IB Business Management: 1.3, 1.4, 1.5, 1.6

1.3 Business Objectives

Common Business Objectives

Business Objectives: the articulated, measurable targets that a business must meet to achieve the aims or long-term goals of the business. It is critical that objectives are specific and measurable.

Business objectives come in three types:

Strategic Objectives: the long-term goals of a business that indicate how the business intends to fulfill its mission. Strategic objectives usually include performance goals, such as increasing market share or improving profitability. Sometimes referred to as “global objectives”, strategic objectives are the medium to long-term objectives set by the senior managers.

Tactical Objectives: the short to medium-term targets that, if consistently met, will help a business reach its strategic goals. Whereas strategic objectives are typically set by the board of directors with top executive management, tactical objectives are usually set by executive management working with middle-level management.

Operational Objectives: are the day-to-day objectives set by floor managers (and sometimes workers themselves) so that the company can reach its tactical objectives.

SMART Objectives

Smart objectives are as follows:

- Specific: is the objective clear and well defined?

- Measurable: can the objective be measured to see whether it has been achieved or not?

- Achievable - can the objective be achieved (is it realistic)?

- Relevant - is the objective actually of any use?

- Time-specific - has a sufficient time frame been set?

Business Strategies

- A business strategy is a plan to achieve a strategic objective in order to work towards the aims of the business. This strategy will be medium to long term.

- Strategies are not unplanned or spur of the moment. They involve:

- Careful analysis of where the business is

- The development of a plan (strategy) for how to get to where the business wants to be (aims).

- Careful consideration of how to implement the strategy.

- A periodic evaluation process to determine whether the plan is working or, after a specific period of time, has worked.

- A business tactic is a plan to achieve a tactical objective to work towards the strategies of the business, which themselves are the path to reaching the aims of the business. This tactic will be short-term.

The need for organizations to change objectives

Objectives change because of changes in either of these environments:

- The internal environment, which refers to changes in the conditions with the business

- The external environment, which refers to anything outside the business that nonetheless has a bearing on its operation or performance.

Industrial action: refers to actions taken by unions or other forms of organized labor.

Changes in the internal environment

- Leadership

- HR

- Organization

- Product

- Finance

- Operations

Changes in the external environment (STEEPLE)

- Social: this refers to changes in society or culture

- Technological

- Economic: changes in the market conditions or simply changes in the economy

- Ethical

- Political: a country risk assessment attempts to determine the likelihood that drastic political change in a country could put at risk the investment or operations of a business there

- Legal

- Ecological

Resource Recovery Models: they help to recycle waste into secondary raw material, thus reducing the final disposal of waste and reducing the extraction and processing of virgin natural resources.

Corporate Social Responsibility (CSR)

CSR is the view that businesses, rather than focusing solely on increasing shareholder value, should contribute to the economic, social, and environmental well-being of society.

Why do organisations set ethical objectives?

- Building up customer loyalty

- Creating a positive image

- Developing a positive work environment

- Reducing the risk of legal redress

- Satisfying customers’ ever-higher expectations for ethical behaviour

- Increasing profits

The impact of implementing ethical objectives

- The business itself

- Competitors

- Suppliers

- Customers

- The local community

- Government

Greenwashing: the process where a company tries to create the impression that it is “green” when in reality, it is not.

SWOT Analysis

Developed in the 1960s.

SWOT stands for strengths, weaknesses, opportunities, and threats. Organisations often use this tool themselves during a strategic planning process.

Strengths (Internal to the business) and Opportunities (External to the business) are positive factors while Weaknesses (Internal to the business) and Threats (External to the business) are negative factors.

SWOT Analysis and Market Position

Growth Strategies are best achieved by combining the strengths of a business with the market opportunities, which produces the most positive short-term strategy available from the matrix. This business should pursue growth strategies when it is confident that it has no big issues in any other area.

Defensive Strategies are adopted when a business is at its most vulnerable. When threats and weakness exist in combination, the business needs to act defensively and quickly. Defensive strategies are the most “negative” short-term strategies, but they may be necessary to help the business survive.

Re-orientation Strategies are adopted when a business focuses on addressing its weaknesses in order to use them for the opportunities available in the market. Re-orientation strategies are positive and long term. Their adoption assumes that the business will first address its weaknesses, then can re-orientate itself in a new direction.

Defusing Strategies are designed to eliminate threats in the market by focusing on the strengths of the business. Defusing strategies assume that the business does not need to look for new market opportunities but can simply defuse the threats through a focus on core strengths. This is a neutral and medium to short-term strategy.

