Economics

A social science that studies the optimal/efficient allocation and distribution of scarce resources to satisfy unlimited human wants and needs

KEY TERMS

Scarcity - The state of being scarce or short in supply

Trade-offs - Giving up one thing in return for another

opportunity costs - Cost of the decision that wasn’t chosen, EX. Instead of studying you play. and the opportunity cost is being able to study to get a good grade

Macroeconomics and Microeconomics

macro - economy as a whole (Interest rates, national productivity)

micro - single factors and effects of individual decisions by decision takers (households, firms)

Fields of Study in Economics

Agriculture, Natural Resources, Environment, Development, Labor, Behavioral, Financial, Monetary, Business, Health and education, Mathematical/Quantitative, History, International Trade and Finance

Ten economic principles

1. People Face Trade-offs

When you have to choose an option that causes you to lose something as well

2. Opportunity cost

The cost of something is what you give up to get it

3. Rational people think at the margin

if the people is giving benefits accept the person, you decide on the additional cost/benefit

4. People respond to Incentives

People are more willing to do work when there is reward in return from it

5. Trade can make everyone better off

This economic principle may not be appliable to all but some trades may make everyone better off.

6. Markets are usually a Good way to optimize Economic Activity

Trades in the market can be used to determine if there are many demands for a certain product or how much supply there is

7. Governments Can sometimes improve market outcomes

Pandemic, vaccines

8. A country's standard of living depends on its ability to produce goods and services

trade offs due to scarce resources, have to make choices because of scarce resources

9. Prices rise when the government prints too much money

Inflation

10. Society faces a short run trade off between inflation and unemployment

Increasing employment, prices go up, inflation go up - lesser employees prices go down, inflation go down

Four Fundamental Economic Questions

1. What to produce

2. How to produce

3. How much to produce

4. For whom to produce

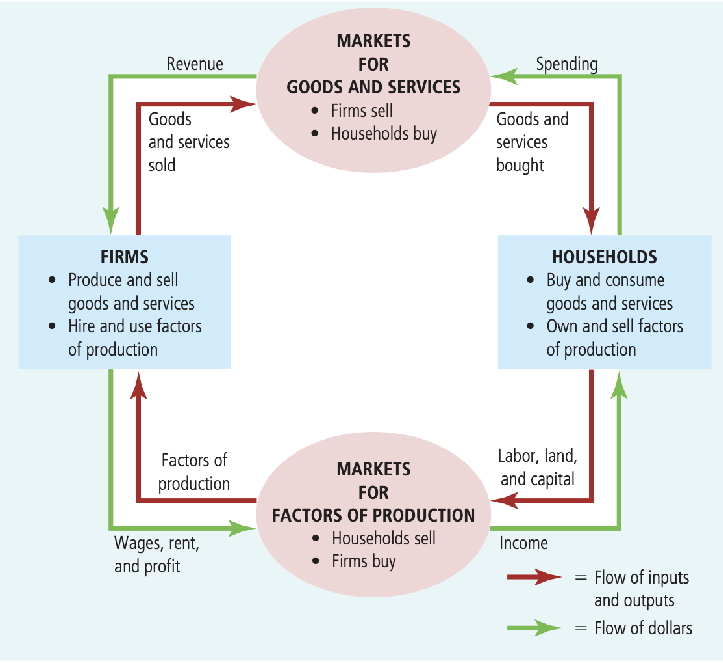

The circular flow diagram

The circular flow diagram

Flow of dollars - FGHP firms, goods, households, production flow of input reverse, PHGF

Households (buy and consume goods and services) - Markets for Goods and Services (Profit from the purchases of households) - Firms (use profit to expan factory and production) - Markets for Factors or Production (goes into wages and rent and profit)

FGHP - firms, goods, households, production

PHGF - sell to households, buy and consume, households buy. produce and sell

MODULE - 2

—————————————————————-

Economist as Scientist

Scientific Method - Acquiring knowledge with careful observation through testing and experimenting

Role of Assumptions - Assume something even without proof

Economic Models - Simplified models of reality

Economist as Policy Adviser

Positive(Describing) vs normative(To prescribe, must, should) analysis

For malacanang palace, Batasan Pambansa - to keep order

Economic policy is a messy affair - Economics isn’t something that everyone can agree upon as there are conflicting opinions and ideas

Economic Systems

government - private - mixed economy

private laissez Faire' - let people do as they choose “allow to do

Why Economists Disagree

Difference in Scientific Judgements

Difference in Values

Perception vs Reality

People

John Maynard Keynes - founder of modern macroeconomics, philosophical or politician both still hold great influence over economics “The market will sort itself out but, in the long run we are all dead“ Does not believe in the invisible hand, the government should take initative

