POA

BANK RECONCILIATION STATEMENT

Bank Reconciliation

The process of keeping a personal account of your transactions in a cashbook to ensure no errors in bank statement book

Types of Payments in B.R

UNPRESENTED CHEQUES

Cheques that are sent but have not been recorded by the recipient

LATE LODGEMENT

Delayed money deposit by a business into their accounts by the bank

STANDING ORDER

Instructions given by a business to a bank to pay specified amounts at given dates

DIRECT DEBIT

An authorization for regular withdrawals from a bank account to pay bills or expenses.

BANK CHARGES

Payments of the business for services provided by the bank.

CREDIT TRANSFER

A direct electronic transfer of funds from one bank account to another.

DISHONOURED CHEQUE

A cheque that a bank refuses to pay due to insufficient funds, stale-dated cheques, error on cheque

Items in Cashbook but not Bank Statement

Unpresented Cheques (CR)

Late Lodgement (DR)

Items in Bank statement but not Cashbook

Bank charges (CR)

Standing order (CR)

Direct debit (CR)

Dishonoured cheques (CR)

Interest (CR)

Credit Transfer (DR)

Errors

CASH BOOK ERRORS

Errors made during the writing up of the cash book. Should be corrected while cash book is being adjusted.

BANK ERRORS

Should not be corrected in the cash book. Instead, should be shown as adjustments at the bottom of the bank recon statement.

ACCRUALS & PREPAYMENT

Adjusting Entries

Entries made at the end of an accounting period to allocate revenue and expenses to the period they belong to as required by the Matching/Accruals Concept.

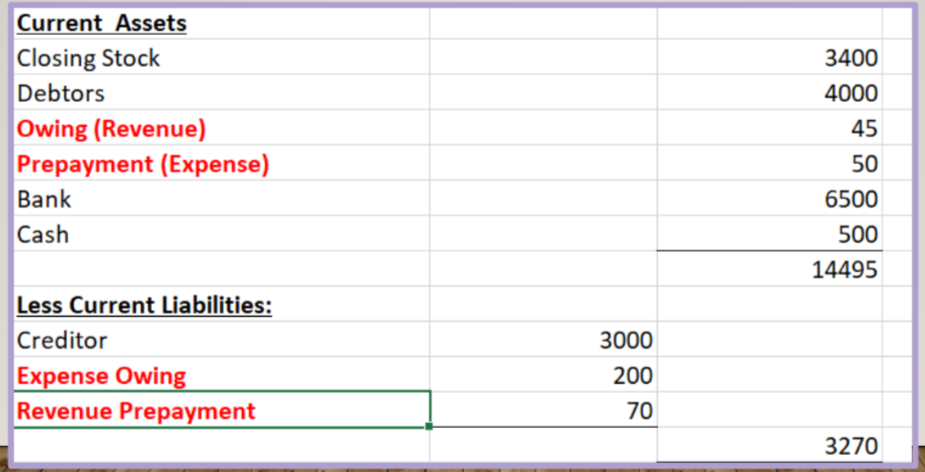

Balance Sheet Extract

Capital VS Revenue Expenditure

CAPITAL EXPENDITURE

Expenditure on non-current assets such as purchasing a non-current asset

REVENUE EXPENDITURE

Expenditure on the day-to-day running costs of an organization

DEPRECIATION

Define Depreciation

the decline in the the useful life of a fixed asset.

INCOME STATEMENTS (TRADING & PROFIT AND LOSS)

Purpose of Income Statement

Its purpose is to show how much profit or loss has been made over a period of time. The main purpose of the trading and profit and loss account (income statement) is for the owners to be able to see how profitably the business is being run

Gross Profit (Net Sales-Cost of Goods Sold)

The excess of sales over the cost of goods sold in the period.

