Chapter 26: Inflation

What is inflation?

Inflation: general and continuing rise in prices measuered as a rate

Deflation: a fall in prices or economic slowdown

Aggregate demand: total demand in the economy from consumers, businesses, government and foreign buyers

How is it measured?

CPI (Consumer Price Index): a measure of the general price level

We use this to:

Compare average costs of months from previous years in the form of percentage change

Demand pull inflation

inflation caused by an increase in demand in the economy

Possible causes of increase in aggregate demand:

Rising consumer spending

encouraged by tax cuts or low interest rates

Sharp increases in government spending

RIsing demand for resources

Booming demand for exports

Cost pull inflation

Inflation is caused by rising business costs. Businesses put up prices to protect profit margins

Possible causes of rising business costs:

Rising business costs of imports

increase in wage

increase in taxation

Relationship between interest rates and inflation

Interest rates: Price paid to lenders for borrowed money

Monetarists: Economists who believe there is a strong link between growth in the money supply and inflation

money supply: the stock of notes and cost, bank deposits and other financial assets in the economy

Key concept: Monetarists believe that inflation may be caused when households, firms and the government borrow money from banks to fund extra spending

Adds to money supply because there are more bank deposits (increases bank balance)

Extra money lent creates more demand and prices go up

This type of inflation is likely to happen if interest rates are low

because borrowing is likely to occur if interest rates are low

How interest rates can be used to lower inflation

High interest rates reduce borrowing because the price of money increases

Money supply therefore rows less quickly

Demand will therefore fall (less disposable income)

pressure on prices is relieved

Inflation will fall

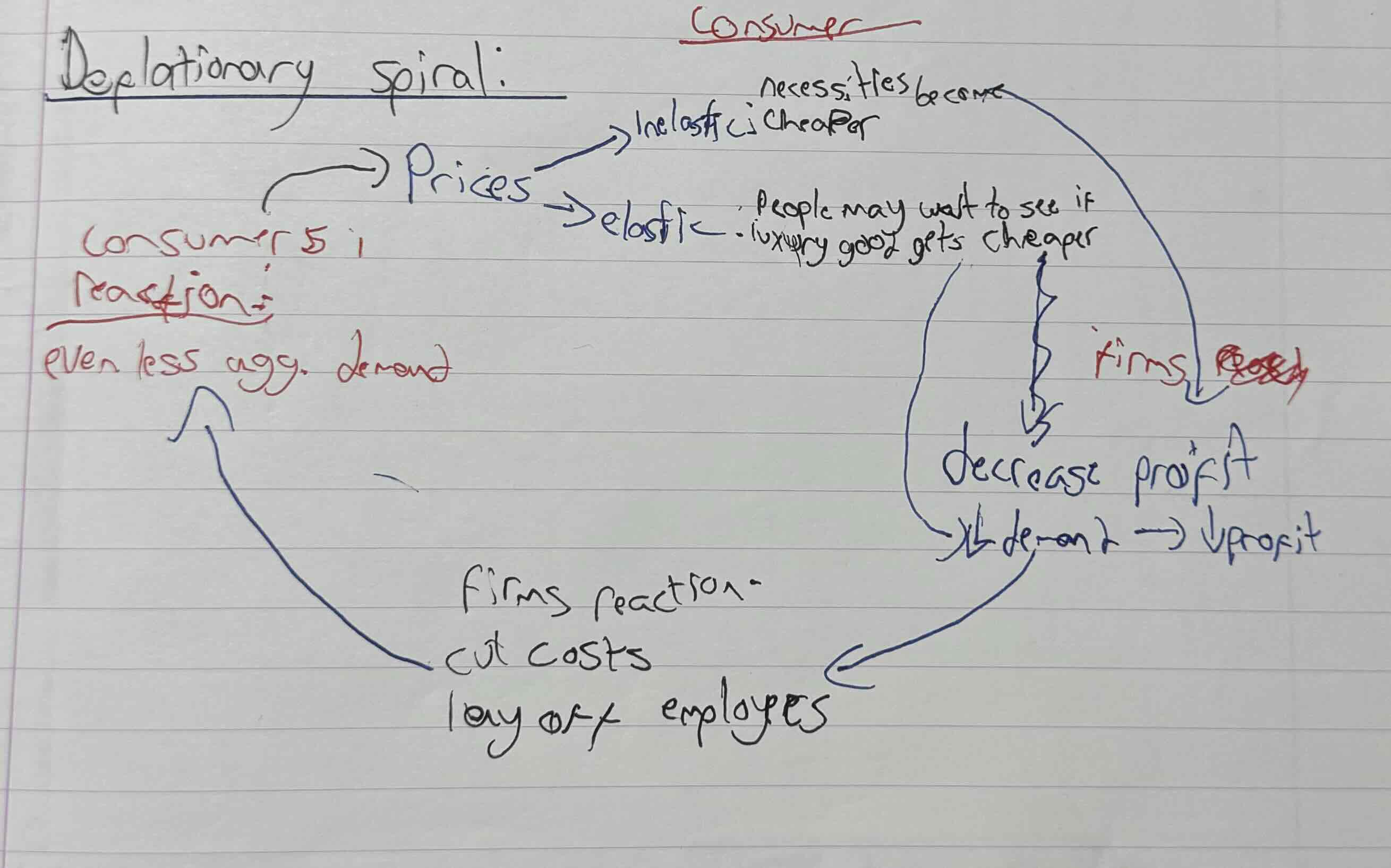

Deflationary spiral:

Impacts of Inflation:

Prices:

Prices Rise, which reduces the power of the money, meaning people can buy less goods and services with the same income

Wage

If prices rise, workers will want higher wages to compensate, and sometimes negotiate it successfully

However, higher wages mean higher production costs, so firms mat rise prices further, creating a wage/price spiral

Exports

When prices increase domestically, firms will find it harder to sell goods overseas (price of exports rise) → Demand for exports falls → balance of payments is affected negatively

Fall in demand for exports could lead to domestic job loss

Unemployment

Inflation causes an increase in aggregate demand → firms want to produce more since prices are rising (more revenue) → more workers are needed to produce these goods → reduction of unemployment

Tradeoff between inflation and unemployment

Menu costs

If inflation is rapid, firms increase their prices frequently

Increases menu costs (cost of changing price in “menu”)

Shoe leather costs

This is the (non-monetary) costs for individuals and businesses of shopping around more to look for the best prices,, time and other resources are wasted

Uncertainty

If inflation is high, firms will find it difficult to predict prices for the next few months/years, which makes business decision/investment making difficult

Difficult for businesses to establish long term contracts

Business & Consumer Confidence

Consumers might feel anxious about inflation → less willing to borrow money → more likely to save “just in case” (less spending → lower aggregate demand → potentially higher unemployment

Businesses may postpone growth plans or reduce spending

Hyperinflation: prices spiral off control

Consumers might “buy now” before increase in prices

Investment

Investment require less spending in large sums in hopes of future returns (earning that money back and more)

Uncertainty leads to low business confidence, meaning investment projects are likely to be cancelled → negative impact on economic growth & employment