35: Investment appraisal

Payback method of investment appraisal

Accounting rate of return (ARR)

Net present value (NPV)

Factors to decide investment

Investment appraisal: evaluate the profitability of an investment

Net present value (NPV): today’s value of estimated cash flow (both in and out flow) from an investment

Forecasted net cash flow: Forecast cash inflow - outflow (forecast profitability)

Qualitative factor for investment appraisal

How long can that investment be used?

Residual value, how much can we sell asset after its useful life

Quantitative technique

Establish investment criteria based on 3 methods. Payback, ARR, NPV

Payback method

How long it takes for net cash inflows to pay back the buying price of an investment

The table starts with year 0 (the time of purchase)

If a project costs $100,000, and annual earning is $30,000. The business receive $90,000 after 3 years, but how many months does it take to pay back $10,000 with $30,000 earning?

Formula: (extra money needed ÷ annual cash flow in year 4) x 12 months = … time (years and months)

10,000 ÷ 30,000 times 12 = 4 months

So it takes 3 years and 4 months to pay back

Compare the payback time between projects for decision making

Long payback time = long bank loan. More interest to pay

Money in future has less value than money now ==> inflation

External factor change over time, long payback period’s cash return is less stable

Does not include external factors that affect cash flow

Useful for business that prefer liquidity over profit

Easy to calculate for new entrepreneur

Focus on short-term return make business miss out better investment just because they take longer to payback

Does not take money losing value into consideration (hence use discounted value)

We only know when we get enough money, not how much money we can get after this, that’s why we use ARR

Accounting / Average rate of return (ARR)

How much annual return is compared to average investment in percentage

ARR = (average annual profit ÷ average investment) x 100 = …%

average annual profit = total profit of those years ÷ the number of years

average investment = (initial buying cost + residual value) ÷ 2

*average investment has residual value even though its an earning because we are finding the total value in money of the whole project, so money invested + residual ÷ 2 to find average. Average is more accurate just need to know that

Criterion rate: The minimum ARR a business wants a project to be

If criterion rate is 18%. Project X ARR is 15%, the business will not do the project

Criterion rate set by business aim, if want profit maximisation, go for high rate. If want safe and less risk, go for low rate.

(Realistically, criterion rate higher than bank interest is good. Doesn’t have to be 20%)

We know the rate of money earned in the future, we know the percentage

Compare with return on other projects + pre-set criterion rate

Far future cash flow is less certain, inaccurate

Ignore timing of cash flow, 2 similar projects but one might pay back faster

Does not include external factors that affect cash flow

Ignore money losing value in the future, so we need discounted cash flow

Discounted cash flow + Net Present Value (NPV)

Money will always lose value over time => Find out how much future money is worth in today’s time with discounted cash flow

Depends on: Interest rate in the future + how long the future cash is

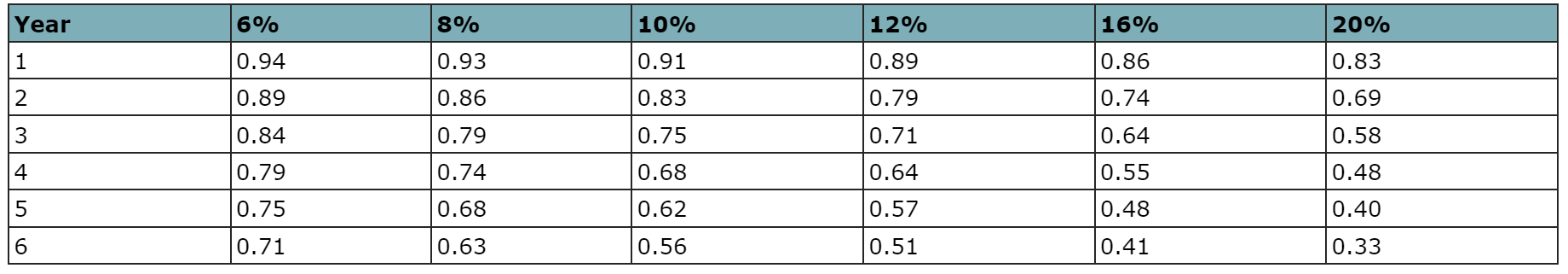

We have a discount factor ( a list of discount over years ). To find the value of future cash flow, multiple the discount factor of that year with the future cash

E.g: $3,000 future cash flow in 3 years with 10% interest rate. Look at discount factor in year 3 at 10%, it will be 0.75. Take 0.75 x $3,000. We will have $2,250

NPV

Means how much profit the future project earns in today’s value

Calculate the discount cash flow for every year and add them all together

Minus it with the original capital cost

E.g: Investment cost $1,000. First year cash flow is $600, interest rate is 0.93 -→ 558. Second year the same so 558 × 2 = $1116. So the earning is 1116-1000 = $116 profit in today’s term

Only compare projects using NPV if initial cost is the same

Find out earning in today’s value, compare with opportunity cost today

Take interest rate into account Interest rate prediction might be wrong, especially during fluctuating periods

Future CF is also just prediction, can be wrong

Only compare with same initial cost projects

Qualitative factor on investment

Whether the government or local accept the investment

Aim of business

Impact on workforce

Degree of risk taking in manager