Government intervention in Microeconomics

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

forms of government intervention

price controls : price ceilings + floor

indirect taxes

subsidies

direct provision

command and control regulation + legislation

consumer nudges

why do governments intervene in markets

earn revenue for the government

provide support to firms

provide support to households on low income

influence the level of production of firms

influence the levels of consumption of households/consumers

correct market failure

promote equality

why do governments provide support to firms?

support to smaller firms to help them get established + be able to compete.

support to firms in an industry whose growth the governments want to encourage. (e.g produce environmentally friendly forms of energy.)

in the form of subsidies or floors

protect domestic firms from foreign competition (support through trade protection measures)

how does the government provide support to low income households

subsidies, price ceilings, direct provision of services (e.g healthcare, education)

transfer payments : e.g unemployment benefits, child benefits, maternity benefits,etc.

command and control definition

government laws and regulations that everyone must follow

indirect taxes definition

taxes levied on spending to buy goods and services

paid partly by consumers but are paid to the government by producers

direct taxes definition

taxes paid directly to the government tax authorities

e.g income taxes, corporate income taxes, wealth taxes

do taxes increase or decrease allocative efficiency?

depends on the degree of allocative efficiency before tax is imposed

economy begins with efficient allocation of resources → tax creates inefficiency and welfare loss

Why do governments impose indirect taxes

source of government revenue

discourage the consumption of demerit g/s

can be used to redistribute income (tax goods that only high income earners can buy)

improve the allocation of resources by correcting negative externalities

types of indirect taxes

ad valorem taxes

specific taxes

ad valorem vs specific taxes

ad valorem - percentage tax, amount of tax increases as price increases

specific - fixed amount per unit on top of sales price

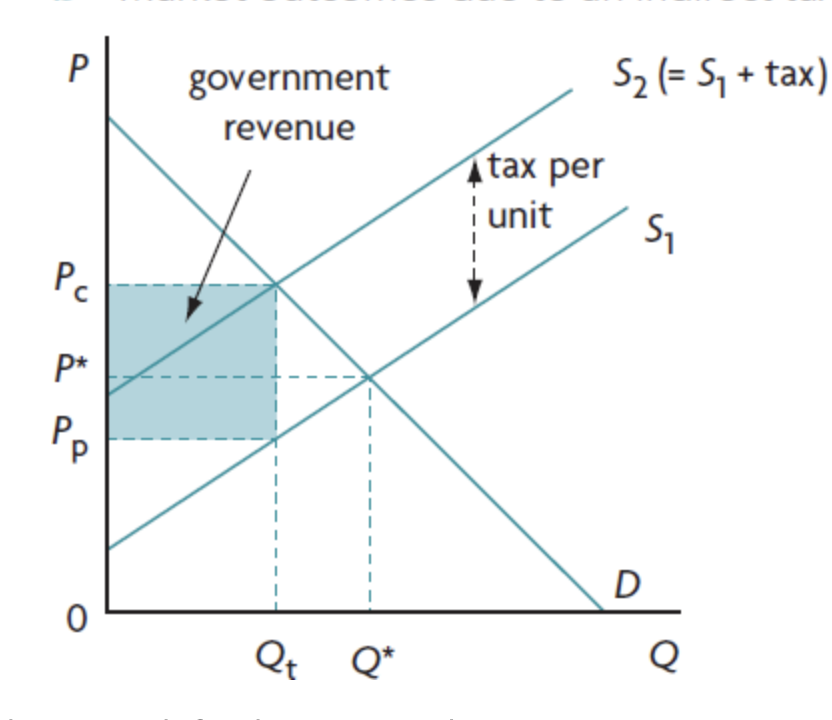

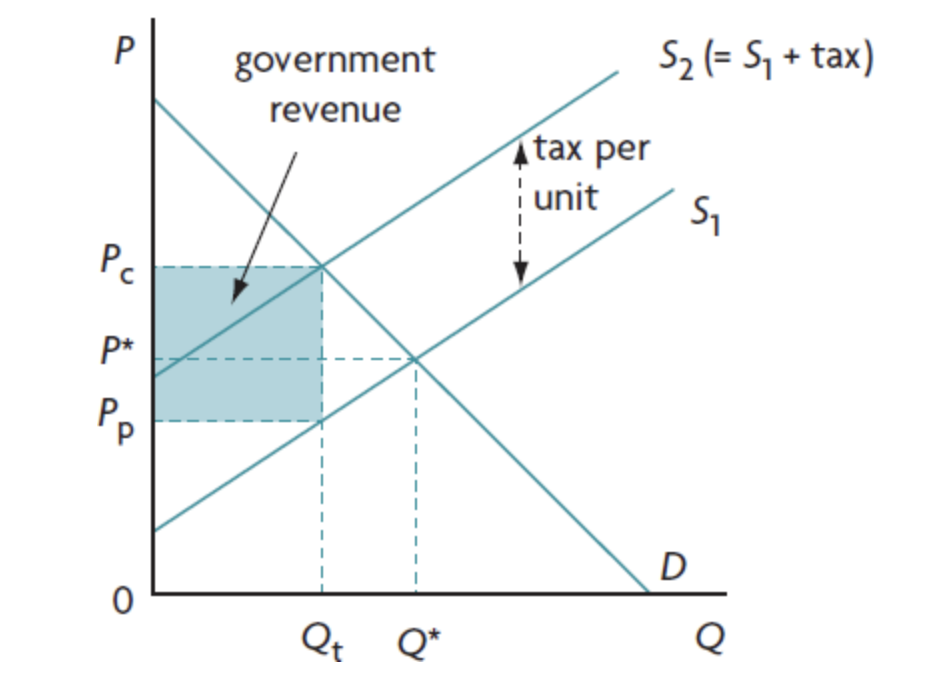

affect of indirect taxes on demand and supply graph

decrease in supply (shift left/upwards) by amount of tax (S2=S1+tax) (vertical difference between S curves = tax per unit)

government revenue = Q tx (Pc-Pp)

