6 - Valuing Equity Instruments

Share Basics

Ordinary shares: Shareholder rights

Annual meeting (AGM)

Event at which managers and directors answer question from shareholders, and shareholders vote on the election of directors and other proposals

Proxy: an act through which shareholders direct that their shares be voted for them

Amount of shares correlates to voting power

Proxy contest

Preference shares

Preference over ordinary shares in the distribution of dividends or cash during liquidation

Cumulative vs non-cumulative preferred shares

With cumulative preference shares, any unpaid dividends are carried forward

Non-cumulative preference shares, missed dividends do non accumulate, and the firm can pay current dividend payments first to preference and then to ordinary share shareholders

Preference shares: Equity or debt (hybrid shares)

Debt: pay a given rate over a period of time

Equity: company can skip that payment and it will either accumulate or not accumulate, depending on the type of share it is

Stock Prices and Returns

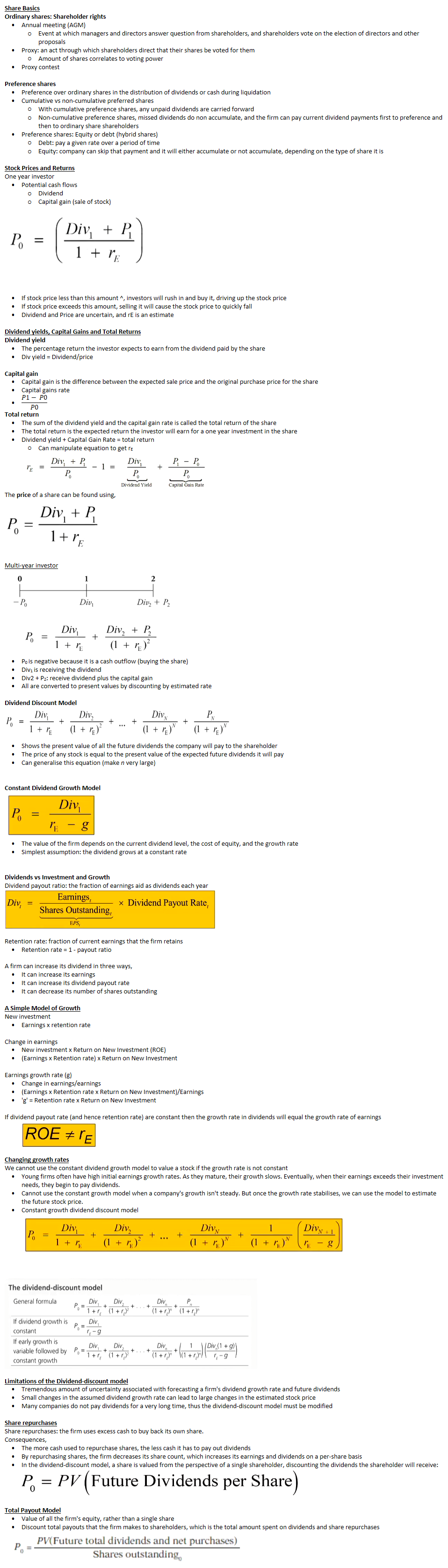

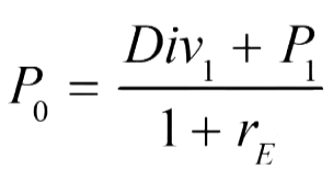

One year investor

Potential cash flows

Dividend

Capital gain (sale of stock)

If stock price less than this amount ^, investors will rush in and buy it, driving up the stock price

If stock price exceeds this amount, selling it will cause the stock price to quickly fall

Dividend and Price are uncertain, and rE is an estimate

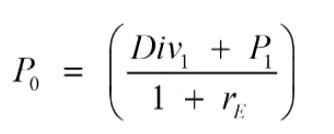

Dividend yields, Capital Gains and Total Returns

Dividend yield

The percentage return the investor expects to earn from the dividend paid by the share

Div yield = Dividend/price

Capital gain

Capital gain is the difference between the expected sale price and the original purchase price for the share

Capital gains rate

Total return

The sum of the dividend yield and the capital gain rate is called the total return of the share

The total return is the expected return the investor will earn for a one year investment in the share

Dividend yield + Capital Gain Rate = total return

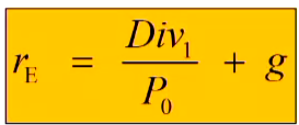

Can manipulate equation to get rE

The price of a share can be found using,

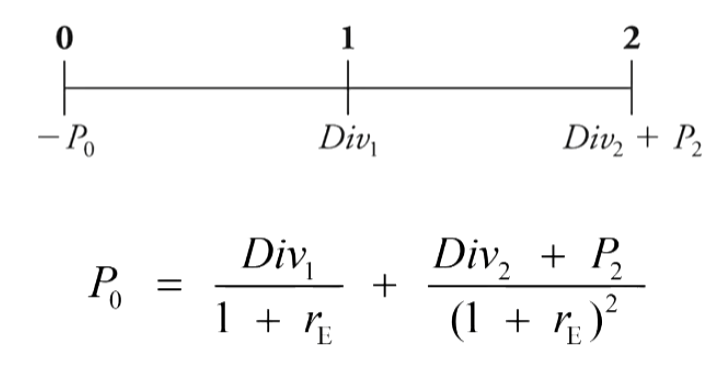

Multi-year investor

P0 is negative because it is a cash outflow (buying the share)

