Chapter 5 - Documentary Sale

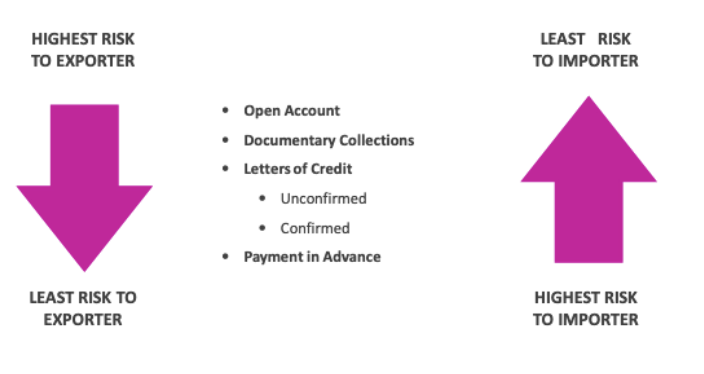

Where is the Risk?

Currency, Quality, Payment/Credit, Delivery

Currency Risk?

Review Chapter 1: Exchange Rate Risk

Assign the risk (determined by which currency is chosen)

REMEMBER: You cannot agree to an exchange rate in your contract

Quality Risk?

Clear and Complete description of the product

Express and Implied warranties

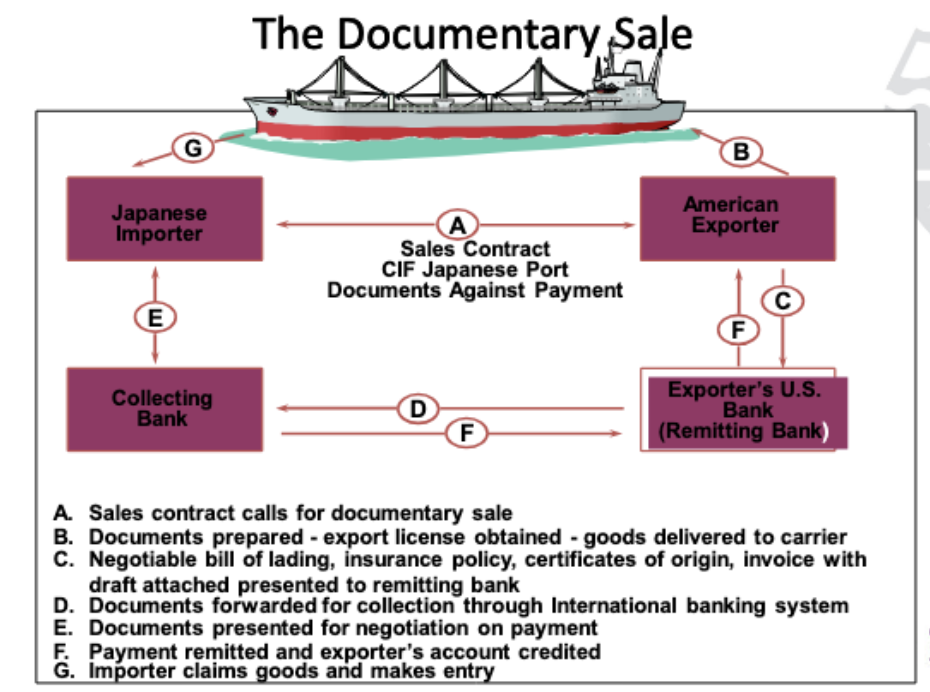

The Documentary Sale

Type of contract for sale of goods in which: Sale of goods – sale of documents (Possession and ownership of goods is transferred to buyer through negotiation and delivery of a negotiable document of title issuedby an ocean carrier)

Buyer must pay Seller when NEGOTIABLE DOCUMENT OF TITLE is presented for the goods

Bill of Lading & Document of title – Three functions

1. Document of Title: Evidence of ownership dock; Issued by Bailee when goods taken into possession from Bailor (owner of goods), Ownership of goods passes with the documents, Transforms sale of goods into sale of documents

2. A receipt for the goods from the carrier (noting visible damage to goods at time of loading)

3. A Transportation Document (Contract for Carriage between person shipping & carrier)

Constructive Delivery

Ownership of goods is transferred by the ownership of the paper documents which represent the goods

If I have the documents, I own the goods

Bill of Lading Negotiable or Nonnegotiable

Negotiable: “to order of _____” or “to bearer”

Negotiation = transfer in manner that transfers title to documents, title to goods, right to claim the goods

Order documents: Ownership transferred by endorsement & delivery, Must be delivered to identified person, Carrier may only surrender goods to holder (or carrier liable for misdelivery)

Bearer Documents: Ownership transferred by delivery, Not used in international transactions

:max_bytes(150000):strip_icc()/bill-of-lading-01-9ea02358e8a04863b781b4fe33ff809d.jpg)

Holder by due negotiation - The Good Faith Purchaser

Purchases negotiable document

1. For Value (not in settlement of a debt)

2. In good faith & without notice of claim(s) against the goods

3. In the ordinary course of business

Good faith purchaser gets the negotiable document of title free from adverse claims against the goods or document by third parties (except carrier for shipping charges and custom authorities claims)

Carrier’s Liability for Misdelivery of the Goods

Carrier may only deliver the goods to holder of original bill of lading.

Assume Hakenberg GmbH entrusts ocean shipment of goods to the Viking and gets an ocean bill of lading.

