Unit 3 Study guide

Aggregate Demand

Explain why the AD curve is down-sloping, and what it represents

As the PL increases, people want to buy less goods

Real Wealth effect: higher price levels diminish consumer purchasing power, leading to a decrease in the quantity of goods demanded (AD)

Interest rate effect: When the price level rises, consumers and businesses require more money for transactions, leading to higher interest rates. This results in reduced investment and consumer spending, further decreasing the quantity of goods demanded.

Net export effect: A change in the price level changes the amount that people from other countries are willing and able to purchase (exports increase)

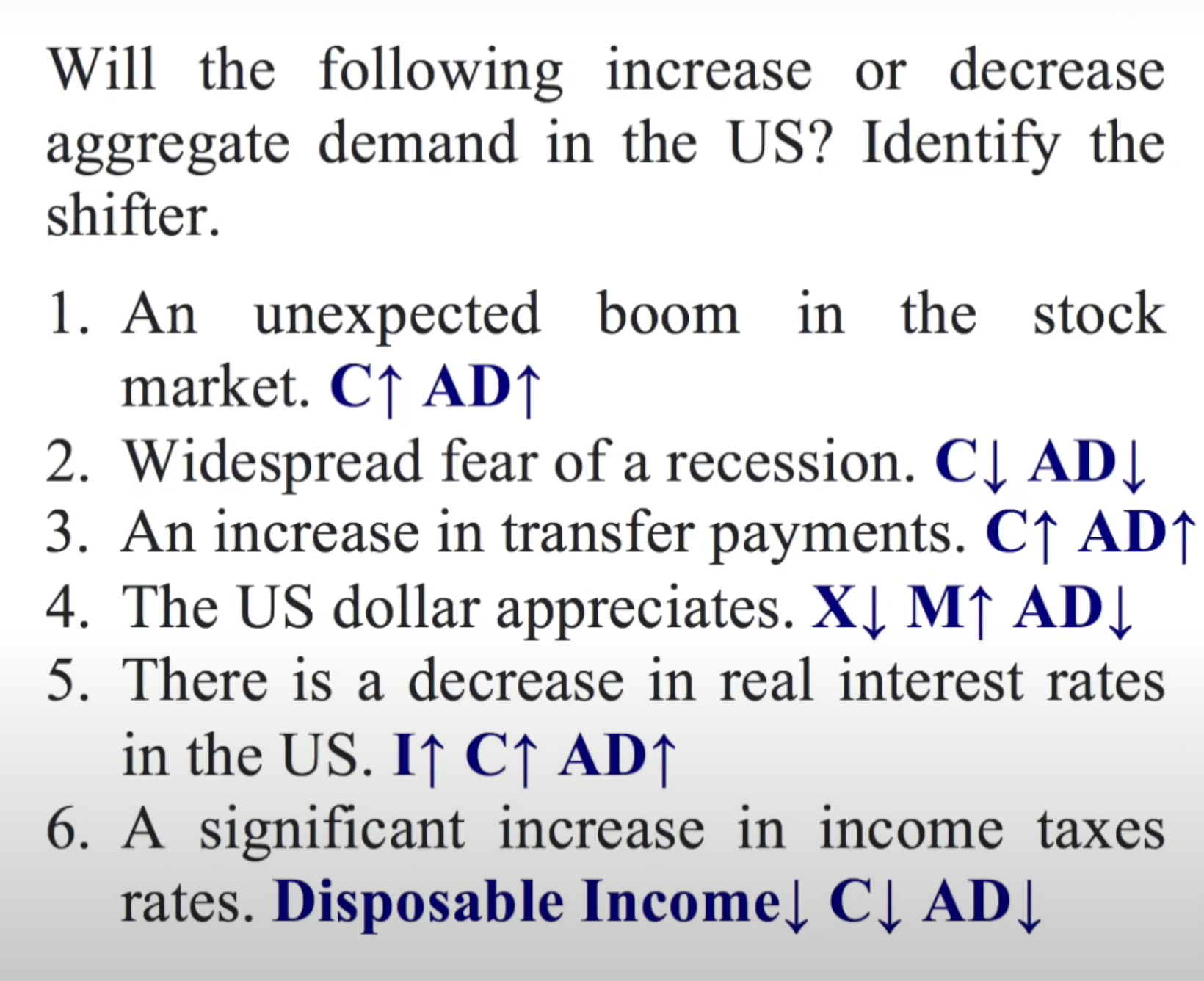

Know the determinants (shifters) of the AD curve (BASICALLY.. C + I + G + Xn)

Consumer spending

wealth

borrowing

expectations

taxes

investment

real interest rates

expected returns

future conditions

technology

capacity

business taxes

Government policies

fiscal policies

monetary policies

Net exports

national income abroad

exchange rates

