AP Microeconomics unit 3 Test

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

66 Terms

total revenue

is the amount a firm receives from the sale of g/s (items sold x price)

total cost

is the amount a firm spends to produce and/or sell g/s (sum of individual costs of the resources) (explicit+implicit costs)

profit

results when total revenue is higher than total cost

loss

results when total revenue is less than total cost

explicit costs

tangible out-of-pocket expenses (seen on balance sheet (wages))

implicit costs

the costs of resources already owned, for which no out-of-pocket payment is made (oppurtunity costs, each alternative use of the money is an implicit cost, hard to calculate _)

accounting profit

is calculated by subtracting the explicit costs from total revenue(total revenue - explicit costs)

economic profit

calculated by subtracting both the explicit costs and the implicit costs from total revenue (gives a more complete assessment of how the firm is doing, always less than accounting profit, can be negative (firm not doing well))

output

the product a firm creates

factors of production

the inputs (land, labor, and capital) used in producing g/s

productino function

describes the relationship between the inputs a firm uses and the output it creates (keep costs down, specialization, production per worker increase as additional works increase their specialization)

marginal product

the change in output associated with one additional unit of an input (normally starts positive and goes negative)

diminishing marginal product

occurs when successive increases in inputs are associated with a slower rise in input (after all inputs are fully utilized, additional units cause the marginal product to decline, managers hire the number of workers that maximizes their total output)

variable costs

change with the rate of output (number of workers, electricity used, ingredients, (things the company doesn’t need without customers)

fixed costs

unavoidable; they do not vary with output in the short run, fixed costs are aka overhead (building insurance, property tax, rent, ect)

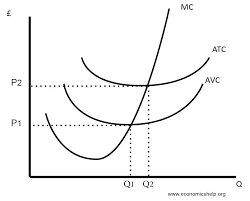

average variable cost (AVC)

determined by dividing variable cost by the output (quanity)

average fixed cost (AFC)

determined by dividing fixed costs by the output (as output incerase AFC decreases, it is often not pictured on the graph, so it is just the difference between ATC and AVC, decreasaing line on the graph)

in the short run do both fixed and variable costs exist?

yes

in the long run do both fixed and variable costs exist?

no, you can change everything in the long run

average total cost

sum of average variable cost and average fixed costs

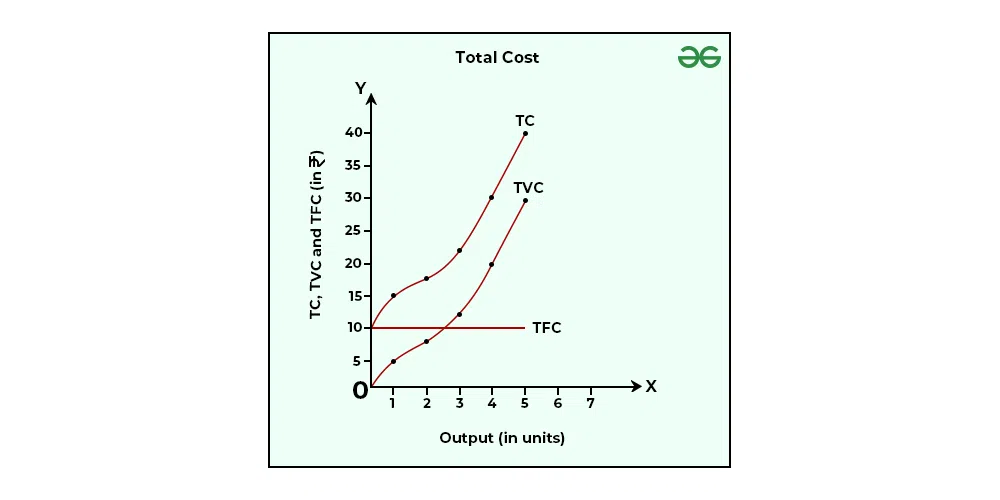

what does a total cost curve look like

what does an average cost curve look like

marginal cost

increase in cost that occurs from producing 1 additional unit (reaches its lowest point before the lowest point of the AVC and ATC curves(signal that the total cost will increase)

scale

refers to the size of the production process (increase or decrease operations, avoid a situation of negative marginal product)

efficient scale

output level that maximizes average total cost in the long run

economies of scale

long run AC fall as more output is produced (getting bigger is cheaper)

diseconomies of scale

AC increasing as more product is produced. Company becomes so big that they have to hire extra people and add stuff to their buildings and increase their AVC

