1. Principles of auditing and professional ethics

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

what is a company

organisation set up for a specific purpose

separate legal entity

registered under the Companies Act 2006 - provides the company with specific rights and responsibilities

collection of related stakeholders

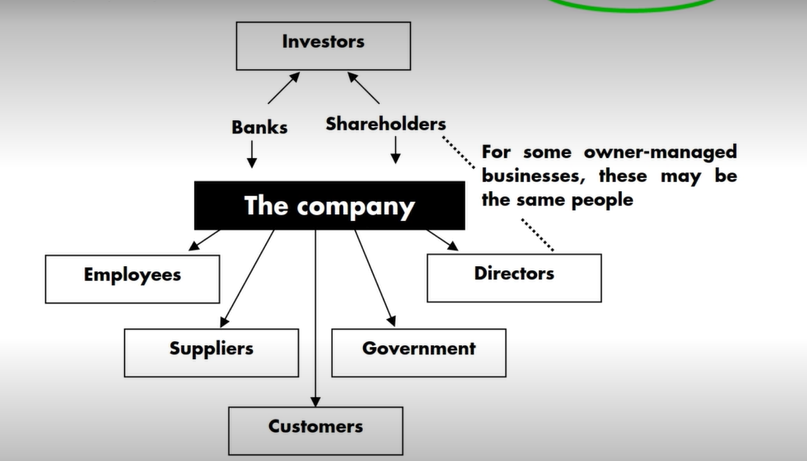

company diagram

benefits of being a company

limited legal liability

responsibilities of being a company

keep accounting records

provide financial statements

accounting records should be held for ___ years for a private company,

and _____ years for a public company

3

6

true and fair representation

true means honest and factual

fair means unbiased and free from discrimination

faithful representation

complete, neutral and free from error

solution to agency problem is

audit

define audit

an audit in an independent review of the financial statements and disclosures produced by directors to ensure that they are both honest and unbiased

an audit in an ________review of the financial statements and disclosures produced by directors to ensure that they are both _____and ______

independent

honest

unbiased

define assurance

assurance is a degree of confidence that is provides by a practitioner when reviewing subject matter. Assurance can be expressed in different ways and to different extents

assurance is a degree of _______that is provides by a practitioner when reviewing subject matter. Assurance can be expressed in different ways and to different extents

confidence

practical uses of assurance

audits

internal control reports

reviews on business plans

sustainability and corporate social responsibility

shareholders usually appoint the audit

shareholders usually appoint the audit

audit exemptions

can be expensive, time consuming and inconclusive

e.g owner managed businesses would find a review of their own work unhelpful

how to qualify for audit exemptions

needs to satisfy at least 2, for 2 consecutive years

turnover (revenue) of not more than £10.2 million during the year

balance sheet total (sofp) of not more than £5.1 million

not more than 50 employees

how to qualify for audit exemptions:

needs to satisfy at least 2, for 2 consecutive years

turnover (revenue) of not more than £______ million during the year

balance sheet total (sofp) of not more than £___ million

not more than ____employees

10.2

5.1

50

audit exemption cannot be claimed if a company falls into the following:

plc

bank or insurance company

companies which are a part of the 2 above

dormant companies

those which have not recorded any transactions within the accounting period are also exempt

still need to meet the criteria

BUT they can be a plc

benefits of assurance

satisfies external stakeholders

act as a deterrent against the threat of fraud

business may grow to levels beyond the exemption, so are used to being audited

overall objective of the auditor

to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement whether due to fraud or error, thereby enabling the auditor to express an opinion on whether the financial statements are prepared, in all material respects, in accordance to the applicable reporting framework

report on the financial statements and communicates as required by the ISAs, in accordance to auditor’s findings.