AP Macro unit 4 and 5

1/67

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

68 Terms

Bond

Certificate of in debt that specifies the obligations of the borrower to the holder of the bond

stock

claim of partial ownership with a firm/ business

Financial intermediaries

institutions allow savers to provide funds directly to borrowers

mutual funds

sells shares and uses the funds to buy stocks and bonds

liquidity

the ease in which an asset can be accessible and turned into cash

rate of return

net gain or loss of an investment over a specified period of time

risk

the chance that an investment’s outcome actual gains are different than expected

GDP formula

Y=C+I+G+NX

closed economy

a closed economy loses international trade (NX).

Y=C+I+G

Y-C-G

Is the total income that remains after paying for consumption and government purchases

national savings

also equals investment

savings = investments

Savings formula

S=(Y-T-C)+(T-G)

Private saving

amount of income a household has left after paying taxes and consumption

Y-T-C

Public saving

amount of tax revenue the government has left after paying its spending

T-G

budget surplus

T>G; Taxes are greater than government spending. S>0

Budget deficit

T<G; Government spending is greater than tax revenue; S<0

Nominal Interest rates =

real interest rates + Inflation

Real Interest rates =

Nominal Interest Rates - Inflation

If inflation is greater than expected inflation,

real interest rates will decrease

If inflation is less than expected inflation,

real interest rates will increase

Fiat money

serves as currency

No other purpose

US Dollar

Commodity Money

can perform the function of money

gold or oil

M1

High liquidity

Currency, transaction accounts, and travelers’ checks.

M2

medium liquidity

Savings Accounts, Certificates of Deposit and other Liquid assets.

M3

Low Liquidity

Accounts from M2 that are above 100,000$

medium of exchange

Money is used to buy goods and services without complications of bartering.

Unit of account

Money is used to measure values of goods and services.

Store of value

Money is used to preserve or save purchasing power for future consumption.

Fractional Reserve Banking

Banks accept deposits and are required to to hold a small fraction of what is deposited

Money multiplier

1/reserve requirement

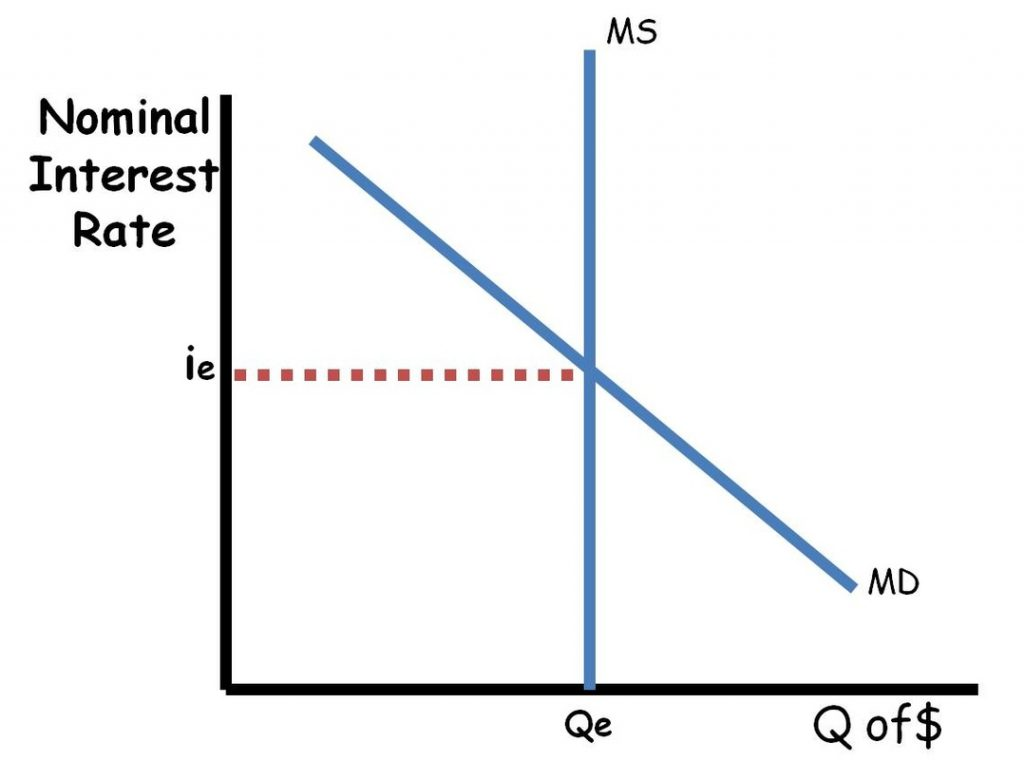

Demand for moeny inverse

People demand a certain amount of money.