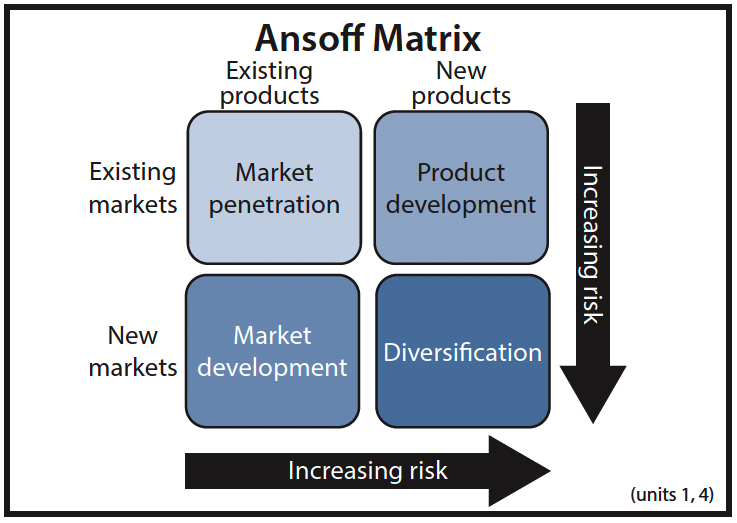

The Ansoff Matrix

Designed in 1957 by Igor Ansoff

The Ansoff matrix looks at the growth potential of a business in terms of the market and product. It considers both the existing markets and products, and new markets and products.

Market Penetration occurs when a business grows by increasing its market share, selling more of its existing products in the same market. Market penetration is considered the safest option for growth, but opportunities for increasing market share may be limited by the competitors in the market. Market penetration relies heavily on promoting brand loyalty in order to encourage repeat customers, and on promotion in general to lure customers away from the competition.

Key factors to increase the chance of success are:

- The growth potential of the market

- The strength of customer loyalty

- The power and ability of competitors

Marker Development expands the market by looking for new markets or for new market segments in the existing market. Market development is a riskier strategy than market penetration, as the business may not understand the new markets.

Key factors to reduce the risks of market development are:

- Effective market research

- Having local knowledge on the ground

- Having an effective distribution channel

Product Development is the development of new products for the existing market. Sometimes it may be a genuinely and wholly new product. Often, however, so-called “new” products are upgrades of existing products. At other times, a “new product” is a variation on an existing product. Product development is riskier than market penetration, with much depending on how loyal customers are to the original products. Key factors to reduce the risks of product development are:

- Effective market research

- Having a strong research and development system

- Having first-mover advantage

Diversification is the riskiest growth strategy a business can pursue. When diversifying—introducing a new product into a new marker—a business combines two elements of risk:

- Lack of familiarity and experience in the new market

- The fact that the new product is untested

Key factors to reduce the risks of diversification are:

- Effective market research

- Due diligence testing to determine

- The attractiveness of the market

- The cost of entering the market

- Recognition of the existing business

- Possible tie-ups with other businesses with the necessary experience

Practice Question: Route 11 Chips

- Privately held companies have a high level of privacy. They do not have to share their financial records with the public and only with the tax agencies. Owners of privately held companies also have a higher sense of control over the business decisions because there are only a limited number of shareholders.

- Corporate social responsibility is that view that businesses should contribute to economic, social, or environmental development instead of only focusing on increasing profit. Route 11 Chips uses 100% renewable hydroelectric power to run its factory and offices. In this way, the business has a focus on sustainability which adds to the business’s corporate social responsibility. Additionally, the business also uses certified organic sweet potatoes which again adds to its corporate social responsibility as it is quite evident that they care about health.

- One challenge that Route 11 Chips faced was that it had no real factory, no distribution network, and no name recognition when starting the business. This meant they had no background knowledge about the business and no resources ready to execute the business idea. However, they were soon able to make the situation positive by an opportunity that they encountered that led them to buy equipment from a chip manufacturer that was going out of business. Thus, this ultimately helped them in the long run.

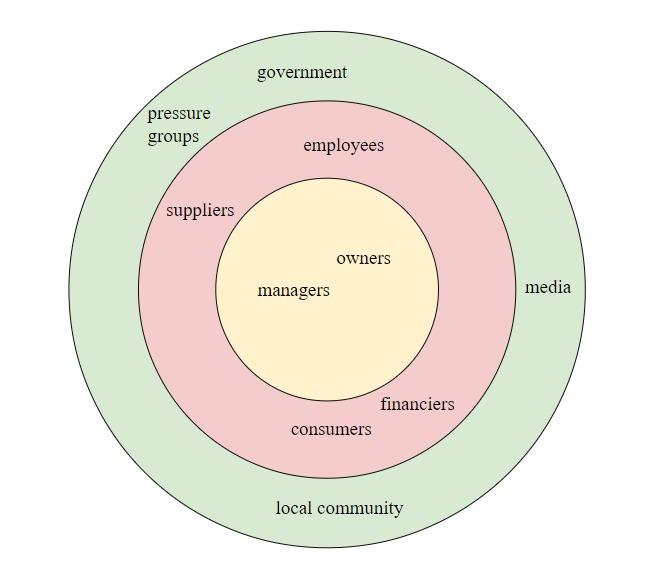

1.4 Stakeholders

Stakeholders are any individual or groups of individuals who have a direct interest in a business because the actions of the business will affect them directly. Sometimes the stake is directly financial and other times it is less direct.

Internal and external stakeholders

One way to categorise stakeholders is to separate them into market and non-market stakeholders. Market stakeholders are those that the organisation has a commercial relationship with. Market stakeholders include groups such as customers, suppliers, and lenders. Non-market stakeholders are stakeholders with which money does not change hands, like the media or the community.

