4a. Fiscal policy

Fiscal policy

The goals of fiscal policy is to stimulate economic growth (through increasing AD) and to provide macroeconomic stability (reducing the large peaks and booms of the economic cycle)

Fiscal Policy (Government Spending + Taxation) is set out each year by the Chancellor of the Exchequer in the budget.

If the government spends more than it receives, this is called a budget deficit. If they receive more than they spend, this is a budget surplus.

To fund a deficit a government will borrow money by issuing government bonds. Anyone can buy government bonds and they are considered to be a safe way of investing money.

The UK regularly spends more than it receives in taxes. This creates a fiscal deficit. The

accumulation of all of these deficits over the years is the National Debt. Therefore, every year

we have a fiscal deficit, the national debt increases.

Tax Terminology

- Direct taxation – a tax levied on an individual or organisation.

- Indirect taxation – a tax levied on goods/services.

- Progressive tax – The proportion (%) of income paid in tax rises as the income of the taxpayer rises.

- Proportional tax – The proportion of income paid is the same for all taxpayers.

- Regressive tax – The proportion of income paid in tax falls as the income of the taxpayer rises. i.e. taxation that takes a larger percentage of a lower income and a smaller percentage of a higher income

- Hypothecated tax – a tax that raises revenue for a particular area of spending

Types of tax

Income tax - Tax is taken directly from the income. This is called progressive, redistributive taxation. Basically, the principle is, earn more, pay more to share more.

Corporation tax - A tax on company profits- the company pays this directly to the government

National insurance - Paid by individuals and companies. Employees pay 13.5% of earnings a month after a set amount and an additional 2% for higher earners. Employers pay a similar amount for their employees by some employers may receive a rebate for low paid workers.

VAT - This is a sales tax which is paid when purchasing goods and services. There are 3 rates of VAT:

- a standard rate, currently 20% (reduced to 15% in 2009 before being increased back to 17.5%)

- a reduced rate, currently 5% (e.g.. energy, children car seats)

- a zero rate (e.g. food, books, public transport)

This is seen as regressive as for example an increase in the price of your weekly food shop will take up a larger % of a poor person’s income compared to a richer person’s.

Excise duties - An additional sales tax on goods (in addition to VAT). It tends to be on goods which create negative externalities.

Business rates - A tax on the value of business property. Like council tax larger properties attract larger tax bills. Like council tax it varies by council. It is therefore also indirect and regressive.

Stamp duty - A tax paid when purchasing a new home based on the value of the home

Inheritance tax - Tax paid on inheritance received. Some argue that a persons money has already been taxed once and therefore it is unfair to tax it a second time when it is passed on.

Capital gains tax - Capital Gains Tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value. You pay tax on the ‘gain’ rather than the overall value of the sale.

Council tax - A tax on domestic property dependent on the 1991(!) value of your home (varies by council)

Expansionary fiscal policy

Any changes to tax or spending that shifts AD outwards (this means either reducing taxes or increasing spending)

Contractionary fiscal policy

Any changes to tax or spending that shifts AD inwards (increasing taxes or reducing spending)

