Chapter 37: International Trade

Background

- A trade deficit is when imports exceed exports

- A trade surplus is when exports exceed imports

- Like other advanced industrial nations, the United States imports some of the same categories of goods that it exports

- Canada is the United States’ most important trading partner quantitatively

- The United States leads the world in the combined volume of exports and imports, as measured in dollars

- International trade (and finance) links world economies

The economic basis for trade

- International trade enables nations to specialize their production, enhance their resource productivity, and acquire more goods and services

- Why do nations trade?

- Uneven distribution of natural, human, and capital resources between nations

- Efficient production of goods requires different technologies or resources

- Products are differentiated as to quality and other nonprice attributes

- Labor-intensive goods - Goods whose design and production require much skilled labor

- Land-intensive goods - Goods that require vast amounts of land

- Capital-intensive goods - Goods whose production requires much capital

- As national economies evolve, the efficiency with which a nation can produce specific goods will also change

Specializing based on comparative advantage

- Opportunity-cost ratio - The domestic exchange ratio for two products

- Specialization and trade are mutually beneficial to 2 nations if the comparative opportunity costs of producing the two products within the two nations differ

- Principle of comparative advantage - Total output will be greatest when each good is produced by the nation that has the lowest domestic opportunity cost for that good

- The world would not be employing its resources economically if coffee were produced by a high-cost producer rather than by a low-cost producer

Terms of trade - The exchange ratio at which 2 nations trade 2 goods

- Determine how the gains from international specialization and trade are divided between the two nations

- The actual exchange ratio depends on world supply and demand for the two products

Gains from trade

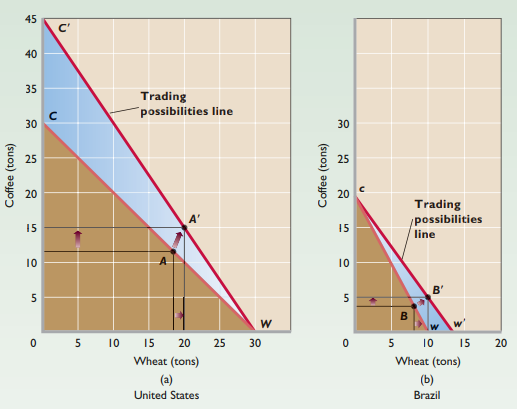

- Trading possibilities line - Shows the amounts of two products a nation can obtain by specializing in one product and trading for the other

- Specialization and trade create a new exchange ratio between 2 goods, reflected in each nation’s trading possibilities line

- Makes self-sufficiency undesirable

- By specializing on the basis of comparative advantage and by trading for goods that are produced in the nation with greater domestic efficiency, nations can realize combinations of goods beyond their production possibilities curves

- Gains from trade - The net benefits to economic agents from being allowed an increase in voluntary trading with each other

- The outcome of international specialization and trade is equivalent to having more and better resources or discovering improved production techniques

Trade with increasing costs

- Over time, resources less and less suitable to the production of a certain good must be allocated to this industry in expanding its output, which means increasing costs

- There will often be domestically produced products competing directly against identical or similar imported products within a particular economy

The case for free trade

- Through free trade based on the principle of comparative advantage, the world economy can achieve a more efficient allocation of resources and a higher level of material well-being than it can without free trade

- Each nation should produce goods for which its domestic opportunity costs are lower than the domestic opportunity costs of other nations and exchange those goods for products for which its domestic opportunity costs are high relative to those of other nations

- Promotes competition and deters monopoly

- Links national interests and breaks down national animosities

Supply and demand analysis of exports and imports

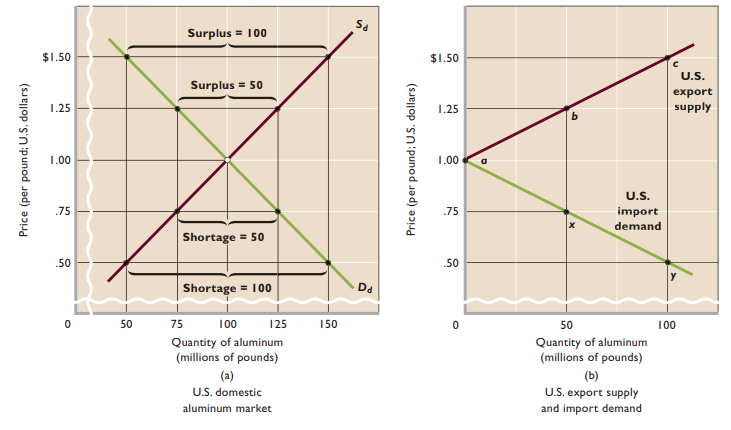

- World price - The price that equates the quantities supplied and demanded globally

- Domestic price - The price that would prevail in a closed economy that does not engage in international trade

- Export supply curve - Shows the amount of a good that the producers of a nation will export at each world price

- Slopes upward

- Import demand curve - Shows the amount of a good that a nation will import at each world price

- Slopes downward

Equilibrium world price, exports, and imports

- Equilibrium world price - The price of a good at equilibrium world levels of exports and imports when the world is opened to trade

- International equilibrium occurs in this two-nation model where one nation’s import demand curve intersects another nation’s export supply curve

- Only one price for a standardized commodity can persist in a highly competitive world market

Trade barriers

- Tariffs - Excise taxes on imported goods

- Revenue tariff - Usually applied to a product that is not being produced domestically

- Protective tariff - Designed to shield domestic producers from foreign competition

- Import quota - Specifies the maximum amount of a commodity that may be imported in any period

- Nontariff barrier (NTB) - Refers either to a licensing requirement that specifies unreasonable standards pertaining to product quality and safety, or to unnecessary bureaucratic red tape that is used to restrict imports

- Voluntary export restriction (VER) - A trade barrier by which foreign firms “voluntarily” limit the amount of their exports to a particular country

Economic impact of tariffs

- Direct effects

- Decline in consumption

- Increased domestic production

- Decline in imports

- Tariff revenue

- Indirect effects

- US export industries must cut production and release resources

- Expansion of inefficient industries

- Resources are shifted in the wrong direction

Economic impact of quotas

- A tariff produces a better economic outcome than a quota, other things being the same

- A tariff generates government revenue that can be used to cut other taxes or to finance public goods and services that benefit the United States

- The higher price created by quotas results in additional revenue for foreign producers

The case for protection

- Military self-sufficiency argument - Protective tariffs are needed to preserve or strengthen industries that produce the materials essential for national defense

- Diversification for stability argument - The economies of unstable nations need tariff and quota protection to enable greater industrial diversification

- Infant industry argument - Protective tariffs are needed to allow new domestic industries to establish themselves

- Temporarily shielding young domestic firms from the severe competition of more mature and more efficient foreign firms will give infant industries a chance to develop and become efficient producers

- Strategic trade policy - The advances achieved in one domestic industry often can be transferred to other domestic industries

- Protection against dumping argument - Tariffs are needed to protect domestic firms from “dumping” by foreign producers

- Dumping - The sale of a product in a foreign country at prices either below cost or below the prices commonly charged at home

- Increased domestic employment argument - A tariff will save US jobs

- Smoot-Hawley Tariff Act - Although that act was meant to reduce imports and stimulate U.S. production, the high tariffs it authorized prompted adversely affected nations to retaliate with tariffs equally high

- Cheap foreign labor argument - Domestic firms and workers must be shielded from the ruinous competition of countries where wages are low

World Trade Organization (WTO) - Oversees trade agreements and rules on disputes relating to them