Pre-economics

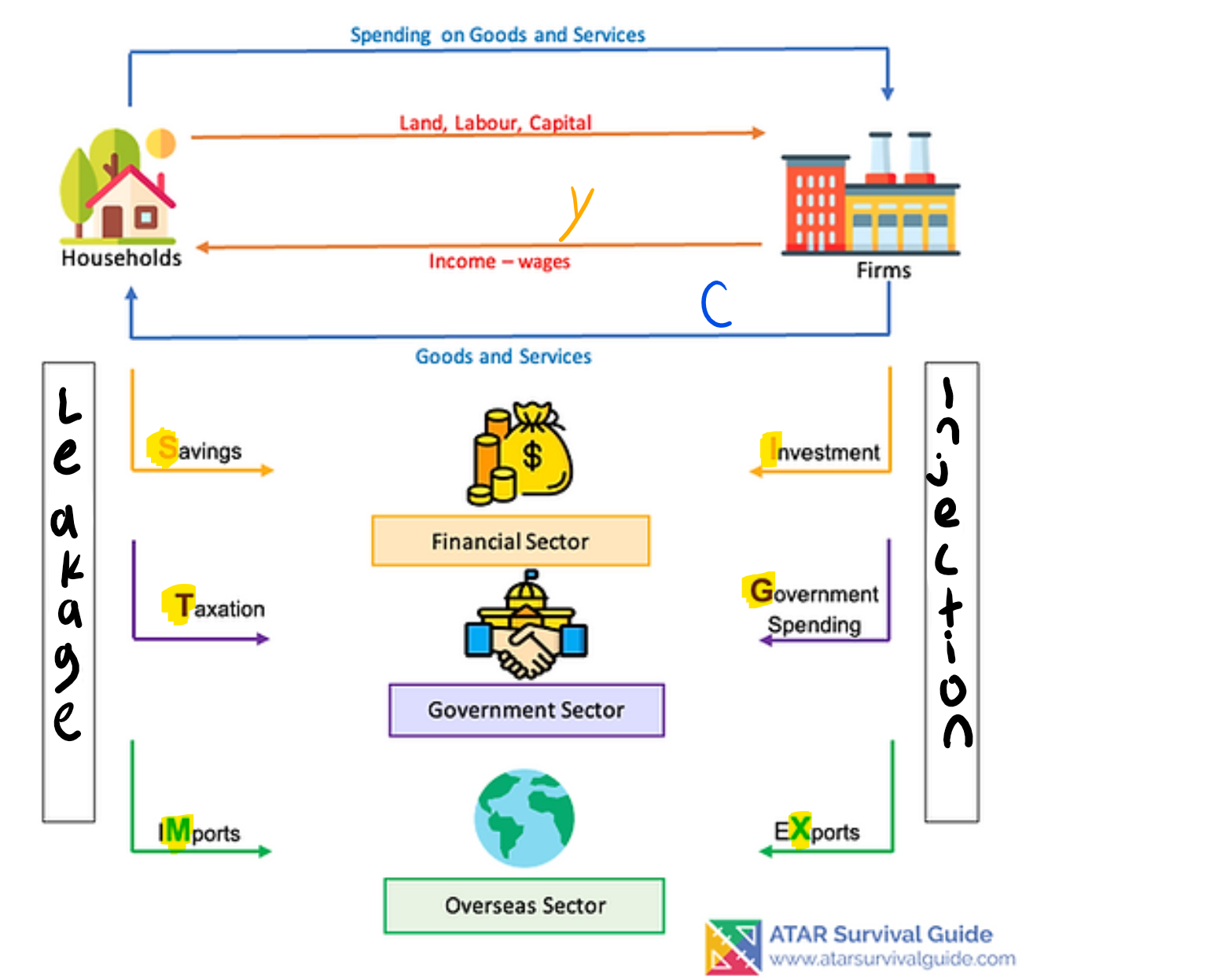

The Circular Flow

The HOUSEHOLD sector

- Made up of consumers

- Consumers provide economic resources in the form of labour

- Provided income in exchange for the economic resource

- Use this income to buy various goods and services - known as consumption

The BUSINESS sector

- Use resources (labour) to produce goods and services – known as production

- Consumers and firms are interdependent on each other – neither would survive without the other

