1&2 - cash and cash equivalents

cash - medium of exchange

all transactions are measured and recognized in financial statements

keyword: unrestricted

cash on hand

coins and currencies, check not postdated, money order (basta check)

postdated check - check in the future

di cash kasi may restriction, receivable siya eh

if posted checks are issued, these cash of the entity part of cash in bank(what) what does sir mean sa issued

careful sa issuer ng check, changes what it is

stale checks- checks not yet in cash by entity for at least 6 months

except if stale checks are issued by entity

di ko gets yung iba 4:30 abt cash issued emerut

cash in bank

savings deposit and demand deposit

excludes:

time deposit, if more than 1 year, long term investment. cash equivalent lang if 3 months or less

bank overdraft - current liability except if may is a pang bank acct entity na positive balance tapos pwede maoffset

compensating balance legally restricted as to withdrawal - except if not legally restricted

unreleased checks - remain in possession of issuer

IOUs (I owe u)- receivables

cash fund

tax fund, travel fund, any funds set aside for current purposes

excludes: funds set aside for non current purposes

bond sinking fund - bond is long term

except if bond is 1 year or less, current liability ang bond liability

asset replacement fund- set aside to acquire a new non-current asset

cash surrender value - fund related to life insurance of entity’s key officers ,, after expiration of term kaya non-current

other funds: contingent fund, insurance fund, etc

cash equivalents

short term investments readable convertible to a cash

maturity 3 months or less from date of acquiring

includes

certificate of deposits

t-bills - issued by government (long term is treasury bonds pero can be cash)

commercial paper - like a tbill but w higher interest rates

money market funds

excludes

equity securities- unless redeemable

sfp valuation

cash is face value

pag nabankrupt, nagiging receivable. acquired only at nrv

cash control system

imprest system - minimizes amount of cash being maintained in company to avoid possible cash related fraud

all significant payments in the form of checks except for small payments (petty cash fund)

petty cash fund- used to pay small expenses of company

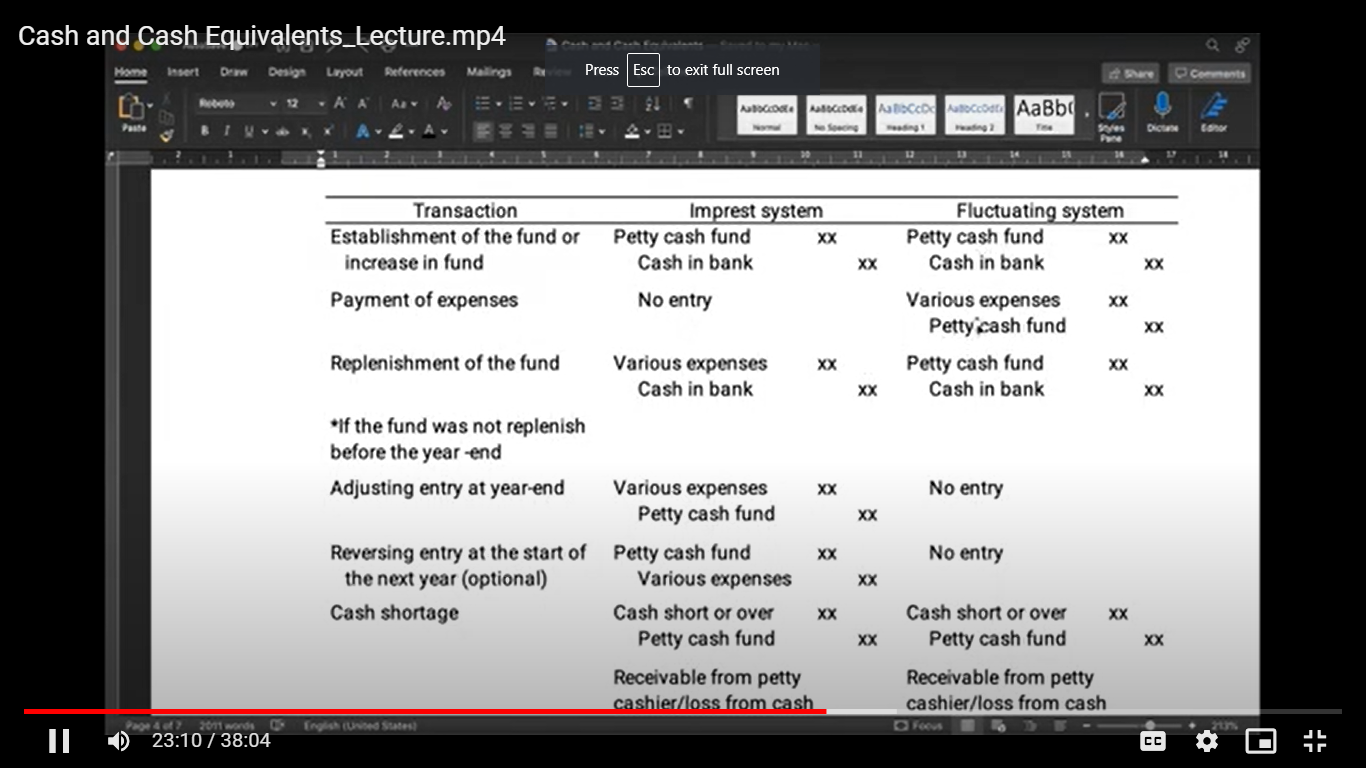

imprest system

same adjusting entry at year end sa payment of expenses

fluctuating system

voucher system - all payments supported by a voucher, recorded in voucher register before recording in check register

segregation of duties - control preventing one person to have authorization, custody, and recording

periodic reconciliation of balances - bank reconciliation

3 methods: book to bank method, bank to book method, adjusted balances method

adjusted book is same as adjusted bank balance

28:00

bank reconciling items

book reconciling items

SYNCH SESSION NOTES:

lease back transaction - u sell building then u still rent it

KAHOOT:

false?

