Bond Valuation and Bond Markets

All Valuation Problems are the Same

• Establishing the value today of future cashflows is the central problem of Finance.

• Although we will often talk about a specific type of valuation problem (Bond, Stock, Project) it is important to recognize that these problems are all simply variations on a theme.

• Thinking about valuation as a generalized problem will simplify the subject of Finance.

Basics of Risk and Investor Required Returns

• So Far – Required return has been arbitrary.

• In Practice – Required return is linked to uncertainty about future cash flows.

• Determining the appropriate required return for a valuation application requires a framework to compare the uncertainty or “risk” of investment opportunities.

Generally:

– The more uncertain the cashflows of a particular investment the higher the risk.

– The higher the risk, the higher the required interest rate.

• In practice this relationship is more complicated and we will look at this later in the semester.

• For Now: Higher Risk results in Higher Required Return.

Basics of Security Valuation

• Security Markets trade in prices.

• Investor’s estimate future cashflows and discount them using the required return to establish the price.

• As cashflow estimates increase/(decrease) market prices increase/(decrease.)

• As investor required returns increase/(decrease) market prices decline/(increase.)

Basics of Bond Valuation

• Bond - The financial asset issued when the government or a corporation wants to borrow money.

• An investor “lends” the company money in return for a promise to receive:

– Regular interest payments until maturity

– The face value of the bond at maturity

Bond Definitions

• Maturity Date

– The contractual final redemption date.

• Principal or Face Value

– The value that the Issuer agrees to repay, this is the amount on which interest is generally calculated.

• Coupon Rate

– The stated interest rate paid under the bond.

– Usually the same as the market rate when the bond is originally issued.

– For most bonds this rate is fixed until maturity

Other Types of Bonds

• Callable Bonds - Bonds where a right (option) is granted to the Issuer to buy back the bond, usually at face value, before the Maturity Date.

• Convertible Bonds - Bonds where a right (option) is granted to the Investor to exchange the bond for some other specified security, usually common stock, before the Maturity Date.

• Zero-Coupon Bonds - Bonds that pay only the face value at maturity, no coupons.

Bond Markets

• Primary Market

– Auctions

– Investment Banks

• Secondary Markets

– Over-the-Counter (OTC) Markets

– Dealers and Brokers

Bond Valuation

Pricing a bond is a simple two step process

1. Define the cashflows.

2. Calculate the aggregate present value of the cashflows.

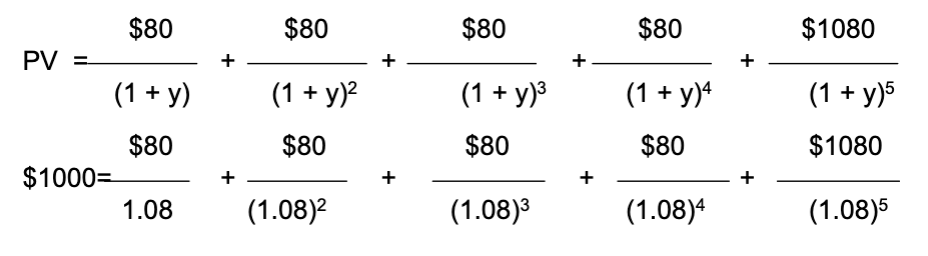

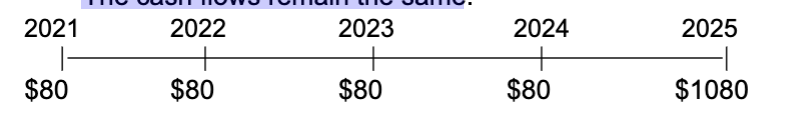

Example

– Five year 8% annual coupon bond

– Discount Rate of 8%

What happens if the discount rate drops to 6%?

What happens if the discount rate increases to 10%?