Viking (wrongly) delivers the goods to Harvest Moon, Inc. without asking to produce documents

Without knowing that this happened, Hakenberg sells the documents to Acme Corporation [who takes the goods for value & in good faith]

Against whom does Acme have an action? Post answer on Canvas

Documentary Collection: Payment against documents

Separating goods and documents (title) facilitates trade

Controlling documents means you control the goods

Use Banks in the process

Negotiable instruments are also important

The Documents

Negotiable bill or lading or multimodal transport document

Marine insurance policy (if required)

Certificate of origin

Documentary Draft

The Law of Negotiable Instruments: Drafts or Bills of Exchange [Chapter 7]

Facilitates payment: Act as a substitute for money

Seller (Drawer) orders

Buyer (Drawee) to pay a specified amount at a specified time (Sight Draft – when presented; Time Draft – at a specified time)

May be “order” or “bearer” documents

Negotiability is a matter of form UCC Article 3

Instrument must: Be in writing, signed, contain unconditional order or promise to pay, fixed amount of money, no other undertaking, payable on demand or specific time, payable to order of a specific person or to bearer

Terminology for your Contract

Documents against Payment or

Cash against Documents (used with a Sight Draft)

Documents against Acceptance used with a Time Draft (60 days after date; 60 days sight)

Stages in Documentary Transaction

Exhibit 5.2

Buyer & Seller negotiate a K for the sale of goods

e.g. C.I.F. Kobe, Japan (Cash against documents, Documents against payment)

What is the payment method specified in Pro forma invoice last chapter (Chapter 4, p.97 – Exhibit 4.2)?

[Sales Contract specifies which documents are required]

Documents ...

Stipulate in your contract WHICH documents are necessary to be presented for payment...

Bill of Lading (what kind ... we are coming to this)

Certificate of Inspection –

Certificate of Origin

Insurance?

Anything special for the type of goods?

Types of Bills of Lading

Clean Bill of Lading: No notations by carrier that indicates visible damage to the goods or containers

Carrier inspects: protection from liability for pre-shipment damage

Buyers want a clean bill of lading (it is not a guarantee that the goods meet quality standards nor that nor that they won’t be damaged)

Foul Bill of Lading

Onboard Bill of Lading: signed statement that the goods have been loaded aboard a certain vessel

CONSIDER YOUR INCOTERM: Can you get an onboard Bill of Lading for FAS? EXW?

Negotiable, Clean, Onboard Bill of Lading

Received for shipment bill of lading

Issued by a carrier when goods are delivered

Can be converted to an on board bill of lading if the carrier notes the vessel name and date of loading on the face of the bill of lading

Straight Bill of Lading: Nonnegotiable

Used when goods sold directly to a Consignee (specific named person only)

Seller using own shipping agent

Buyer, Buyer’s bank, Customs agent

Carrier may only deliver to named party or be liable for misdelivery

Straight bills no not represent transferable title to the goods

Air Waybills

Air freight handled through Air Waybills

Delivery to Consignee (sometimes a bank)

Negotiability not as important

Warsaw Convention – limits on liability of air carriers

Ocean Transportation

Long transit time

May ship bulk, containerized, or other ways

Several container sizes; can ship less than a container load (for a premium)

Typically lower cost, but more transit risk

May involve trucking and/or trains

Air Transportation

Fast transit time

Typically higher cost, but consider the time element and the type of freight

High-value? Time-sensitive? Lightweight?

May be light but “dimensional”—freight may be priced on how much room it takes

May be transported on passenger lines

Stricter limits on what can be sent

Also involves trucking aspects

Allocating Shipping Responsibilities and Risk of Loss

Freight and Transportation Charges

Who is going to pay the freight charges?

Who will be responsible for damages during the voyage?

(How does this impact the price for the goods – see pro forma invoice page 195)

Think INCOterms

Freight Forwarders

“Travel agents for freight”

Arrange transportation, customs clearance, inbound trucking, etc.

Purchase shipping space to resell at a profit (still cheaper than spot rates)

May consolidate freight for better rates

Agents for exporters/importers – do not take title to goods

Forwarders v. Carriers

Freight forwarders: “non-asset”, meaning they own no ships or planes.

Carriers: own the equipment (Fed Ex, UPS, Maersk).

Freight and Transportation

Who pays for transportation?

Who pays for other charges? (What are they?)

How does this impact the price?

Risk of Loss or Damage in Transit

Negotiate responsibilities of buyer and seller

Choice of Law will have gap filler rules (what are they) or

Allocate Risk of Loss or Damage

Spell it out in detail in your contract OR

Trade terms can be used as a short hand for assigned responsibilities and allocating when the risk passes from one party to another.

Types of Contracts

Shipment contract- risk passes when goods are delivered to the first carrier

Presumption of shipment contract if not specified

Destination contract- risk passes when goods are delivered to buyer at destination point

Delivery of the goods – CISG Articles 31 – 34

Where does Risk of Loss pass under the CISG (IF you do not specify in your contract?)

If the contract involves carriage of goods – when they are handed over to the first carrier

Risk of Loss – CISG Articles 66 – 70

Art. 66 – Loss or damage AFTER risk passes to Buyer does not discharge from obligation to pay (unless act or omission of seller)

Art. 67 – If contract of sale involves Contract of Carriage risk passes (generally) when handed to the first carrier as required by contract

The fact that the seller may retain the documents controlling disposition of the goods does not affect passage of risk