Pp= price recieved by producers after tax

market outcomes due to indirect taxes

equilibrium quantity falls from Q1 to Qt

equilibrium price rises from P1 to Pc (price paid by consumers

firms revenue falls from P1xQ1 to

consequences of indirect taxes on consumers + producers.

consumers - increase in the price of the g/s + decrease in the quantity they buy.

producers - fall in price they recieve + fall in quantity they sell → fall in revenue

consequences of indirect taxes on the government + workers

government - only stakeholder that gains → increase in revenue

workers → lower amount of output means that fewer workers are needed → taxes lead to unemployment

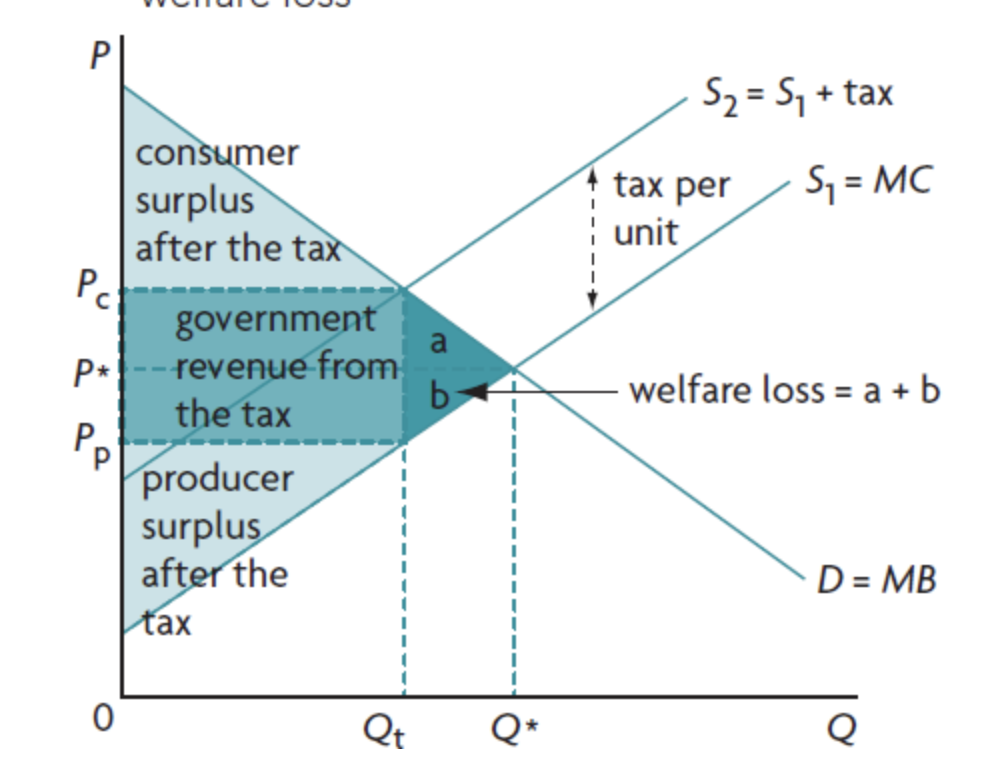

how do indirect taxes affect society as a whole

society is worse off as a result of the tax due to underallocation of resources to the production of the good (Qt<Q1) (underproduction)

taxes create deadweight welfare loss

government tax revenue goes back into society through government spending

after tax MB>MC and so consumers would be better off if more of the good would be produced

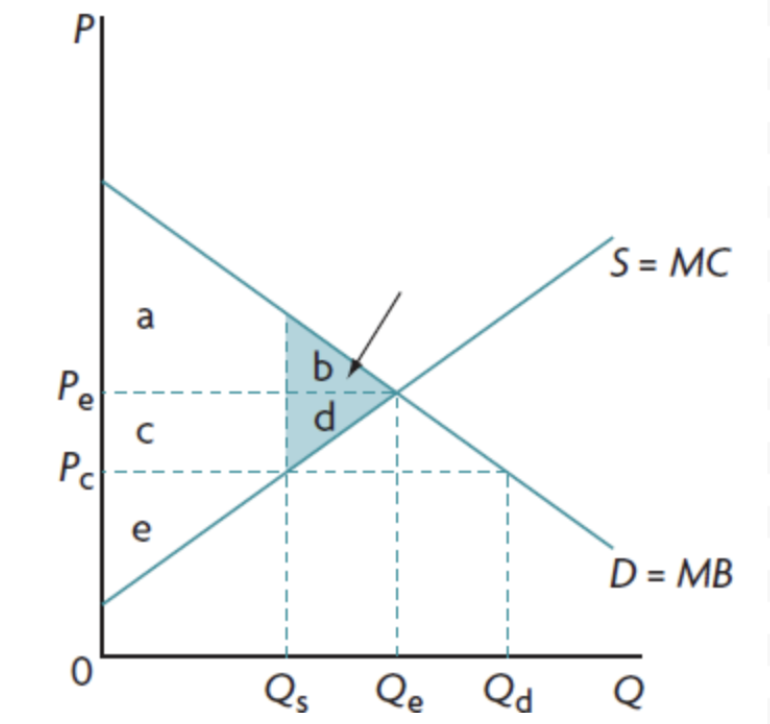

affect of indirect taxes on consumer and producer surplus

portion of CS goes to government tax revenue portion of PS goes to government tax revenue

affect of indirect taxes on social surplus

after tax social surplus = after tax consumer surplus + after tax producer surplus + government tax revenue

after tax social surplus is less than before tax social surplus by the DWL

why do indirect taxes create deadweight welfare loss?

