Chapter 6: Reporting & Interpreting Sales Revenue, Receivables, and Cash

Chapter 6:

Revenues Recognition Principle:

When a company transfers promised goods/services to a customer

In the amount expected to receive

Transferred: When titles & risks of ownership transfer to the buyer

Options:

When the goods are shipped → FOB Shipping Point

When the goods reach their destination → FOB Destination

Revenue on Income Statement:

Gross Revenues → Revenue Acct (R)

Contra-Rev Acct (XR)

Credit Card “Discounts”

Sales Discounts

Returns & Allowances

Net Sales Revenue → Where the income statement starts

Credit Card Sales (Customers):

Companies often accept Credit card payments from customers

Credit card companies charge a fee for this service (credit card discount)

Since the company will never collect this cash, revenue should be reduced

Some Companies report credit card discounts in other operating expense line items, ie Selling, General, & Administrative Expenses

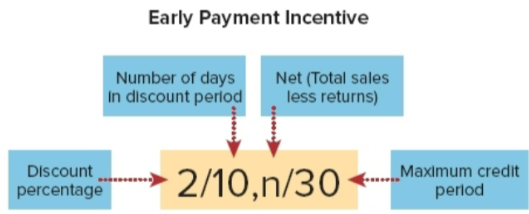

Sales Discounts to Businesses:

Companies often provide direct credit to business customers

Credit sales occur on an “open account” with no formal written promissory note

Credit sale terms are printed on a sales document & invoice

Sales Discounts encourage prompt payment from customers, reducing the need for the company to borrow money to meet operating needs

Customers often pay bills by providing discounts first

Sales Returns & Allowances:

Customers have a right to return unsatisfactory or damaged merchandise and receive a refund or adjustment to their bill (allowance)

Sales (& associated receivables) must be reduced when returns occur or when allowances are offered

Revenue for Bundled Goods & Services:

Bundling of goods & services within one sales contract is common in a variety of industries

When a seller promises multiple goods or services in a single sales contract, they must:

Determining the value of each good & service

Recognize revenue when the performance obligation is satisfied

Receivables:

When companies generate credit sales, companies record receivables

Because receivables represent a right to collect cash in the future

A certain portion may become uncollectible

GAAP requires companies to record Bad Debt Expense (E) to reflect the estimated uncollectible amount

Since collectability is often uncertain, companies use an allowance account, Allowance for Doubtful Accounts (XA), to record aggregated bad debt expense

Writing off Specific Accounts:

Occasionally, it becomes known that a specific account is uncollectible (ie bankruptcy)

Receivable needs to be removed (credited) since it is no longer expected to provide a future economic benefit

Allowance also needs to be reduced (debited) since a reserved portion of the estimated uncollectible amount has been realized

Calculating Bad Debt/Allowance:

Two main methods to estimate Bad Debt in the period of the sale

Percentage of Credit Sales:

Focus on changes

Calculate Bad Debt Expense as a present of total credit sales for the period

Use historical % of credit sales resulting in bad debts

Bad Debt Expense = Total Credit Sales x Bad Debt 5

Debit calculated Bad Debt Expense

As a debit & credit Allowance for Doubtful Accounts for the same amount

Aging of The Accounts Receivable:

Focus on the Balance

Calculate the uncollectible portion of A/R (allowance) based on the age of existing receivables

As receivable gets older & more overdue, it is less likely to be collected

Record Bad Debt Expenses to update the Allowance balance to the desired amount