Interest Rates, Inflation & The Economy

Interest Rate Quotes and Adjustments

• Annual Percentage Rates (APR)

– Indicates the amount of simple interest earned (incurred) in one year, that is the amount of interest without the effect of compounding.

– Because it does not include the effect of compounding, the AP R quote is typically less than the actual amount of interest you will earn (incur).

Interest Rate Quotes and Adjustments

• Annual Percentage Rates (AP R)

– Because the AP R does not reflect the true amount you will earn (incur) over one year, the AP R itself cannot be used as a discount rate

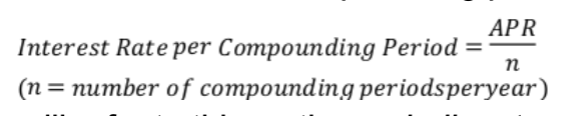

– Instead, the AP R is a way of quoting the actual interest earned each compounding period:

– We will refer to this as the periodic rate and use it in our formula depending on the facts of the problems (i.e. compounding periods/payments are greater than

once per year).

Interest Rate Quotes and Adjustments

• Annual Percentage Rates (AP R)

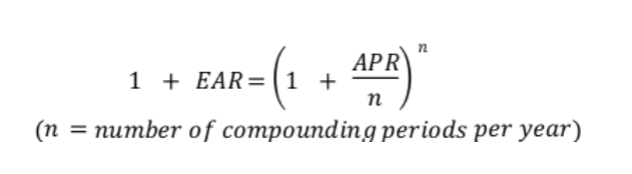

– Converting an AP R to an EA R

• Once the interest earned per compounding period is computed, the equivalent interest rate for any other time interval can be computed.

• Specifically for EA R to AP R conversions, we have the following formula:

Periodic Interest Rates

• Interest rates can be stated in periods other than annual. These rates are often multiplied by the number of periods to get the Annual Percentage Rate.

Example

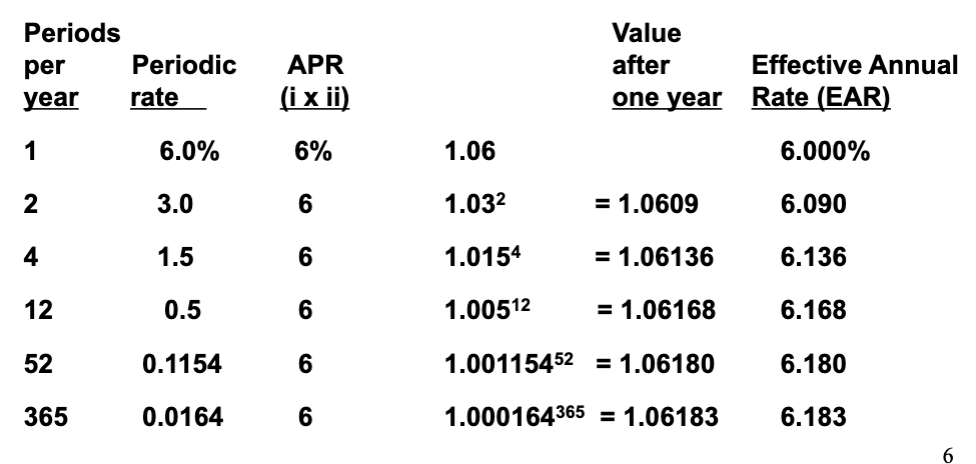

• When a 1.5% rate compounded monthly is referred to as an 18% APR, 18% understates the actual equivalent annually compounded rate.

• When compounded we get the following result:

(1+.18/12)12= 1.01512 = 1.1956 or 19.56%.

• Therefore this 18% APR is equivalent to an annual rate of 19.56%.

APR and Compound Interest.

Simple interest rates (annual percentage rates or APRs) are calculated

by multiplying the rate per period by the number of periods.

Compound interest recognizes the opportunity to earn interest on interest

Effective Annual Rates

• When comparing interest rates it is important to be consistent about the periods and the compounding.

• Effective Annual Rates use annual rate periods and annual compounding.

