ECO Unit 4 outcome 1

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Direct taxation

Revenue received on the income of or profits of the person who pays it. E.g Income tax, company tax, superannuation fund tax

Indirect taxation

Revenue received from the sale of goods or services. E.g GST, Tariffs, Excise tax

Progressive tax

Those that narrow the gap between individuals on higher as opposed to lower incomes. E.g personal income tax system (those on low income below a certain number are not taxed. People on higher numbers are taxed alot more.)

Regressive tax

Taxes that increase income inequality, being opposite to progressive taxes.

Proportional tax

Remains constant no matter how much or how little income is earned. An example of a proportional tax is company tax where large businesses pay at the rate of 30 per cent of each dollar of profit, while small and medium enterprises (SMEs) now pay 25 per cent.

Revenue from GBE’s

Revenue received from the profits of businesses owned by the gov. E.g Aus post profits

Revenue from sale of gov assests

Revenue received when items under control of the gov are sold. E.g sale of the ABC (hypothetical)

GOV EXPENSES

Current expenditure

Capital expenditure

Transfer payments

Current expenditure

Day-to-day operating costs of gov departments, with benefits consumed within a 12 day period. E.g Wages, salaries, stationary, rent.

Capital expenditure

Expenses paid by the gov on g&s that have a benefit for longer than a 12 month period. E.g Building of schools, uni, airports, roads.

Transfer payments

A government payment made in which no g&s are received in exchange. E.g Pension, unemployment benefit, housing assistance, disability payment.

Budget outcome

Reflects difference in value between gov receipts and outlays for the year

Balanced budget

When gov receipts and expenditure are equal.

R/S to debt

N/R.

Budget deficit

When gov expenditure is greater than receipts.

R/S to debt

Debt+ through sale of gov bunds to fund shortfall.

Budget surplus

When gov receipts are greater than expenditure.

R/S to debt

Debt’s MAY reduce if gov chooses to use surplus to pay down debt. Other option is to return money to economy for short run or long run benefits.

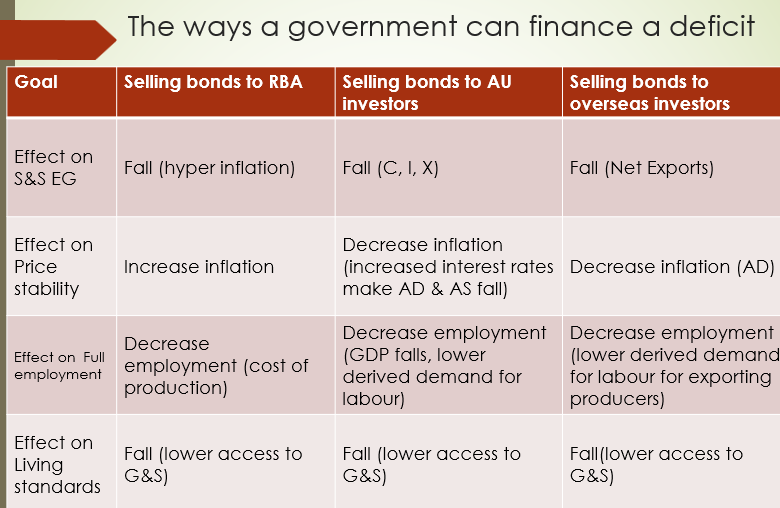

3 Ways for gov to finance deficit

Selling bonds to RBA

Selling bonds to Aus investors

Selling bonds to overseas investors

Selling bonds to RBA

Asking RBA to print more money, increasing supply of money into economy once the gov starts to spend the money received. This has negative effects on inflation, with prices articifially + due to market forces with negative effects on GDP

Selling bonds to Aus investors

Process removes money from the economy, making it more scarce. This means price of money (interest rate) rises, affecting investment and priv consumption negatively. This results in fall in AD & GDP

Selling bonds to overseas investors

Process increases demand for Aus currency, as borrowed cash is converted to AUD. This means price of AUD appreciates, making it relatively more expensive for overseas eco agents. This means AU exports = more expensive, -X and +M, causing fall in AD & GDP