Net Profit (Gross Profit-Total Exp)

What is left of the gross profit after all other expenses have been deducted

Format for Income Statement

Sales | xxx | |

|---|---|---|

Less Sales Return | xxx | |

Net Sales | xxx | |

Less Cost of Goods Sold | ||

Opening Stock | xxx | |

Add Purchases | xxx | |

Add Carriage Inwards | xxx | |

xxx | ||

Less Return Outwards | xxx | |

Costs of Goods Available for Sale | xxx | |

Less Closing Stock | xxx | |

Cost of Goods Sold | xxx | |

Gross Profit (Net Sales-Cost of Goods Sold) | xxx | |

Additional Revenue | xxx | |

Less Expenses | ||

Expenses | xxx | |

Last Expense | xxx | |

Total Expenses | xxx | |

Net Profit (Gross Profit-Total Exp) | xxx (Double Underline) |

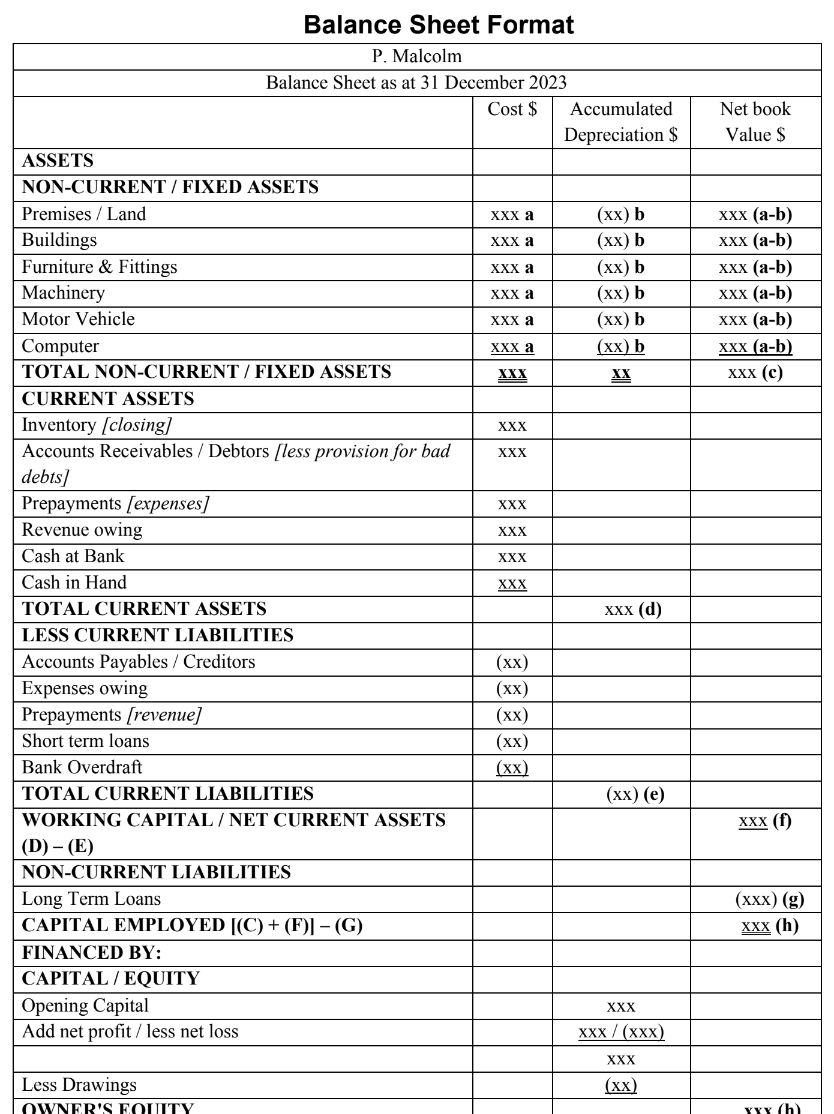

BALANCE SHEET (STATEMENT OF FINANCIAL POSITION)

Components of Balance Sheet

NON-CURRENT ASSETS

Furniture & Fittings

Vehicles

Land and Premises

Buildings

Machinery

CURRENT ASSETS

Accounts Receivable/debtors

Cash in hand

Cash at bank

Inventory

Prepayment (Expense)

Accruals (Revenue)

