Inflation: An Overview - Section 3, Module 14

hyperinflation - very high and accelerating rates of inflation

misconception about inflation - it makes everyone poorer

real wage - the wage rate divided by the price level (to adjust for inflation/deflation) doesn’t change

income and prices are both reduced

real income - income divided bye the price level to adjust for the effects of inflation or deflation

the level of prices does not matter

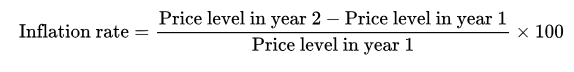

inflation rate - the percentage increase in the overall level of prices per year

calculation:

high rates of inflation impose economic costs: shoe-leather costs, menu costs, and unit of account costs

shoe-leather costs - increased costs of transactions caused by inflation

happens because during high inflation, people are discouraged from holding money beacause their purchasing power steadily decreases as the overall prices increases

menu costs - the real cost of changing a listed price

during inflation, firms have to change prices more often, which means higher prices for the economy as a whole

unit of account role of money - the role of the dollar as a basis of contracts/calculations

unit of account costs - costs arising form the way inflation makes money a less realiable unit of measurement

super important in taxes bc inflation can distort the measures of income on which a tax is collected

inflation can hurt some and hurt others

interest rate - percentage of the loan amount that the borrower must pay to the lended in addition to the repayment of the loan

nominal interest rate - the interest rate that is actually paid for a loan, unadjusted for the effects of inflation

real interest rate - nominal interest rate ajdusted for inflation (subtract the inflation rate from the nominal interest rate)

IF INFLATION IS HIGHER THAN EXPECTED - borrowers benefit because they get to pay the money back in cheaper dollars

IF INFLATION IS LOWER THAN EXPECTED - lenders benefit because buyers have to pay the loans back with funds that have a higehr real value

disinflation - bringing the inflation rate down → very difficult and costly once a higher inflation rate has become established in a country

sometimes the only way to end inflation is through disinflation and creating a temporary depression