6b. Subsidies

A subsidy is any form of government support (financial or otherwise) provided to producers and very occasional consumers.

Advantages of subsidies

To keep prices down and control inflation

To encourage consumption of merit goods and services which are said to generate positive externalities (increased social benefits).

Reduce the cost of capital investment projects

Boost demand for industries during a recession e.g. the car scrappage scheme

Can protect jobs for workers in that industry

Disadvantages of subsidies

Opportunity cost to the government

Expensive

Reduces incentive to cut costs

Once a subsidy is implemented it can be difficult to remove

How/who decides on the industries to support? • Should failing industries be supported or allowed to fail?

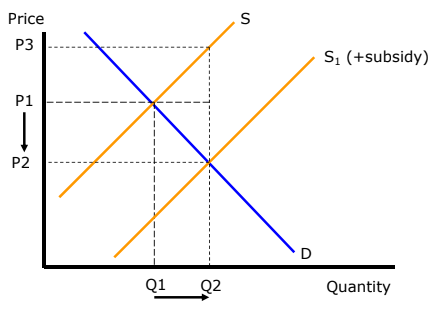

Subsidy diagram

A subsidy has the effect of reducing the cost of production for firms in that market. This means they can produce more than previously for the same price.

Once the functions of the price mechanism has taken place the quantity increases from Q1 to Q2 and the price for consumers falls from P1 to P2. P3 is an effective price the firm receives. 0 to P2 is paid by the consumer and P2 to P3 is paid by the government in the form of the subsidy.

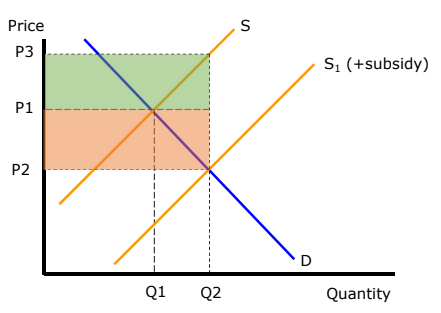

Incidence of a subsidy

If the demand for the good is unitary, the incidence of the subsidy will be split equally between the producer and the consumer.

On the diagram, the consumer benefit it the lower shaded area. They benefit as the price falls and the quantity is now 0 to Q2.

The producer benefit is the higher shaded area as they benefit from the higher price.

Those areas combined represent the cost of the subsidy to the government.

If demand for the good is inelastic, consumers will benefit more.

If demand for the good is elastic, producer benefit is greater.

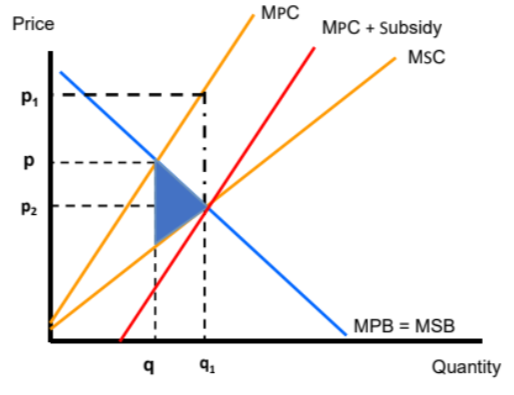

Subsidising consumption externalities

A subsidy has the effect of internalising the welfare gain by shifting the MPC to a point where the new equilibrium of MPC=MPB is in line with the socially optimal point of Q2.

The effective price received by the producer can still be shown on these diagrams.

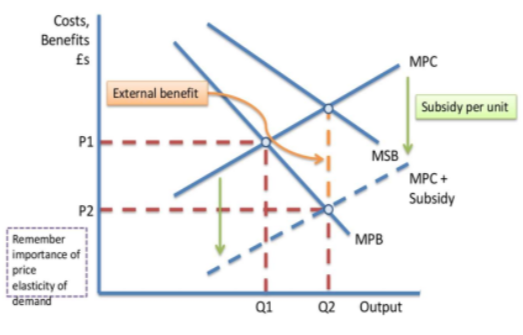

Subsidising production externalities

A subsidy has the effect of internalising the welfare gain by shifting the MPC to a point where the new equilibrium of MPC=MPB is in line with the socially optimal point of Q1.