CURRENT LIABILITIES

Bank Overdraft

Accounts Payable/creditors

Short term loan

Accruals (Expense)

Prepayment (Revenue)

WORKING CAPITAL

Formula: Total Current Assets - Total Current Liabilities

NON-CURRENT LIABILITIES

Long term Loan

Mortgage

CAPITAL EMPLOYED

Total Non-Current Assets+Working Capital

FINANCED BY:

Capital

Opening Balance

Add Net Profit

Less Drawings

Format of Balance Sheet (Sample) with provision for doubtful debts

Non-Current Asset | Cost | Depreciation | Net Book Value | |

|---|---|---|---|---|

Land and Premises (Building) | xxx | xxx | xxx | |

Fixtures | xxx | xxx | xxx | |

(Total) | xxx | xxx | xxx | |

Current Asset | ||||

Closing Inventory | xxx | |||

Accounts Receivable | xxx | |||

Less provision for doubtful debts | (xxx) | |||

xxx | ||||

Bank | xxx | |||

(Total) | xxx | |||

Less Current Liabilities | ||||

Accounts payable | xxx | |||

Accruals | xxx | |||

(Total Current Liabilities) | (xxx) | |||

Working capital (Total Current Assets - Total Current Liabilities) | xxx | |||

(Add Working Capital + Total Non-Current Assets) | xxx Double underline | |||

Less non-current liability | ||||

Long term loan from … | (xxx) | |||

Capital Employed | xxx double underline | |||

Financed by: | ||||

Capital | ||||

Opening Balance | xxx | |||