Div1 is receiving the dividend

Div2 + P2: receive dividend plus the capital gain

All are converted to present values by discounting by estimated rate

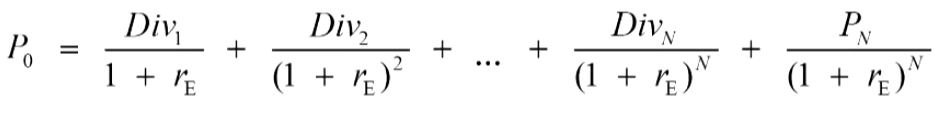

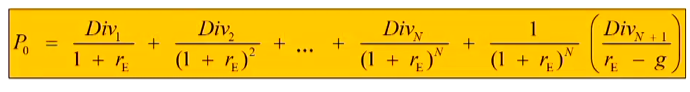

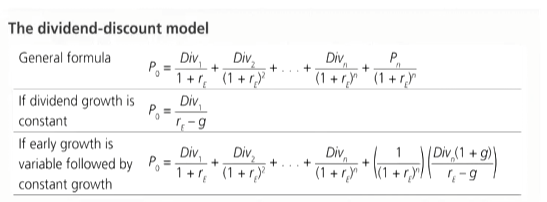

Dividend Discount Model

Shows the present value of all the future dividends the company will pay to the shareholder

The price of any stock is equal to the present value of the expected future dividends it will pay

Can generalise this equation (make n very large)

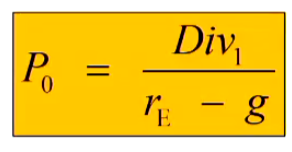

Constant Dividend Growth Model

The value of the firm depends on the current dividend level, the cost of equity, and the growth rate

Simplest assumption: the dividend grows at a constant rate

Dividends vs Investment and Growth

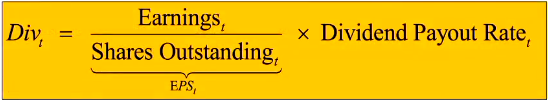

Dividend payout ratio: the fraction of earnings aid as dividends each year

Retention rate: fraction of current earnings that the firm retains

Retention rate = 1 - payout ratio

A firm can increase its dividend in three ways,

It can increase its earnings

It can increase its dividend payout rate

It can decrease its number of shares outstanding

A Simple Model of Growth

New investment

Earnings x retention rate

Change in earnings

New investment x Return on New Investment (ROE)

(Earnings x Retention rate) x Return on New Investment

Earnings growth rate (g)

Change in earnings/earnings

(Earnings x Retention rate x Return on New Investment)/Earnings

'g' = Retention rate x Return on New Investment

If dividend payout rate (and hence retention rate) are constant then the growth rate in dividends will equal the growth rate of earnings

Changing growth rates

We cannot use the constant dividend growth model to value a stock if the growth rate is not constant

Young firms often have high initial earnings growth rates. As they mature, their growth slows. Eventually, when their earnings exceeds their investment needs, they begin to pay dividends.

Cannot use the constant growth model when a company's growth isn't steady. But once the growth rate stabilises, we can use the model to estimate the future stock price.

Constant growth dividend discount model

Limitations of the Dividend-discount model

Tremendous amount of uncertainty associated with forecasting a firm's dividend growth rate and future dividends

Small changes in the assumed dividend growth rate can lead to large changes in the estimated stock price

Many companies do not pay dividends for a very long time, thus the dividend-discount model must be modified

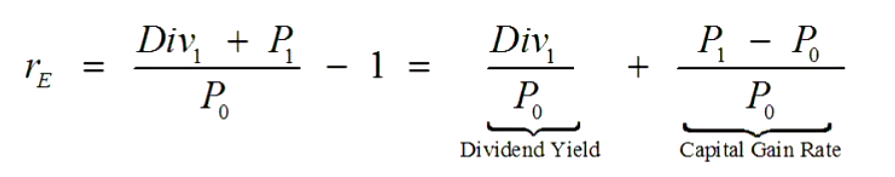

Share repurchases

Share repurchases: the firm uses excess cash to buy back its own share.

Consequences,

The more cash used to repurchase shares, the less cash it has to pay out dividends

By repurchasing shares, the firm decreases its share count, which increases its earnings and dividends on a per-share basis

In the dividend-discount model, a share is valued from the perspective of a single shareholder, discounting the dividends the shareholder will receive:

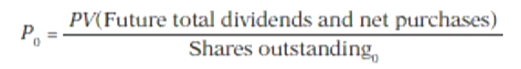

Total Payout Model

Value of all the firm's equity, rather than a single share

Discount total payouts that the firm makes to shareholders, which is the total amount spent on dividends and share repurchases