Another common distinction is between primary and secondary stakeholders. Primary stakeholders are those directly affected by or affecting the organisation, whereas secondary stakeholders have an indirect relationship with the organisation.

There is a third common way to categorise stakeholders:

Internal stakeholders are individuals or groups that work within the business

External stakeholders are individuals that are outside the business.

The interests of internal stakeholders

- Shareholders focus on returns on their investments.

- The CEO or managing director focuses on coordinating the business strategy and delivering profits and returns that satisfy the shareholders.

- Senior managers focus on the strategic objectives for their functional areas.

- Middle managers focus on the tactical objectives for their functional areas.

- Foremen and supervisors focus on organising tactical objectives and formulating operational objectives.

- Employees and their unions focus on protecting their rights and working conditions.

The interests of external stakeholders

- Government (at all levels) focuses on how the business operates in the business environment

- Suppliers focus on maintaining a stable relationship.

- Customers and consumers focus on the best product that meets their needs.

- People in the local community focus on the impact of the business in the local area.

- Financiers focus on return on their investments.

- Pressure groups focus on how the business has impact on their area of concern.

- The media focuses on the impact of the business in terms of news stories

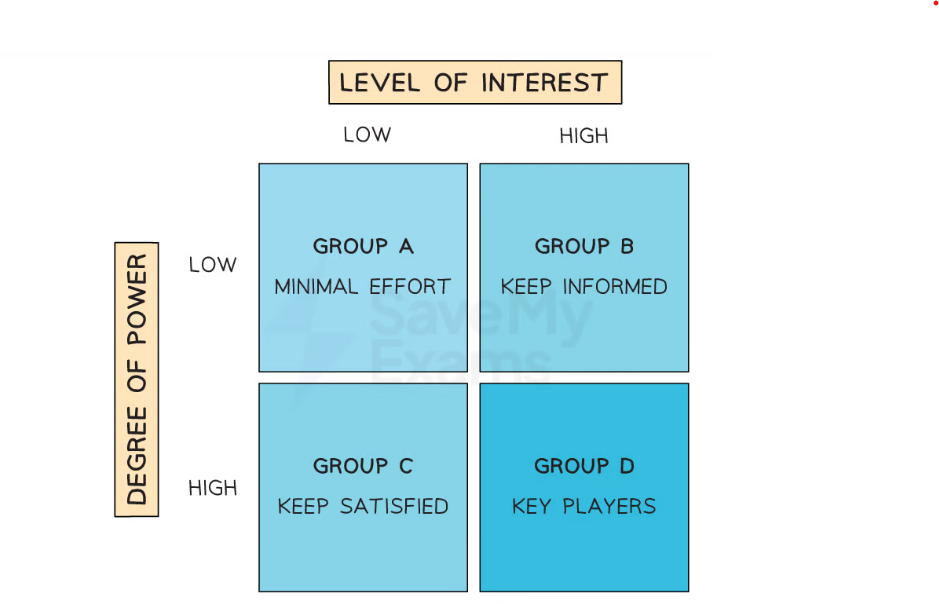

Stakeholder Analysis

Stakeholder Mapping (Power-Interest Model by Johnson and Scholes)

Practice Question: Ecosoluciones

- The internal stakeholders in this case study are the management of Ecosoluciones who realised they may not be able to maintain Alumbre’s wind generators. They realised that they may not be able to fulfil their aims through their strategic and tactical objectives which impacts them directly. The external stakeholders are the community, the Peruvian government and Peru Telecom who are focusing on creating the best outcome possible.

- Oftentimes, conflicts between stakeholders of a business arise. One of the main areas of conflict between stakeholders in the Alumbre project is the fact that the Spanish government suspended part of their funding for Ecosoluciones and as a result, the management felt that they would no longer be able to maintain Alumbre’s wind generators. This will have a chain reaction as the entire community will be affected by the project shutting down. The withdrawal of funding may have caused a conflict between multiple stakeholders including the management of Ecosoluciones and the Peruvian government as this project was helping develop depressed parts of the country and now it will negatively affect them.

Another conflict that can arise is between the management and the textile factory. When the Alumbre project started, the textile factory bought new machinery and new jobs were created. However, while the management of Ecosoluciones can justify shutting down the project because of the minimal funding received, conflict can arise because this will negatively affect the factory. Firstly, they bought costly and new equipment that was run on wind generators that were to be maintained by Ecosoluciones. Since the management may pull out of this plan, the factory will have to look for new employees who know how to fix those types of generators or even another organisation which is time consuming and wastes the factory’s resources. Additionally, employees had to have been trained in working these new machines that were bought and now that there is a chance that the machines might be useful if the generators stop working and the factory cannot afford to fix them, this again will negatively affect the factory.