Net Profit | xxx | |||

xxx | ||||

Less Drawings | (xxx) | |||

Owner’s equity | xxx double underline |

Simple Balance Sheet Format

TO NOTE

SALES RETURN ON TRIAL BALANCE

DEBITED: RETURN INWARDS

CREDITED: RETURN OUTWARDS

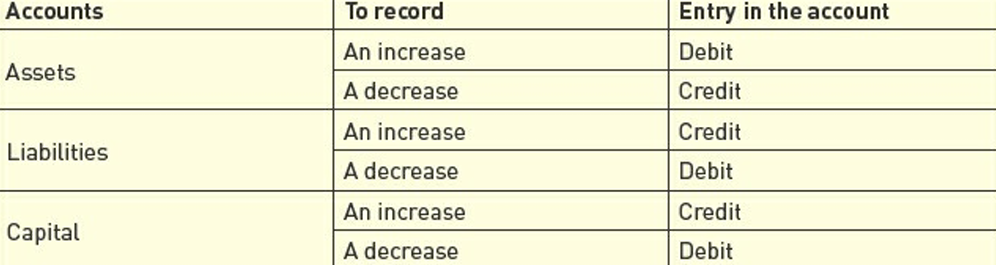

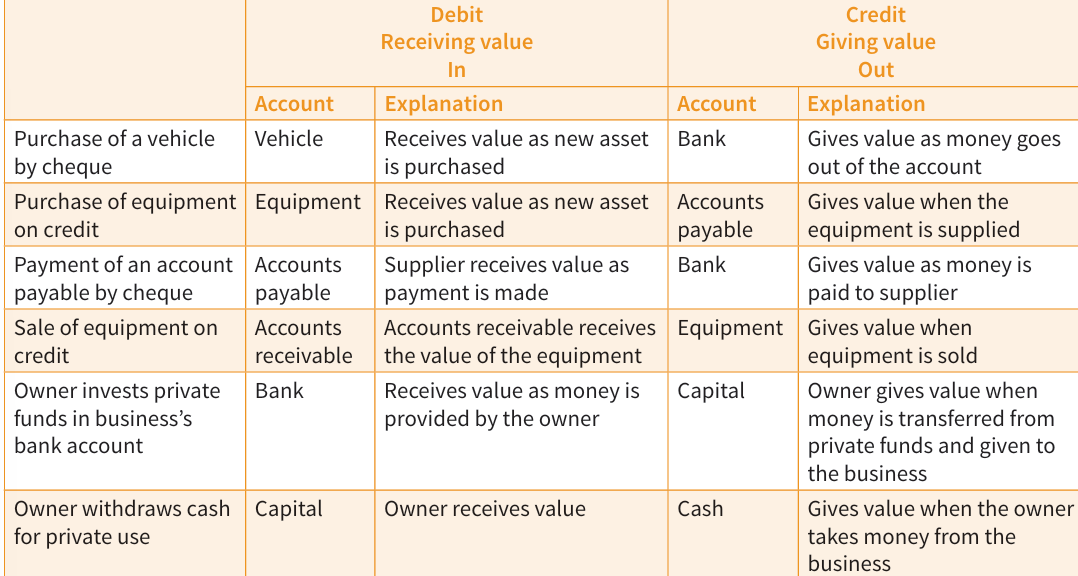

DOUBLE ENTRY SYSTEM

DEFINITION

A record-keeping system, where every transaction is recorded with at least two entries: a debit and a credit.

Types of Accounts

Personal Accounts

Accounts receivable

Real Accounts

Assets, liability, capital

Nominal Accounts

Expenses and revenue

REVENUE

Income earned by the business, such as:

Rent Received

Interest Received

Discount Received

Reduction in Prov. for Bad Debt

Commission Received

EXPENSES

Costs of operating the business

Rent

Salary

Electricity

Utilities

Carriage

Motor Expenses

Insurance

Advertising

Miscellaneous

CASH BOOK

Define Cash Book

A book of original entry in which all cash and bank transactions are recorded.

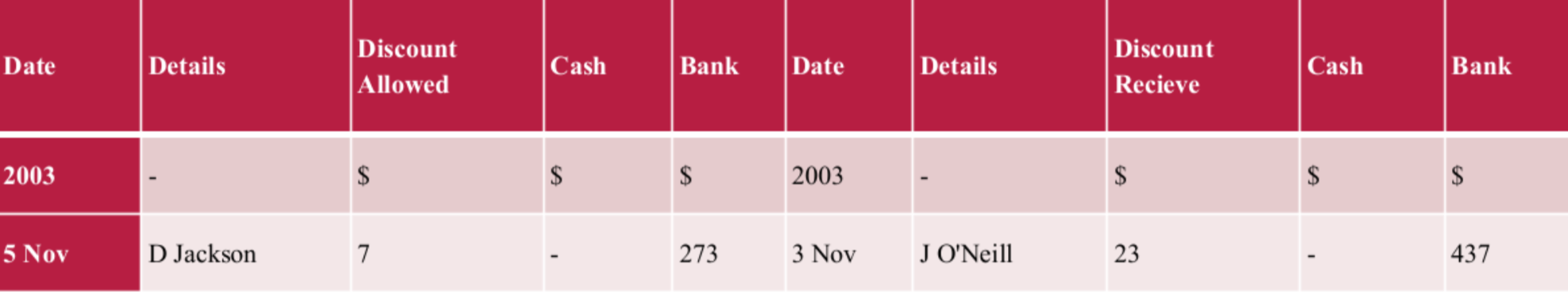

Three Column Cashbook

DIFFERENCE BETWEEN TWO VS THREE COLUMN

Three column makes provision for discounts while two does not

Contra Entry

An entry where a single transaction affects both the receipt and payment side of the cashbook. Both cash and bank columns are affected