Adam Smith - believed that government should enforce contracts, copy rights and ideas “father of economics“

positive - based on observation this graph is increasing

normative - this graph should increase

Fiscal Policies - budget balance, deficit, surplus (Taxes - Govt Spending)

Monetary Policies - Money supply, inflation rate, interest rate (Savings - Investments)

Trade Policies - Trade balance, surplus, deficit (Imports - Exports)

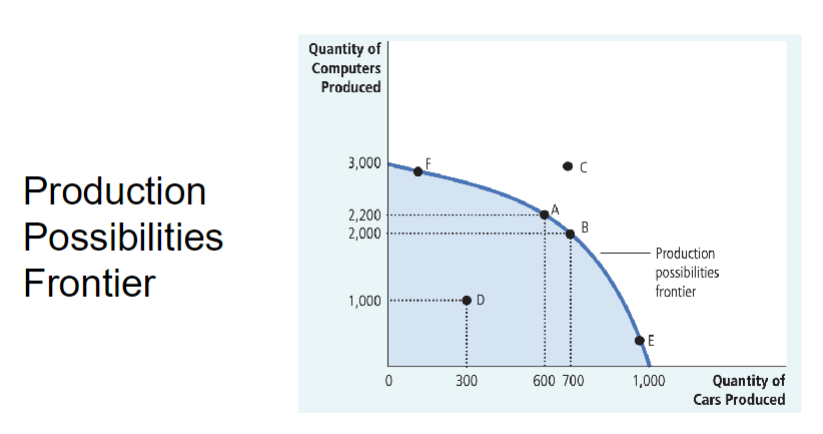

Production Possibilities Frontier (PPF)

Definition

The Production Possibilities Frontier (PPF) is a curve that illustrates the maximum feasible amount of two goods that an economy can produce with available resources and technology.

Key Concepts

Opportunity Cost: The cost of forgoing the next best alternative when making a decision. Represented by the slope of the PPF.

Efficiency: Points on the PPF represent efficient production levels. Points inside the curve indicate inefficiency, while points outside are unattainable with current resources.

Trade-offs: Moving along the PPF shows the trade-off between the production of two goods.

Shape of the PPF

Concave Shape: Typically bowed outward due to increasing opportunity costs. As production of one good increases, more of the other good must be sacrificed.

Linear PPF: Indicates constant opportunity costs, which is rare in real-world scenarios.

Shifts in the PPF

Outward Shift: Indicates economic growth, improvements in technology, or an increase in resources.

Inward Shift: Represents a decrease in resources or a decline in technology, leading to reduced production capacity.

Applications

Resource Allocation: Helps in understanding how to allocate resources efficiently between different goods.

Economic Planning: Assists policymakers in visualizing trade-offs and making informed decisions about production priorities.

Examples

Guns vs. Butter: A classic example illustrating the trade-off between military goods (guns) and consumer goods (butter).

Agricultural Production: A farmer deciding between planting corn or wheat, illustrating the opportunity costs involved.

Limitations

Simplification: The PPF simplifies complex economic realities and assumes only two goods.

Static Analysis: It does not account for changes in technology or resources over time unless shifts are illustrated.

Conclusion

The PPF is a fundamental concept in economics that helps visualize trade-offs, opportunity costs, and the implications of resource allocation decisions. Understanding the PPF is essential for analyzing economic efficiency and growth.

MODULE 3

Recession

decline of real GDP for at least two consecutive quarters (shorter)

Depression

decline of real GDP lasting several years (longer)

The great depression 1929-1939

1920s - Roaring 20s

1929 - Black Thursday, Black Tuesday, 10 million jobless, Dust bowl migration( )

1933 - GDP bounced back 9%

1937 - Sharp recession

1939 - recession

1941 - WWII begins

What is great depression?

The worst economic crisis in 20th century

Between 1929 - 1933

output in the US declined by 1/3

Unemployment rate increased by 25%

inflation rate declined by 2% - 5%

stock market lost 80%

7,000 banks failed

Absence of regulatory institutions

as GDP goes up EMPLOYMENT goes down, as GDP goes down EMPLOYMENT goes up

Causes of Great Depression

1920’s: Sum of Excesses

1929 stock market crash

Misguided government policies

Consumers’ pessimism

Smooth-Hawley Tariff of 1930

Collapse of banking system

Contraction of money stock

Four day Nationwide Bank Holiday

Shut down banking system

Restored consumer confidence to banks

Emergency Banking Act of 1933

Federal Reserve created de facto 100% deposit insurance

Reestablished integrity of US banking system

New Deal (1933-1939)

Three R’s: Relief (for unemployed and poor), Recovery (of the economy), Reform (of financial system)

New Deal Coalition: labor unions, blue collar workers, minorities

Tennessee Valley authority - govt program

Works progress administration - govt program

Federal Deposit Insurance Corp.

