14-16

Chapter 14. Oligarchy

An oligopoly is a market structure where a small number of interdependent firms compete. Three examples of oligopolies in the United States are industries that produce or sell automobiles, athletic footware, and cigarettes.

One measure of the extent of competition in an industry is the concentration ratio. Concentration ratios do not include imports from foreign firms, consider only national markets, and include firms that participate in multiple industries only in one industry.

Concentration ratios do not include sales in the United States by foreign firms.

Concentration ratios are calculated for the national market even though the competition in some industries is mainly local.

Competition sometimes exists between firms in different industries.

Concentration Ratio (CR)=Sum of market shares of the top n firms

In the U.S., a four-firm concentration ratio greater than 40% is typically taken to indicate that an industry is an oligopoly.

natural oligopoly - a market in which the number of firms that minimizes total industry cost is greater than one, but not so large as to make the market competitive.

The government would be willing to impose barriers to:

encourage firms to carry out research and development of new and better products.

protect the public from incompetent practitioners.

protect U.S. firms from international competition.

An example of a government-imposed barrier to entry is a tariff on imports and occupational licensing.

Barriers to entry are anything that keeps new firms from entering an industry in which firms are earning economic profits

The Aluminum Company of America (Alcoa) controlled most of the world's supply of high-quality bauxite, the mineral needed to produce aluminum.

The De Beers Company of South Africa was able to block competition in the diamond market by controlling the output of most of the world's diamond mines.

Ocean Spray, until the 1990s, had very little competition in the market for fresh and frozen cranberries because it controlled almost the entire supply of cranberries.

Economies of scale exist when a firm's long-run average costs fall as it increases output.

Dominant strategy - A strategy that is the best for a firm, no matter what strategies other firms use.

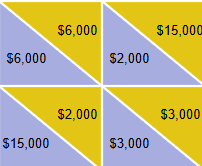

If Walmart charges $25, then Target is better off charging $15 and receiving profit of $15,000 (instead of profit of $6,000 from charging $25).

If Walmart charges $15, then Target is better off charging $15 and receiving profit of $3,000 (instead of profit of $2,000 from charging $25).

Since Target is better off charging $15 regardless of what Walmart does, charging $15 is Target's dominant strategy.

Nash equilibrium - A situation in which each firm chooses the best strategy, given the strategies chosen by other firms.

A Nash equilibrium in which no player can make himself better off by changing his decision at any decision node is called a subgame-perfect equilibrium.

Since Target and Walmart both have dominant strategies of charging $15, this is the Nash equilibrium.

That is, if each store charges $15, then neither store has an incentive to change their behavior.

If one store were to instead charge $25, then their profit would decrease from $3,000 to $2,000.

Explicit collusion, where firms meet and agree to charge the same price or otherwise not compete, is illegal. However, there may be ways to implicitly collude that are within the law by firms signaling to one another.

Implicit collusion is where firms signal to each other without actually meeting and agreeing to charge the same price.

Managers may cooperate by implicitly colluding. If they can find a way to signal each other, they can collude without breaking the law.

One form of implicit collusion occurs as a result of price leadership, where one firm takes the lead in announcing a price change that other firms in the industry then match.

Another is for one firm to advertise that it will match the lowest price offered by any competitor.

Collusion - An agreement among firms to charge the same price or otherwise not to compete.

Collusion makes firms better off because if they act as a single entity, like a monopoly, they can reduce output, increase prices, and increase profits.

Given the incentives to collude, why doesn't every industry become a cartel?LOADING...

Most firms that collude have an incentive to "cheat."

High profits attract entry into the market.

Collusion is illegal in the United States.

The members of OPEC meet periodically and agree on quotas, which are quantities of oil that each country agrees to produce. The quotas are intended to reduce oil production well below the competitive level to force up the price of oil and increase the profits of member countries.

OPEC quotas, or "internal production targets" are intended to reduce oil production well below the competitive level to force up the price of oil and increase the profits of member countries.

OPEC can agree to lower their joint production levels, thereby raising the price.

A simultaneous game is a game a where all firms act simultaneously.

A sequential game is a game where one firm acts first and then the other firms respond.

The five competitive forces are a model developed by Michael Porter of the Harvard Business School that shows how five competitive forces determine the overall level of competition in an industry.

competition from existing firms,

the threat of potential entrants,

competition from substitutes,

the bargaining power of buyers,

and the bargaining power of suppliers.

In a one-shot Prisoner's Dilemma, firms (or players) act in their own self-interest and defect, usually by charging a low price, which leads to lower profits for both.

However, in a repeated game, firms can recognize patterns and punish uncooperative behavior in future rounds. This threat of future retaliation encourages cooperation, such as:

Charging higher prices together

Maintaining profits through mutual understanding or tacit collusion

In a repeated game, the prisoner's dilemma often results in cooperation instead of mutual defection, because players weigh long-term benefits and consequences—not just immediate gains.

15.

If you own the only hardware store in a small town, do you have a monopoly?

Yes. You would have a monopoly if your profits are not competed away in the long run.

