Microeconomics Final

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

8 Terms

Antitrust and competition policy

Definition: Policies/regulations government put in class about what firms can and cannot do/ Government policy aimed at limiting the negative effects of market power

Antitrust (U.S) / Competition policy (Europe)

Department of justice that determines whether firms should be allowed to merge, is there too much market power in a given sector

Main areas:

price fixing (collusion, cartels)

merger policy

abuse of dominant position

Other relevant policy areas

market regulation

firm regulation

consumer protection

There’s a huge difference between the U.S. and Europe with their approaches:

In the U.S., antitrust is all about the impact on the consumers (the DOJ, what’s the impact on the consumers)

Whether we allow mergers to take place in this country, it affects consumers (like consumers paying higher prices)

In Europe, it is about consumers but mostly the impact on rival firms/competitors

They had a reversal of roles: The Great Reversal

In the 20th century, the US was the world leader in competition policy whereas Europe was better known for its industrial policy (national champion)

However, these two countries experienced a reversal of roles

US: loose merger policy, tolerant of dominant firms

Except for trust-busters like Biden who broke up firms

Europe: especially through DG comp: though merger policy, aggressive treatment of dominant firms (Microsoft, Apple, Google, Facebook, Intel, etc)

Trends in market power

Variety of indicators suggest that market power has increased considerably during the 21st century, especially in the US

Higher estimated markups

More concentrated ownership

Higher industry concentration (fewer competitors)

Many (unchallenged) mergers (e.g., hospitals)

Rise of superstar firms (especially in big tech)

Amazon, Meta, Google, etc

Evolution of market power in the U.S.

The higher the mark-up, the higher the market power. What drives up mark-ups?

Low marginal cost

High fixed cost

Value of elasticity of demand is getting smaller

In the 1980s, Reagan came into power

Deregulation of certain industries like transportation sector

Allowed mergers to take place, and had a fairly loose attitude towards antitrust. He believed merging companies would make companies bigger, thus, more efficient, so ”economies of scale” and more competition on the international stage

In the 1990s, there’s an IT revolution

Internet, cell-phones, computers

Those firms who operate in the tech sector, they have fixed costs and margin costs that affect their market power

Right before COVID

Greater concentration in big tech firms

Evolution of market power

Hard to establish a causal relationship between increases in concentration and increases in prices

But part of increase in markups is due to emergence of digital firms with high fixed cost and low marginal cost (e.g., Microsoft or Google)

However, secular increase in concentration and in prices is observed even if we restrict to more “traditional” industries like housing construction and health care

More concentrated ownership

A related trend is that, for a given number of competitors, we observe an increasing overlap in ownership

Specifically, many investment funds own shares in multiple competitors within the same industry

Berkshire Hathaway, JP Morgan, PRIMECAP, Vanguard, etc

Why does concentration of ownership imply greater market power?

When there’s more overlapping ownership, prices are higher and output is lower, market value is higher

Some evidence that when, for some unrelated reason, institutional investors increase their ownership of multiple competitors, market prices increase and firm values increase

Some anecdotal evidence that shareholders have an influence on industry managers in direction of increasing prices and decreasing output

Healthcare in the US

Health care represents an increasing share of the economy

In the US, health expenditures account for about 17 percent of GDP, which is strikingly high

Why do Americans spend so much on healthcare?

Why does the U.S. spend more money on healthcare than any other country

One possible answer is that the quality of US healthcare is higher than in other equally developed countries

But does not seem to be true, especially considering the gap in health expenditures

One explanation on which economists generally agree is market power

Mergers

Prices have increased, and this is probably related to increased concentration of hospital ownership

But we are faced with the common problem of distinguishing correlation from causality

Causal relationship: could be that when hospitals merge, they get bigger, so they raise prices

Causation: maybe some hospitals became better, were able to increase prices, and thus become more attractive targets for a merger, which in turn led to association of a merger with higher prices (even though there is no causal effect of mergers on prices)