Mission

Insures Deposit

Examines and supervises financial institutions

Works to make large and complex financial institutions resolvable

Manage receiverships

created in response to the thousands of bank failures that occurred in the great depression

Securities and Exchange Commission

enforce laws against market manipulation

Mission

protect investors

Social Security act of 1935

created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement

unemployment insurance

MODULE 4

4 Key Macroeconomic Variables

Economic output: GDP Growth Rate

Overall Prices: Inflation Rate

Labor: Unemployment Rate

Trade: Exports and Imports

→ They all have social implications

Gross Domestic Product

Total market value of all final goods and services produced within an economy in a given period of time

Total expenditure on domestically-produced final goods and services

Total income earned by domestically located factors of production

Focus: Production Side

Market Value: Currency

There’s a territorial aspect, within an economy of a country

GDP is the aggregate of gross value added (GVA) of all resident producer units in the country

Value Added

A firm’s value added is the value of its output minus the value of the intermediate goods the firm used to produce that output

Gross National Income (Formerly, Gross National Product)

Income of your citizens regardless of where they are, walang pake sa territory basta citizen ka ng country

Calculating GDP: Expenditure Approach

Produced in the country

Consumption is 70-75% of all goods and services produced; consumables

GDP:

Overall positive gdp growth rate given growth rates in C, I, and G, even through m is larger than x

C

Strong filipino consumer base driven by young, dynamis, anc economically, active population

M

Is always red because imports are not part of the gpd

Height of COVID (2020)

C = Down (consumption)

I = Down (Investment)

G = UP (Government)

X(export) M(Import) = Down

Covid 2021

C = UP

I = UP

G = UP

X - M = UP

RUSSA-UKRAINE CONFLICT 2022

C = Down

I = Down

G =

X - M =

2023 and Beyond

C = UP

I = UP

G = UP

X - M = UP

Calculating GDP = Value-added Approach

Agriculutre + Industry + Services = GDP

Nominal vs. Real GDP

Nominal - valued at current prices (same values 1-1, 2-2, 3-3)

Real - valued at constant prices (same price 1-1, 2-1, 3-1)

GDP = Quantity x Price

Base Year - normal year (no typhoons, disasters, financial meltdowns)

GDP Deflator - A measure of the price level calculated as the ratio of nominal GDP to real GDP times 100

Principle #8

A country’s standard of living depends on its ability to produce goods and services

Inflation

Situation in which the economy’s overall price level is rising

How to get inflation rate

Consumer Price Index

Like the GDP deflator, it also measures price level

Composed of selected prices of goods and services bought by atypical consumer

More popular measure than GDP deflator

CPI and INflation Rate: Philippine Definition

CPI - An indicator of change in the average retail prices of fixed basket of goods and services commonly purchased by households for their day-to day consumption relative to a base year

5 Steps for Calculating CPI and Inflation Rate

Survey consumers to determine a fix basket go goods

Find the price of each good in each year

Compute the cost of the basket of goods in each year

Choose one year as a base and compute for cpi in each year

Use the CPI to compute the inflation rate from previous year

Homework

Cost of Basket

360

440

520

CPI

100

122.2

144.4

Inflation rate

N/A

22.2%

18.1%

Labor Force

Labor force participation rate: fraction of adult population who are in the labor force

Labor Force

aka economically active population refers to persons 15 years old and over who are either employed or unemployed

Unemployment rate: the fraction of labor force is not employed

Unemployment rate = Number of unemployed/labor force * 100

Labor-Force participation rate = Labor force/adult population * 100

Underemployed

include all employed persons who expressed the desire to have additional hours of work in their present job or an additional job, or to have a new job with longer working hours

Unemployed

Include all those who, during the reference period are 15 years old and over as of their last birthday who have no job/business and actively looking for work. Also considered as unemployed are persons without a job or business who are reported not looking for work because of their belief that no work was available or because of temporary illness/disability, bad weather, pending job application or waiting for job interview.