Bond Valuation

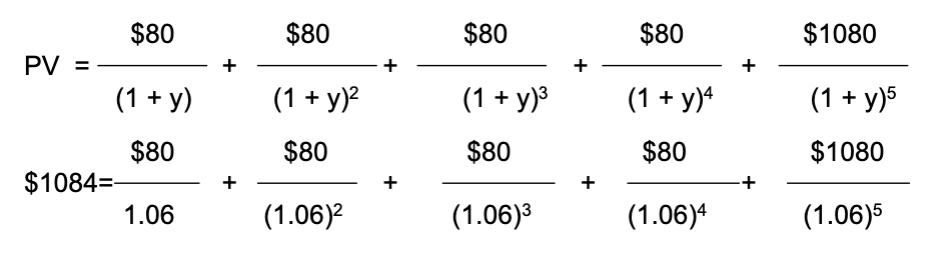

At a 8% discount rate the bond has a value of $1,000 which is the sum of the PV of the Cashflows.

Example: A 8% coupon bond matures in 2025. In 2020 the bond had these future cash flows:

If the required discount rate or Yield (y) on similar bonds is 8%. Then the value of 8% Coupon Bonds is

Bond Valuation

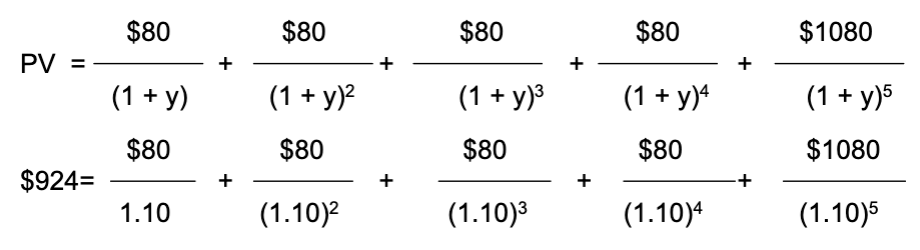

If the discount rate or Yield decreases, the value of the bond increases.

Example: A 8% coupon bond matures in 2025. The cash flows remain the same

If the required discount rate or Yield (y) on similar bonds is 6%.

Then the value of 8% Coupon Bonds is

If the required discount rate or Yield (y) on similar bonds is 10%.

Then the value of 8% Coupon Bonds is

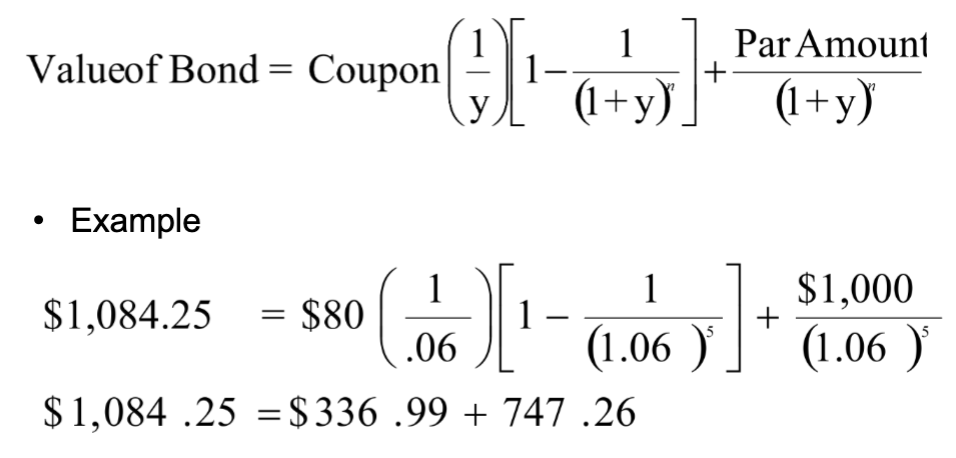

Bond Valuation Using the Annuity Formula

• Value a Bond with a combination of the Annuity and the Present Value formulas.

Yield to Maturity (YTM)

• Yield to Maturity - The single discount rate (internal rate of return) used to calculate the market price of the bond.

– Represents an estimate of the ex-ante expected return on the bond.

– Reflects the required market interest rate for the bond.

– Assumes the bond is held to maturity.

– Different than the coupon rate.