The inverse relationship is as interest rates go down, demand for money goes up and vice versa

Shifters of Demand in the Money Market

Price Level

Real GDP

Transaction Costs

Supply for the money market

The Supply of Money will remain constant compared to the change in nominal interest rates.

It will only change based on the FED’s monetary policy.

how to increases money supply/expansionary monetary policy

Decrease Discount Rate

Decrease reserve ratio

buy bonds

decrease the federal funds rate

how to decrease money supply

increase discount rate

increasereserve ratio

sell bonds

increase the federal funds rate

Investment demand

the desired quantity of investment spending by firms across the country.

inverse relationship between nominal interest rates and the quantity of investment demanded.

the quantity demanded will decrease or increase based on the monetary policy.

Expansionary Policy (Easy Monetary Policy)

This policy increases money supply and real GDP output

Contractionary Policy (Tight Monetary Policy)

This policy decreases the money supply and real GDP output.

Recessionary Gap

Fed Reserve will increase money supply

Inflationary gap

Fed Reserve will decrease money supply

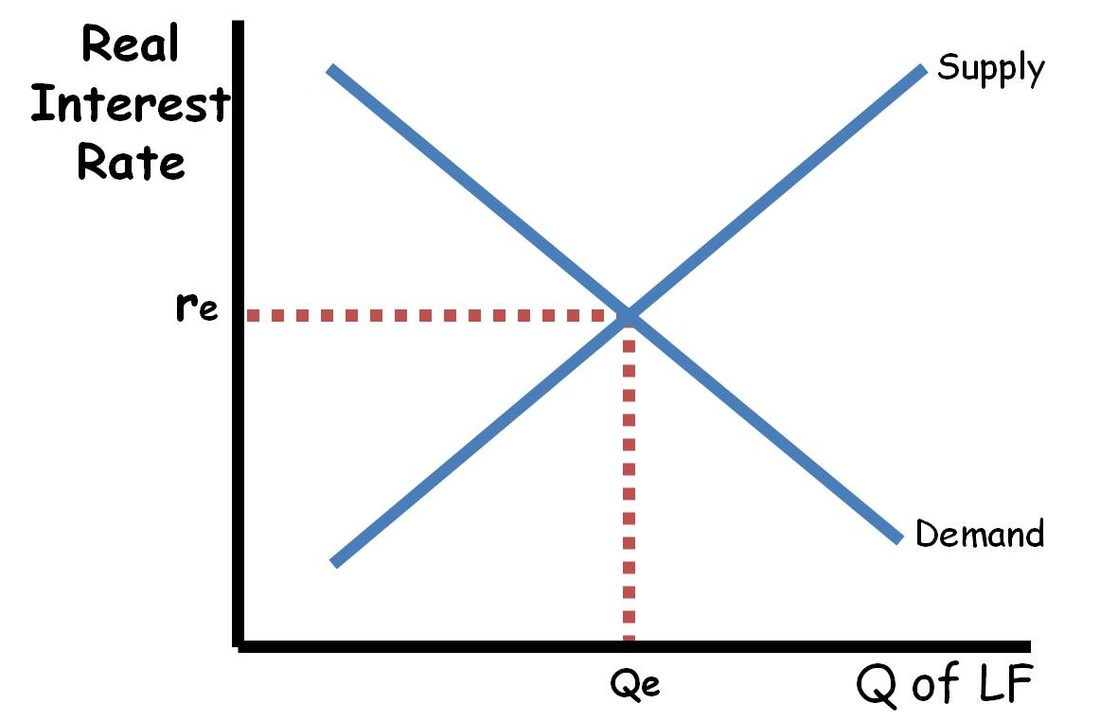

Loanable funds market

is a market perpetuated by borrowers and savers.

Borrowers demand the loans while saver supply them.

The market is in equilibrium when the real interest rate adjusts to a point where the amount of borrowing equals the amount of saving.

Demand of loanable funds market

When real interest rates increase, quantity for loanable funds demanded decreases.

When real interest rates decrease, quantity for loanable funds demanded increases.