The GOVERNMENT sector

- Refers to local, state, and federal governments with two roles in the model

- Collecting taxation from individuals and businesses when they earn an income

- Spending money on infrastructure, welfare payments, education, and health

The FINANCIAL sector

- Banks

- Act as middlemen between savers and borrowers in an economy

- Saving and investing - are both important factors in the economy

- Investment is an injection into the economy whereas saving is a leakage

The OVERSEAS sector

==S+T+M=I+G+X== (balanced economy)

S+T+M>I+G+X (economic decline as leakages are greater than injections)

%%S+T+M<I+G+X%% (economic growth as injections are greater than leakages)

The Economic and Business Environment

- The nature of the economy

- The circular flow of the income model

- Shows the connections between the 5 different sectors

- Shows where the money is being injected into the economy (right side) and where it is being leaked from the economy (left side)

- Is used to create an equation that will calculate the changes in injections and leakages to help economists determine the changes in the level of economic activity within an economy (left side)

- Is used to create an equation that will calculate the changes in injections and leakages to help economists determine the changes in the level of economic activity within an economy

- Interdependence of the sectors

- The consumer and business sectors are interdependent as they rely on each other for economic resources to provide/consume the goods and services produced in an economy

- Governments regulate the financial sector to protect consumers (ASIC - independent Commonwealth government body) - Corporations Act 2001 (Cwlth), National Consumer Credit Protection Act 2009 (Cwlth)

- They monitor the financial services industry

- Provide consumer protection in financial services (shares, managed funds, superannuation, insurance)

- The financial sector facilitates business investment - business expansion relies on the use of saved funds held by banks

