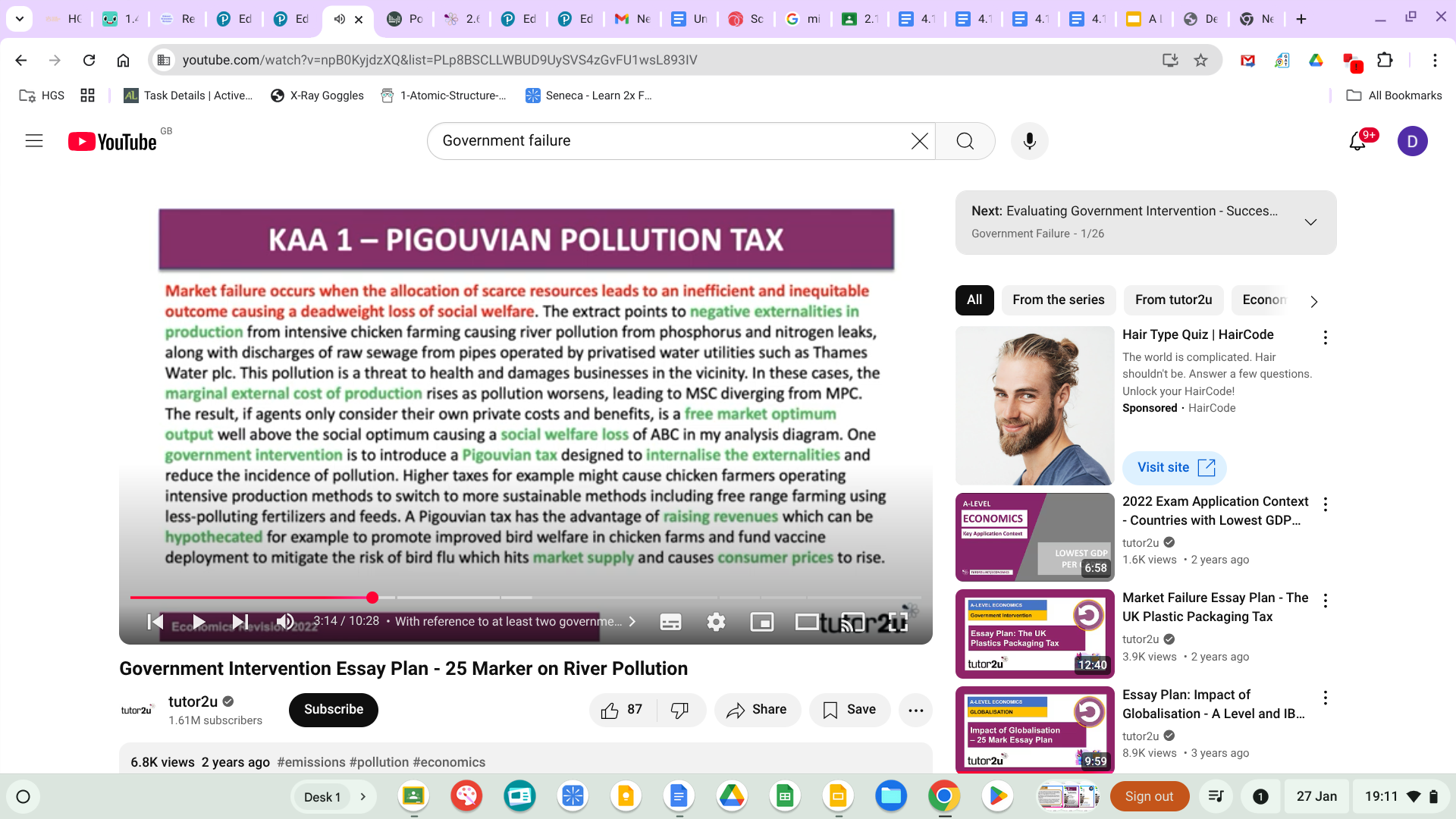

Market failure = When the price mechanism leads to an inefficient allocation of goods and services and a dead weight loss of economic welfare

Examples of market failure:

Neg and Pos externalities - self interest as firms are profit maximisers and consumers are utility miximisers

Under provision of public goods - free rider

De-merit goods/ merit goods - information failure which may make consumers make irrational decisions when purchasing

Information failure

Monopolies - one dominant seller and high barriers to entry

Inability of the factors to move

Assessing Indirect taxes

Effectiveness:

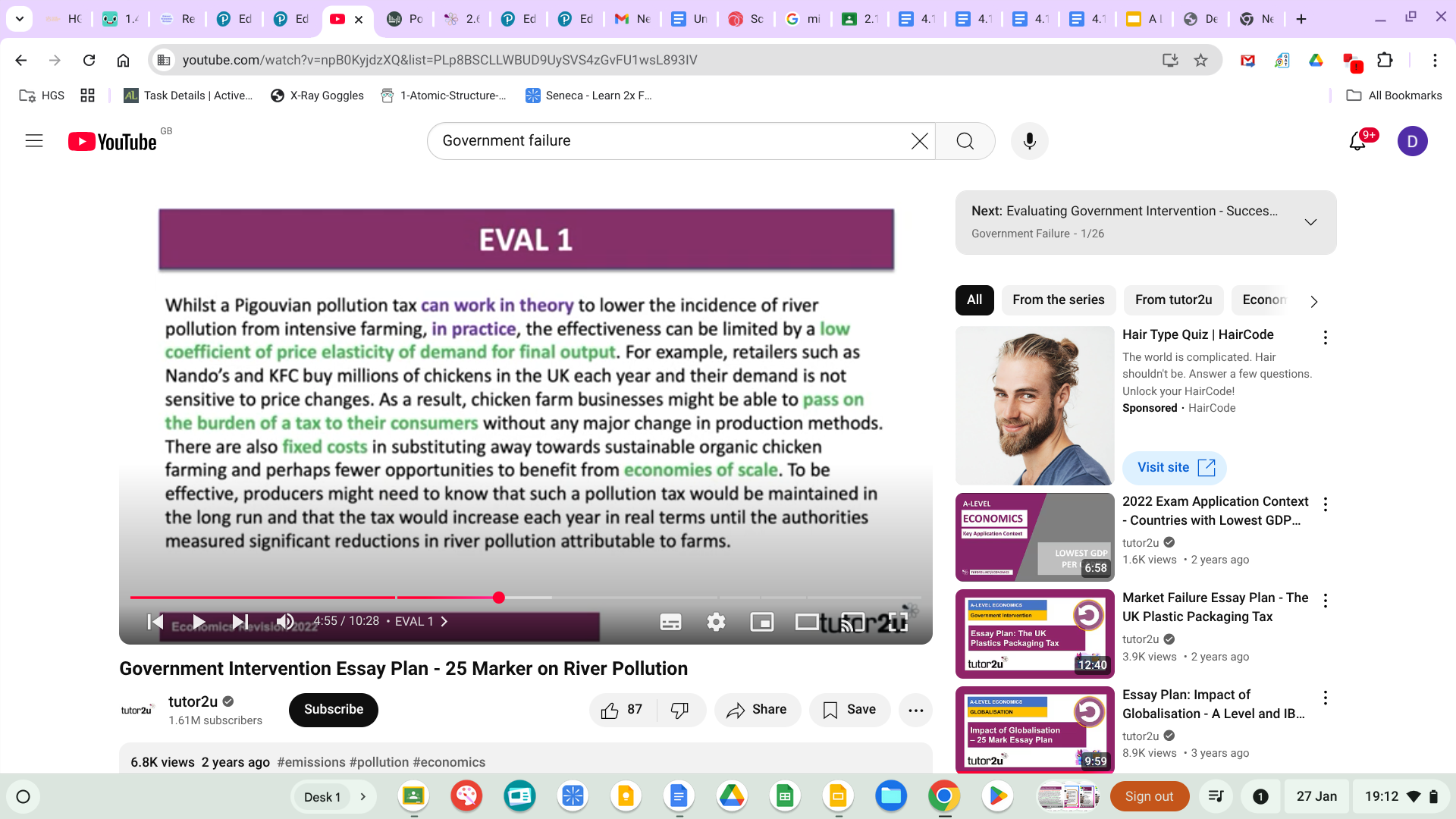

Depends on the PED

Problems associated with setting tax at the right level yo achieve aims

Unintended consequences - i.e. inequality

Does it raise revenue ? Does it generate sufficient revenue especially in elastic demand

How is the tax revenue used ? Is it used for a specific purpose i.e. sugar and sport in primary schools.

What are the effects on competitiveness ? Will businesses cut back on jobs or investment ?

Consequences for equity/ redistribution on wealth ? Who are the winners/ losers ? Is it regressive i.e. VAT

Assessing Subsidies

Effectiveness:

Will they achieve their desired stimulus / incentivise an increase in demand i.e. if PED is low there may need another incentive

Will a subsidy effect productivity and efficiency ? Subsidies for research and investment will bring about positive spillovers but cane some firms become too dependant on govt. subsidies

How much does the subsidy cost ? Who is pay? Is it part self financing i.e. creates more jobs therefore generates more taxation or will it create an added burden onto the tax payer.

Does it really correct market failure ???

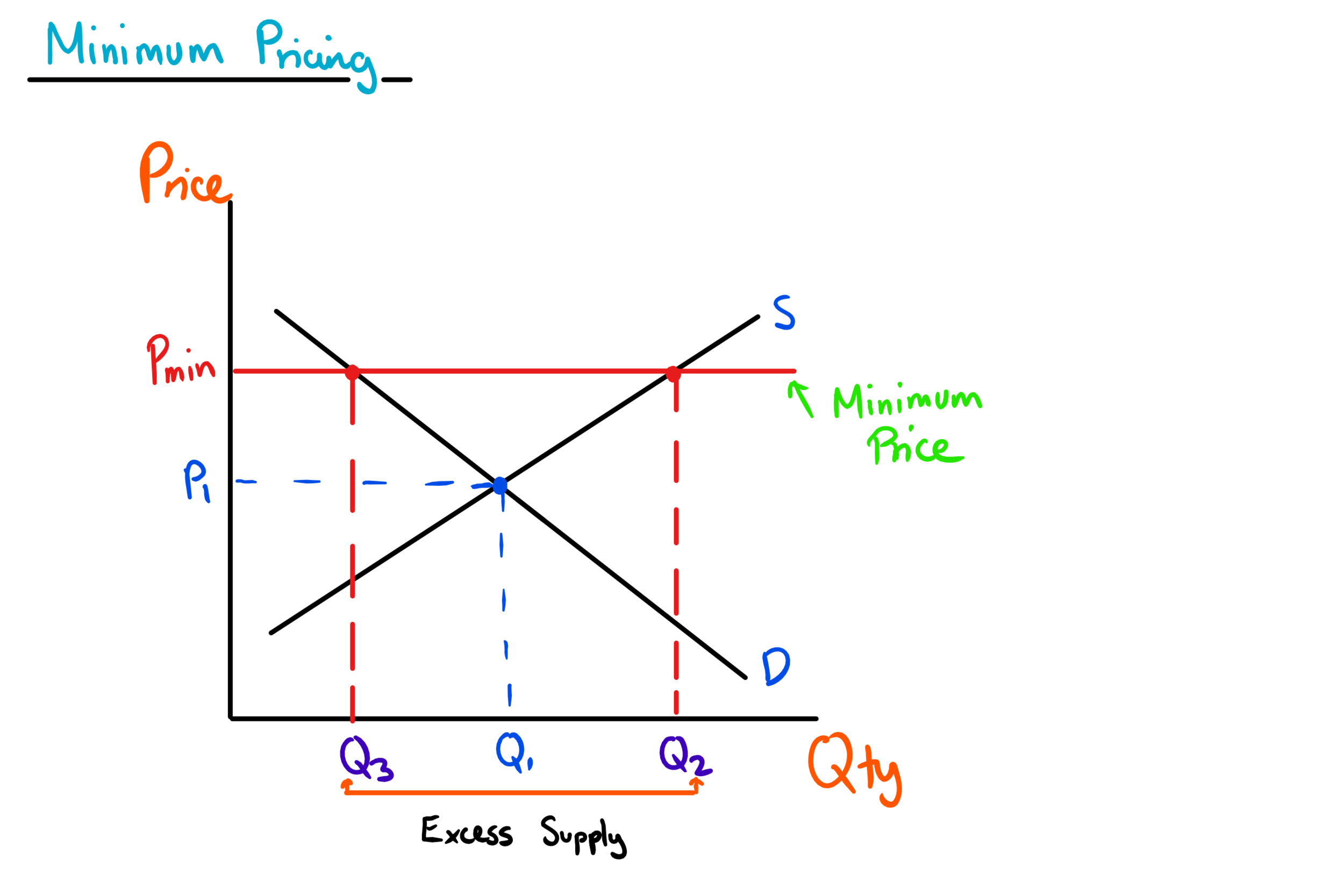

Minimum Prices

Minimum price + = a legally imposed price floor mostly associated with minimum wages

Or Minimum price per unit i.e. Scotland and alcohol at 50p per unit and minimum care price

Always consider PED for labour ect. to build analysis - when considering the extent of contraction of demand

Aim: not to contract supply rather decrease/shift demand

Disadvantages:

If demand has a high PED ( elastic ) this could hit production, profits and jobs in the drinks industry

Impact on high consumption groups may be regressive in nature

Doesn’t actually bring in any tax revenue for the govt. for reinvestment

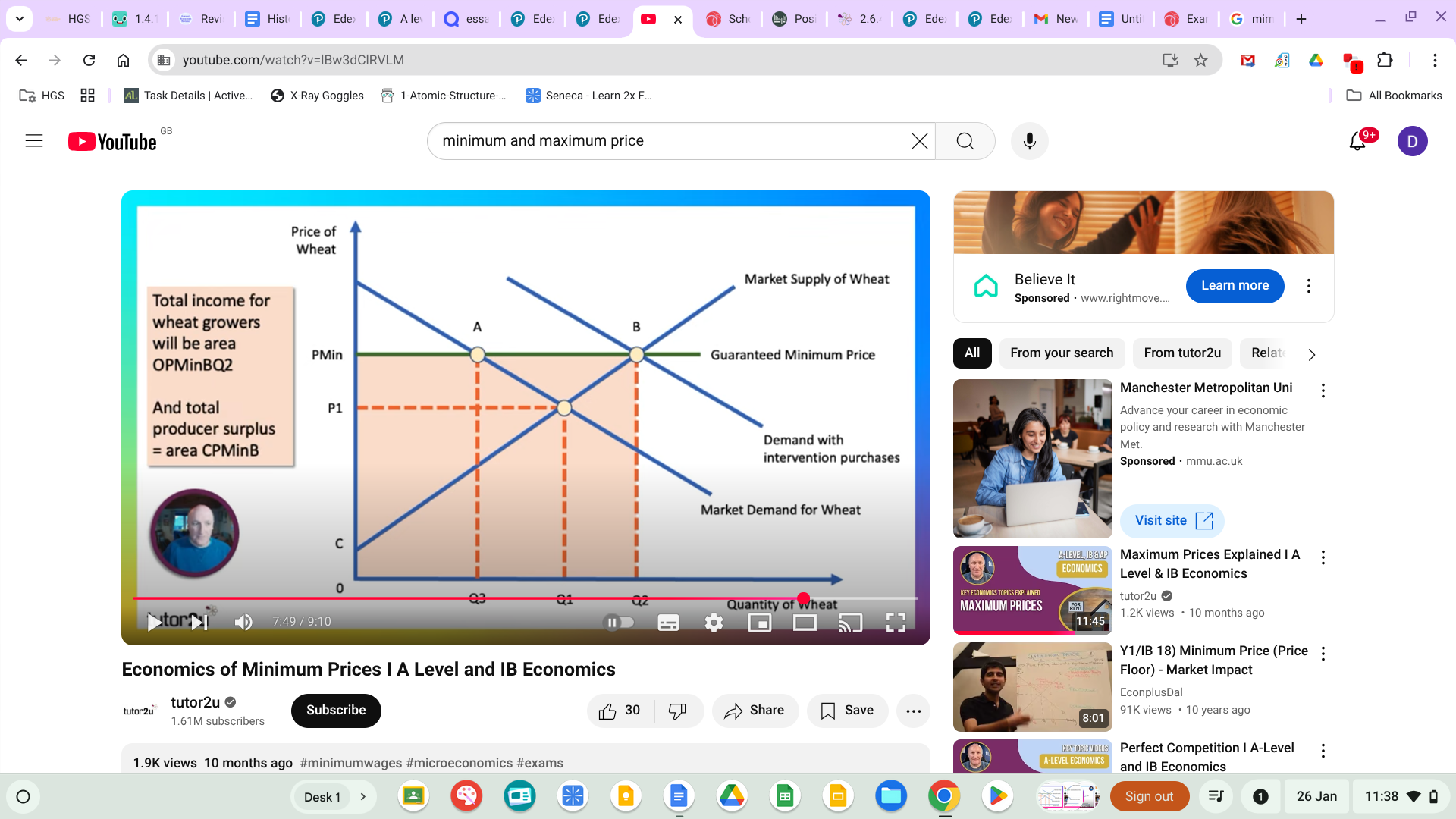

Causes excess supply in the market - market distortions - over production

These surpluses may require extra govt. intervention such as storage and export subsidies to prevent waste

Risks of waste dumping and trade wars - which may occur if nations are accused of waste dumping to get rid of extra stirage

Minimum price may discourage innovation and efficiency esp in agri market

What are the alternatives:

Indirect taxes

Behavioural nudges i.e. provision of education to change demand - lessen imperfect info

