✨ Policies - Monetary and Fiscal ✨

Fiscal Policies (FP)

def. The use of government spending and taxation affects the level of economic activity, resource allocation, and income distribution.

Annual budget changes in May to inform the population of the FP for the following tax year. Progressive Taxation, lower-income owners get lower taxation and higher-income owners get higher taxation.

Fiscal policies involve changing the tax revenue (T) or government expenditure (G).

Direct or Indirect tax

Goods and services (Roads, Parks, Defense) or transfer payments (Cash benefits for groups Students, Elderly, Disabled)

Taxes - Direct vs Indirect

Direct Tax

Is determined by a person’s income, wealth and assets. The burden of direct taxes cannot be shifted to other people by the taxpayer - if you own it then you have to pay for it. E.g. personal income tax, corporate income tax, estate duties, property tax…

Indirect Tax

Is imposed on expenditures of goods and services consumed. The burden of indirect tax can be shifted to a party other than the one on whom the tax is levied i.e. producers or sellers can try to pass the tax burden to consumers by including the tax in the selling price. E.g. ==GST, Value added Tax, etc… ==

The May Budgets

How revenue should be raised and funds allocated to areas of need.

Re-distributes income from the wealthy to the less wealthy.

Influences the level of macroeconomic activity.

Types of Fiscal Policies

Non-Discretionary (automatic stabilisers)

Automatic or built-in stabilizers. e.g. Present tax structure, unemployment benefits. Used to smoothen fluctuation of the economic cycle without the need for government intervention

Discretionary

Deliberate use of taxes or government spending to influence the economy. direct taxes. Used when the non-discretionary FP is insufficient.

Monetary Policies (MP)

def. Monetary policy is a set of actions available to a nations central bank to achieve sustainable economic growth by adjusting the money supply (through cash rates).

Main tool of MP a cash rate is the interest rate that a central bank - RBA or federal Reserve - will charge commercial banks for overnight loans. This contributed to the macroeconomic stability. The primary focus is always price stability, monetary policies also concerned with economic growth and employment levels.

Australia has a flexible medium-term inflation target, which is to keep consumer price inflation between 2 and 3 percent, on average, over time. - why inflation is not too high - cost of living pressures, unemployment, growth starts to slow, and stress. why is inflation i not too low?

Transparency and Accountability

The RBA decisions about monetary policy are explained publicly through several channels to ensure accountability. Announcing and explaining the monetary policy decision on the day it is made. - First Tuesday of every month excluding January