• Any periodic rate can be converted to an effective annual rate as follows:

Effective Annual Rate = (1+periodic rate)# of periods -1

Interest Rate Quotes and Adjustments

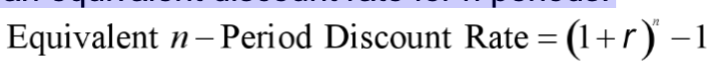

• Adjusting the Discount Rate to Different Time Periods

– A discount rate of r for one period can be converted to an equivalent discount rate for n periods:

– When computing present or future values, you should adjust the discount rate to match the time period of the cash flows

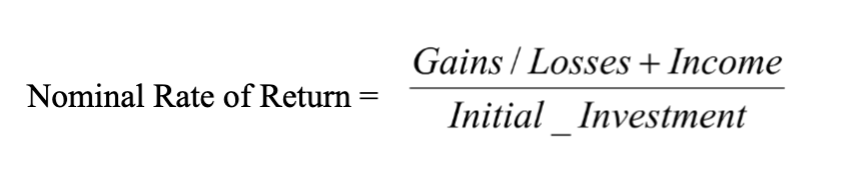

Nominal Rates of Return

• This unadjusted rate of return is called the “nominal” rate of return.

• Nominal returns are used to evaluate investment return

• Problem - “A dollar isn’t worth what it used to be.”

Rates of Return and Inflation

• The value of a nominal return to an individual depends on the rate at which prices of goods and services are increasing (Inflation).

• CPI (Consumer Price Index) is a proxy for inflation

• If inflation exceeds the nominal rate of return, the purchasing power actually declines.

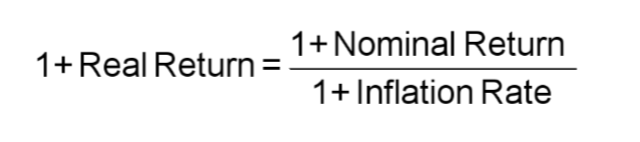

• A rate of return adjusted for inflation is called a “real” rate of return.

Calculating the Real Rate of Return

• We are interested in real rates of return to evaluate the “real wealth” generated from investment.

• Nominal returns of 10% in a 2.5% inflation environment result in attractive real returns of 7.32%.

• Nominal returns of 10% in the 12% inflation environment of 1981 would have resulted in a negative real return of (1.78%)

Realized versus Expected Returns

• We don’t know what the inflation rate is until a year is complete.

• However it is obvious that future rates of inflation will have an effect on real returns.

• The expected future inflation rate must be built into market interest rates.

• We use ex post to refer to historical realized returns

• We use ex ante to refer to expected returns.

• Valuation and Finance deal primarily with ex ante returns.

• For some perspective lets look at Inflation since 1914.

Factors Influencing Interest Rates

• Financial researchers and economists have suggested that interest rates are derived from:

– Expected Inflation

– Preference for consumption today

– Supply and demand for money

– Risk

• The first three of these are independent of any valuation problem and therefore the same for any valuation problem.

• Risk is unique for each valuation so we will spend a considerable amount of effort measuring risk and leave the other factors for the economists to debate.

Real versus Nominal Dollars

• Nominal Dollars refer to the actual dollar amounts either now or in the future.

– Inflation erodes the value of nominal dollars over time.

– Nominal Dollars must be valued using nominal rates.

• Real Dollars refer to dollars with constant purchasing power.

– Real Dollars “adjust” for the effect of inflation.

– Real Dollars must be valued using real rates.

• Nominal Dollar calculations can be converted to Real Dollars by discounting using the inflation rate.

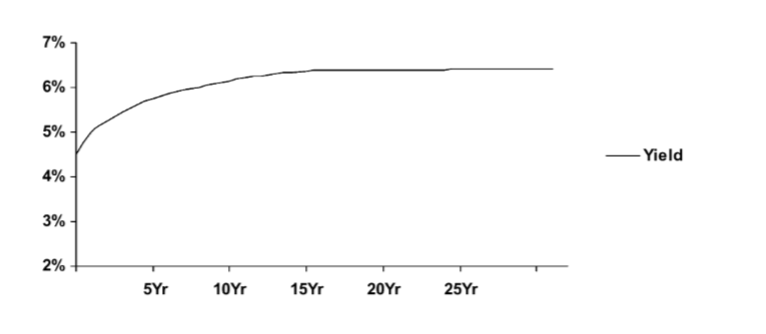

Treasury Yield Curve

• The relationship between yields and time to maturity is called a yield curve.