Raise minimum drinking age to 21 - regulation

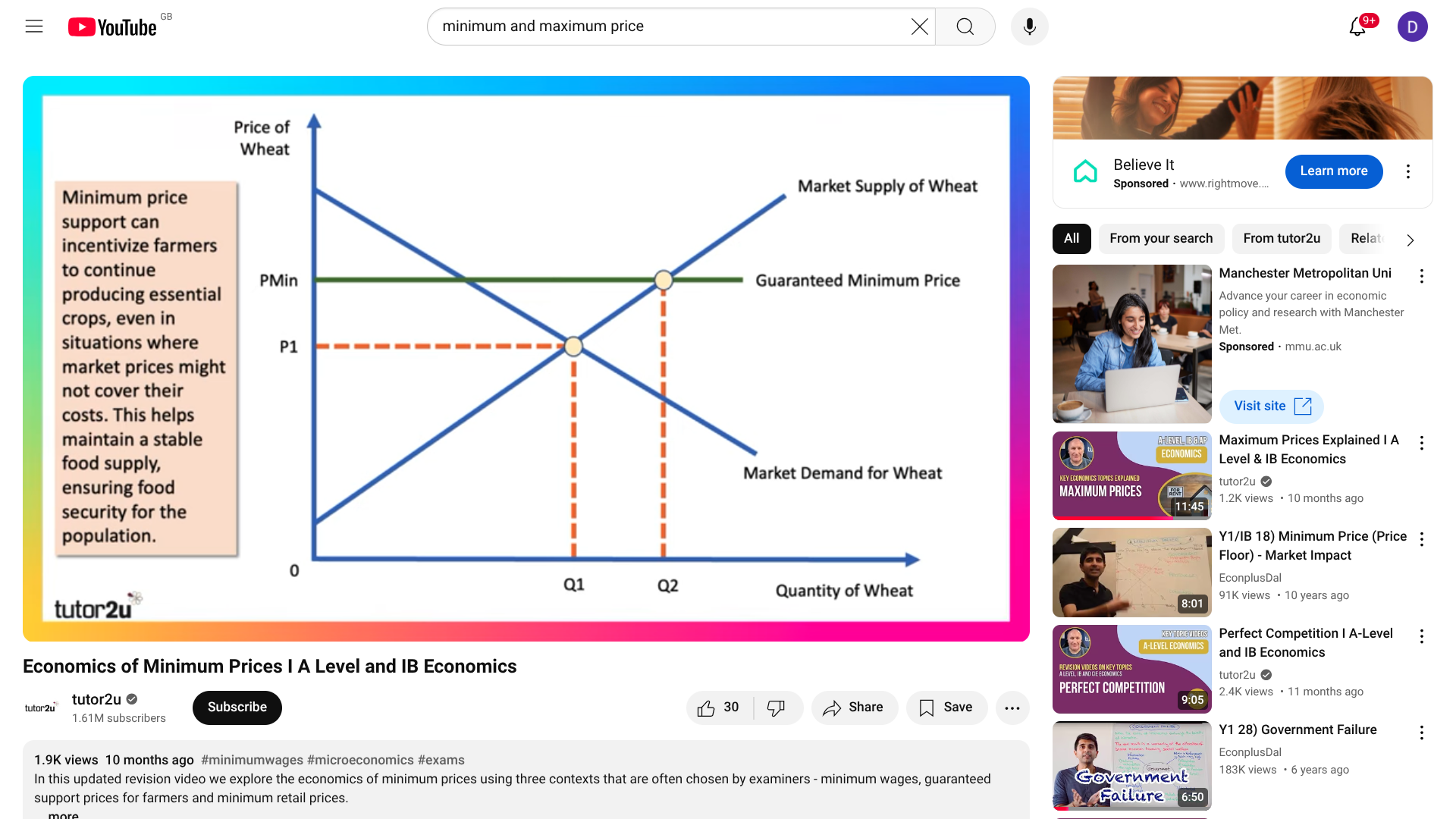

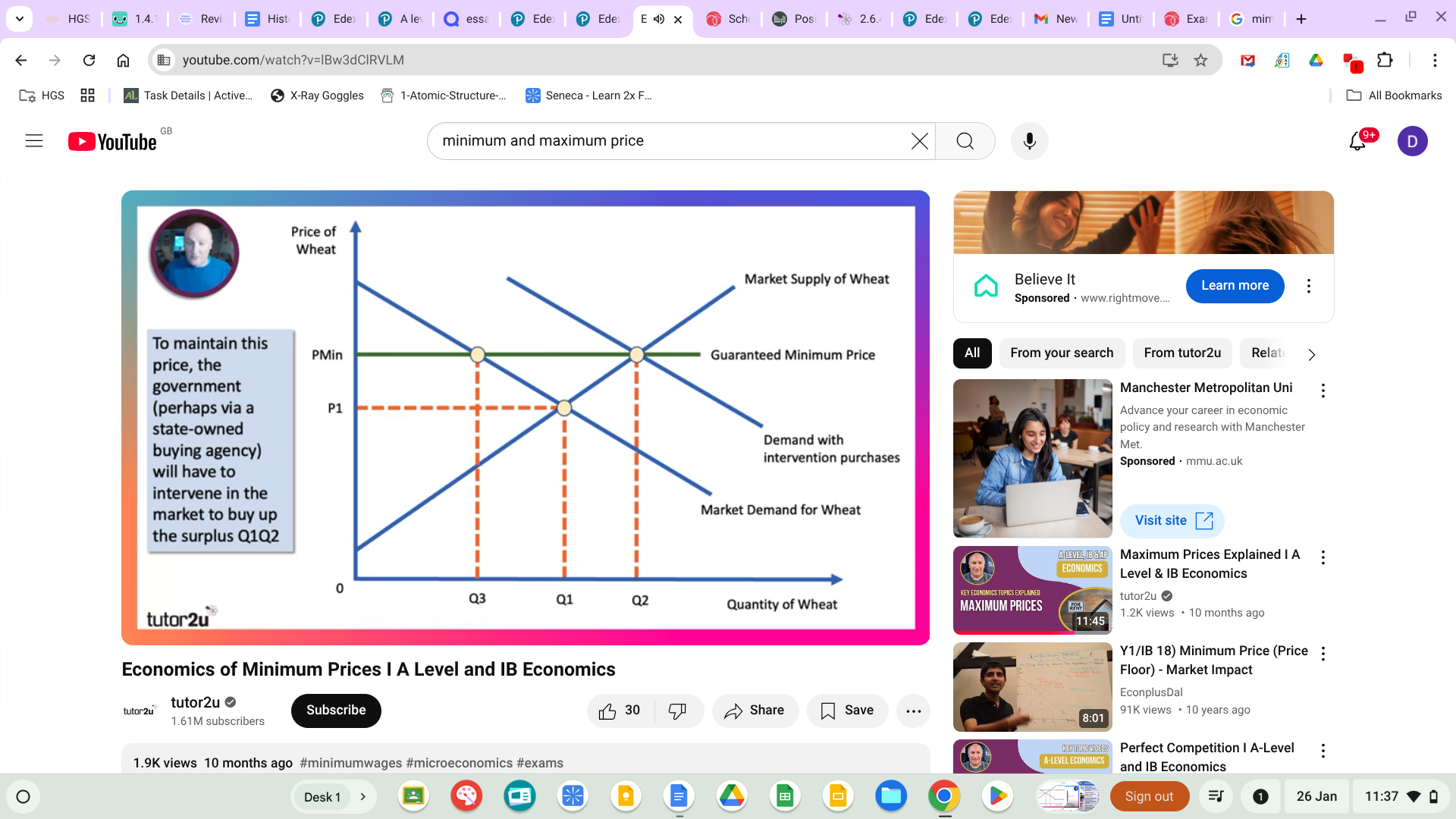

Minimum Prices for Farmers:

So, this is usually a positive as farmers are essentially price takers

So minimum prices in the agri industry is designed to stabalise farmers incomes and ensure they receive at least a certain amount for their produce i.e. corn and wheat

By setting a floor price the govt. ensures farmers are receiving a minimum level of income to cover all costs of production to maintain livelihood and protect smaller farmers