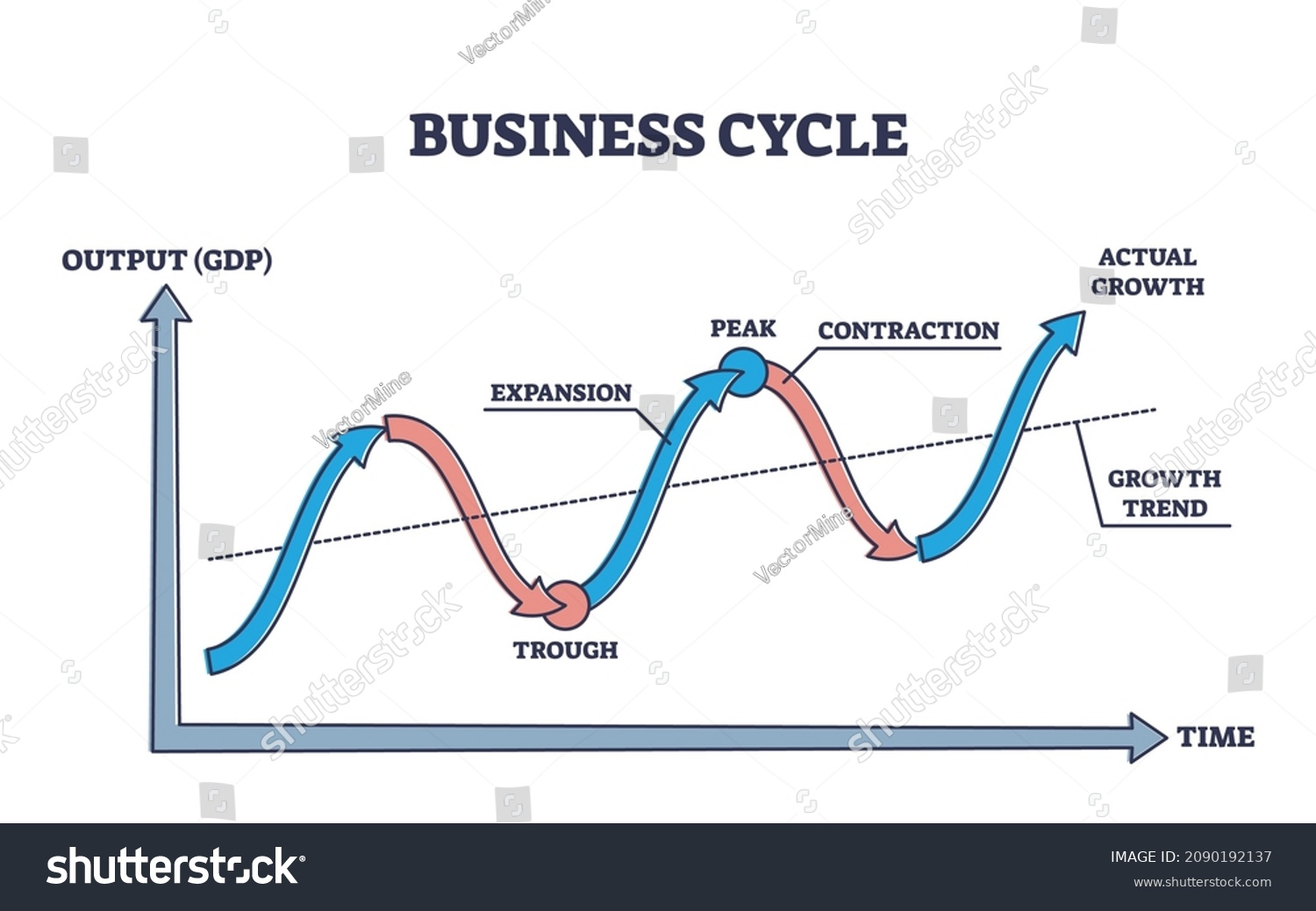

The Business Cycle

The business cycle shows the ‘ups and downs’ of the economy which will impact

- Consumer spending

- Business output

- Unemployment

- Business investment

- Inflation

- Economic growth

- Recovery/Upturn (Expansion)

- Businesses invest

- Output increases

- Consumer spending rises

- Jobs created

- Law but increasing economic growth

- Consumer Confidence increases

- Boom (Peak)

- High investment

- High profits and wages

- High consumer spending

- Low unemployment

- Inflation

- Consumer Confidence high

- Downturn (Contraction)

- Demand and consumer spending slows

- Output decreases

- Unemployment increases

- Inflation falls

- Low/negative economic growth

- Consumer Confidence drops

- Slump/Depression (Trough)

- Low investment

- Low profits and wages

- Low consumer spending

- High unemployment

- Low/negative economic growth

- Consumer Confidence low

| Firm production/sales | Household income | Household consumption | Financial sector | Imports | Exports | Government Sector | |

|---|---|---|---|---|---|---|---|

| Expansion/Boom | Increase | Increase | Increase | More goods | IncreaseOne dollar is strong | Decrease | Spend LessMore Tax |

| Contraction/Trough | Decrease | Decrease | Decrease | Less goods | DecreaseOne dollar is weak | Increase | Spend MoreDecrease Tax |

- No economic system works all the time perfectly

- The level of economic activity fluctuates (moves up and down)

- Total production, incomes, spending, and employment rise and fall - fluctuations are caused by changes in the level of total spending (consumer spending CONSUMPTION, business spending INVESTMENT, government spending and exports) within the economy

- The RBA and the government work together to smooth out the peaks and troughs through a mix of monetary and fiscal policy decisions

- 2-3% is the target inflation rate

- Features of an expansion:

- The upwards-sloping section of the business cycle

- Having hit its trough, the economy begins to grow again

- Consumption and investment start to rise

- Production starts to increase

- Features of a contraction

- The downward-sloping section of the business cycle

- Having hit its peak, the economy begins to slow down

- Consumption and investment begin to fall

- Production starts to slow down

- Unemployment starts to increase

- Interest rates may start to be lowered

- Features of a peak

- Low unemployment

- High incomes

- Maximum production of goods and services

- Maximum consumption and investment

- High standard of living

- The scarcity of resources becomes an issue

- Prices rise - inflation

- During a peak, the government uses an automatic stabiliser which causes progressive taxes

- During a trough, the government uses an automatic stabiliser which causes transfer payments

The Great Depression

- All economies go through their good times and their bad times

- The role of the government (and a nation’s central bank) is to try and minimise the level of fluctuation between the peaks and the troughs.

- Sometimes, when another economy contracts, Australia is impacted. This is because globalisation has allowed investment and lending between nations. This connects economies and means that the collapse of one nation impacts other nations that it has economic connections.