false?false nga. annually yung financial statements na complete set

sa financial accounting - comply with timing ng regulatory. pupublish quarterly dapat sa regulation

true . . .

true . . .false wtf

yellow

yellowtamuh

presented separately if material

presented separately if materialmaterial - high amount

true

truefalse

other comprehensive income also comes in when building is revalued

entity has option to divide these statements, hindi siya single statement lang

true

true going concern

going concern twelve months

twelve months false!

false!function vs nature of expenses

both red and blue

both red and blue true

true yellaw

yellaw true

true3 persons max

65 questions based on book

required book bilhin

submission on the day we discuss the topic

madali lng daw sha magquiz hm

chaps 1-2 ang quiz

before we start on Friday nakasubmit na

walang minus sa grades kung di perfect

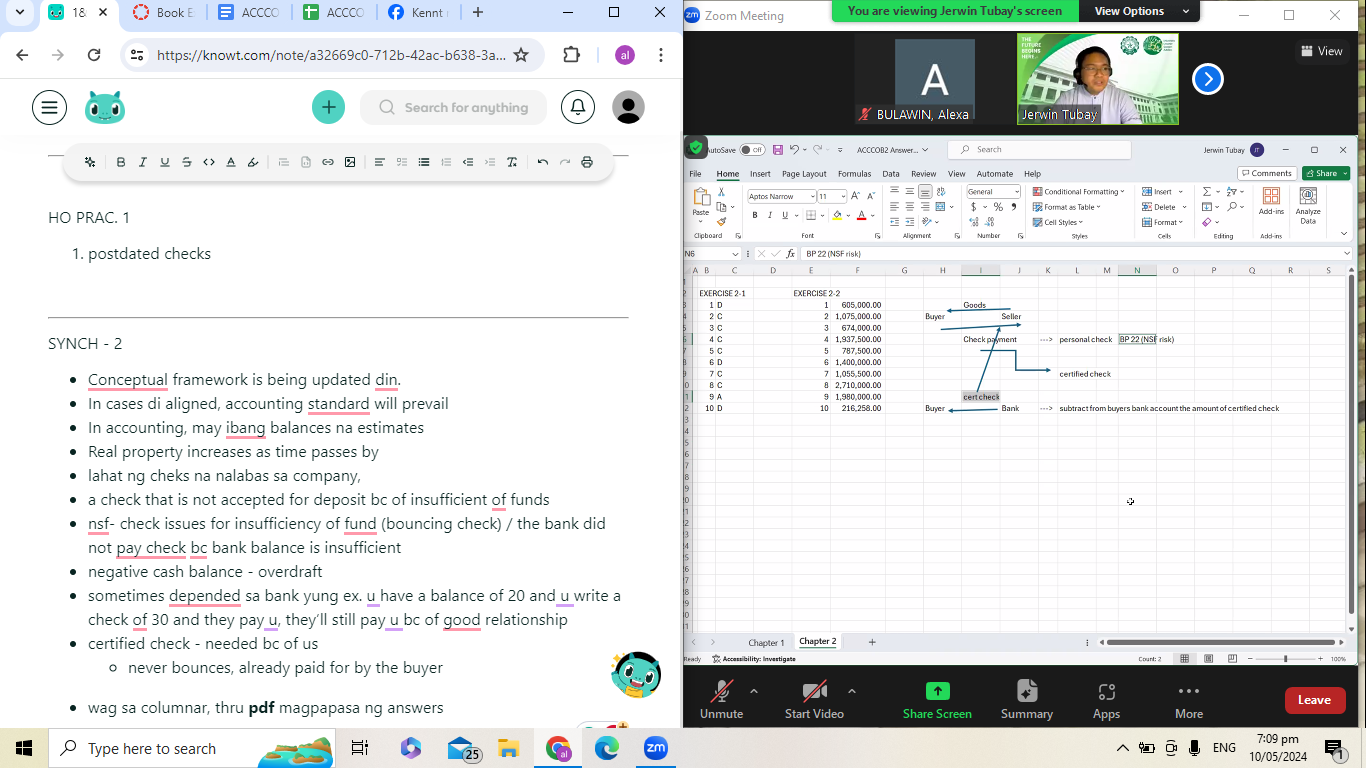

HO PRAC. 1

postdated checks

SYNCH - 2

Conceptual framework is being updated din.

In cases di aligned, accounting standard will prevail

In accounting, may ibang balances na estimates

Real property increases as time passes by

lahat ng cheks na nalabas sa company,

a check that is not accepted for deposit bc of insufficient of funds

nsf- check issues for insufficiency of fund (bouncing check) / the bank did not pay check bc bank balance is insufficient

negative cash balance - overdraft

sometimes depended sa bank yung ex. u have a balance of 20 and u write a check of 30 and they pay u, they’ll still pay u bc of good relationship

certified check - needed bc of us

never bounces, already paid for by the buyer

never nastastale certified check

wag sa columnar, thru pdf magpapasa ng answers