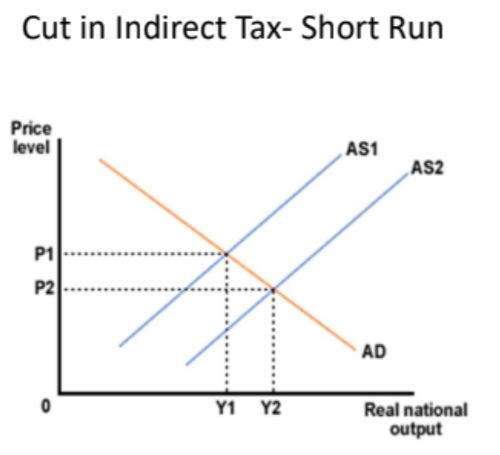

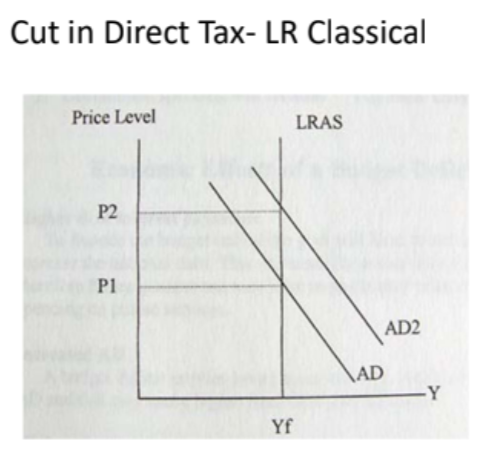

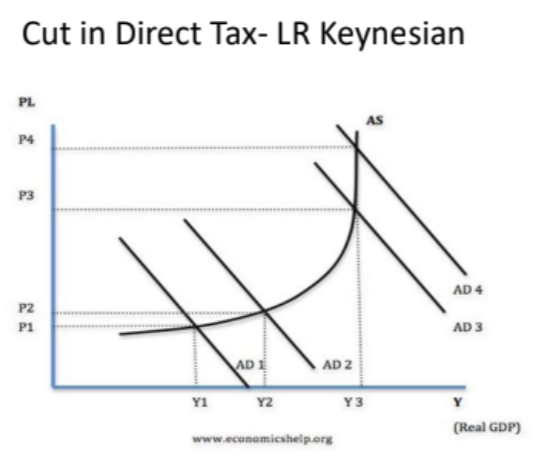

Fiscal policy diagrams

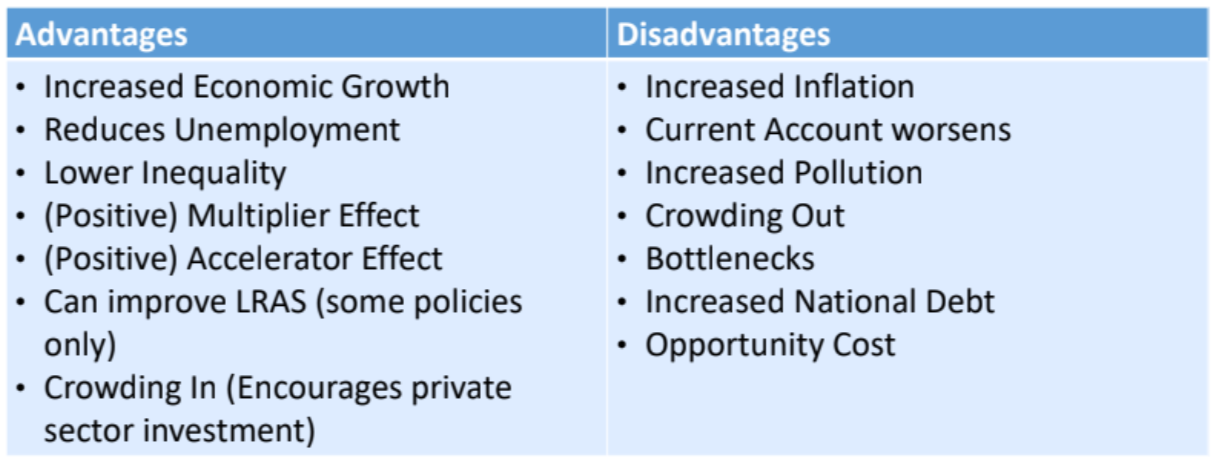

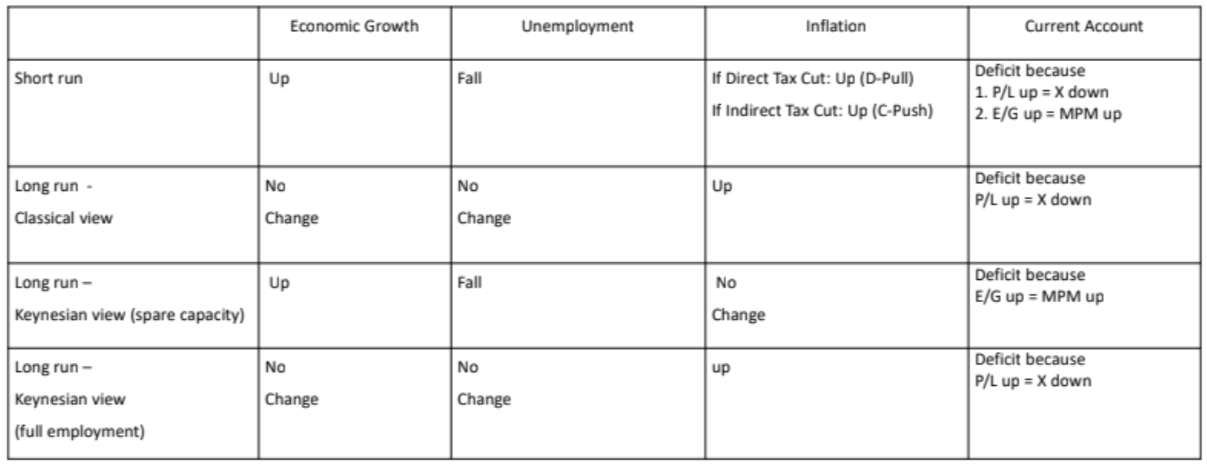

Impact of expansionary fiscal policy

Impact of expansionary fiscal policy

Inequality

- Government spending tends to benefit the poor (the rich will have private schools and healthcare) more but any tax change depends on the progressiveness of the tax

Environment

- Generally, more economic growth harms the environment unless spending is on green areas

Fiscal Balance

Should get worse