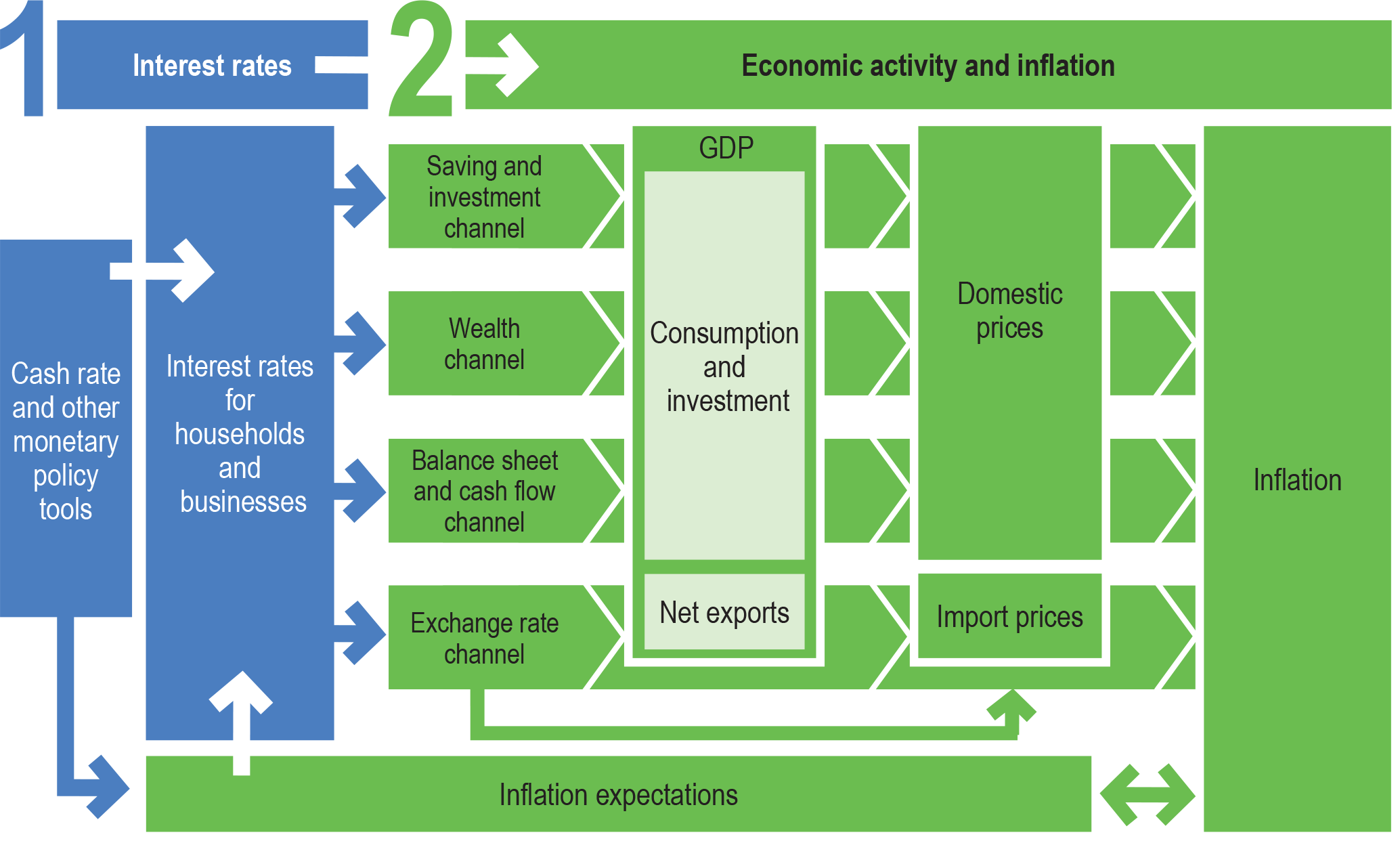

Transmission of Monetary Policy

Changes to the cash rate flow through to other interest rates in the economy → Changes to these interest rates affect economic activity and inflation through channels

Describes how changes by the RBA to the cash rate - the instrument of monetary policy - flow through to economic activity and inflation.

cash rate → interest rate→ economic activity → inflation

Monetary policy in Australia is determined by the RBB and is set in terms of a target for the cash rate.

While the cash rate acts as a benchmark for interest rates in the economy, it is not the only determinant. Other factors such as conditions in financial markets, changes in competition, and the risk associated with different types of loans, can also impact interest rates.

Changes to interest rates influence economic act

short answer and data interpretation - article?

Aggregate Demand - Total demand

Lower interest rates increase aggregate demand by stimulating spending. Aggregate demand is initially greater than aggregate supply, putting upward pressure on prices. As businesses increase their prices more rapidly in response to higher demand, this leads to higher inflation. There is a law between changes to monetary policy and its effect on economic activity and inflation because households and businesses take time to adjust their behaviour. It can take 1 or two years for monetary policy to have its maximum effect.

1. Saving and Investment Channel

Interest rates influence economic activity by changing the incentives for saving and investment.

This channel typically affects consumption, housing investment and business investment

Lower lending rates can encourage households to increase their borrowing (lower cost of borrowing) as they face lower repayments and because banks will generally lend more to them. Because of this, lower lending rates support higher demand for housing assets. Higher demand for houses and higher demand for cars →

Lower lending rates can increase

more investment and less savings → increase in economic activity and growth → higher inflation

2. Cash-flow Channel

Interest rates influence the decisions of households and businesses by changing the amount of cash they have available to spend on goods and services.