taxes cause a smaller than optimum quantity to be produced → allocative inefficiency

how to calculate price received by producers after an indirect tax

price that consumers pay - tax per unit

how to calculate government revenue after tax

(price paid by consumers - price received by producers) x tax per unit

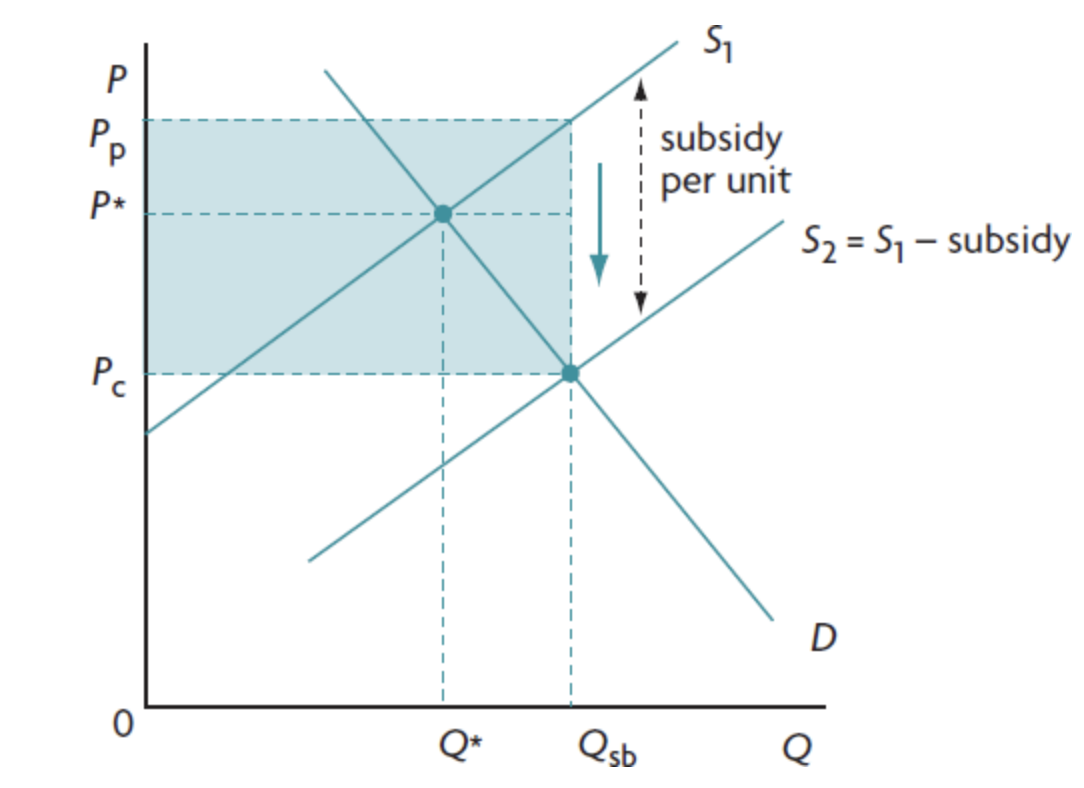

subsidy definition

amount of money paid by the government to producers in order to lower the costs of production per unit.

types of subsidies

direct cash payment (type: specific subsidy → fixed amount per output)