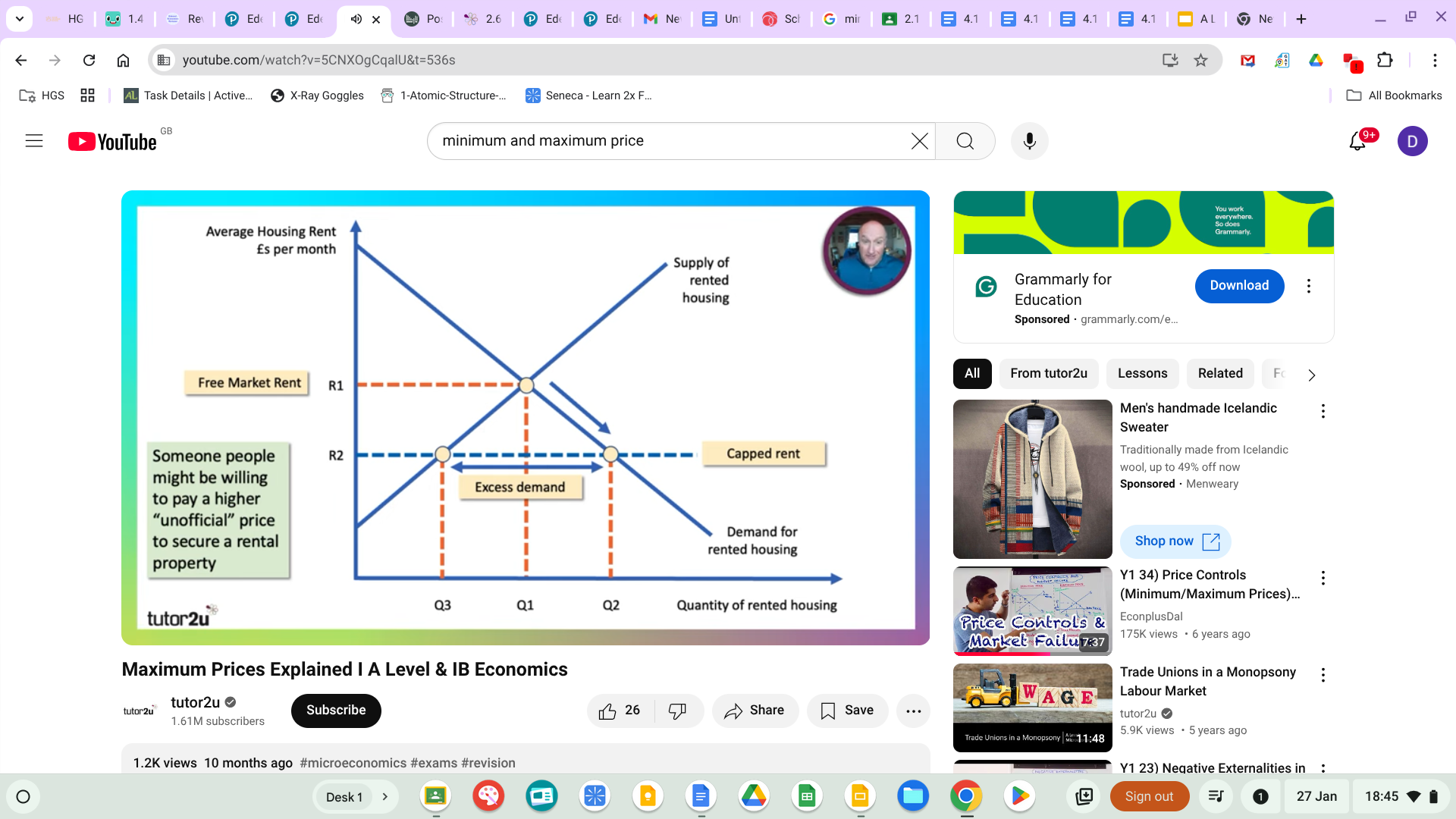

Maximum Prices

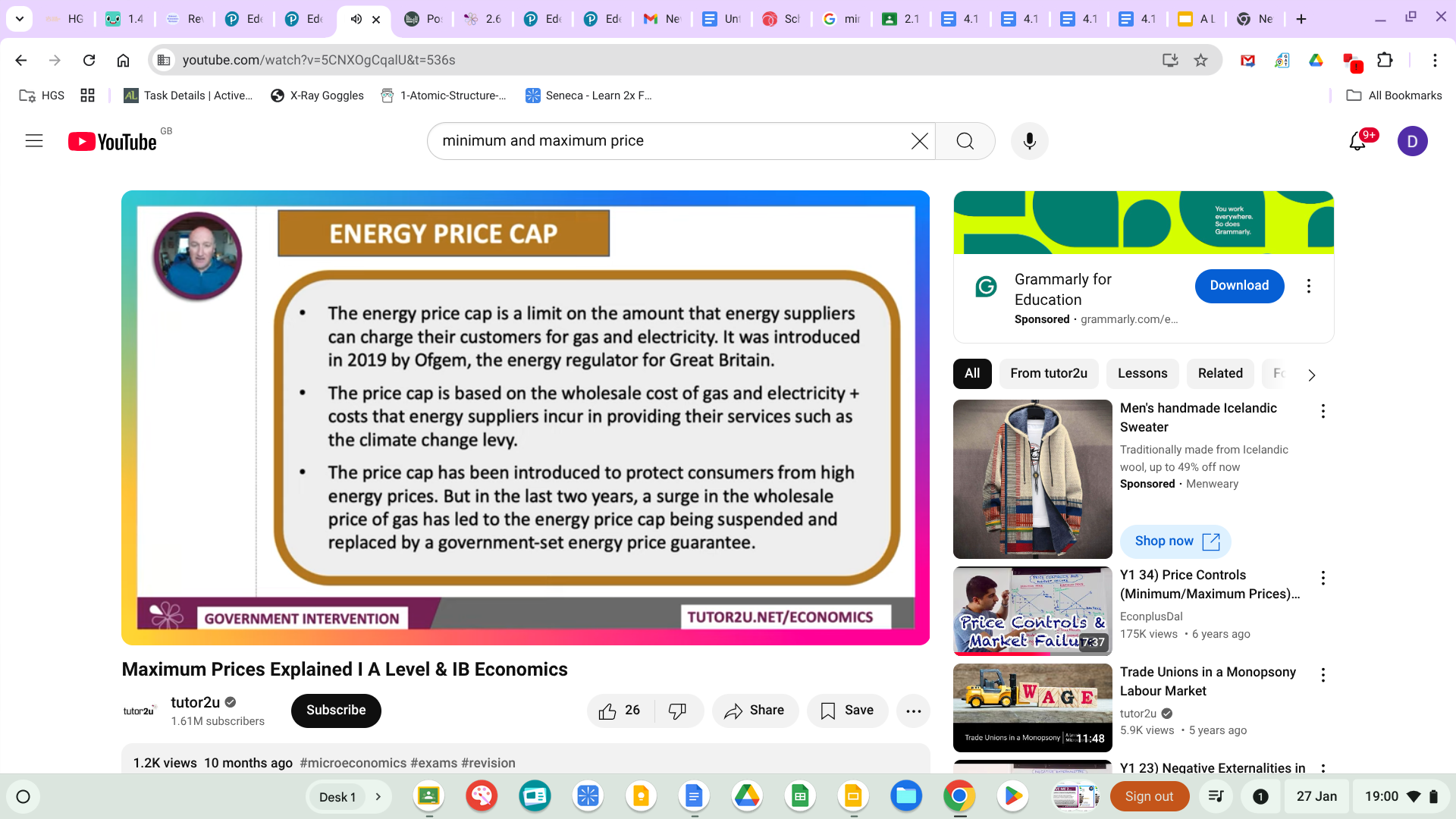

Maximum prices act as a price ceiling of which suppliers cannot exceed i.e. Rent control in Oregon and energy price caps