1.5 Growth Evolution

The impact of the external environment on a business

PEST: Political, Economic, Social, and Technological (first emerged in 1967)

PESTLE: Political, Economic, Social, and Technological, Legal, and Ethical

STEEPLE: Sociocultural, Technological, Economic, Environmental (also known as Ecological), Political, Legal, and Ethical

Common Influences in STEEPLE Analysis

Sociocultural

- Lifestyles

- Social mobility

- Demographics

- Education

- Fashion or tastes

Technological

- Technological improvements

- New technology transfer

- Infrastructure

- ICT

- Research and development costs

Economic

- The economic or business cycle

- The rate of economic growth

- The rate of inflation

- The rate of unemployment

- The exchange rate

- Interest rates

Ethical

- Corruption

- Codes of business behaviour

- Transparency

- Fair trade

Political

- Political stability

- Trade policies

- Regional policies

- Lobbying or electioneering

Legal

- Regulations

- Employment laws

- Health and safety legislation

- Competition laws

Environmental

- Depletion of renewable resources

- Global warming

- Organic farming

- Carbon footprints

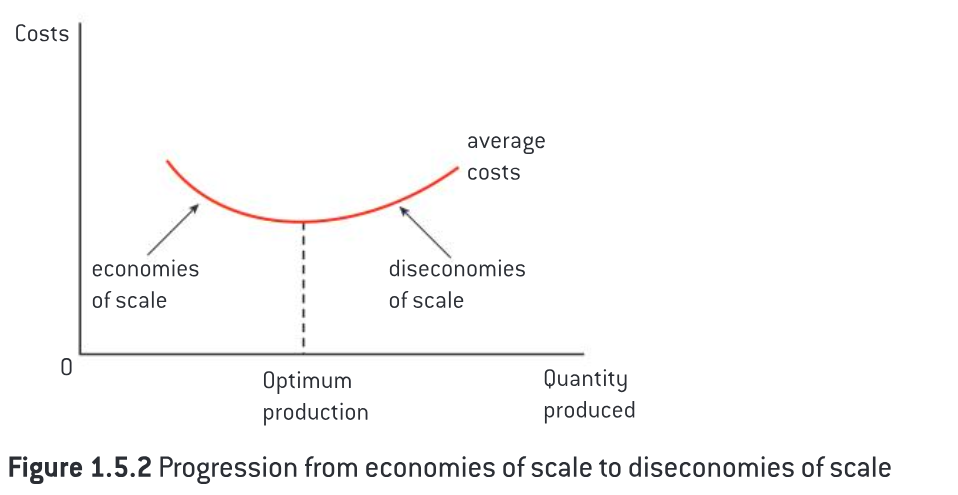

Economies and diseconomies of scale

Scale of operations refers to the size or volume of output. When a business increases its scale of operations and in the process becomes more efficient, the business has achieved economies of scale. The term “economies of scale” refers to the reduction in the average unit cost as a business increases in size.

Economy of scale: the decrease in per unit production cost as output or activity increases.

Diseconomy of scale: the increase in per unit production cost as output or activity increases.

Efficiency is measured in terms of costs of production per unit.

TC = FC+VC

Fixed costs are costs which do not change accordion to the amount of goods or services produced by the business

Variable costs are costs which increase or decrease according to the amount of goods or services produced.

Average costs (or unit costs or average unit costs) - all three refer to the total cost per unit

Average cost = total cost/quantity produced

A business can become more efficient if it can lower average unit costs. Efficiency is not related to production alone.

Internal and external economies of scale

Internal economies of scale

- Technical: Bigger units of production can reduce costs because of the law of variable proportions—the increase in variable costs spread against a set of fixed costs. This law states that when the quantity of one factor of production is increased, while keeping all other factors constant, it will result in the decline of the marginal product of that factor. Law of variable proportion is also known as the Law of proportionality. When the variable factor is increased while keeping all other factors constant, the total product will increase initially at an increasing rate, next it will be increasing at a diminishing rate and eventually there will be a decline in the rate of production.

- Managerial: A bigger business can afford to have managers specialising in one job as opposed to trying to do everything.

- Financial: Bigger businesses are less risky than smaller businesses.

- Marketing: Bigger businesses can run more effective marketing campaigns.

- Purchasing: Big businesses can gain discounts by bulk buying—buying in large quantities.

- Risk bearing: Big businesses can afford to produce a bigger range of products and in doing so spread the risk of one product failing—hedging their bets.