low interest/interest free loans

direct provision of g+s by the government below equilibrium price

tax relief

others

why do governments grant subsidies

increase revenue of producers

make necessity goods affordable for low income workers

encourage the production + consumption of merit g/s

support the growth of particular industries in an economy

encourage exports of a particular good

improve allocation of resources by correcting positive externalities

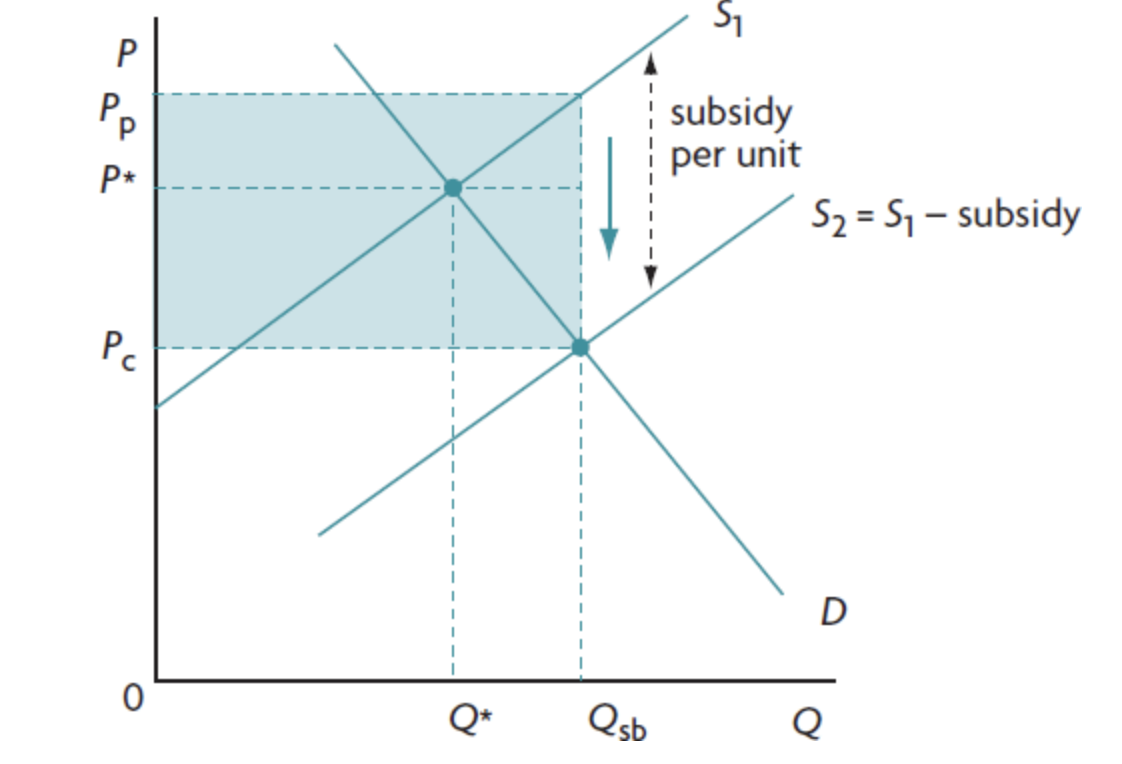

what is the new consumer expenditure + producer revenue after a subsidy

consumer expenditure - price paid by consumer x quantity

producer revenue - (price paid by consumers x quantity) + subsidy per unit

market outcomes due to subsidy

equilibrium quantity produced + consumed increases (from Q1 to Qsb)

equilibrium price falls

price recieved by producers increases

overallocation of resources as Qsb is greater than Q1

government spending on subsidy calculation

amount of subsidy = ( price received by producers - price paid by consumers) x Qsb

consequences of subsidies on producers + consumers

consumers - better off as they can buy more of the good and at a lower price

producers - better off as they receive a higher price and produce a larger quantity (increase in revenue)

consequence of subsidy on the government + workers

government - pays subsidy → burden on budget → has to reduce expenditure somewhere else/raise taxes/run in a budget deficit

workers - subsidies increase supply → firms are likely to hire more workers (workers who find a job are better off)

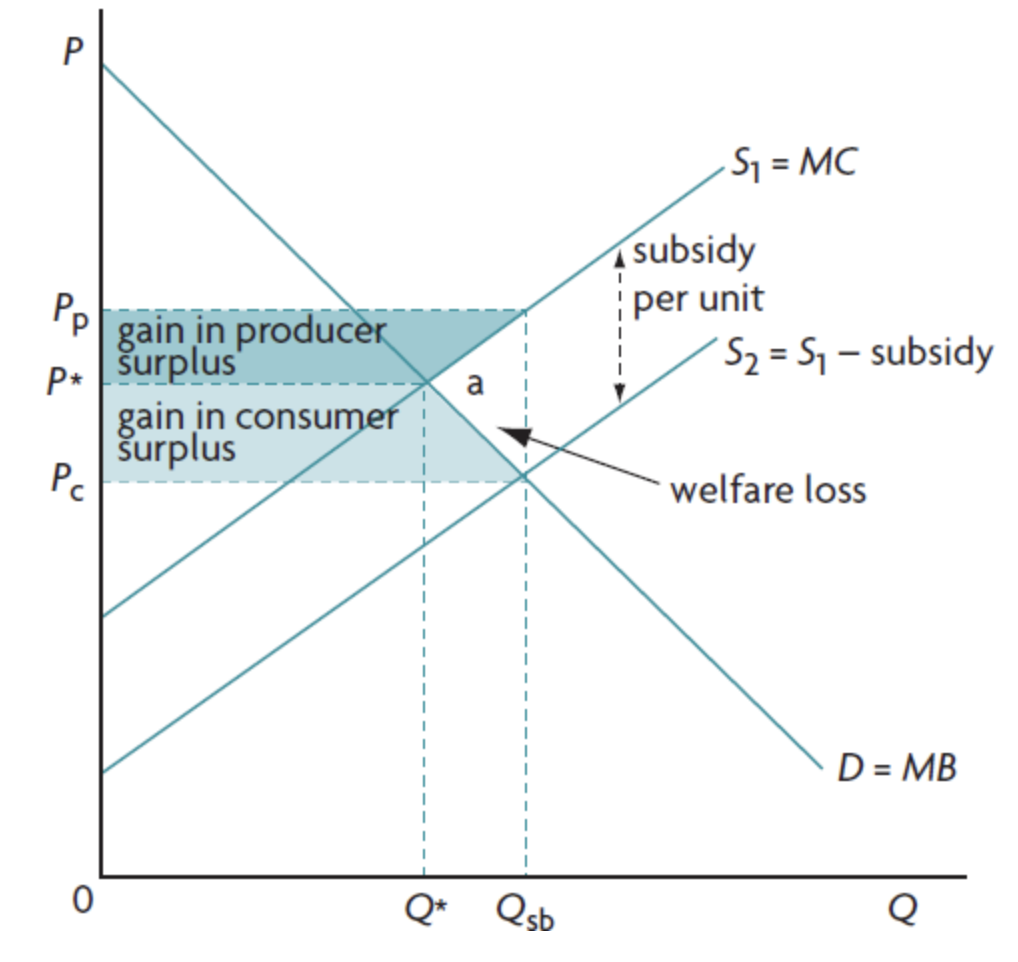

consequence of subsidy on society as a whole

worse off due to overallocation of resources to the production of the good (overproduction) (Qsb>Q1)

