UNIT 6- International Trade

Reasons We Trade With Other Countries

To improve our standard of living

Every country lacks some vital resources it can only get through trade

Each country’s climate, labor force, natural resources make it efficient in some production and inefficient in others

Specialization allows for mass production and greater efficiency

Determining What to Trade

Absolute Advantage → occurs when one nation produces a product more efficiently than another nation

Comparative Advantage → occurs when one nation can produce a product at a lower opportunity cost than another nation

How to determine absolute/comparative advantage:

Input or output problem:

input = resources (time, land, etc.) to produce a constant output

output = production given a constant resource (input)

Absolute advantage: input → less resources, output → more production

Comparative advantage: input = into/under, output = over

**Comparative Advantage is always based on the lower OPPORTUNITY COST**

whichever you have comparative advantage in is what you will export

Exchange Rates

Exchange rate states the price in terms of one currency at which another currency can be bought

Dollar vs. Euro, vs. Peso, etc.

Fixed Exchange Rates:

government sets exchange rate

Devaluation → decrease the value of the currency

used to boost tourism, increase exports, improve trade balance

makes goods cheaper

used to fight recession because it increases aggregate demand

Revaluation → increase the value of the currency

used to fight inflation because it decreases aggregate demand

Floating Exchange Rates:

exchange rate is determined by the market forces of supply and demand for that currency

Currency Depreciation → value of currency decreases; a weak dollar

caused by a decrease in interest rates, increase in domestic inflation, less demand for US goods

weak dollar causes increase in exports and decrease in imports (trade balance)

Currency Appreciation → the value of the currency increases; a strong dollar

caused by an increase in interest rates, a decrease in domestic inflation, increased demand for U.S. goods

strong dollar causes decrease in exports and increase in imports

Effects of Fiscal Policy:

expansionary fiscal policy increases interest rates → dollar appreciates

contractionary fiscal policy decreases interest rates → dollar depreciates

Effects of Monetary Policy:

expansionary monetary policy decreases interest rates → dollar depreciates

contractionary monetary policy increases interest rates → dollar appreciates

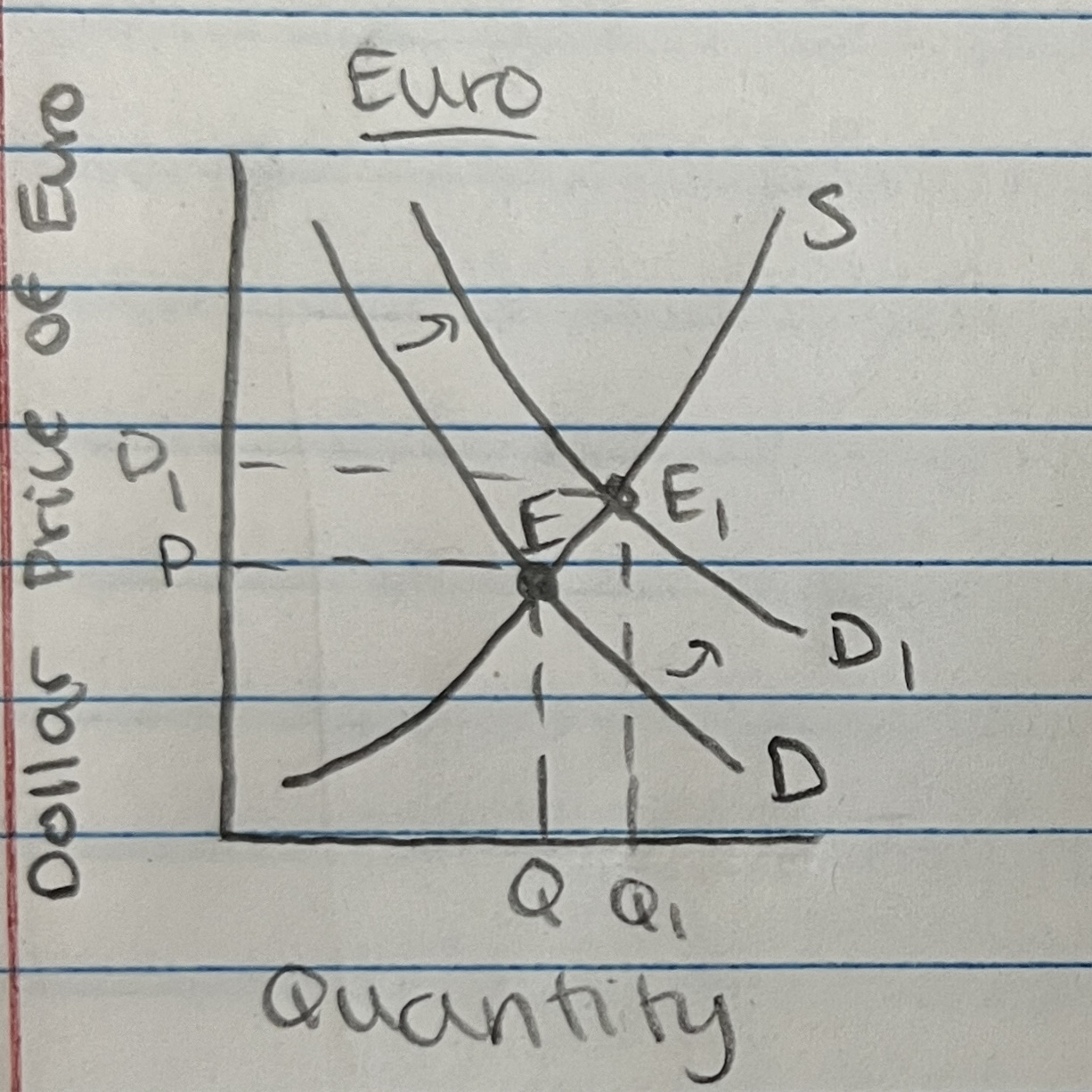

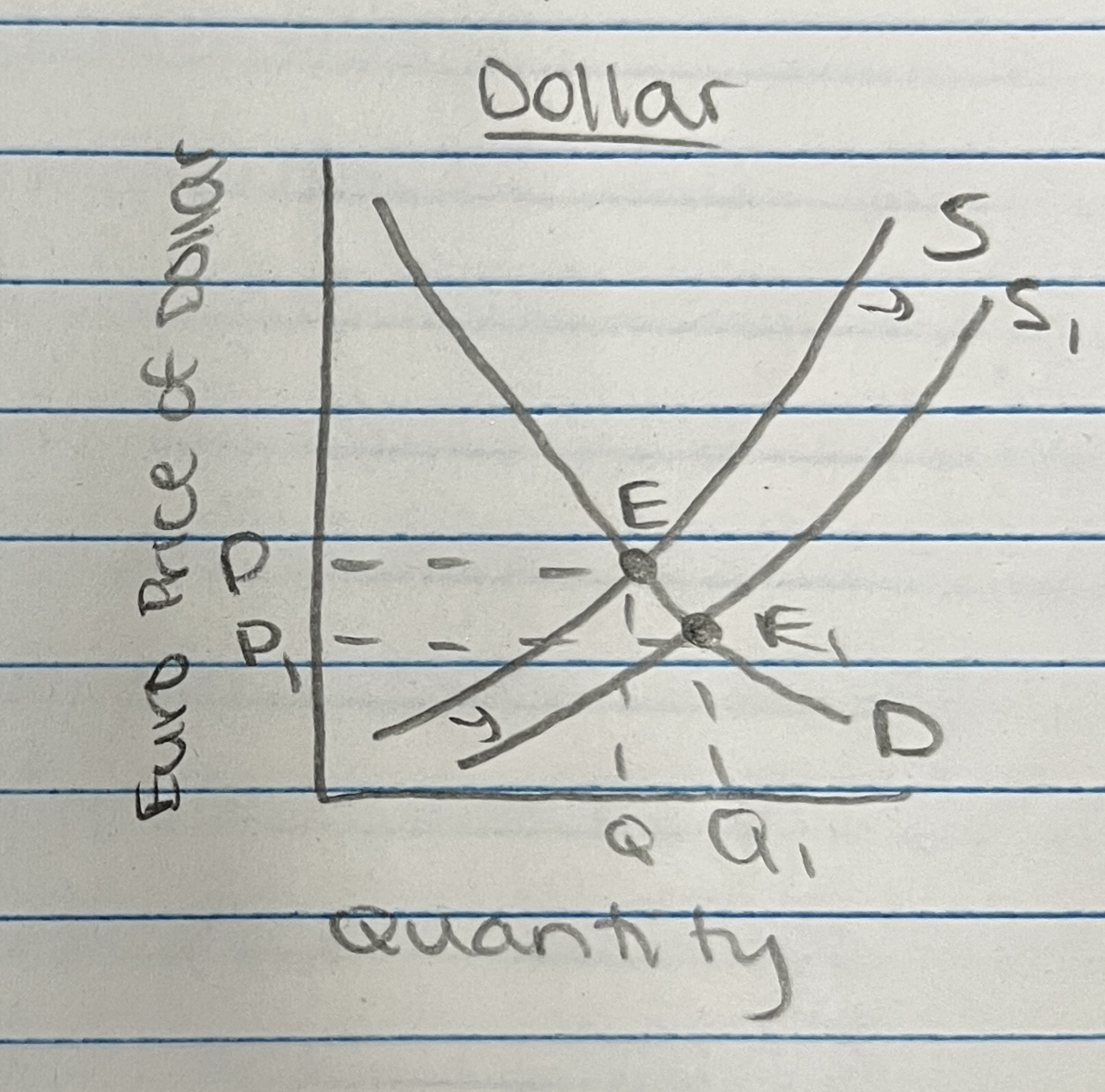

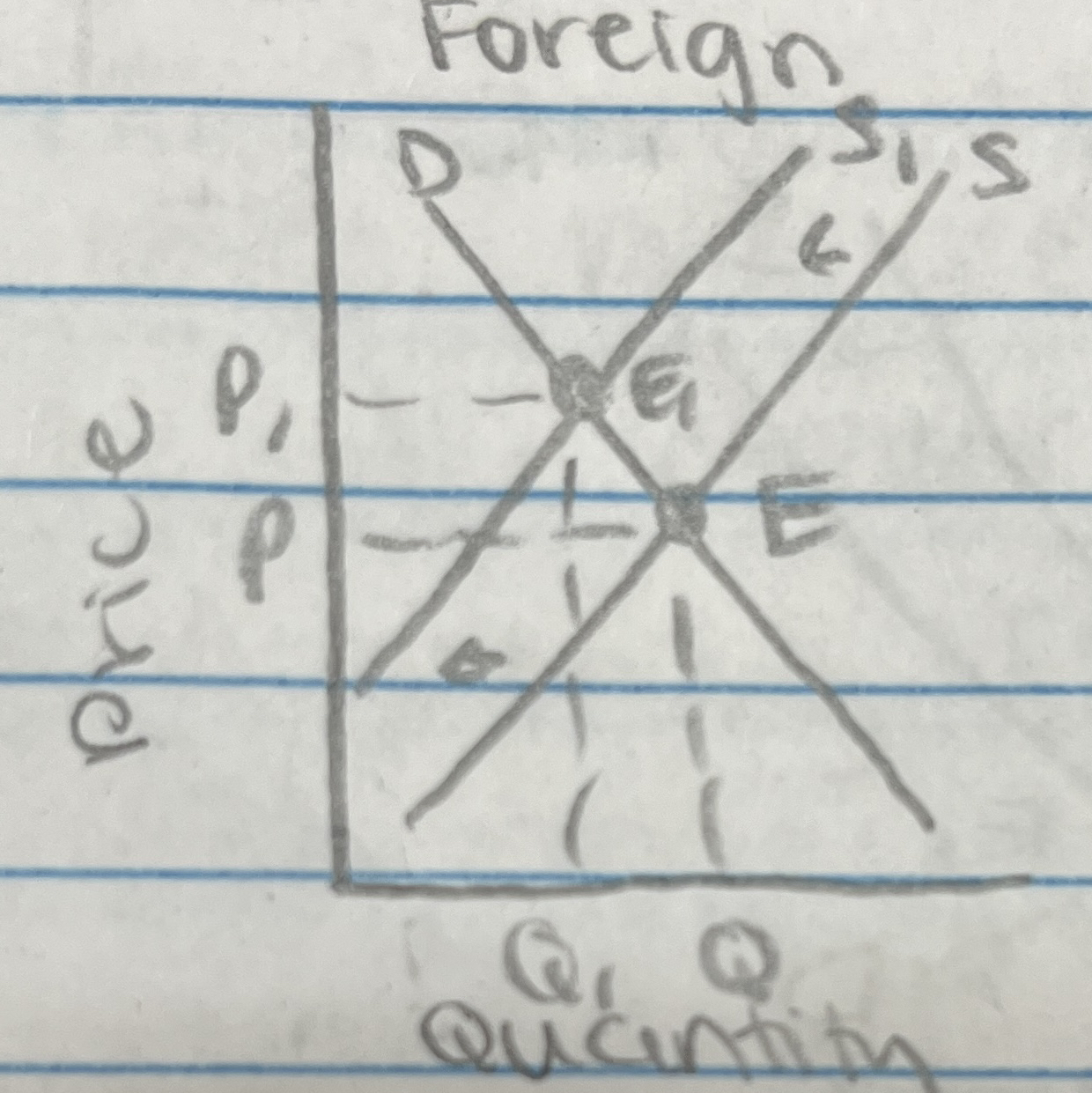

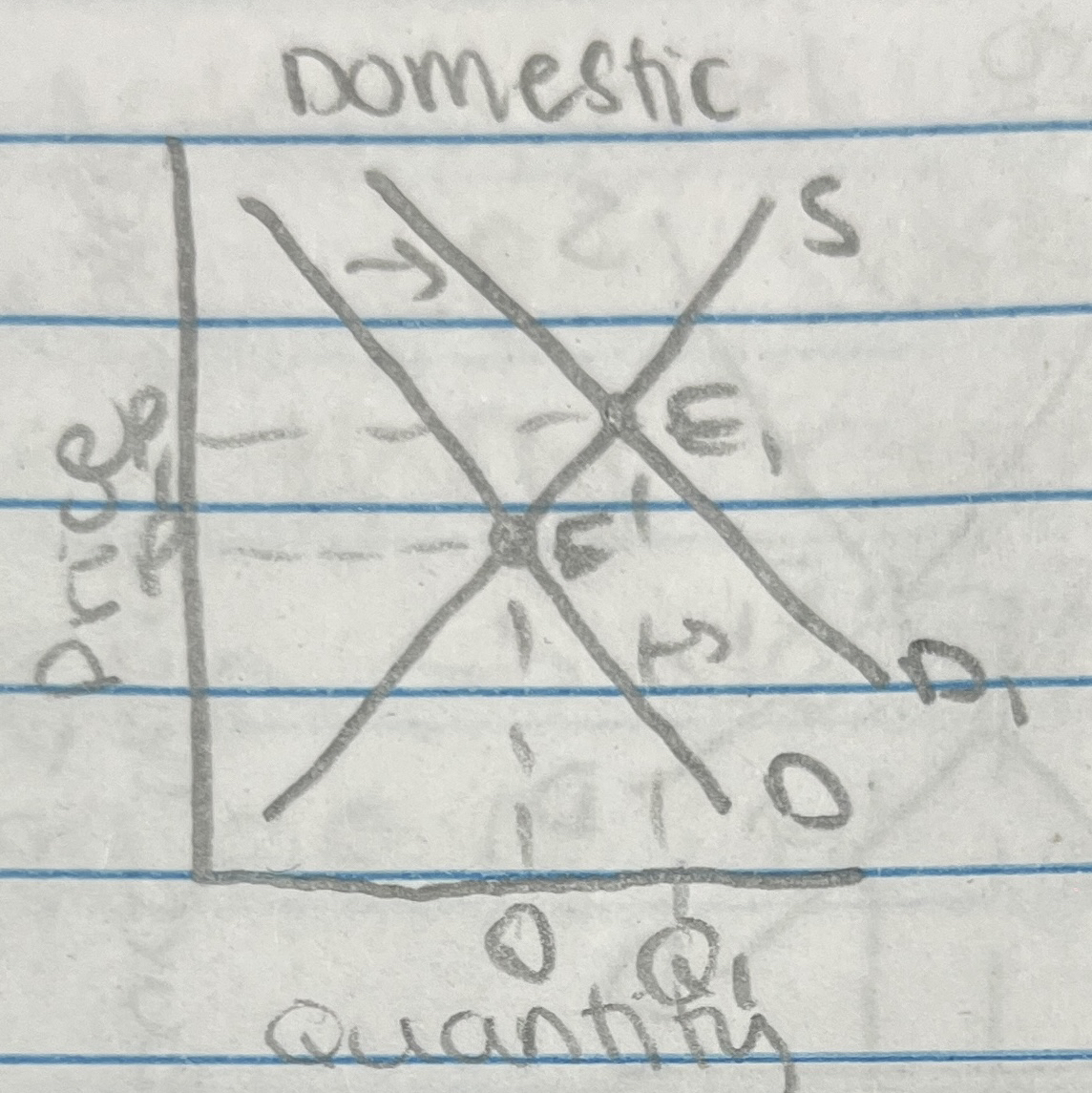

Foreign Exchange Market Graph:

Free Trade vs. Protectionism

Free trade → no tariffs, no quotas, no barriers to trade

Protectionism → workers in import competing firms

Arguments for protectionism:

self-sufficient military → the industries that produce for the military don’t want to have to import in the time of war

preserve domestic goods → protect your job

cheap foreign labor argument → how can Americans compete

protection against dumping → where a foreign government gives an export subsidy to a foreign company so they can sell goods below market price in the home market

infant industry argument → protect new industries long enough until they have a chance to compete

Tariff = a tax on imported goods

Quotas = a limit on a good that is imported

Balance of Payments

The balance of spending flowing into the country from other countries and spending flowing out of the country into other countries

Credit (+) → money flowing into country

Debit (-) → money flowing out of country

Tracks all money coming into the country and all money that leaves the country

Current Account:

Balance of Trade = exports - imports

Net Investment Income = interest/dividends

Net Transfer Payments → government aid to another country

Net Services → a foreign company providing services for a U.S. company and vice versa