Effects on goals

Ways a gov can utilise a surplus

Invest in financial markets

Repay existing debt

Return to economy next time

Place into specific purpose funds

Invest in financial markets

Buying of gov bonds to domestic or overseas investors

ADV

Future interest repayments can be received in times of deficit

Repay existing debt

Paying down of existing debt used previous to fund budget deficits

ADV

Improvement in credit rating, reduced interest rates, sovereign solvency

Return to economy next time

Either increasing expenditure or lowering receipts through discretionary budget measures next budget

ADV

Stimulate eco growth and achievement of domestic macroeconomic goals

Place into specific purpose funds

Investment into nation-building funds to improve inter-temporal efficiency

ADV

Helps grow nations sovereign wealth making future payouts possible for important national projects

Effect of a deficit on level of gov public debt

Increase in public debt due to gov needing to borrow money to cover the difference, accumulating debt over time. Repeated deficit = steady increase in overall level of gov debt.

Effect of a surplus on level of gov public debt

Decreases level of gov public debt as surplus can be used to repay or buy back gov debt, reducing amount of outstanding debt.

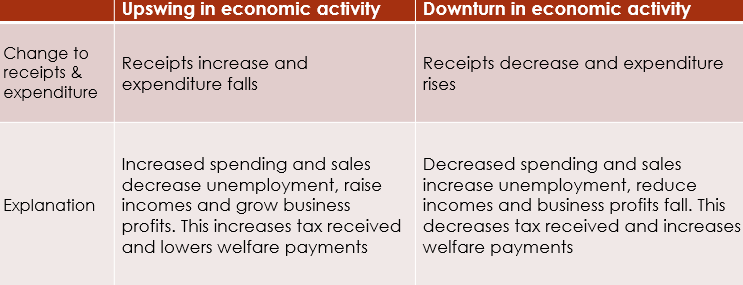

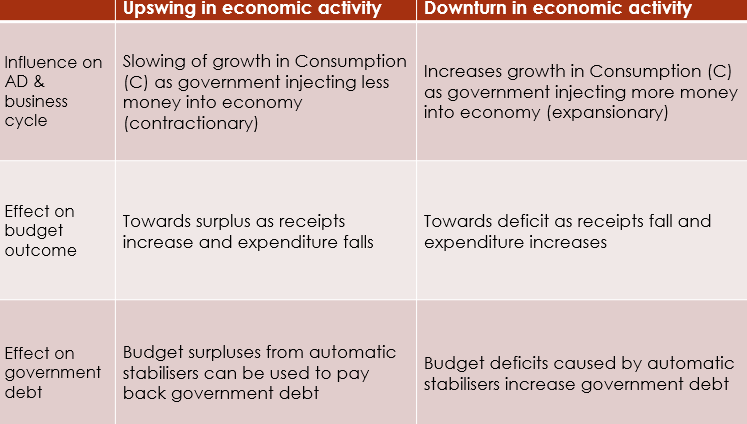

Automatic stabilisers

Change in budget receipts or expenditure that boost or slow AD and eco activity without federal treasurer purposely changing their level or announcing new policies. E.g Unemployment benefits GST received

AS p1

AS p2

Discretionary stabilisers

Deliberate changes to budget receipts and outlays. E.g Tax rates, welfare payment thresholds, infrastructure.

