3f. Price mechanism

Prices and incentives

The price mechanism describes the means by which millions of decisions taken by consumers and businesses interact to determine the allocation of scarce resources between competing uses

The price mechanism plays three important functions in a market

- The signalling function

- The rationing function

- The incentive function

The signalling function

Prices perform a signalling function – they adjust to demonstrate where resources are required, and where they are not

Prices rise and fall to reflect scarcities and surpluses (excesses)

If prices are rising because of high demand from consumers, this is a signal to suppliers to expand production to meet the higher demand

If there is excess supply in the market the price mechanism will help to eliminate a surplus of a good by allowing the market price to fall

The incentive function

Through their choices consumers send information to producers about the changing nature of needs and wants

Higher prices act as an incentive to raise output because the supplier stands to make a better profit.

When demand is weaker in a recession then supply contracts as producers cut back on output.

The rationing function

Prices serve to ration scarce resources when demand in a market outstrips supply.

When there is a shortage, the price is bid up – leaving only those with the willingness and ability to pay to purchase the product. Be it the demand for tickets among England supporters for an Ashes cricket series or the demand for a rare antique, the market price acts a rationing device to equate demand with supply.

The popularity of auctions as a means of allocating resources is worth considering as a means of allocating resources and clearing a market.

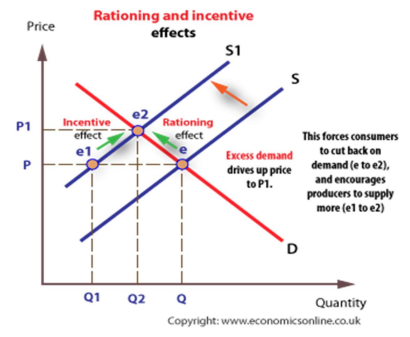

- Imagine there is a supply shock such as a fire at an oil refinery causing supply to shift to S1.

- This means there is now excess demand at a price of P.

- To eliminate this excess demand the price needs to rise to P1.

- This incentivises producers to increase output from Q1 to Q2.

- The higher price also rations demand from Q to Q2 as consumers can no longer afford it

Prices and incentives

Incentives matter. For competitive markets to work efficiently all economic agents must respond to appropriate price signals in the market.

Market failure occurs when the signalling and incentive functions of the price mechanism fail to operate optimally leading to a loss of economic and social welfare. For example, the market may fail to take into account the external costs and benefits arising from production and consumption. Consumer preferences for goods and services may be based on imperfect information on the costs and benefits of a particular decision to buy and consume