WEEK 7

Understanding Mortgages

Definition: A mortgage is a loan provided by a bank or building society to help individuals buy a property. The property serves as collateral for the loan.

Lender's Rights: If mortgage repayments are missed, the lender can repossess and sell the property to recover the owed amount.

Historical Context

1970s and 1980s: Contrary to controlled lending in the 1950s and 60s, home ownership increased due to government initiatives like the "right to buy" and relaxed lending regulations.

Tax Relief: Tax relief on mortgage interest payments (1980-2000) encouraged home purchases.

Recent Trends: Post-2008, banks are more cautious, usually requiring a significant deposit for mortgage approval, with government schemes occasionally available.

Key Financial Concepts

Negative Equity: Occurs when the mortgage value exceeds the property's market value.

Equity in Home: Difference between the sale price of a property and the outstanding mortgage amount.

Loan-to-Value Ratio (LTV): Ratio of the mortgage amount relative to the property's value. For example, a £60,000 mortgage on a £100,000 property gives an LTV of rac{60,000}{100,000} = 60 ext{%}.

Annual Percentage Rate (APR): Represents the cost of borrowing annually, including the interest and unavoidable fees.

Types of Mortgages

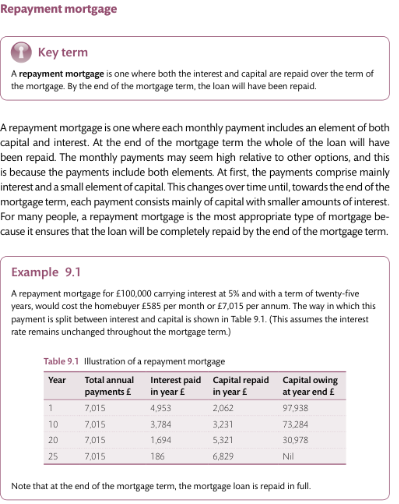

Repayment Mortgage: Both principal and interest are paid off, reducing the loan balance over time.

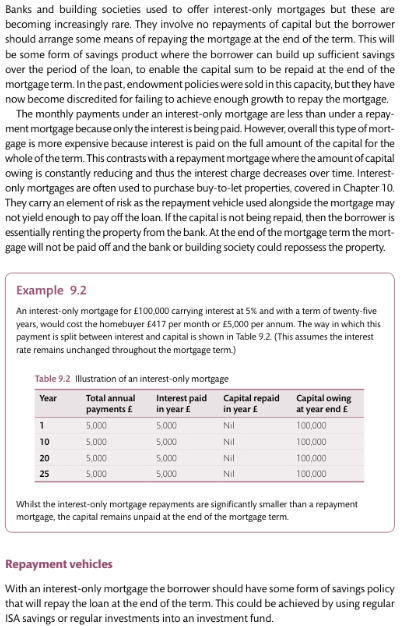

Interest-Only Mortgage: Only interest is paid monthly; the principal remains unchanged until the end of the term.

Fixed Rate Mortgage: The interest rate remains constant for a set period, offering predictability for budgeting.

Standard Variable Rate (SVR): Interest rates can fluctuate based on the lender's discretion.

Tracker Mortgage: Interest rate follows the Bank of England's base rate movements, typically lower than SVR.

Offset Mortgage: Combines savings with the mortgage to reduce the interest paid.

Mortgage Repayment Options

Capital Repayment Method: Regular payments reduce both capital and interest, ensuring the mortgage balance decreases over time.

Insurance for Risks: Coverage options like life assurance and permanent health insurance are available to protect against unexpected events affecting mortgage payments.

Costs of Home Buying

Initial Costs: Include Stamp Duty Land Tax (SDLT), legal fees, survey costs, and home insurance.

Ongoing Costs: Repairs, maintenance, and property insurance remain key financial obligations post-purchase.

Affordability Rule: Generally, one should not spend more than one-third of their available income on mortgage payments after tax and deductions.

Equity Release Schemes for Older Homeowners

Lifetime Mortgages: Allows accessing home equity without needing immediate repayment; interest rolls up until the property is sold.

Home Reversion Plans: Sell part or all of a property to an investment company while retaining the right to live there until death or sale.

Islamic Mortgages

Ijara: A leasing agreement allowed under Sharia law, selling the property back to the buyer over time.

Murabaha: A profit-sharing agreement where the lender buys the property for the borrower and sells it at a markup, allowing repayment over time.

Summary of Home Ownership

Home buying is a long-term investment with both costs and benefits compared to renting.

Understanding various types of mortgages is crucial for making informed decisions.