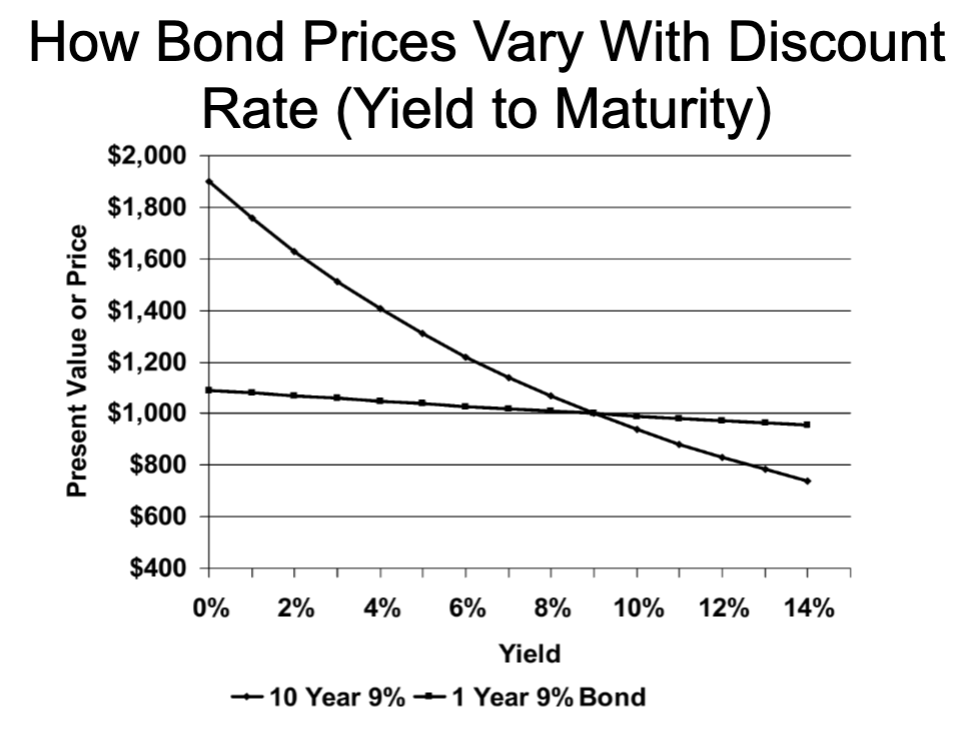

Interest Rates Up (Down) = Prices (Down) Up

• As interest rates increase the value of a bond decreases, conversely as interest rates decrease the value of a bond increases. Therefore generally the

following holds:

• coupon rate < required yield = discount price (<100)

• coupon rate = required yield = par price (100)

• coupon rate > required yield = premium price (>100)

Interest Rate Risk

• The fluctuations in price due to changes in interest rates is called interest rate risk. This risk is present in a bond even if the future cash flows are certain (i.e. risk free).

• This risk increases as maturity increases.

Calculating Returns

• Holding Period Return

– AKA - Internal Rate of Return (solve for r)