- An economic shock is when there is a significant disruption to the flow of income in an economy and possibly other economies. This can result in a deeper trough for a prolonged period

- In 1929 the United States of America had never been richer. People rushed to buy shares in order to ‘get rich quick’.

- On 24 October 1929, the euphoria rapidly evaporated. On what has become known as ‘Black Thursday’, the New York Stock Exchange saw share values begin to fall sharply. American factories soon found it difficult to sell their goods. Employers were forced to reduce wages and dismiss many workers. This meant more people had less money to spend, and so the whole process accelerated. As a result, US businesses cut back on production and investment. Business and consumer confidence were shattered. Thousands of businesses were declared bankrupt. Mass unemployment became common. Lifetime savings were wiped out when thousands of banks suspended their operations. Farmers went bankrupt, families were evicted from their homes for not being able to meet their mortgage repayments, and the unemployment queues grew longer.

- What Australia Experienced

- Hundreds of thousands out of work - unemployment reached 32%

- Households with not enough to eat - many dependent on ‘susso’ which means payment for sustenance/bare minimum

- Family breakdowns

- Charity groups were the only source of relief

- Men travelled around the country looking for work - setting up ‘shanty towns on the edge of communities

- Wool and wheat prices fell impacting export income to Australia

- Australian government borrowed heavily from the Bank of London until even they ran out of money

The GFC 2008

- In September 2009, the US financial system felt a massive loss of confidence as homeowners defaulted on their mortgage payments. Large financial institutions became bankrupt or were bought out, and governments were forced to implement rescue packages.

- The GFC led to a severe global economic recession, and world economic growth and trade severely declined, with a consequent increase in unemployment.

- Governments implemented expansionary fiscal and monetary policies to stimulate consumer apsneding and business investment.

European Union Debt Crisis

- In 2011, five smaller EU countries - Portugal, Italy, Ireland, Greece, and Spain (PIIGS)- struggled to repay the national debt.

- Greece’s debt was so large it exceeded the nation’s entire economy, and so the PIIGS risked defaulting on their loans.

- This would cause a recession in many countries including the US due to its large export sales to that region.

- Out of fear, the crisis would spread, loans were organised to help bail out the PIIGS on the condition they adopt cost-saving measures to ensure the bailout money was repaid.

- The PIIGS faced a difficult time paying off the debt while at the same time trying to expand their economies.

- The Troika is a term used to refer to the single decision group created by three entities, the European Commission (EC), the European Central Bank (ECB) and the International Monetary Fund (IMF).

- Unemployment above 25%

Exchange Rates

| Year | Inflation | Economic Growth | Unemployment | Cash Rate | Exchange Rate |

|---|---|---|---|---|---|

| 2022/3 | 6% | 3.25% | 3.5% | 4.1% | 1AUD = 0.68USD |

| High/Low? | High compared to Gov. target of 3% | Fair - target range is 3-4% | Low - NAIRU is 4.5/5% | Very high | Weak - average is about 70/77 |

| Forecast for 2023/4 - Up/down? | 3.25% due to monetary policy measures by RBA |

Keywords

- GDP - Gross Domestic Product

- A measure of economic growth

- If divided by the population, this provides GDP per capita which is a measure of living standards per individual in the economy

- Material Living Standards

- Material living conditions refer to an individual's standard of living as expressed through three different sub-dimensions: income, consumption and material living conditions.

- Non-material Living Standards

- Factors that affect a person's quality of life irrespective of income. Includes things such as crime rates, public health facilities, pollution levels, stress levels, etc.

- Inflation

- A general increase in prices over time

- In 1985 Paddle Pops were 25c, now they’re approx. $2

- Economic Stability

- An economy’s ability to pay its debts in the long term

- Aim is to increase exports and minimise imports

- Australia has a ‘savings / investment gap’ requiring global investment (positively impacts business growth but negatively impacts external stability as profits/dividends leak out of the economy)

Living Standards

- Government Aims

- Improve Living Standards

- Increase GDP per capita

- We don’t want our economic growth to be too steep, we want it to be stable.

- Keep an eye on inflation and unemployment and external stability

- Will the cost of living ever go down?