Supply of loanable funds market

When real interest rates increase, the quantity of loanable funds supplied increases.

When the real interest rates decrease, quantity of loanable funds supplied decreases.

Shifters of demand in the loanable funds market

Foreign Demand for Domestic Currency

All Borrowing, Lending and Credit

Deficit Spending - This will increase borrowing.

Expectations for the Future

Shifters of supply in the loanable funds market

Savings Rate

Expectations for the Future

Lending at the Discount Window

Foreign Purchases of Domestic Assets

Interest rates

The proportion rate of a loan that one is charged based on a percentage of a loan over a period of time

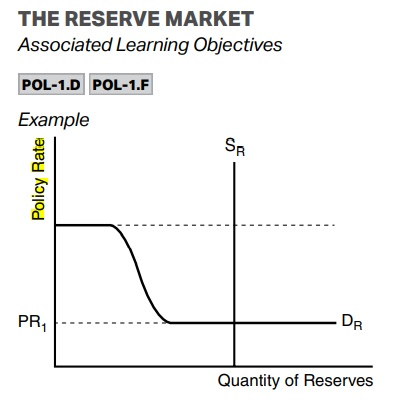

reserve market

Ample Reserves: When the Federal Reserve pays IOR (Interest on Reserves) that is higher than the Federal Funds Rate so banks will place their reserves in the central bank.

Limited Reserves: When the Discount Rate is cheaper than the Federal Funds rate.

Money market

The money market graph shows how the supply of money and the demand for money interact to determine the equilibrium nominal interest rate. It includes a vertical money supply curve, controlled by the central bank, and a downward-sloping money demand curve, influenced by factors like income and interest rates. Changes in the money supply (a shift of the vertical curve) directly impact interest rates, as a shift to the right lowers rates and a shift to the left raises them.

Fiscal Policy for a recessionary gap

Actions: Government spending increases, Taxes decreased

Results: Leads to AD increase

Monetary policy for recessionary gap

Actions: Reserve Ratio decrease, Discount rate decrease, or Buy bonds

Results: Leads to an increase in the money supply which lowers interest rates which will increase AD

No policy for recesionary gap

Actions: Wages will drop

Results: SRAS will increase

Fiscal policy for inflationary gaps

Actions: Government spending decreases, Taxes increased

Results: Lead to AD decrease

Monetary policy for inflationary gaps

Actions: Reserve Ratio increase, Discount rate increase, or Sell bonds

Results: Leads to a decrease in the money supply which raises interest rates which will decrease AD

No policy for inflationary gap

Actions: Wages will increase

Results: SRAS will decrease

Money growth formula

M*V=P*Y

M = Money

V = Velocity of Money

P = Price

Y = Real Output

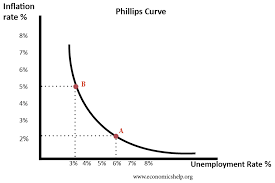

The Phillips Curve

Inflation Rate and Unemployment Rate are inverse

Demand pull inflation

Either caused by Consumer Demand increasing or Government Deficit Spending increasing

Cost push inflation

Decrease in production due to an increase in costs. Labor, Natural Resource Shortages

Wage price spiral

Prices of Goods go up, Need Higher Wages, Higher Labor Costs, Less goods, price increase, Higher Wages, Higher Labor Costs, Less goods, Higher prices

Fiscal Stimulus

Use of expansionary fiscal policy, Increase in government spending, decrease in personal taxes, or increase in income transfers.

Fiscal restraint

Use of contractionary fiscal policy, Decrease in government spending, increase in personal taxes, or decrease in income transfers.

Government revenue

Total income gained by the government at all levels through taxes.

Goverment Expedentures

Total spending payments towards discretionary and non-discretionary purchases.

Budget surplus

This takes place when government revenues exceed government expenditures. Tax Revenues > Government spending

Budget Deficit

This takes place when government spending exceeds government tax revenue. Government Spending > Tax Revenues

National debt

All deficits accumulated over the course of multiple years

Crowding out

This is an economic theory that takes place when the public sector spending can eliminate or lessen the private sector spending.

Economic growth

Economic Growth is critical for raising the standard of living (Real GDP per Capita). This is completed through the advancement of:

Technology

Amount of Physical Capital

Amount of Human Capital

How does our Economy Grow through Public Policy?

Increase Education Spending

Increase Infrastructure Spending

Promotion for innovation