– N = maturity, PMT = coupon, FV = par, PV = price, solve for I/Y

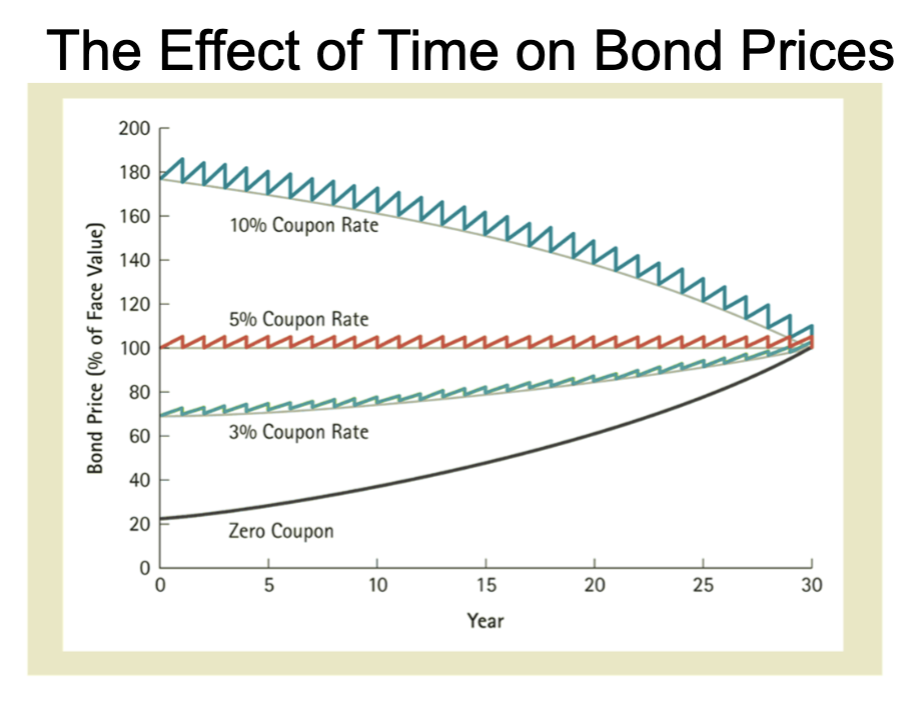

Zero Coupon Bonds

• These bonds pay no coupon interest.

• Treasury bills, which are U.S government bonds with a maturity of up to one year, are issued as zero-coupon bonds.

• Your return is based on paying a discounted price initially and getting back the full par value at maturity.