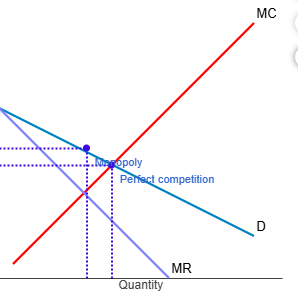

Monopolies maximize profit by producing the quantity where marginal revenue equals marginal cost and then picking the price at which consumers demand the profit-maximizing quantity.

A narrow definition of monopoly that some economists use is that a firm has a monopoly if it can ignore the actions of all other firms. Many economists, however, use a broader definition of monopoly: A firm has a monopoly if there are no other firms selling a substitute close enough that the firm's economic profits are competed away in the long run.

Barriers to entry: To have a monopoly, barriers to entering the market must be so high that no other firms can enter.

Barriers to entry may be high enough to keep out competing firms for four main reasons:

1. The government blocks entry of more than one firm into a market.

2. One firm has control of a key resource necessary to produce a good.

3. There are important network externalities in supplying the good or service.

4. Economies of scale are so large that one firm has a natural monopoly.

Governments ordinarily try to promote competition in markets, but sometimes governments take action to block entry into a market.

In the United States, government blocks entry in two main ways:

1. by granting a patent or copyright to an individual or firm, giving it the exclusive right to produce a product, and

2. by granting a firm a public franchise, making it the exclusive legal provider of a good or service.

A public franchise is a firm designated by the government as the only legal provider of a good or service. all public franchises are not natural monopolies, and all natural monopolies are not public franchises.

A natural monopoly develops automatically due to economies of scale.

Network externalities are present when the usefulness of a product increases with the number of consumers who use it. However, natural monopolies may or may not experience network externalities.

A natural monopoly occurs when economies of scale are so large that one firm can supply the entire market at a lower average total cost than can two or more firms. The USPS is probably not a natural monopoly. If it were, then a law banning competition would be unnecessary.

The relationship between a monopolist's demand curve and the market demand curve

is that a monopolist's demand curve is the same as the market demand curve.

The relationship between a monopolist's demand curve and its marginal revenue curve is that a monopolist's marginal revenue curve has twice the slope of its demand curve, because to sell more output, a monopoly must lower price.

Economic surplus: Economic surplus provides a way of characterizing the economic efficiency of a market.

Economic surplus is the sum of consumer surplus and producer surplus.

Consumer surplus is the difference between the highest price a consumer is willing to pay and the price the consumer actually pays.

Producer surplus is the difference between the lowest price a firm would be willing to accept and the price it actually receives.

Equilibrium in a perfectly competitive market results in the greatest amount of economic surplus, or total benefit to society, from the production of a good or service.

Thus, perfectly competitive markets are more economically efficient than monopolies.

explain why society is worse off when a monopolist charges a price that earns monopoly profits rather than when price is set at the "competitive level."

Economic surplus is reduced.

The Robinson−Patman Act prohibited charging buyers different prices if the result would reduce competition.

The Cellar-Kefauver Act prohibited any merger that would reduce competition.

The Sherman Act prohibited restraint of trade, including price fixing and collusion and makes monopolization, attempts to monopolize, or conspiracies to monopolize illegal. Price fixing reduces competition in an industry and results in higher prices and less economic efficiency.

The Federal Trade Commission Act established the Federal Trade Commission.

The Clayton Act prohibited firms from buying stock in competitors.

A horizontal merger refers to whether the firms are in the same industry, while a vertical merger refers to whether the firms are at the same stage of the production process. Horizontal mergers are more likely to increase market power than vertical mergers. This is because the merger of two firms in the same industry is more likely to increase market concentration, allowing the merged firm to reduce output and raise prices.

The Herfindahl-Hirschman Index (HHI) of concentration squares the market shares of each firm in the industry and adds up the values of the squares.

Mergers and monopoly: Lawyers initially enforced antitrust laws, and they rarely considered economic arguments, such as the possibility that consumers might be made better off by a merger if economic efficiency were significantly improved.

However, this began to change in the 1960s, and economists played a major role in the development of merger guidelines by the Department of Justice and the Federal Trade Commission in 1982.

The guidelines have three main parts:

1. Market definition.

2. Measure of concentration.

3. Merger standards.

Chapter 16

Derived demand The demand for a factor of production that is derived from the demand for the good the factor produces.

Sony's demand for the labor to make PlayStation 3 is derived from the underlying consumer demand for PlayStation 3.

The marginal product of labor is the additional output a firm produces as a result of hiring one more worker.

The value of the marginal product of labor is the change in a firm's revenue as a result of hiring one more worker.

PROFIT is the additional profit received by the firm from hiring one more worker.

If a firm is a price taker, then it cannot affect price (or wages); conversely,

if it is a price maker, then it affects price (or wages).

The firm's demand curve for labor is its value of the marginal product curve for labor.

If there is an increase in the price of televisions, then this will result in an increase in the demand for labor by firms. Thus, the demand curve will shift to the right.

Firms entering the television market in China will shift the labor demand curve to the right.

An increase in human capital will increase the quantity of labor demanded by firms.

