Investment Risk Management

📈 Monthly Returns

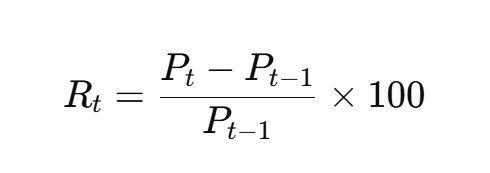

Definition: The percentage change in a stock's value from the start to the end of each month.

Formula:

Purpose: Breaks down performance over shorter periods to detect seasonal trends, momentum, or volatility patterns.

Kid-Friendly Notes

What it is:

“How much money the stock made or lost each month.”

📉 Standard Deviation (σ)

Definition: Measures how much monthly returns deviate from the average return.

Indicates:

High σ = High risk/volatility.

Low σ = Stable returns.

Strategic use: Investors may prefer lower σ for long-term holdings, higher σ if seeking aggressive gains with controlled exposure.

Kid-Friendly Notes

What it is:

“How bumpy the ride is.”

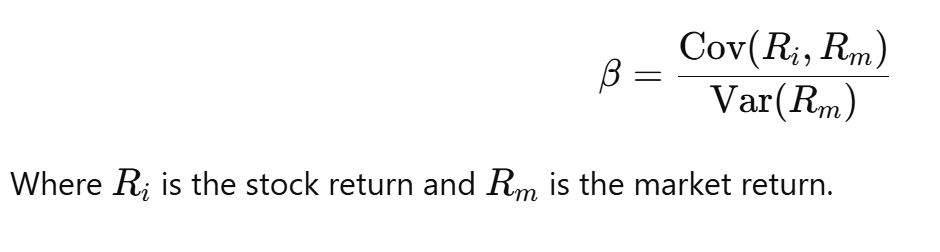

📊 Task 3: Calculating Beta (β)

📐 Beta (β)

Definition: A stock’s sensitivity to movements in the overall market (systematic risk).

Formula: β = Covariance (stock, market) / Variance (market)

📌 Interpretation:

β=1: Stock moves in line with the market.

β>1: More volatile than the market.

β<1: Less volatile (defensive).

β<0: Moves opposite to the market.

🧠 Strategic use:

Use high-beta stocks in bull markets for leverage.

Use low-beta stocks in downturns for protection.

Beta informs portfolio diversification and asset allocation.

Kid-Friendly Notes

What it is:

“How much a stock moves when the whole market moves.”The market is like a dog pulling a leash. Some stocks run fast with it (high beta), some walk slowly (low beta), and some even go backward (negative beta).

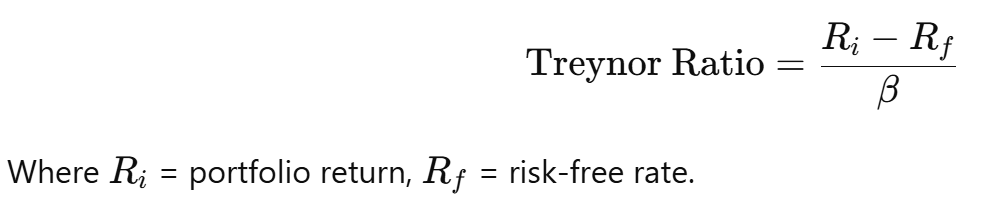

📐 Task 4: Calculating Treynor Ratio

📊 Treynor Ratio (TR)

Definition: Measures return per unit of systematic risk (beta).

Formula:

📌 Interpretation:

High TR → Better risk-adjusted return for market risk.

It complements Sharpe Ratio, but focuses only on systematic risk, not total risk.

🧠 Strategic use:

Ideal for comparing well-diversified portfolios.

Helps assess performance of fund managers who take systematic risk.

Kid-Friendly Notes

What it is:

“How many points you score for each level of danger from the market.”You’re in a video game. If you earn lots of coins without facing too many monsters (market risk), you’re really good at playing. That’s a high Treynor Ratio.

📉 Task 5: Calculating Value at Risk (VaR)

🧮 Value at Risk (VaR)

Definition: The maximum expected loss over a period, at a given confidence level.

Formula (Parametric Method): VaR=Z×σ×t

Where:

Z-score for confidence level (e.g. 1.65 for 95%)

σ = standard deviation of returns

t = time horizon

📌 Interpretation:

E.g. “At 95% confidence, we won’t lose more than $X in a day.”

Types: Parametric (normal), Historical, Monte Carlo

🧠 Strategic use:

Essential for capital allocation, stress testing, and regulatory compliance.

Helps managers cap tail risk and plan for worst-case scenarios.

Kid-Friendly Notes

What it is:

“How much money you might lose on a really bad day.”You have $100. VaR tells you, “You might lose $5 tomorrow — but only if things go really wrong.” It’s like checking the weather for money storms.

🧠 Summary: Decision-Making Framework

Metric | Purpose | Use For |

|---|---|---|

Mean Return | Measures average gain | Return expectation |

Std. Deviation | Measures total risk | Volatility assessment |

Beta (β) | Sensitivity to market | Portfolio construction |

Sharpe Ratio | Return per total risk | Comparing diversified assets |

Sortino Ratio | Return per downside risk | Managing drawdowns |

Treynor Ratio | Return per market risk | Evaluating fund managers |

VaR | Worst-case loss estimation | Risk control & capital planning |

✅ Monthly Returns

excel複製編輯

=(B2 - B1) / B1

(Assumes B1 and B2 are consecutive monthly closing prices)

📉 Standard Deviation of Returns

excel複製編輯

=STDEV(C2:C13)

(Assumes C2:C13 contains monthly return values)

📐 Beta (β)

excel複製編輯

=SLOPE(C2:C13, D2:D13)

(C2:C13 = stock returns, D2:D13 = market returns)

🏆 Treynor Ratio

excel複製編輯

=(AVERAGE(C2:C13) - RiskFreeRate) / Beta

Replace

RiskFreeRateandBetawith actual values or cell references

🚨 Value at Risk (VaR) – Parametric (95%)

excel複製編輯

=NORM.S.INV(0.05) * STDEV(C2:C13)

(Negative number = expected loss)

📊 Sharpe Ratio

excel複製編輯

=(AVERAGE(C2:C13) - RiskFreeRate) / STDEV(C2:C13)

📉 Sortino Ratio

excel複製編輯

=(AVERAGE(C2:C13) - RiskFreeRate) / STDEVP(FILTER(C2:C13, C2:C13 < RiskFreeRate))

.