Topic 10: 10.1 & 10.2 | Low unemployment and Costs of Unemployments

🎯Main Focus: The 4 Macroeconomic Objectives

These will be the central themes for the coming weeks:

Low and stable inflation

Low unemployment

Sustainable economic growth

Equitable distribution of income

📚 Key Definitions: Inflation Terms

Inflation = A persistent increase in the average/general price level in an economy.

Deflation = A sustained decrease in the average/general price level.

Disinflation = A slower (decrease in) rate of inflation (prices still rise, but more slowly than before).

⚠ Don’t confuse these terms:

Inflation ≠ Deflation ≠ Disinflation

💥 Consequences of High Inflation

Think of how different economic actors are affected:

Workers, Consumers, Producers, Government, Savers, Lenders, Borrowers, Society

🚫 Negative Impacts:

My answers (which are also correct btw)

Increased poverty and inequality

People can’t afford basic needs → this worsens poverty and inequality.

Reduced real demand for goods/services (especially in cost-push inflation)

Cost-push inflation can lead to lower demand due to reduced purchasing power.

Falling real wages – workers can buy less

Due to the lowered purchasing power, workers feel poorer, even if they’re earning "more" on paper.

Lower profits for producers due to rising input costs

When input costs (like raw materials, fuel, wages) rise, profit margins shrink.

If producers can’t pass those costs to consumers (due to low demand), they suffer losses.

Reduced consumer confidence and spending

As purchasing power decreases → less demand → lower revenue → less reinvestment → economic slowdown.

Loss of trust in the government or central bank

Citizens blame the government for rising prices.

It hurts political stability, especially if inflation is high for a long time (→ think elections, strikes, protests).

Lower GDP

Inflation can lead to a fall in Real GDP, particularly when:

It’s cost-push inflation:

Prices go up because supply decreases (e.g., supply chain crisis, war, natural disasters).

Output falls → unemployment rises → GDP falls.

This is called stagflation: stagnant growth + inflation.

Consumer spending drops:

If wages don’t keep up with rising prices → real income falls → people buy less.

Less consumption = lower Aggregate Demand (AD) → lower GDP.

Business investment decreases:

Inflation creates uncertainty.

Businesses may delay investment → less economic growth.

According to the teacher

Decreased Purchasing Power

Prices rise faster than income → people can afford less.

Example: Potatoes cost 100 MZN → now 150 MZN. If your salary doesn’t increase, you buy less.

Real vs Nominal Income

Nominal income: The amount of money you earn.

Real income: What you can actually buy with that money.

If inflation increases and your salary doesn’t → your real income falls.

Falling Export Competitiveness

Domestic products become more expensive abroad → exports decrease.

People may import more (e.g. shopping in South Africa instead of Maputo).

→ Leads to a decrease in Aggregate Demand (AD).

GDP : AD = C + I + G + (X - M) |and| AD=GDP, meaning that lower AD, means lower GDP.

Savers Lose Out

If interest rate at the bank = 5%, but inflation = 8% → your savings lose value.

You earn less than the inflation rate → real savings decline.

Lenders Lose, Borrowers Gain

If you lend money, and inflation rises, you get repaid with weaker money.

Borrowers win, lenders lose.

Fixed-Income Workers Struggle

Salaries that don’t adjust with inflation → loss of real income.

Widening Income Inequality

Low- and middle-income households suffer more.

They spend most of their money on basic goods → no buffer.

The rich get richer, the poor get poorer.

📊 Inflation Models

🔼 Demand-Pull Inflation

Cause: A rise in aggregate demand (AD shifts right)

Linked to:

Economic growth

Lower unemployment

Triggers:

More government spending

More investment

Seen as less harmful than cost-push inflation.

🔽 Cost-Push Inflation

Cause: A fall in aggregate supply (AS shifts left)

Linked to:

Higher prices and higher unemployment

Triggers:

Natural disasters

Global supply issues

War, pandemics, fuel price hikes

Considered more harmful and harder to control.

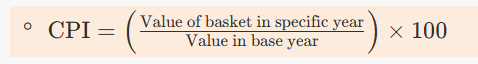

📈 Consumer Price Index (CPI)

Used to measure inflation.

Tracks the cost of a fixed “basket” of goods and services over time (e.g. food, transport, healthcare).

Formula for CPI:

🎯🎯

Base year CPI is always 100.

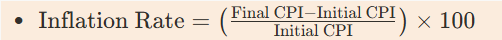

🧮 Inflation Rate Calculation:

Positive % = Inflation

Negative % = Deflation

🧠 Final Key Points to Remember

Inflation doesn’t just affect prices—it reshapes the economy, especially:

Savings and spending habits

Trade balance (exports vs imports)

Wage contracts

Social equity and income inequality