Ch 17 - Demand Management (demand-side policies)

Fiscal policy: involves the government changing the levels of taxations and government spending in order to influence aggregate demand and the level of economic activity

- AD is the total level of planned expenditure in an economy

Purpose of Fiscal policy:

- Stimulate economic growth during a period of recession

- Keep inflation low

- Stabilise economic growth

- Often simultaneously used monetary policy

- Governments prefer using monetary policy to stabilise the economy

- Fiscal policy depends on size of multiplier

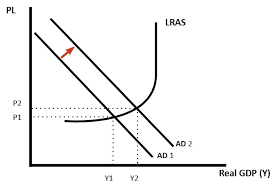

Expansionary fiscal policy:

- Involves increasing AD

- Government will increase spending and cut taxes

- Lower taxes increase government spending → more disposable income

- Will worsen the government budget, governments will need to increase borrowing

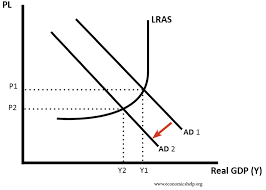

Deflationary Fiscal policy:

- Decreasing AD

- Governments will cut government spending and increase taxes

- Higher taxes → reduce consumer spending

- Improves government budget deficit

Fine tuning: maintaining a steady rate of economic growth using fiscal policy

- If growth is below the trend rate of growth, governments cut taxes to boost spending and economic growth → tax increases, consumption decreases

- If growth is too fast + inflationary, governments increase tax to decrease/slow down consumer spending and reduce economic growth

Limitations of fine tuning:

- Time lags: government spending takes several to integrate in the economy

- Political costs: increasing taxes imposes problems on consumers

- Difficulty forecasting: predicting the state of the economy requires the government to have plenty of info on the likeliness of growth

Demand Management policies: efforts to influence the level of aggregate demand (AD) in an economy. Main types: monetary and fiscal policy

- Consumer confidence is an indirect factor since it helps encourage investments and encourage consumers to spend

Monetary policy: involves cutting or raising interest rates

- Lower interest rates make it cheaper to borrow leading a boost in consumer spending and investment

- Lower interest rates reduce the value of the exchange rate (making exports more competitive and boosting export demand)

- Set by banks

- Independent in selling rates but have to meet the government inflation target

- Cutting interest rates may fail to boost spending, some banks could be unwilling to offer loans which makes lowering interest rates ineffective

Quantitative easing: when banks buy bonds to lower the interest rates on savings and loans

- Reduces long term interest rates and boosts the money supply

Aim of monetary policy:

- Low inflation: enables higher investments in the long term

- Stable economic growth maintains a sustainable rate of economic growth +keeps unemployment low

Based on the trends of the banks, they can choose:

- Higher inflation + higher growth → increase interest rates

- Lower growth + decrease in inflation rates → lower interest rates

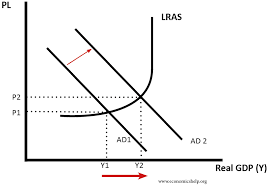

Expansionary monetary policy: expands monetary supply faster than usual or lowering short term interest rates

- If central bank predicts inflation rates dropping below the government’s target, they will cut interest rates

- Lower interest rates stimulate economic activity

- Lower interest rates reduce borrowing costs

- Increases disposable income of consumers

Contractionary monetary policy:

- Central bank increases interest rates to reduce rate of economic growth and reduce inflationary pressure

- Increase in interest rates causes fall in consumer spending and investment leading to lower inflation

Cost push inflation: occurs when the economy experiences rising prices due to higher costs of production and higher costs of raw material

Demand pull inflation: occurs when aggregate demand grows faster than aggregate supply