higher price received by producers protects inefficient ones and allows them to continue producing

consequence of subsidy on consumer + producer surplus

both CS and PS increase

social loss due to government subsidy are greater than the gains in CS + PS by the amount a=DWL → caused by larger than optimum qt. produced

society would be better of if less of the good was produced since MB<MC

how do subsidies on exports affect foreign producers

good for domestic producers as they are more internationally competitive

bad for foreign producers as they might not be able to compete with the lower price of subsidised goods

price controls definition

setting of minimum or maximum prices by the government (or private organisations) and do not allow a new equilibrium creating shortages or surpluses

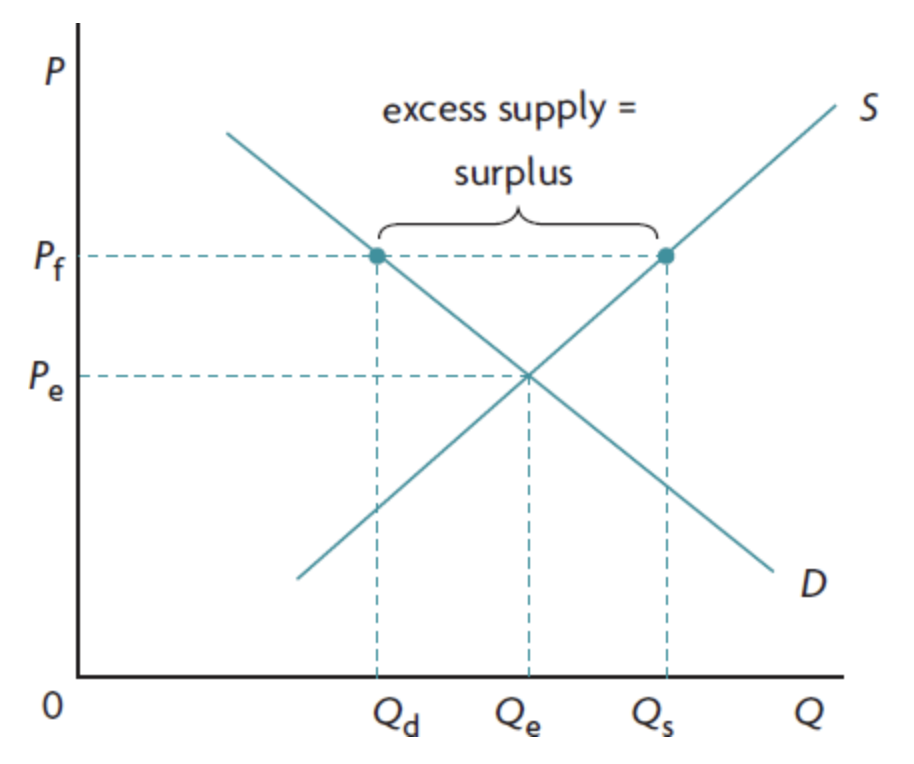

price floor definition

a legally set minimum price

price floor on demand + supply diagram

excess supply is created (amount = difference between Qs and Qd)

increase in quantity supplied (expansion)

decrease in quantity demanded (contraction)

why do governments impose price floors?

provide income support to farmers (price control in product market)

to protect low-skilled low-wage workers by offering them a wage higher than the equilibrium (price control in resource market)

farmers incomes before setting a price floor

before price floor farmers incomes are unsustainable/too low due to unstable agriculture product prices which occurs due to low PED + PES