External economies of scale

- Consumers

- Employees

Internal and external diseconomies of scale

Internal diseconomies of scale

- Technical

- Managerial

- Financial

- Marketing

- Purchasing

- Risk bearing

External diseconomies of scale

- Employees

Reasons for businesses to grow or stay small

Reasons for businesses to grow

- Survival

- Economies of scale

- Higher status

- Market leader status

- Increased market share

Reasons for businesses to stay small

- Greater focus

- Greater prestige

- Greater motivation

- Competitive advantage

- Less competition

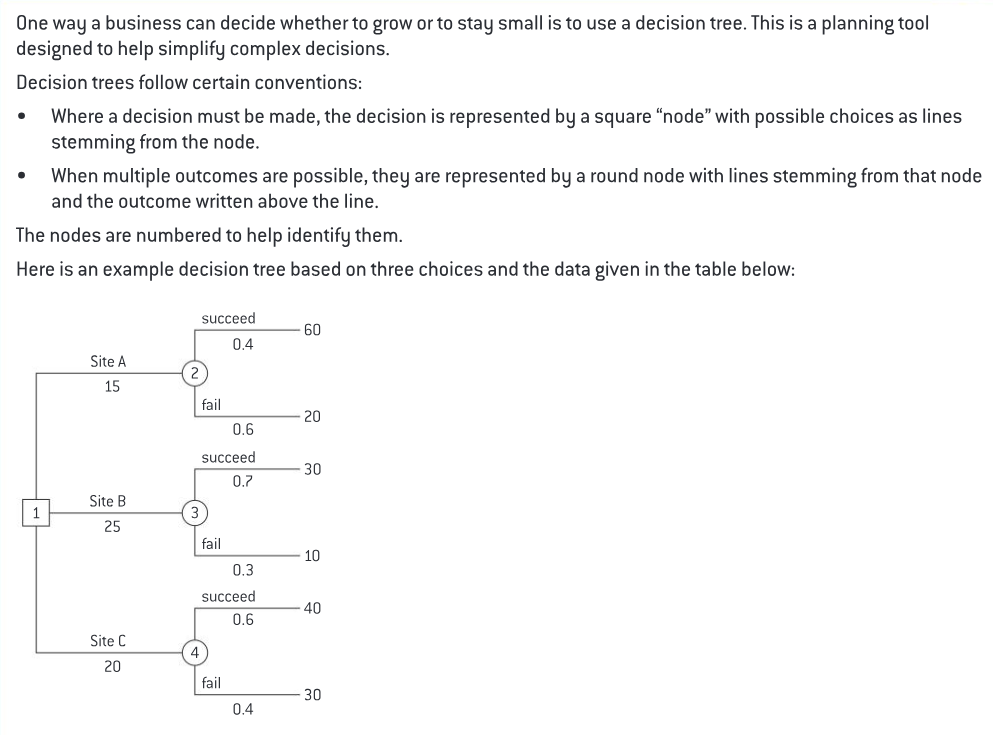

Decision tree

The difference between internal and external growth

Internal growth is sometimes referred to as organic growth. This occurs when a business grows by relying on its own resources and capabilities: investment in new products, or new sales channels, or more stores etc. to increase sales. It is a less risky way of growth.

External (fast-track) growth occurs when a business expands with the aid of resources and capabilities not developed internally by the company itself. Instead, the company obtains these new resources and capabilities by acquiring another company or forming some type of relationship, like a joint venture, with another organisation. It is riskier but faster.

External growth methods

Mergers and acquisitions (M&As) and takeovers

Merger occurs when two companies that are theoretically “equal” legally become one company.

Acquisition is when one company purchases a majority or all the shares of another company.

Takeover is when one company acquires a majority or all the shares in another company. When the word “takeover” is used, the situation usually means that the company being acquired does not welcome the transaction. Also known as hostile takeover. Only publicly held companies can be taken over. Public companies, whose shares sell in public forums, can be taken over.

Integration occurs in the one the following ways:

Horizontal integration occurs when the two businesses being integrated are not merely in the same broad industry, but are actually in the same line of business and in the same chain of production

Vertical integration occurs when one business integrates with another at a different stage in the chain of production, or when a business begins operations in an earlier stage through internal growth.

- If a business becomes involved in an earlier stage in the chain of production (either through integration or internal growth), this process is called backwards vertical integration. This usually occurs when a business wants to protect its supply chain.

- Forwards vertical integration occurs when one business integrates further forward (to a later stage) in the chain of production. This usually occurs when a business wants to ensure a secure outlet for its products.

Conglomeration occurs when two businesses in unrelated lines of business integrate. This type of integration is also known as diversification. It occurs for many reasons but mainly to reduce overall corporate risk. Another reason that a business may diversify is to have complementary seasonal activity.

Integration has many advantages, including economies of scale, complementary activities, and control up or down the chain of production. However, M&As can be costly. A culture clash can also occur. The profitability of an integration can change over time.

Joint ventures is when an organisation is created, owned, and operated by or more other organisations. The joint venture is legally distinct from the organisations that created it. After the defined time period is over, the new business is either dissolved or incorporated into one of the parent businesses, or the two parent firms extend the time frame. Sometimes in a joint venture, one of the partners begins to play a dominant role and then buys out the other.

Joint ventures have the advantage that the two forms typically enjoy greater sales, but neither loses legal existence or its identity. They also have the advantage of the two businesses forming the joint venture can bring different areas of expertise, amalgamating to create a powerful combination. However sometimes joint ventures do not produce the desired outcome or a company realises that it could have accomplished what the joint venture is doing without having to share the profits with the other company. All partnerships run the risk that a disagreement between partners will occur.

Strategic alliances occur when two or more businesses cooperate in some legal way that enhances the value for all parties. Members of the alliance retain their independence. A strategic alliance is less binding than a joint venture, as no new organisation is created. Strategic alliances differ from joint ventures in several fundamental ways:

- More than two businesses may be part of the alliance

- No new business is created

- Individual businesses in the alliance remain independent

- Strategic alliances are more fluid than joint ventures

All of these strengths are also weaknesses. The more businesses that are involved in a strategic alliance, the more challenging coordination and agreement becomes. Without legal existence, the alliance has less force than an enterprise that exists in law. Individual businesses may benefit from the alliance, but remaining independent means that they do not get the capital strength of legal merger with other enterprises, nor do they enjoy economies of scale that other forms of external growth provide. Lastly, greater fluidity of members also means that the alliance lacks stability.