- The economy at large follows the “business cycle”, meaning it experiences an unending roller coaster of booms (high economic output) and troughs or busts(low economic output, sometimes called a recession)

- When inflation is low, the cost of living will go down, while high inflation drives it up again.

- The current 2022-2023 cost of living crisis has been primarily driven by supply chain disruptions from the pandemic, flooding, and global conflicts like Russia’s Invasion of Ukraine

- Many of these disruptions have and will continue to ease over time, which will stabilise prices. Experts predict high inflation will ease off by 2024 and 2025

- Economic Growth

- Defined as the real growth in the volume of goods and services produced by an economy over a period of time

- This measurement is linked to many other aspects of the economy

- Economic growth occurs when there is an increase in the volume of goods and services produced over a period of time

- The most common way of measuring GDP is by using the aggregate demand (expenditure) method

- AD = C + I + G + X - M with an acceptable rate of 3-4% which will allow for an increase in population, replacement of G&S that have been consumed and innovation / new products

Income Distribution

- Income can be classified in four ways by economists

- Income from labour: wages, salaries, and profits (earned income)

- Income from property or investments: dividends, rent, royalties, and interest (unearned income)

- Income from the government: social services and subsidies (transfer payments)

- Fiscal spending (Gov. Expenditure) is a part of the budget

- Income in kind which represents a substitution for money in the form of goods and services: company car or a place to stay

- Equitable distribution of income

- This is how evenly or equitable productive income is divided among members of the economy

- Some members of society have the ability to acquire greater amounts of income than others

- Many Australians still live in poverty and lack access to education, healthcare and other services

- In the past 70 years, Australia’s gap between the rich and poor has widened

- The population is broken into quintiles (5 ranks - lowest 20% of income earners to the highest 20%)

- Lowest quintile earns 8% of all income (1% of wealth)

- Highest quintile earns 40% of all income (63% of wealth)

- Causes and Effects of greater equality

- Causes of Inequality

- Unemployment, hours worked, and incomes

- As per the business cycle, when the economy contracts, businesses cut production, reducing the hours of their workers and impacting the incomes earned. This usually impacts the lowest quintiles.

- Inflation and purchasing power of incomes

- Inflation reduces the real wage of individuals

- Capitalist economic system

- Supply and demand will mean that if they have limited supply, those that can afford will get it. Those that can’t afford, will go without it.

- Effects of equality

- Better living standards

- Government aim to redistribute the economy by taxing the rich and giving it to the poor

- Better resource allocation

- Higher production levels and lower unemployment rates

- Reduced labour productivity and less motivation to work

- Income Distribution as an Indicator

- The government interfere to redistribute income and makes the distribution more equal than would be the case under laissez-faire (no government interference) capitalism

- Welfare benefits: direct payments to vulnerable Australians as well as specific payments such as First home owners grant and Family tax benefit payment

- Progressive taxes: Higher income earners pay more tax than lower income earners. Money collected pays for welfare to those vulnerable Australians. Tax-free threshold protects very low-income earners.

- Provision of essential services: Government also uses tax collection to pay for healthcare, public education, concession travel cards for school students and rent assistance

- Compulsory superannuation: reducing the reliance on government pensions - 9.5% of wages earned

Environmental Sustainability

- Economic growth should be sustainable

- This means that the rate of growth should occur without jeopardising the living standards of future generations

- Issue

- Demand for non-renewable natural resources is causing serious environmental problems such as pollution, global warming, resource depletion, and loss of biodiversity

- Consequence

- Reduced living standards for future generations

- Depleted non-renewable resources, degradation of the environment, reduced ability to satisfy needs and wants in the future

- A trade-off exists between economic growth and future living standards

- Types of Policies to Address Issues

- Regulations

- Prohibitions

- Regulations about how goods/services should be produced

- Requirements to follow certain environmental procedures

- Market-based Policies

- Involve financial incentives and disincentives (such as subsidies and taxes) to influence the behaviour of households and businesses

- Market-based policies aim to respond to the negative externalities that arise from economic activity

- Eg: Carbon tax , fuel levies, emission trading schemes, subsidies for solar power installation

Government Macroeconomic Policy

- Macroeconomics is the branch of economics that involves the level of aggregate demand or amount of expenditure.