Low farmer incomes may arise due to low YED

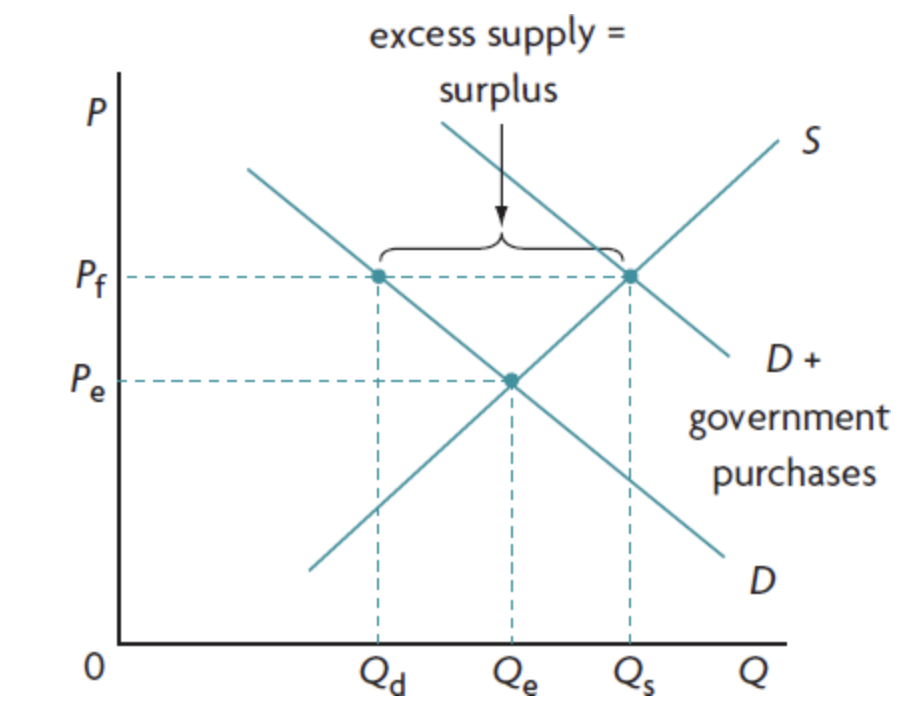

buffer stock scheme

governments buy up the excess supply → demand curve shifts to the right

allows government to maintain price floor (without it farmers would have excess supply and no buyers)

What does the government do with the excess surplus it buys from buffer stock scheme

store it - however gives rise to additional storage costs above purchasing costs

export surplus - requires subsidy to lower price of good as foreign consumers wouldn’t want to buy it at the higher price

consequence of price floor on firm efficiency

leads to inefficiency

this is as they are not incentivised to lower the costs by using a more efficient production method as the high price offers them protection

allocation of resources after a price floor is set

overallocation of resources to the production of the good (overproduction) → allocative inefficiency

more than optimum quantity produced

MB<MC indicates that society is getting too much of the good

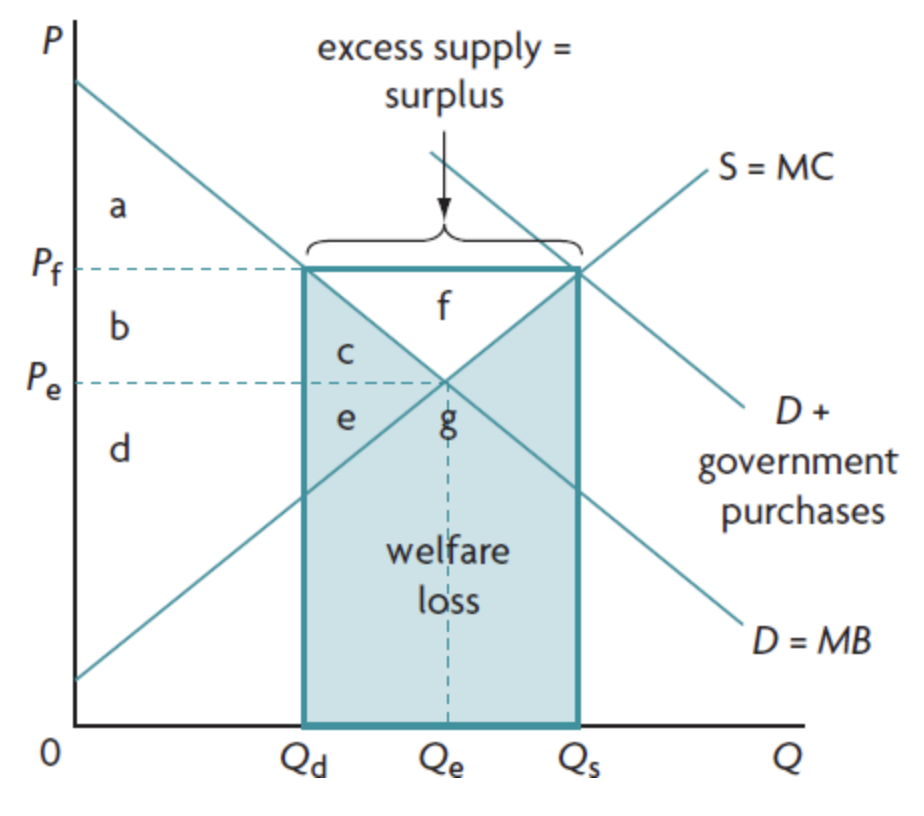

label

new CS = a

new PS = b+c+d+e+f

sum of CS and PS increases by f

area b+c is lost by consumers and gained by producers

DWL = c+e+g+h

excess supply = i

how to calculate government spending to buy excess supply after a price floor

price paid per unit x surplus quantity it purchases (Qs-Qd) (rectangle outline)

consequences of price floors for consumers + producers

consumers - worse off → pay a higher price + buy a smaller quantity (loss in CS)

producers - gain → receive a higher price + produce a larger quantity → increase revenue due to government buying surplus

consequences of price floors for workers + government

workers - better off as employment increases due to greater production needed

government - worse off due to having to buy excess supply → burden on budget → cannot use the money on other desirable activities. Also further costs arise for storing/exporting excess supply

consequences of price floors for stakeholders in other countries

more developed countries rely on price floors to support farmers. → excess supply then exported at lower price → lower world prices due to extra supply available

countries without price floors are forced to sell agricultural products at low world prices → signals local farmers to cut back on production → under allocation of resources

overall a global misallocation of resources occurs (waste in resources) as price floors cause high-cost producers to produce more and low-cost producers to produce less than social optimum

minimum wage definition

a minimum price of labour set by governments in order to ensure that low-skilled workers can earn a wage high enough so that they can afford necessity goods/services. (type of price floor)