Franchising is a method of distributing products or services, where the franchisor develops products or services and its brand and then sells the right to use the brand and its products or services to franchisees. The franchisee pays a fee and typically some percentage of revenue or profits to the franchisor.

A business that starts to franchise is the franchisor.

The cost of the franchise has two parts. First, the franchisee must pay for the franchise itself—essentially a right to operate a business offering the franchisor's concept and product or service. Then the franchisee must typically pay royalties—a percentage of sales or flat fee—which go to the franchisor.

The franchisor will provide:

- The stock

- The fittings

- The uniform

- Staff training

- Legal and financial help

- Global advertising

- Global promotions

The franchisee will:

- Employ staff

- Set prices and wages

- Pay an agreed royalty on sales

- Create local promotions

- Sell only the products of the franchisor

- Advertise locally

Advantages to the franchisee:

- The product exists and is usually well known

- The format for selling the product as established

- The setup costs are reduced

- The franchisee has a secure supply of stock

- The franchisor can provide legal, financial, managerial, and technical help

Disadvantages to the franchisee:

The franchisee:

- has unlimited liability for the franchise

- has to pay royalties to the franchisor

- has no control over what to sell

- has no control over supplies

Advantages to the franchisor:

The franchisor:

- gains quick access to wider markets

- makes use of local knowledge and expertise

- does not assume the risks and liability of running the franchise

- gains more profit and the sign-up fees

- makes all the global decisions

Disadvantages to the franchisor:

The franchisor:

- loses some control in the day-to-day running of the business

- can see its image suffer if a franchise fails or does not perform properly

Practice Question: Statson Inc (SI)

- In this case study, Statson Inc acquired a faucet manufacturer. One of the main features of an acquisition is that a company buys all or most of the shares of another business. Another feature is that the business that is being acquired agrees to such an acquisition.

- Economies of scale happen when a business becomes more efficient, and the cost per unit decreases as production of goods increases. In this case, Staston Inc anticipated economies of scale to happen when they acquired another company, however the opposite occurred. Diseconomies of scales is the increase in the cost per unit as the production of goods increases.

- One of the reasons why SI grew is because they wanted to acquire the market leader status. This is also why they acquired another company because by becoming the market leader, they can control what the price of goods will be in the market and they become the market standard. However, a reason why they should have remained small is that their customers would have thought them to be more reliable because the personal connection between the business and the customer that comes from smaller businesses is harder to communicate in a bigger business.

1.6 Multinational Companies (MNCs)

Globalisation

Globalisation is processed by which the world's regional economies are becoming one integrated global unit. Post-national businesses means that, although these companies have a home of record (the “home” office is legally registered in one country), the businesses are otherwise transnational; apart from the legal home of record, these businesses consider no place their home (or every place their home).

Globalisation can have a significant impact on the growth of domestic businesses:

- Increased competition

- Greater brand awareness

- Skills transfer

- Closer collaboration

Reasons for the growth of multinational companies

Multinational corporation (MNC) is a company that operates in two or more countries. It is generally a very large company, but it does not have to be. MNCs are also sometimes referred to as multinational enterprises (MNEs).

Four factors have allowed multinational companies to grow rapidly:

- Improved communications - not only ICT, but also transport and distribution networks.

- Dismantling trade barriers - allowing easier movement of raw materials, components, and finished products.

- Deregulation of the world’s financial markets - allowing for easier transfer of funds, as well as tax avoidance

- Increasing economic and political power of the multinational companies - this can be of enormous benefit, especially in middle and low-income countries.

The impact of multinational companies on the host countries:

Advantages:

- Economic growth

- New ideas

- Skills transfer

- Greater choice of products

- Short-term infrastructure projects

Disadvantages:

- Profits being repatriated

- Loss of cultural identity

- Brain drain

- Loss of market share

- Short-term plans

Practice Question: Khumalo Pottery (KP)

- There are many advantages and disadvantages of the American company opening a factory in Johannesburg that positively and negatively impact South Africa.

Opening a factory in Johannesburg benefits South Africa in multiple ways. South Africans will now have more options to choose from and it also expands the South African market and leads to economic growth. Since the company will be providing employment, it also benefits South Africa by increasing opportunities and jobs. Moreover, the company will be providing fringe payments that KP does not offer and the salary is also higher. This again increases opportunities for South Africans and increases the employees’ financial status. Additionally, a skills transfer will take place where not only the local people will benefit the company but the company itself can show new ideas and tactics to the employees.

However, there are also some negative effects of the American company opening a factory in Johannesburg. One of the biggest ones is the brain drain that will happen. As many of the citizens and even employees of KP flock to the American company, many of the highly skilled workers will be lost to a company that provides jobs that require low skills. Additionally, there will be a loss of cultural identity where the precision required for the artwork will be lost as the employees now go to jobs where the traditional African designs and artwork are not the main focus.

2.1 Introduction to human resource management

Human resource management is how an organisation manages its human resources; includes recruitment and retention, setting compensation and benefits, and specifying job responsibilities.

Demographic changes are shifts in demographic factors, such as birth rates, death rates, education levels, religion, ethnicity, age, etc.