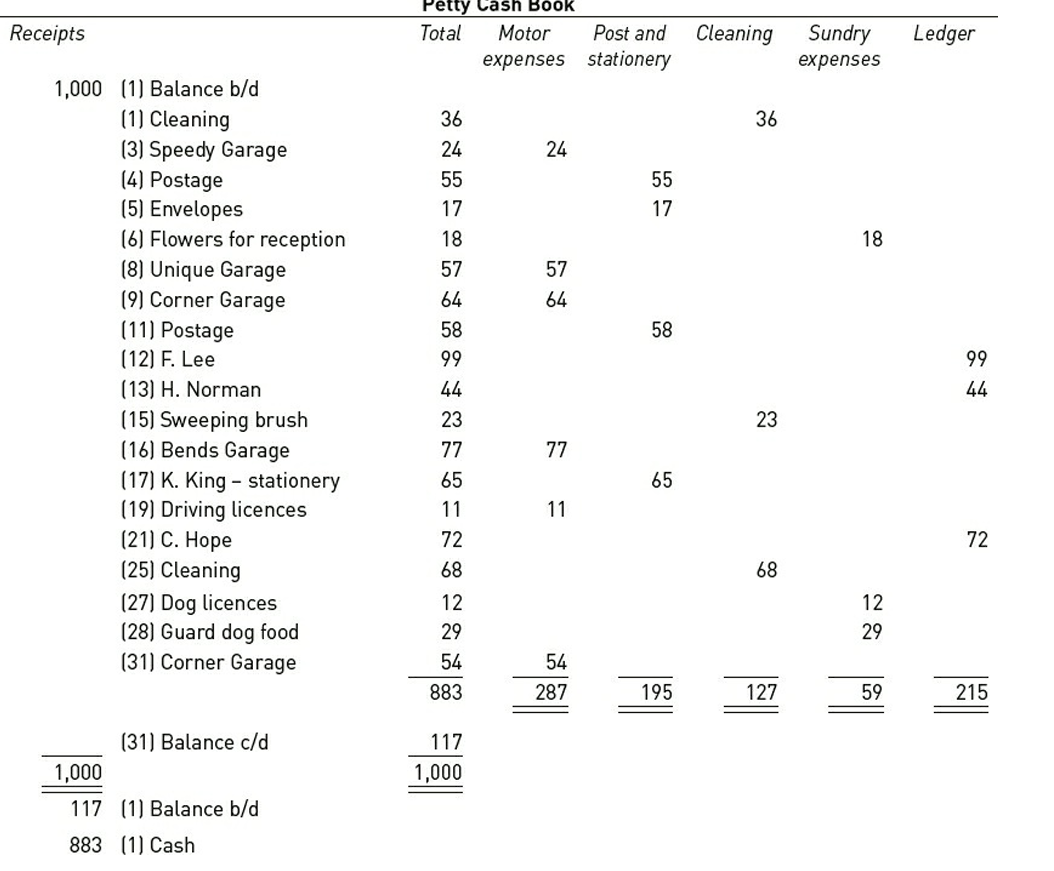

PETTY CASH BOOK

Define Petty Cash Book

A book of original entry that tracks small cash expenditures in a business

SOURCE DOCUMENT

Petty Cash Voucher

Imprest System

A system where the cashier gives the petty cashier enough cash to meet the needs of the next period

Petty Cash Book Example/Format

Receipt | Date | Detail | Voucher Number | Total | Petty expenses (Wages,etc) | Ledger Folio | Ledger Accounts |

|---|---|---|---|---|---|---|---|

^ 21.1 PG 342

^ 21.1 PG 342

SOURCE DOCUMENTS

Cash Book

Cash Receipt

Withdrawal Slip

Cheque Counterfoil

Bank Receipt

Pay-in-Slip

Debit and credit receipts

Cash Memo

Statement

Petty Cash Book

Petty Cash Voucher

Return Inwards/Outwards Journal

Credit Notes - INWARDS

Debit Notes - OUTWARDS

ACCOUNTING CONCEPTS

Definition

Fundamental rules that must be followed when preparing financial statements.

List of Concepts

ACCRUALS (MATCHING)

In order to calculate profit, income for a financial period is matched with expenses that relate to that accounting period, whether paid or not.

PRUDENCE (CONSERVATISM)

When there is doubt, asset and profit values should be understated rather than overstated.

CONSISTENCY

Accounting policies should be carried out in the same way year after year so that comparisons of performance can be made on a valid basis.

SEPARATE ENTITY

Only transactions affecting the financial position of the business are recorded in its books of accounts. The owner’s private financial affairs are not recorded.

HISTORICAL COST

Assets are normally shown at cost price

DOUBLE ENTRY/DUAL

For every transaction, giving of value and receiving of value occurs

MONEY MEASUREMENT

Accounting is concerned only with monetary transactions.