government trade policies

Examples:

Aggregate Supply

Explain why the AS curve is up-sloping, and what it represents

positive relationship between price level and quantity supplied, indicating that as prices increase, producers are willing to supply more goods and services to the market.

represents the total production of goods and services that firms in the economy are wiling and able to supply at various price levels → output changes in response to changes in price

Know the determinants (shifters) of the AS curve (basically anything that affects production from a producer’s standpoint)

input/resource prices

wages

commodity prices

productivity

business taxes and regulations

Explain the difference between the 3 types of AS curves: Immediate Short Run, Short Run, and Long Run

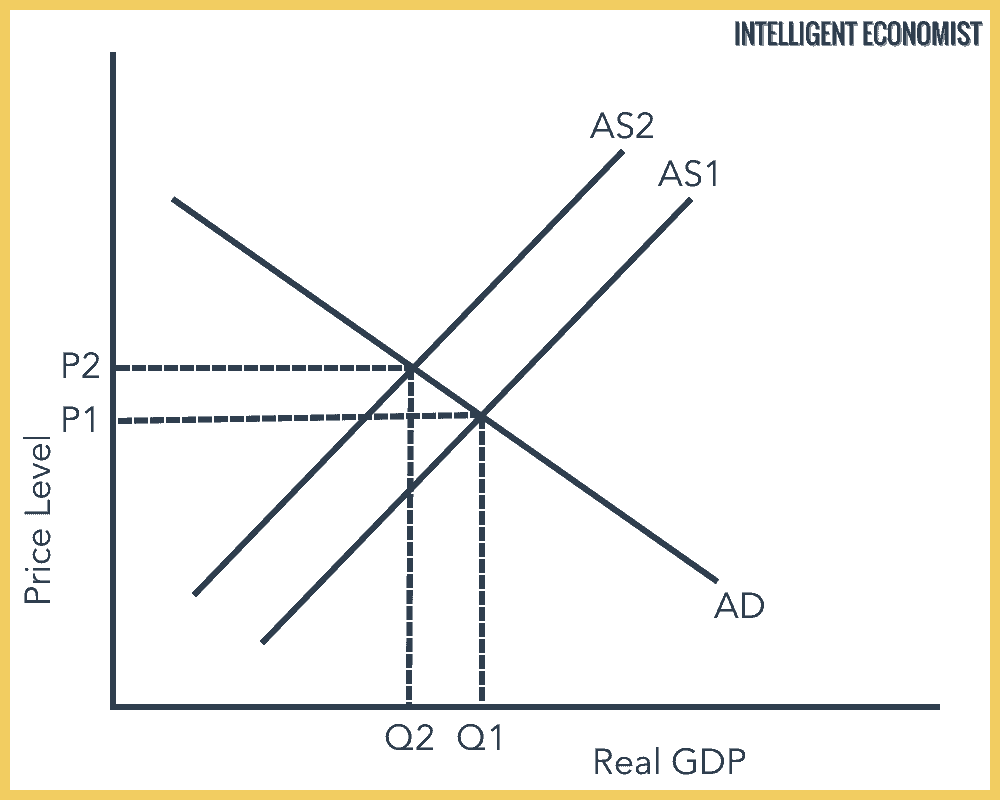

Equilibrium in the AS/AD Model

Determine equilibrium Price and Quantity in the AS/AD Model

Know the difference between Recessionary and Inflationary gap

recessionary:

Occurs when the actual output of an economy is less than its potential output at full employment.