I.e. Paydays loans at 0.8% and gambling

Evaluating ( i.e. Rent )

Lead to an extension in Demand from Q1 - Q3 as consumer surplus increases and more people can now afford

However, in turn this results in a shortage of supply due to the now excess demand in a market - distorting the price mechanisms

If some people are willing to pay higher prices this risks black market transactions which results in an even higher price

Benefits

Rent controls are needed to reduce excess profits of landlords from those in need

High rents impede on the geographical mobility of labour which may in turn have a direct affect on unemployment

High rents reduce peoples disposable income which will cause a decrease in AD as well as an increased reliance on the benefits system - taxes

Drawbacks:

May result in landlords withdrawing from investment resulting in a diminished supply of private sector rented housing

Landlords may cut back on large levels of maintenance spending reducing the quality of rented housing and increase risks for tenants - external costs - i.e. dampness

Some landlords may switch markets from rented property to houses to buy which will ultimately increase housing prices

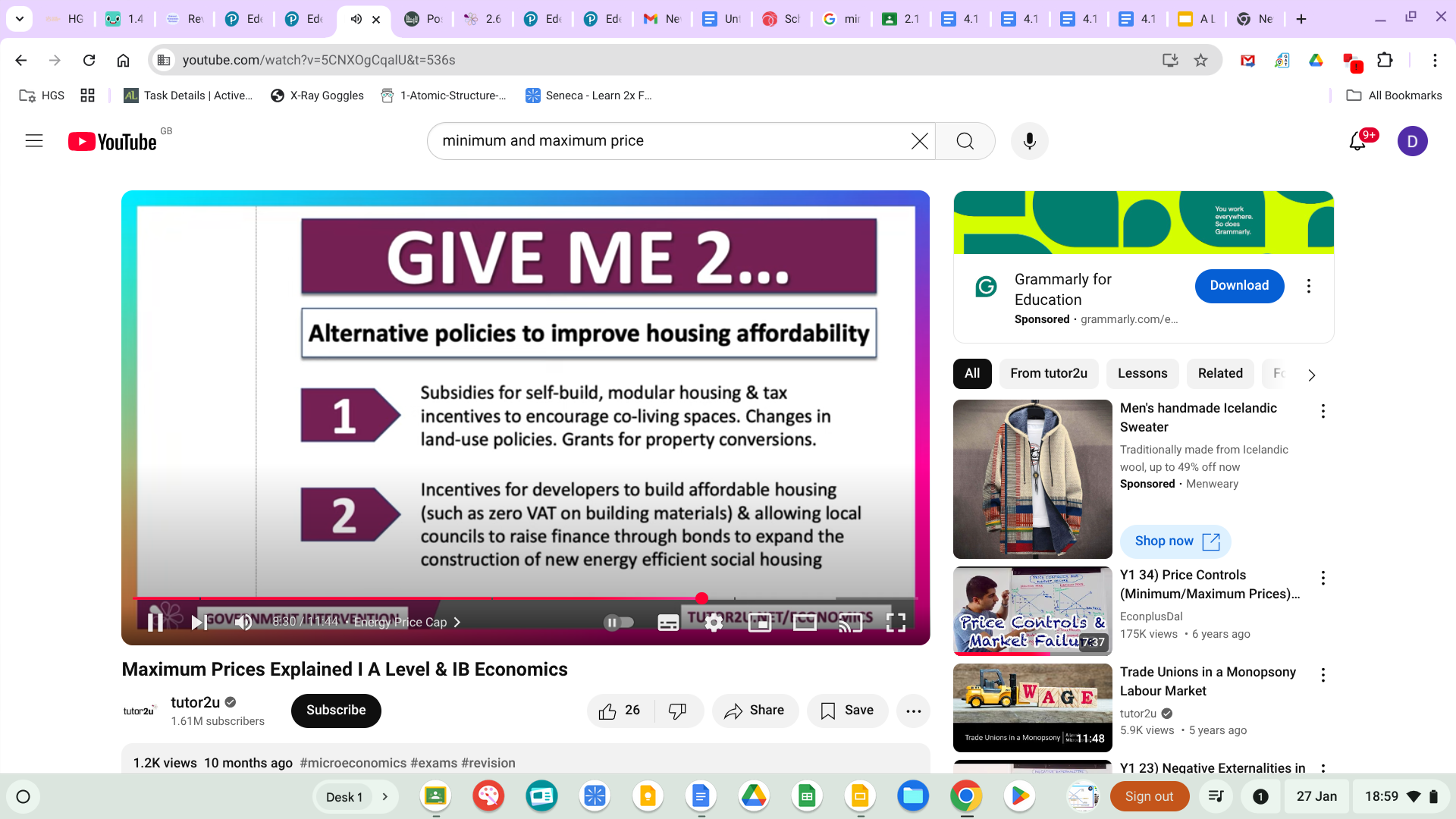

In evaluation in the exam always consider alternatives for example:

Govt could consider tax relief when building affordable houses on brownfield sites

Increased spending on social housing

Always discuss PED

May benefit from better education - to reduce imperfect knowledge

Contextual knowledge: Rent in London is over double that of Newcastle - also 3x

Trade Pollution Permits

Means to target climate change

Used by the UK and India - fairly common

Aim to reduce CO2 emissions

Cap set at socially optimum level assuming that govt. know what this is

Permits are issued to match the cap exactly

A markets for permits is then created - a market for sollution

Supply is then vertical because supply of permits is inelastic

Firms then have to make a decision as to whether it would be more cost efficient to operate in an environmentally friendly way i.e. invest in green tech or buy permits - whereas blanket regulation does not give firms this choice

Then pollution will be reduced to the socially optimum level of output and allocative efficiency will be achieved as a result

AND in turn the LR incentive is to invest in green tech so they won’t be burdened when permit prices rise and as the govt. gradually tighten the cap - this is socially beneficial

Evaluation:

Can enforcement be afforded ? Especially in developing countries - without enforcement and technology ti measure emissions then policy won’t work

Imperfect information - govt. do not know the socially optimum level

Unintended consequences - due to imperfect info, govt. could set the cap too high and then LRAC will increase for a firm - resulting in higher prices ( inflationary )or simply shut down or move to different countries where policies are more lacked - results in carbon leakages