GOING CONCERN

This concept implies that the business will continue to operate for the foreseeable future.

REALIZATION

Revenue can only be recognized after it has been earned.

MATERIALITY

Determines whether the omission/misstatement of information in a financial report would impact a reasonable user's decision making

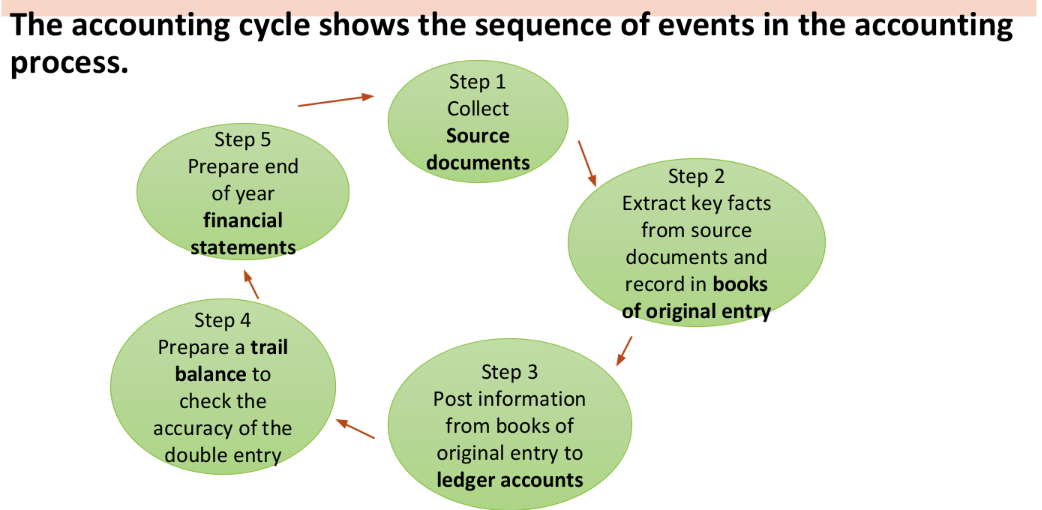

Accounting Cycle

ETHICS

Factors that Influence Ethical Views

CULTURE

What is immoral or illegal in some cultures is acceptable behaviour in others. Thus, ethics can differ in different cultures.

LAW

Illegal behaviour is unethical even when the law differs between countries. A company’s code of ethics always states that an employee must abide by local laws of the country.

CONSEQUENCES

Individuals react to ethical or unethical behaviour based on the consequences.

CODE OF ETHICS

When there is a code of ethics, behaviours are judged based on the code

Principles of Ethics

INTEGRITY

A professional accountant should be straightforward and honest in all professional and business relationships.

OBJECTIVITY

Professional accountants must stay unbiased, avoid conflicts of interest, and resist outside influence to make ethical decisions.

PROFESSIONAL COMPETENCE AND DUE CARE

A professional accountant needs to be independent, unbiased, and informed about industry updates to offer competent services. They must act diligently and follow technical and professional standards when working with clients or employers.

CONFIDENTIALITY

A professional accountant must keep information confidential from professional and business relationships, only sharing with proper authority or when required by law. They should not use this information for personal gain or benefit others.

PROFESSIONAL BEHAVIOUR

A professional accountant must follow laws and regulations, maintaining ethical behavior to uphold the profession's reputation. This includes ensuring the firm's ads are truthful and not misleading.

Application of Ethical Principles

treat people with respect and courtesy

act responsibly and honestly

ensure confidentiality

be accountable for your actions

be trustworthy

apply technical skills and competence

comply with legal requirements and organisation laws and regulations

avoid conflicts of interest.

Inappropriate Applications of E.P

not working in the best interests of your employer

being dishonest and untrustworthy

disregarding confidentiality

undermining colleagues

causing conflict

intimidation or harassment of colleagues to gain an advantage in a particular area

accepting bribes or gifts in return for a favour.

