Ch 24 - Free Trade and Protectionism

- Free trade: international trade (imports and exports) without government restrictions

- Trade of goods and services without trade barriers

- Protectionism:

- Protection of domestic industries against foreign competition

- Government restrictions are placed on the imports of foreign competitors (tariffs, quotas and subsidies)

Arguments for protectionism:

- Protecting domestic employment

- Protecting the economy from low cost labour

- Protecting the economy from low cost labour

- Protecting an infant (sunrise) industry

To conclude:

- Protectionism raises prices to the consumers and producers of the input

- Less choice for consumers

- Competition would diminish and domestic firms would become inefficient

- Reduced economic growth

- Comparative advantage is distorted leading to inefficient use of world resources

Types of protectionism:

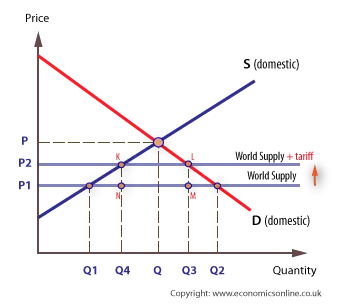

Tariff : a tax that is charged on an imported good. Any tax will cause suppliers to supply less

If wheat (example) is not purchased there is a deadweight loss of welfare

There is a deadweight loss of welfare

There is inefficiency of domestic products and a loss of world efficiency

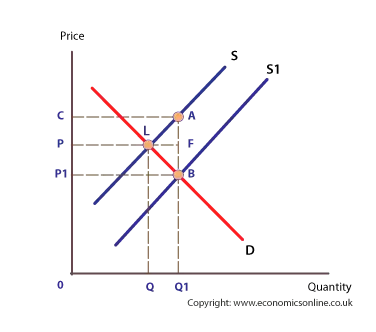

Subsidy: an amount of money paid by the government to a form per unit of output

- Government is giving the subsidy to the fir to make it more competitive

- Domestic supply curve will shift downward reducing the price

- Consumers are indirectly affected by the government’s use of tax revenues to find the subsidy

- Could lead to higher taxes and is an opportunity cost, governments could spend taxes on other things

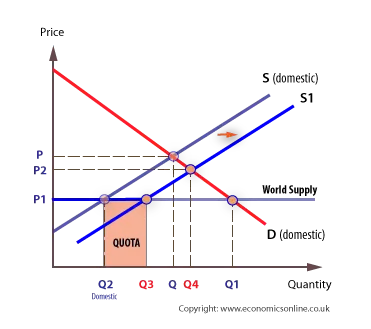

Quotas: physical limit on the number of value of goods that can be imported to a country

- Excess demand of Q3Q2, prices begin to rise

- As price rises, imports are not allowed to supply more

- Domestic products begin to enter the market attracted by the high price of wheat

Voluntary export restraints:

- Agreements between exporting and importing countries in which the exporting country agrees to limit the quality of exports of a specific good below a certain level

Administrative barriers:

- When goods are imported there are always administrative processes

Health, safety, and environmental standards:

- When restrictions are put on the type of goods that can sold in the domestic market

- Embargoes: complete ban on imports

- National embargoes: marketing campaigns to encourage people to buy domestic goods