Persons not part of Labor Force

15 years old and over who are neither employed nor unemployed according… Those not in the labor force are those persons who are not looking for work because of reasons such as housekeeping schooling

Arthur M. Okun (1928 - 1980)

American Econoimst, Yale Professor

PhD at Columbia Uni

Okun’s Law

GDP and unemployment rate and negatively related

inversely related

Misery Index

sum of inflation rate and unemployment rate

Module:5 Government and the Economy

Promote inclusive, sustainable, equitable economic growth

Government

provide goods and services

set standards

regulatory framework

maintain or enhance competition

redistribute income

address externalities

Market Failure

not optimal distribution of goods and services in the market

Externalities

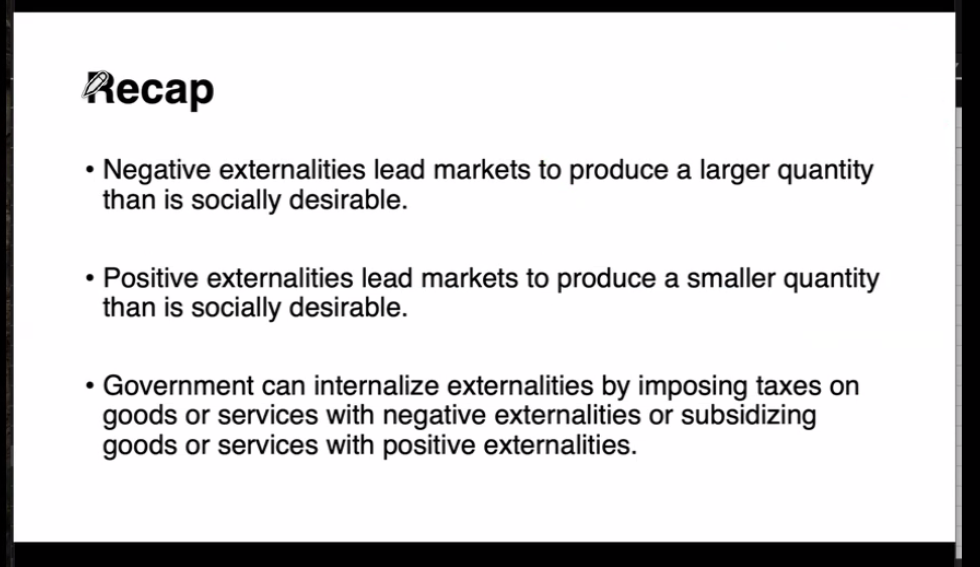

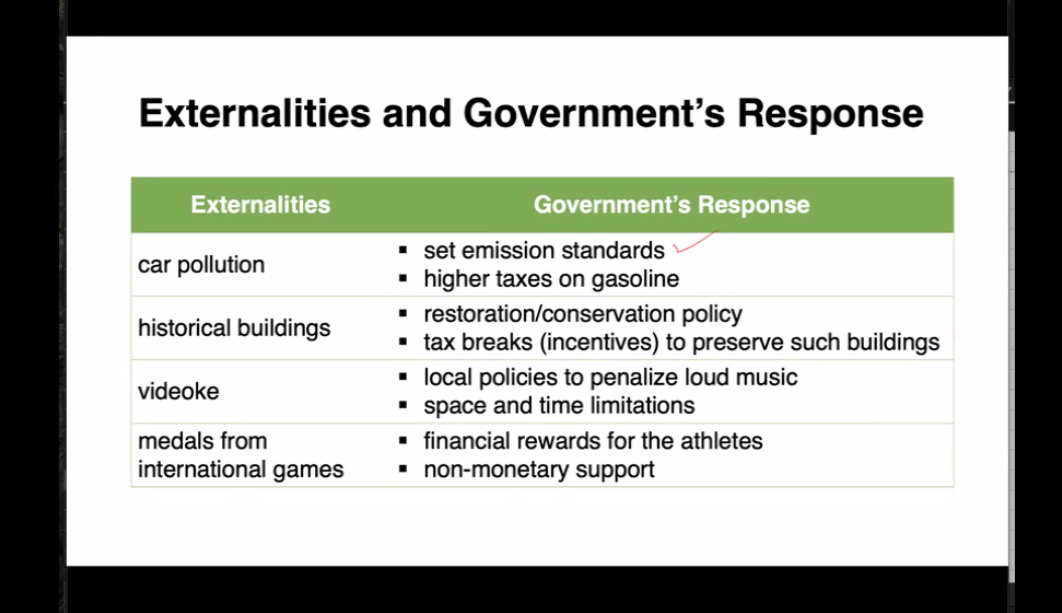

The uncompensated impact of one person’s actions on the-well being of a bystander