- The government will use Fiscal Policy which is where they consider

- Tax receipts

- Government expenditure

- Monetary policy

- Operated by the RBA (reserve bank of australia)

- Controls the interest rates

- The goal is to keep inflation to a target range of 2-3%

- Does not need approval from government

- A low-interest rate makes borrowing cheaper

- Interest spending

- A high-interest rate makes borrowing expensive

- Decrease spending

- This will be outlined in the annual budget - which shows receipts and expenditures and how this is prioritised

- The difference between the receipts and expenditures is called the budget outcome

- Monetary Policy and Fiscal Policy are both key to macroeconomic policy as they work together to achieve government objectives

- Fiscal policy

- Policy that alters the level of government spending and receipts through a budget

- Balance budget

- Where taxes received are the same as money spent

- Surplus budget

- Where spending is less than taxes received

- Deficit budget

- When spending is more than taxes received, a deficit budget will see economic growth and an increase in demand

- Receipts

- Direct taxes

- Personal income tax

- Superannuation tax

- Indirect taxes

- GST

- If the Government and RBA want to slow down the economy, the government may decrease it’s spending, increase taxes, and the RBA will increase the cash rate

- If the Government and the RBA want to grow the economy, the Government may increase it’s spending, decrease taxes, and the RBA will decrease the cash rate.

Government Microeconomic Policy

- Microeconomics targets specific industries to increase aggregate supply with a focus on productivity

- There are 4 main focus areas

- Trade liberalisation (Removal of protection)

- Taxes on imports and need to pay tarriffs

- Labour market reforms (Wages)

- Market deregulation (Government removed from business sphere)

- National reform agenda (Increase in competition and protecting consumers)

Supply and Demand

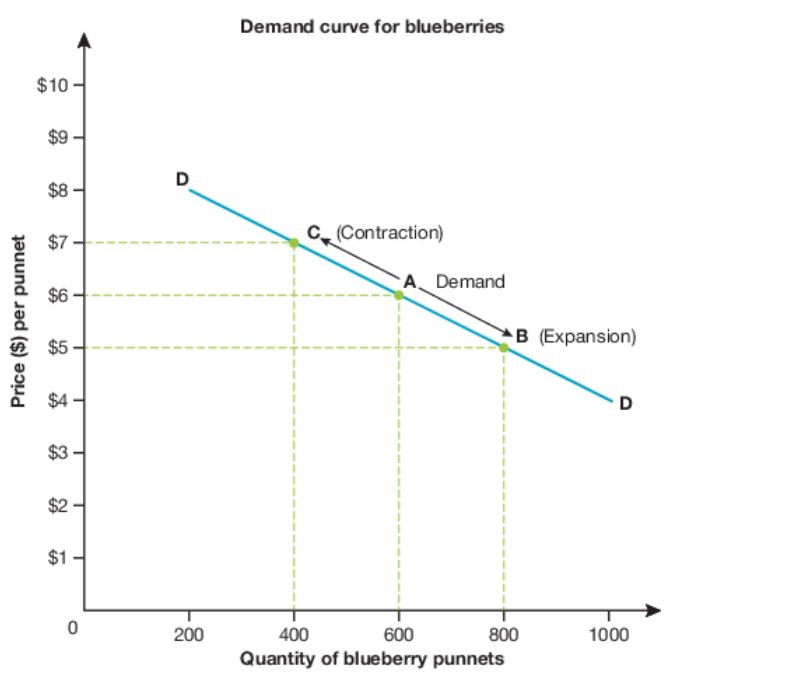

Demand

- Demand is the quanitity of a prodt consumers are willing to purchase at a particular price