Labour mobility is the ability of workers to move occupationally or geographically (within countries or internationally) i.e. how easily workers can change their place or type of work.

The internal and external factors that influence HR planning

External factors

- Technological change

- Government regulations

- Demographic change

- Social trends

- The state of the economy

- Changes in education

- Labour mobility

- Immigration

- Changes such as flexi-time, remote working, or gig-economy contracts can also influence how people work

Immigration is the international movement of people into countries where they are not citizens. People who are temporarily in a foreign country, like tourists or students, are not considered to be immigrants; rather immigrants are those who seek permanent residency in the new country.

Flexi-time is a flexible work schedule that allows workers to adjust starting and finishing times of their work day, giving them flexibility to meet other demands (such as childcare requirements).

Gig economy is an economy where many positions are temporary and organisations hire independent workers to short-term commitments.

Internal factors

- Changes in business organisation

- Changes in labour relations

- Changes in business strategy

- Changes in business finance

Changes in work patterns, practices, and preferences

Some of the factors changing the work environment include:

- Privatisation and the move away from public-sector to private-sector employment.

- Increased migration of potential employees in a country or region and across the globe.

- Increasing participation of females in the workforce.

- Changing educational opportunities.

- Increasing urbanisation and the consequent rise in stress levels

- An ageing population and increasing average age of the workforce

Changes in work practices

Work practices in decline

- Full-time work

- Permanent contracts

Work practices on the increase

- Part-time work: when employees work less than the full-time weekly maximum hours.

- Temporary work: when work that is on a fixed-term contract, usually of a temporary nature (for example, to cover maternity leave). The employee would normally sign up to an agency who finds them work.

- Freelancing: when someone who is self-employed works for several different employers at the same time.

- Teleworking: work taking place from home or a telecommunication centre. Usually, the employee would have a core number of hours they have to work at the office, and the remainder would be from home.

- Homeworking: when an employee works from home. Usually, the employee would have a core number of hours they have to work at the office, and the remainder would be from home.

- Flexi-time: work involving a set number of hours of an employee’s own choosing. Usually, the employee would have a core number of hours they have to work at the office; the rest is up to the employee.

- Casual Fridays: when an employee is allowed to wear less formal dress on a Friday so that it is easier to go away at the weekend.

- Three-day weekend: instead of working, say, five eight-hour days, the employee works four ten-hour days and so has a three-day weekend.

- The gig economy: where organisations hire independent workers for short-term commitments. Some people laud the gig economy for its flexibility for both employers and employees, while others criticise it as it typically means workers are not receiving most of the benefits of full-time employment, such as sick leave or paid vacation.

Changes in work preferences

- Career breaks “sabbatical”

- Job share

- Downshifting

- Study leave

The impact of innovation, ethical considerations, and cultural differences

Innovation

A business committed to being innovative must have a greater strategic focus on HR than any other business function. Innovations come from people. The business will not be successfully innovative unless it recruits and retains the right people. Developing a supportive and stimulating business environment—a vital part of HR planning—will help the creative process.

Ethical Considerations

HR processes are based on relationships, which are reflected in the way that the business treats its employees. Today most stakeholders rightly insist that businesses should treat their employees ethically. The internet enables people to send and receive information. Social network sites, in particular, can be places where employees can tell others how they have been treated. As a result, businesses must be careful to act in an ethical manner—or at least to create that appearance

Ethical issues in the HR plan:

- Performance appraisal

- Right to privacy

- Lay-offs and/or redundancies

- Restructuring

- Employment

- Discrimination

- Health and safety

- Salaries and financial remuneration

Cultural differences

The citizens of many countries are becoming increasingly diverse as children of migrant workers grow up as citizens and their parents’ adopted country. Businesses that adopt their HR plan to suit a more varied cultural workforce are more likely to be successful with the diverse workforce, especially if their markets are as diverse as their workforce.

Some of the factors that might affect the cultural expectations of a business’s employees:

- Power distance

- Individualism

- Masculinity

- Uncertainty avoidance

- Long-term orientation

- Humour

- Personal space

- Body language

- Dress

The concept of “power distance" was developed by Geert Hofstede to indicate the acceptance by society of inequality. Power distance refers to the extent to which people in a particular society or organisation accept that power is not distributed equally. Inequality is a fact, not a problem, and all members of the culture accept this fact.

According to Hofstede, employees from a society with a high level of power distance would not expect to be consulted and included in decision making. They are more accepting of authority. Employees from countries with a low score would expect the opposite.

Training people to work in diverse workforces can reduce potential misunderstanding and friction that can emerge from cultural differences. Such training can also help businesses to take advantage of one of the most important benefits of a diverse workforce: increased innovation and creativity. Innovation occurs when people see a problem and solve it. When people from different backgrounds are gathered together to solve problems, the diversity of perspectives increases the likelihood that a successful and novel solution will be found.