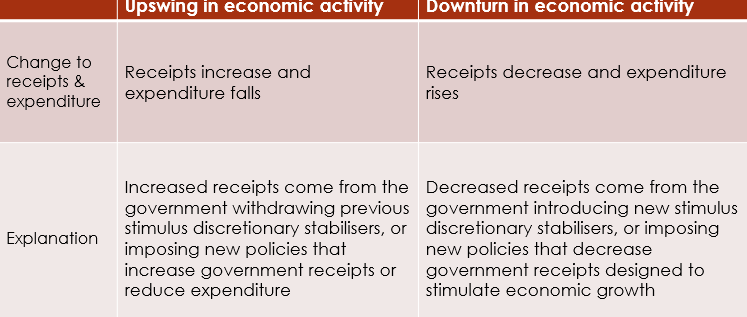

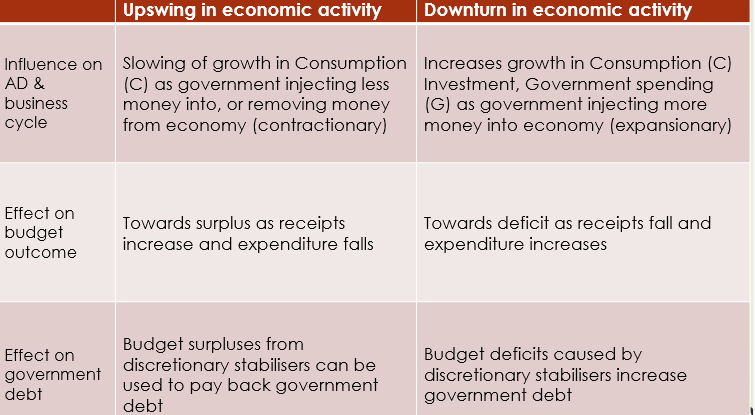

DS p1

DS p2

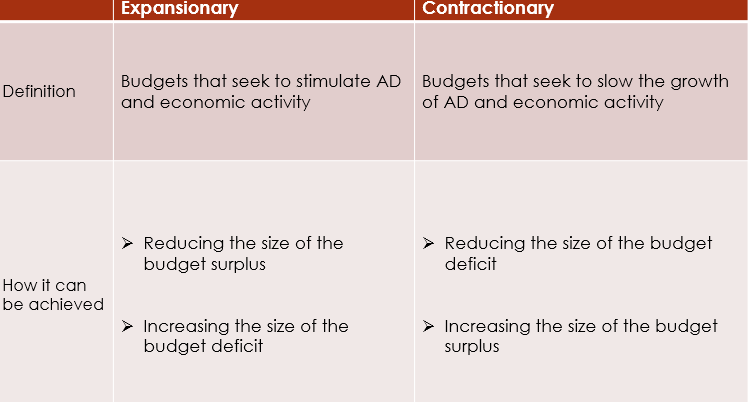

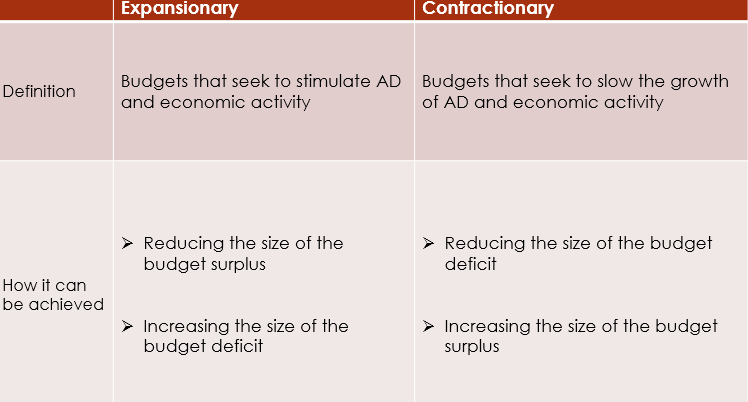

Budgetary policy

Effect of budgetary initiatives on goals

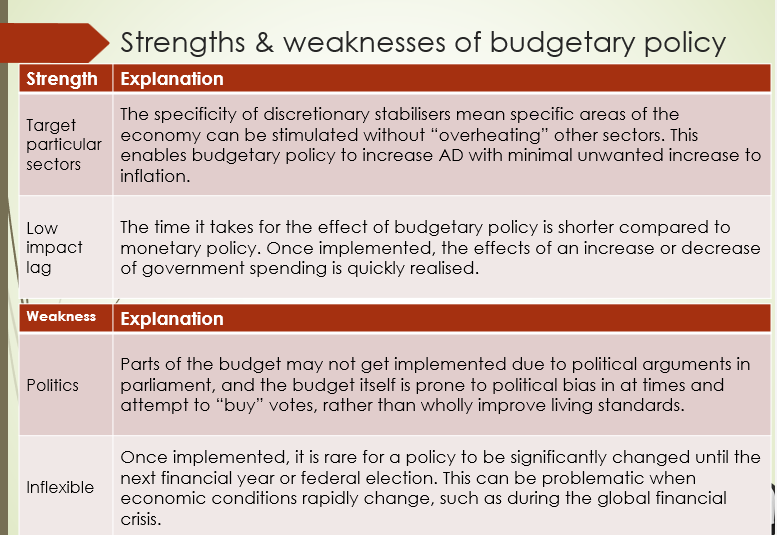

Adv and disadv of budgetary policy