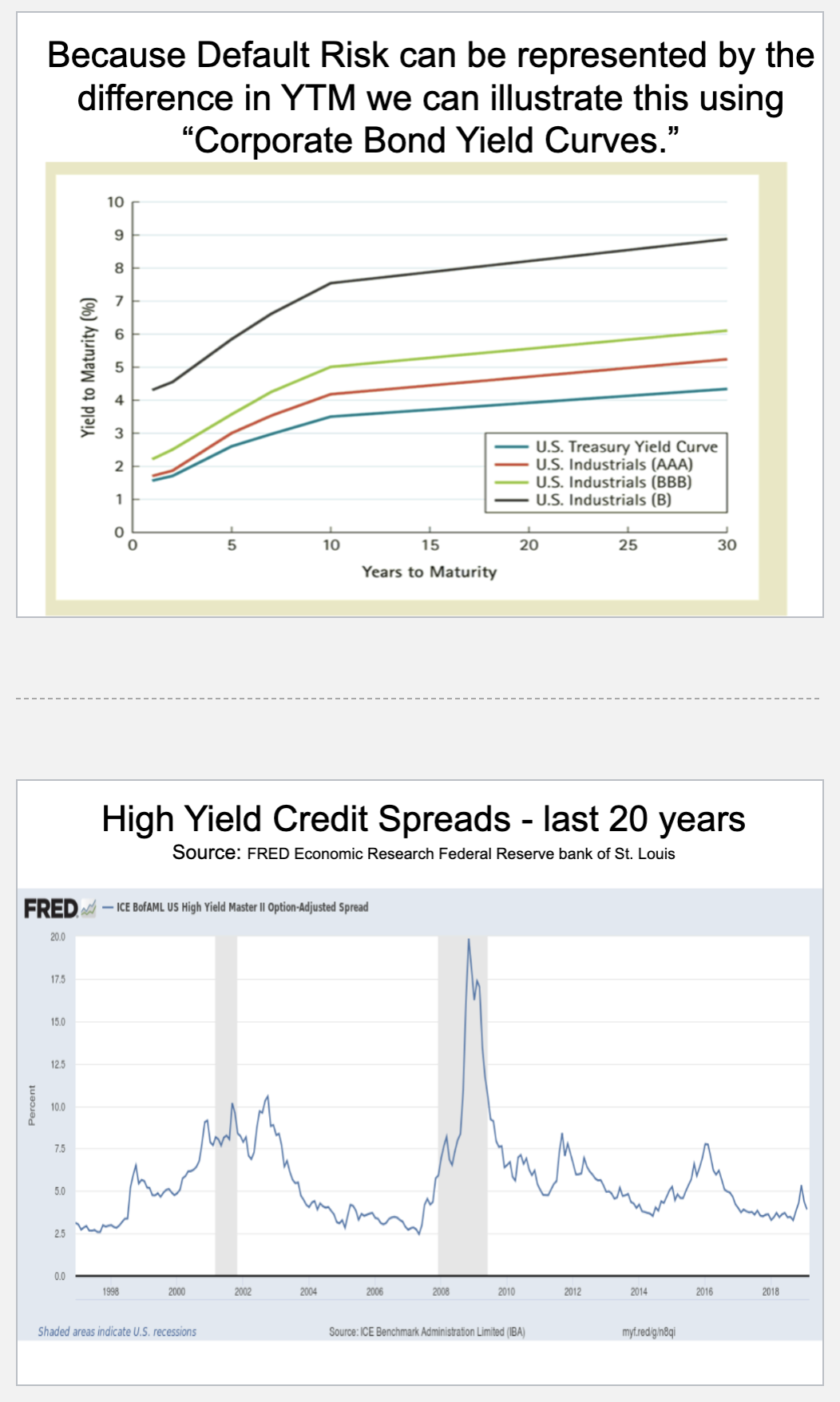

Corporate Bonds and Interest Rates

• The price of a five year 8% annual coupon corporate bond must be lower than the price of a five year 8% annual coupon Treasury bond since there is a possibility that the corporation might default, or fail to make the required payments in the future.

• Corporate issuers need to offer higher YTMs.

• The higher the perceived risk in the corporate bond the higher the YTM.

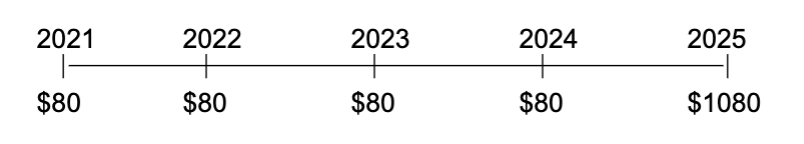

• The difference between treasury YTMs and corporate YTMs is called the spread or default premium.

Corporate Bond YTMs

• The cash flows promised by the bond are the most that bondholders can hope to receive.

• Due to credit risk, the cash flows that a purchaser of a corporate bond actually expects to receive may be less than that amount.

• Investors in these bonds incorporate an increased probability that the bond payments will not be made as promised and prices of the bond would fall.

• Yield to maturity of these bonds is computed by comparing the price to the promised cash flows

Estimating Default Risk

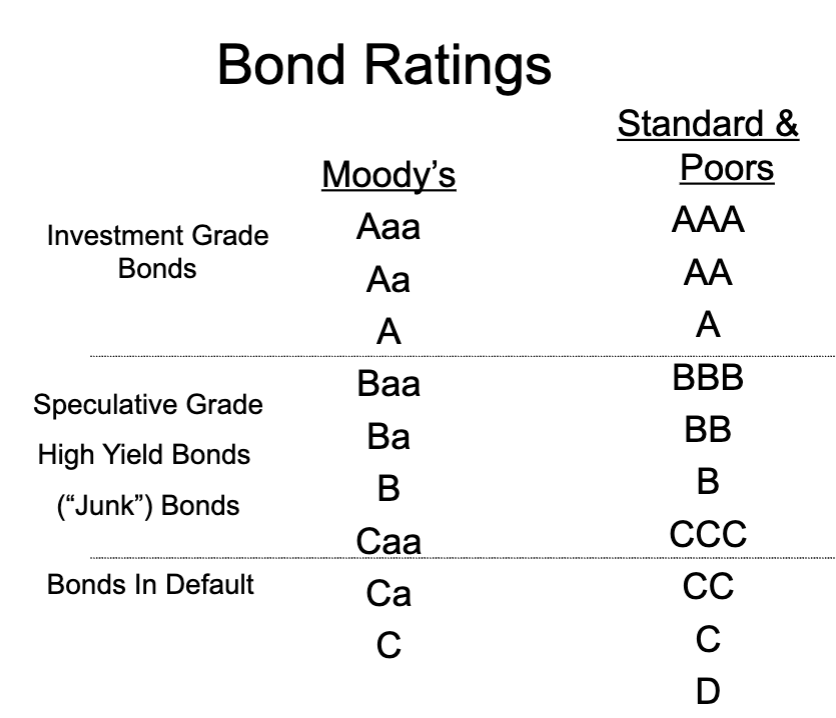

• The likelihood that a corporation will default on their bonds is reflected in the market prices of their bonds.

• This likelihood is also estimated by Bond Rating Agencies.

• There are numerous rating agencies, all of whom charge a fee (paid by the issuer) for their services.

• The two largest rating agencies are Moodys and Standard & Poors.