Reasons for resistance to change in the workplace

- Discomfort

- Fear

- Insufficient reward

- Lack of job skills

- Loss of control

- Mistrust

- Poor communication

- Poor timing

- Prior experience

- Social support

HR strategies to reduce the impact of change and resistance to it

Organisations and managers can reduce the impact of change through various steps. The first is simply assessing the potential impact of the change, assessing employees’ possible reactions to it, and determining the degree to which managers can control the change process. Thereafter, the

management team should take the following steps:

- Develop a vision for the change process and the desired outcomes. If necessary, the business may have to realign its largest aims and vision for the organisation.

- Forecast and allocate the necessary resources to implement the change.

- Involve employees in the change process from the outset so they are not surprised and so they do not feel powerless.

- Regularly communicate to all appropriate stakeholders how the change process is unfolding. Managers should not be afraid to report problems or implementation dips. Pretending that problems in the process are not occurring when they clearly are will weaken employees’ confidence. On the other hand, managers should report successes in the change process to inspire confidence.

- Train employees in advance of those changes that affect them directly, which should allow them to see the benefits of change immediately. If employees are not properly trained, the fears of lack of competence will be heightened.

- Routinely communicate the benefits of the changes.

- Be aware of the stress that change can cause and support employees as much as possible before, during, and after change.

Practice Question: Premium Fruit Drinks (PFD)

- Gig economy refers to an economy where work is usually temporary and independent workers are hired with short-term commitments. In this case, PFD is thinking of reaching out to independent contractors who belong in the gig economy.

- Human resources are responsible for multiple things. One of them is hiring the best workers after appraising the tasks that will need to be performed. For example, PFD usually requires low-skilled workers; however, to run the machines and nutritionists, they need to find more employees. This is where human resources come in. They have to make sure they are hiring the best people for the job. Additionally, these specialised workers will need to be trained and need to be paid high salaries. Human resources will again make sure that the workers are being trained properly and are being given the right compensation.

- One internal factor that will influence PFD’s human resource planning is the fact that they also want to focus on the development of new drinks. This change in business strategy will influence human resource planning because PFD will need to hire specialised workers and nutritionists. An external factor that will influence PFD’s human resource planning is that Kuala Lumpur has grown significantly in the past 30 years and there are more technical schools and universities. Thus, they can focus on students looking for jobs and who are easier to train.

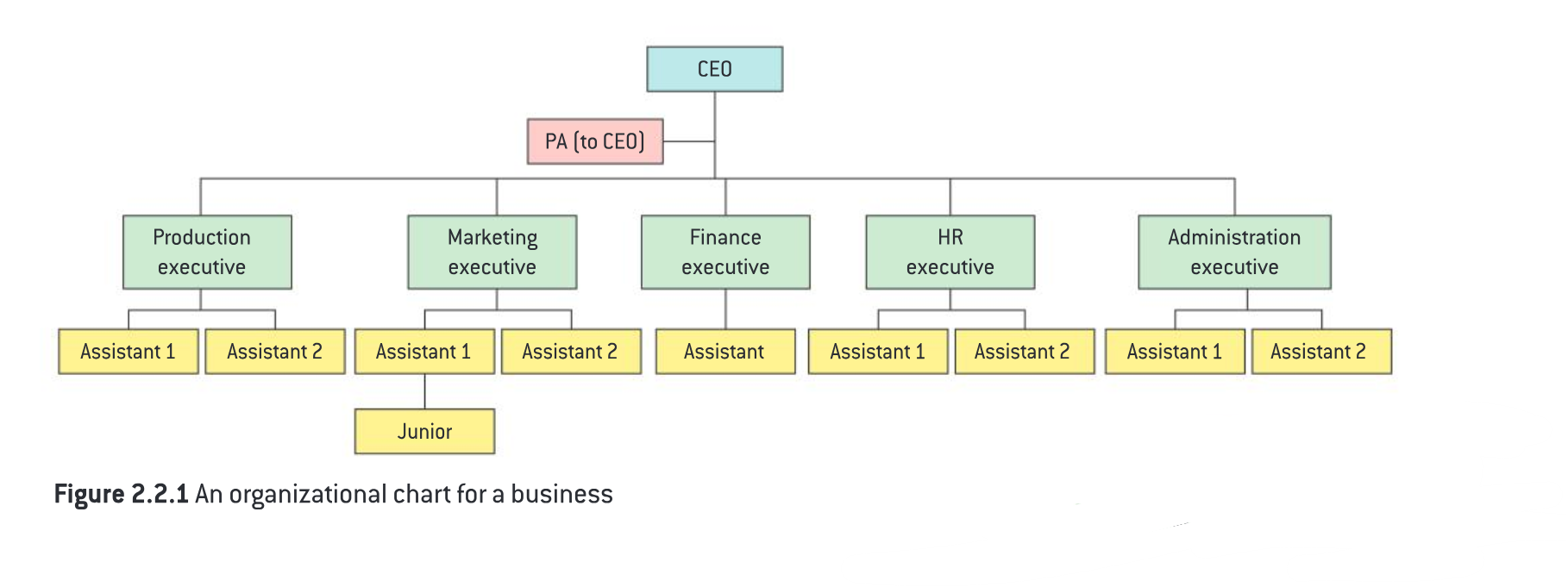

2.2 Organisational Structure

The organisational chart depicts the reporting relationships within an organisation. All levels of the organisation are depicted and the chart shows who reports to who down to the least senior level of employees in the organisation.