- As the price increases, demand for the good or service decreases

- If the price decreases, the demand for that good or service increases

- This is the LAW OF DEMAND

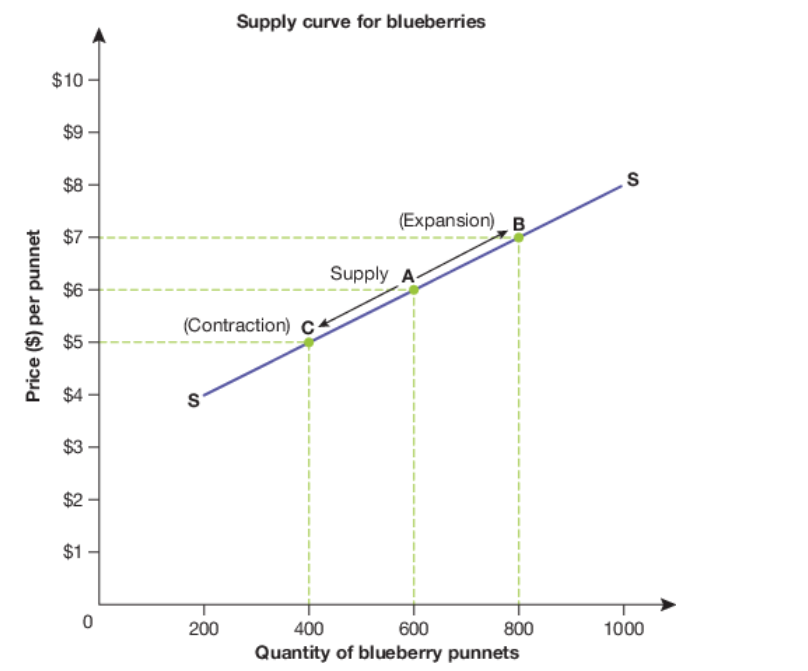

Supply

- Supply is the quantity of a product that producers are willing to make at a particular price

- As the price increases, supply for that good or service also increases

- If the price decreases, the supply for that good or service also decreases

- This is the LAW OF SUPPLY

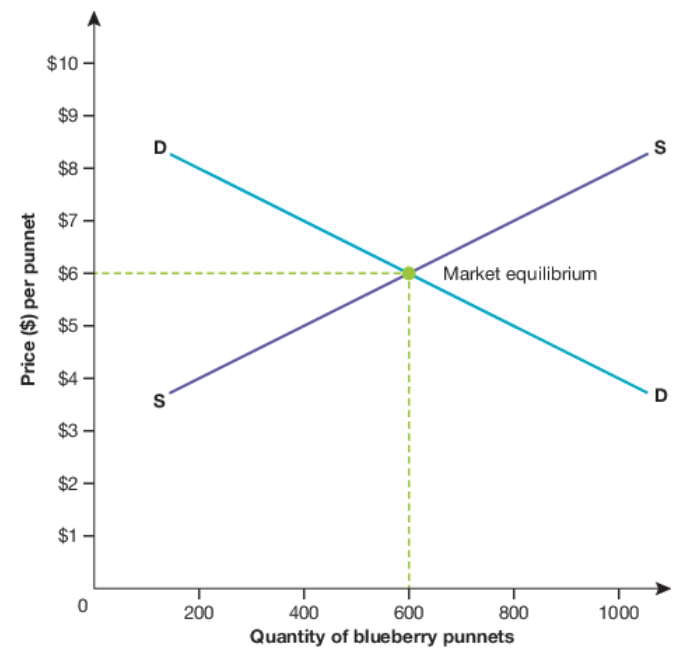

The price mechanism

- When both demand and supply curves are put on the same graph we can see that there is a point where they intersect. This point is called the market equilibrium.

- The market equilibrium is the point at which buyers and sellers agree on a price for a good or service.

- The price mechanism is the force of demand and supply in determining the equilibrium point for the price and quantity of a good or service.

\

The Market and Reasons for Intervention

- A market is any situation where buyers and sellers come together to exchange goods and services. A market can:

- Have a physical location

- Be spread over multiple locations

- Have no location at all

- Examples of different markets include:

- Retail markets

- Businesses supplying goods and services to consumer to demands the product

- Labour markets

- Employers demanding workers and employees supplying labour

- Financial markets

- Financial institutions such as banks supplying loans to customers who demand funds for large purchases at a cost of interest

- Stock markets

- Buyers demanding and sellers supplying shares on the securities exchange

- Why does the government need to intervene in the market at times?

- Most of the time, markets are very efficient allocators of resources. Meaning that resources used are maximised for efficiency.

- Sometimes, however, due to profit motives and growth aspirations, the government needs to intervene in the form of regulations, governance, and restrictions in order to reduce these problems.

