Introduction into Accounting: Terminology & Equations

Term | Definition |

Budget | A financial or quantitative plan of activity for a future period that has been authorised for implementation. |

Cashflow | The movement of money into and out of a business over a specific period. |

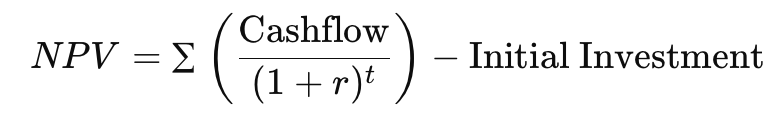

Net Present Value (NPV) | The difference between the present value of cash inflows and outflows used to assess the profitability of an investment. |

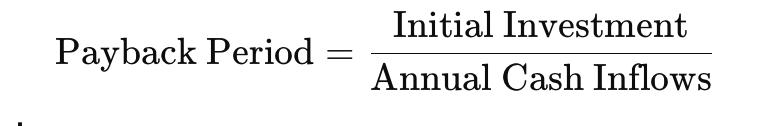

Payback Period | The length of time required to recover the initial investment in a project. |

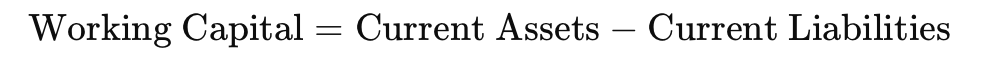

Working Capital | The difference between current assets and current liabilities, measuring short-term financial health. |

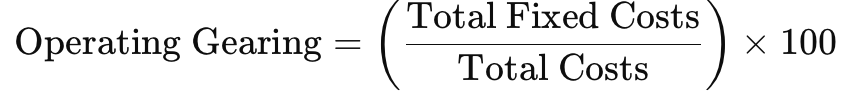

Operating Gearing | The proportion of fixed and variable costs in a business affecting risk and profitability. |

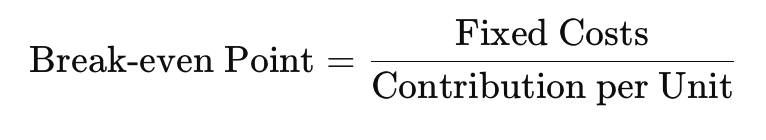

Break-even Point | The sales volume at which total revenue equals total costs results in zero profit. |

Statement of Financial Position | A financial statement that reports a company’s financial position at a given time, showing assets, liabilities, and equity. |

Depreciation | The allocation of the cost of an asset over its useful life. |

Contribution | The difference between sales revenue and variable costs is used to cover fixed costs and generate profit. |

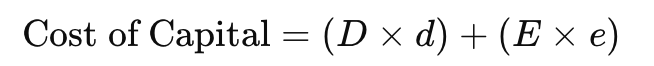

Cost of Capital | Calculates the overall cost of financing using debt and equity proportions. |

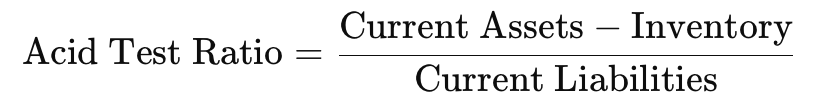

Acid Test Ratio | Measures liquidity by comparing quick assets to short-term liabilities. |

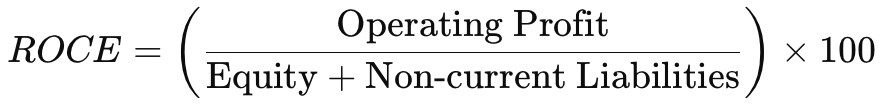

Return on Capital Employed (ROCE) | Assesses the efficiency of capital investment in generating profits. |

Net Profit = Total Revenue - Total Expenses

Margin % = (Net Profit / Revenue) × 100

Return on Investment (ROI) = (Net Profit / Investment) × 100

Annual Growth % = [(New Revenue - Old Revenue) / Old Revenue] × 100

gross margin

Equation Name | Formula |

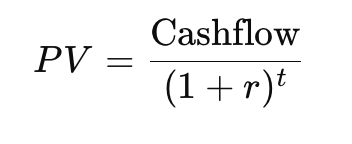

Present Value |  |

Net Present Value (NPV) |  |

Payback Period |  |

Working Capital |  |

Operating Gearing |  |

Break-even Point |  |

Contribution |  |

Cost of Capital |  |

Acid Test Ratio |  |

Return on Capital Employed (ROCE) |  |