constant returns to scale

Average costs will level off (when producing a product, there is no way to get below a certain cost)

what is the relatoinship between MC and MP

MC is the opposite graph of MP`

How does AVC work in the long run

follows MC and intersects at AVC lowest point, increases as output increases, ATC and AVC get closer but never touch because the difference between them is AFC

what are the axis on a average cost curve graph

y = price, x = quantity

How does ATC work in the long run

sum of AFC and AVC, follows the mc, lowest point will intersect the MC

where is constant returns to scale on a long run graph

the middle

where is economics of scale on a long run graph

left side

where is diseconomics of scale on a long run graph

right side

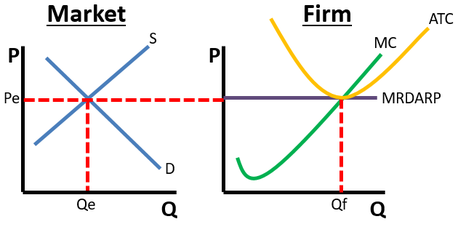

price takers

have no control over the price set by the marke. it takes (accepts) the price determined from the overall supply and demand conditions that regulate the market (each seller is a small compared to the overall market, an indicidual sellers choices have no impact on the market price)

what is the impact of barries to entry and exit

High barriers to entry reduce competition, leading to higher profitability for established firms, while low barriers lead to high competition and lower profit margins

profit-maximizing rule

states that profit maximization occurs when a firm chooses the quantity of output that equates marginal revenue and marginal cost (MR = MC)

How do you decide how much to produce in a competitive market

Locate point at which the firm will maximize its profits (MR = MC) then look for the profixt maximizing output (move down the vertixal dashed line to the x axis at point q (point of maximum profit quantity) (any quanityt greater than or less than Q would result in lower profit)

how do firms decide whether to shut down or not

Short-run calculation - if the firm would lose less by shutting down than staying open it should shut down (as long as the MR > minimum point on the AVC, the firm will choose to operate )

sunk costs

unrecoverable costs that have been incurred as a result of past decisions

the firms long-run supply curve

firms decisions are directly tied to profits, only exists when the firm expects to cover its total costs of production

signals

of profits and losses convey information about the profitability of various markets

what do profit/losses signal

profits - encourage new market entry / losses - encourage exiting the market

what are the characteristics of competitve markets

homogeneous goods, many buyers and seller, price takers, free entry and exit

why is MC u-shaped?

because marginal costs are the opposite of the marginal product curve. due to initial increasing returns followed by diminishing marginal returns

why does average follow the marginal?

because the lowest AVC and ATC intersect at the MC

what does the side by side graph look liked in a perfeclty competitve market in the long run

what is the profit in a perflectly competitive industry?

$0

why do you stay in this market even if the profit is $0?

economic profit at $0 is okay because all explicit costs are covered by revenue and becasue all of the implicit costs are covered by revenue

what does a profit look like in a perfectly competitve short run firm?

ATC below MR/D/AR/P (important point where MC intersects MR/D/AR/P (where long run ATC should be), important point where ATC intersects the profit maximizing quantity (dashed line from the previously mentioned important point)

what does a loss look like in a perfectly competitve short run firm?

ATC above the MR/D/AR/P line

how do you change from SR → LR?

supply and demand shift causes MR/D/AR/P to increase/decrease and intersect ATC at its lowest point

is there DWL?

NO

how do you find the profit/loss rectangle?

for profit it is the difference between the point MC intersects MR/D/AR/P and the point where ATC are at the profit maximizing qunaity.

For loss it is the differemce between the same two points but you have to bring the dashed line up wards

what does a change in fixed costs do to the margin

does not change it

when the MR is below the AVC and ATC line what will happen?

shut down because it is not covering any fc and not all VC

when the MR is above the lowest point of AVC what will they do?

stay open because it is covering all variable costs and some fixed costs

When the MR is at the lowest point of AVC what will they do?

shut down because they are only covering VC and ont fixed costs

Where does diminishing marginal returns begin?

point where MC is minimized because the next unit of output iwll be produced at a higher cost, which is a result of diminishing returns

What are the axis for the marginal product curve?

y - output

x - input

why does the TVC dip in the short run total cost curve?

because of specialization

law of diminishing marginal return

firms max profit when MC = MR

What is marginal analysis

a decision-making process that compares the additional benefits of one more unit of an action against the additional costs of that action

what does a change in variable costs do

changes avc, atc, and mc

what does a change in fixed costs do

changes afc and atc