• The Yield curve for Treasury Bonds is in the Wall Street Journal every day.

• These “risk-free” interest rates are influenced by the expectations of future inflation, supply and demand for money.

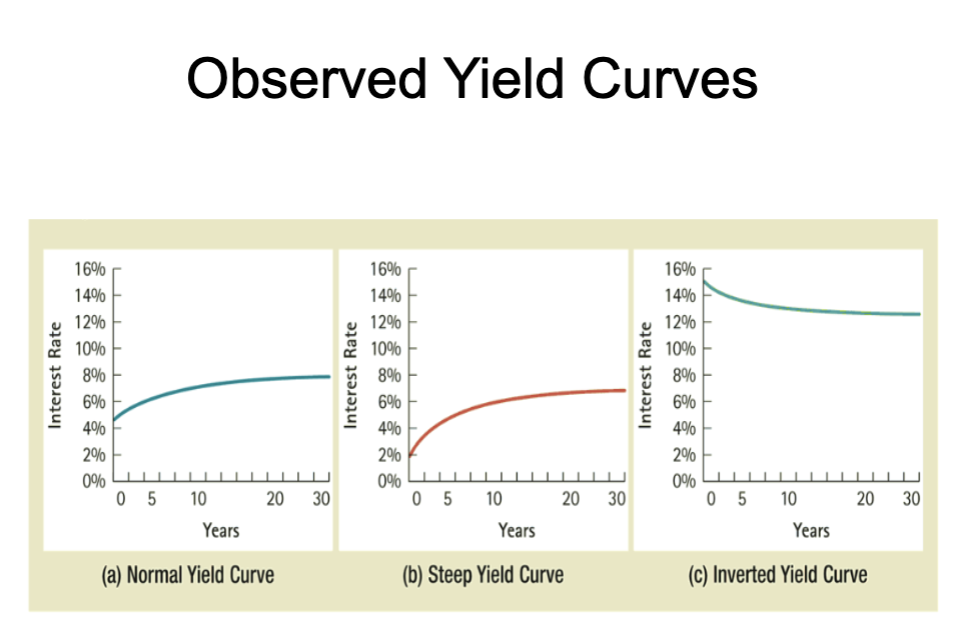

What Influences the Shape of the Yield Curve

• Various theories have developed to explain the observed shapes of the yield curve.

• These theories consider investor expectations, risk premiums, liquidity, demand & supply, and arbitrage arguments to attempt to explain observed yield curves.

• None of these theories fully explains all of the observed yield curve environments.

• Yet, They are helpful because the theories give us a framework to better understand the implications of the pattern of interest rates over time.

Investor Expectations and Interest Rates

• While there are many factors influencing interest rates, it is generally agreed that investor expectations play a large role.

• Expectations about future interest rates and the factors contributing to these rates should influence the pattern of rates over time.

– Normal – Long term rates higher than short term

– Steep – Long term rates much higher than short

term

– Inverted – Short term rates higher than long term

– Flat – All rates the same

Interest Rates in Valuation

• The market based fair “rent” for the use of money is expressed as an interest rate.

• For a specific valuation application this interest rate reflects the minimum required return an investor in the firm needs to earn on similar investments.

• Different applications use different terminology to describe the identical “required return” concept:

– Bond Valuation - Yield

– Stock Valuation - Expected Return or Investor

Required Return

– Project Valuation - Opportunity Cost of Capital

Opportunity Cost of Capital

• Business decisions are uncertain so they involve risk.

• Discount rates used to evaluate these decisions must include additional compensation for this uncertainty.

• Opportunity Cost of Capital: The best available expected return offered in the market on an investment of comparable risk and term to the cash flow being discounted.