USERS OF ACCOUNTING INFO

Internal Users

OWNER

To create informed decisions in order to gain a profit to their business

MANAGER

To make informed decisions to improve the business

EMPLOYEES

A sound business with a good working environment will help to keep employees’ morale high and will be able to attract high-calibre new staff

External Users

BANK

To determine if a business is eligible to take/repay bank loans

INVESTORS

Private individuals, companies or banks, which will want to monitor the performance of the business to ensure that they will get a return on their investment

CUSTOMERS

To ensure the good/service is of high quality to purchase

SUPPLIERS

This group will need to be sure of the financial stability of the business before accepting orders

TYPES OF BUSINESS ORGANIZATIONS

SOLE TRADER

An individual trading alone in his or her name, or under a recognised trading name. He or she is solely liable for all business debts but when successful takes all the profits.

PARTNERSHIP

A group of more than two people and a maximum of twenty, carrying on a particular business to make a profit.

LIMITED COMPANIES

A private limited company is a legal entity which must have at least one shareholder and one director who may be the sole shareholder. The liability is limited to the amount that they have agreed to invest.

A public limited company is a legal entity with limited shareholder liability, but, unlike a private company, it can ask the public to subscribe for its shares.

NON-TRADING ORGANIZATIONS

Clubs, associations and other non profit-making organisations are normally run for the benefit of their members to engage in a particular activity and not to make a profit.

COOPERATIVE SOCIETIES

A business entity created to enhance the economic well-being of its members and society by offering goods or services.

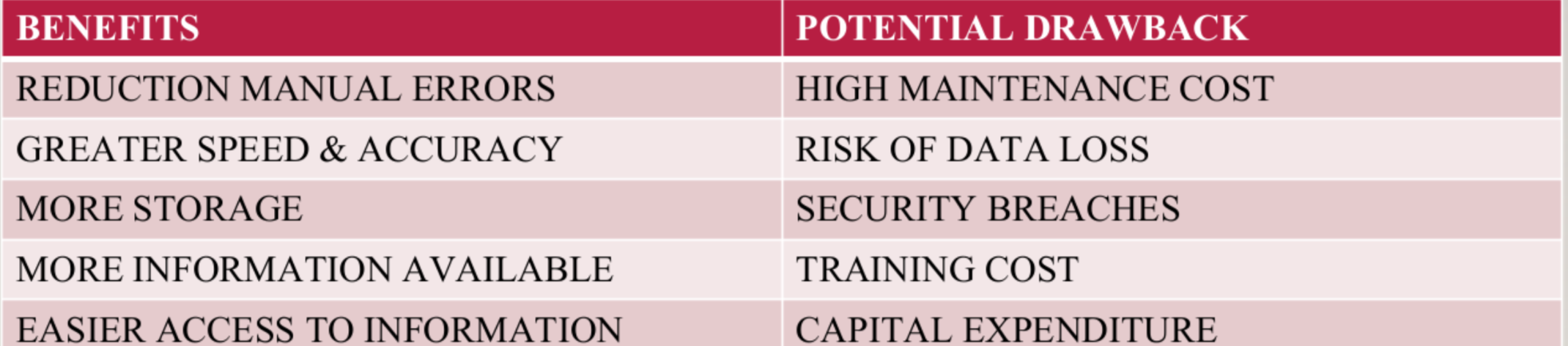

ACCOUNTING TECHNOLOGY

Accounting Software

QUICKBOOKS

FRESHBOOKS

SAGE

MICROSOFT DYNAMICS

NetSuite ERP

Advantages & Disadvantages

Jobs

Accounts Clerk

Financial Analyst

Auditing Clerk

Bookkeeper

Tax Professional

STUDYING CHECKLIST

Account Software/ Computer Software/ Computerized Accounting ( jobs, benefits, advantages and disadvantages)

Types of businesses organizations

Users of accounting information (Internal and external)

Ethical principles

Accounting Concepts ( should be able to apply them)

Ledgers/ T- accounts

Source documents (return inwards and return outwards)

Double Entry System

Petty Cash Book

Cash Book

Income Statements

Financial Position / Balance sheet (current assets)

Bank reconciliation