- Protection of the environment

- Government can attempt to reduce environmental damaged caused by businesses with laws and regulations that restrict people from causing the damage. These laws:

- Ban littering

- Ban the use of some chemicals in manufacturing

- Restrict how and where building developments can take place.

- Government are faced by a trade-off between short term exploitation of natural resources for economic gain, and the long-term needs of both society and the economy.

- For long term growth the environment needs to be sustainably managed.

- When the turtles of Panama gained legal rights, the government of Panama intervened in the market by passing a new law that set strict rules on how much sea turtle eggs could be harvested from the sea. This new law directly impacted the market for sea turtle eggs, which was the main economic activity threatening sea turtles in Panama.

- Businesses don’t adopt environmentally friendly practices due to their focus on making more money and focus on success in the short term rather than long term sustainability that can be quite expensive.

Free Trade Agreements

- Governments have the choice of adopting a free trade policy or a protectionist policy. Protectionist policies occur when a government gives its local industry an artificial advantage over its competitors. This could be by things such as taxes on imports (tarffs), restrictions on the amount of imports (quota), payments to local producers (subsidies) as well as numerous minor rules and regulations.

- Free trade is when a government ensures there are minimal barriers to trade between nations. Austrlaian governments tradtionally adopted a protectionist policy using tariffs, quotas, and subsidies to give local producers an advantage. However, since 1973 barriers to goods entering Australia have been gradually reduced. Currently there are very few restrictions on goods entering Australia.

- There are two different types of trade agreement; multilateral and bilateral.

- @@Multilateral trade @@agreements are agreements that involve three or more nations

- @@Bilateral trade @@agreements are between two nations. The Austrlaian government has signed bilateral trade agreements with many nations including USA, New Zealand, Japan, Singapore, and Thailand

Factors Influencing Business Decisions

- Technology

- The advances in technology have changed many aspects of business. By using technology, businesses can increase efficiency and productivity, create new products, and improve the quality of its products.

- Online Stores

- The internet

- Able to reach more people, expand the market and the amount spent on advertising went down but revenue went up. Able to fit the branding and includes features such as online fitting, abandon cart

- A brief outline of the example provided

- Social Media Platforms

- Interior design and styling

- Implemented social media to get business out there, see products through customers eyes, project her brand on others, easy once she got started.

- Artificial Intelligence

- Social media platforms use AI to filter content such as cyberbullying and search for trigger words and eliminate them

- MILKRUN case study

- MILKRUN’s marketing cost was too high as well as the population density not high enough to deliver an ‘instant’ home delivery service

ATSI Businesses

- Where is the cultural centre located?

- 20 minutes north of Port Douglas

- How is this area significant to indigenous people?

- Mossman Gorge is the root of history and legends that have been passed down through the generations of the Kuku Yalanji.

- One of their greatest legends is a tale about the striking backdrop to the Gorge – Manjal Dimbi. Manjal Dimbi is the most prominent of all nearby mountains. According to Aboriginal dreamtime stories, the large humanoid rock represents Kubirri, who came to the aid of the Kuku Yalanji when they were persecuted by the evil spirit, Wurrumbu. Kubirri holds back the evil spirit, who is now confined to The Bluff above Mossman River, Manjal Dimbi has been translated to "Mt Demi" and Kubirri is known as the "Good Shepherd.”

- What goods and services are available from this business?

- Dreamtime Walks

- Self-Guided Walks

- Group Tours

- Giftshop

- Restaurant with cakes

- What employment opportunities and training programs are available at the centre?

- The Mossman Gorge Cultural Centre has an Indigenous workforce that makes up around 70% of the total workforce.

- How does this centre impact indigenous and non-indigenous people?

- What is the purpose of the Supply Nation Website?

- To provide Indigenous companies with access to a hub of information

- INDIGENOUS CIVIL PLANT AND PERSONNEL PTY LTD

- Construction company

- Construction and equipment hiring

- \

CSR

- CSR

- Corporate social responsibility

- Non-complusory action where businesses stay accountable by contributing to the communities and society. CSR is integreated into a company’s business operations where they address environmental and social issues and build solutions for them.

- Voluntary action taken to interact with problems within the community and take steps towards bettwring the lives of their stakeholders and society.

- Allows a company to understand its impact on the economic, social, and environmental development of society

- Also boosts morale.