The labor demand curve shifts when something changes the value of the marginal product of labor at every wage, such as:

Human capital ↑ (A) → workers become more productive → shift right.

Technology change (C) → can raise or lower productivity → shift.

Price of product change (D) → changes the value of output → shift.

Ask ChatGPT

The profit-maximizing quanity of labor is that quantity where wage equals the value of the marginal product of labor.

The five most important variables that cause the market demand curve for labor to shift are human capital, technology, the price of the product, the quantity of other inputs, and the number of firms in the market.

A decrease in the number of firms in the market will decrease the demand for labor by firms.

The opportunity cost of leisure is the wage that a worker could earn if they were employed instead of taking time off, highlighting the trade-off between working and enjoying free time.

The substitution effect of a wage change refers to the fact that an increase in the wage raises the opportunity cost of leisure and causes a worker to devote more time to working and less time to leisure. At the same time, an increase in the wage will also increase a consumer's purchasing power. Because leisure is a normal good, the income effect of a wage increase will cause a worker to devote less time to working. The labor supply curve will be upward sloping when the substitution effect is larger than the income effect.

For relatively low wages, the labor supply curve is upward sloping and for relatively high wages, the labor supply curve is downward sloping.

the three most important variables that cause the market supply curve for labor to shift the population, demographics, and opportunities in other labor markets.

If the labor supply curve shifts to the left, then labor supply at any given wage will fall, causing the equilibrium wage to rise, but the equilibrium level of employment to fall.

The equilibrium wage In a competitive labor market, the equilibrium wage equals the value of the marginal product of labor.

The more productive workers are and the higher the price workers' output can be sold for, the higher the wages workers will receive.

Major league baseball players are paid more than college professors because the value of the marginal product of major league baseball players is high relative to college professors.

In addition, the supply of people with the ability to play major league baseball is also very limited.

Compensating differentials - Higher wages that compensate workers for unpleasant aspects of a job.

For example, if working in a dangerous factory requires the same degree of education and training as working in a safe factory, a larger number of workers will want to work in the safe factory, and the wages of workers in the dangerous factory will be higher than the wages of workers in the safe factory.

If the government passes a law improving the safety of the dangerous factory such that it is no longer any more dangerous than the safe factory, then the higher wages of workers in the dangerous factory will decline until they are the same as the wages of workers in the safe factory, and the workers in the dangerous factory will not necessarily be any better off.

Experience: Workers with greater experience are, on average, more productive, and women tend to have less experience than men.

Women are much more likely than men to leave their jobs for a period of time after having a child. Women with several children will sometimes have several interruptions in their careers. Some women leave the workforce for several years until their children are of school age.

As a result, on average, women with children have less workforce experience than do men of the same age.

Because workers with greater experience are, on average, more productive, the difference in levels of experience helps to explain some of the difference in earnings between men and women.

Discrimination: When two people are paid different wages, discrimination may be the explanation. But differences in productivity or preferences may also be an explanation.

Unfortunately, it is difficult to measure precisely the differences in productivity or in worker preferences.

As a result, we can't know exactly the extent of economic discrimination in the United States today.

Most economists do believe, however, that most of the differences in wages between different groups are due to factors other than discrimination.

Economic discrimination Paying a person a lower wage or excluding a person from an occupation on the basis of an irrelevant characteristic such as race or gender.

Most economists believe that only a small amount of the gap between the wages of white males and the wages of other groups is due to discrimination.

Instead, most of the gap is explained by three main factors:

1. Differences in education.

2. Differences in experience.

3. Preferences for job

After implementing the new compensation plan, sales increased by more than 20 percent or by nearly $80,000 per salesperson per quarter.

The new plan succeeded in increasing effort by the sales force by increasing the compensation the salespeople received.

The increase in the firm's revenue more than offset the increase in its compensation cost, resulting in a 6 percent increase in the firm's profit.

The demand curve for capital equals the value of the marginal product of capital, and the value of the marginal product of capital equals the marginal product of capital multiplied by the product price.

The price of capital is determined by equilibrium in the market for capital, where the value of the marginal product of capital equals the marginal cost of capital.

The market demand curve for labor is found by horizontally summing the quantities of labor demanded by all firms at each possible wage — not by adding up the wages.

In equilibrium, what determines the price of capital?

The price of capital is determined by the equilibrium in the market for capital, where the value of the marginal product of capital equals the product price.

The economic rent or pure rent of natural resources is determined by

A.

equilibrium in the market for the natural resource, where the marginal product of the natural resource equals the value of the marginal product of the natural resource.

B.

the demand for the natural resource, which is the marginal product of the natural resource.

C.

equilibrium in the market for the natural resource, where the marginal product of the natural resource equals the marginal cost of the natural resource.

D.

equilibrium in the market for the natural resource, where the value of the marginal product of the natural resource equals the product price.

E.

the demand for the natural resource, which is the value of the marginal product of the natural resource.

Economic rent is the wage paid to labor.

the marginal productivity theory of income distribution?

The distribution of income is determined by the marginal productivity of the factors of production that individuals own.