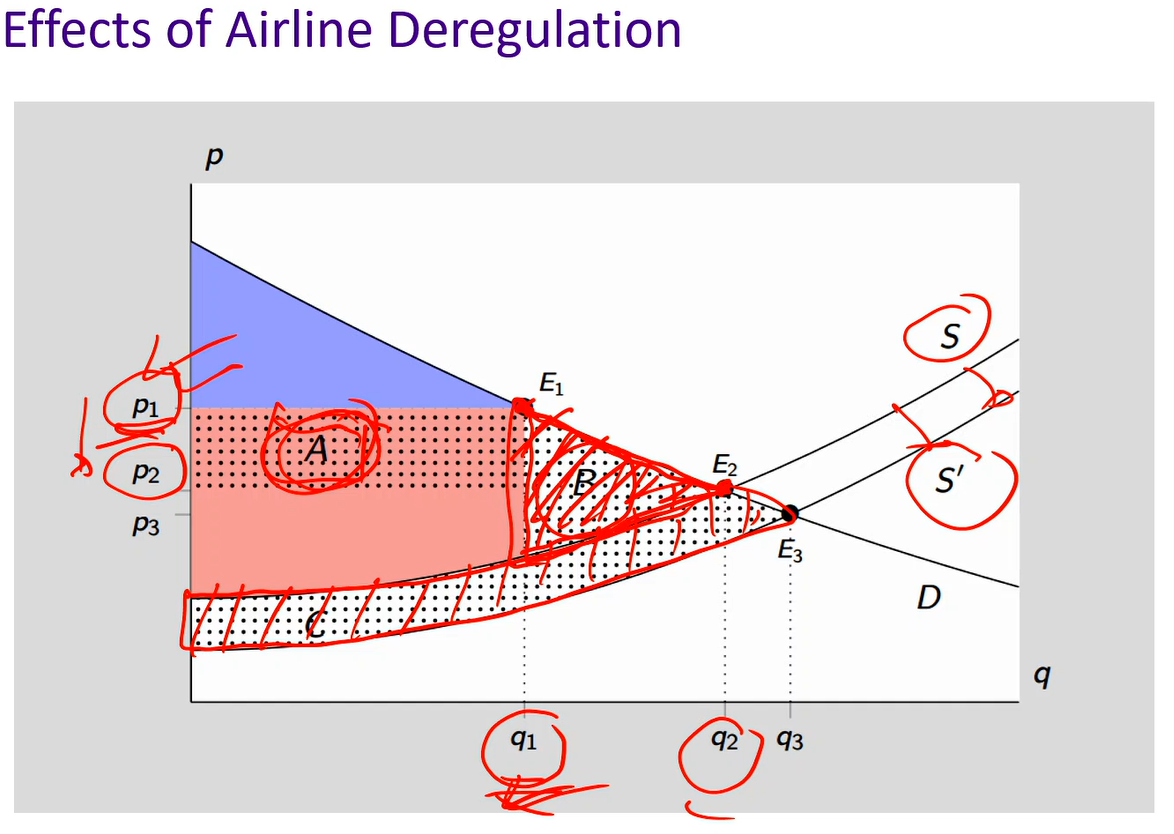

Effects of airline deregulation diagram

Deregulation: Government has no rules in making decisions for firms. Firms now can decide to setting prices, the competition on these certain routes, etc

After the deregulation: Injecting more competition

P1 decreases to P2 and Q1 increases to Q2

Area A: consumers are better off as there’s a transfer from producers to consumers

Area B (allocative inefficiency): Improves deregulation because of dead-weight loss. The value of trades and transactions are foregone.

Area C (productive inefficiency): When there’s more competition, it’s the survival of the fittest. Firms must keep down their marginal cost of production, and when marginal cost goes down, supply curve shifts down.

Merger policy

When Required: Two firms want to merge, especially if:

Large firms

Operate in same industry

Rationale: Reduction in number of competitors may:

Reduce competition

Harm consumers through higher prices, less choice, less innovation

Efficiency Gains (Pro-Merger):

Merger synergies (cost savings)

Economies of scale

Combined capabilities

Operational improvements

Market Power Threats (Anti-Merger):

Reduced competition

Higher prices

Less innovation

Reduced consumer choice