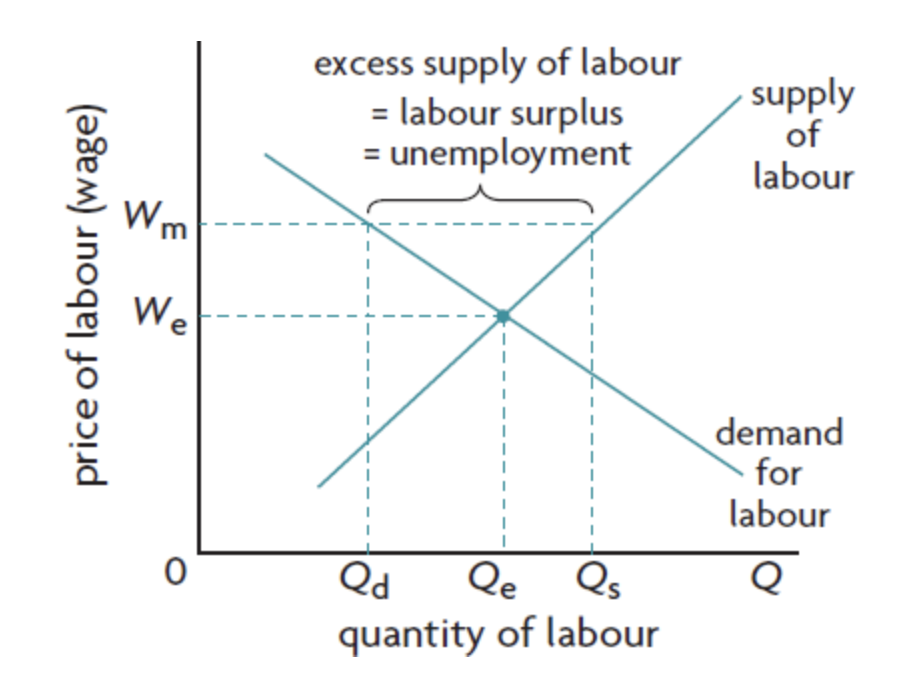

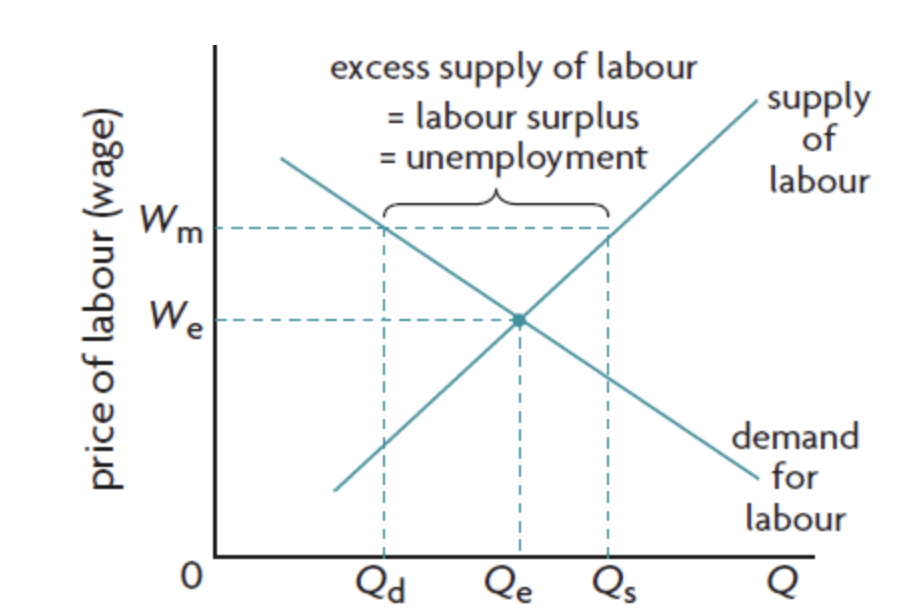

affect of minimum wage on demand + supply diagram

higher quantity of labour supplied

lower quantity of labour demanded

excess supply of labour (=Qs-Qd)→ unemployment

consequences of minimum wages on illegal workers

minimum wages result in the employment of workers that get illegally paid under the minimum wage (usually involves illegal immigrants)

consequences of minimum wages on allocation of labour resources

leads to misallocation of labour resources

industries that rely on un-skilled workers are more likely to be affected + hire less unskilled workers

consequences of minimum wages on allocation in product markets

costs of production increase for firms that rely on unskilled workers → decrease in supply/leftward shift

misallocation of labour resources → misallocation in product markets

consequences of minimum wages on consumers

worse off

increase in labour costs → decrease in supply → higher product prices + lower quantities

how to calculate amount of workers that loose their job due to minimum wages

workers who lost their job - Qe-Qd

new workers (newley willing + able to work) - Qs-Qe

total - Qs-Qd

consequence of minimum wage on labour productivity in real world

some times minimum wage causes an increase in labour productivity as workers feel motivated to work harder

setting fixed prices

prices cannot increase or decrease

usually used for concert/sports events tickets (supply is fixed)