There needs to be international cooperation for this policy to work - climate change is a global issue - but getting international countries is near impossible especially in LDC who are industrialising - annoys developed economies

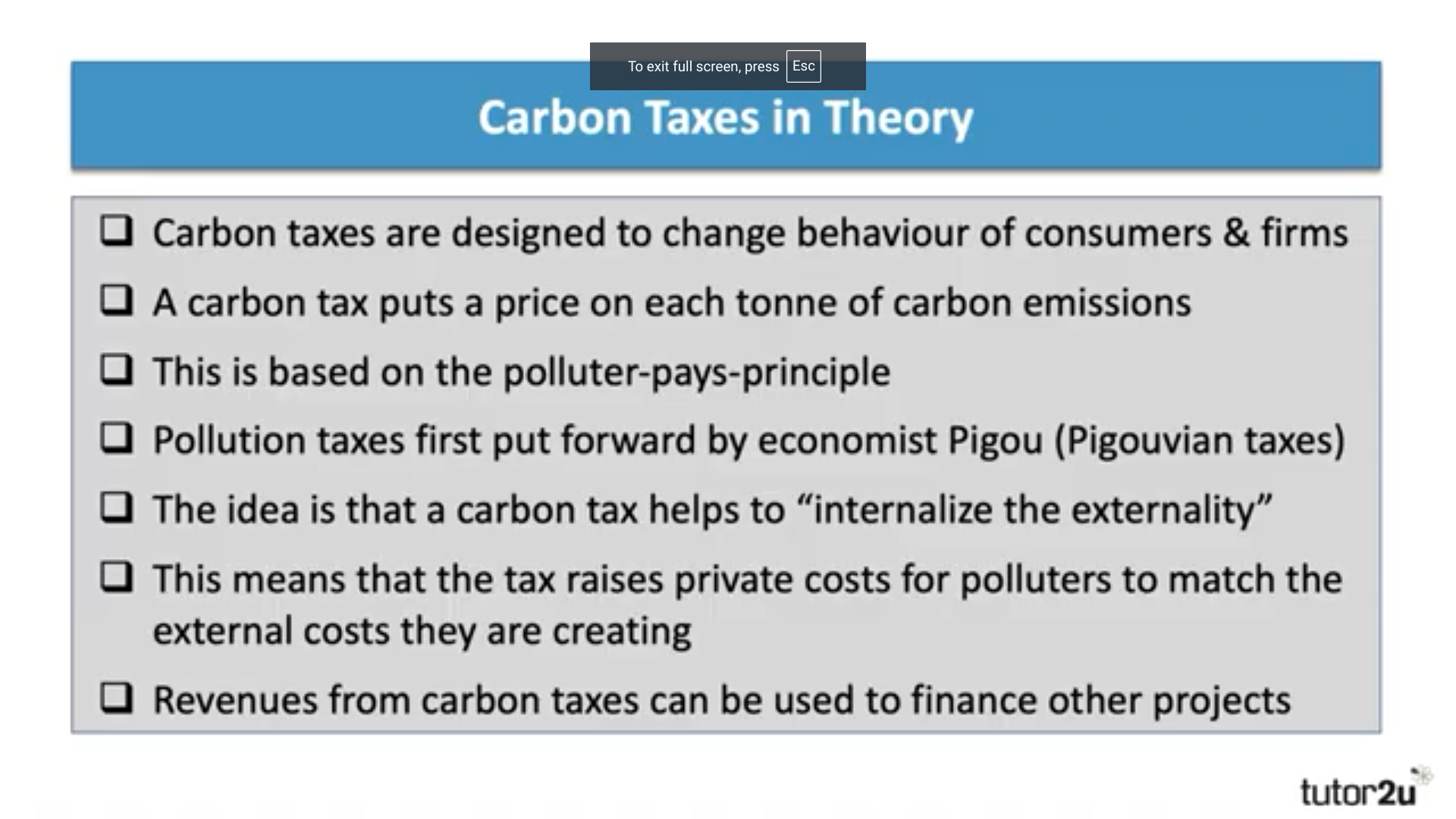

Carbon Tax

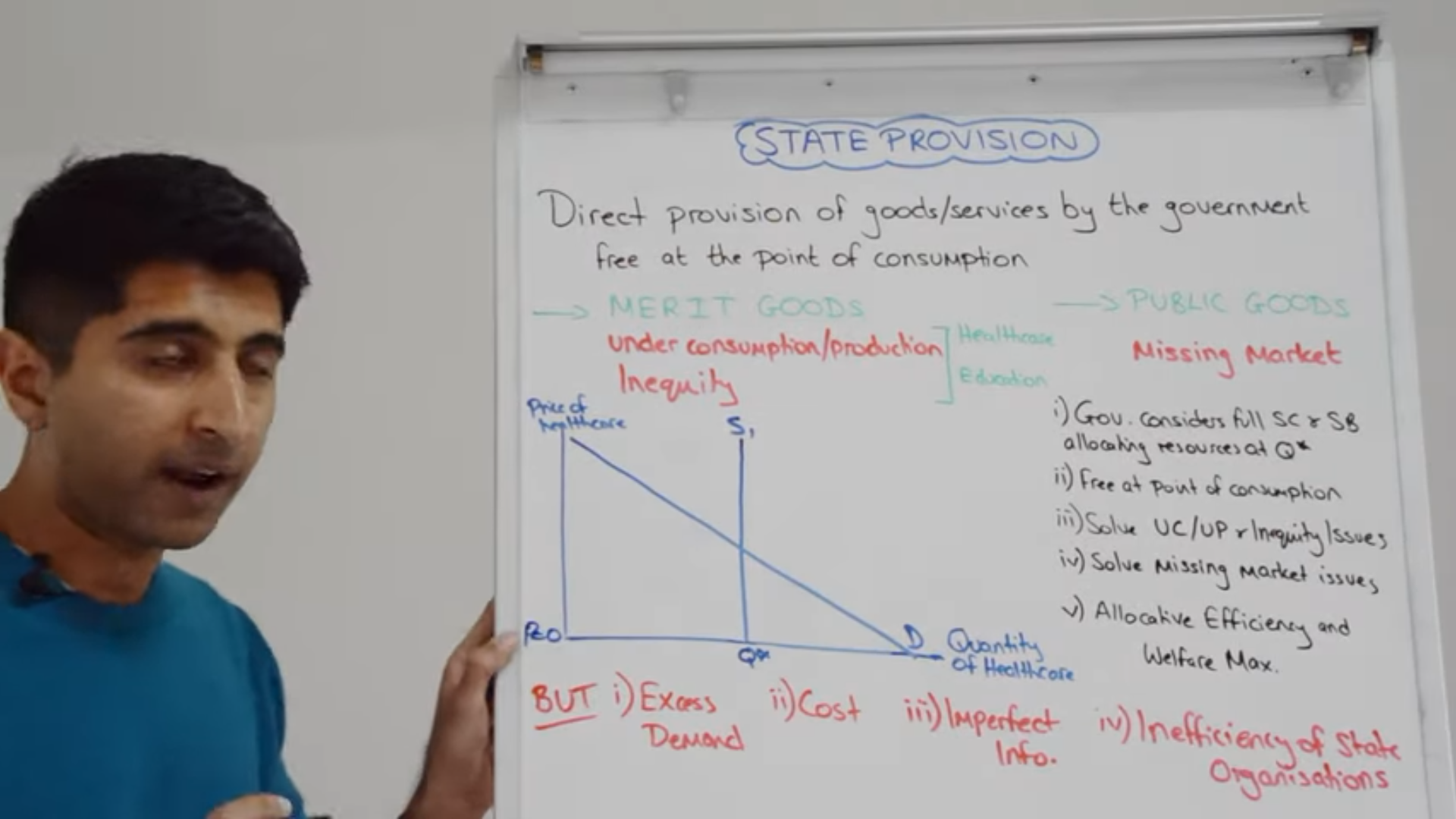

State provision

Direct provision of goods and services at the point of consumption provided by the govt.

Benefits:

Left to the free market there is inequity of merit goods

This is because prices are charged

I.e. education and healthcare

Therefore, it could be argued that state provision in these industries is justified

AND public goods - free rider problem

Assumed that govt. has near perfect information about MSB and MSC and all externalities are valued and the govt. is aware of the socially optimum level of output

Vertical supply curve because the govt. designate a proportion of spending per year to the NHS and education

NO price as free at the point of consumption

This can then used to be solve under consumption and under production issues compounded with inequity issues also - caused by the free market

