Econ Chapter 17 Review

Behavioral Economics & Risk Taking

Behavioral Economics: is a field of economics that studies psychological influences in economic decision making.

So far, we have assumed people act in ways that maximize their utility

but we know from our own experience:

we are influenced by the environment in which we make decisions

we don’t always act in our best interest

Misperception of Probabilities: occur when the true underlying probability is misestimated.

Why do people play the lottery or gamble when there is little chance of winning?

Players have incomplete information or do not try to calculate odds of winning

Players believe they have some control over the game ('“lucky numbers”)

Gambling is fun? Get utility from gambling itself?

Seeing Patterns Where None Exist

Gambler’s Fallacy: The belief that outcomes that have not occurred recently are more likely to occur. Thats a negative correlation.

Hot Hand Fallacy: The belief that outcomes that have occurred recently are more likely to occur. That’s a positive correlation.

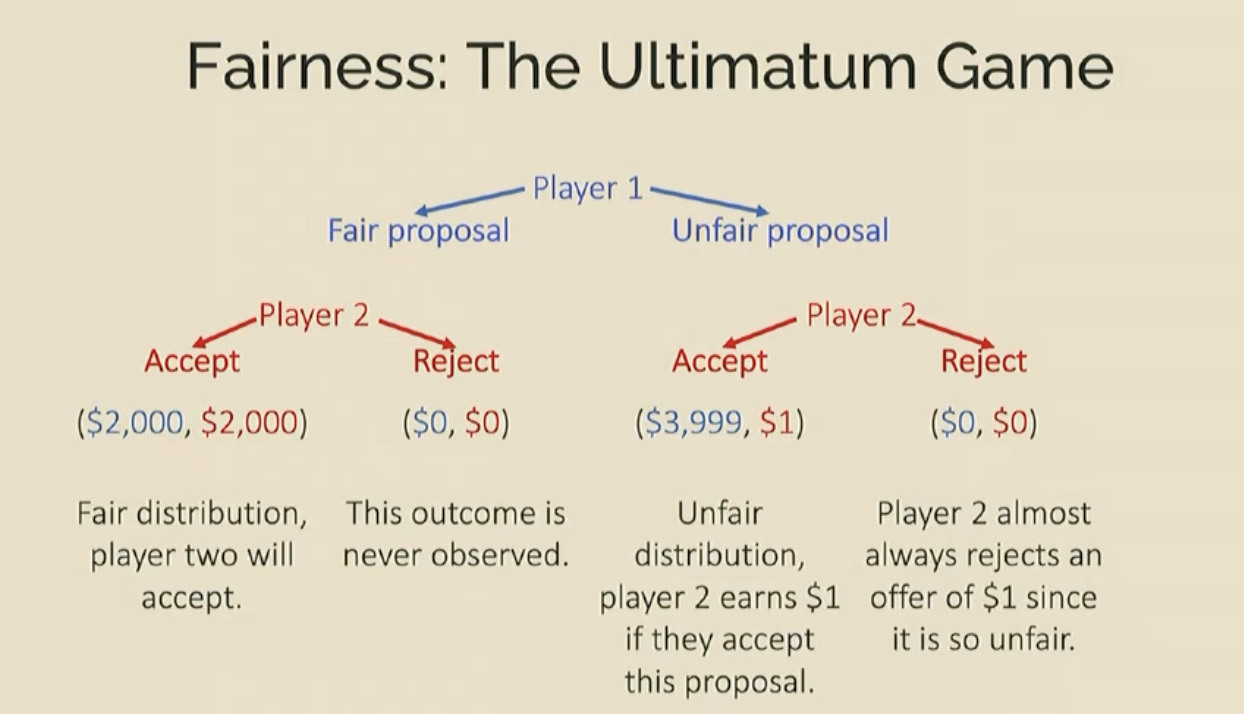

Fairness: The Ultimatum Game

Economic theory of rationality tells us Player 2 should accept the unfair proposal

But real player 1s rarely offer low amounts- often equal splits

and real player 2s often reject offers that are “too low”

Inconsistencies in Decision Making

Intertemporal Choice

Farming

Satus-quo bias

Regret aversion

The Allais Paradox

Prospect Theory

Intertemporal Choice: Planning to do something over a period of time requires the ability to value the present and future consistently.

Describes how individual’s current decisions affect what options become available in the future.

A Nudge: that prompts the consumer to consider the long-run consequences of their actions

Framing: Occurs when an answer is influenced by the way a question is asked, or a decision is influenced by the way alternatives are presented.

You are told that a risky medical procedure has a 90% chance you are alive after 5 years or a 10% chance you are dead after 5 years

The Status-quo bias: is the tendency to keep doing whatever you are currently doing

You can prime people by giving them a default choice, like making the default that you are/are not an organ donor.

Expected values and risk taking

Choice A: You receive $100 with a 40% probability and $20 with a 60% probability

Expected Value (EV)= .4 × 100 +.6 × 20 = $52

Choice B: You receive $100 with a 50% probability, $50 with a 30% probability, and $0 with a 20% probability.

EV= .5 × 100 + .3 × 50 + .20 × 0= $65

Risk- averse person: Prefers a certain payoff to a gamble with a higher EV

Risk- neutral person: Chooses the highest expected value regardless of the risk

Risk- loving (risk- taking) person: Prefers gambling with lower expected values but potentially higher winnings over certain payoff

Example:

Coin-flip game

Heads: you win $100

Tails: you get nothing

EV of the game = .5× 100 +.5 ×0 = $50

How much guaranteed money would it take you to not play the game?

A risk-averse person would take a guaranteed payoff< $50 rather than play

If you offer $35 or the chance to play; will likely take 35$ even tho $35<$50

A risk- neutral person would require a guaranteed payoff of >= $50 to choose not to play

Indifferent between playing and guaranteed $50

Any guaranteed offer> $50 would cause the person to take the offer and not play

A risk- loving person would take a guaranteed payoff > $50 to choose not to play.

Could offer to play or get a guaranteed $60

Depending on level of risk living, may rather play over taking the $60, even though $60 is greater than the EV.

Regret Aversion: When people fear that their decision will turn out to be wrong in hindsight, they exhibit regret aversion.

The Allais Paradox: is a choice problem designed to show an inconsistency of actual observed choices with the predictions of utility theory.

Preference reversal: occurs when people’s risk tolerance is not consistent.

Risk Tolerance depends on financial circumstances

Risk-loving individuals are more likely to participate in large-prize games such as lotteries

large prizes=significant life change

People care about how much they could win and how much they stand to lose

Prospect Theory: People weigh the utilities and risks of gains and losses differently.

individuals place more emphasis on losses than gains

implies that people evaluate the risks that lead to gains separately from the risks that lead to losses

Prospect theory & loss aversion

Loss aversion: people dislike losing more than they enjoy gains

Loss aversion in investing During a downturn:

people often don’t want to invest

BUT investing in a strong market is risker

more upside when stocks at discount

Investors sell to avoid further losses

may miss out on longer term rebound

Investors often prioritizing the avoidance of loss over earning a gain which explains part of why we observe underperformance of the market

Cold Openings

would you go to see a movie if it had no reviews?

Why would any movies studio open a movie without sending it out to reviewers