Week 2.1 Pension

What is a defined benefit pension?

Defined benefit pensions give you a retirement income based on your salary and how many years you’ve been in the pension scheme.

They provide a regular income for life, usually in monthly payments. The payments increase each year in line with inflation.

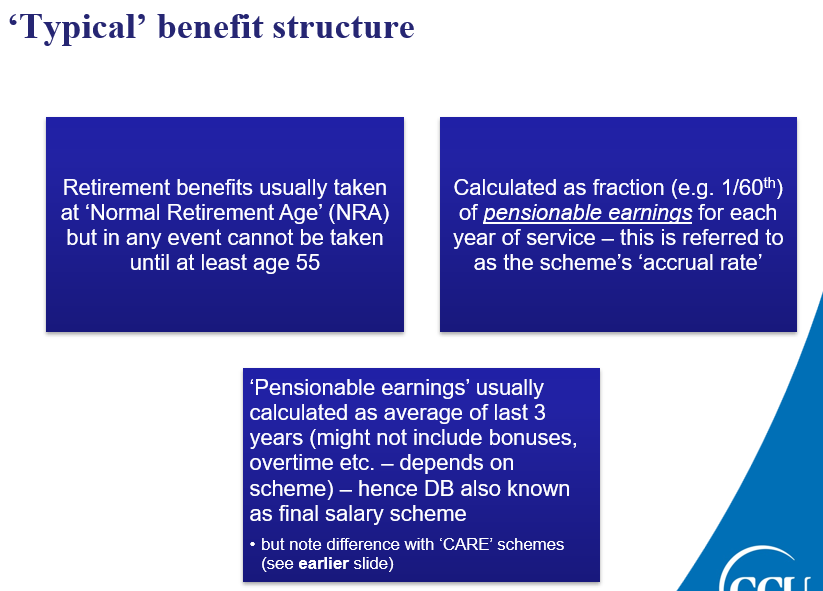

Key terms

•Pensionable service – the period of employment with the employer that counts towards pension benefit calculation

–A scheme may have a ‘waiting period,’ i.e., have joined the employer but service not yet counting towards pension benefits

•Pensionable earnings/remuneration – the salary that counts towards the calculation of benefits. May include bonuses and overtime – although these are often averaged over several years

•Accrual rate – the rate at which benefits accrue for each year of service e.g. 1/60th of pensionable remuneration for each year of service

•Normal Retirement Age – the age to which the employer will pay contributions and at which employees will usually retire (although they don’t have to)

Career Average Revalued (CARE) schemes

•To reduce cost to employers they are more fashionable now.

•Benefits based on revalued benefit earned each year over career in scheme

•Benefit earned based on salary in that year and revalued by RPI/CPI to compensate for inflation

•Can benefit those whose earnings peak in early/mid-career

Hybrid schemes

•A mixture of DB and DC

–Usually providing some certainty/guarantee, but is more limited than a traditional defined benefit scheme promise

–Examples include: Defined contribution with a defined benefit underpin; Defined benefit with a cash sum guarantee

Can also have DC ‘targeted schemes’

Example

Emma reaches her scheme NRA of 65 with 25 years service. Her scheme has an accrual rate of 1/60th final pensionable salary for each year of service and her final pensionable salary at retirement is £90,000.

•Pension at retirement:

•25/60 x £90,000 = £37, 500

Lump Sum

Lump sum (usually tax free) – ‘Pension Commencement Lump Sum’ (PCLS) i.e. lump sum that can be paid when decide to take benefits from pension scheme. This comes in two main ways:

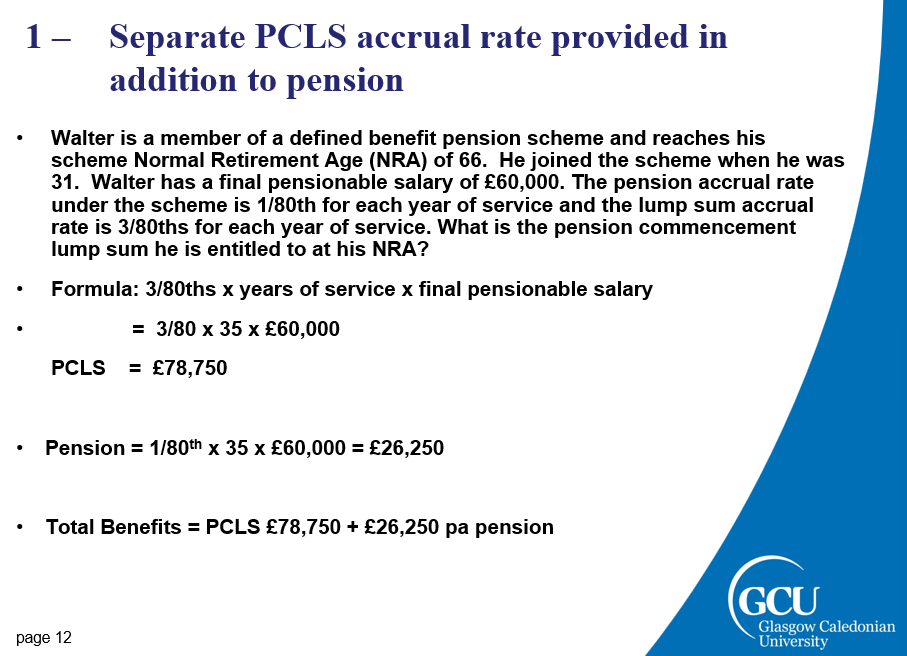

1.Have separate accrual rate for PCLS e.g. 3N/80ths of final salary. This is provided in addition to the pension accrual.

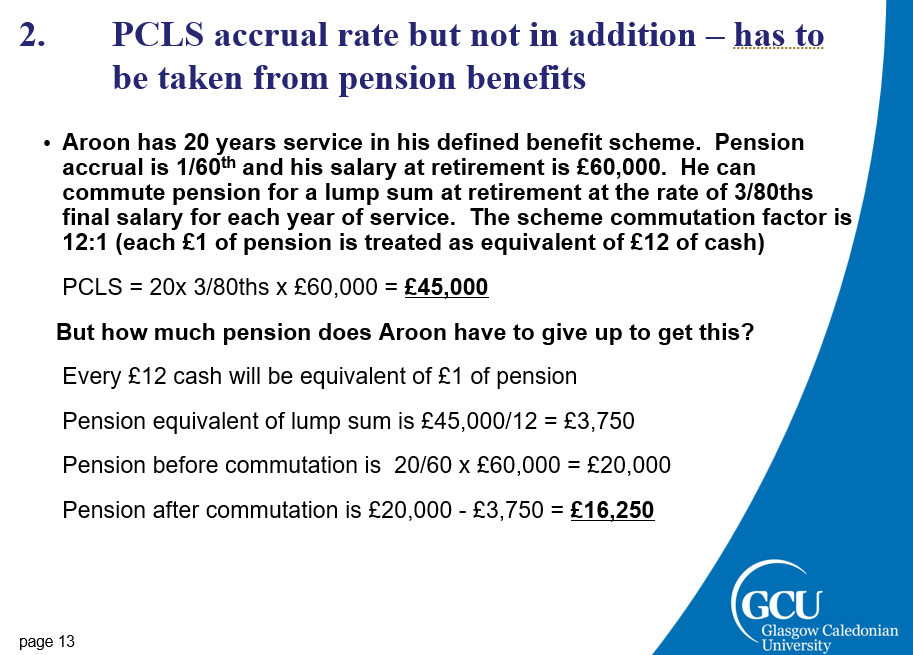

2.Scheme has accrual rate for PCLS e.g. 3N/80ths of final salary. This is not in addition to the pension accrual – you have to ‘cash in’ some of the value of your pension to provide cash lump sum

–This ‘cashing in’ is referred to as ‘commutation’

–It involves a commutation factor – which gives a cash value for each £1 of pension. Schemes can adopt different commutation factors – will be decided by scheme actuary

»e.g. commutation factor of 15:1 means £1 pension treated as being worth £15 cash