Then, allocative efficiency is achieved as is the maximum welfare

BUT this is all in theory, in reality there is far more issues created by state provision than solved

Evaluation:

Excess demand - distorts price mechanism - QD exceeds Q* - left to the free market, rationing would boost prices - govt. can’t do this - causing large back logs and queues - lots of people living in pain - not an efficient solution - i.e. postcode lottery regarding provision of education

Cost - consumers don’t pay in price but they may pay in other ways such as pain or poor quality - therefore, an argument for the needs for a private sector here - consumers that are willing and able to pay will do - this reduces state pressure

Opportunity cost - tax payers money - LR funding - higher taxes - redirected spending

Imperfect info - govt. don’t know everything i.e. value of externalities - so may result in further distortions

Inefficiency - as argued by free market economists - public sector lacks a profit incentive - therefore lacks sufficient efficiencies - may suffer from x-ineffiiciency and then taxes suffer - effective use of public money ?

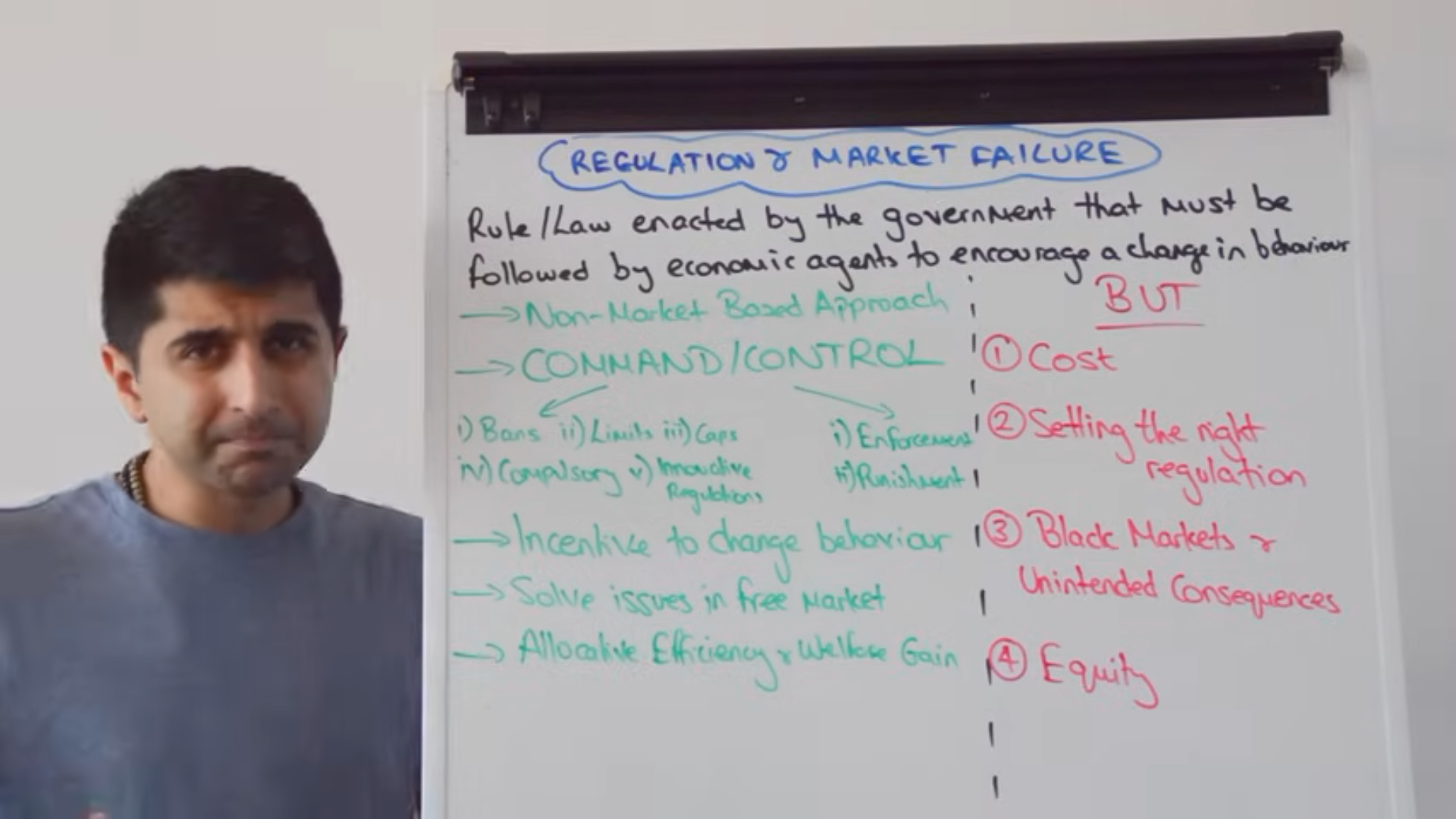

Regulation