This is an important channel for those that are liquidity-constrained - those who cannot spend as much as they want because of the size of interest repayments, or because they cant borrow the amount they want at the current interest rates.

A reduction in lending rates reduces interest repayments on debts, increasing the amount of cash available for households and businesses to spend on goods and service. - a reduction in interest rates lowers repayments for households with variable-rate mortgages, leaving them with more disposable income.

In COVID-19 Reduction in interest rates allowed households to have more disposable income which encouraged spending → economic growth and inflation.

Monthly basis increased in interest rates. Showing a big impact on economic growth and aggregate demand.

At the same time, a reduction in interest rates reduces the amount of income that households and businesses get from deposits, and some may choose to restrict their spending. Has less of an impact in comparison to the loan impacts.

these two effects work in opposite directions, but a reduction in interest rates can be expected to increase spending in the Australian economy through this channel - the effect of loans being bigger than deposits in savings.

3. Asset Prices and Wealth Channel

Asset prices and people’s wealth influence how much they can borrow and how much they spend in the economy. The asset prices and wealth channel typically affects consumption and investment.

Lower interest rates support asset prices such as housing and equities by encouraging demand for assets.

Higher asset prices also increases the equity (collateral - asset like property or securities pledged by a borrower to protect interests of the lender) of an asset that is available for banks to lend against. This can make it easier for households and businesses to borrow.

An increase in asset prices increases peoples wealth. This can lead to higher consumption and housing investment as households generally spend some share of any increase in their wealth.

short answer and data interpretation - article?

Interest rates are affected by cash rates. Cash rate 0.1 and banks were loaning out at like 1%

Current cash rate trends

low during lockdowns

consistent growth ever since lifting of restrictions

Expansionary Monetary Policy - drives up inflation decreasing cash rate

loosening money supply in the economy

Contractionary Monetary Policy - drives down inflation increasing cash rate

tightening money supply in the economy

Neutral Monetary Policy

Practice Questions

Create a list of the initiatives for the year

Delivering cost-of-living relief (supporting the people most in need)

Strengthening Medicare (All Australians can get Medicare)

Growing the economy (Expansion and modernising economy)

Broadening opportunity (Advancing equality and opportunities)

Strengthening the Budget (Putting more money into the budget)

How do they complement the economic objectives

Unemployment (under 5%)

Sustainable economic growth (2-3%)

Price stability low inflation (3%

Cost-of-living relief (reducing inflation aka reducing common prices)

Can you foresee any conflicting economic objectives

Growing the economy → Putting more money into the budget and

Deficit Budget or Surplus budget?

Deficit budget - expansionary fiscal policy

Expansionary or Contractionary Fiscal Policy?

Expansionary fiscal policy - deficit

Expansionary or Contractionary Monetary Policy?

Contractionary policy

Choose one policy and discuss how it will affect the economy

Helping with power bills of households and small businesses during inflation.

Because of the Russia and Ukraine war, energy prices have significantly increased and had large impacts on households and businesses. The Government’s Energy Price Relief Plan helps to shield these Australians from the worst impacts.

$3 billion have been offered in order to help eligible households and businesses. from July 2023, $500 relief for households or $650 for small businesses.

What are the different types of indicators

Economic policy objectives

Business Trade Cycle

Define Monetary Policy

Explain the role of the RBa

State the objectives of the RBA

explain and describe the transmission mechanism of monetary policy

explain and describe the 3 transmission

3 goals of the budget - decides how revnues should be raised, how it should be distributed and how to manage economic environment and distribution

3 goals of RBA and e

why is interest rates and cash rates different - economic uncertainty

fixed and variant interest rates.

Stages 1 → cash rate change and flows into commercial interest rates

Stage 2→

Currently in a contractionary monetary policy → to reduce aggregate demand and reduce economic activity and inflation

During - 0.1 interest rate many people got cars and houses → fresh loans many people are suffering now.

Not neutral → contractionary monetaryr policy overall is contractionary aim. It may not be decreasing or increasing at the moment, that is because they want to see