can result in shortage/surplus

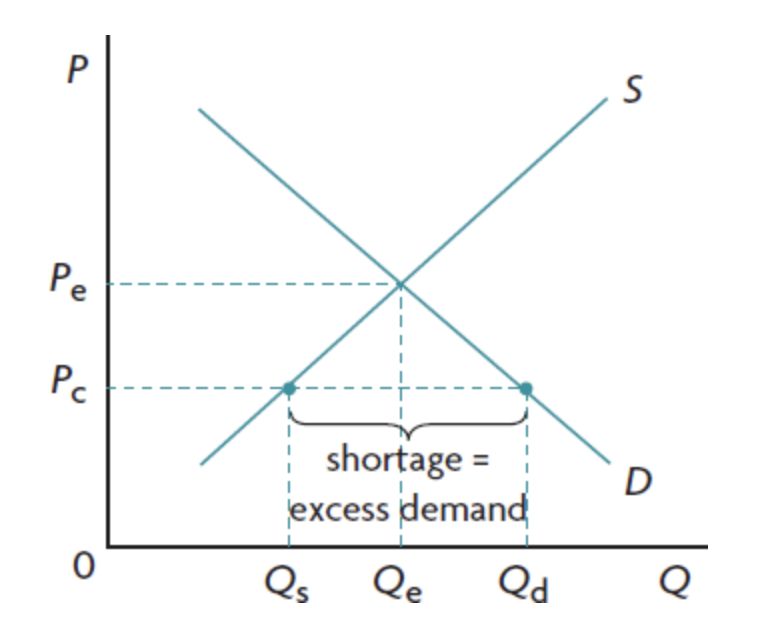

maximum prices definition

prices set by the government below equilibrium price in order to protect consumers (especially low income)

often used for rent control + price of food items

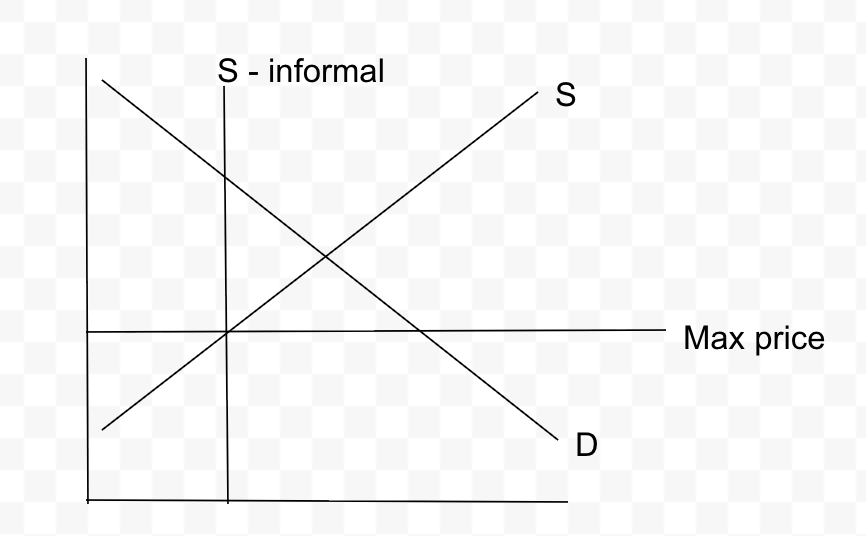

maximum price on a supply + demand diagram - simple

max price line below equilibrium price

supply contracts

demand expands

→ shortage

consequences of maximum prices on markets

shortages - not everyone who is willing + able to buy can buy do to shortage → not enough supply

non price rationing

underground/parallel markets

underallocation of resources to the g/s + allocative inefficiency

negative welfare impacts

non-price rationing - consequences of maximum prices on markets

(not enough of the good/service is produced and so has to be allocated to consumers using non-price rationing techniques such as : )

assumes that all producers sell at max price

first-come first-served

favouritism : sellers sell goods to preferred customers

needs-based allocation

everyone is allocated a certain amount

underground/parallel markets - consequences of maximum prices on markets

involve buying a good at the maximum/legal price and then re-selling it at a price above the legal maximum

underground markets occur when there are dissatisfied people who were not able to buy the g/s as there was not enough of it + are willing to pay more than the price ceiling to get it.

underallocation of resources + allocative inefficiency - consequences of maximum prices on markets

not enough resources are allocated into the production of the g/s → underproduction relative to social optimum

society is worse off

label for normal maximum price and when there is an informal market- consequences of maximum prices on markets

normal -

CS : a + c

PS : e

DWL : b + dinformal

CS : a

PS : c + e

DWL : b + d

welfare loss definition

social surplus or welfare benefits that are lost to society due to allocative inefficiency

how can we see on a demand and supply diagram that maximum prices lead to allocative inefficiency

MB>MC at point of production

the benefit consumers receive from the last unit of the good they buy is greater than the marginal costs of producing it

consequences of maximum prices on stakeholders - consumers

consumers who are now able to buy the good at the lower price are better off

some consumers still remain unsatisfied as even though they were willing + able to buy not enough of the good was produced and so they dont get to buy at all.

consequences of maximum prices on stakeholders - producers

worse off

sell a smaller quantity + at a lower price → revenues fall from equilibrium qt x p to max price x qt demanded at max price

can be seen in loss in producer surplus to consumers + DWL

consequences of maximum prices on stakeholders - workers + government

workers - worse off → qt supplied decreases → workers get fired → unemployment

government - no gain/loss in government budget, however the government can gain in popularity among consumers that are better of due to price ceiling

rent controls - example of max prices

maximum legal rent on housing

housing is more affordable for low income earners

of housing - qt demanded at max price is larger than qt of houses

long waiting lists of tenants

underground market formed where landlords charge above max rent

poorly maintained housing due to land owners not being incentivised to maintain/renovate as it is unprofitable

food price controls - example of max prices

food is more affordable for low-income earners

food shortages

non-price rationing methods take place

underground market creation

failing farmers due to low revenues

more unemployment in agricultural sector

misallocation of resources

greater popularity of government amongst consumers who benefit