Characterized by high unemployment and underutilized resources.

Indicates a lack of aggregate demand in the economy, leading to lower consumer spending and investment.

Inflationary:

occurs when the actual output exceeds the potential output of the economy

characterized by low unemployment (possibly near or below the natural rate) and high demand for goods and services

this typically leads to increased inflationary pressures as demand outstrips supply

Explain what effect various demand/supply (both positive and negative) shocks would have on equilibrium.

Apply the concepts of Stagflation, Demand-Pull Inflation, Cost-Push Inflation and Recession to the AS/AD Model

stagflation

demand-pull inflation

cost-push inflation

recession

Basic Economic Relationships

Explain the following concepts:

MPC/MPS

MPC: the fraction of additional income that a household consumes rather than saves

Formula: MPC = change in spending/change in DI

Aggregate Consumption Function (introduced in Chapter 10, explained more in lecture on Thursday, 2/18)

represents the total consumption expenditure in the economy at different levels of income

typically illustrated with a positive slope, indicating that as disposable income increases, consumption also increases

factors influencing the curve include: household wealth, expected future income, taxes, and real interest rates

Investment Demand

refers to the amount of spending on capital goods that businesses are willing to undertake at various interest rates and economic conditions

influenced by factors such as interest rates, expected returns on investment, business taxes, and overall economic outlook

higher interest rates typically reduce investment demand, while lower rates, encourage more investment spendin

Fiscal Policy

Multipliers

Spending Multiplier: Be able to calculate how much the government should spend/cut back in order to close the output gap.

Tax Multiplier: Be able to calculate how much the government should increase/decrease taxes in order to close the output gap.

Transfer Multiplier: Be able to calculate how much the government should increase/decrease transfers in order to close the output gap (your textbook does not cover the transfer multiplier; we do this in class).

Government Actions

How could a Keynesian Economist (Discretionary) vs a Neo-classical Economist address issues like Stagflation, Demand-Pull Inflation, and Recession?

Keynesian: “in the long run, we are all dead”

believe that we shouldn’t wait for the economy to self correct, and thus take government action (fiscal policy) to correct the economy

Neo-Classical Economist

believe that we should wait for the economy to self correct through flexible nominal wages because in the long run, wages are flexible

Explain the difference between Contractionary and Expansionary Fiscal Policy.

Contractionary Fiscal Policy: which 3 actions can the Government take?

Spending: decrease

Taxes: increase

Transfers: decrease

Expansionary Fiscal Policy: which 3 actions can the Government take?

spending: increase

taxes: decrease

transfers: increase

Explain the time lag issue and other issues with Fiscal Policy

Explain what an Automatic Stabilizer is, and give examples

government policy already in place to counterbalance fluctuations in the economy without the need for explicit government intervention or action → automatically adjust to economic conditions

EX:

unemployment insurance

progressive taxation

welfare programs

food assistance programs

Explain the mechanism behind the “Crowding Out” effect

occurs when government spending increases, leading to higher interest rates

government competes with businesses and individuals for available funds

higher interest rates make borrowing more expensive for private sector, resulting in reduced business investments

instead of boosting the economy, government spending may reduce private sector spending

Things to note:

transfer payments aren’t a part of GDP, therefore they count towards consumer spending

change in price level doesn’t change supply but expected price level does

anything that shift production possibilities curve shifts aggregate supply

interest rates are counted in investment → therefore part of AD (C + I + G + Xn)